Continuous Miner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431400 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Continuous Miner Market Size

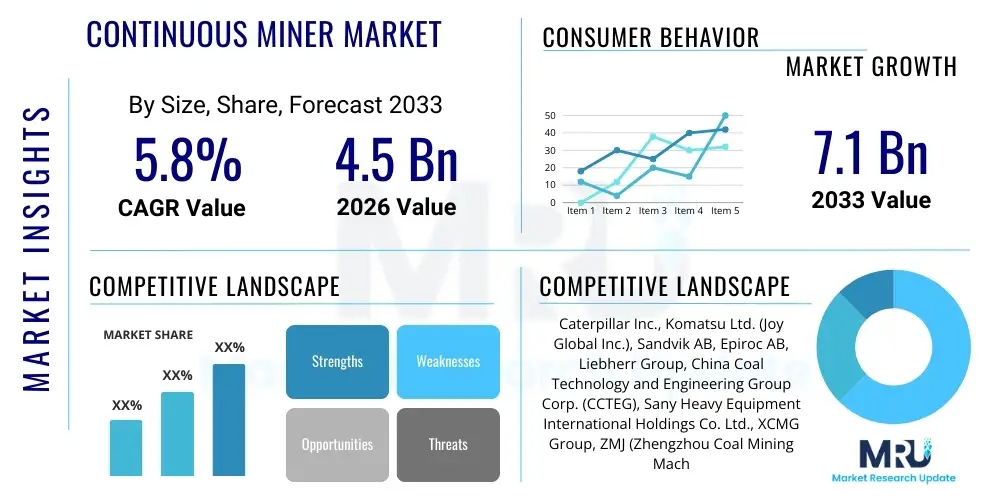

The Continuous Miner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.1 Billion by the end of the forecast period in 2033.

Continuous Miner Market introduction

The Continuous Miner Market encompasses specialized heavy machinery utilized predominantly in underground coal and soft mineral mining operations. Continuous miners are track-mounted, self-propelled machines that employ a rotating drum, fitted with carbide or specialized picks, to cut the material directly from the face. This material is then loaded onto an integrated conveyor system that transports it to shuttle cars or continuous haulage systems, streamlining the process of excavation and loading into a single, highly efficient operation. The core function of these machines is to maximize productivity in room and pillar mining methods, significantly reducing the labor and time associated with traditional drill-and-blast methods, thereby enhancing overall mine efficiency and safety protocols.

Major applications of continuous miners span various sectors of the extractive industry, primarily focusing on coal extraction due to their adaptability to softer seams, but also extending into potash, salt, and gypsum mining where geological conditions permit. The primary benefits driving market adoption include enhanced operational throughput, improved rock fragmentation uniformity, and superior safety profiles afforded by remote operation capabilities. Furthermore, the inherent design allows for faster development rates in complex mine layouts, which is crucial for achieving high recovery ratios and maintaining competitive operational costs in the global commodity market. The robustness and high utilization rates of modern continuous miners contribute directly to lower total cost of ownership over the equipment lifespan.

Driving factors propelling the expansion of this market include sustained global demand for coal, particularly in developing economies prioritizing energy security, alongside increasing regulatory pressure compelling miners to adopt safer, automated equipment to minimize human exposure to hazardous underground environments. Technological advancements, such as enhanced cutting head designs, improved dust suppression systems, and integration of predictive maintenance sensors, further bolster the appeal of new continuous miner models. Investment in mine modernization programs across major mining regions, coupled with the necessity for greater operational efficiency to counteract declining ore grades and rising labor costs, ensures continued steady demand for advanced continuous mining technology.

Continuous Miner Market Executive Summary

The Continuous Miner Market is characterized by robust growth, fueled by strong underlying commodity demand, particularly for metallurgical and thermal coal in the Asia-Pacific region, and aggressive technological adoption focusing on automation and digitalization across established markets like North America and Europe. Business trends indicate a strategic shift towards leasing models and comprehensive aftermarket service contracts by major manufacturers, aiming to optimize uptime and reduce capital expenditure barriers for smaller operators. Furthermore, market competition is intensifying, driven by innovation in battery-electric continuous miners that address environmental concerns and improve air quality in enclosed mining environments, representing a critical long-term growth vector for equipment providers.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, primarily due to substantial coal production capacities in China, India, and Australia, where massive-scale underground operations necessitate high-capacity, reliable excavation equipment. North America and Europe, while slower in production growth, lead the adoption curve for high-specification, autonomous continuous miners, driven by strict safety regulations and high labor costs, making investment in full automation economically viable. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, particularly in industrial mineral extraction, where infrastructural development and mining sector reforms are stimulating new investments in mechanized equipment to replace older, less efficient mining methods.

Segmentation trends reveal that high-capacity (over 20 tons per minute) electric-powered miners hold the largest market share, catering to large-scale, deep-seam coal mines that require maximum output. However, the battery-electric segment is experiencing the highest CAGR, reflective of the industry's commitment to decarbonization and the pursuit of energy-efficient mining practices. The integration of advanced sensor technologies and tele-remote operation capabilities within the continuous miner segment is becoming standard, transforming these machines from simple extraction tools into sophisticated data-generating nodes essential for real-time mine management and optimization.

AI Impact Analysis on Continuous Miner Market

User queries regarding the impact of Artificial Intelligence (AI) on the Continuous Miner Market predominantly revolve around three critical areas: safety enhancement through predictive failure analysis, maximization of operational efficiency via autonomous navigation, and the future role of human operators in highly automated mining environments. Users frequently ask about the quantifiable return on investment (ROI) from implementing AI-driven predictive maintenance systems, specifically focusing on how machine learning algorithms can detect minor anomalies in cutting head vibration, bearing temperature, or hydraulic system pressure long before catastrophic failure occurs. There is significant interest in understanding how AI-powered visualization and decision support systems can aid remote operators in complex geological conditions, ensuring optimal cutting patterns and minimizing dilution, which directly impacts the quality and quantity of extracted material.

The integration of AI transforms continuous miners from conventional mechanical assets into intelligent systems capable of self-optimization. AI algorithms analyze vast datasets generated by onboard sensors—including geotechnical data, cutting forces, power consumption, and thermal imagery—to create predictive models for equipment health and operational parameters. This shift enables proactive maintenance scheduling, dramatically reducing unplanned downtime, which is a significant cost factor in underground operations. Furthermore, AI facilitates real-time adjustment of cutting parameters based on rock hardness changes, ensuring consistent energy consumption and material throughput, thereby maximizing the efficiency of the entire extraction cycle and pushing the boundaries of what is mechanically possible for these machines.

A key outcome of AI deployment is the accelerated development of true autonomous mining capabilities. AI drives the sophisticated control systems required for continuous miners to navigate complex, changing underground environments without direct human intervention. This includes precise localization, collision avoidance, and adaptive tramming paths that optimize travel time between cut faces and loading zones. Beyond navigation, AI contributes significantly to workforce safety by shifting human labor away from the active face, enabling operators to manage multiple machines simultaneously from the surface or a safe control room, thus fundamentally altering the risk profile associated with continuous mining operations and setting new benchmarks for industry safety standards worldwide.

- AI-driven Predictive Maintenance: Reduces unplanned downtime by forecasting mechanical failures (e.g., cutting drum, gearboxes).

- Autonomous Navigation and Tramming: Enables self-driving capabilities underground, optimizing travel paths and cycle times.

- Real-time Cutting Optimization: Uses machine learning to adjust cutting speed and force based on real-time geological feedback, minimizing energy use and maximizing yield.

- Enhanced Safety Protocols: AI algorithms analyze sensor data (gas levels, stability) to proactively alert operators to hazardous conditions.

- Remote Operation Decision Support: Provides advanced data visualization and diagnostics to remote operators, enhancing control precision.

- Optimized Fleet Management: Coordinates multiple continuous miners and auxiliary equipment (shuttle cars) for seamless material flow.

DRO & Impact Forces Of Continuous Miner Market

The Continuous Miner Market is significantly influenced by a confluence of accelerating drivers (D) such as global energy demand and stringent safety regulations, countered by substantial restraints (R) including high initial capital expenditure and volatility in commodity pricing, leading to specific opportunities (O) centered on automation, electrification, and expansion into non-coal mineral applications. The primary driving force remains the imperative for increased mine productivity and efficiency, particularly in deep underground mines where accessibility is challenging, making the integrated cutting and loading function of the continuous miner indispensable. Simultaneously, environmental regulations pushing for cleaner mining practices, alongside the inherent risks associated with underground operations, solidify the move towards tele-remote and automated systems, which are key market accelerators.

Restraints fundamentally shape the adoption timeline, with the most critical being the massive upfront investment required for purchasing and integrating advanced continuous miner technology, particularly the fully automated or battery-electric variants, posing a barrier to entry for smaller mining companies. Furthermore, the specialized skillset required for operating and maintaining these complex machines necessitates substantial investment in training, adding to operational costs. Commodity price volatility also acts as a critical dampener; when coal or mineral prices drop, mining companies frequently defer capital expenditure decisions, directly impacting new equipment procurement cycles and manufacturer revenues.

Opportunities for market growth are strongly tied to technological innovation and diversification. The push for electrification represents a major opportunity, as battery-powered continuous miners eliminate diesel emissions, drastically improving underground air quality and reducing ventilation costs, making them highly desirable for modern, environmentally conscious mines. Furthermore, the integration of advanced data analytics, IoT, and remote diagnostics into continuous miners offers manufacturers avenues for high-margin service contracts and performance guarantees, transforming the business model from equipment sales to comprehensive productivity partnerships. These forces collectively dictate market trajectory, pushing innovation towards greater autonomy, sustainability, and data integration.

Segmentation Analysis

The Continuous Miner Market is systematically segmented based on power source, cutting height, weight class, and end-use application, providing clarity on regional preferences and technological maturity. The segmentation by power source, primarily electric and diesel/hybrid, dictates operational cost and environmental impact, with electric models dominating due to lower running costs and reduced emissions, especially in highly regulated markets. Cutting height segmentation (low, medium, and high seam) is crucial as it directly relates to geological conditions and specific mine layouts, ensuring optimal machine fit for maximum extraction efficiency. End-use segmentation clearly defines the primary consumers, ranging from major coal producers to niche industrial mineral operations, allowing manufacturers to tailor machine specifications and marketing efforts precisely to user needs.

- By Power Source:

- Electric

- Diesel/Hybrid

- Battery-Electric

- By Cutting Height (Seam Thickness):

- Low Seam (Under 1.5 meters)

- Medium Seam (1.5 meters to 2.5 meters)

- High Seam (Above 2.5 meters)

- By Type of Operation:

- Room and Pillar Mining

- Development Mining

- By End-Use Application:

- Coal Mining (Thermal and Metallurgical)

- Industrial Minerals (Potash, Salt, Gypsum)

Value Chain Analysis For Continuous Miner Market

The value chain for the Continuous Miner Market begins with upstream activities focused on the procurement of specialized raw materials, including high-strength steel alloys, proprietary hydraulic components, and advanced electronic sensor technology required for construction. Key upstream suppliers include steel manufacturers, specialized component providers (e.g., Bosch Rexroth for hydraulics, Siemens for electrical controls), and advanced manufacturing service providers. Efficiency in this stage relies heavily on securing stable supply contracts and maintaining high quality standards for fatigue-resistant components necessary for harsh underground environments. Managing commodity price fluctuation, particularly for steel and copper, is paramount for maintaining manufacturer profitability throughout the fabrication process.

The central phase involves Original Equipment Manufacturers (OEMs) who design, assemble, and rigorously test the continuous miners. This phase is characterized by intense research and development investment focused on improving cutting efficiency, enhancing safety features (e.g., methane detection, dust suppression), and integrating automation technologies (e.g., remote control, telemetry). Distribution channels are highly specialized, often involving a combination of direct sales for major contracts and an extensive network of regional dealers or exclusive distributors who handle sales, financing, installation, and critical post-sale support. Direct channels are preferred for high-value custom orders to large multinational mining corporations, ensuring tight control over contract execution and relationship management.

Downstream activities are dominated by comprehensive aftermarket services, which are critical revenue streams for OEMs. These services include the supply of high-wear parts (cutting picks, tracks), major component overhauls, training programs for technical staff, and predictive maintenance contracts utilizing remote diagnostics. The effectiveness of the indirect distribution channel—which comprises authorized service centers and parts distributors—is crucial for minimizing equipment downtime. Potential customers (end-users) place immense value on robust, localized service support, making the quality and speed of downstream support a defining competitive differentiator in the procurement process for continuous miners.

Continuous Miner Market Potential Customers

The primary consumers and potential customers of continuous miners are large-scale mining corporations specializing in underground extraction, spanning both publicly traded multinational entities and state-owned enterprises focused on securing long-term resource supply. These customers operate vast, multi-seam mines where productivity and safety compliance are critical operational metrics. Specifically, coal mining companies, particularly those involved in high-volume thermal coal extraction for power generation or metallurgical coal production for steel manufacturing, constitute the largest buyer group globally, due to the machine’s suitability for room and pillar techniques common in coal seams.

A growing segment of potential customers includes operators in the industrial minerals sector, such as companies extracting potash (for fertilizer production), salt, and gypsum. As these industries seek to modernize extraction methods, replacing less efficient mechanical or drill-and-blast methods with continuous mining offers substantial gains in operational efficiency and purity of the extracted material. These customers often require specialized, often smaller, continuous miner models tailored for non-coal environments, which may necessitate different material handling systems and dust control mechanisms, driving customization requirements within the market.

Furthermore, government-owned or state-backed mining corporations, particularly prevalent in countries such as China, India, and parts of Eastern Europe, represent massive potential customers. These entities often engage in significant fleet modernization projects, driven by national mandates to improve miner safety and increase domestic resource output. Their procurement decisions are frequently large-volume and are highly sensitive to financing terms and long-term service agreements, making them strategic targets for global equipment manufacturers seeking sustained revenue streams in emerging markets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Komatsu Ltd. (Joy Global Inc.), Sandvik AB, Epiroc AB, Liebherr Group, China Coal Technology and Engineering Group Corp. (CCTEG), Sany Heavy Equipment International Holdings Co. Ltd., XCMG Group, ZMJ (Zhengzhou Coal Mining Machinery Group Co., Ltd.), Eickhoff Bergbautechnik GmbH, Deilmann-Haniel Mining Systems GmbH, P&H Mining Equipment (acquired by Komatsu), Metso Outotec, FLSmidth, Famur Group, Hitachi Construction Machinery Co., Ltd., Jennmar Corporation, DSI Underground, Schramm, Inc., and McLanahan Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Continuous Miner Market Key Technology Landscape

The technological landscape of the Continuous Miner Market is rapidly evolving, driven primarily by the need for enhanced safety, maximized uptime, and reduced operational expenditure, focusing on three major pillars: automation, electrification, and data integration. Automation includes sophisticated guidance systems utilizing inertial navigation and laser scanning for precise heading control and navigation in zero-visibility conditions, ensuring accurate cutting paths and minimizing dilution. This shift minimizes the physical presence of personnel near the face, inherently reducing catastrophic risk potential. The adoption of advanced, high-efficiency AC motors over traditional DC systems is also standard, offering better torque control and energy savings, which is vital for deep mine operations where power infrastructure is often strained. The continuous improvement in cutting drum and pick technology, using specialized carbide inserts and optimized cutting patterns, significantly boosts penetration rates and reduces wear-and-tear, directly impacting productivity metrics.

Electrification is reshaping the market, moving away from heavy dependence on diesel or trailing cable electric systems toward robust, high-capacity battery-electric continuous miners. Modern battery technology, often employing advanced lithium-ion or customized lithium-polymer chemistries, offers sufficient power density and operational range to cover full shifts without necessitating cumbersome cable management or frequent recharging interruptions. This transition dramatically lowers heat generation and eliminates toxic diesel particulate matter (DPM) underground, reducing the demand on costly ventilation systems and directly improving air quality compliance. Manufacturers are aggressively investing in fast-charging infrastructure solutions and modular battery swap systems to ensure seamless integration into existing mine logistics, addressing one of the major deployment hurdles.

Data integration and the Internet of Things (IoT) represent the nervous system of modern continuous miners. Advanced sensor arrays capture real-time operational data—such as cutting pressure, vibration spectrum, motor current, and geological feedback—which is transmitted via high-speed underground wireless networks (e.g., Leaky Feeder or proprietary mesh networks) to centralized control systems. This data facilitates high-level analytics, enabling predictive maintenance schedules and allowing remote operators to adjust machine settings proactively for optimal performance. Furthermore, specialized software platforms integrate the continuous miner data with other mine-wide systems (e.g., ventilation, conveyor systems, personnel tracking) to create a holistic, intelligent mining environment, ensuring that the machine operates not in isolation but as a highly coordinated component of the overall production schedule.

Regional Highlights

Regional dynamics heavily influence the adoption rate and technological specifications of continuous miners, reflecting variations in geological conditions, labor costs, and regulatory frameworks across the globe. Asia Pacific (APAC) stands out as the largest market due to the high volume of coal and industrial mineral extraction, particularly in China and India, where continuous miners are essential for scaling up production capacity in deep, mechanized mines. While price sensitivity remains a factor in APAC, there is increasing demand for heavy-duty, high-capacity miners that offer robust durability and proven reliability over sophisticated automation features, though major Australian operations are global leaders in full autonomy deployment.

North America (NA) and Europe represent mature markets characterized by stringent safety and environmental regulations, driving intense investment in fully automated, tele-remote, and battery-electric continuous miners. In NA, high labor costs make the economic case for automation compelling, necessitating equipment that minimizes human presence at the working face. European operations, particularly in Germany and Poland, prioritize equipment that meets the highest environmental standards, making zero-emission electric machines essential for new purchases. These regions serve as critical testing grounds and early adopters for next-generation mining technology.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions for continuous miner adoption, driven primarily by expanding industrial mineral extraction (e.g., potash in LATAM) and the modernization of select coal mining operations. These regions often require rugged, easily maintainable equipment, frequently relying on hybrid power systems where electrical infrastructure is underdeveloped or inconsistent. Market growth here is intrinsically linked to foreign direct investment in large-scale resource projects and the implementation of mining sector reforms aimed at improving efficiency and safety standards to international levels.

- Asia Pacific (APAC): Dominant market share and highest growth rate; driven by massive coal production in China, India, and Indonesia; strong demand for high-capacity, durable electric miners. Australia leads in remote and autonomous deployment for hard rock and coal.

- North America (NA): Leading region for adopting advanced automation and tele-remote technology; investment driven by high labor costs and stringent safety mandates (MSHA); strong shift towards battery-electric models.

- Europe: Focus on safety compliance and environmental sustainability; strong demand for zero-emission and highly controlled equipment; stable market focused on modernizing existing coal and potash mines.

- Latin America (LATAM): Emerging demand fueled by industrial mineral extraction (potash, salt); market growth dependent on infrastructure development and adoption of mechanized mining techniques.

- Middle East & Africa (MEA): Growth potential in high-grade coal and industrial mineral deposits; initial market penetration relies on robust, easy-to-maintain hybrid and diesel-powered equipment due to varying infrastructure quality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Continuous Miner Market.- Caterpillar Inc.

- Komatsu Ltd. (Joy Global Inc.)

- Sandvik AB

- Epiroc AB

- Liebherr Group

- China Coal Technology and Engineering Group Corp. (CCTEG)

- Sany Heavy Equipment International Holdings Co. Ltd.

- XCMG Group

- ZMJ (Zhengzhou Coal Mining Machinery Group Co., Ltd.)

- Eickhoff Bergbautechnik GmbH

- Deilmann-Haniel Mining Systems GmbH

- P&H Mining Equipment

- Metso Outotec

- FLSmidth

- Famur Group

- Hitachi Construction Machinery Co., Ltd.

- Jennmar Corporation

- DSI Underground

- Schramm, Inc.

- McLanahan Corporation

Frequently Asked Questions

Analyze common user questions about the Continuous Miner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of continuous miners?

The primary driver is the necessity for enhanced operational efficiency and safety in underground mining, as continuous miners integrate cutting and loading into one step, significantly increasing productivity while enabling remote operation to protect personnel.

How are battery-electric continuous miners impacting market sustainability?

Battery-electric miners eliminate diesel emissions and reduce heat generation underground, drastically improving air quality and decreasing reliance on costly, high-volume ventilation systems, thus lowering operating expenses and aligning with global decarbonization goals.

Which geographical region holds the largest market share for continuous miners?

The Asia Pacific (APAC) region currently holds the largest market share, driven by extensive coal mining activities and modernization efforts in countries like China, India, and Australia, demanding high-capacity extraction machinery.

What role does Artificial Intelligence (AI) play in modern continuous miners?

AI is crucial for predictive maintenance, analyzing sensor data to preempt equipment failure, and enabling advanced autonomous navigation and optimal real-time cutting adjustments, thereby maximizing uptime and extraction yield.

What is the difference between room and pillar mining and longwall mining regarding continuous miner use?

Continuous miners are the core equipment used exclusively in room and pillar mining to cut precise entries and panels. Longwall mining uses a shearer to extract coal from a large face, making continuous miners non-applicable for the primary extraction method in longwall sections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager