Conventional lathe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437718 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Conventional lathe Market Size

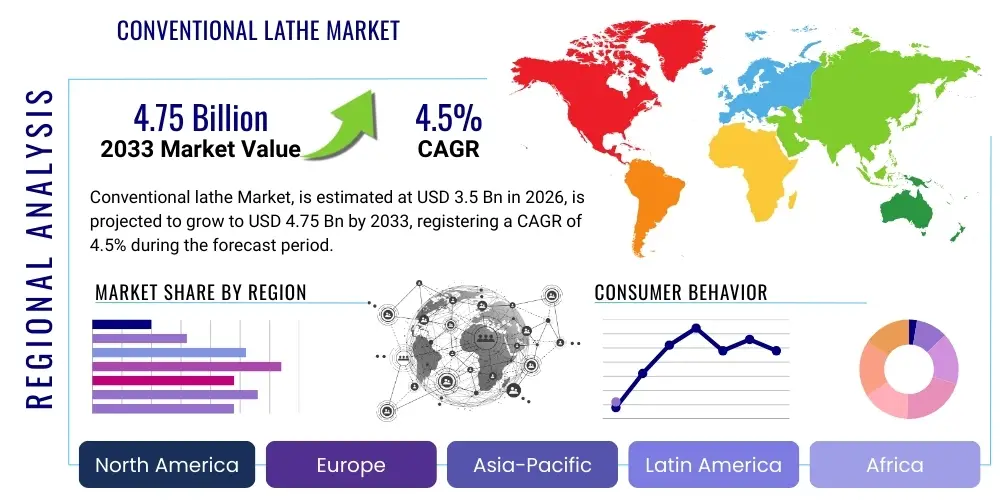

The Conventional lathe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 4.75 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily driven by the sustained demand for cost-effective and versatile machining solutions across developing economies and the continued need for basic repair, maintenance, and educational applications where complex automation is not required.

Conventional lathe Market introduction

The Conventional Lathe Market, often referred to as the manual or engine lathe market, encompasses traditional machine tools used for turning, facing, drilling, and threading operations. These machines utilize manual control to shape workpieces by rotating them against a cutting tool. Unlike their Computer Numerical Control (CNC) counterparts, conventional lathes are favored for their lower initial cost, ease of maintenance, and suitability for small-batch production, prototyping, and intricate job shop tasks where operator skill dictates precision.

Major applications of conventional lathes span diverse industrial sectors, including general engineering workshops, automotive repair and maintenance (MRO), vocational training institutes, and small-scale manufacturing units specializing in custom parts. The primary benefit of adopting conventional lathes lies in their operational simplicity and versatility, allowing skilled machinists to perform a wide variety of operations without extensive programming setup time, which is crucial for repair work and specialized modifications. Furthermore, these machines offer robustness and longevity, making them a foundational investment for new enterprises.

Driving factors for this market include the global expansion of infrastructure projects requiring on-site fabrication and repair capabilities, the increasing focus on vocational education and skilled trades development, and the robust demand from emerging markets where capital expenditure constraints favor reliable, manually operated machinery. While the market faces competition from advanced CNC technologies, the niche requirements for conventional lathes ensure their sustained presence, particularly in regions prioritizing accessibility and fundamental mechanical training.

Conventional lathe Market Executive Summary

The Conventional Lathe Market is characterized by stable demand driven predominantly by the manufacturing sectors in emerging economies and the global maintenance, repair, and overhaul (MRO) industry. Key business trends indicate a gradual shift towards semi-automated conventional lathes equipped with digital readouts (DROs) to enhance precision without incurring the full cost of CNC integration. Manufacturers are focusing on improving ergonomic designs, incorporating safety features, and utilizing advanced materials to increase the rigidity and lifespan of manual machines. Strategic partnerships aimed at training technicians and ensuring global distribution reach are central to sustaining market presence against automated alternatives.

Regionally, Asia Pacific (APAC) remains the dominant market, fueled by massive industrialization initiatives in countries like India, Vietnam, and Indonesia, where conventional machining serves as the backbone of small and medium enterprises (SMEs). Europe and North America, while having largely transitioned to CNC for high-volume production, still maintain significant conventional lathe installations primarily for specialized job shops, tool rooms, and educational facilities. The trends highlight that while overall growth rates are moderate compared to high-tech sectors, the market demonstrates resilience due to its fundamental role in manufacturing infrastructure.

Segment trends reveal that the demand for light-duty and medium-duty conventional lathes, which cater to general workshops and vocational training, is outpacing heavy-duty lathes. In terms of technology, machines integrating advanced features such as variable speed drives (VSDs) and enhanced quick-change tooling systems are experiencing increased adoption, improving efficiency and operational flexibility. The long-term outlook suggests stable replacement demand and continued sales to educational institutions globally, ensuring a steady revenue stream for established market players.

AI Impact Analysis on Conventional lathe Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Conventional Lathe Market often revolve around obsolescence, integration of basic predictive maintenance, and whether AI tools can enhance the precision of manual operations. Users are concerned about whether traditional skills will become irrelevant and how small workshops, which cannot afford full CNC conversion, might leverage smart technologies. The key themes summarized from user concerns are the possibility of using machine learning for fault detection in aging conventional equipment, the potential for AI-driven training modules to rapidly upskill novice operators, and the application of computer vision systems to monitor manual machining accuracy in real-time without automating the entire process. Users generally expect AI to serve as an augmentation tool rather than a replacement mechanism in this highly manual sector.

While direct AI integration into the core mechanical function of conventional lathes is minimal due to their manual nature, AI indirectly influences the ecosystem through supply chain optimization, predictive maintenance scheduling, and advanced quality control systems. AI algorithms can analyze vibration data and temperature fluctuations collected via retrofit sensors (IoT devices) installed on conventional machines, allowing operators to predict component failures and schedule maintenance proactively. This significantly reduces unplanned downtime, a major operational constraint for small workshops relying heavily on conventional equipment.

Furthermore, AI-powered software solutions are transforming inventory management for conventional lathe users, optimizing the stocking of tools, spare parts, and consumables based on historical usage patterns and anticipated repair cycles. This analytical capability ensures that workshops maintain operational readiness without excessive capital tied up in inventory. Although the lathes themselves remain manual, the surrounding operational efficiency and maintenance regimes are becoming increasingly sophisticated through AI and machine learning techniques, extending the useful life and enhancing the productivity of these traditional assets.

- AI-driven predictive maintenance planning minimizes conventional lathe downtime.

- Machine learning algorithms optimize spare parts inventory management for workshops.

- Computer vision systems enhance quality control checks on manually machined parts.

- AI-enhanced digital training simulators accelerate the skill development of manual machinists.

- Supply chain optimization using AI ensures quicker availability of conventional lathe components.

- Data analytics derived from conventional lathe operation helps manufacturers refine machine designs.

DRO & Impact Forces Of Conventional lathe Market

The Conventional Lathe Market is shaped by a unique balance of foundational industrial needs (Drivers) and the pervasive advancement of automated technology (Restraints), creating distinct avenues for market penetration and specialization (Opportunity). The primary driver is the necessity for affordable, durable, and highly flexible machining solutions, particularly in developing economies and in specialized repair workshops that prioritize operator control and quick setup times over mass production speed. Restraints largely stem from the productivity gap compared to CNC machinery, the increasing difficulty in sourcing skilled manual machinists, and growing industrial safety regulations that sometimes favor automated enclosed systems. The core impact force driving change is the continuous push for modernization through retrofit technologies, such as advanced Digital Readouts (DRO) and variable speed controls, which bridge the gap between traditional manual control and digital precision.

A significant opportunity lies in the educational and vocational training sector globally, where conventional lathes serve as indispensable tools for teaching foundational machining principles before progressing to complex CNC programming. Furthermore, the rising trend of decentralized manufacturing and the increasing demand for customized, one-off parts provides conventional lathes with a competitive advantage over expensive, programmed automation. The impact forces are continually pushing conventional lathe manufacturers to innovate in areas of safety, ergonomics, and ease of use, ensuring that the manual operation remains compliant with modern workshop standards while maintaining the core benefits of versatility and low maintenance.

The market faces the dual pressure of technological substitution (CNC) and workforce retirement (skilled machinists). Successfully navigating this landscape requires focusing on markets where skill levels are high or where initial investment costs are critical constraints. The long-term resilience of conventional lathes is embedded in their operational reliability under harsh conditions and their utility in applications where electronic failure is unacceptable, thereby cementing their irreplaceable role in specific industrial niches and educational ecosystems.

Segmentation Analysis

The Conventional Lathe Market segmentation provides a granular view of product specialization, reflecting diverse end-user requirements based on size, application, and level of operational complexity. The market is primarily segmented by machine type (Benchtop, Engine, Tool Room, Big Bore), application (Repair/MRO, General Manufacturing, Education), and end-user industry (Automotive, General Engineering, Vocational Centers). Analyzing these segments helps manufacturers tailor machine specifications, such as spindle bore size, swing capacity, and power ratings, to target specific industrial niches effectively. Benchtop lathes, for instance, are highly sought after by small prototyping labs and educational institutions due to their compact footprint and ease of handling, while heavy-duty engine lathes dominate the traditional shipbuilding and large-scale metal fabrication segments.

The differentiation between light-duty (benchtop and small engine lathes) and heavy-duty (large engine and big bore lathes) is crucial for understanding revenue distribution. Light-duty segments exhibit higher unit sales volume, driven by educational and small job shop demand, while heavy-duty segments contribute substantially to overall market value due to the high price point of robust, high-capacity machinery designed for demanding industrial environments. Furthermore, the inclusion of digital readouts (DROs) or specialized threading capabilities often defines premium sub-segments within the broader conventional category.

Geographically, market segmentation reveals distinct preferences: developed economies emphasize tool room lathes and models featuring high precision for limited runs, whereas developing regions prioritize robust, standard engine lathes known for durability and simple repairability. This layered segmentation assists stakeholders in formulating targeted marketing strategies and optimizing distribution channels to meet localized industrial demands and purchasing power constraints across the global landscape.

- By Product Type:

- Benchtop Lathes (Small, low power, often used for hobbyists and educational purposes)

- Engine Lathes (Standard industrial workhorse, versatile for general turning)

- Tool Room Lathes (High precision, used for tooling, dies, and gauges)

- Big Bore Lathes (Heavy-duty, high capacity for large diameter workpieces, common in oil/gas and marine industries)

- By Application:

- Maintenance, Repair, and Overhaul (MRO)

- General Manufacturing and Fabrication

- Vocational Training and Education

- Prototyping and Tooling

- By End-User Industry:

- Automotive and Transport (Repair shops, custom component fabrication)

- General Engineering and Job Shops

- Academic and Research Institutions

- Oil and Gas / Marine (Heavy-duty repair)

- By Operational Feature:

- Standard Manual Control

- Manual with Digital Readout (DRO)

Value Chain Analysis For Conventional lathe Market

The value chain of the Conventional Lathe Market starts with the upstream activities of raw material procurement, encompassing high-grade cast iron, steel, and electrical components. Key upstream challenges involve maintaining consistent quality and managing volatility in global metal prices, as conventional lathes are inherently material-intensive products requiring large, rigid castings for the machine beds and headstocks. Suppliers of specialized components, such as bearings, motors, and gearboxes, play a critical role in determining the final performance characteristics and longevity of the lathe, requiring manufacturers to establish robust supplier qualification processes to ensure reliability and minimize long-term maintenance issues for the end-user.

Midstream activities involve the core manufacturing processes: casting, precision machining of key components (like the spindle and ways), assembly, quality testing, and painting. Due to the requirement for high geometric accuracy and rigidity, manufacturers of conventional lathes often integrate advanced precision grinding and scraping techniques, even though the final machine is manual. Direct distribution channels are often favored for sales to large industrial customers and government tenders, allowing manufacturers to offer installation support, direct training, and comprehensive warranty packages. This direct approach helps in maintaining a strong customer relationship and gathering feedback crucial for incremental design improvements and customization requirements specific to heavy-duty conventional machines.

Downstream activities center on distribution, sales, installation, and after-sales service, which is particularly vital for conventional machinery that may require periodic alignment and mechanical adjustments over a decades-long lifespan. Indirect distribution, utilizing authorized dealers and specialized machinery distributors, dominates sales to SMEs and educational institutions, providing localized inventory, technical support, and financing options. The aftermarket segment—including spare parts (e.g., gears, lead screws, belts) and tooling accessories—forms a significant and stable revenue stream, emphasizing the long-term utility and repairability that defines the competitive advantage of conventional lathes in the market.

Conventional lathe Market Potential Customers

Potential customers for conventional lathes are primarily end-users who require highly versatile, durable, and cost-effective metal shaping tools, often prioritizing initial capital expenditure constraints over the higher throughput rates offered by CNC technology. The largest segment of buyers includes general engineering job shops and small-to-medium enterprises (SMEs) across the globe, particularly those involved in custom fabrication, repair work, and producing small batches of specialized components where setup time needs to be minimal. These buyers value the straightforward mechanical design, which simplifies routine maintenance and allows for quick, on-the-spot modifications by a skilled operator without reliance on complex electronic diagnostics or proprietary software updates.

Another major demographic consists of the Maintenance, Repair, and Overhaul (MRO) departments within large industries, such as mining, maritime, railway, and energy sectors. These departments rely on conventional lathes for emergency repairs, fabricating custom bushings, shafts, and fittings to keep critical heavy machinery operational. In these environments, reliability, robustness, and the ability to operate in non-climate-controlled or remote locations make the conventional lathe indispensable, as failure of automated systems is often a greater risk than the lower speed of manual operation.

Finally, educational institutions—including technical high schools, community colleges, and vocational training centers—represent a core and stable customer base. Conventional lathes are essential pedagogical tools, providing students with hands-on experience in fundamental mechanical principles, tool geometry, and precision measurement, which are prerequisite skills for future progression into advanced machining technologies. These institutions drive demand for benchtop and light-to-medium duty tool room lathes, often prioritizing safety features and educational support materials from the supplier.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 4.75 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hardinge Inc., JMT Industrial Machinery, DMT Kern GmbH, Romi S.A., South Bend Lathe, Clausing Industrial, Inc., Acra Machinery, Kent Industrial Co., Ltd., WEILER Werkzeugmaschinen GmbH, Birmingham Machine Tools, Knuth Machine Tools, Emco Maier Group, Jet (JPW Industries), Grizzly Industrial, Inc., Precision Matthews, Victor Taichung Machinery Works Co., Ltd., Summit Machine Tool, Leblond Ltd., Baileigh Industrial Holdings LLC, ZMM Bulgaria Holding. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conventional lathe Market Key Technology Landscape

The technological landscape of the Conventional Lathe Market is defined less by revolutionary innovation and more by incremental, pragmatic enhancements designed to maximize precision, safety, and longevity while preserving the fundamental manual operation. The most significant technological feature driving modern conventional lathe adoption is the integration of Digital Readout (DRO) systems. These electronic displays, often utilizing glass scales or magnetic encoders, provide real-time, high-precision feedback on the carriage, cross-slide, and compound slide positions. The DRO capability effectively minimizes human error in reading manual dials, dramatically improving machining accuracy without requiring the operator to learn complex programming languages, thereby acting as a critical bridge technology between fully manual and CNC systems.

Beyond digital precision aids, conventional lathe technology focuses on mechanical and materials engineering advancements. Modern manufacturers utilize stress-relieved, heavily ribbed cast iron beds and induction-hardened, precision-ground ways to ensure superior rigidity and long-term dimensional stability. Features like quick-change tool posts (QCTPs) and standardized tooling systems, while not new, are increasingly adopted across entry-level models to reduce setup time and enhance operational flexibility. Furthermore, variable speed drive (VSD) technology, replacing traditional stepped belt or gear changes, allows for smoother, on-the-fly spindle speed adjustments, optimizing cutting conditions for diverse materials and minimizing mechanical wear and tear on the drivetrain.

Safety technology represents another crucial area of focus. Conventional lathes are increasingly equipped with integrated safety features compliant with modern industrial standards, particularly in developed markets. These include spindle chuck guards with safety interlocks, emergency stop mechanisms (E-stops) placed strategically, and specialized splash and chip shields. These enhancements address industrial concerns regarding operator protection, ensuring that the essential reliability and functionality of the conventional lathe are maintained within a secure working environment, which is highly valued by educational institutions and high-standard manufacturing operations globally.

Regional Highlights

- Asia Pacific (APAC): APAC is the epicenter of the Conventional Lathe Market, commanding the largest market share and exhibiting strong growth potential. This dominance is attributed to the presence of large manufacturing bases in China, India, and Southeast Asian nations where conventional lathes serve as the primary machine tools for SMEs due to their affordability and durability. High demand from vocational training institutions, coupled with significant MRO requirements in the automotive and general engineering sectors, ensures sustained growth. Investment in local manufacturing capabilities and the establishment of new industrial clusters further solidify APAC’s leading position, particularly in the production and consumption of medium-duty engine lathes.

- North America: The North American market maintains a mature yet stable conventional lathe presence, driven primarily by replacement cycles in specialized tool rooms, custom fabrication shops, and the aerospace sector where highly skilled manual operation is sometimes preferred for specific, complex geometries or material handling. Demand here focuses on high-precision tool room lathes and models with advanced DRO systems and ergonomic designs. The robust academic sector, encompassing technical colleges and universities, represents a consistent source of demand for new, safety-compliant benchtop and light-duty conventional machines used for foundational training.

- Europe: Europe represents a sophisticated market characterized by a strong emphasis on high-quality, high-precision conventional lathes, particularly from German and Italian manufacturers. While mass production heavily relies on CNC technology, conventional lathes are essential in the tooling, prototyping, and highly regulated repair industries (e.g., defense and energy). Strict safety and environmental regulations necessitate that conventional machines sold in this region are compliant with the latest standards, often featuring advanced guarding and integrated extraction systems, driving demand for premium, technologically updated manual machines.

- Latin America (LATAM): The LATAM market is characterized by high price sensitivity and a dependence on imports, showing steady demand for conventional lathes used in general repair and small-scale industrial operations across Brazil, Mexico, and Argentina. Economic volatility sometimes slows capital investment, yet the necessity for reliable, mechanically simple machinery ensures the conventional lathe remains preferred over complex, expensive automated alternatives, particularly in mining and agricultural equipment maintenance where ruggedness is paramount.

- Middle East and Africa (MEA): The MEA region exhibits rising demand, driven by expansion in oil and gas infrastructure, which requires substantial heavy-duty conventional lathes for maintenance and repair of large pipes and equipment (Big Bore lathes). Investment in vocational education and government initiatives aimed at localizing industrial production further stimulate the market for standard engine lathes. However, market growth is often dependent on large governmental or private sector investments in foundational industrial capacity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conventional lathe Market.- Hardinge Inc. (Known for high-precision tool room lathes and advanced manual machines)

- JMT Industrial Machinery (Offers a wide range of metalworking equipment, including conventional engine lathes)

- DMT Kern GmbH (Specializes in high-quality, high-precision manual and conventional turning solutions)

- Romi S.A. (A major global player providing robust conventional lathes suitable for heavy-duty applications)

- South Bend Lathe (An established brand recognized for reliable conventional and tool room lathes)

- Clausing Industrial, Inc. (Distributor and manufacturer known for versatility and educational applications)

- Acra Machinery (Provider of diverse machining tools focusing on conventional and manual equipment)

- Kent Industrial Co., Ltd. (Offers a comprehensive line of dependable conventional engine lathes and mills)

- WEILER Werkzeugmaschinen GmbH (European manufacturer focused on high-end conventional and cycle-controlled lathes)

- Birmingham Machine Tools (Supplier known for affordable and reliable conventional machinery for job shops)

- Knuth Machine Tools (International supplier offering a broad portfolio of conventional metalworking machines)

- Emco Maier Group (Focuses on training and small-to-medium conventional lathes, prominent in vocational education)

- Jet (JPW Industries) (Strong market presence in light-duty and educational conventional lathes)

- Grizzly Industrial, Inc. (Major supplier of conventional lathes catering primarily to hobbyists and small workshops)

- Precision Matthews (Known for high-quality, imported conventional lathes often used in professional job shops)

- Victor Taichung Machinery Works Co., Ltd. (Offers heavy-duty and robust conventional engine lathes)

- Summit Machine Tool (Provides large capacity and high-performance conventional lathes for industrial use)

- Leblond Ltd. (Manufacturer with a long history in robust conventional engine lathe production)

- Baileigh Industrial Holdings LLC (Supplier offering diverse metal fabrication and conventional machining equipment)

- ZMM Bulgaria Holding (European manufacturer specializing in heavy-duty conventional turning machines)

Frequently Asked Questions

Analyze common user questions about the Conventional lathe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a conventional lathe and a CNC lathe?

The primary difference is the method of operation and control. Conventional lathes are manually operated, relying entirely on the machinist's skill for precision and movement, making them ideal for prototypes, repair, and low-volume custom work. CNC (Computer Numerical Control) lathes are automated, using programmed instructions to execute complex, high-speed, and high-volume operations with extreme repeatable precision, typically requiring higher initial investment and specific programming knowledge.

Why are conventional lathes still relevant in an era dominated by CNC technology?

Conventional lathes remain highly relevant due to several critical factors: lower capital cost, reduced maintenance complexity, superior versatility for one-off and repair jobs (MRO), and their foundational role in vocational education. They are indispensable in environments where power supply might be unstable, or where complex part modifications require immediate, on-the-spot operator control without time-consuming programming setups.

Which end-user segment drives the highest demand for conventional lathes globally?

The Small and Medium Enterprise (SME) sector, particularly general engineering job shops and automotive repair facilities in the Asia Pacific and emerging markets, drives the highest unit demand. These users prioritize the machine's durability, low operational cost, and adaptability for varied tasks over high automation, making the conventional engine lathe an essential, cost-effective investment for basic industrial capabilities.

How does the integration of Digital Readouts (DRO) affect the Conventional Lathe Market?

DRO integration significantly enhances the market appeal of conventional lathes by addressing the major limitation of manual operation: precision and reading accuracy. DRO systems provide instantaneous, digital feedback on axis movement, substantially reducing setup errors and increasing the attainable precision without converting the machine to complex CNC control. This technological addition stabilizes the market by offering a cost-effective path to modern precision standards.

What are the key safety features being standardized on modern conventional lathes?

Modern conventional lathes incorporate mandatory safety features such as integrated spindle chuck guards equipped with safety interlocks that prevent operation when the guard is open. Other crucial standardized features include comprehensive emergency stop buttons (E-stops), lead screw and feed rod covers, and specialized splash and chip shields to protect the operator, ensuring compliance with global industrial safety directives and enhancing training environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager