Conventional and Alternative Pain Treatment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436445 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Conventional and Alternative Pain Treatment Market Size

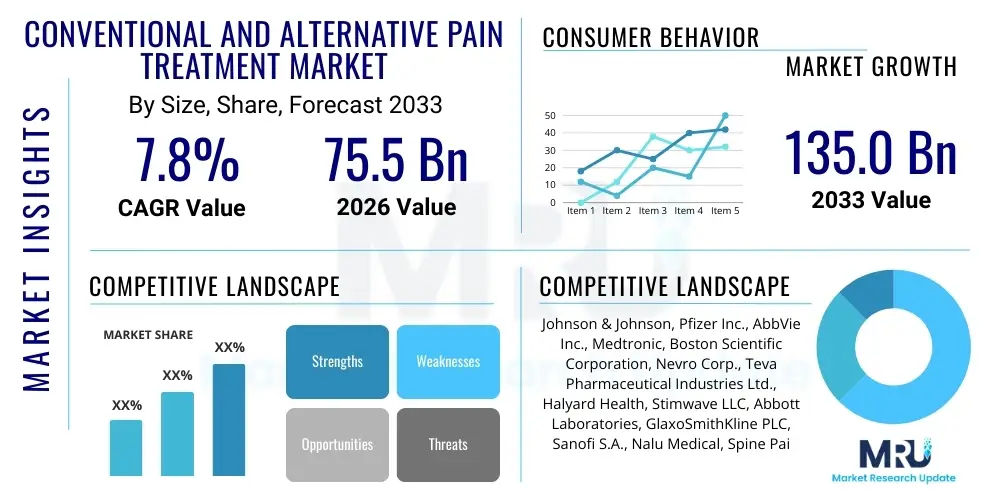

The Conventional and Alternative Pain Treatment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 75.5 Billion in 2026 and is projected to reach USD 135.0 Billion by the end of the forecast period in 2033.

Conventional and Alternative Pain Treatment Market introduction

The Conventional and Alternative Pain Treatment Market encompasses a broad spectrum of therapeutics aimed at managing acute and chronic pain conditions globally. Conventional treatments predominantly include pharmacological interventions such as Non-Steroidal Anti-Inflammatory Drugs (NSAIDs), opioids, local anesthetics, and increasingly, biological therapies targeting specific inflammatory pathways. The consistent rise in the global prevalence of chronic diseases, musculoskeletal disorders, and aging populations serves as the primary demographic driver necessitating advanced pain management solutions. Furthermore, the societal cost associated with chronic pain, impacting productivity and quality of life, compels healthcare systems and pharmaceutical companies to invest heavily in innovative treatment modalities.

The product description within this market includes a duality of offerings. On the conventional side, innovation is focused on developing non-addictive analgesics and optimizing drug delivery systems to minimize systemic side effects, particularly addressing the ongoing opioid crisis in regions like North America. Alternative treatments, or Complementary and Integrative Health (CIH) approaches, include acupuncture, chiropractic care, massage therapy, herbal supplements, and mind-body techniques such as meditation and yoga. These alternative methods are gaining significant traction, fueled by patient preference for non-pharmacological options and growing clinical evidence supporting their efficacy, especially when used adjunctively with conventional care.

Major applications of pain treatments span numerous medical domains, including orthopedic pain management, cancer pain, neuropathic disorders (like diabetic neuropathy and post-herpetic neuralgia), and migraine relief. The driving factors behind market expansion are multifaceted, including technological advancements in neuromodulation devices (spinal cord stimulators, dorsal root ganglion stimulation), enhanced understanding of pain mechanisms leading to targeted therapies, favorable regulatory approvals for novel biologics, and robust insurance coverage expansion for alternative therapies. The synergistic integration of conventional medicine with evidence-based alternative therapies represents a key benefit, offering patients personalized, multi-modal pain relief strategies that improve functional outcomes and reduce dependence on high-risk medications.

Conventional and Alternative Pain Treatment Market Executive Summary

The Conventional and Alternative Pain Treatment Market is experiencing a pivotal transformation marked by significant shifts in treatment paradigms, regional market buoyancy, and specialized segment growth. Business trends indicate a strong move away from legacy pharmaceutical dependence toward holistic, patient-centric care models. Key industry players are strategically diversifying their portfolios to include advanced medical devices, such as implantable pain pumps and sophisticated neurostimulators, alongside investments in digital health platforms that facilitate remote monitoring and personalized therapy adjustments. The global opioid crisis continues to exert profound downward pressure on prescription volume for traditional opioid narcotics, simultaneously spurring unprecedented research and development efforts into novel, non-opioid pharmacological agents and gene therapies for chronic pain management. Mergers and acquisitions are frequent, often targeting niche companies specializing in herbal remedies, sophisticated delivery technologies, or AI-driven diagnostic tools that can better phenotype pain conditions.

Regionally, North America maintains its dominance due to high chronic disease burden, extensive healthcare expenditure, and rapid adoption of innovative medical technologies, particularly in advanced neuromodulation. However, the Asia Pacific (APAC) region is projected to register the fastest growth, propelled by increasing patient awareness, improving healthcare infrastructure, and the deep cultural integration of traditional Asian medicine (like Traditional Chinese Medicine and Ayurveda) which often aligns perfectly with the 'alternative' segment definition. European markets show stable growth, driven by favorable reimbursement policies for multidisciplinary pain clinics and a regulatory environment that encourages the validation and integration of complementary therapies into standard clinical guidelines. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging markets, characterized by improving access to conventional treatments and nascent adoption of high-cost advanced devices.

Segment trends demonstrate robust performance in the device category, particularly in radiofrequency ablation and spinal cord stimulation (SCS), driven by long-term efficacy and reduced invasiveness compared to surgery. Within pharmaceuticals, the focus has shifted heavily toward biologics and specialized non-opioid drugs, such as selective nerve block agents and novel antidepressants repurposed for neuropathic pain. The alternative treatment segment is capitalizing on the growing consumer preference for natural remedies and preventative care, with physical therapy and chiropractic services experiencing widespread adoption. Furthermore, the distinction between conventional and alternative is blurring, leading to a surge in demand for integrated solutions that offer the benefits of both worlds, validating the overarching trend toward integrated pain management centers.

AI Impact Analysis on Conventional and Alternative Pain Treatment Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Conventional and Alternative Pain Treatment Market center heavily on how AI can personalize treatment protocols, reduce diagnostic uncertainty, and accelerate the development of non-addictive analgesics. Users frequently ask about AI's role in predicting patient response to specific therapies (e.g., who will benefit most from acupuncture versus SCS), the ethical implications of using machine learning models to recommend treatments, and the potential for AI-driven remote monitoring systems to improve adherence and adjust dosages in real-time. Key concerns revolve around data privacy when integrating diverse data sets—from electronic health records to wearable device data—and ensuring that AI tools effectively integrate traditional CIH data, which is often qualitative or less standardized than conventional medical data. Overall, user expectation is high regarding AI's ability to revolutionize personalized pain relief, moving beyond standardized treatment algorithms to precision pain management.

- AI accelerates drug discovery by simulating molecular interactions, significantly reducing the time and cost associated with identifying novel non-opioid targets and analgesic compounds.

- Predictive analytics driven by AI models allow for the precise stratification of patients based on pain phenotype, optimizing the selection between conventional drugs, neuromodulation, or alternative therapies.

- Machine learning algorithms enhance diagnostic accuracy by analyzing complex medical imaging, patient histories, and genomic markers, facilitating earlier intervention for chronic pain generators.

- AI-powered digital therapeutics offer personalized behavioral coaching, biofeedback mechanisms, and therapeutic interventions accessible via smartphone applications, improving patient self-management and reducing reliance on clinic visits.

- Natural Language Processing (NLP) is utilized to analyze unstructured data from patient notes and qualitative assessments of pain (e.g., patient diaries or sentiment analysis) to provide richer insights into pain perception and treatment effectiveness, particularly for alternative therapies.

DRO & Impact Forces Of Conventional and Alternative Pain Treatment Market

The dynamics of the Conventional and Alternative Pain Treatment Market are significantly shaped by a confluence of influential factors encapsulated within the Drivers, Restraints, and Opportunities (DRO) framework, which collectively defines the market's trajectory and immediate impact forces. A primary driver is the undeniable global demographic shift, characterized by an accelerating aging population that naturally experiences a higher incidence of age-related degenerative conditions, musculoskeletal pain, and chronic neuropathies, thereby escalating the demand for both pharmaceutical and device-based pain relief solutions. Concurrently, the increasing clinical acceptance and regulatory approval of integrated medicine approaches, which validate the efficacy of evidence-based alternative treatments, provide patients with a broader, safer array of management options, mitigating some of the risk associated with conventional pharmaceutical overuse.

Restraints primarily revolve around stringent regulatory pathways, especially for novel drug entities and high-cost implantable devices, which often require extensive, expensive clinical trials demonstrating both long-term safety and superior efficacy compared to existing standards of care. Furthermore, the lack of standardized reimbursement policies for many alternative treatments, despite growing clinical evidence, acts as a financial barrier for widespread patient adoption across various healthcare systems. The pervasive issue of addiction and misuse associated with potent conventional treatments, particularly opioids, imposes significant regulatory hurdles and public scrutiny, compelling companies to divert substantial R&D resources toward developing abuse-deterrent formulations or entirely new classes of analgesics, which is a costly and protracted process.

Opportunities for growth are prominently found in the burgeoning telehealth and digital therapeutics space, which offers scalable solutions for chronic pain management, enabling remote consultation, monitoring, and delivery of cognitive behavioral therapy (CBT) and other self-management techniques. There is a substantial untapped market in personalized medicine, where genomic and biomarker analysis can tailor pain treatment, maximizing therapeutic response while minimizing adverse effects. Additionally, investing in emerging markets, such as those in APAC and LATAM, provides high-growth potential driven by expanding healthcare infrastructure and increased disposable income dedicated to quality-of-life improvements. The overarching impact forces include rising chronic disease prevalence, governmental intervention (anti-opioid campaigns), technological advancements in minimally invasive procedures, and a strong consumer-driven demand for holistic, non-pharmacological pain solutions.

Segmentation Analysis

The Conventional and Alternative Pain Treatment Market is intricately segmented based on treatment type, application, and distribution channel, reflecting the diverse approaches required for comprehensive pain management. The treatment type segmentation distinguishes between pharmacological interventions, which remain the largest revenue generator but face significant regulatory pressure, and non-pharmacological methods, which are experiencing the fastest growth due to safety profile and consumer demand. Within the application segment, musculoskeletal pain and neuropathic pain represent the most critical areas, driven by high global incidence rates and the chronic nature of these conditions, requiring long-term, multi-modal treatment strategies. Understanding these segment dynamics is crucial for stakeholders to align their product development and market penetration strategies with the areas of highest unmet medical need and consumer willingness to pay.

The market's complexity is further highlighted by the segmentation of alternative treatments, which span physical manipulation techniques, energy-based therapies, and biological supplements. This specific segment is becoming increasingly formalized, moving from independent practices to integration within hospital-affiliated pain clinics, driven by a desire to offer patients integrated care pathways. Distribution channels reflect this integration, with hospital pharmacies and dedicated pain clinics being critical for conventional treatments and high-cost devices, while online platforms and specialized retail stores play a vital role in the accessibility of over-the-counter NSAIDs and herbal/nutritional supplements for pain and inflammation management. The interplay between these segments demonstrates a market moving toward specialized, localized care, dictated by the specific etiology and severity of the patient's pain experience.

- By Treatment Type:

- Conventional Treatments

- Pharmacological Agents (Opioids, NSAIDs, Local Anesthetics, Anticonvulsants, Antidepressants, Biologics)

- Medical Devices (Neuromodulation Devices - Spinal Cord Stimulators, Dorsal Root Ganglion Stimulators, Neuroablation Devices, Infusion Pumps)

- Alternative Treatments

- Body-Based Therapies (Acupuncture, Chiropractic, Massage Therapy, Physical Therapy)

- Mind-Body Techniques (Meditation, Yoga, Biofeedback)

- Biological Products (Herbal Supplements, Vitamins, Homeopathy)

- By Application:

- Musculoskeletal Pain (Chronic Back Pain, Arthritis, Fibromyalgia)

- Neuropathic Pain (Diabetic Neuropathy, Post-Herpetic Neuralgia)

- Cancer Pain

- Migraine and Headache

- Post-Operative Pain

- By Distribution Channel:

- Hospital Pharmacies

- Retail Pharmacies and Drug Stores

- E-commerce and Online Pharmacies

- Pain Management Clinics

Value Chain Analysis For Conventional and Alternative Pain Treatment Market

The value chain for the Conventional and Alternative Pain Treatment Market is complex, stretching from intensive upstream research and development activities to highly personalized downstream patient administration. Upstream analysis focuses predominantly on pharmaceutical and medical device innovation, including clinical trials for new drug entities and the engineering and miniaturization of neuromodulation devices. This phase is characterized by high capital expenditure, intellectual property creation, and collaboration between academic institutions, biotechnology startups, and major pharmaceutical firms. For alternative therapies, the upstream phase involves botanical sourcing, extraction standardization (for herbal products), and formal scientific validation of traditional practices to ensure safety and efficacy, which is a growing bottleneck requiring scientific rigor comparable to conventional treatments.

The midstream phase involves manufacturing, quality assurance, and regulatory compliance. Manufacturing of conventional drugs requires Good Manufacturing Practices (GMP) and rigorous quality control, while device manufacturing demands precision engineering and sterilization. For alternative products, midstream activities focus on supply chain transparency, ensuring raw material purity, and adhering to dietary supplement regulations, which vary significantly by geography. The effective management of inventory and logistics in this phase is critical, especially for high-value biological drugs or implantable devices which require careful temperature control and distribution protocols.

The downstream segment, focusing on distribution and patient access, is multi-faceted. Conventional treatments utilize established distribution channels (wholesalers, hospital networks, retail pharmacies), often requiring specialized handling for controlled substances (opioids). Direct distribution channels are prominent for advanced medical devices, requiring highly trained sales representatives and clinical specialists for device implantation and programming. Indirect channels are more common for OTC alternative products sold via e-commerce or retail supplement stores. Potential customers are segmented by the channel they utilize, ranging from institutional purchasers (hospitals and pain centers) seeking integrated device and drug portfolios, to individual consumers purchasing over-the-counter or prescribed therapies directly from pharmacies or dedicated pain specialists.

Conventional and Alternative Pain Treatment Market Potential Customers

Potential customers in the Conventional and Alternative Pain Treatment Market are highly diverse, spanning individual patients suffering from various pain etiologies, healthcare providers recommending treatment plans, and large institutional buyers managing patient populations. The largest segment of end-users consists of chronic pain patients, encompassing millions globally who suffer from conditions like osteoarthritis, rheumatoid arthritis, chronic low back pain, and cancer-related pain, requiring continuous or intermittent therapeutic intervention. These patients act as the ultimate consumers, driving demand for innovative, safer, and more effective treatments. Their purchasing decisions are heavily influenced by physician recommendation, insurance coverage, perceived efficacy, and the risk profile associated with the therapy, particularly the fear of addiction or long-term side effects.

Institutional buyers, primarily hospitals, specialized pain management clinics, and Ambulatory Surgical Centers (ASCs), represent another critical customer segment. These entities purchase pain relief products in bulk, including sophisticated surgical devices, high-volume injectables, and pharmaceutical stock. Their purchasing decisions are guided by clinical effectiveness, overall cost-effectiveness, supply chain reliability, and the ability of the product to integrate seamlessly into existing clinical workflows. Pain management clinics, which often specialize in multidisciplinary care, are particularly important customers for advanced diagnostic tools and integrated packages combining conventional and alternative modalities.

Furthermore, physicians, including anesthesiologists, orthopedic surgeons, neurologists, and primary care providers, serve as crucial gatekeepers, acting as the immediate buyers or prescribers of these products. Their adoption rate of new treatments is dictated by clinical evidence published in peer-reviewed journals, training programs, and the demonstrated superior patient outcomes. Increasingly, self-pay patients and consumers prioritizing wellness are driving the growth in the alternative treatment sector, purchasing supplements, services (acupuncture, chiropractic), and digital health subscriptions directly, representing a substantial direct-to-consumer segment focused on preventative and maintenance pain care.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 75.5 Billion |

| Market Forecast in 2033 | USD 135.0 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Pfizer Inc., AbbVie Inc., Medtronic, Boston Scientific Corporation, Nevro Corp., Teva Pharmaceutical Industries Ltd., Halyard Health, Stimwave LLC, Abbott Laboratories, GlaxoSmithKline PLC, Sanofi S.A., Nalu Medical, Spine Pain Management, Becton, Dickinson and Company, Integra LifeSciences, Collegium Pharmaceutical, Indivior PLC, Sun Pharma, Hologic, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conventional and Alternative Pain Treatment Market Key Technology Landscape

The Conventional and Alternative Pain Treatment Market is heavily influenced by a dynamic technological landscape, driven by the imperative to offer highly effective, minimally invasive, and non-addictive solutions. A paramount technological advancement lies in the field of Neuromodulation, particularly in High-Frequency and Burst Spinal Cord Stimulation (SCS) systems, which offer superior paresthesia-free pain relief and expanded battery longevity. These devices utilize advanced waveforms and software algorithms to precisely target nerve pathways, providing sustained pain relief for intractable chronic back and leg pain. Furthermore, the miniaturization of implantable devices and the development of rechargeable systems have significantly improved patient compliance and quality of life. This technological sophistication is moving towards closed-loop systems, where devices adjust stimulation parameters in real-time based on the patient's physiological feedback, optimizing pain control autonomously.

Another crucial technological area involves targeted drug delivery systems, designed to maximize therapeutic concentrations at the site of pain while minimizing systemic exposure and associated side effects. This includes sophisticated intrathecal drug delivery pumps, which precisely administer micro-doses of pain medication directly into the cerebrospinal fluid, offering superior relief for severe pain conditions, often reducing the total required dosage of systemic opioids. Parallel technological innovation is evident in the development of novel pharmacological agents, specifically P2X3 receptor antagonists and Nav1.7 sodium channel blockers, which represent the next generation of non-opioid medications targeting specific pain signaling pathways at the molecular level. These technologies promise to fundamentally change the pharmaceutical segment by providing high-efficacy alternatives without the risk of dependence.

The convergence of digital technology and therapeutic practice forms the third major pillar of innovation. This includes the rapid adoption of digital therapeutics (DTx), utilizing validated software programs delivered via mobile devices to provide structured interventions like Cognitive Behavioral Therapy for Chronic Pain (CBT-CP) and virtual reality (VR) immersive experiences for distraction and pain reduction. Wearable technology, integrated with AI and machine learning, is also becoming critical for monitoring patient activity levels, sleep quality, and physiological pain markers in real-time, allowing clinicians to tailor both conventional and alternative treatment plans with unprecedented precision. For the alternative segment, technology is standardizing practices; for example, advanced biofeedback devices quantify physiological responses during practices like meditation, providing measurable evidence of efficacy for previously qualitative therapies.

Regional Highlights

The regional analysis reveals distinct market maturity and growth dynamics across the globe, driven by varying healthcare expenditures, regulatory environments, and chronic disease prevalence rates. North America, encompassing the United States and Canada, currently holds the largest market share. This dominance is attributed to robust adoption rates of advanced medical devices, high disposable income facilitating access to expensive treatments (such as SCS and biologics), and the severe impact of the opioid epidemic, which fuels intensive research and governmental mandates for safer alternatives, thereby driving innovation in non-addictive conventional and highly integrated alternative therapies. Extensive insurance coverage and a well-established network of pain management specialists further solidify the region's leading position, particularly for complex neuropathic and post-surgical pain management.

Europe represents the second-largest market, characterized by stable growth driven by universal healthcare systems that increasingly recognize the cost-effectiveness of multidisciplinary pain management approaches. Countries like Germany, the UK, and France show high adoption of minimally invasive procedures and established guidelines for integrating complementary and alternative medicine (CAM) into standard care, especially for musculoskeletal conditions. Regulatory frameworks under the European Medicines Agency (EMA) facilitate timely approval for targeted pharmaceuticals and specialized medical devices. The aging population across Western Europe ensures sustained demand, with emphasis placed on improving the quality of life for elderly patients through personalized pain management plans and increased utilization of specialized pain clinics.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily fueled by vast, underserved patient populations, fast-improving healthcare access in emerging economies like China and India, and the rising prevalence of chronic conditions linked to lifestyle changes. APAC benefits uniquely from the deep cultural roots and established practices of traditional medicines, such as Traditional Chinese Medicine (TCM) and Ayurveda, which are inherently recognized as sophisticated alternative pain treatments. Market growth is further accelerated by increasing foreign direct investment in healthcare infrastructure and rising awareness among local populations regarding advanced Western conventional treatments, leading to a dynamic market where both high-tech devices and traditional remedies coexist and compete.

- North America: Market leader; driven by high spending on advanced medical technology (neuromodulation) and substantial investments aimed at solving the opioid crisis. High prevalence of chronic conditions and favorable reimbursement policies for specialized procedures.

- Europe: Mature market focusing on integrated care models and high quality of life. Strong adoption of non-pharmacological interventions and biologics, supported by universal healthcare coverage and established pain management guidelines.

- Asia Pacific (APAC): Fastest growing region; characterized by rapid economic development, improving healthcare infrastructure, and significant utilization of traditional systems (Acupuncture, Ayurveda) alongside modern conventional treatments. High volume of patients suffering from age-related and lifestyle-related pain.

- Latin America (LATAM): Emerging market with growing potential, driven by urbanization and rising incidence of diabetes-related neuropathic pain. Growth is often constrained by varying healthcare accessibility and affordability, leading to higher consumption of generic pharmaceuticals.

- Middle East and Africa (MEA): Growth focused on Gulf Cooperation Council (GCC) countries due to high healthcare tourism and infrastructure investment. Significant market penetration challenges remain in Africa due to infrastructural limitations and low healthcare spending per capita, although demand for essential conventional treatments is rising.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conventional and Alternative Pain Treatment Market.- Johnson & Johnson

- Pfizer Inc.

- AbbVie Inc.

- Medtronic

- Boston Scientific Corporation

- Nevro Corp.

- Teva Pharmaceutical Industries Ltd.

- Halyard Health (now part of Owens & Minor)

- Stimwave LLC

- Abbott Laboratories

- GlaxoSmithKline PLC

- Sanofi S.A.

- Nalu Medical

- Spine Pain Management

- Becton, Dickinson and Company (BD)

- Integra LifeSciences

- Collegium Pharmaceutical

- Indivior PLC

- Sun Pharma

- Hologic, Inc.

- Grünenthal GmbH

- Mallinckrodt Pharmaceuticals

- Acupuncture & Massage College (representing service providers)

- Deep Genomics (AI focused)

- BioDelivery Sciences International

Frequently Asked Questions

Analyze common user questions about the Conventional and Alternative Pain Treatment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Conventional and Alternative Pain Treatment Market?

The primary driver is the accelerating global prevalence of chronic pain conditions linked to the aging demographic, alongside the critical societal need for effective, non-addictive treatment options spurred by the global opioid crisis.

How is Artificial Intelligence (AI) influencing pain diagnosis and treatment selection?

AI is transforming pain management through predictive analytics, enabling personalized treatment recommendations based on complex patient data (genomics, imaging), thus optimizing the choice between pharmacological, device, and alternative therapies for maximum efficacy.

Which treatment segment is expected to show the highest growth rate during the forecast period?

The Alternative Treatments segment, particularly body-based therapies and digital therapeutics, is projected to exhibit the fastest CAGR, driven by patient demand for holistic, non-pharmacological interventions and increasing clinical validation of these methods.

What are the key technological advancements redefining conventional pain treatment devices?

Key advancements include the development of high-frequency and burst waveform spinal cord stimulators (SCS), the miniaturization of implantable neurostimulation devices, and the integration of closed-loop feedback systems for real-time therapy adjustment.

What regulatory challenge most significantly restrains market expansion?

The most significant restraint is the stringent regulatory scrutiny and complex approval process for novel non-opioid pharmaceutical agents and implantable devices, compounded by the inconsistent reimbursement policies for many alternative pain treatments across various jurisdictions.

How are conventional treatments evolving to address concerns about addiction?

Conventional treatments are evolving through the intensive development of novel non-opioid mechanisms of action (e.g., Nav1.7 blockers), abuse-deterrent formulations (ADFs) for existing opioids, and the increased utilization of targeted delivery systems like intrathecal pumps to reduce systemic exposure.

Which geographical region holds the largest market share for pain treatments?

North America maintains the largest market share due to its high healthcare expenditure, established infrastructure for advanced medical devices, and robust investment in R&D focusing on innovative pain management solutions.

What role do digital therapeutics play in chronic pain management?

Digital therapeutics (DTx) deliver scalable, software-based interventions such as cognitive behavioral therapy for chronic pain (CBT-CP) and virtual reality platforms, providing remote monitoring, personalized coaching, and behavioral modification tools that complement physical treatments.

What is the significance of integrated pain management clinics in the current market trend?

Integrated pain management clinics are crucial as they offer a multidisciplinary approach, combining pharmacological, interventional, physical, and alternative therapies under one roof. This holistic model is preferred by patients and increasingly supported by clinical evidence for superior long-term outcomes.

How do varying reimbursement policies affect the adoption of alternative pain treatments?

Varying reimbursement policies create significant barriers to adoption for many alternative treatments. Where coverage is standardized and favorable (often in Europe and integrated US systems), adoption is high; conversely, lack of coverage forces patients into self-pay models, limiting market penetration.

What are biologics and their potential in pain treatment?

Biologics are complex, large-molecule drugs derived from living systems, such as monoclonal antibodies, that target specific inflammatory mediators or nerve growth factors. They hold immense potential for treating chronic inflammatory and neuropathic pain by modulating the underlying disease processes rather than merely masking symptoms.

Beyond devices and drugs, what non-traditional methods are seeing increased clinical acceptance?

Non-traditional methods seeing increased clinical acceptance include mindfulness-based stress reduction (MBSR), therapeutic yoga, and formalized acupuncture protocols, especially for chronic low back pain and fibromyalgia, often recommended as first-line non-pharmacological treatments.

What challenges exist in standardizing efficacy measurement for alternative pain treatments?

Standardizing efficacy for alternative treatments is challenging due to inherent heterogeneity in practice techniques (e.g., different styles of acupuncture), lack of large-scale randomized controlled trials (RCTs), and the difficulty in designing effective placebo controls for non-pharmacological interventions.

What is the key difference between conventional and alternative pain treatment market components?

Conventional treatments primarily rely on pharmaceutical agents and medical devices regulated by strict medical bodies and typically involve invasive or synthetic interventions. Alternative treatments emphasize natural, holistic, and non-invasive methods, including mind-body practices and nutritional supplements, often focusing on wellness and self-care alongside pain relief.

How are manufacturers addressing the issue of device longevity and battery life in neuromodulation?

Manufacturers are innovating by developing rechargeable implantable pulse generators (IPGs) with extended battery life (often exceeding 10 years), reducing the need for costly and invasive battery replacement surgeries, thereby lowering the total cost of ownership for patients and providers.

What role does genetic testing play in future pain management?

Genetic testing is anticipated to play a crucial role in pharmacogenomics, predicting how an individual metabolizes or responds to specific pain medications (e.g., opioids, antidepressants), allowing for personalized dosing and selection to minimize adverse effects and maximize therapeutic response.

Which application segment holds the largest share in the pain treatment market?

Musculoskeletal pain management, encompassing conditions like chronic back pain and various forms of arthritis, constitutes the largest application segment globally due to its extremely high prevalence across all age groups and its significant contribution to disability.

What is the significance of pain phenotyping in modern pain research?

Pain phenotyping involves classifying chronic pain based on underlying biological and psychological mechanisms rather than just anatomical location. This allows researchers to match specific pain subtypes with targeted conventional and alternative therapies, moving away from a one-size-fits-all approach.

How is the e-commerce distribution channel impacting the market?

The e-commerce channel is rapidly growing, primarily facilitating the accessible distribution of over-the-counter NSAIDs, dietary supplements, and herbal remedies. It enhances consumer access, often at competitive prices, especially in regions with limited physical pharmacy infrastructure.

What impact has the COVID-19 pandemic had on the adoption of telehealth for pain management?

The COVID-19 pandemic significantly accelerated the adoption of telehealth for pain management, enabling remote consultations, virtual physical therapy, and remote delivery of cognitive therapies, which has permanently altered the delivery structure of chronic pain care services.

What are the primary drivers of growth specifically within the Asia Pacific pain treatment market?

Key drivers in APAC include the rapidly growing elderly population, improving healthcare infrastructure investments, rising disposable incomes, and the strong cultural acceptance and integration of traditional pain management systems alongside modern medical approaches.

How do novel analgesic targets differ from traditional opioid mechanisms?

Novel analgesic targets focus on modulating non-opioid pathways involved in pain signal transmission, such as specific voltage-gated ion channels (Nav1.7), G-protein coupled receptors, or specific inflammatory cytokines, aiming to interrupt pain perception without engaging the mu-opioid receptor associated with addiction.

In the Value Chain, where is the highest financial risk concentrated?

The highest financial risk is concentrated in the Upstream R&D phase, particularly in novel pharmaceutical drug development and the clinical trials required for high-cost implantable medical devices, which demand significant capital expenditure with high failure rates.

Why are patient outcomes often improved when combining conventional and alternative treatments?

Combining conventional and alternative treatments offers synergistic benefits: conventional methods address acute symptoms and immediate physical pathology, while alternative methods (like mind-body practices or physical therapy) address chronic inflammation, psychological factors, and functional limitations, leading to more comprehensive and sustained pain relief.

What are the key differences in regulatory challenges between the US and EU markets for pain treatments?

The US market (FDA) tends to prioritize speed of innovation but faces higher public scrutiny regarding opioid safety, while the EU market (EMA) often requires more comprehensive and long-term efficacy data, but integrates alternative/CAM therapies more readily into national guidelines if sufficient evidence is provided.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager