Contract or Temporary Staffing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436100 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Contract or Temporary Staffing Services Market Size

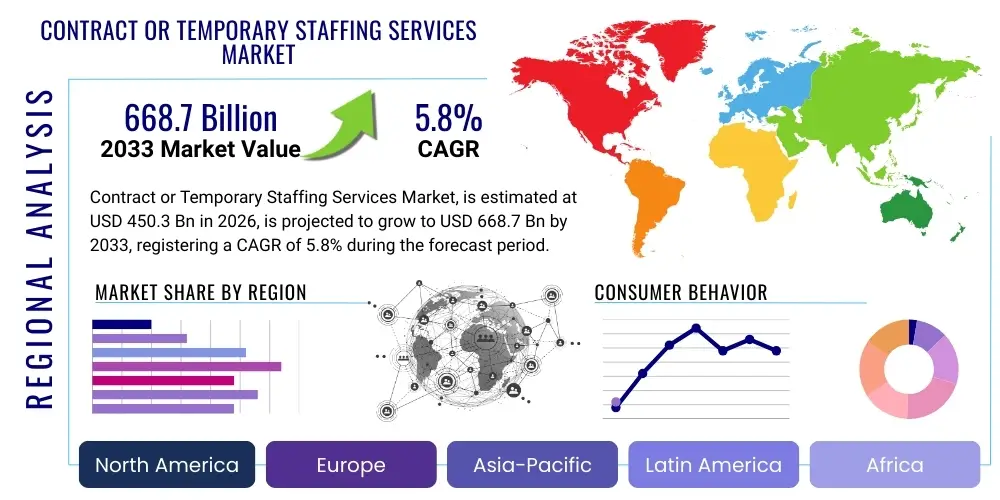

The Contract or Temporary Staffing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450.3 Billion in 2026 and is projected to reach USD 668.7 Billion by the end of the forecast period in 2033.

Contract or Temporary Staffing Services Market introduction

The Contract or Temporary Staffing Services Market encompasses the specialized segment of the human resource industry dedicated to providing organizations with flexible workforce solutions on a contract, temporary, or project basis. This includes supplying workers across various skill sets—from administrative and light industrial roles to highly specialized IT, engineering, and professional services—to help companies manage fluctuating workloads, fill short-term skill gaps, or bypass the lengthy and costly processes associated with permanent hiring. These services are essential in modern business environments characterized by volatility and a pronounced need for scalable human capital management, enabling businesses to maintain operational efficiency and respond rapidly to shifting market demands without expanding their permanent headcount.

The primary applications of contract staffing span nearly every industry vertical, including technology, healthcare, finance, manufacturing, and retail. The fundamental product offered is access to pre-vetted, specialized talent pools, often on demand. Benefits derived by clients include reduced overhead costs, improved time-to-hire metrics, mitigation of employment risk, and immediate access to niche expertise that may not be available internally. This operational flexibility is particularly crucial for businesses undergoing digital transformation or seasonal peaks, allowing them to optimize labor expenditure against output requirements.

Market growth is predominantly driven by global trends emphasizing workforce agility, the increasing complexity of regulatory compliance in permanent hiring, and the burgeoning prevalence of the gig economy model, which normalizes non-traditional employment structures. Furthermore, rapid technological advancements, especially in areas such as cloud computing, artificial intelligence, and cybersecurity, continually generate demand for highly specialized contract professionals who can execute specific, short-term mandates. This structural reliance on external expertise solidifies the vital role temporary staffing agencies play in maintaining the fluidity and competitiveness of the global labor market ecosystem.

Contract or Temporary Staffing Services Market Executive Summary

The global Contract or Temporary Staffing Services Market is experiencing robust expansion, fundamentally driven by shifts towards flexible work models and sustained enterprise demand for specialized, on-demand talent. Current business trends indicate a strong move toward professional staffing segments, particularly IT and healthcare, where skill shortages are acute. Companies are increasingly leveraging external staffing partners not just for cost reduction but for strategic talent acquisition, treating temporary labor as a mechanism for project acceleration and risk management. This strategic pivot requires staffing firms to integrate advanced technology, such as AI-powered matching algorithms and robust VMS (Vendor Management Systems), to efficiently service high-volume, high-complexity client needs.

Regionally, North America and Europe continue to dominate the market share due to mature regulatory frameworks, high labor costs encouraging outsourcing, and extensive corporate adoption of flexible hiring strategies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This acceleration in APAC is fueled by rapid industrialization, increasing foreign direct investment, the professionalization of staffing services in emerging economies like India and China, and the growing acceptance of temporary employment among younger, tech-savvy workers. Economic recovery post-global disruptions has further incentivized businesses across all regions to prioritize temporary staffing over permanent expansion to hedge against future economic uncertainties.

Segment-wise, professional staffing, particularly focusing on technology roles (Software Development, Data Science, Cybersecurity), remains the leading segment in terms of revenue and growth potential. Light industrial staffing, serving logistics, manufacturing, and e-commerce, also shows strong, sustained growth, directly correlated with the expansion of global supply chains and online retail penetration. The competitive landscape is characterized by consolidation, with large multinational firms acquiring regional specialists to broaden their geographic footprint and enhance niche capabilities. Technology integration and adherence to complex global labor laws represent the primary operational challenges and differentiators for successful market participants.

AI Impact Analysis on Contract or Temporary Staffing Services Market

Common user questions regarding AI's impact on the staffing sector frequently revolve around efficiency gains in recruitment, the potential displacement of recruiters, and the evolution of job roles suitable for temporary placement. Users are primarily concerned with whether AI will standardize the hiring process to the point of commoditization, or if it will simply augment human recruiters, freeing them for more strategic tasks like client relationship management and complex negotiation. Key expectations center on AI’s ability to predict candidate performance, automate initial screening and sourcing, and minimize bias in the selection process, thereby increasing placement quality and speed. This heightened interest suggests the market views AI as an essential mechanism for navigating intense competition and severe talent shortages, rather than solely a cost-cutting tool.

- AI-driven sourcing tools reduce time-to-fill rates by analyzing vast datasets of candidate profiles and job descriptions.

- Predictive analytics models improve candidate-job matching accuracy, leading to higher retention rates for contract placements.

- Automation of routine administrative tasks (e.g., scheduling interviews, processing timesheets) allows human recruiters to focus on strategic client consulting.

- Natural Language Processing (NLP) is utilized for automated resume parsing and sentiment analysis during initial candidate interactions via chatbots.

- AI assists in identifying potential skill gaps within a client organization, allowing staffing firms to proactively train or source relevant temporary talent.

- Enhanced security and compliance monitoring through AI systems that track regulatory changes affecting contract labor laws.

- The development of intelligent platforms that facilitate frictionless onboarding and offboarding for high-volume temporary assignments.

- Creation of specialized AI tools for assessing soft skills and cultural fit, moving beyond traditional keyword matching.

DRO & Impact Forces Of Contract or Temporary Staffing Services Market

The dynamics of the Contract or Temporary Staffing Services Market are shaped by a complex interplay of internal industry factors and external macroeconomic forces. The primary drivers (D) include the escalating need for operational flexibility across industries, the widening skills gap in specialized technological fields, and the global acceptance of contingent workforce models as a strategic human resource tool. These factors collectively push enterprises toward external staffing solutions. Conversely, significant restraints (R) exist, notably the high cyclical vulnerability of the industry to economic downturns, complex and divergent national labor regulations regarding temporary worker rights and classification, and the inherent difficulty in maintaining candidate loyalty in a highly competitive freelance environment.

Opportunities (O) abound, driven largely by digital transformation initiatives worldwide, creating sustained demand for niche IT and project-based contract talent. Furthermore, the expansion into underserved verticals, such as advanced manufacturing and renewable energy, offers lucrative growth paths. The adoption of advanced technology—such as comprehensive VMS and AI matching algorithms—also presents an opportunity for staffing firms to enhance efficiency, reduce operational costs, and solidify competitive advantage by offering superior service quality and faster fulfillment rates. Strategic partnerships with training institutions to develop bespoke talent pipelines represent another significant avenue for market expansion.

The most prominent impact forces affecting the market include macroeconomic volatility (directly influencing hiring confidence), regulatory shifts (determining the legality and cost of temporary labor), and technological disruption (both internally through AI adoption and externally through client-driven skill requirements). These forces dictate pricing power, scalability, and regional market penetration. The continuous push-pull between the demand for highly skilled, expensive temporary talent and the pressure to maintain cost-effectiveness defines the operational landscape for industry leaders.

Segmentation Analysis

The Contract or Temporary Staffing Services Market is comprehensively segmented based on skill type, employment duration, industry vertical, and geographic region, allowing for granular analysis of demand patterns and growth trajectories. The segmentation by skill type, encompassing professional, industrial, and administrative categories, reveals differentiated growth rates, with professional staffing—particularly in IT and healthcare—exhibiting the highest CAGR due to acute talent shortages. Segmentation by industry vertical highlights the resilience of the healthcare and technology sectors as consistent consumers of temporary staff, irrespective of broader economic cycles. Analyzing these segments provides strategic intelligence on where resources should be allocated for optimal market returns.

Key segmentation analysis reveals that the distinction between traditional temporary staffing (covering seasonal or short-term absences) and contract staffing (covering long-term project-based roles) is becoming increasingly blurred, driven by client demand for hybrid solutions. The shift toward outcomes-based staffing models, where agencies are paid based on project milestones rather than hours worked, is influencing the revenue structure within professional services segments. Furthermore, geographical segmentation is critical, as local labor laws and economic stability drastically impact the permissible scope and profitability of temporary work arrangements, necessitating regionally tailored operational strategies by global market leaders.

- By Skill Type:

- Professional Staffing (IT, Engineering, Finance, Legal, Scientific)

- Industrial Staffing (Manufacturing, Logistics, Light Industrial)

- Administrative and Clerical Staffing

- Healthcare Staffing (Nurses, Allied Health Professionals)

- Other Staffing Services

- By Employment Duration:

- Short-Term Temporary

- Long-Term Contract

- Temp-to-Hire

- By End-User Industry:

- IT and Telecom

- Healthcare

- Manufacturing and Automotive

- BFSI (Banking, Financial Services, and Insurance)

- Retail and Consumer Goods

- Government and Public Sector

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Contract or Temporary Staffing Services Market

The value chain for temporary staffing services begins with upstream activities focused on talent acquisition and management. This involves rigorous sourcing, screening, background checks, and skill verification processes, often augmented by proprietary technologies like AI matching platforms. Key upstream stakeholders include educational institutions (as talent sources), technology providers (for recruitment software and analytics), and job board operators. The efficiency of the upstream segment is paramount as it determines the quality and speed of talent fulfillment, which are core competitive differentiators in this service market.

The midstream segment is characterized by the core service delivery provided by staffing agencies. This involves client engagement, understanding complex staffing requirements, contract negotiation, compliance management, and deployment of the temporary workforce. Effective distribution channels are critical, primarily including direct sales teams managing key accounts, specialized recruiting divisions, and increasingly, online talent marketplaces and Vendor Management Systems (VMS) which act as managed intermediaries between large clients and multiple staffing providers. Direct channels allow for customized, high-touch solutions for specialized roles, while indirect channels via VMS or MSP (Managed Service Provider) relationships facilitate high-volume, standardized placements.

Downstream activities focus on the client organization (end-user) and the ongoing management of the deployed workforce. This includes payroll, benefits administration, performance tracking, conflict resolution, and compliance adherence specific to the contract duration and geographic location. The downstream process often involves collaboration between the staffing firm and the client's internal HR or procurement departments to ensure seamless integration. Customer satisfaction and successful conversion of temp-to-hire arrangements serve as critical indicators of value chain efficacy, driving repeat business and long-term strategic partnerships.

Contract or Temporary Staffing Services Market Potential Customers

Potential customers for Contract or Temporary Staffing Services are virtually all entities requiring flexible labor, ranging from multinational corporations to small and medium-sized enterprises (SMEs), and governmental bodies. The primary end-user profile includes organizations facing rapid growth cycles, those operating in highly regulated or project-intensive industries (like pharmaceuticals or construction), and companies undergoing internal restructuring or digital transformation. These buyers prioritize agility and speed, viewing contract staff as an essential resource for scaling operations without committing to the fixed costs of permanent employees.

Within the largest market segments, technology companies constitute a high-value customer group, consistently seeking specialized contractors for niche roles such as cloud architecture, DevOps, and data analytics, often needing these skills on short notice for defined project durations. Similarly, healthcare providers, particularly hospitals and clinics, are perpetually constrained by shortages of nurses and specialty clinicians, making them heavy, consistent consumers of temporary medical staffing services to maintain mandatory staffing levels and quality of care. The procurement models vary significantly across customer types, with large enterprises using centralized procurement and VMS platforms, while SMEs often rely on localized direct relationships with regional staffing firms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.3 Billion |

| Market Forecast in 2033 | USD 668.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Adecco Group, Randstad N.V., ManpowerGroup, Allegis Group, Kelly Services, Hays plc, Robert Half International, TrueBlue Inc., Recruit Holdings, CDI Corporation, Kforce Inc., ASCO Group, On Assignment, Insight Global, TEKsystems, Spherion, Aerotek, GattiHR, Cross Country Healthcare, Collabera |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Contract or Temporary Staffing Services Market Key Technology Landscape

The technological evolution within the Contract or Temporary Staffing Services Market is centered on enhancing speed, compliance, and placement quality through sophisticated automation and data analysis. Central to this landscape are proprietary Applicant Tracking Systems (ATS) and Vendor Management Systems (VMS). Modern ATS are integrated with AI and machine learning capabilities to rapidly process vast quantities of candidate data, moving far beyond simple keyword matching to assess semantic relevance and predict success indicators. VMS platforms, deployed by large clients, standardize the process of engaging multiple staffing agencies, managing contracts, tracking expenditures, and ensuring regulatory compliance across a decentralized workforce. The competitive advantage increasingly lies in the seamless integration and interoperability of these systems.

A significant trend is the rise of specialized talent marketplaces and platform models (sometimes referred to as "staffing-as-a-service"). These digital platforms directly connect clients with pre-vetted freelancers and contractors, bypassing traditional agency processes for certain segments, particularly high-skill, project-based roles. Staffing firms are responding by either developing their own proprietary platforms to manage their curated talent pools or by integrating third-party platform technologies. Blockchain technology is also gaining traction, particularly for secure verification of professional credentials, minimizing fraud, and streamlining cross-border payments for global contract placements, addressing critical trust and compliance issues.

Furthermore, the focus on candidate and employee experience necessitates the use of robust mobile applications for communication, time tracking, expense reporting, and accessing benefits information. Predictive analytics tools are being deployed not just for candidate matching but also for forecasting client demand based on economic indicators and project pipelines. This technological stack transforms the staffing agency from a mere intermediary into a data-driven consultancy, capable of providing strategic workforce planning advice and optimizing labor utilization across complex enterprise environments. Cybersecurity investment is also critical, given the massive volumes of sensitive personal and corporate data handled during the recruitment and payroll processes.

Regional Highlights

The global market exhibits diverse growth dynamics shaped by regional economic maturity, regulatory environments, and industry composition. North America remains the leading market in terms of revenue, driven by aggressive digital transformation in the US and Canada, sustained demand for high-tech contract labor, and a business culture highly receptive to contingent workforce models. The maturity of Managed Service Provider (MSP) and Vendor Management System (VMS) adoption in this region further cements its dominance, standardizing procurement practices across large multinational corporations.

Europe holds a substantial market share, characterized by complex, heterogeneous labor laws across member states (e.g., Atypical work regulations in France, specific temporary worker directives in Germany). Growth is strong, particularly in professional services and manufacturing sectors. Regulatory compliance is the single most critical factor in European operations, often requiring highly sophisticated local expertise from staffing firms. The UK, despite recent shifts, remains a central hub for professional contract roles, particularly in financial services and IT.

Asia Pacific (APAC) represents the fastest-growing region. This explosive growth is attributed to rapid economic development, urbanization, massive infrastructure projects, and the increasing professionalization of the staffing industry in emerging economies like India, China, and Southeast Asia. While industrial and administrative staffing initially drove demand, the region is now seeing a significant surge in demand for specialized contract talent in technology and digital commerce sectors, reflecting massive foreign investment and local enterprise innovation. Latin America and the Middle East & Africa (MEA) are emerging, offering substantial long-term potential driven by natural resource projects and diversified economic initiatives, though market penetration rates remain lower compared to established regions.

- North America (Dominance): High adoption of technology professionals; strategic use of VMS/MSP programs; robust regulatory structure supporting flexible employment in many states.

- Europe (Compliance-Driven): Strong demand in professional and healthcare segments; growth constrained by stringent temporary labor directives and high worker protection laws; significant focus on cross-border compliance.

- Asia Pacific (Fastest Growth): Driven by high economic growth rates and expanding manufacturing/e-commerce sectors; increasing demand for localized IT and engineering expertise; gradual relaxation of rigid employment laws.

- Latin America (Emerging Potential): Focus on light industrial and resource-extraction staffing; market expansion tied closely to foreign investment stability and infrastructure development.

- Middle East and Africa (Niche Growth): Demand concentrated in high-value sectors such as Oil & Gas, infrastructure, and technology; market highly influenced by government investment policies and expatriate workforce management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Contract or Temporary Staffing Services Market.- Adecco Group

- Randstad N.V.

- ManpowerGroup

- Allegis Group

- Kelly Services

- Hays plc

- Robert Half International

- TrueBlue Inc.

- Recruit Holdings

- CDI Corporation (A ManpowerGroup Brand)

- Kforce Inc.

- ASCO Group

- On Assignment (now part of ASGN Incorporated)

- Insight Global

- TEKsystems (A subsidiary of Allegis Group)

- Spherion

- Aerotek (A subsidiary of Allegis Group)

- GattiHR

- Cross Country Healthcare

- Collabera

Frequently Asked Questions

Analyze common user questions about the Contract or Temporary Staffing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current high demand for specialized IT contract staffing?

The high demand for specialized IT contract staffing is primarily driven by accelerated digital transformation across all industries, rapid adoption of cloud computing, cybersecurity threats, and the need for scarce expertise in areas like AI/ML and data science, which companies prefer to acquire on a project basis rather than through lengthy permanent hiring processes. Contract roles offer immediate access to expert skills necessary to launch critical digital projects quickly.

How does the global economic forecast influence the temporary staffing industry?

The temporary staffing industry is highly cyclical and serves as a leading economic indicator. During periods of economic uncertainty, businesses increase reliance on temporary staff to manage labor costs and maintain flexibility, accelerating market growth. Conversely, during strong economic expansion, companies may shift to permanent hiring, stabilizing but sometimes slowing temporary staffing growth, though specialized contract demand usually remains robust.

What role do Vendor Management Systems (VMS) play in the staffing market?

VMS platforms serve as centralized technological ecosystems used by large enterprises to manage their contingent workforce program, including procurement, sourcing from multiple staffing agencies, contract management, time tracking, and expense processing. VMS standardizes vendor performance metrics and ensures compliance, creating efficiency and transparency, particularly for high-volume staffing users.

What regulatory challenges most affect international temporary staffing firms?

International staffing firms face challenges relating to worker misclassification (ensuring contractors are not treated as permanent employees), diverse social security and tax requirements across different countries, and adhering to local "equal treatment" regulations, which mandate that temporary workers receive comparable pay and benefits to permanent staff in the client organization.

How are staffing agencies adapting to the rise of the independent gig economy workforce?

Staffing agencies are adapting by developing hybrid models, leveraging technology platforms to engage and manage independent contractors directly, and offering compliance and payroll services tailored specifically for the gig workforce. This allows them to monetize the gig economy trend while providing the structure and risk mitigation that corporate clients require.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager