Contract Manufacturing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432777 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Contract Manufacturing Services Market Size

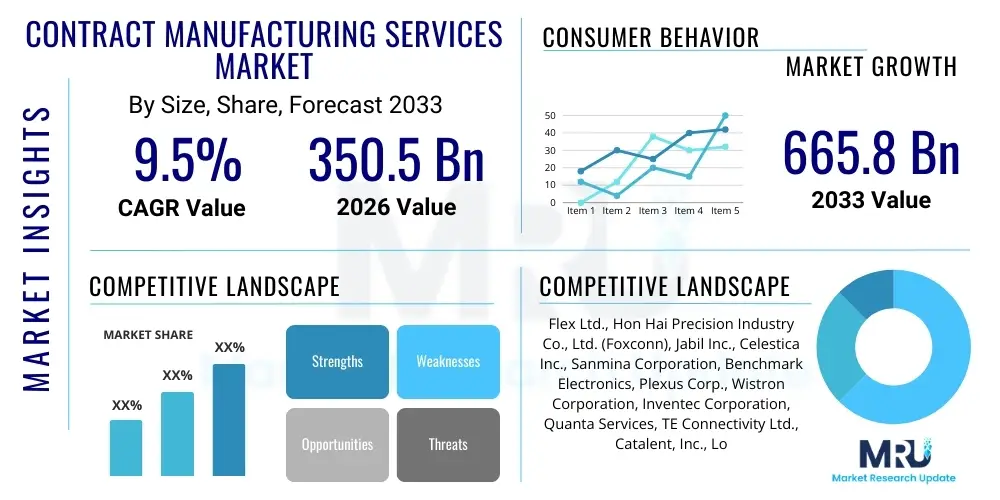

The Contract Manufacturing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 350.5 Billion in 2026 and is projected to reach USD 665.8 Billion by the end of the forecast period in 2033.

Contract Manufacturing Services Market introduction

The Contract Manufacturing Services (CMS) Market encompasses the outsourcing of production processes, from design and fabrication to assembly and packaging, to third-party providers. These providers, known as contract manufacturers (CMs), specialize in efficiently producing goods for original equipment manufacturers (OEMs) across various sectors, including electronics, pharmaceuticals, medical devices, automotive, and consumer goods. The primary motivation for OEMs utilizing CMS is the ability to reduce capital expenditure, optimize production scalability, and access specialized technical expertise and advanced manufacturing infrastructure without significant upfront investment. This business model allows OEMs to focus their core competencies on research, development, and marketing, driving faster time-to-market for innovative products.

Major applications of contract manufacturing services span complex system integration, precision component fabrication, and high-volume assembly lines. In the electronics sector, CMs handle everything from printed circuit board (PCB) assembly to complete system integration for computing and telecommunication devices. Within the life sciences, contract development and manufacturing organizations (CDMOs) provide critical services ranging from drug substance manufacturing to sterile fill-finish operations. The benefits derived by outsourcing include operational efficiency gains, lower labor costs in certain geographies, and mitigation of supply chain risks through diversified manufacturing footprints. Furthermore, CMs often possess economies of scale and sophisticated quality management systems that smaller or niche OEMs might struggle to maintain independently.

Key driving factors accelerating market growth include the escalating complexity of modern products, especially in high-tech fields requiring micro-miniaturization and robust traceability. Regulatory pressures in industries like medical devices and aerospace necessitate highly compliant manufacturing environments, which CMs are often better equipped to handle. The global trend towards lean manufacturing and asset-light strategies among leading multinational corporations further fuels the demand for reliable outsourcing partners capable of global logistics and just-in-time delivery. The convergence of Industry 4.0 technologies, such as advanced robotics and Industrial IoT (IIoT), also elevates the service offerings of leading CMs, positioning them as essential innovation partners rather than just production facilities.

Contract Manufacturing Services Market Executive Summary

The global Contract Manufacturing Services (CMS) market is characterized by robust expansion driven primarily by digitalization across end-use industries and the sustained requirement for supply chain resilience post-pandemic. Business trends indicate a movement towards highly specialized, long-term strategic partnerships replacing traditional transactional outsourcing relationships. Leading CMs are aggressively investing in vertical integration, particularly in semiconductor and specialized component sourcing, to mitigate global supply disruptions. Furthermore, sustainability and environmental, social, and governance (ESG) compliance are becoming critical differentiators, with OEMs prioritizing partners who demonstrate strong commitments to ethical sourcing and low-carbon manufacturing processes. The competitive landscape is consolidating, with larger players acquiring smaller, niche CMs to expand geographical reach and technical capabilities, especially in emerging fields like electric vehicle components and advanced biologics manufacturing.

Regional trends highlight the continued dominance of the Asia Pacific (APAC) region, particularly China and Southeast Asian nations, driven by established electronics manufacturing ecosystems and favorable cost structures. However, North America and Europe are witnessing significant growth in high-value, highly regulated segments such as pharmaceutical CDMOs and complex medical device manufacturing, often termed "nearshoring" or "reshoring" due to geopolitical risks and the desire for shorter, more secure supply chains. Latin America and the Middle East and Africa (MEA) are emerging markets, primarily focusing on domestic demand fulfillment and localized assembly operations, supported by governmental initiatives encouraging industrialization and foreign direct investment into manufacturing sectors.

Segmentation trends reveal strong performance in the Electronics and Industrial sectors, which benefit immensely from rapid technological obsolescence and the need for mass customization. Within the services segment, Engineering & Design services are exhibiting the highest growth rate, reflecting the willingness of OEMs to involve CMs early in the product lifecycle for Design for Manufacturability (DFM) optimization. The Pharmaceutical segment, specifically encompassing Biologics Manufacturing and Cell & Gene Therapy production, is a major growth engine, demanding significant capital investment in specialized sterile facilities and highly skilled personnel, providing high margins for specialized Contract Development and Manufacturing Organizations (CDMOs).

AI Impact Analysis on Contract Manufacturing Services Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Contract Manufacturing Services (CMS) market frequently revolve around themes of automation, predictive maintenance, quality control enhancement, and supply chain optimization. Users are keen to understand how AI will reshape the traditional labor-intensive nature of manufacturing and whether it will lead to higher efficiency gains or displacement of human workers. There is also considerable interest in AI's role in mitigating supply chain volatility, specifically through predictive analytics for inventory management and risk assessment. Expectations are high that AI integration will allow CMs to offer more personalized and scalable services, moving beyond simple production into complex, data-driven operational management, thus becoming indispensable strategic partners rather than mere executors of production plans.

AI adoption is transforming the operational backbone of contract manufacturing, moving systems toward autonomous decision-making and continuous process improvement. In terms of production, machine learning algorithms are utilized for real-time monitoring of equipment performance, predicting potential failures before they occur, which significantly reduces unplanned downtime and maximizes asset utilization (predictive maintenance). For quality assurance, AI-powered vision systems are capable of inspecting products at speeds and accuracies far surpassing human capabilities, ensuring adherence to stringent quality standards, particularly in high-precision industries like medical devices and aerospace components. This proactive approach to operations management enhances overall equipment effectiveness (OEE) and contributes directly to improved profitability for CMs.

Furthermore, AI plays a crucial role in optimizing the highly complex global supply chains managed by contract manufacturers. By analyzing massive datasets related to global logistics, commodity pricing, geopolitical events, and historical demand patterns, AI algorithms provide advanced forecasting capabilities. This allows CMs to strategically purchase raw materials, optimize routing, and manage inventories across multiple geographic locations with minimal waste and cost. The implementation of AI tools also facilitates better client interaction by providing granular transparency into production schedules and potential delays, enhancing trust and fostering stronger collaborative relationships between the OEM and the contract manufacturer.

- Enhanced Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failure, dramatically reducing unscheduled downtime.

- Optimized Quality Control: AI vision systems perform high-speed, accurate defect detection and quality inspection on assembly lines.

- Supply Chain Resilience: Machine learning predicts demand fluctuations and logistical risks, enabling proactive inventory and sourcing adjustments.

- Automated Process Optimization: AI fine-tunes manufacturing parameters in real-time to maximize yield and energy efficiency.

- Improved Design for Manufacturability (DFM): Generative AI assists in early-stage product design iteration based on manufacturing constraints.

- Robot Collaboration: AI coordinates complex tasks between human workers and autonomous mobile robots (AMRs) on the shop floor.

- Customized Mass Production: Enables flexible manufacturing lines that can quickly switch between product variants based on AI-driven market signals.

DRO & Impact Forces Of Contract Manufacturing Services Market

The Contract Manufacturing Services market expansion is fundamentally driven by the rising complexity of product designs and the persistent pressure on Original Equipment Manufacturers (OEMs) to lower operational costs while accelerating time-to-market. The primary drivers include the necessity for specialized, high-capital equipment (especially in semiconductor and advanced medical manufacturing), the trend toward asset-light business models, and the need for scalable production capabilities to respond rapidly to fluctuating global demand. However, significant restraints include the high initial costs associated with transitioning production and stringent regulatory compliance hurdles, particularly in heavily regulated sectors like pharmaceuticals and aerospace, which require lengthy validation processes and often limit flexibility. Additionally, intellectual property (IP) protection concerns remain a restraint, requiring robust contractual frameworks and trust between parties.

Opportunities in this market are manifold, centered around the proliferation of specialized technologies such as 5G network infrastructure, electric vehicle (EV) components, and advanced personalized medicine (e.g., cell and gene therapies). Contract manufacturers who invest in these highly specialized niches and acquire necessary certifications stand to gain substantial market share. Furthermore, the push towards regionalized supply chains (reshoring/nearshoring) driven by geopolitical instability presents opportunities for CMs located in stable, high-cost regions, provided they can leverage high levels of automation and digital integration to maintain cost competitiveness. The growing emphasis on sustainable manufacturing also creates opportunities for CMs offering "green manufacturing" services and robust traceability solutions.

The impact forces within the CMS market are characterized by intense competition and rapid technological change. Technological forces dictate that CMs must continuously update their machinery and integrate Industry 4.0 technologies (IoT, AI, advanced robotics) to remain relevant. Economic forces, including fluctuating raw material prices and global trade policies, directly impact profitability and sourcing strategies, making risk management crucial. Regulatory forces mandate strict adherence to global quality standards (such as ISO, FDA, and EMA guidelines), acting as a significant barrier to entry for new players but cementing the position of established, compliant CMs. These interconnected forces compel CMs to evolve from simple production partners into comprehensive strategic providers offering end-to-end services, encompassing design, prototyping, regulatory affairs, and complex global logistics management.

Segmentation Analysis

The Contract Manufacturing Services (CMS) market is broadly segmented based on the type of service offered, the specific end-use industry being served, and the geographic region. This granular segmentation allows stakeholders to understand the distinct growth dynamics and competitive intensity within specific market pockets. Key service types include Electronic Manufacturing Services (EMS), which dominate the volume segment, and Contract Development and Manufacturing Organizations (CDMOs) for pharmaceuticals, which command the highest revenue per unit due to complexity and regulatory requirements. Analyzing these segments provides strategic clarity on where capital investment and technological specialization should be directed to maximize long-term return on investment (ROI).

The segmentation by end-use industry is crucial as it reflects the differing needs for scale, precision, and compliance. The electronics sector requires speed and flexibility in high-volume production, while the medical device and aerospace industries demand meticulous quality control and long-term product lifecycle management. The Industrial sector, encompassing machinery and heavy equipment, focuses on durability and complex component assembly. Understanding the specific sector requirements allows CMs to tailor their operational setup, quality systems, and workforce skills, ensuring they meet the highly specialized demands of their target clientele and maintain a competitive edge through focused expertise.

Geographic segmentation remains a pivotal factor, reflecting disparities in manufacturing costs, regulatory environments, and regional market demand. While APAC dominates mass production capabilities, North America and Europe lead in innovation-driven, highly regulated, and complex manufacturing operations. The trend of diversifying manufacturing hubs away from sole reliance on one region influences strategic expansion and footprint optimization among global contract manufacturers, driving growth in emerging economies that offer strategic logistical advantages and developing domestic markets.

- By Service Type:

- Electronic Manufacturing Services (EMS)

- Contract Development and Manufacturing Organizations (CDMO)

- Engineering and Design Services

- Aftermarket Services

- Assembly and Fabrication

- Testing and Certification

- By End-Use Industry:

- Electronics & Telecommunication

- Medical Devices

- Pharmaceuticals & Biotechnology

- Automotive & Transportation (including EV components)

- Aerospace & Defense

- Industrial

- Consumer Goods

- By Component/Product:

- Printed Circuit Board (PCB) Assembly

- Box Build Assembly

- Semiconductor Components

- Finished Pharmaceutical Dosage Forms

- Mechanical Components

Value Chain Analysis For Contract Manufacturing Services Market

The value chain for the Contract Manufacturing Services market is highly complex, beginning with upstream activities focused on raw material procurement and component sourcing. Upstream suppliers include providers of basic raw materials (metals, plastics, chemicals), specialized electronic components (semiconductors, passive components), and proprietary software. Given the current global focus on supply chain resilience, upstream analysis emphasizes strategic partnerships, dual sourcing, and long-term agreements to ensure stability and cost control. The procurement function is central, relying heavily on global vendor management systems and sophisticated risk assessment tools to navigate geopolitical and logistical challenges impacting material availability.

The core of the value chain involves the CM's internal processes, encompassing design and engineering, manufacturing (including SMT, assembly, testing), and quality control/compliance. The distribution channel analysis focuses on both direct and indirect routes. Direct distribution involves the CM shipping finished goods directly to the OEM's distribution centers or, increasingly, managing fulfillment directly to the OEM’s end customer (drop-shipping model). Indirect channels involve using third-party logistics (3PL) providers to handle complex global movements, warehousing, and regional distribution needs. The trend favors CMs offering integrated logistics services, consolidating the downstream activities for the OEM.

Downstream activities include post-manufacturing services such as final packaging, labeling, global logistics, and increasingly important aftermarket services, including repair, refurbishment, and warranty management. The direct relationship between the CM and the OEM involves extensive data exchange and collaborative planning, especially concerning forecasting and inventory buffer management. The overall efficiency and value creation in this chain are now heavily dependent on digital integration, ensuring real-time visibility from the raw material supplier through to the final delivery point, solidifying the CM's role as a vital link in the product's entire lifecycle.

Contract Manufacturing Services Market Potential Customers

The primary customers and end-users of Contract Manufacturing Services are Original Equipment Manufacturers (OEMs) across technologically demanding and compliance-heavy industries. These potential buyers include multinational technology conglomerates seeking to offload large-scale production volumes and emerging startups that lack the capital required to build their own manufacturing facilities. Specifically, major customers reside within the electronics sector, comprising companies that produce computers, smartphones, network equipment, and consumer electronics, driven by short product lifecycles and high volume requirements.

Another significant customer base is found in the highly regulated life sciences sector, encompassing pharmaceutical companies, large biotechnology firms, and medical device manufacturers. These entities rely on CMs (CDMOs) for highly specialized services like sterile manufacturing, compliance documentation, and complex clinical trial material production. For these customers, the primary drivers are regulatory expertise, quality assurance, and the ability to rapidly scale production of new drugs or devices. The automotive industry, particularly the rapidly expanding Electric Vehicle (EV) segment, represents a growing customer cluster seeking specialized battery management system (BMS) assembly and advanced electronic component manufacturing.

In essence, any company that wishes to maintain an asset-light balance sheet, focus resources on innovation, or requires access to specialized global manufacturing expertise represents a potential customer. The shift in buyer behavior is moving away from prioritizing lowest cost to valuing strategic capabilities, including supply chain flexibility, regional presence, sustainability credentials, and access to advanced manufacturing technologies (like 3D printing or AI-driven automation). Therefore, CMs offering these strategic advantages are best positioned to secure high-value, long-term contracts from sophisticated global buyers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Billion |

| Market Forecast in 2033 | USD 665.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Flex Ltd., Hon Hai Precision Industry Co., Ltd. (Foxconn), Jabil Inc., Celestica Inc., Sanmina Corporation, Benchmark Electronics, Plexus Corp., Wistron Corporation, Inventec Corporation, Quanta Services, TE Connectivity Ltd., Catalent, Inc., Lonza Group AG, Samsung SDI, TTM Technologies, Universal Scientific Industrial (USI), Venture Corporation Limited, Zollner Elektronik AG, Kimball Electronics, Beyonics Technology Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contract Manufacturing Services Market Key Technology Landscape

The technological landscape within the Contract Manufacturing Services (CMS) market is rapidly evolving, driven by the adoption of Industry 4.0 principles, which merge physical production and operations with smart digital technology. Central to this transformation is the deployment of the Industrial Internet of Things (IIoT), utilizing interconnected sensors and devices to collect vast amounts of data in real-time. This data feeds into Manufacturing Execution Systems (MES) and Enterprise Resource Planning (ERP) systems, allowing for unparalleled visibility into the production process, optimizing material flow, and facilitating responsive decision-making. Advanced robotics and cobots (collaborative robots) are also critical, increasing precision and speed in assembly while improving worker safety in complex or repetitive tasks, which is essential for maintaining cost competitiveness in high-wage regions.

A second crucial technological focus area is additive manufacturing, or 3D printing. While not yet suitable for all high-volume production, 3D printing offers significant advantages in rapid prototyping, small-batch customization, and the production of specialized tooling and jigs. This capability allows contract manufacturers to significantly compress the development cycle for new products, moving quickly from design validation to initial production runs. Furthermore, sophisticated simulation software and digital twin technology are being employed to model and test entire manufacturing lines and supply chain scenarios virtually before physical implementation, minimizing risks and maximizing operational efficiency prior to mass production commencement.

Data analytics and Artificial Intelligence (AI) form the third foundational pillar, crucial for optimizing complex global operations. AI is used not only for predictive maintenance and quality inspection, as previously noted, but also for complex scheduling and load balancing across geographically dispersed factories. Blockchain technology is also gaining traction, particularly in the pharmaceutical and medical device sectors, where tamper-proof traceability of components and finished products is mandatory for regulatory compliance and preventing counterfeiting. CMs proficient in integrating these advanced digital tools become highly strategic partners capable of offering smart, flexible, and fully traceable manufacturing solutions.

Regional Highlights

The geographic distribution of the Contract Manufacturing Services (CMS) market reflects global supply chain dynamics, cost advantages, and proximity to key customer bases. Asia Pacific (APAC) currently holds the dominant share, largely due to China's established prowess in high-volume electronics manufacturing and the subsequent rise of manufacturing hubs in Southeast Asian countries like Vietnam, Malaysia, and Thailand. This region benefits from mature supply chain ecosystems, lower operating costs, and strong government support for industrial expansion. Growth in APAC is further fueled by the burgeoning domestic demand for consumer electronics, automotive components, and healthcare products within these rapidly developing economies, positioning the region as both a production base and a vast consumer market.

North America and Europe represent highly mature markets characterized by substantial demand for specialized, high-mix, low-volume (HMLV) manufacturing services. These regions lead in technological adoption, particularly in AI integration, and maintain stringent regulatory environments, driving demand for specialized CDMOs and medical device CMs. The current geopolitical climate and lessons learned from pandemic-induced supply disruptions are promoting significant "reshoring" and "nearshoring" initiatives. This strategic shift is encouraging OEMs to bring critical production back closer to domestic markets to enhance supply chain control and reduce time-to-market, particularly for sensitive products related to national security or critical infrastructure.

Latin America and the Middle East & Africa (MEA) are emerging markets for contract manufacturing. Latin America, particularly Mexico and Brazil, serves as an important nearshoring hub for North American OEMs, benefiting from regional trade agreements and reduced shipping costs. The MEA region is developing its manufacturing capabilities, focused initially on local market needs, particularly in industrial and pharmaceutical sectors. Investment in infrastructure and skilled labor development are key factors determining the future growth trajectory of contract manufacturing in these regions, offering diversified manufacturing options outside the traditional APAC corridor.

- Asia Pacific (APAC): Dominates due to massive volume production capabilities in electronics (China, Taiwan) and increasing strategic diversification into Vietnam and India; leads in EMS market revenue.

- North America: Strong focus on high-value, highly regulated industries (Pharma CDMOs, Medical Devices, Aerospace); driving the reshoring trend for critical components.

- Europe: Characterized by high technological integration, strong regulatory frameworks (EU MDR, EMA), and expertise in specialized automotive components and advanced industrial machinery.

- Latin America (LATAM): Strategic location, particularly Mexico, serving as a critical nearshoring gateway for U.S.-based OEMs in the automotive and industrial sectors.

- Middle East & Africa (MEA): Emerging growth driven by regional government initiatives to localize pharmaceutical production and reduce dependency on global imports.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contract Manufacturing Services Market.- Flex Ltd.

- Hon Hai Precision Industry Co., Ltd. (Foxconn)

- Jabil Inc.

- Celestica Inc.

- Sanmina Corporation

- Benchmark Electronics

- Plexus Corp.

- Wistron Corporation

- Inventec Corporation

- Quanta Services

- TE Connectivity Ltd.

- Catalent, Inc.

- Lonza Group AG

- Samsung SDI

- TTM Technologies

- Universal Scientific Industrial (USI)

- Venture Corporation Limited

- Zollner Elektronik AG

- Kimball Electronics

- Beyonics Technology Ltd.

Frequently Asked Questions

Analyze common user questions about the Contract Manufacturing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for outsourcing production to Contract Manufacturers?

The primary driver is the need for Original Equipment Manufacturers (OEMs) to reduce capital expenditure, achieve high-volume scalability rapidly, and access specialized technological expertise and advanced infrastructure without owning fixed assets. This allows OEMs to concentrate resources on core competencies like innovation and market penetration.

How is Industry 4.0 influencing the competitive dynamics of the CMS market?

Industry 4.0, incorporating AI, IoT, and advanced automation, is shifting the competitive landscape by rewarding CMs that invest heavily in digital transformation. These technologies enable higher operational efficiency, superior predictive quality control, and the offering of complex, integrated supply chain services, positioning technologically advanced CMs as strategic partners.

Which geographic region currently dominates the global Contract Manufacturing Services market?

The Asia Pacific (APAC) region currently dominates the global CMS market, primarily driven by established manufacturing ecosystems in China and Taiwan for Electronic Manufacturing Services (EMS), coupled with favorable cost structures and high production capacity throughout Southeast Asia.

What is the key difference between EMS and CDMO services?

Electronic Manufacturing Services (EMS) focus on the production of electronic components, assemblies, and systems (e.g., PCBs and box builds) typically for the technology and consumer goods sectors. Contract Development and Manufacturing Organizations (CDMOs) specialize in the development and production of pharmaceutical drug substances and finished dosage forms, operating under extremely stringent regulatory requirements (FDA/EMA).

What are the main risks associated with utilizing Contract Manufacturing Services?

The main risks include potential issues concerning Intellectual Property (IP) security and data leakage, challenges in maintaining consistent quality control across different outsourced facilities, and managing supply chain dependency on a third party, necessitating robust legal frameworks and rigorous auditing procedures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager