Container Storage and Rental Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433869 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Container Storage and Rental Market Size

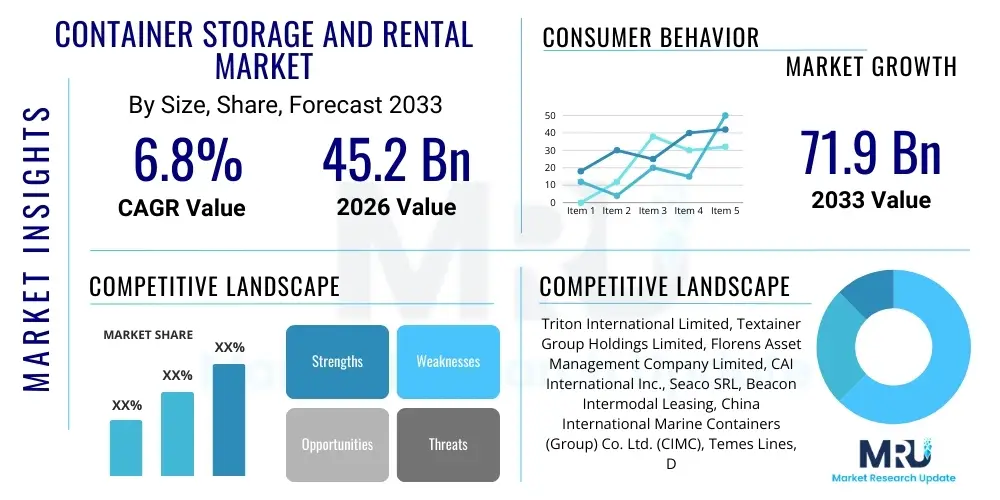

The Container Storage and Rental Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 71.9 Billion by the end of the forecast period in 2033.

Container Storage and Rental Market introduction

The Container Storage and Rental Market encompasses the leasing and provision of standardized intermodal containers used primarily for the transportation and temporary storage of goods across various logistics chains. This market is fundamentally driven by the expansion of global trade, the increasing complexity of supply chain logistics, and the need for flexible, secure, and standardized solutions for both shipping and non-shipping applications. The core product, the shipping container, serves as the backbone of global commerce, enabling efficient multimodal transportation across sea, road, and rail. Rental services provide crucial flexibility to operators, allowing them to scale their capacity instantly based on fluctuating demand without the massive capital expenditure required for container ownership. Applications range widely, from conventional cargo transport and refrigerated logistics to modular construction, temporary office space, and specialized storage for industrial materials.

Major applications of containers extend beyond traditional maritime transport, penetrating sectors like construction, retail, and agriculture. The demand for specialized containers, such as refrigerated (reefer) units for perishable goods and tank containers for liquids and gases, is escalating, reflecting evolving consumer demands and regulatory standards for sensitive cargo handling. Benefits of container rental include reduced operational risk, maintenance burden transfer to the rental provider, and enhanced capital efficiency. This versatility positions container rental as an indispensable service supporting just-in-time inventory management and resilient supply chain operations across industrialized and developing economies alike. Market growth is further catalyzed by infrastructural developments, particularly the expansion and modernization of ports and intermodal terminals globally.

Driving factors supporting sustained market expansion include the burgeoning e-commerce sector, which necessitates sophisticated warehousing and last-mile delivery solutions often utilizing temporary container storage hubs. Furthermore, the push towards greater sustainability in logistics is prompting rental companies to invest in newer, more energy-efficient, and structurally sound containers, which also drives replacement cycles and rental uptake. Geopolitical diversification of manufacturing bases and increasing urbanization are also major influences, creating specific regional demands for flexible storage solutions near key population centers and production sites. The inherent standardization provided by ISO containers remains a paramount advantage, facilitating seamless cross-border movement and technological integration within complex logistics ecosystems.

Container Storage and Rental Market Executive Summary

The Container Storage and Rental Market is experiencing robust expansion driven by pronounced structural shifts in global trade and logistics paradigms, notably the ongoing diversification of supply chains away from single-source manufacturing models. Key business trends include the strong adoption of digital logistics platforms for real-time tracking, inventory management, and container booking, optimizing utilization rates and reducing empty mileage. There is a palpable shift towards specialized rental offerings, particularly in the cold chain logistics segment, where high-specification reefer containers are demanded to meet stringent food safety and pharmaceutical transportation requirements. Moreover, sustainability is increasingly central to procurement decisions, leading to higher demand for newer, eco-friendly containers manufactured using low-carbon processes, positioning sustainable operational practices as a competitive differentiator among rental providers.

Regionally, the Asia Pacific (APAC) continues to dominate the market, primarily due to its pivotal role as the world's leading manufacturing hub and the resultant massive volume of container traffic originating from key economies like China, India, and Southeast Asian nations. North America and Europe, however, exhibit higher rental rates and advanced technological adoption, especially concerning smart containers equipped with IoT sensors for monitoring environmental conditions and security. Latin America and the Middle East & Africa (MEA) are emerging as high-growth markets, fueled by substantial investments in port infrastructure and regional economic integration initiatives aimed at boosting international trade capacity. The development of inland logistics hubs in these regions is particularly dependent on reliable container rental services to manage localized storage demands.

Segment trends reveal that the Dry Container segment remains the largest volume contributor, indispensable for manufactured goods transport, while the Reefer Container segment shows the fastest growth, propelled by the expanding trade in perishable goods and pharmaceuticals. From an end-user perspective, the Shipping and Logistics segment dominates, but the Retail and E-commerce segments are demonstrating accelerated growth in their reliance on containers for temporary storage and pop-up distribution centers, reflecting a shift toward modular and scalable warehousing solutions. The rental model, preferred over outright purchasing by many medium and small-sized enterprises (SMEs), continues to gain traction due to its lower capital expenditure requirement and operational flexibility.

AI Impact Analysis on Container Storage and Rental Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Container Storage and Rental Market predominantly center on operational efficiency, predictive maintenance capabilities, and enhanced supply chain resilience. Users are keenly interested in how AI can optimize container flow, minimize empty container repositioning costs (a major industry expense), and forecast demand accurately to align inventory levels. Concerns also revolve around the integration challenges of implementing complex AI systems with legacy IT infrastructure and the necessary data quality standards required to feed machine learning models effectively. The consensus expectation is that AI will fundamentally transform how containers are managed, moving from reactive maintenance and static planning to highly optimized, dynamic, and autonomous logistic processes.

Specifically, key themes include the potential for AI to dramatically reduce idle time through sophisticated scheduling algorithms that consider real-time port congestion, weather patterns, and fluctuating localized rental needs. Users seek confirmation that AI-driven diagnostics will extend the lifespan of high-value assets, particularly reefer containers, by predicting component failures before they occur. Furthermore, questions arise regarding AI's role in security—using computer vision and machine learning for automated damage assessment and tamper detection during handovers. This integration of intelligence aims to create a more resilient, cost-effective, and transparent container ecosystem, directly impacting rental prices and utilization rates across the globe.

- AI-powered predictive maintenance reduces container downtime and extends asset lifecycle, minimizing costly unforeseen repairs.

- Optimized container repositioning algorithms minimize empty container mileage and logistics costs, enhancing fleet utilization rates.

- Advanced demand forecasting using machine learning improves inventory planning and ensures optimal availability across key rental hubs.

- Automation of inspection processes using computer vision detects damage rapidly and accurately during interchange points.

- Real-time dynamic pricing models, informed by AI analysis of market variables, optimize rental revenue generation.

- Enhanced security monitoring via AI detects anomalies and unauthorized access attempts, reducing cargo loss risk.

DRO & Impact Forces Of Container Storage and Rental Market

The Container Storage and Rental Market is primarily driven by the consistent expansion of global merchandise trade, necessitating reliable and standardized transport units, alongside significant government and private sector investment in modernizing port infrastructure and logistics hubs globally. Restraints predominantly involve the high capital investment required for new container fabrication and fleet expansion, coupled with persistent geopolitical tensions and trade protectionism that can introduce volatility into shipping volumes. Opportunities lie in the burgeoning market for specialized storage solutions, such as cold chain logistics supporting the pharmaceutical and perishable food sectors, and the increasing adoption of smart container technologies (IoT tracking) that enhance service offerings. These factors collectively exert significant impact forces on market dynamics, compelling providers to constantly balance capacity, technological adoption, and operational efficiency to remain competitive.

Specifically addressing drivers, the rise of intra-regional trade blocks and the necessity for flexible inventory management in high-growth e-commerce sectors significantly increase demand for rental services, as businesses prefer operational leasing over ownership to maintain agility. The continued shift toward modular construction methods, utilizing shipping containers as basic structural elements, also provides a stable, non-shipping revenue stream for container owners. However, the market faces structural restraints related to cyclical oversupply during periods of global economic slowdown, which pressures rental rates, alongside the regulatory complexities of cross-border leasing and adherence to diverse environmental standards (e.g., emissions from reefer cooling units).

The core opportunities revolve around technological advancement, where integrating telematics and sensors allows rental companies to offer premium monitoring services, justifying higher margins. Furthermore, the imperative for sustainable logistics solutions is an emerging opportunity, promoting the development and rental of lightweight, high-strength steel containers that improve fuel efficiency in transport. The impact forces are characterized by high market concentration among top leasing firms, which dictates global fleet pricing, coupled with the critical influence of global shipping alliances and macroeconomic trends, such as interest rate fluctuations affecting capital costs for fleet expansion.

Segmentation Analysis

The Container Storage and Rental Market is comprehensively segmented across several dimensions, including Type, Size, and End-User, reflecting the diverse applications and specialized needs within global logistics and supplementary storage markets. Understanding these segments is crucial for strategic planning, as distinct categories exhibit varied growth rates, pricing dynamics, and susceptibility to economic cycles. For instance, specialized containers, such as Reefers and Tank containers, command significantly higher rental rates and require specific maintenance protocols compared to standard dry cargo units. Geographical analysis further refines segmentation insights, showing that demand for large, 40 ft containers is highest on major east-west trade lanes, while smaller, 20 ft units are often favored for localized storage and inter-regional transport in emerging markets, necessitating localized fleet management strategies.

Segmentation by Type remains the most fundamental categorization, distinguishing between the dominant Dry segment and the high-growth specialized segments, each serving unique industrial requirements. The Type segmentation dictates the technological complexity required for maintenance and the necessary infrastructural support at depots. End-User segmentation reveals patterns of demand stability; while the Shipping & Logistics sector provides massive volume, sectors like Construction and Retail offer resilience and counter-cyclical growth, particularly concerning non-shipping domestic storage rentals. The dynamics within these segments are continuously reshaped by regulatory changes (e.g., cold chain regulations) and technological innovations (e.g., IoT integration), making continuous monitoring of segment performance essential for market participants.

- By Container Type:

- Dry Containers

- Reefer Containers (Refrigerated)

- Tank Containers

- Flat Rack Containers

- Open Top Containers

- Specialized & Others (e.g., Platform, Half-Height)

- By Container Size:

- 20 ft Containers

- 40 ft Containers

- 45 ft Containers and Others (e.g., 10 ft, 53 ft)

- By End-User:

- Shipping & Logistics

- Construction & Mining

- Retail & E-commerce

- Oil & Gas and Chemicals

- Agriculture & Fisheries (Cold Chain)

- Government & Disaster Relief

- Others (e.g., Modular Housing)

Value Chain Analysis For Container Storage and Rental Market

The value chain of the Container Storage and Rental Market begins with upstream activities centered on container manufacturing, primarily involving steel production and fabrication, dominated by manufacturers in China and Southeast Asia who adhere strictly to ISO standards. This phase is capital-intensive and subject to volatility in raw material (steel) prices. Following manufacturing, the value moves to specialized leasing companies and shipping lines (the primary renters and buyers), who manage large global fleets. These entities undertake critical financial management, maintenance, repair, and inspection (M&R) activities, which are essential for maintaining asset integrity and regulatory compliance. Effective upstream management requires long-term contracts with fabricators to ensure supply stability and cost control.

The midstream segment involves the core rental and storage services, facilitated through a complex network of distribution channels. Direct channels include transactions between large leasing companies and major global shipping lines, often involving long-term master lease agreements. Indirect channels involve brokers, freight forwarders, and regional depots that handle short-term rentals, localized storage, and specialized container leasing for niche applications (e.g., construction sites or temporary cold storage). Distribution efficiency relies heavily on depot networks strategically located near major ports and industrial zones to minimize positioning costs, which is a key determinant of overall profitability. The management of these depots, including handling, repair, and inventory tracking, forms the operational backbone of the rental market.

Downstream activities focus on the end-users—shipping lines, logistics providers, construction firms, and retailers—who utilize the containers for transportation or storage. The final stages involve the off-hiring and eventual disposition or recycling of containers nearing the end of their operational lifespan. A significant portion of older containers is repurposed for non-shipping applications, creating a secondary market often managed by specialized traders. The entire value chain is characterized by high asset mobility, requiring sophisticated IT systems for tracking, billing, and ensuring compliance across multiple jurisdictions. Technological integration, particularly IoT and blockchain, is increasingly being utilized downstream to enhance transparency and security for the end-user.

Container Storage and Rental Market Potential Customers

Potential customers for the Container Storage and Rental Market are highly diversified, encompassing entities across the entire spectrum of global commerce and industrial activity, ranging from multinational conglomerates to small, localized enterprises. The largest volume buyers are global container shipping lines and Non-Vessel Operating Common Carriers (NVOCCs), who rely on rental companies to maintain fleet flexibility and meet seasonal or unexpected spikes in demand across specific trade routes without committing permanent capital. These major clients typically engage in long-term master lease agreements, prioritizing reliability, standardized maintenance, and global reach from their rental partners. Their buying decisions are primarily influenced by fleet utilization rates, bunker fuel costs, and prevailing global freight rates.

Beyond the core shipping sector, a rapidly growing segment of potential customers includes businesses requiring static or temporary storage solutions. This includes the retail sector utilizing containers for peak season inventory overflow, particularly accelerated by the growth of e-commerce, and the construction industry using containers for on-site secure storage of equipment, tools, and materials. Furthermore, specialized end-users, such as pharmaceutical manufacturers and large grocery chains, constitute crucial customers for reefer container rental, where the focus shifts from volume to highly technical specification compliance, temperature monitoring capabilities, and rapid deployment in remote locations. These customers place a high value on advanced tracking technology and stringent regulatory adherence.

Another significant customer group involves governmental agencies and NGOs, especially those engaged in disaster relief and infrastructure development projects. These organizations require rapid access to large, standardized storage and housing units that can be deployed quickly and securely in challenging environments. Furthermore, companies involved in the Oil & Gas, Chemicals, and specialized manufacturing industries are critical buyers for tank and specialized containers, necessitating rental providers that offer deep expertise in handling hazardous materials and complex logistical certifications. The trend toward customized, value-added services—such as pre-modification for office space or specialized shelving—is increasingly attracting niche customers looking for turnkey solutions rather than just bare metal units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 71.9 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Triton International Limited, Textainer Group Holdings Limited, Florens Asset Management Company Limited, CAI International Inc., Seaco SRL, Beacon Intermodal Leasing, China International Marine Containers (Group) Co. Ltd. (CIMC), Temes Lines, Direct Container, Blue Sky Intermodal, Touax Group, Container leasing International (CLI), Unitas, UES International, Ocean Box, Gold Container Corporation, SeaCube Container Leasing, Milestone Equipment Holdings, Rent-A-Container, Container xChange. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Container Storage and Rental Market Key Technology Landscape

The Container Storage and Rental Market is undergoing a rapid technological transformation, moving beyond purely physical asset management towards integrated digital platforms. The primary technological advancements center around the deployment of Internet of Things (IoT) sensors and telematics devices integrated directly into the containers, transforming them into "smart containers." These devices provide real-time data on location, temperature, humidity, light exposure, shock events, and door opening status. This data is critical for ensuring cargo safety, particularly for high-value or temperature-sensitive goods in the reefer segment, allowing rental companies to offer premium monitoring services and enhance accountability throughout the supply chain. The adoption of smart technology is raising the standard of service, moving rental offerings from basic asset provision to comprehensive logistical solutions.

Furthermore, the utilization of sophisticated data analytics and Artificial Intelligence (AI) is crucial for optimizing internal operations. AI algorithms are used for predictive maintenance scheduling, significantly reducing unexpected operational failures by analyzing sensor data patterns and historical repair records. Machine learning models are also being deployed to optimize the complex logistics of container repositioning, minimizing the costly movement of empty units by accurately predicting localized demand and supply imbalances several weeks in advance. This focus on optimization technologies directly impacts profitability by reducing operating costs and maximizing fleet utilization, which is essential given the high capital expenditure associated with container acquisition.

Blockchain technology represents another emerging element in the technology landscape, offering immutable and transparent record-keeping for container ownership transfers, maintenance history, and rental contract execution. This enhances trust and efficiency in transactions, particularly across multiple international parties. Additionally, advancements in material science are influencing container technology, with lighter, more durable, and corrosion-resistant materials being introduced to improve operational efficiency and lifespan, reducing long-term maintenance needs. The combination of these digital and material innovations is creating a highly competitive environment where technological capability is becoming a key differentiator among leading rental service providers.

Regional Highlights

Regional variations in trade volume, infrastructure quality, and logistical maturity significantly influence the Container Storage and Rental Market dynamics, creating distinct opportunities and challenges across key geographical areas. Asia Pacific (APAC) stands out as the dominant region, commanding the largest market share due to its entrenched position as the global manufacturing hub, driving massive export volumes. Countries like China, Vietnam, and India fuel this demand, necessitating vast rental fleets to manage the high turnover of containers at major gateway ports. Furthermore, infrastructural expansion in Southeast Asia and the rising consumer class within APAC are boosting intra-regional trade, increasing the complexity and size of localized container movement and storage needs.

North America and Europe represent mature markets characterized by higher rental rates, stringent regulatory environments, and advanced technological adoption. In North America, the market is characterized by significant demand for specialized containers, particularly high-cube 53 ft units for domestic intermodal transport and substantial requirements for dry storage containers used in retail, construction, and temporary warehousing near major metropolitan areas. European demand is driven by dense pan-European trade networks and strict environmental regulations, which accelerate the adoption of newer, energy-efficient reefer containers and mandate efficient logistics processes, often leading to earlier adoption of smart container tracking technologies.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-growth regions. LATAM's growth is tied to agricultural exports (requiring significant reefer capacity) and internal infrastructure projects, although growth can be volatile due to local economic and political instability. The MEA region is heavily influenced by large-scale government investments in logistics hubs, such as the Suez Canal economic zone and Gulf Cooperation Council (GCC) ports, aimed at diversifying economies away from oil. These investments are generating massive demand for modern container fleets and specialized storage infrastructure, positioning the MEA as a critical future growth corridor for the rental market, focusing on developing sophisticated transshipment capabilities.

- Asia Pacific (APAC): Dominates the market share driven by massive manufacturing exports and extensive port infrastructure expansion in East and Southeast Asia; strong growth in intra-regional trade and e-commerce requiring localized storage.

- North America: High penetration of specialized containers (e.g., 53 ft domestic boxes); characterized by high technological adoption in tracking and security; substantial demand from construction and retail sectors for domestic storage rentals.

- Europe: Focus on modern, eco-friendly container fleets; demand concentrated on efficient intermodal and short-sea shipping networks; stringent regulations driving adoption of advanced reefer technology and digital platforms.

- Latin America (LATAM): High demand volatility linked to commodity and agricultural export cycles; significant opportunities in cold chain logistics to support perishable goods transport; infrastructural constraints necessitate efficient localized rental services.

- Middle East and Africa (MEA): Rapidly increasing market size due to massive governmental investments in regional port expansion and trade diversification strategies; pivotal role as a global transshipment hub driving demand for high-volume container throughput capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Container Storage and Rental Market.- Triton International Limited

- Textainer Group Holdings Limited

- Florens Asset Management Company Limited

- CAI International Inc.

- Seaco SRL

- Beacon Intermodal Leasing

- China International Marine Containers (Group) Co. Ltd. (CIMC)

- Temes Lines

- Direct Container

- Blue Sky Intermodal

- Touax Group

- Container leasing International (CLI)

- Unitas

- UES International

- Ocean Box

- Gold Container Corporation

- SeaCube Container Leasing

- Milestone Equipment Holdings

- Rent-A-Container

- Container xChange

Frequently Asked Questions

Analyze common user questions about the Container Storage and Rental market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Container Storage and Rental Market?

Market growth is primarily driven by the expansion of global merchandise trade, the proliferation of e-commerce necessitating flexible logistics and temporary storage hubs, and significant worldwide investment in port and intermodal infrastructure. The intrinsic cost-efficiency and flexibility of renting assets over purchasing them also significantly fuels demand, particularly among scaling logistics providers.

How is technological innovation affecting the operational costs of container rental companies?

Technological innovation, particularly the integration of AI for predictive maintenance and optimization of container repositioning, is substantially reducing operational costs. By minimizing empty container mileage and preventing unexpected high-cost failures, smart container technologies lead to higher asset utilization rates and extend the operational lifespan of the rental fleet.

Which container segment exhibits the highest growth potential in the forecast period?

The Reefer Container segment is projected to exhibit the highest growth potential. This accelerated growth is primarily attributed to the expanding global trade in pharmaceuticals and perishable food items, coupled with increasingly stringent regulatory requirements for temperature-controlled logistics, demanding specialized, high-specification rental units.

What role does sustainability play in the purchasing and rental decisions within the container market?

Sustainability is becoming a crucial factor, influencing decisions toward newer, energy-efficient, and structurally sound containers. End-users, especially large shipping lines and corporations, prioritize rental providers that demonstrate commitment to lower carbon footprints, demanding units that are lightweight or utilize sustainable refrigerant gases for reefer operations.

Which region dominates the Container Storage and Rental Market in terms of market share?

The Asia Pacific (APAC) region currently dominates the market share due to its status as the world's primary manufacturing and export hub. The sheer volume of container traffic originating from countries like China and the extensive coastal and intermodal infrastructure supporting this trade ensure APAC maintains the largest share of the global container fleet and rental activity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager