Continuous Ship Unloader Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431535 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Continuous Ship Unloader Market Size

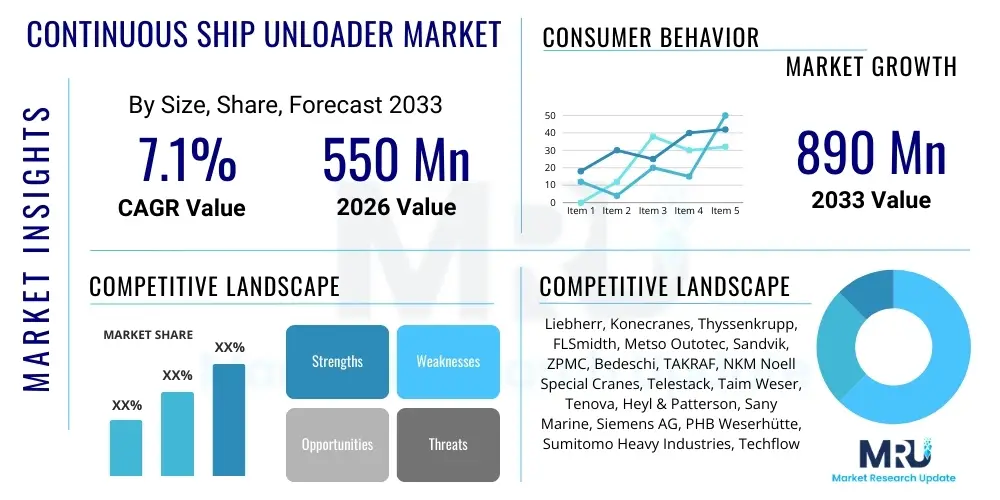

The Continuous Ship Unloader Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% between 2026 and 2033. The market is estimated at USD 550 Million in 2026 and is projected to reach USD 890 Million by the end of the forecast period in 2033. This steady expansion is primarily fueled by increasing global seaborne trade volumes of bulk commodities such as iron ore, coal, and grains, necessitating highly efficient, rapid, and environmentally compliant port handling equipment. Investments in new port infrastructure and the modernization of aging terminal facilities across Asia Pacific and emerging economies are crucial factors driving this financial trajectory, emphasizing the shift from traditional grab unloaders to high-capacity continuous systems for optimized logistics performance and reduced demurrage costs.

Continuous Ship Unloader Market introduction

The Continuous Ship Unloader (CSU) Market encompasses the design, manufacturing, deployment, and servicing of specialized port machinery utilized for the efficient, high-volume transfer of bulk solid materials from ships to shore storage or conveyance systems. CSUs, distinct from conventional grab-based systems, operate continuously, ensuring higher average unloading rates, reduced material spillage, lower dust emissions, and minimized power consumption per ton of material handled. These sophisticated machines are essential for terminals handling massive quantities of free-flowing and semi-free-flowing materials like mineral concentrates, agricultural products, and energy sources, providing a crucial link in the global supply chain for raw materials.

Major applications for CSUs span across critical industrial sectors, including power generation (coal handling), steel production (iron ore and pellets), agriculture (grain and feedstuffs), and infrastructure development (cement and clinker). The primary benefits of adopting CSU technology include superior operational efficiency due to uninterrupted material flow, enhanced environmental compliance through enclosed conveyance mechanisms, and significant savings in operational expenditures (OPEX) attributed to lower maintenance frequency and automated operations. The inherent capability of CSUs to maintain high unloading speeds even in the lower holds of vessels dramatically reduces vessel turnaround time, which is a major financial incentive for terminal operators globally.

Key driving factors accelerating market adoption include global infrastructure development initiatives, particularly in developing nations, leading to increased demand for bulk commodities. Furthermore, stringent environmental regulations imposed by international maritime organizations and local port authorities are compelling operators to replace older, dust-generating equipment with enclosed, continuous systems. Technological advancements, notably integration with automation systems, advanced sensors, and predictive maintenance capabilities, are enhancing the reliability and productivity of CSUs, further solidifying their position as the preferred solution for high-throughput bulk material handling at major global ports and dedicated industrial terminals.

Continuous Ship Unloader Market Executive Summary

The Continuous Ship Unloader (CSU) Market is defined by intense technological competition focused on increasing handling capacity, improving energy efficiency, and integrating digital solutions for fully autonomous operation. Business trends indicate a strong move towards modular designs and standardized components to facilitate easier installation and maintenance, while strategic partnerships between specialized machinery manufacturers and technology providers (focusing on IoT and AI) are becoming common to deliver integrated smart terminal solutions. The market structure is moderately consolidated, with major players competing primarily on after-sales service quality, customization capabilities, and proven reliability in harsh maritime environments. Sustainability has emerged as a critical business imperative, driving the demand for electric-powered CSUs over traditional diesel-hydraulic models.

Regionally, Asia Pacific maintains the dominant market share, driven by extensive port expansion projects in China, India, and Southeast Asian nations that are rapidly industrializing and heavily reliant on imported raw materials. North America and Europe, while having slower market growth in terms of new construction, show significant demand for modernization and refurbishment, focusing on high-efficiency, low-emission replacement units to meet stringent regional environmental standards and optimize existing terminal throughput. Emerging markets in Latin America and the Middle East and Africa (MEA) are witnessing increased investment in dedicated bulk handling terminals, especially for mineral export and fertilizer import, presenting substantial long-term growth opportunities.

Segmentation trends reveal a persistent high demand for Screw Type CSUs due to their efficiency in handling abrasive and fine materials like cement and grain, coupled with minimal spillage. However, Bucket Wheel Type and Chain Bucket Type CSUs are retaining prominence for ultra-high-capacity handling of large-volume commodities like coal and iron ore, especially in large-scale dedicated mining ports. In terms of capacity, the 1000-2500 Tonnes Per Hour (TPH) segment currently dominates, representing the sweet spot for general-purpose high-volume ports, although there is a notable increase in orders for systems exceeding 2500 TPH to service the latest generation of Capesize and VLOC vessels.

AI Impact Analysis on Continuous Ship Unloader Market

Common user questions regarding AI’s impact on Continuous Ship Unloader systems primarily revolve around operational autonomy, predictive maintenance accuracy, and optimization of unloading cycles under variable conditions. Users are deeply concerned with how AI integration can maximize throughput consistency regardless of material characteristics or tide variations, while simultaneously reducing the need for direct human intervention in hazardous environments. Key concerns also include the cybersecurity implications of connecting vital port machinery to centralized AI networks and the cost-benefit analysis of retrofitting existing conventional CSUs with advanced sensor packages and machine learning algorithms. Users are seeking validated evidence regarding AI's ability to minimize machine downtime through precise failure prediction and its role in enhancing energy efficiency by optimizing motor speeds and movements based on real-time power consumption data and fluctuating demand profiles.

The influence of Artificial Intelligence (AI) on the Continuous Ship Unloader market is transformative, shifting operations from reactive monitoring to proactive, intelligent performance management. AI algorithms, particularly those leveraging machine learning and deep learning models, are being applied to analyze vast streams of operational data—including load cell readings, motor current consumption, vibration analysis, and visual data from onboard cameras. This analytical capability allows CSUs to dynamically adjust operational parameters, such as boom position, slewing speed, and digging depth, in real-time to maintain peak efficiency throughout the unloading process, even when dealing with difficult or compacted materials. This dynamic optimization significantly increases the average net unloading rate (ANUR) while simultaneously reducing structural stress on the machinery.

Furthermore, AI is pivotal in advancing Condition Monitoring (CM) and Predictive Maintenance (PdM) within the CSU sector. By correlating sensor data with historical failure patterns, AI models can accurately predict component degradation (e.g., wear on bucket chain links, gearbox issues, or rope fatigue) days or weeks before catastrophic failure occurs. This capability enables terminal operators to schedule maintenance precisely during planned downtime, eliminating unexpected breakdowns that lead to costly vessel delays. The resulting reduction in unscheduled downtime, coupled with AI-driven optimization of power usage, positions AI as a core technology for future CSU development, ensuring higher asset utilization and lower total cost of ownership (TCO).

- AI optimizes unloading trajectories and speed based on 3D scanning of the vessel hold, maximizing bulk recovery and minimizing cycle time.

- Machine learning enhances predictive maintenance capabilities, forecasting component failures in gearboxes and conveyance systems with high accuracy, reducing unplanned downtime by up to 20%.

- AI-driven automation supports remote operation and full autonomy, improving operator safety and allowing single-operator management of multiple high-capacity units.

- Integration of computer vision systems with AI algorithms detects and classifies foreign objects (e.g., dunnage, debris) entering the unloading system, preventing internal damage.

- Artificial Neural Networks (ANNs) optimize energy consumption by dynamically balancing mechanical loads against motor power output, leading to significant reductions in specific energy use per ton.

- AI systems analyze environmental factors (wind, dust levels) and adjust operations automatically to maintain compliance and material integrity, crucial for agricultural products.

- Implementation of sophisticated AI models is necessary for cybersecurity protection of integrated operational technology (OT) systems within smart ports handling critical infrastructure.

DRO & Impact Forces Of Continuous Ship Unloader Market

The Continuous Ship Unloader (CSU) market is propelled by key drivers such as escalating global commodity trade, stringent environmental mandates demanding cleaner handling solutions, and the operational necessity for faster vessel turnaround times, directly impacting profitability for port operators. However, growth is restrained by the high initial capital expenditure required for purchasing and installing these massive, specialized machines, alongside the complexity and cost associated with maintaining sophisticated automated systems. The primary opportunities lie in the modernization and replacement cycle in established markets, the growth of greenfield ports in developing economies, and the increasing focus on customized, high-capacity CSUs capable of handling next-generation mega-vessels. These forces create a dynamic environment where investment decisions are heavily weighted by the long-term operational efficiencies and regulatory compliance offered by continuous systems.

Drivers are rooted in macroeconomic factors and regulatory pressure. The sustained urbanization and industrial expansion in Asia require massive imports of raw materials, maintaining pressure on ports to scale up throughput. Environmentally, the push towards enclosed systems to reduce particulate matter emissions (dust pollution) and noise levels is making CSUs mandatory in many urban-adjacent ports, rendering older equipment obsolete. Furthermore, as shipping lines deploy larger vessels (like Valemax and Chinamax), ports must invest in ultra-high-capacity unloaders to prevent efficiency bottlenecks, making continuous systems the only viable option for achieving target unloading rates exceeding 3,000 TPH.

Restraints are primarily financial and technological. The initial investment for a modern CSU can run into tens of millions of dollars, posing a significant barrier to entry for smaller port operators or those operating under tight budget constraints. The advanced control systems and specialized mechanical components of CSUs demand highly trained technicians and expensive spare parts, contributing to elevated maintenance complexity and cost. Additionally, port infrastructure limitations, such as restricted quay space or insufficient berth depth, can sometimes restrict the deployment of the largest, most efficient CSU models, forcing operators to compromise on capacity.

Opportunities are strongly aligned with innovation and regional expansion. The development of lighter, modular, and more energy-efficient models (e.g., all-electric CSUs) is making continuous unloading technology more accessible to a broader range of ports. The massive potential for system integration, leveraging IoT and AI to achieve true automation, opens up opportunities for manufacturers to offer high-value software and service contracts. Geographically, emerging economies that are currently heavily investing in export-oriented terminals for mining and energy projects offer significant greenfield sales prospects, particularly in Africa and Latin America, where bulk export capacity is rapidly expanding.

Segmentation Analysis

The Continuous Ship Unloader market is comprehensively segmented based on Type, Application (material handled), and Capacity, allowing for granular analysis of demand patterns driven by specific industrial requirements and logistical constraints. The segmentation by Type—including Screw, Bucket Wheel, Chain Bucket, and others—reflects the mechanical approach utilized to lift and convey the bulk material, with each type optimized for different material characteristics, such as abrasiveness, flowability, and density. This segmentation is crucial for manufacturers tailoring their designs to specific client needs, for instance, high-density iron ore versus light, fine grain materials.

Segmentation by Application dictates the operational environment and material volume. Coal and Iron Ore handling constitute the largest segment globally due to the sheer volume of these commodities traded, necessitating ultra-high-capacity CSUs operating under harsh, continuous duty cycles. Conversely, segments like Grain and Cement require precision handling to minimize contamination and dust, driving demand for enclosed Screw Type unloaders. Capacity segmentation is vital for matching the equipment size to the predominant vessel classes a port services, ranging from smaller feeders up to Very Large Ore Carriers (VLOCs), directly influencing terminal efficiency metrics and investment scales.

- By Type:

- Screw Type Continuous Ship Unloaders (CSUs)

- Bucket Wheel Type Continuous Ship Unloaders (CSUs)

- Chain Bucket Type Continuous Ship Unloaders (CSUs)

- Pneumatic Type Continuous Ship Unloaders (Pneumatic Systems primarily for fine powders)

- Others (Combination and specialized designs)

- By Application (Material Handled):

- Coal and Lignite

- Iron Ore and Pellets

- Grain (Wheat, Corn, Soybeans)

- Cement, Clinker, and Gypsum

- Fertilizers and Chemicals (Phosphate rock, Potash)

- Others (Alumina, Bauxite, Mineral Concentrates)

- By Capacity (Tonnes Per Hour - TPH):

- Below 1000 TPH (Suitable for smaller ports and specialized terminals)

- 1000 TPH to 2500 TPH (Standard high-throughput units for Panamax/Capesize vessels)

- Above 2500 TPH (Designed for Super-Capesize and VLOC/ULOC vessels)

Value Chain Analysis For Continuous Ship Unloader Market

The value chain for the Continuous Ship Unloader market begins with specialized upstream suppliers providing high-quality, durable components. This includes manufacturers of high-performance steel structures, heavy-duty mechanical components such as gearboxes, bearings, and specialized conveyor belts or screws designed for abrasive bulk handling environments. Critical electronic and control systems components, including Programmable Logic Controllers (PLCs), advanced sensors (for load and position monitoring), and drive systems (motors and variable frequency drives) are also supplied upstream. Quality control, material sourcing, and reliability of these upstream components directly impact the lifespan and performance guarantee of the final CSU product, leading manufacturers to form long-term, strategic sourcing agreements with established component suppliers.

The core of the value chain is the manufacturing and assembly stage, performed by Original Equipment Manufacturers (OEMs). This involves complex engineering design, fabrication, precise integration of mechanical, electrical, and hydraulic systems, and rigorous testing before installation. Direct distribution is the prevailing channel, where OEMs manage the entire sales, customization, and commissioning process. Given the highly specialized and capital-intensive nature of CSUs, sales often involve long procurement cycles and direct negotiation with port authorities, terminal operating companies, or large industrial end-users (like power generation utilities or mining companies). Indirect channels may occasionally involve engineering, procurement, and construction (EPC) firms acting as intermediaries, managing the procurement and integration of the CSU into a larger port development project.

The downstream analysis focuses heavily on deployment, commissioning, and, most importantly, post-sales service and maintenance. Installation requires specialized heavy lifting and marine construction expertise, often performed by the OEM or certified contractors. The profitability of CSUs is increasingly shifting towards the aftermarket segment, including scheduled maintenance, repair, spare parts supply, and system upgrades (especially retrofitting older units with modern automation and IoT capabilities). The direct relationship between the OEM and the terminal operator is critical downstream, ensuring rapid response to technical issues, providing operational training, and offering customized long-term service agreements based on performance metrics, driving customer lifetime value and establishing a competitive edge.

Continuous Ship Unloader Market Potential Customers

The primary consumers and end-users of Continuous Ship Unloaders are entities involved in high-volume seaborne trade of bulk commodities. This includes major international and regional port authorities responsible for managing public terminals, and specialized private terminal operators who lease space and manage cargo handling on behalf of third parties. These customers prioritize equipment that offers the highest throughput, minimizes vessel downtime, and ensures adherence to increasingly strict environmental standards regarding dust and noise pollution. Their purchasing decisions are heavily influenced by the equipment's proven Mean Time Between Failure (MTBF) and overall energy efficiency.

A significant segment of potential customers comprises large industrial end-users that own and operate dedicated captive terminals. This includes major global mining companies (e.g., iron ore and coal producers), integrated steel producers, large-scale power generation utilities reliant on seaborne coal or biomass, and multinational agricultural traders who operate their own dedicated grain handling facilities. For these customers, the CSU is a mission-critical asset directly impacting their production chain and raw material security. Their specific demands often involve customization for specialized materials and extreme operational reliability under 24/7 duty cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 550 Million |

| Market Forecast in 2033 | USD 890 Million |

| Growth Rate | 7.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Liebherr, Konecranes, Thyssenkrupp, FLSmidth, Metso Outotec, Sandvik, ZPMC, Bedeschi, TAKRAF, NKM Noell Special Cranes, Telestack, Taim Weser, Tenova, Heyl & Patterson, Sany Marine, Siemens AG, PHB Weserhütte, Sumitomo Heavy Industries, Techflow, GOTTWALD Port Technology. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Continuous Ship Unloader Market Key Technology Landscape

The technological landscape of the Continuous Ship Unloader market is rapidly evolving, driven by the imperative for higher efficiency, reduced environmental impact, and seamless integration with terminal logistics systems. A critical technological shift involves the mass adoption of electric drive systems, moving away from hydraulic systems, to enhance energy efficiency, lower noise pollution, and simplify maintenance. Modern CSUs incorporate high-precision sensor arrays, including laser scanners and 3D positioning systems, to accurately map the vessel hold, optimize the digging trajectory, and ensure full cargo cleanup with minimal manual intervention. Advanced materials, such as high-strength, lightweight alloys and wear-resistant ceramics, are increasingly used in crucial handling components (screws, buckets, and chutes) to prolong operational life and reduce overall equipment weight, leading to lower structural stress and improved energy efficiency.

Automation and remote control capabilities form another core technological pillar. Today’s CSUs feature sophisticated PLC-based control systems that manage anti-sway functionalities, collision avoidance (between the unloader and the ship or quay), and automated sequence controls for the entire unloading process. The application of Variable Frequency Drives (VFDs) ensures precise motor control, optimizing power consumption based on the actual load being handled. This level of control allows for continuous flow management, crucial for integration with subsequent conveying systems on the pier, preventing bottlenecks and maximizing the efficiency of the entire terminal infrastructure. The focus is now on achieving Level 4 and Level 5 automation, enabling fully autonomous unloading operations supervised remotely from a central control room.

Furthermore, the incorporation of Industrial Internet of Things (IIoT) frameworks is standard practice. IIoT enables real-time data collection from hundreds of sensors (vibration, temperature, current draw) on critical mechanical components. This data is fed into cloud-based platforms where AI and machine learning algorithms perform complex data analysis for condition-based monitoring and predictive maintenance. This technological capability reduces operational risks, significantly extends the intervals between major overhauls, and transitions the maintenance strategy from time-based to condition-based. Future technological development is expected to concentrate heavily on integrating CSUs with wider port logistics systems, including automatic communication with stackers, reclaimers, and inventory management systems, creating a fully synchronized, "smart" bulk terminal ecosystem.

Regional Highlights

Regional dynamics heavily influence the demand for Continuous Ship Unloaders, reflecting varied stages of industrial maturity, differing levels of commodity reliance, and regional environmental regulatory stringency. The distribution of demand is clearly bifurcated between high-volume greenfield development in emerging regions and technology-driven replacement and modernization in established markets.

- Asia Pacific (APAC): Dominant Market Share and Growth Engine

APAC represents the largest and fastest-growing market due to rapid industrialization, massive infrastructure projects, and reliance on imported bulk materials (especially coal for power and iron ore for steel). Countries like China, India, Indonesia, and Vietnam are constantly expanding or constructing new ports to handle the immense commodity flow. The region’s growth is characterized by high demand for ultra-high-capacity CSUs (2500 TPH+) to service the largest vessel classes. Environmental pressure, particularly in China and India, is also driving accelerated adoption of enclosed, eco-friendly CSUs to replace older grab cranes, underpinning consistent investment in continuous systems technology.

- China and India are key investment centers due to unprecedented bulk import volumes.

- Strong governmental focus on port modernization and logistics efficiency drives rapid adoption of automated systems.

- Demand is high across all capacity segments, specifically for coal, iron ore, and grain handling.

- North America: Replacement and High Efficiency Focus

The North American market is mature, and demand is predominantly driven by replacement cycles, optimization of existing assets, and strict environmental compliance. Operators in the U.S. and Canada prioritize systems offering maximum operational safety, minimal energy consumption, and superior dust control, often opting for Screw Type CSUs for sensitive materials like grain and fertilizers. Investments are focused on retrofitting existing terminals with modern automation packages and digital monitoring tools rather than constructing entirely new greenfield facilities, prioritizing the long-term operational cost savings offered by electric and highly automated units.

- Focus on upgrading existing infrastructure and enhancing performance efficiency.

- Stringent environmental regulations necessitate enclosed handling systems, favoring CSUs over conventional alternatives.

- Demand concentrated in major grain export ports and coastal coal/mineral receiving terminals.

- Europe: Environmental Leadership and Automation

Europe’s market is characterized by a strong emphasis on sustainability, digitalization, and integration. European ports, particularly the major hubs in the North Sea region (e.g., Rotterdam, Antwerp), are leaders in developing "Green Ports" initiatives. This drives demand for completely electric, low-noise CSUs and highly sophisticated automation technologies, including remote monitoring and predictive maintenance solutions. While overall volume growth is slower than in APAC, the value of the market is high, reflecting the preference for premium, highly customized, and technologically advanced equipment that meets the highest safety and environmental standards.

- Market driven by environmental compliance and the adoption of fully electric, emission-free equipment.

- High investment in digital twinning, remote operations, and AI-driven efficiency software.

- Focus on handling specialized bulk cargoes and sustainable energy materials (e.g., biomass).

- Latin America (LATAM): Resource Export Driven Growth

LATAM presents significant opportunities, particularly in countries like Brazil, Chile, and Peru, which are major global exporters of iron ore, copper concentrates, and agricultural products. Market activity is heavily tied to global commodity prices, driving investment in new, dedicated bulk export terminals and the expansion of existing facilities to improve global competitiveness. The demand profile is generally skewed towards robust, high-capacity Chain Bucket or Bucket Wheel systems designed for aggressive, high-throughput loading and unloading of mineral cargoes destined for Asian markets.

- Growth is directly linked to the expansion of mining and agricultural export capacity.

- High demand for heavy-duty, high-capacity machinery capable of handling abrasive mineral products.

- Infrastructure projects are often backed by international mining and commodity trading corporations.

- Middle East and Africa (MEA): Strategic Port Development

The MEA region is experiencing increasing investment in strategic port development, supporting regional logistics hubs and domestic industrial expansion. The Middle East focuses on infrastructure for importing construction materials (cement, clinker) and exporting refined products, while Africa, particularly South Africa and West Africa, is a massive hub for mineral and raw material export. Demand is rising for reliable, medium to large-capacity CSUs to professionalize bulk handling operations and reduce material losses, often driven by government-led initiatives to improve national logistics efficiency.

- Rising investment in new coastal infrastructure and dedicated industrial ports.

- Specific demand for CSUs to handle strategic materials like fertilizers, clinker, and mining products.

- Market growth is supported by large-scale sovereign wealth fund investments in logistics infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Continuous Ship Unloader Market.- Liebherr Group

- Konecranes Oyj

- Thyssenkrupp Industrial Solutions AG

- FLSmidth A/S

- Metso Outotec Corporation

- Sandvik AB

- ZPMC (Zhenhua Port Machinery Company)

- Bedeschi S.p.A.

- TAKRAF GmbH (Tenova Group)

- NKM Noell Special Cranes GmbH

- Telestack Ltd.

- Taim Weser S.A.

- Tenova S.p.A.

- Heyl & Patterson Inc.

- Sany Marine Heavy Industry Co., Ltd.

- Siemens AG (Automation and Drive Systems Provider)

- PHB Weserhütte GmbH (PWH)

- Sumitomo Heavy Industries, Ltd.

- Techflow Engineers Private Limited

- GOTTWALD Port Technology (now part of Konecranes)

Frequently Asked Questions

Analyze common user questions about the Continuous Ship Unloader market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary operational advantage of a Continuous Ship Unloader (CSU) compared to a conventional grab crane?

The primary advantage of a CSU is its superior, consistent throughput rate achieved through uninterrupted material transfer, significantly reducing vessel turnaround time and operating costs. CSUs also offer enhanced environmental performance through reduced dust emissions and spillage.

Which type of CSU is best suited for handling fine, abrasive materials like cement or grains?

The Screw Type Continuous Ship Unloader is generally considered the most suitable for fine, abrasive materials such as cement, clinker, and grains. Screw types provide a fully enclosed handling path, minimizing dust generation and contamination, while achieving high efficiency with good flowable bulk solids.

How is the Continuous Ship Unloader market addressing global sustainability mandates?

The market is addressing sustainability mandates through the development and deployment of all-electric CSUs, which eliminate direct carbon emissions and significantly reduce noise pollution. Furthermore, enclosed conveying systems drastically minimize fugitive dust emissions, meeting stringent port environmental regulations worldwide.

What role does Artificial Intelligence (AI) play in modern CSU operations?

AI is crucial for optimizing CSU performance by enabling predictive maintenance through real-time sensor data analysis, maximizing throughput via dynamic trajectory adjustments within the ship's hold, and facilitating advanced levels of remote control and full operational autonomy, thereby increasing safety and asset utilization.

Which geographical region exhibits the strongest demand for new high-capacity Continuous Ship Unloaders?

The Asia Pacific (APAC) region currently exhibits the strongest demand for new high-capacity CSUs. This is driven by massive governmental investments in new port infrastructure and the necessity to handle high-volume imports of raw materials like iron ore and coal required for rapid regional industrial growth and expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager