Container Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437033 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Container Glass Market Size

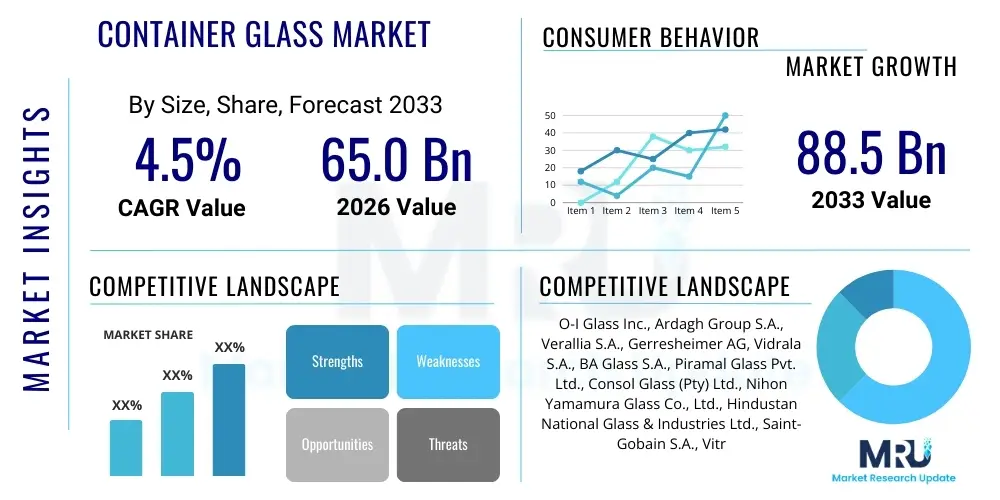

The Container Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 65.0 Billion in 2026 and is projected to reach USD 88.5 Billion by the end of the forecast period in 2033.

Container Glass Market introduction

The Container Glass Market encompasses the production and utilization of glass packaging solutions across various industries, primarily food and beverage, pharmaceuticals, and cosmetics. Container glass, valued for its inertness, barrier properties, recyclability, and aesthetic appeal, serves as a premium packaging material crucial for product integrity and shelf-life extension. This market is highly sensitive to consumer preference shifts towards sustainable and premium packaging formats, driving innovation in lightweighting and design customization. The inherent non-permeability of glass ensures that packaged contents remain untainted, making it indispensable for sectors requiring stringent quality control, such as high-end spirits and injectable pharmaceuticals.

Products within this domain include bottles, jars, vials, and ampoules, manufactured through processes like blow-and-blow or press-and-blow, utilizing silica sand, soda ash, and limestone as primary raw materials. Major applications span alcoholic beverages (beer, wine, spirits), non-alcoholic drinks (juices, waters), packaged foods (jams, sauces), and medicinal formulations. The primary benefits of container glass include its infinite recyclability without loss of quality, chemical stability, and superior resistance to temperature variations. This profile positions glass as a preferred choice over plastics in contexts where environmental impact and product purity are prioritized by both regulators and end-consumers.

Driving factors propelling market expansion include the global surge in demand for premium bottled beverages, particularly craft beers and specialized spirits, which often utilize unique glass bottle designs for branding differentiation. Furthermore, the stringent regulatory environment governing pharmaceutical packaging favors glass due to its established reliability and non-leaching characteristics. Increased environmental awareness and corporate sustainability commitments further amplify demand, as companies seek to reduce their reliance on single-use plastics and embrace circular economy principles through highly recyclable packaging materials.

Container Glass Market Executive Summary

The Container Glass Market is characterized by robust business trends focusing heavily on sustainability and operational efficiency. Manufacturers are heavily investing in furnace technology upgrades and electric melting to reduce carbon emissions, responding directly to tightening environmental regulations and consumer demands for eco-friendly products. Lightweighting technology remains a core business strategy, aiming to reduce raw material usage and transportation costs while maintaining mechanical strength, thereby enhancing the competitive profile of glass against alternative packaging materials. Mergers and acquisitions are also prominent, consolidating regional market power and leveraging economies of scale, particularly among major international players seeking to optimize global supply chains and enhance production capacity in high-growth regions like Asia Pacific.

Regional trends indicate significant divergence in market maturity and growth dynamics. Asia Pacific is the fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and the expanding pharmaceutical and alcoholic beverage markets in countries like China and India. Conversely, mature markets in North America and Europe emphasize premiumization and sustainability, with robust demand for customized, high-value glass containers for food and luxury goods. Europe, in particular, benefits from highly efficient glass collection and recycling infrastructures, driving the utilization of cullet (recycled glass) and supporting the circular economy model, which is a key differentiator in regional competitiveness.

Segment trends highlight the dominance of the Alcoholic Beverages segment, which consumes the largest volume of container glass globally, driven by sustained consumption patterns and a preference for glass packaging in the wine and spirits categories. The Pharmaceutical segment is demonstrating accelerated growth, supported by the expanding biosimilar and injectable drug markets, requiring high-quality, specialized glass vials and ampoules. Color segmentation shows clear glass (flint) maintaining a leading share due to its wide applicability across food, beverage, and pharma, though amber glass demand is surging, particularly for beer and sensitive drug formulations requiring UV light protection. This segmentation analysis confirms a market moving towards specialization based on end-user functional requirements.

AI Impact Analysis on Container Glass Market

Common user questions regarding AI's impact on the Container Glass Market revolve primarily around operational efficiency, quality control, and predictive maintenance. Users frequently inquire about how AI algorithms can optimize complex glass melting processes, reduce energy consumption in high-temperature furnaces, and minimize defect rates during high-speed production runs. There is significant interest in using machine learning for analyzing vast streams of sensor data from forming machines (IS machines) to predict equipment failure before it occurs, ensuring continuous production and reducing costly downtime. Furthermore, stakeholders are concerned with how AI-driven vision systems can enhance flaw detection, ensuring the highest purity standards required by pharmaceutical and high-end beverage industries. The overarching expectation is that AI will be a transformative tool, moving the industry towards highly automated, energy-efficient, and zero-defect manufacturing environments.

The integration of Artificial Intelligence and machine learning models into glass manufacturing is fundamentally reshaping operational dynamics. AI is currently being deployed in the cold end of the production line through advanced vision systems. These systems utilize deep learning to recognize and classify microscopic defects at speeds unattainable by traditional inspection technologies, significantly elevating quality assurance standards, especially for pharmaceutical vials and high-pressure beverage bottles. This not only minimizes product recalls but also enhances brand reputation by ensuring product consistency. The continuous feedback loop established by these AI systems allows for real-time adjustments to the forming process, moving the industry closer to the goal of zero manufacturing defects.

Beyond quality control, AI plays a crucial role in optimizing the energy-intensive hot end of the process. Machine learning algorithms analyze historical data on batch composition, furnace temperature, and pull rates to dynamically adjust parameters, resulting in optimized fuel consumption and reduced greenhouse gas emissions. Predictive maintenance, facilitated by AI analyzing vibration, thermal, and acoustic signatures from complex machinery like IS machines and batch house equipment, is dramatically reducing unscheduled stoppages. This predictive capability translates directly into higher asset utilization rates and lower overall maintenance expenditure, providing a substantial competitive advantage to early adopters in the container glass sector.

- Enhanced Furnace Optimization: AI algorithms reduce energy consumption by predicting optimal firing curves and batch composition mixing.

- Predictive Maintenance: Machine learning minimizes downtime by forecasting equipment failures in IS machines and conveyer systems.

- Advanced Quality Control: Deep learning-based vision systems detect minute, complex defects at high speed, ensuring product purity.

- Supply Chain Management: AI improves forecasting accuracy for raw materials (silica, cullet) and finished goods distribution.

- Process Automation: Increased automation of repetitive tasks, reducing human error and improving operational throughput.

DRO & Impact Forces Of Container Glass Market

The Container Glass Market dynamics are heavily influenced by a balanced set of Drivers, Restraints, and Opportunities, collectively determining the overall impact forces on industry growth. Key drivers include the robust consumer preference for sustainable and infinitely recyclable packaging options, intensified regulatory scrutiny on single-use plastics, and the consistent demand from the high-growth beverage and pharmaceutical sectors. These forces propel innovation in lightweighting and the adoption of closed-loop recycling systems. Conversely, major restraints involve the high capital expenditure required for furnace construction and upgrades, the intense volatility and high cost associated with energy sources (natural gas, electricity), and the competitive threat posed by highly adaptable and lightweight alternative packaging materials like PET and aluminum cans, particularly in high-volume, low-margin segments.

Opportunities for market players lie in aggressive technological advancements focused on decarbonization and efficiency. This includes exploring electric melting technologies, utilizing higher percentages of cullet in the batch mix, and developing smart manufacturing facilities integrated with IoT and AI to enhance precision and throughput. Furthermore, the global expansion of high-end specialty products, such as premium spirits and specialized pharmaceutical biologics, presents a lucrative niche requiring advanced, high-quality container glass, allowing manufacturers to secure higher profit margins and differentiate their offerings based on technical superiority and customization capabilities. These opportunities necessitate continuous investment in research and development to remain relevant.

The resulting impact forces compel the industry towards rapid modernization. High energy costs force operational optimization through predictive models and advanced process controls, while competitive pressure from plastics drives continuous lightweighting innovations. The powerful societal demand for environmental stewardship mandates investment in recycling infrastructure and greener production methods. Consequently, major players are positioning themselves not merely as packaging suppliers but as providers of sustainable, high-integrity packaging solutions, making operational efficiency and environmental credentials the primary determinants of market success and long-term viability against competing materials.

Segmentation Analysis

The Container Glass Market is segmented primarily based on end-user applications, glass color, and manufacturing process, allowing for granular analysis of demand drivers and technological focus areas. Segmentation by end-user reveals the fundamental reliance of the market on the food and beverage industry, which dictates volume, while the pharmaceutical sector drives specialized product innovation and quality control standards. Color segmentation highlights the functional requirements of products, where clear glass is prioritized for visibility and amber for UV protection. Analyzing these segments provides strategic insights into which applications offer the highest growth potential and require the most stringent manufacturing compliance.

- By End-User Industry:

- Alcoholic Beverages (Beer, Wine, Spirits)

- Non-Alcoholic Beverages (Water, Juices, Soft Drinks)

- Food Packaging (Jars for Sauces, Jams, Pickles)

- Pharmaceuticals (Vials, Ampoules, Bottles for Syrups)

- Cosmetics and Personal Care (Perfume Bottles, Cream Jars)

- By Color:

- Flint (Clear) Glass

- Amber Glass

- Green Glass

- Other Colors (Blue, Black)

- By Manufacturing Process:

- Blow and Blow (BB)

- Press and Blow (PB)

- Narrow Neck Press and Blow (NNPB)

Value Chain Analysis For Container Glass Market

The value chain for the Container Glass Market begins with upstream activities focused on raw material sourcing and preparation. This stage involves the mining and processing of essential materials such as silica sand, soda ash, limestone, and the crucial procurement of cullet (recycled glass). Efficient and localized cullet sourcing is a critical competitive advantage, as it reduces energy costs and minimizes the environmental footprint of the product. The complexity in the upstream segment lies in maintaining consistent material quality and managing the volatile supply and pricing of energy required for the melting process, which forms the backbone of the manufacturing phase. Strategic relationships with raw material suppliers and waste management companies are essential for supply stability.

The midstream involves the manufacturing process itself, encompassing batch mixing, melting in high-temperature furnaces, forming using IS (Individual Section) machines, annealing, and rigorous quality inspection. Continuous technological upgrades, particularly in forming techniques like Narrow Neck Press and Blow (NNPB), are vital for producing lighter yet stronger containers, thereby enhancing material efficiency. Following manufacturing, the downstream phase focuses on distribution and end-user integration. Finished container glass products are packaged, warehoused, and transported through various distribution channels to final end-users in the beverage, food, and pharmaceutical sectors. Due to the fragility and volume of glass, logistics efficiency, often managed through specialized third-party logistics (3PL) providers, is a key determinant of overall cost.

Distribution channels are categorized into direct and indirect methods. Direct distribution involves large manufacturers supplying high volumes directly to major multinational beverage or pharmaceutical corporations under long-term contracts, often requiring strict just-in-time (JIT) delivery protocols. Indirect distribution utilizes specialized packaging distributors and wholesalers who cater to smaller regional beverage producers, craft breweries, and niche cosmetic firms. The choice of channel depends on the scale and geographic spread of the end-user. The final and critical step in the value chain is the post-consumer recycling process, which ensures the availability of cullet, completing the closed-loop system, which is a major value differentiator for the glass packaging industry.

Container Glass Market Potential Customers

Potential customers for container glass are broadly categorized into major industrial segments that require high-integrity, non-reactive, and aesthetically pleasing packaging solutions. The beverage industry constitutes the largest consuming segment, particularly companies producing alcoholic beverages such as premium spirits, wines, and international and craft beers, which rely on glass for preserving flavor profiles and maintaining a high-end brand image. Non-alcoholic beverage producers, especially those focused on health drinks and sparkling waters, are increasingly transitioning back to glass due to its neutrality and superior environmental perception compared to plastics, representing significant potential growth areas.

The pharmaceutical sector represents a high-value, highly regulated customer base requiring specialized glass containers, including borosilicate glass vials, ampoules, and cartridges, due to their chemical inertness and resistance to temperature changes, critical for preserving sensitive drug formulations, vaccines, and biologics. Regulatory compliance and validation are paramount in this segment. The food processing industry, including manufacturers of gourmet foods, sauces, jams, and baby food, are perpetual buyers, valuing glass for its long shelf life, hygienic properties, and consumer-friendly storage features.

Finally, the cosmetics and personal care industry forms a growing niche, utilizing container glass, often highly customized and decorative, for luxury perfumes, essential oils, and high-end cosmetic creams. These customers prioritize design, clarity, and the perceived premium quality that glass conveys. Each of these end-user/buyer groups mandates specific quality control standards, making specialized manufacturing capabilities crucial for securing long-term contracts and maximizing market share across different application areas.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.0 Billion |

| Market Forecast in 2033 | USD 88.5 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | O-I Glass Inc., Ardagh Group S.A., Verallia S.A., Gerresheimer AG, Vidrala S.A., BA Glass S.A., Piramal Glass Pvt. Ltd., Consol Glass (Pty) Ltd., Nihon Yamamura Glass Co., Ltd., Hindustan National Glass & Industries Ltd., Saint-Gobain S.A., Vitro S.A.B. de C.V., Owens-Illinois, Inc., Berlin Packaging, Wiegand-Glas, Stoelzle Glass Group, Fevisa, Gallo Glass Company, Rocky Mountain Bottle Company, Şişecam Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Container Glass Market Key Technology Landscape

The technological landscape of the Container Glass Market is centered on optimizing the manufacturing processes for efficiency, quality, and environmental sustainability. A primary focus is the evolution of forming technologies, particularly the widespread adoption of the Narrow Neck Press and Blow (NNPB) process. NNPB allows manufacturers to produce bottles with significantly thinner walls and reduced overall weight compared to the traditional Blow and Blow method, without compromising structural integrity. This lightweighting capability is crucial for reducing raw material consumption, cutting energy usage during melting, and decreasing transportation emissions, thus directly addressing core industry demands related to cost efficiency and environmental impact. Continuous innovation in mold design, including the use of advanced coatings and alloy compositions, further enhances the precision and speed of the forming process.

Energy management technology represents another critical area of innovation, driven by the need to decarbonize the production process. The industry is actively shifting towards oxy-fuel firing systems, which use pure oxygen instead of air in the combustion process, resulting in higher flame temperatures, increased thermal efficiency, and significantly reduced nitrogen oxide (NOx) emissions. Furthermore, electric melting technology, utilizing renewable energy sources, is gaining traction, particularly in regions with abundant green electricity access, offering the potential for near-zero emission glass production. These advancements are complemented by sophisticated furnace control systems that employ AI and sensors to ensure highly stable and energy-efficient melting operations, maximizing the inclusion rate of cullet (recycled glass) into the batch mix.

In the post-production phase, the technological focus is on inspection and decoration. High-speed, high-resolution camera systems, often powered by machine learning algorithms, are standard for 100% inspection of every container to detect structural faults, dimensional deviations, and surface defects critical for pharmaceutical and pressurized beverage applications. Surface treatment technologies, such as hot-end and cold-end coatings, are essential for improving the scratch resistance and strength of the glass, protecting it during subsequent handling and filling processes. Decoration technologies, including digital printing and advanced screen printing, offer high levels of customization and detail, catering to the aesthetic demands of premium beverage and cosmetic brands seeking unique visual appeal.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, driven by significant investments in the food and beverage industry, rising consumption of alcoholic and non-alcoholic beverages due to expanding middle-class populations, and robust growth in the regional pharmaceutical sector. Countries like China and India are experiencing massive infrastructure development in manufacturing capacity.

- Europe: Europe is a mature market characterized by high consumer awareness regarding sustainability and stringent regulatory frameworks favoring glass recycling. The region maintains high growth, particularly in premium segments like wine, spirits, and olive oil. Europe leads in adopting advanced sustainable technologies, including high cullet usage rates (often exceeding 80%) and electric melting trials.

- North America: The North American market is defined by high demand for premium packaged goods, especially craft beverages (beer and spirits), demanding specialized and customized glass formats. The market focuses heavily on lightweighting and localized supply chains, though recycling infrastructure varies significantly by state, impacting cullet availability compared to Europe.

- Latin America (LATAM): Growth in LATAM is closely linked to economic stability and the large-scale beer and soft drink industries, which dominate container glass consumption. Key markets like Brazil and Mexico are seeing increased demand, albeit frequently facing challenges related to currency volatility and logistics infrastructure, making localized production crucial.

- Middle East and Africa (MEA): MEA is an emerging market with specialized demand patterns. While the region sees strong demand from pharmaceutical sectors and bottled water segments, consumption is highly segmented, often focusing on high-end glass for imported luxury goods and utilizing localized production for staple beverages, driven by urbanization trends in nations like Saudi Arabia and South Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Container Glass Market.- O-I Glass Inc.

- Ardagh Group S.A.

- Verallia S.A.

- Gerresheimer AG

- Vidrala S.A.

- BA Glass S.A.

- Piramal Glass Pvt. Ltd.

- Consol Glass (Pty) Ltd.

- Nihon Yamamura Glass Co., Ltd.

- Hindustan National Glass & Industries Ltd.

- Saint-Gobain S.A.

- Vitro S.A.B. de C.V.

- Owens-Illinois, Inc.

- Berlin Packaging

- Wiegand-Glas

- Stoelzle Glass Group

- Fevisa

- Gallo Glass Company

- Rocky Mountain Bottle Company

- Şişecam Group

Frequently Asked Questions

Analyze common user questions about the Container Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Container Glass Market?

The primary driver is the increasing global consumer and regulatory shift towards sustainable packaging materials, favoring glass due to its infinite recyclability, coupled with robust demand from the premium alcoholic beverage and pharmaceutical sectors.

How does lightweighting technology affect container glass manufacturing?

Lightweighting, primarily achieved through techniques like Narrow Neck Press and Blow (NNPB), reduces the amount of raw material needed, lowers production energy consumption, and decreases transportation costs, making glass more cost-competitive against plastic and metal alternatives.

Which geographical region exhibits the highest growth potential in this market?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, fueled by rapidly growing pharmaceutical manufacturing capabilities, urbanization, and rising disposable incomes driving premium beverage consumption in countries like China and India.

What are the main restraints impacting the profitability of container glass producers?

Major restraints include the high volatility and substantial cost of energy (natural gas and electricity) required for furnace operation, high capital investment requirements for plant modernization, and intense competition from lighter-weight alternative packaging formats.

How is AI being used to enhance efficiency in the container glass industry?

AI is employed for predictive maintenance to minimize unscheduled downtime, optimize high-temperature furnace performance for energy savings, and power advanced vision systems for enhanced, high-speed defect detection and quality assurance on the production line.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager