Contract Mining Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437277 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Contract Mining Services Market Size

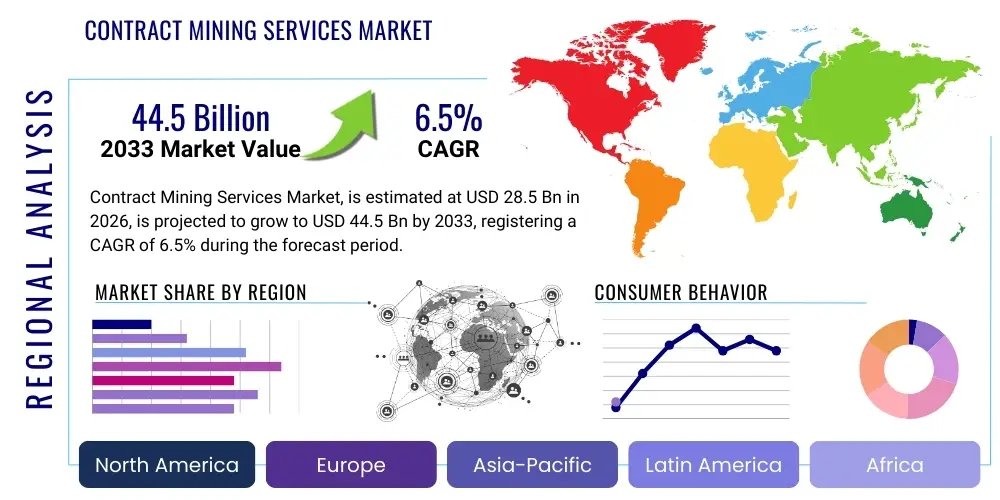

The Contract Mining Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 44.5 Billion by the end of the forecast period in 2033.

Contract Mining Services Market introduction

Contract mining services encompass the specialized provision of equipment, labor, and expertise to mine owners for the execution of specific mining operations, ranging from excavation and hauling to drilling and processing. These services are critical in both surface and underground mining environments, allowing mining companies to focus on core resource management and long-term strategy while outsourcing the capital-intensive and operational complexities of extraction. The product description involves providing end-to-end operational solutions, optimizing fleet management, and implementing advanced safety protocols, often tailored for harsh, remote environments globally. Major applications span key resource sectors, including the extraction of thermal and metallurgical coal, various base and precious metals like copper, gold, and iron ore, and industrial minerals suchations.

The primary benefits of utilizing contract mining services include significant reductions in capital expenditure for mine owners, operational flexibility in scaling output according to market demand, and access to specialized technologies and highly skilled personnel that might be prohibitively expensive to maintain in-house. Contractors bring efficiencies through optimized fleet utilization and sophisticated planning software, leading to lower operating costs per ton. Furthermore, shifting operational risks, such as equipment breakdowns and regulatory compliance burdens, onto the contracting partner allows mine owners to achieve predictable cost structures and focus resources on exploration and resource definition, thereby enhancing overall shareholder value.

Driving factors for market expansion are fundamentally linked to the global demand for essential commodities, particularly those critical for the energy transition and infrastructure development, such as copper, lithium, and nickel. Increasing complexity in mineral deposits, coupled with stricter environmental, social, and governance (ESG) standards, necessitates specialized operational expertise that contract miners are better positioned to provide. Economic factors, including volatile commodity prices that encourage capital preservation among mining companies, further accelerate the trend of outsourcing mining operations to maintain agility and financial health in cyclical markets. This strategic shift towards operational outsourcing ensures that production targets are met efficiently under varying market conditions.

Contract Mining Services Market Executive Summary

The Contract Mining Services Market is exhibiting strong growth driven by pronounced business trends favoring operational outsourcing, capital preservation strategies, and the global push for critical minerals required for the electrification transition. Major mining houses are increasingly utilizing contracts to access specialized, high-efficiency equipment and advanced technology platforms, thereby mitigating risks associated with large-scale capital investments and operational labor management. This transition is characterized by contractors offering highly integrated, technologically sophisticated solutions, moving beyond simple excavation to include complex aspects like grade control and site remediation. The demand stability for key commodities like iron ore and the escalating requirement for battery metals underpin the favorable business environment, fostering long-term contract awards and strategic partnerships globally.

Regional trends indicate significant dynamism, with Asia Pacific (APAC) maintaining its dominance due to extensive mining activity, particularly in coal and iron ore across Australia, India, and Indonesia. However, rapid expansion is noted in North America and Latin America, specifically driven by the resurgence of gold and copper mining, where complex geological structures necessitate specialized underground and surface contract mining expertise. The Middle East and Africa (MEA) region present substantial opportunity due to large, untapped mineral reserves and a growing governmental push towards resource monetization, often facilitated through international contracting firms that bring necessary foreign direct investment and technological know-how. Europe, while smaller in scale, emphasizes sustainable and technologically advanced operations, favoring contractors with strong ESG credentials and automation capabilities.

Segment trends reveal that the Surface Mining segment, driven by high volume operations for bulk commodities, continues to hold the largest market share, but the Underground Mining segment is projected to experience faster growth owing to the depletion of easily accessible shallow deposits and the increased need for deeper, more complex extraction methods. Furthermore, the application segment shows strong performance in the Metals category (specifically copper and battery metals), surpassing traditional reliance on Coal, reflecting the fundamental shift in global energy and manufacturing priorities. Technology adoption is increasingly segmenting the market, with clients favoring contractors who integrate automation, remote operations, and predictive maintenance tools into their service offerings, thereby enhancing productivity and safety metrics across all operational environments.

AI Impact Analysis on Contract Mining Services Market

Common user questions regarding AI's impact on the Contract Mining Services Market revolve heavily around productivity gains, workforce displacement, and the investment required for implementation. Users frequently inquire about how Artificial Intelligence enhances decision-making in fleet management, minimizes downtime through predictive maintenance, and improves safety protocols in hazardous mining environments. A major theme is the expectation that AI and Machine Learning (ML) will transform optimization efforts, moving from reactive management to proactive, data-driven operational control. Concerns often focus on data security, the necessity of upskilling current labor forces to manage these technologies, and the scalability of AI solutions across diverse geological and operational sites globally. The consensus expectation is that contractors adopting AI early will gain a significant competitive advantage by offering higher reliability and lower operational costs per ton to their clients.

The integration of AI fundamentally changes the competitive landscape for contract miners by enabling unprecedented levels of operational efficiency and precision. AI algorithms process vast quantities of data generated by sensors on mining equipment, environmental monitors, and geological surveys, synthesizing this information to provide real-time recommendations for trajectory optimization, blast pattern design, and material blending. This capability allows contractors to execute complex mining plans with minimal variance, ensuring maximum resource recovery and reduced waste. Furthermore, AI-powered systems facilitate autonomous operation of hauling trucks and drilling rigs, significantly lowering labor costs and exposure to risk, thereby making AI implementation a non-negotiable component for future contract bids.

The substantial investment required for implementing AI infrastructure—including high-speed connectivity, robust sensor networks, and data processing capacity—acts as a barrier for smaller or regionally focused contract mining firms. However, larger, globally active contractors are leveraging AI not only for direct operational efficiency but also for strategic planning, such as predicting commodity price fluctuations or optimizing contract structures based on predictive cost modeling. This advanced analytical capability allows contractors to offer more attractive, risk-sharing contract models to mine owners. Over time, AI will transition contract mining from a service based primarily on labor and machinery provision to a knowledge-intensive industry centered on data mastery and operational intelligence, demanding a fundamental shift in core competencies.

- Enhanced Predictive Maintenance: AI analyzes equipment sensor data to forecast failures, minimizing unscheduled downtime and optimizing maintenance schedules, drastically increasing asset utilization.

- Autonomous Fleet Management: AI controls and optimizes the movement and coordination of fleets (haul trucks, loaders), reducing cycle times and fuel consumption while eliminating human error.

- Real-time Grade Control: Machine learning algorithms process sensor and assay data to dynamically adjust excavation strategies, ensuring the highest possible grade material is selectively extracted.

- Safety and Risk Mitigation: AI monitors worker behavior and environmental conditions, identifying potential hazards (e.g., ground instability) and triggering alerts faster than traditional systems.

- Optimized Blast Planning: ML models simulate different blast patterns based on rock mass characteristics, maximizing fragmentation efficiency and reducing the need for secondary breakage.

DRO & Impact Forces Of Contract Mining Services Market

The Contract Mining Services Market is primarily driven by the imperative of major mining companies to preserve capital, minimize operational risks, and gain access to specialized technologies without significant upfront investment. Restraints include the inherent volatility of commodity prices, which directly impacts project viability and contract renewals, alongside stringent regulatory hurdles related to environmental protection and permitting processes that can delay or halt operations. Opportunities are abundant in the high-growth segments of battery metals (lithium, cobalt, nickel) and advanced automation services, allowing contractors to differentiate their offerings. The collective impact forces reflect a transition towards a service-oriented model where efficiency, technology adoption, and robust safety performance are the core determinants of competitive success and market share growth.

Key drivers center around the global energy transition requiring massive inputs of critical minerals, compelling mine owners to accelerate production schedules, a task often best handled by flexible contractors. Additionally, the increasing complexity and depth of ore bodies necessitate highly specialized equipment and technical expertise that general mining companies may lack internally. Outsourcing allows mine owners to convert fixed operating costs into variable costs, providing superior financial flexibility, particularly in a period of economic uncertainty and capital scrutiny. Furthermore, the contractors' ability to rapidly mobilize large fleets and skilled labor, coupled with continuous investment in cutting-edge machinery, ensures projects adhere to tight schedules and maximize throughput, thereby driving sustained demand for their specialized services.

However, the market faces significant restraints, notably the cyclical nature of the mining industry. Sharp drops in commodity prices can lead to immediate project cancellations or contract renegotiations, severely impacting contractor revenue and planning stability. Labor constraints, particularly the scarcity of highly trained technicians capable of operating and maintaining advanced automated systems, pose a persistent challenge, especially in remote regions. Environmental, Social, and Governance (ESG) mandates represent both a restraint and an opportunity; while demanding stricter compliance and higher initial investment in sustainable practices, they also create a competitive barrier favoring contractors who demonstrate impeccable environmental stewardship and community engagement, pushing out non-compliant firms.

Segmentation Analysis

The Contract Mining Services market is comprehensively segmented based on the type of mining operation, the specific equipment utilized, and the application of the services across different commodities. This segmentation provides a granular view of market dynamics, revealing varying growth rates and demand drivers across different operational environments. The Type segmentation distinguishes between surface (open-pit) and underground operations, reflecting distinct technological requirements and risk profiles. The Equipment segmentation highlights the capital intensity of the industry, focusing on specialized machinery necessary for earth movement and extraction. Finally, the Application segmentation directly links market activity to global commodity demand, reflecting the shift from fossil fuels towards critical and battery metals.

- By Type:

- Surface Mining (Open Pit)

- Underground Mining

- By Equipment:

- Excavators and Shovels

- Haul Trucks and Dumpers

- Drilling and Blasting Equipment

- Loaders and Dozers

- Continuous Miners and Roadheaders

- By Application:

- Coal Mining (Thermal and Metallurgical)

- Metals Mining (Iron Ore, Copper, Gold, Silver, Aluminum)

- Minerals Mining (Limestone, Phosphate, Potash)

- Battery Metals Mining (Lithium, Nickel, Cobalt)

Value Chain Analysis For Contract Mining Services Market

The value chain for the Contract Mining Services market is complex and highly integrated, starting with upstream activities involving the sourcing of high-value capital equipment and specialized technology. Upstream analysis focuses on relationships with major Original Equipment Manufacturers (OEMs) for machinery (e.g., haul trucks, drills) and technology providers for mine planning software, automation systems, and remote operation centers. Strong procurement leverage and reliable partnerships with OEMs are critical for contractors to ensure fleet availability, minimize maintenance costs, and incorporate the latest technological advancements. Financial services and insurance providers also play a crucial upstream role in supporting the high capital intensity required for fleet investment and operational risk mitigation.

Midstream activities are centered on the core service delivery, which includes mine development, extraction, loading, hauling, and processing support. This stage involves meticulous operational planning, sophisticated logistics management, and efficient utilization of human capital and machinery. Downstream analysis focuses on the interaction between the contract miner and the mine owner (the client). The distribution channel in this context is direct; the service is delivered on-site, directly converting the resource in the ground into an extracted product ready for further processing or shipment. The success of the downstream relationship hinges on performance metrics such as cost-per-ton, adherence to safety standards, and operational transparency, which dictates contract renewal and expansion opportunities.

Direct engagement with the client (mine owner) is the primary distribution model, often managed through long-term, output-based contracts ranging from three to ten years. Indirect influences, however, come from regulatory bodies, environmental agencies, and local communities, whose approval and support are essential for operational continuity. The effectiveness of the value chain is measured by the contractor's ability to seamlessly integrate upstream technology procurement with midstream operational execution, thereby delivering cost-effective and compliant output to the downstream client. Optimization of this chain involves digital integration, linking OEM diagnostics, maintenance scheduling, and on-site operational feedback loops to ensure maximum productivity and sustainability across the entire project lifecycle.

Contract Mining Services Market Potential Customers

Potential customers for Contract Mining Services are primarily defined as organizations that hold mineral rights and require efficient, specialized extraction expertise without incurring substantial capital expenditure on equipment and operational overheads. The core end-users include major multinational mining corporations (Majors), who utilize contractors to manage marginal, deep, or geographically challenging operations, or to ramp up production quickly during boom cycles. Mid-tier and Junior mining companies form another significant customer base; often lacking the balance sheet strength or internal expertise for large-scale operations, these companies rely heavily on contractors to execute feasibility studies, mine development, and full production services, particularly for new project startups.

Government entities and state-owned enterprises (SOEs) in resource-rich nations also represent substantial potential buyers, especially in emerging economies where foreign contractors are sought for their technology transfer capabilities and adherence to international operational standards. These entities frequently tender contracts to accelerate the monetization of national resources while minimizing direct state operational involvement and risk. Furthermore, specialized processing companies or infrastructure developers that require captive mineral supply, such as cement producers needing limestone or steel mills needing metallurgical coal, often seek contract miners to secure reliable raw material extraction under long-term agreements, ensuring supply chain stability.

The decision to engage a contract miner is typically driven by financial optimization and risk management. Buyers of contract mining services prioritize firms that can demonstrate a robust safety record, proven technological integration (e.g., automation, remote operations), and highly competitive cost-per-ton metrics. Therefore, contractors who specialize in specific commodities or difficult terrains (like deep underground or high-altitude operations) are particularly attractive to potential customers seeking specialized solutions that cannot be efficiently achieved through in-house teams. The continuous global demand for base metals and the surging requirement for battery metals solidifies these mining companies as sustained, high-volume potential customers for specialized contract mining services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 44.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CIMIC Group, Downer Group, Thiess, BCM International, Barminco, Redpath Mining, Macmahon Holdings, Byrnecut, Murray & Roberts Cementation, NQ Group, Golding Contractors, Ausdrill, Metso Outotec, Sandvik, FLSmidth, Boart Longyear, Perenti Global, Nordgold, HSE Mining, Pybar Mining Services. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contract Mining Services Market Key Technology Landscape

The technology landscape in the Contract Mining Services market is rapidly evolving, moving towards advanced digitalization, automation, and data analytics to maximize efficiency and safety. Key technologies include autonomous drilling and hauling systems, which remove personnel from high-risk areas and operate 24/7 with optimized precision. Furthermore, high-speed, reliable wireless network infrastructure (such as 5G and industrial IoT) is crucial for enabling real-time communication between automated equipment, control centers, and cloud-based analytical platforms. The integration of advanced fleet management systems allows contractors to track operational metrics, predict maintenance needs, and dynamically reallocate resources based on real-time mine planning adjustments, significantly reducing operational slack.

Software and data solutions are equally transformative. Sophisticated mine planning and simulation software allows contractors to model various operational scenarios, optimizing blast designs and excavation sequences before work begins. Geospatial technologies, including high-resolution drone mapping and satellite imagery combined with LiDAR scanning, provide highly accurate 3D models of the mine site, enabling precise volume measurement and grade control. This use of precision data ensures resources are extracted efficiently, minimizing dilution and maximizing the value delivered to the client. The core technological drive is centered on creating a digital twin of the mine, allowing predictive monitoring and remote optimization from centralized operational centers.

The adoption of environmentally friendly and sustainable technologies is also a major focus. This includes the deployment of battery electric vehicles (BEVs) for underground operations to improve air quality and reduce ventilation costs, as well as energy management systems that optimize power consumption across the site. Contractors who invest heavily in these sustainable technologies and demonstrate reduced carbon footprints gain a distinct competitive advantage, aligning with the growing ESG mandates of major global mining houses. The convergence of AI, automation, and sustainable power sources defines the modern contract mining technological requirement, shifting the focus from sheer horsepower to intelligent, data-driven execution.

Regional Highlights

The Contract Mining Services Market exhibits diverse regional growth profiles, reflecting variations in mineral endowment, regulatory environments, and the maturity of local mining industries. Asia Pacific (APAC) dominates the market, primarily driven by massive iron ore and coal extraction activities in Australia, India, and Indonesia. Australia, in particular, serves as a global hub for advanced contract mining services, characterized by large-scale, highly mechanized operations and early adoption of autonomous technology. The substantial investment in infrastructure and energy requirements across emerging Asian economies ensures continued high demand for bulk commodities, anchoring APAC's market leadership.

North America (NA) and Latin America (LATAM) represent critical growth regions, with LATAM being essential for global copper and iron ore supply, and NA focusing on gold, copper, and specialized industrial minerals. In LATAM, complex geological structures and remote locations, such as those found in the high-altitude mines of the Andes, necessitate specialized contract mining expertise for underground development and high-capacity hauling. NA's growth is fueled by renewed investment in mineral projects, often driven by government initiatives to secure domestic supply chains for critical minerals, favoring contractors with proven compliance records and advanced safety protocols.

The Middle East and Africa (MEA) region is emerging as a significant opportunity, characterized by vast, largely untapped mineral reserves (gold, phosphate, bauxite). Many African countries are modernizing their mining sectors, seeking international contract miners to bring in expertise, technology, and adherence to global ESG standards, bypassing the need for large domestic capital outlays. While Europe is a more mature and smaller market, it remains highly specialized, focusing on sustainable mining practices and innovative technologies, particularly in Sweden and Finland, where contractors are pioneering deep-mine automation and efficient resource processing techniques.

- Asia Pacific (APAC): Market leader driven by large-scale bulk commodity mining (iron ore, coal) in Australia and Indonesia; characterized by advanced autonomous and mechanized operations.

- North America (NA): Strong growth linked to the focus on domestic supply chains for critical minerals (copper, lithium) and the implementation of stringent safety and environmental regulations favoring sophisticated contractors.

- Latin America (LATAM): High demand for specialized underground and high-altitude mining services, critical for the global supply of copper, gold, and iron ore; growth is linked to new project developments in Chile and Peru.

- Middle East and Africa (MEA): Emerging powerhouse with substantial growth potential due to untapped reserves of gold and base metals; reliant on international contractors for expertise, technology transfer, and compliance standards.

- Europe: Highly specialized market focused on sustainable and deep-mine operations; leaders in automation and the use of battery electric vehicles for environmentally conscious extraction.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contract Mining Services Market.- CIMIC Group

- Downer Group

- Thiess

- BCM International

- Barminco (part of Perenti Global)

- Redpath Mining

- Macmahon Holdings

- Byrnecut

- Murray & Roberts Cementation

- NQ Group

- Golding Contractors

- Ausdrill (part of Perenti Global)

- Metso Outotec

- Sandvik

- FLSmidth

- Boart Longyear

- Perenti Global

- Nordgold

- HSE Mining

- Pybar Mining Services

Frequently Asked Questions

Analyze common user questions about the Contract Mining Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of utilizing contract mining services over in-house operations?

The primary advantages include significant reduction in capital expenditure (CapEx), converting fixed costs to variable costs, gaining access to specialized, high-tech equipment and skilled labor immediately, mitigating operational risks (such as equipment failure), and allowing the mine owner to focus organizational resources on core activities like exploration and resource strategy.

How does the volatile price of commodities affect the Contract Mining Services market?

Commodity price volatility introduces instability; sharp price drops can lead mine owners to postpone or cancel projects, directly affecting contract revenue. Conversely, high prices incentivize rapid production ramp-ups, increasing demand for flexible contract services. Contractors must manage this risk by diversifying commodity exposure and utilizing flexible contract pricing models.

Which geographical region holds the largest market share for contract mining, and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is due to extensive, large-scale mining operations for bulk commodities like iron ore and coal, especially in Australia and Indonesia, coupled with high levels of investment in mechanized operations and supportive government policies for resource extraction.

What role does automation and AI play in differentiating contract mining service providers?

Automation and AI are crucial differentiators, allowing leading contractors to offer superior efficiency, safety, and productivity. AI-powered systems enable predictive maintenance, autonomous fleet management, and optimized grade control, reducing operational costs per ton and providing a competitive edge, which is highly valued by global mining corporations.

What are the key growth opportunities in the Contract Mining Services market for the next decade?

The key growth opportunities are concentrated in the battery metals sector (lithium, nickel, cobalt) driven by the global energy transition. Further opportunities arise from the increasing demand for specialized underground mining expertise as easily accessible surface deposits deplete, and the widespread adoption of ESG-compliant, sustainable mining technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager