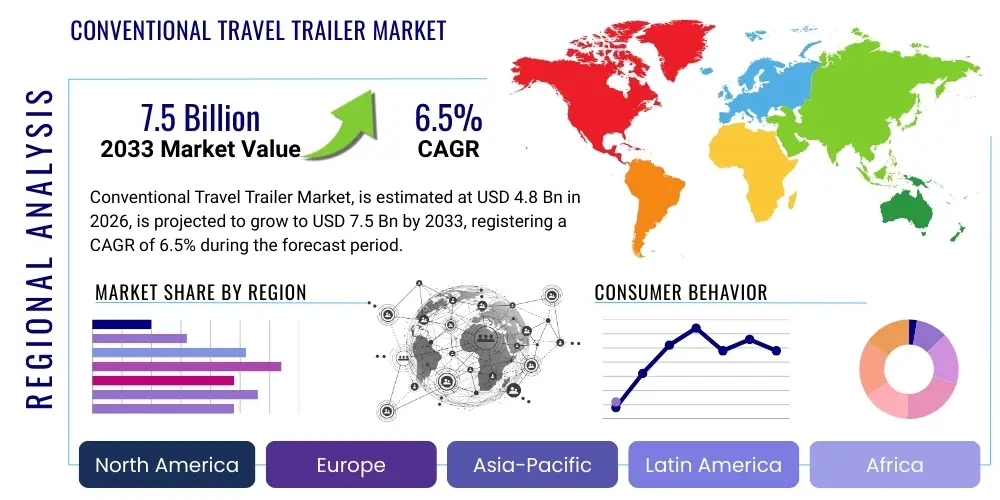

Conventional Travel Trailer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438853 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Conventional Travel Trailer Market Size

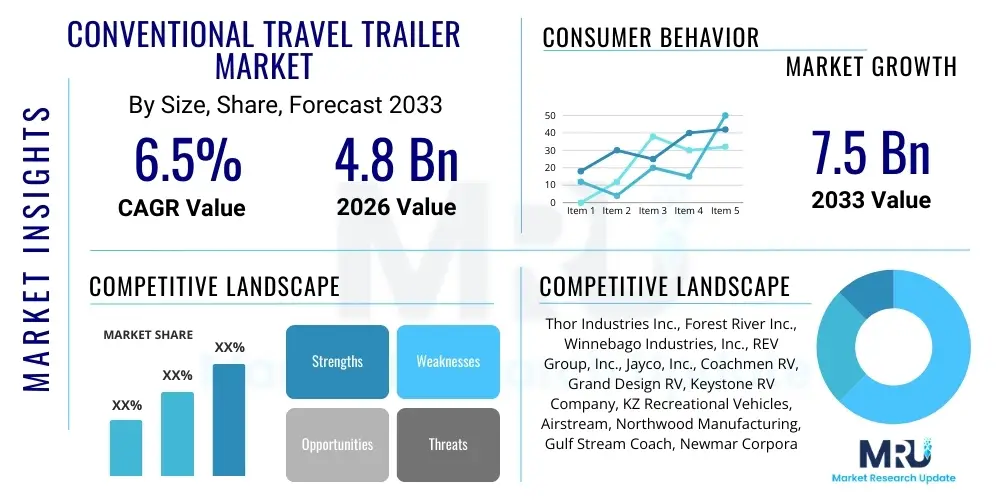

The Conventional Travel Trailer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $4.8 Billion in 2026 and is projected to reach $7.5 Billion by the end of the forecast period in 2033.

Conventional Travel Trailer Market introduction

The Conventional Travel Trailer Market encompasses the manufacturing and sale of towable recreational vehicles (RVs) that are not motorized. These trailers, often referred to simply as travel trailers, are designed for temporary living and sleeping accommodations, providing a cost-effective and flexible solution for leisure travel, family vacations, and outdoor recreation. Characterized by a solid body construction and a tow hitch, conventional travel trailers range significantly in size, floor plan, and amenities, catering to diverse consumer needs from basic weekend campers to luxurious extended-stay models. The foundational appeal of this product lies in its ability to offer the comforts of home while allowing users to explore various destinations without the need for fixed lodging.

Major applications of conventional travel trailers primarily revolve around recreational use, including camping, road trips, and participation in outdoor sporting events. Beyond leisure, they are increasingly utilized for temporary housing solutions, such as accommodations during home renovations, remote work setups, or as emergency shelter. The core benefits driving consumer adoption include the flexibility of detaching the accommodation unit from the towing vehicle, which allows for greater mobility once settled, and generally lower purchasing and maintenance costs compared to their motorized counterparts (Class A, B, or C RVs). Furthermore, the extensive aftermarket customization options and the relative ease of towing contribute significantly to their market penetration across various demographic groups.

Driving factors propelling the expansion of this market include the growing trend of experiential travel, where consumers prioritize unique experiences over material possessions, often facilitated by self-directed road trips. Increased disposable income in developed and rapidly developing economies allows more families to invest in recreational assets. The infrastructural improvements in campgrounds and RV parks, coupled with a persistent desire for activities that promote social distancing and connection with nature post-pandemic, solidify the travel trailer as a highly attractive consumer product. Additionally, continuous innovation in materials science, focusing on lighter, more durable, and fuel-efficient trailer designs, enhances the product's practicality and broadens its user base.

Conventional Travel Trailer Market Executive Summary

The Conventional Travel Trailer Market is experiencing robust growth, primarily fueled by shifting consumer preferences towards flexible, self-contained travel options and the increasing accessibility of financing for recreational purchases. Business trends emphasize product diversification, with manufacturers focusing heavily on lightweight composite materials and incorporating smart home technologies to enhance user comfort and convenience. The competitive landscape is characterized by strategic mergers and acquisitions aimed at consolidating manufacturing capabilities and expanding distribution networks, particularly targeting niche segments such as off-road capable or eco-friendly trailers. Demand elasticity remains a key factor, with economic downturns temporarily impacting high-end sales, while affordable entry-level models maintain steady traction, showcasing the market's resilience across economic cycles.

Regionally, North America maintains its dominance due to a deeply entrenched RV culture, extensive road infrastructure, and high rates of recreational vehicle ownership, particularly within the United States. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, driven by rising middle-class income, increasing urbanization leading to a desire for rural escapes, and government initiatives promoting domestic tourism. Europe, while constrained by stricter towing regulations and smaller road networks, shows steady growth, particularly in the lightweight and compact trailer segments. Manufacturers are thus tailoring models specifically for regional constraints, focusing on modular designs suitable for international markets.

Segment trends highlight the premiumization of the mid-to-large length category (20 to 30 feet), which offers extensive amenities appealing to long-term travelers and retirees. Conversely, the smaller (under 20 feet) and lightweight segment is witnessing rapid expansion, catering to younger consumers and those seeking easier towability with standard vehicles. The application segment shows sustained growth in pure leisure use, but the rising prominence of the "work-from-anywhere" culture is driving demand for units equipped with enhanced connectivity packages and dedicated office spaces, transforming the travel trailer from a purely recreational asset into a multifunctional mobile platform.

AI Impact Analysis on Conventional Travel Trailer Market

Analysis of common user questions regarding AI and Conventional Travel Trailers reveals key themes centered on safety, maintenance predictability, and enhanced personalized travel experiences. Users frequently inquire about how AI could prevent mechanical failures while on the road, optimize towing dynamics for safety and fuel efficiency, and integrate predictive maintenance alerts for major components like axles, brakes, and electrical systems. There is also significant consumer interest in AI-powered trip planning assistants that can automatically suggest routes, campgrounds, and local activities based on user preferences, trailer dimensions, and real-time road conditions. Concerns often revolve around data privacy and the complexity of integrating advanced AI systems into relatively simple, towed units, raising expectations for seamless, invisible technology integration rather than cumbersome interfaces.

The influence of Artificial Intelligence (AI) and Machine Learning (ML) is rapidly transitioning from the manufacturing floor into the operational experience of conventional travel trailers. In manufacturing, AI optimizes supply chain logistics, predicts equipment failure in assembly lines, and analyzes quality control data to minimize defects, leading to substantial cost reductions and improved product reliability. Operationally, AI is foundational to developing smart RV systems that manage power consumption (optimizing solar and battery use), automate climate control based on occupancy patterns, and integrate sophisticated voice-activated controls. This shift is crucial for positioning conventional travel trailers not just as temporary shelters, but as advanced, self-managing mobile habitats capable of providing superior comfort and safety through intelligent automation.

- AI-driven predictive maintenance algorithms alert owners to potential component failures (e.g., bearings, tires, brakes) before they become critical, significantly improving road safety and minimizing unplanned stops.

- Implementation of smart leveling systems using AI to automatically stabilize the trailer upon arrival, compensating for uneven terrain with minimal user intervention.

- AI optimizes energy management systems, dynamically balancing power draw from onboard appliances, battery banks, and solar inputs for maximum off-grid endurance.

- Integration of advanced towing assistance features, utilizing machine learning to adjust braking and stability control based on real-time vehicle dynamics and wind conditions.

- Enhanced personalization of the user experience through AI-powered environmental controls, entertainment systems, and localized travel recommendations tailored to historical user behavior.

- Streamlining of warranty claims and diagnostics through remote AI-based fault analysis, reducing the need for physical dealership visits for initial troubleshooting.

DRO & Impact Forces Of Conventional Travel Trailer Market

The Conventional Travel Trailer Market is shaped by a powerful interplay of drivers, restraints, and opportunities that dictate its growth trajectory and resilience. Key drivers include the sustained cultural shift toward outdoor recreation and the increasing prioritization of self-directed travel experiences, particularly among younger demographics who view RV ownership as an investment in lifestyle freedom. Restraints primarily involve macroeconomic factors such as rising interest rates impacting consumer financing, volatility in material costs (especially aluminum and lumber), and the ongoing challenge of maintaining adequate infrastructure (e.g., crowded campgrounds, limited availability of large towing vehicles). Opportunities lie significantly in technological innovation, focusing on ultra-lightweight construction using advanced composites and the incorporation of sustainable power solutions, alongside leveraging the growing demand for highly customizable, modular interior layouts.

Impact forces within the market are predominantly driven by consumer spending confidence and regulatory environments. High fuel prices exert substantial pressure on usage frequency, acting as a frictional force against market expansion, compelling manufacturers to prioritize aerodynamic and weight-reducing designs. Conversely, the demographic shift, particularly the early retirement trends and the Millennial generation entering peak earning years, provides a powerful underlying force of consistent demand. The market also faces competitive forces from alternative lodging (e.g., short-term rentals, glamping), necessitating continuous product improvement, enhanced warranty offerings, and superior customer service to maintain market share against these experiential alternatives.

Furthermore, government policies related to road safety and environmental standards significantly impact product design. Regulations dictating maximum trailer length, weight, and emissions standards for towing vehicles necessitate ongoing research and development investment. The market must balance the consumer desire for large, feature-rich units with regulatory and infrastructural limitations. Successful market participants are those who effectively harness opportunities related to connectivity and modularity, mitigating restraints such as material cost fluctuations through strategic sourcing and long-term supplier agreements, thereby stabilizing their competitive position in this cyclical industry.

Segmentation Analysis

The Conventional Travel Trailer Market is complexly segmented based on critical operational and structural characteristics, allowing manufacturers to target specific consumer needs and usage scenarios. Primary segmentation criteria include the length of the trailer (which directly correlates with capacity and amenity level), the number of axles (impacting stability and weight limits), and the specific application (eisure, temporary housing, or specialty). These segments reflect the diverse demographics of RV owners, ranging from weekend adventurers seeking compact, easily maneuverable units to full-time residents requiring extensive living space and residential amenities. Understanding these divisions is crucial for strategic marketing, product development, and inventory management, ensuring that product offerings align precisely with defined consumer demand profiles and regional towing capacities.

- By Length:

- Small (Under 20 feet)

- Medium (20 to 30 feet)

- Large (Above 30 feet)

- By Axle Type:

- Single Axle

- Tandem Axle

- Triple Axle

- By Application:

- Leisure and Recreation

- Temporary and Seasonal Housing

- Specialty and Commercial Use

- By Material Type:

- Aluminum Frame

- Wood Frame

- Composite Materials (Fiberglass, Vacuum-bonded laminates)

- By Price Point:

- Economy

- Mid-Range

- Luxury

Value Chain Analysis For Conventional Travel Trailer Market

The value chain for the Conventional Travel Trailer Market begins with the upstream procurement of essential raw materials, including high-grade aluminum and steel for chassis construction, various woods and composites for framing and interior cabinetry, and specialized components like axles, tires, and mechanical systems (HVAC, plumbing). Efficiency in this stage is paramount, as volatility in commodity pricing—particularly lumber and metals—directly impacts manufacturing costs and, consequently, final retail prices. Strong relationships with material suppliers and long-term procurement contracts are key strategies employed by large manufacturers to mitigate these risks and ensure a stable supply of high-quality components necessary for meeting stringent safety and durability standards.

The core manufacturing and assembly process involves design, fabrication, and integration. Manufacturers invest heavily in automated assembly lines and specialized tooling to efficiently build the trailer’s frame, install internal systems, and affix the exterior cladding. This stage is highly labor-intensive, requiring skilled technicians for systems integration and detailed finishing work. Following assembly, quality control and testing are critical steps before the product enters the distribution phase. Distribution is multi-layered, primarily relying on a robust network of authorized dealerships (indirect channel). These dealerships handle sales, financing, trade-ins, and critical warranty and repair services, acting as the primary customer interface.

The downstream activities involve sales, service, and aftermarket support. Direct sales channels, though less common, are utilized by a few specialized or direct-to-consumer brands, offering higher profit margins but requiring significant capital investment in showrooms and service centers. The indirect channel dominates because dealerships provide regional market expertise and critical physical service infrastructure. Post-sale activities, including maintenance, spare parts provision, and warranty fulfillment, significantly influence brand loyalty and customer satisfaction. The efficiency of the entire value chain, from raw material sourcing to post-sale support, dictates the overall competitiveness and profitability within the Conventional Travel Trailer Market.

Conventional Travel Trailer Market Potential Customers

Potential customers for conventional travel trailers span a broad demographic spectrum, though they can be broadly categorized into distinct groups based on lifestyle and usage patterns. The largest segment remains families (often with young children or teenagers) seeking affordable, customizable, and recurring vacation solutions. These buyers typically opt for medium to large tandem-axle trailers that provide adequate sleeping capacity, dedicated bunk areas, and residential-style amenities. This group values durability, ease of maintenance, and strong resale value, using the trailer primarily for short-to-medium length trips during peak holiday seasons. The purchase decision for families is often driven by the cost-per-trip savings compared to alternative vacation methods.

Another rapidly growing customer segment comprises retirees and empty nesters who represent the full-time or extended-stay market. These individuals often sell their primary residences or use the travel trailer for months-long seasonal migrations (snowbirds). They require luxury-level amenities, robust connectivity, high-capacity storage, and residential comforts, leading them towards the largest and highest-priced units, often equipped with triple axles and specialized insulation packages. A third critical segment includes younger generations, specifically Millennials and Generation Z, who are drawn to smaller, more rugged, and aesthetically unique trailers (often termed "glamping" or "boondocking" models). This segment prioritizes lightweight construction, off-grid capabilities (solar power), and digital integration, viewing the trailer as a tool for experiential or remote working travel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.8 Billion |

| Market Forecast in 2033 | $7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thor Industries Inc., Forest River Inc., Winnebago Industries, Inc., REV Group, Inc., Jayco, Inc., Coachmen RV, Grand Design RV, Keystone RV Company, KZ Recreational Vehicles, Airstream, Northwood Manufacturing, Gulf Stream Coach, Newmar Corporation, Cruiser RV, Lance Camper Manufacturing Corp., nuCamp RV, Palomino RV, Starcraft RV, Tiffin Motorhomes, SylvanSport. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conventional Travel Trailer Market Key Technology Landscape

The Conventional Travel Trailer Market is undergoing a significant technological evolution, moving beyond basic utility toward integration with residential-grade smart systems and advanced material science. A primary focus is on weight reduction without compromising structural integrity, driven by consumer demand for increased fuel efficiency and easier towing. This involves the widespread adoption of high-strength, lightweight composites such as vacuum-bonded fiberglass laminated panels and aluminum skeletal structures, replacing traditional heavy wood frames. These materials not only reduce the overall mass but also improve insulation properties, leading to enhanced energy efficiency for climate control systems and contributing to the trailer's longevity and resistance to moisture damage.

The second major technological wave involves the integration of "Smart RV" features, which leverage IoT (Internet of Things) connectivity to enhance user control and monitoring. This includes centralized digital control panels that manage multiple functions—such as lighting, slides, leveling jacks, and HVAC—through a single interface or a mobile application. Furthermore, advanced power management systems incorporating high-capacity lithium-ion battery banks and integrated solar power solutions are becoming standard, enabling consumers to engage in extensive "boondocking" (off-grid camping) with residential-level power availability. These technological advancements fundamentally redefine the camping experience, transitioning it toward a more convenient, automated, and sustainable endeavor.

Safety and towing technologies represent another critical area of innovation. Manufacturers are increasingly incorporating anti-sway technology, electronic stability control (ESC), and sophisticated tire pressure monitoring systems (TPMS) directly integrated into the trailer’s electrical architecture, providing real-time data to the tow vehicle operator. Furthermore, advances in suspension systems, such as independent suspension and specialized damping technologies, improve ride quality and reduce wear and tear on the trailer structure during transit. These features are vital for addressing consumer concerns about the safety and difficulty of towing larger units, thereby broadening the market appeal to less experienced RV users and ensuring compliance with evolving road safety standards.

Regional Highlights

- North America: This region holds the largest market share globally for Conventional Travel Trailers, largely driven by the U.S. market, which benefits from an expansive, well-maintained highway system and a deeply ingrained culture of long-distance road trips and recreational camping. High levels of disposable income, a strong manufacturing base with key industry leaders (e.g., Thor Industries, Forest River), and the continuous expansion of state and national park facilities ensure steady demand. The market here is characterized by a preference for large, amenity-rich units (tandem and triple-axle models) designed for extended stays.

- Europe: The European market is growing steadily but focuses predominantly on smaller, lighter, and more aerodynamic trailers due to stricter road regulations regarding length and weight, and narrower road infrastructure. Key markets like Germany, the UK, and France show high adoption rates, driven by cross-border travel and short-term leisure use. Innovation is concentrated in developing high-quality, lightweight materials and compact, efficient floor plans that maximize internal space while maintaining towability by standard European passenger vehicles.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, albeit starting from a smaller base. Key growth drivers include rapid urbanization leading to increased interest in rural escapes, rising middle-class income, and governmental efforts to promote domestic tourism infrastructure (e.g., establishing new RV parks and dedicated camping zones in China and Australia). The demand profile leans towards imported luxury models in Australia/New Zealand and smaller, locally manufactured utility trailers in markets like China and South Korea, where the RV culture is nascent but rapidly evolving.

- Latin America (LATAM): Market development in LATAM is constrained by economic volatility and less developed recreational infrastructure. Demand is concentrated in highly specific, affluent niches in countries like Brazil and Argentina. The market primarily features smaller, rugged trailers suited for varied terrain, often relying on specialized importers rather than large-scale domestic manufacturing. Growth potential exists but is highly dependent on stabilizing economic conditions and investment in tourism infrastructure.

- Middle East and Africa (MEA): This region represents the smallest market share, with demand concentrated in wealthy Gulf Cooperation Council (GCC) countries for luxury, customized trailers often used in desert environments or coastal resorts. High temperatures necessitate specialized cooling and insulation technologies. The African market remains largely untapped, with minimal recreational infrastructure supporting RV travel outside of specific tourist areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conventional Travel Trailer Market.- Thor Industries Inc.

- Forest River Inc.

- Winnebago Industries, Inc.

- REV Group, Inc.

- Jayco, Inc.

- Keystone RV Company

- Grand Design RV

- Coachmen RV

- KZ Recreational Vehicles

- Airstream

- Gulf Stream Coach

- Northwood Manufacturing

- Newmar Corporation

- Cruiser RV

- Lance Camper Manufacturing Corp.

- nuCamp RV

- Palomino RV

- Starcraft RV

- Shasta RV

- Tiffin Motorhomes

Frequently Asked Questions

Analyze common user questions about the Conventional Travel Trailer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current demand growth for conventional travel trailers?

Demand is primarily driven by the increasing consumer preference for self-contained, flexible travel solutions, the rising popularity of outdoor and experiential recreation, and the cultural acceptance of remote work (digital nomadism), which allows for longer, nomadic stays away from home. Affordable financing options and product innovations focused on lightweight construction also contribute significantly.

Which segment of conventional travel trailers offers the best growth potential?

The medium-sized segment (20 to 30 feet) and the lightweight/composite segment (under 20 feet) offer the highest growth potential. Medium units appeal to the large family market seeking residential comfort, while lightweight units cater to Millennials, first-time buyers, and those prioritizing fuel efficiency and ease of towing with standard vehicles.

How are manufacturers addressing concerns related to the weight and fuel consumption of travel trailers?

Manufacturers are focusing intensely on advanced materials, substituting traditional wood structures with aluminum framing and high-strength, vacuum-bonded composite laminates (fiberglass and foam core). This weight reduction minimizes the load on the tow vehicle, significantly improving aerodynamics and fuel efficiency while maintaining or increasing structural integrity.

What role does technology play in modern conventional travel trailers?

Technology is crucial for safety and convenience. Modern trailers feature advanced smart systems for centralized control (lighting, leveling, slides), integrated electronic stability control (ESC) for safer towing, high-capacity lithium battery banks, and built-in solar charging capabilities for extended off-grid use, transforming the user experience.

Is the North American market expected to maintain its dominance in the conventional travel trailer sector?

Yes, North America is expected to maintain its volume dominance due to strong recreational vehicle ownership culture and established infrastructure. However, the Asia Pacific region is projected to exhibit the fastest percentage growth rate over the forecast period, driven by rapid infrastructure development and growing middle-class engagement in leisure travel.

Detailed Market Dynamics and Competitive Landscape

The operational landscape of the Conventional Travel Trailer Market is heavily influenced by cyclical economic patterns, particularly in North America and Europe, where discretionary spending correlates closely with RV sales. Unlike highly essential industries, the travel trailer sector experiences sharp peaks during periods of high consumer confidence and low interest rates, followed by necessary adjustments during economic contractions. This inherent cyclicality necessitates that manufacturers maintain flexible production schedules and robust inventory management strategies. Furthermore, the industry is increasingly facing regulatory scrutiny regarding environmental impact, particularly concerning the manufacturing processes and the durability of materials used, pushing companies toward adopting sustainable practices and achieving LEED certifications for manufacturing facilities.

Competitive dynamics within the market are intensely concentrated, with a few large conglomerates, most notably Thor Industries and Forest River (a subsidiary of Berkshire Hathaway), controlling a substantial majority of the market share through extensive brand portfolios. This consolidation allows for economies of scale in raw material procurement and distribution, making it challenging for smaller, independent manufacturers to compete on price point in the mass market. However, smaller players often find success by focusing on niche segments such as ultra-lightweight campers, highly specialized off-road models, or luxury custom builds, emphasizing superior craftsmanship and unique design aesthetics rather than volume production.

A key differentiator in the modern competitive environment is the quality of the dealership network and the aftermarket service provided. Since a travel trailer purchase often represents a significant long-term investment, customer satisfaction hinges critically on the availability of timely, expert repair services and readily accessible spare parts. Companies that invest in rigorous dealer training programs, provide strong warranty coverage, and maintain streamlined supply chains for component replacements gain a significant advantage in cultivating long-term brand loyalty. This focus on the full product lifecycle management, rather than just the initial sale, is becoming a paramount strategy for sustaining market leadership.

Market Challenges and Risk Factors

Despite the positive growth outlook, the Conventional Travel Trailer Market faces several systemic challenges. One major restraint is the enduring volatility in commodity prices, particularly steel, aluminum, and resins, which directly impacts the cost of goods sold and compresses profit margins if these costs cannot be fully passed on to consumers. Furthermore, the industry grapples with labor shortages, particularly skilled tradespeople required for complex assembly and systems installation, which can limit production capacity and increase operational costs in peak seasons. The reliance on highly regionalized campground infrastructure also presents a barrier; increasing popularity sometimes leads to overcrowding and difficulty in securing reservations, negatively impacting the user experience and potentially dampening future purchases.

Regulatory risks, particularly in European markets, pose constraints on product design. Strict maximum width and length restrictions limit the size of European travel trailers, forcing manufacturers to innovate within tighter dimensional constraints. In North America, the risk involves potential shifts in fuel excise taxes or tightening emissions standards for towing vehicles, which could indirectly increase the total cost of RV ownership and usage, deterring price-sensitive consumers. Companies must maintain a robust regulatory compliance department to preemptively adapt designs and manufacturing processes to forthcoming standards, minimizing disruption and ensuring market access.

Another significant risk factor is the threat of economic recession. As travel trailers are highly discretionary purchases, consumer demand is elastic. A prolonged economic downturn or significant spike in unemployment could lead to deferred purchases and increased trade-ins, negatively affecting new unit sales. To mitigate this, manufacturers often diversify their product lines to include entry-level, highly affordable models that maintain appeal even during economic uncertainty, alongside premium units that cater to resilient high-net-worth segments. Effective risk management requires balancing inventory levels and production forecasts based on real-time macroeconomic indicators rather than relying solely on historical demand data.

Growth Opportunities through Customization and Digitalization

Customization represents a major opportunity for market expansion, particularly appealing to the younger, discerning consumer base. Modular interior designs that allow owners to easily reconfigure sleeping, dining, or office spaces based on their immediate needs are gaining traction. This flexibility extends the utility of the trailer beyond mere recreation, allowing it to function as a mobile office, classroom, or dedicated hobby space. Manufacturers leveraging virtual reality (VR) and augmented reality (AR) tools to allow prospective buyers to virtually design and walk through custom floor plans before production are creating significant competitive differentiation and enhancing customer engagement.

Digitalization offers transformative potential across the entire value chain. Beyond the "Smart RV" features, digitalization is optimizing sales and service. Online platforms for inventory search, virtual tours, and remote financing approvals streamline the purchasing process. For service departments, implementing sophisticated telematics and remote diagnostics capabilities allows dealers to troubleshoot issues before the customer arrives, drastically reducing service wait times and improving repair accuracy. Furthermore, utilizing big data analytics gathered from integrated RV systems can provide manufacturers with valuable insights into usage patterns, component performance, and customer satisfaction, feeding directly into future product design improvements and predictive maintenance programs.

Analysis of Key Segment Dynamics

Length-Based Segmentation

The Large (Above 30 feet) segment caters to the premium, full-time living, or "snowbird" demographic. While this segment commands the highest average selling price (ASP) and profit margins per unit, its volume growth is slower due to high purchase costs and the necessary specialized towing equipment. Manufacturers focus on maximizing residential comfort, insulation, and storage capacity, often featuring luxury interior finishes, multiple slide-outs, and washer/dryer hookups. Marketing efforts emphasize long-term value, durability, and a residential experience.

The Medium (20 to 30 feet) segment is the sweet spot for volume sales, attracting the core family demographic. These trailers strike an optimal balance between manageable towing size and sufficient amenities, often including dedicated bunk rooms and large dinettes. Price competition is highest here, forcing manufacturers to focus on cost-effective, durable construction and maximizing feature density per square foot. Innovation focuses on optimizing floor plans for multi-use living areas.

The Small (Under 20 feet) segment is experiencing the fastest proportional growth, driven by Millennials and Gen Z buyers seeking affordability and lightweight convenience. These units are often single-axle, highly aerodynamic, and designed for ease of use. Key features include rugged suspension for off-road use (boondocking models) and high-efficiency power systems (solar readiness). Their lower entry price point makes them highly attractive to first-time buyers and casual weekend users.

Axle Type Segmentation

Tandem Axle trailers dominate the market due to their superior stability, higher weight capacity, and safety advantages (ability to operate temporarily on one tire if the other fails). They are the standard for most medium and large travel trailers and are preferred by manufacturers for optimal distribution of weight. Single Axle units are exclusive to the small and ultra-lightweight segments, valued for their maneuverability and minimal impact on the tow vehicle, although they have lower payload capacities. Triple Axle configurations are reserved for the heaviest, most luxurious conventional trailers, providing maximum stability and safety when towing exceptionally heavy loads, though they require powerful tow vehicles and are more difficult to maneuver in tight spaces.

Market Impact of Post-Pandemic Behavioral Shifts

The COVID-19 pandemic catalyzed a significant and likely permanent shift in consumer behavior, profoundly benefiting the Conventional Travel Trailer Market. The desire for safe, self-contained travel alternatives that mitigate public health risks drove unprecedented demand, especially for new buyers unfamiliar with RVing. This surge led to depleted inventories and extended lead times through 2021 and 2022. While demand has normalized, the market retains a higher base level of participation than pre-2020. This "new wave" of RV owners, who initially purchased trailers for safety reasons, have now integrated RV travel into their regular lifestyle. Manufacturers are adapting by offering introductory education programs and enhanced digital support to ensure these new customers remain engaged and satisfied with their purchase, thereby mitigating the risk of high attrition rates as general travel options return to normal.

Furthermore, the pandemic accelerated the trend of remote work. Many conventional travel trailers are now being purchased specifically as dual-purpose units—recreational vehicles that also serve as fully functional mobile offices. This shift requires trailers to be equipped with high-speed cellular boosters, dedicated desks, reliable climate control for year-round use, and enhanced sound dampening. This expansion of the trailer’s application spectrum from purely leisure to essential workspace adds stability to the market, making purchases less dependent solely on vacation budgets and more integrated into professional lifestyle spending.

The heightened consumer focus on personal wellness and outdoor connection, amplified during periods of lockdown, continues to sustain interest in RV travel. This cultural momentum is visible in marketing campaigns that emphasize mental health benefits, family bonding, and access to nature. The industry is responding by developing specialized "off-grid" packages that enable extended stays in remote locations, including sophisticated water filtration systems, composting toilets, and high-efficiency solar setups, appealing directly to consumers seeking maximum isolation and self-sufficiency.

Future Outlook and Strategic Recommendations

The long-term outlook for the Conventional Travel Trailer Market remains positive, anchored by favorable demographic trends (retiree segment growth, Millennial entry) and persistent technological innovation. Future growth will be increasingly dictated by the industry’s ability to successfully transition toward sustainability and integrate sophisticated vehicle intelligence. Companies that proactively invest in R&D focusing on hydrogen fuel cell integration for onboard power, fully recyclable structural materials, and enhanced connectivity infrastructure will be positioned for competitive dominance in the next decade.

A crucial strategic recommendation for manufacturers involves deepening their engagement with the financing sector. Since most RV purchases involve loans, establishing proprietary or preferred financing arrangements that offer competitive rates and flexible terms can significantly influence purchasing decisions, particularly in volatile economic climates. Furthermore, expanding geographical focus beyond traditional North American markets, specifically through strategic partnerships in the rapidly developing APAC region, is essential for unlocking substantial new revenue streams and diversifying market exposure against regional economic downturns.

Finally, enhancing the digital customer journey is non-negotiable. This includes deploying advanced digital tools for visualization, configuration, and remote diagnostics. Establishing a unified digital platform that seamlessly connects prospective buyers, manufacturers, and the dealership network for sales, scheduling, and service remains a primary opportunity. Brands that provide the easiest, most transparent, and digitally integrated ownership experience will successfully capture the loyalty of the increasingly tech-savvy consumer base and secure sustained market leadership.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager