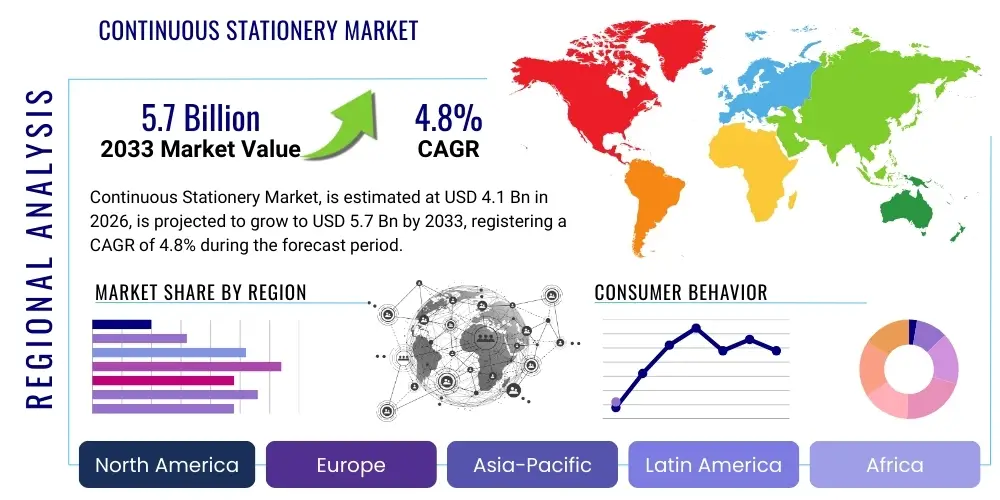

Continuous Stationery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434660 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Continuous Stationery Market Size

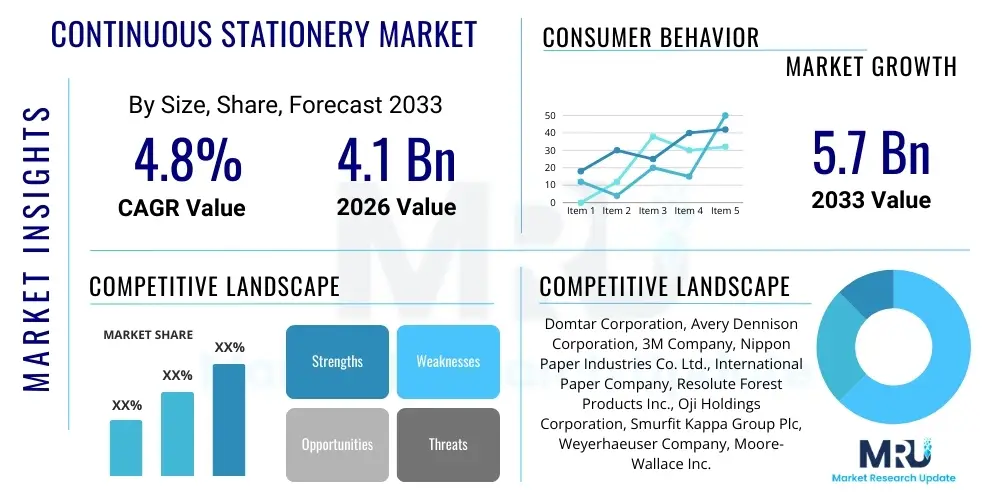

The Continuous Stationery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 5.7 Billion by the end of the forecast period in 2033.

Continuous Stationery Market introduction

The Continuous Stationery Market encompasses specialized paper products designed for high-volume, continuous printing operations, primarily utilizing dot matrix, line printers, or thermal transfer technologies. These products, characterized by their perforated edges and tractor feed holes, include multipart forms, invoices, payroll slips, statements, and standardized record-keeping documents. Although digital transformation has significantly impacted traditional printing requirements, continuous stationery maintains vital relevance in specific sectors, particularly in supply chain logistics, high-security financial record production, legacy systems integration (ERP and mainframe environments), and environments requiring carbon copies or physical archival consistency. The enduring demand stems from the necessity to process large batches of identical or sequentially numbered documents efficiently and cost-effectively, especially where older, robust printing infrastructure is already established and mission-critical.

The primary applications of continuous stationery span across governmental agencies, banking and financial services (for standardized cheque books and account statements), healthcare (for patient records and prescription pads), and manufacturing/logistics industries (for shipping labels, packing lists, and inventory control). The product itself offers numerous operational benefits, including superior reliability in batch processing, resistance to printer jamming in high-throughput settings, and the immediate creation of multiple, legally binding hard copies without the need for secondary duplication. Furthermore, the capacity for custom pre-printing of logos, specific form fields, and security features enhances its utility in contexts demanding brand consistency and fraud prevention.

Key driving factors supporting the market's stability, despite the secular decline in general paper consumption, involve mandatory regulatory compliance in sectors like pharmaceuticals and finance, which necessitate long-term physical archival of transaction records. The expansion of e-commerce and global supply chain networks continues to generate substantial demand for continuous packing slips and thermal transfer labels, ensuring that the logistics segment remains a major consumer. Moreover, the inherent cost efficiency of continuous form printing compared to laser printing for massive, repetitive data output in specific large-scale enterprise resource planning (ERP) environments provides a persistent underpinning for market demand, particularly in developing economies where digital adoption curves are less mature than in established markets.

Continuous Stationery Market Executive Summary

The Continuous Stationery Market, while mature, exhibits resilient pockets of growth driven primarily by specialized industrial and logistical requirements rather than general office use. Current business trends indicate a definitive shift towards customized, high-security forms incorporating features like microprinting, watermarks, and security inks, addressing escalating corporate requirements for data integrity and document fraud mitigation. Geographically, the market demonstrates robust activity in the Asia Pacific region, fueled by rapid industrialization, expansion of manufacturing bases, and the resultant increase in logistics documentation required for intra-regional and global trade. Conversely, established markets in North America and Europe show a managed decline in volume, offset partially by higher revenue generation from premium, technically advanced products designed for niche applications like pharmaceutical tracking and specialized financial reporting, where form accuracy is paramount and non-negotiable.

Regional trends reveal distinct demand patterns: North America and Europe focus on consolidation and high-value, digitally integrated forms suitable for hybrid systems, linking legacy data output with digital archives. The demand here prioritizes quality, security features, and customization flexibility. In contrast, emerging economies in APAC and Latin America emphasize high-volume, cost-effective transactional forms supporting massive public sector undertakings, utility billing, and accelerating e-commerce documentation. This geographical divergence necessitates localized strategic sourcing and manufacturing capabilities for major market participants to effectively serve varied regulatory and infrastructural landscapes.

Segmentation analysis highlights the dominance of the multipart forms segment, essential for critical transactions requiring immediate hard copies for multiple stakeholders (e.g., shipping receipts, insurance claims). Technology-wise, the thermal and thermal transfer paper sub-segments are experiencing significant uplift due to their critical function in automated labeling processes within logistics and warehousing. Supplier consolidation is a notable segment trend, where larger entities are acquiring smaller, regional specialized printers to enhance geographical reach and secure long-term contractual agreements with large governmental and industrial clients, thereby maintaining market stability despite underlying volume pressures.

AI Impact Analysis on Continuous Stationery Market

User queries regarding the impact of Artificial Intelligence (AI) on the Continuous Stationery Market primarily revolve around the speed of digital displacement, the potential for AI-driven process automation to eliminate the need for physical forms, and the role of AI in optimizing remaining paper-based workflows. Key themes emerging from these analyses include concerns about the longevity of legacy hardware systems tied to continuous forms, the feasibility of using AI to interpret and digitize information captured on existing paper forms (e.g., Optical Character Recognition/Intelligent Document Processing powered by AI), and the expectation that while general administrative use of continuous stationery will diminish rapidly, high-compliance and specialized logistics segments might be indirectly optimized rather than eliminated by AI. Users are specifically keen to understand if AI can make the transition from paper to digital seamless enough to justify the upfront investment, or if the risk aversion inherent in sectors like finance and healthcare will indefinitely preserve a demand floor for physical, continuous records.

The application of AI and related technologies such as machine learning (ML) primarily targets the downstream processes associated with continuous stationery—specifically data entry, archival, and verification. AI-powered Intelligent Document Processing (IDP) solutions are rapidly maturing, enabling companies to scan massive volumes of completed continuous forms (invoices, manifests, payroll data) and extract structured data with high accuracy, minimizing human error and accelerating data ingestion into digital systems. This capability does not immediately eradicate the need for the physical forms themselves, which are often required for legal proof-of-transaction at the point of origin, but it significantly reduces the duration forms need to exist as primary records, thereby shifting value from storage to rapid digitization.

Furthermore, AI-driven predictive analytics are influencing inventory management for continuous stationery suppliers. By analyzing historical usage rates, seasonal demand spikes (e.g., tax season, holiday shipping surges), and upcoming regulatory changes, AI algorithms optimize production schedules and supply chain logistics for continuous paper, reducing waste and ensuring just-in-time delivery for high-volume users. This optimization allows manufacturers to operate more efficiently in a consolidating market environment, ensuring that the remaining demand is met with optimal resource allocation, thus maximizing profitability in specialized segments that continue to require robust physical documentation.

- AI accelerates the implementation of Intelligent Document Processing (IDP) for rapid digitization and data extraction from continuous forms, minimizing long-term physical storage needs.

- Predictive maintenance analytics, often AI-driven, extends the operational life of legacy dot matrix and line printers, indirectly supporting sustained demand for continuous stationery compatible with these systems.

- AI algorithms assist logistics companies in optimizing the use and placement of continuous thermal labels, improving inventory accuracy and reducing application errors.

- The rise of sophisticated AI-powered cybersecurity features influences the development of high-security continuous forms, incorporating AI-detectable features to combat counterfeiting.

- Process automation driven by AI may diminish low-value transactional printing but supports the resilience of high-value, mandatory compliance documentation output.

DRO & Impact Forces Of Continuous Stationery Market

The Continuous Stationery Market operates under a complex set of internal and external forces, balancing the persistent need for hard-copy archival and logistics documentation (Drivers) against the irreversible global trend of digitization and environmental mandates (Restraints). Opportunities primarily lie in serving niche high-security and customized thermal labeling applications, particularly within the booming e-commerce and specialized healthcare tracking sectors. These dynamics collectively create moderate impact forces, characterized by slow volume erosion but stable revenue generation from premium, value-added products. Key drivers include regulatory mandates requiring physical transaction records and the continued reliance on robust, cost-effective dot matrix printing infrastructure in large-scale data processing centers and supply chain environments.

Restraints fundamentally center on the widespread adoption of digital invoicing, electronic health records (EHRs), and paperless office policies enforced globally across corporate and governmental sectors. These digitization efforts significantly reduce the overall transactional volume of continuous paper needed for internal documentation. Additionally, heightened environmental consciousness and sustainability pressures compel organizations to minimize paper consumption, favoring digital alternatives where regulatory compliance permits. This pressure necessitates continuous stationery manufacturers to invest heavily in sustainable sourcing and recycling initiatives to mitigate ecological concerns and maintain market acceptance, thereby imposing additional operational complexities.

Opportunities for market growth are concentrated in the specialized high-performance segments. The rapid expansion of global e-commerce demands ever-increasing quantities of thermal transfer continuous labels for shipping, tracking, and warehousing management—a segment less susceptible to digitization displacement in the immediate term. Furthermore, the necessity for specialized security features in forms used for financial documents (cheques, statements) and high-value logistics (pharmaceutical traceability) allows manufacturers to command premium pricing. The ability to integrate advanced anti-counterfeiting technologies into continuous forms represents a substantial avenue for value creation and sustainable competitive differentiation within this mature industry.

Segmentation Analysis

The Continuous Stationery Market is fundamentally segmented based on the type of product, material, end-use application, and printing technology compatibility. The product type segmentation typically includes standard computer paper (plain or pre-printed), multipart forms (carbonless or carbon-interleaved), and specialized continuous labels (thermal, laser-compatible). Understanding these segments is crucial as they reflect divergent demand elasticity; standard transactional forms are highly sensitive to digitization, whereas specialized thermal labels and high-security multipart forms exhibit significant resilience and growth potential driven by specific industrial processes and regulatory needs. Geographic analysis further refines this view, highlighting high-volume, cost-sensitive demand in emerging economies versus high-specification, compliance-driven demand in mature markets.

Material segmentation focuses on the substrate used, primarily wood-pulp-based paper but increasingly incorporating synthetic and eco-friendly recycled content to address sustainability concerns. Crucially, the differentiation between carbonless (NCR - No Carbon Required) paper and traditional carbon-interleaved paper dictates printing quality, archival capabilities, and ease of handling, with NCR forms dominating modern multipart applications due to their cleaner handling and superior image transfer. The end-use application segmentation—including government, BFSI (Banking, Financial Services, and Insurance), transportation and logistics, and healthcare—provides deep insight into purchasing behaviors, regulatory burdens, and volume consumption patterns, directly influencing manufacturer strategic priorities and product development pipelines, particularly towards compliance-specific products.

The growth dynamics across these segments are characterized by fragmentation in demand but consolidation in supply. While overall tonnage may be flat or slightly declining, the demand for specialized, smaller-run, highly customized forms is rising, requiring manufacturers to shift towards flexible, digitized printing workflows. This transition emphasizes quality control, security integration (such as RFID integration in labels), and rapid turnaround times, positioning the market evolution as a move from a commodity-driven environment to one focused on high-specification, industrial inputs essential for complex logistical and compliance functions globally.

- By Product Type:

- Standard Continuous Computer Paper (One-part forms)

- Multipart Forms (2-part, 3-part, 4-part, and more)

- Continuous Labels and Tags (Thermal Transfer, Direct Thermal)

- Pre-printed Continuous Stationery

- By Material:

- Wood Pulp Paper

- Carbonless Paper (NCR)

- Synthetic Materials (for durability/outdoor use)

- Recycled Paper

- By Application/End-Use:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Public Sector

- Transportation and Logistics

- Healthcare and Pharmaceuticals

- Manufacturing and Industrial

- Retail and E-commerce

- By Printing Technology Compatibility:

- Dot Matrix/Line Printers

- Thermal Printers (Direct and Transfer)

- Laser (Specialized continuous forms)

Value Chain Analysis For Continuous Stationery Market

The value chain for the Continuous Stationery Market begins intensely at the upstream level with the sourcing of raw materials, primarily specialized bleached pulp, and chemical coatings necessary for carbonless (NCR) paper production and adhesive manufacturing for labels. Key upstream suppliers include large global pulp and paper corporations and specialty chemical companies providing the necessary microencapsulated dyes and developers that enable image transfer without carbon sheets. Pricing volatility in virgin wood pulp and rising energy costs for paper production present consistent cost pressures at this initial stage. Efficient upstream management involves securing long-term supply contracts and prioritizing raw material suppliers that adhere to strict environmental and sustainability certifications, a non-negotiable requirement for many institutional buyers in developed markets.

The core manufacturing and processing stage involves highly specialized printing and converting operations, where large rolls of paper are processed into continuous forms, incorporating complex steps like perforation, punching of tractor holes, folding, multi-layer collation (for multipart forms), and precise application of security features or adhesives. Distribution channels are bifurcated: direct sales channels handle high-volume, customized orders placed by major governmental bodies or large corporations (BFSI, large logistics firms) who require dedicated contractual supply. Indirect channels leverage a network of specialized office supply wholesalers, regional distributors, and e-commerce platforms to reach small to medium-sized enterprises (SMEs) and general office users requiring standard stock forms.

Downstream analysis focuses on the final consumption and eventual disposal. Continuous stationery is consumed by end-users across diverse sectors, requiring integration with specific legacy or industrial printing equipment. The efficiency of the consumption stage is often linked to the performance of the printing hardware and the smooth integration of the forms into automated processes, such as payroll or large-scale billing systems. Post-consumption, the value chain faces the challenge of managing paper waste. While standard continuous paper is recyclable, multipart forms or forms containing thermal coatings and adhesives require specific handling, necessitating robust recycling infrastructure or disposal methods, which can impact the perceived environmental footprint of the product.

Continuous Stationery Market Potential Customers

The primary customers for continuous stationery are large enterprises and governmental bodies whose operations necessitate high-volume, reliable output of physical documentation, often tied to mission-critical or regulatory functions. The most significant segment remains the Banking, Financial Services, and Insurance (BFSI) sector, which requires specialized continuous forms for checks, bank statements, proprietary forms for transactions, and secure internal documentation where physical records must be maintained for seven or more years. These institutions prioritize security features, paper quality, and guaranteed contractual supply, making them highly valuable but demanding clients.

Another robust customer base resides in the Transportation, Logistics, and E-commerce sectors. The relentless growth of global supply chains and online retail necessitates continuous thermal labels for warehousing, shipment tracking, inventory control, and manifest documentation. These customers value speed, durability (especially for external shipping labels), and compatibility with automated label application systems. The demand here is highly transactional and volume-driven, showing sustained growth proportional to the expansion of commercial shipping volumes worldwide, particularly in fast-developing regions where fulfillment centers are rapidly scaling operations.

The third major segment encompasses the Government and Public Sector, including utility companies, post offices, and national defense agencies. These entities are often slower to adopt full digitization due to infrastructure limitations, vast geographical reach, and complex regulatory archiving requirements. They represent steady, long-term contracts for standardized continuous forms, often utilized for mass utility billing, census data collection, vehicle registration, and other public service outputs. Healthcare providers, particularly hospitals and clinics, also remain potential customers, using continuous stationery for internal record-keeping, prescription pads, and laboratory result forms where immediate physical documentation is essential at the point of care, despite the trend toward electronic health records (EHRs).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 5.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Domtar Corporation, Avery Dennison Corporation, 3M Company, Nippon Paper Industries Co. Ltd., International Paper Company, Resolute Forest Products Inc., Oji Holdings Corporation, Smurfit Kappa Group Plc, Weyerhaeuser Company, Moore-Wallace Inc., Canon, Inc., R.R. Donnelley & Sons Company, BillerudKorsnäs AB, H-O Continuous Forms, Datamann Forms, Inc., Reliance Printing, Specialty Forms, Inc., Consolidated Business Forms. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Continuous Stationery Market Key Technology Landscape

The technology landscape governing the Continuous Stationery Market is bifurcated between the established printing systems that necessitate continuous forms and the specialized material science that enhances the functionality and security of the paper itself. Core printing technology remains centered around robust, high-speed dot matrix and line printers, particularly those utilized in mainframe and large-scale data center environments for batch processing of transactional data. While older, these systems offer unmatched throughput and low per-page operational cost for plain text and numerical data output, ensuring a stable, albeit non-growing, demand for compatible continuous computer paper. However, the rapidly growing segment relies heavily on thermal printing technology, both direct thermal and thermal transfer, which mandates specific continuous roll labels impregnated with heat-sensitive or ribbon-activated coatings crucial for logistics and retail applications requiring rapid, high-resolution printing of barcodes and tracking information.

Innovation within the material science domain is significantly more active than in the printing hardware segment. Manufacturers are increasingly focused on developing advanced carbonless (NCR) paper that provides superior image clarity, reduced residue, and enhanced durability for archival purposes. Furthermore, the integration of advanced security technologies into the paper substrate represents a major technological advancement. This includes papers embedded with UV fibers, holograms, microprinting capabilities, and chemically reactive security features designed to prevent unauthorized duplication or alteration of critical documents like checks and prescriptions. This technological investment aims to shift the continuous stationery product from a simple commodity to a high-security, value-added functional component of organizational compliance and fraud prevention strategies.

The future technology trajectory involves greater integration with digital systems through hybrid solutions. For instance, continuous labels are increasingly being equipped with embedded technologies such as RFID chips or NFC tags, transforming the paper product into an intelligent element within the supply chain, facilitating automated tracking and verification far beyond simple visual inspection. Furthermore, in response to environmental mandates, there is ongoing research into developing truly biodegradable and high-quality recycled paper substrates that meet the stringent performance requirements of high-speed printing without compromising on tensile strength or coating consistency, ensuring the market aligns with global sustainability goals while maintaining operational integrity.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid industrialization, burgeoning e-commerce platforms, and massive governmental investments in infrastructure and public services (utility billing, postal services). Countries like India and China maintain substantial reliance on continuous forms for high-volume logistics documentation and large enterprise transactional output due to the sheer scale of operations and the continued existence of extensive legacy systems in developing sectors. The demand here is largely volume-driven and cost-sensitive, focused on both standard computer paper and thermal labels for burgeoning supply chains.

- North America: This region represents a mature, high-value market characterized by high regulatory scrutiny. While overall volume is declining due to advanced digitization in many corporate offices, the demand for specialized, high-security continuous forms (e.g., checks, financial statements, pharmaceutical tracking forms) remains stable. North American market players emphasize product quality, customization, security features (anti-fraud inks, microprinting), and sustainable sourcing to maintain premium pricing in specialized, compliance-heavy segments.

- Europe: Similar to North America, the European market is characterized by maturity and stringent environmental regulations. Demand is concentrated in highly industrialized sectors, particularly in logistics (Germany) and finance (UK, Switzerland), where specific legacy systems require continuous forms. There is a strong regional emphasis on sustainability, driving demand for recycled and sustainably certified continuous stationery, compelling manufacturers to invest heavily in eco-friendly production methods to comply with EU directives.

- Latin America (LATAM): The LATAM region shows moderate growth, supported by expanding retail, manufacturing, and increasing governmental use of paper forms for public administration across diverse geographical areas. Market penetration is often linked to economic stability and investment in commercial infrastructure. Affordability and availability of standard continuous forms for bulk transactional printing are key market drivers in countries like Brazil and Mexico.

- Middle East and Africa (MEA): Growth in MEA is highly uneven, concentrated primarily in the GCC (Gulf Cooperation Council) states due to large-scale infrastructure projects, rapid retail expansion, and a growing financial sector. Demand is high for both standard continuous computer paper for utility companies and thermal labels supporting new, automated port and logistics operations, though security and custom requirements often drive procurement decisions in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Continuous Stationery Market.- Domtar Corporation

- Avery Dennison Corporation

- 3M Company

- Nippon Paper Industries Co. Ltd.

- International Paper Company

- Resolute Forest Products Inc.

- Oji Holdings Corporation

- Smurfit Kappa Group Plc

- Weyerhaeuser Company

- Moore-Wallace Inc. (now part of R.R. Donnelley & Sons)

- Canon, Inc. (Focusing on printing systems and compatible supplies)

- R.R. Donnelley & Sons Company (LSC Communications)

- BillerudKorsnäs AB

- H-O Continuous Forms

- Datamann Forms, Inc.

- Reliance Printing

- Specialty Forms, Inc.

- Consolidated Business Forms

- Glatfelter Corporation

- New Page Corporation (A subsidiary of Verso Corporation)

Frequently Asked Questions

Analyze common user questions about the Continuous Stationery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued demand for Continuous Stationery despite digital transformation?

The persistent demand is primarily driven by regulatory compliance mandates requiring physical archival of critical transactional data (especially in finance and healthcare), the inherent operational efficiency of high-speed batch printing in legacy ERP systems, and the explosive growth in logistics documentation requiring continuous thermal labels for e-commerce and global supply chain management.

How is the environmental impact of continuous paper being addressed by manufacturers?

Manufacturers are addressing environmental concerns by prioritizing the use of sustainably sourced and certified wood pulp (FSC/PEFC), increasing the integration of high-quality recycled paper content, and developing eco-friendly carbonless (NCR) chemistries and specialized biodegradable adhesives for continuous labels to reduce overall waste footprint.

Which continuous stationery segment is expected to show the highest growth rate during the forecast period?

The Continuous Labels and Tags segment, particularly those designed for thermal transfer printing, is projected to exhibit the highest growth rate. This growth is directly correlated with the global expansion of automated warehousing, third-party logistics (3PL) services, and the scaling needs of the e-commerce fulfillment infrastructure worldwide.

What role does security play in the procurement of continuous stationery for the BFSI sector?

Security is paramount in the BFSI sector, driving the procurement of specialized, continuous forms that incorporate advanced anti-fraud features. These features include microprinting, watermarks, void pantographs, specialized security inks (UV and chemical reactive), and tamper-evident materials designed to protect high-value documents such as checks and official statements from counterfeiting and unauthorized alteration.

Are continuous stationery products compatible with modern enterprise printing systems?

While continuous stationery is historically tied to legacy dot matrix and line printers, manufacturers now offer highly specialized continuous forms and labels compatible with select modern thermal transfer and high-speed laser printing technologies. Compatibility is dependent on the application; forms are optimized for high-volume, repetitive output rather than general office color printing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager