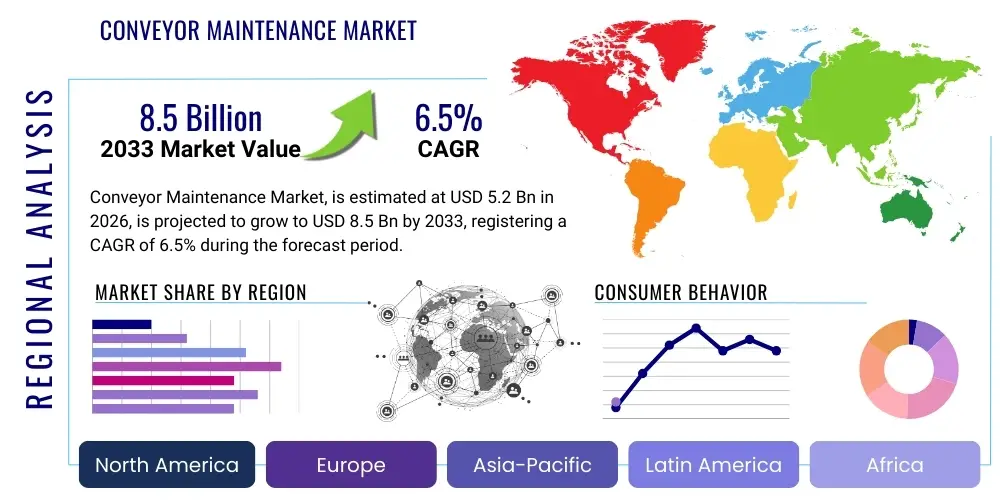

Conveyor Maintenance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435823 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Conveyor Maintenance Market Size

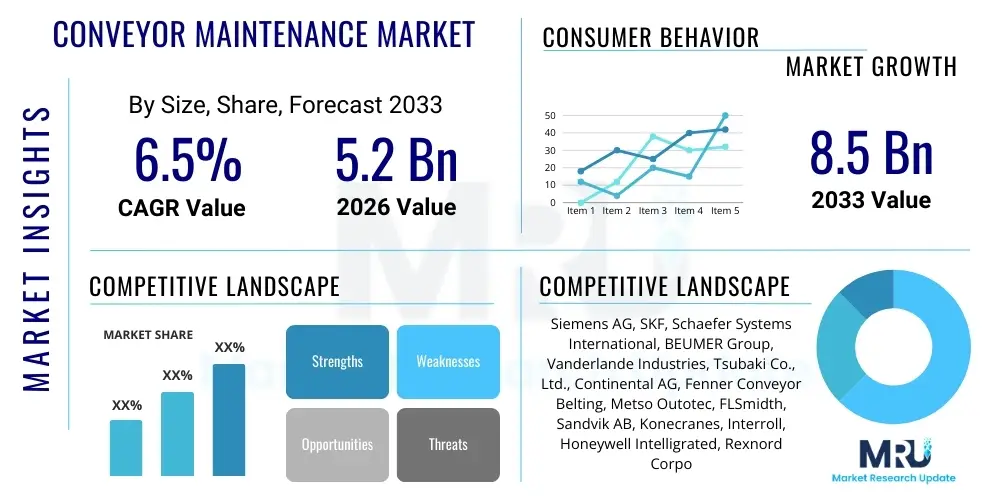

The Conveyor Maintenance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.5 Billion by the end of the forecast period in 2033.

Conveyor Maintenance Market introduction

The Conveyor Maintenance Market encompasses a broad spectrum of services, components, and technological solutions dedicated to ensuring the operational efficiency, longevity, and safety of material handling conveyor systems across diverse industrial sectors. These systems are critical infrastructure in manufacturing, mining, logistics, food and beverage processing, and warehousing, making their continuous operation essential for production continuity. Maintenance services range from routine preventive tasks, such as belt cleaning, tensioning, and lubrication, to complex corrective and predictive interventions involving component replacement, system upgrades, and digital monitoring integration. The core product description includes specialized conveyor belts, idlers, rollers, pulleys, gearboxes, monitoring sensors, and specialized tools required for system repair and upkeep.

Major applications for conveyor maintenance services are concentrated in high-throughput environments where system failure leads to significant economic loss. In the mining and bulk material handling sector, robust maintenance is necessary due to harsh operating conditions and abrasive materials, requiring frequent belt splicing, tracking adjustments, and structural inspections. In the e-commerce and logistics industry, maintenance focuses heavily on maximizing uptime for high-speed sortation and automated storage and retrieval systems (AS/RS), emphasizing predictive diagnostics powered by IoT sensors. The primary benefits of effective maintenance include minimized unplanned downtime, extended asset lifespan, improved energy efficiency, enhanced worker safety through regulatory compliance, and optimization of overall operational throughput, directly contributing to profitability.

Key driving factors accelerating the market growth include the global surge in e-commerce necessitating rapid expansion of automated warehousing facilities, increasing regulatory mandates regarding industrial safety and equipment standards, and the aging conveyor infrastructure in established industrial economies requiring modernization and overhaul. Furthermore, the rising adoption of sophisticated maintenance strategies, particularly those leveraging digitalization, such as condition monitoring and predictive maintenance (PdM), is shifting market dynamics towards service contracts that offer guaranteed uptime. The emphasis on operational excellence and lean manufacturing principles across industries also compels organizations to invest proactively in specialized conveyor maintenance solutions rather than relying on reactive repairs.

Conveyor Maintenance Market Executive Summary

The Conveyor Maintenance Market is experiencing transformative shifts driven by global supply chain pressures and technological innovation, particularly the integration of Industry 4.0 principles. Current business trends indicate a strong movement away from traditional reactive maintenance towards long-term, data-driven service contracts focused on asset performance management (APM). Key industry players are increasingly bundling advanced diagnostic capabilities, often including remote monitoring and digital twins, into their offerings to provide comprehensive maintenance management. This strategic shift is aimed at capturing higher value through recurring service revenue and establishing deeper partnerships with end-users seeking operational resilience. Furthermore, mergers and acquisitions are common as specialized technology providers integrate with established maintenance service firms to create holistic, end-to-end solutions capable of addressing the complex needs of modern automated facilities.

Regionally, the Asia Pacific (APAC) market is demonstrating the highest growth trajectory, primarily fueled by massive infrastructure development in countries like China, India, and Southeast Asia, coupled with rapid urbanization driving the expansion of manufacturing and logistics hubs. North America and Europe, while representing mature markets, are leading in the adoption of advanced maintenance technologies, including robotic inspection and sophisticated sensor deployment, driven by stringent labor costs and high regulatory standards for operational safety. The Middle East and Africa (MEA) region shows significant potential, particularly in the mining, oil and gas, and bulk material handling sectors, where large-scale projects demand robust and reliable conveyor systems supported by specialized field maintenance services.

Segment trends highlight the significant dominance of the Services segment over the Parts segment, reflecting the increasing complexity of modern conveyor systems that require expert intervention and specialized skills for diagnostics and repair. Within services, predictive maintenance is the fastest-growing sub-segment, driven by its proven return on investment (ROI) by minimizing unscheduled downtime. Material Handling is the leading application segment, encompassing the vast logistical networks used by e-commerce giants and distribution centers. Furthermore, the shift towards modular and standardized components facilitates faster replacement cycles, though the adoption of smart components necessitates higher technical proficiency among maintenance personnel, influencing training and specialization within the market.

AI Impact Analysis on Conveyor Maintenance Market

User inquiries regarding the integration of Artificial Intelligence (AI) into conveyor maintenance commonly focus on its potential to revolutionize predictive capabilities, automate inspection processes, and optimize resource allocation. Key themes revolve around how AI can enhance failure prediction accuracy beyond traditional statistical models, the feasibility of implementing machine vision systems for real-time defect detection on belts and components, and the expected reduction in maintenance costs and safety incidents. Users are concerned about data security, the required upfront investment in sensor technology (IoT), and the integration challenges of new AI platforms with existing legacy enterprise resource planning (ERP) and computer maintenance management systems (CMMS). Expectations are high for AI to deliver prescriptive insights—telling maintenance teams not only that a failure is likely, but exactly what corrective action is needed and when, minimizing human error and maximizing system uptime.

AI's primary influence is establishing next-generation predictive maintenance frameworks. By processing vast amounts of sensor data—including vibration analysis, temperature readings, acoustic monitoring, and current signatures—AI algorithms can detect subtle anomalies indicative of component wear or imminent failure long before standard monitoring techniques. This shift allows maintenance schedules to be optimized precisely based on the actual condition and remaining useful life (RUL) of components, moving beyond time-based or cycle-based schedules. Moreover, machine learning models are being deployed to optimize belt tracking and tensioning systems automatically, responding dynamically to load changes and environmental factors, which significantly reduces friction and energy consumption.

Furthermore, AI is instrumental in streamlining fault diagnosis and optimizing spare parts inventory management. By learning from historical maintenance logs, failure patterns, and operational variables, AI systems can instantly suggest the probable root cause of an issue, drastically reducing troubleshooting time. This enhancement in diagnostic speed is crucial for high-speed logistics operations. In inventory management, AI algorithms forecast the exact demand for critical spares based on projected component wear rates across an entire fleet, ensuring that the right parts are available just in time (JIT), thereby lowering carrying costs while mitigating the risk of stockouts during critical failures. The integration of AI tools is becoming a competitive necessity for maintenance service providers seeking to offer guaranteed performance contracts.

- Enhanced Predictive Accuracy: AI algorithms process multi-sensor data (vibration, thermal, acoustic) to predict failures with superior precision, extending component RUL.

- Automated Visual Inspection: Machine vision systems powered by AI detect surface defects (belt tears, roller damage) in real-time, reducing manual inspection needs.

- Optimization of Resource Scheduling: AI analyzes workload, technician availability, and travel time to assign maintenance tasks optimally, increasing labor efficiency.

- Prescriptive Maintenance Recommendations: Generating step-by-step guidance for technicians based on diagnosed failure mode, improving first-time fix rates.

- Digital Twin Simulation: AI models run "what-if" scenarios on digital replicas of conveyor systems to test maintenance strategies before physical implementation.

- Improved Energy Efficiency: AI dynamically adjusts system parameters (e.g., belt speed, tension) based on load, reducing power consumption and wear.

- Inventory Optimization: Forecasting demand for critical spares based on fleet health and predicted component failures, minimizing inventory costs.

DRO & Impact Forces Of Conveyor Maintenance Market

The Conveyor Maintenance Market is fundamentally shaped by a complex interplay of industrial demands, economic pressures, and technological advancements. Drivers include the relentless expansion of global logistics networks, necessitating continuous high-uptime operation, and the widespread necessity to comply with increasingly strict workplace safety and environmental regulations (e.g., mandatory inspections, dust control, and noise reduction). Restraints primarily involve the high initial capital investment required for implementing advanced predictive maintenance technologies, such as sophisticated sensor arrays and analytics platforms, which can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the pervasive scarcity of highly skilled technicians capable of servicing, interpreting, and repairing digitally enhanced conveyor systems poses a significant structural restraint across most geographic regions. Opportunities emerge from the push towards sustainable operations, driving demand for maintenance services focused on extending equipment life and enhancing energy efficiency, alongside the burgeoning market for retrofitting existing legacy conveyor infrastructure with IoT and AI capabilities.

Key drivers center on the global explosion in material handling requirements, directly linked to rapid industrialization and the maturation of e-commerce supply chains. Every increase in warehouse capacity or mining output inherently escalates the demand for reliable conveyor uptime and maintenance services. The transition to higher capacity, faster-moving conveyor systems in both bulk and unit handling applications requires more frequent and sophisticated preventative interventions to manage wear and tear effectively. Additionally, the operational cost implications of unplanned downtime in modern, interconnected manufacturing environments—where a single conveyor failure can halt an entire production line—mandate proactive maintenance investments as a form of business continuity insurance. This economic imperative drives the adoption of premium service contracts.

The primary impact forces acting on the market are technological disruption and operational standardization. The rise of condition monitoring technologies (e.g., infrared thermography, ultrasonic monitoring, and vibration analysis) is a major force, enabling the shift to predictive models that fundamentally alter maintenance scheduling and service delivery. Standardization efforts, particularly ISO standards related to maintenance quality and asset management (like ISO 55000), compel end-users to seek certified, structured maintenance programs, favoring large service providers capable of ensuring compliance. Conversely, the market faces impact from macroeconomic forces such as fluctuating raw material costs (affecting replacement part pricing) and global economic volatility, which can temporarily curb large-scale capital expenditure on system modernizations, pushing focus toward essential repair and overhaul services.

Segmentation Analysis

The Conveyor Maintenance Market is strategically segmented across several dimensions, including the type of service offered, the specific component involved, the end-use industry utilizing the system, and the deployment model of the maintenance service. Analyzing these segments provides a clear understanding of market dynamics, identifies high-growth niches, and highlights areas where specialized technical expertise is most valued. The move towards highly specific component maintenance, such as specialized repair for complex gearboxes or patented belting materials, allows service providers to command premium pricing and establish long-term contractual relationships. Furthermore, segmentation by industry reveals critical differences in maintenance requirements; for instance, clean-room standards in pharmaceuticals necessitate different maintenance protocols than the rugged demands of the aggregate mining sector.

Segmentation based on Service Type—specifically dividing the market into repair, preventative maintenance (PM), and predictive maintenance (PdM)—demonstrates the market's technological maturation. While repair services remain essential for emergencies, PM is the foundational routine activity, often managed through Computerized Maintenance Management Systems (CMMS). However, the fastest evolution is occurring in the PdM segment, driven by IoT and data analytics. This segment demands specialized skills in data science and machinery diagnostics, attracting high-tech firms that partner with traditional service providers to deliver sophisticated, value-added contracts focused on uptime guarantees rather than simply labor hours.

The segmentation by Component Type is crucial for manufacturers of conveyor parts and specialized tools. This includes belts (the most frequently maintained component), idlers and rollers (critical for smooth operation and energy consumption), and mechanical drives (gearboxes, motors, pulleys). As conveyor systems become faster and carry heavier loads, the demand for high-performance, durable, and frequently inspected components grows. Similarly, the industry segmentation highlights dominant end-users: Mining, Logistics/Warehousing, and Manufacturing (including Automotive and Food & Beverage). Each industry requires tailored maintenance strategies concerning environment, cleanliness, speed, and safety standards, making industry specialization a key competitive differentiator for maintenance firms.

- By Service Type:

- Preventive Maintenance (PM)

- Predictive Maintenance (PdM)

- Corrective Maintenance/Repair

- Overhaul and Modernization

- Inspection and Auditing Services

- By Component:

- Conveyor Belts (Fabric, Steel Cord, Specialty)

- Rollers, Idlers, and Frames

- Pulleys and Drives (Motor, Gearbox)

- Tensioning Systems and Cleaners

- Monitoring and Sensor Devices

- By End-Use Industry:

- Mining and Aggregate

- Logistics, Post, and Parcel (E-commerce)

- Food & Beverage

- Automotive and Manufacturing

- Chemical and Pharmaceuticals

- Airport Handling Systems

- By Maintenance Model:

- In-House/Self-Maintenance

- Outsourced Contract Maintenance (CM)

- Hybrid Models

Value Chain Analysis For Conveyor Maintenance Market

The value chain for the Conveyor Maintenance Market begins with upstream activities focused on the manufacturing and supply of raw materials and advanced components necessary for both new installations and replacement parts. Key upstream participants include specialized steel manufacturers (for frames, rollers, and structure), rubber and polymer suppliers (for belting), and technology firms providing high-precision sensors, IoT devices, and specialized diagnostic software. The quality and availability of these core materials directly influence the longevity and maintainability of the final conveyor system. Establishing strong, reliable relationships with these upstream suppliers is crucial for maintenance service providers to ensure the rapid availability of authentic, high-quality replacement parts, which is essential for minimizing customer downtime.

Midstream activities constitute the core service delivery, involving the conveyor system manufacturers, maintenance service providers, and specialized integrators. Manufacturers often offer maintenance packages as part of their warranty and post-sale support, ensuring compliance with original specifications. Independent third-party maintenance firms provide specialized labor, diagnostic expertise, and emergency repair services. The efficiency in this stage is determined by logistical capabilities, technical certification levels of field staff, and the effectiveness of planning and scheduling systems (CMMS). The shift toward PdM heavily relies on data analysis capabilities, positioning maintenance software providers as critical value enhancers in the midstream.

Downstream activities involve the end-users—the various industrial clients in mining, logistics, and manufacturing—who consume the maintenance service. Distribution channels for maintenance services are primarily direct, involving contractual agreements between the service provider and the client, particularly for complex, long-term predictive contracts. However, component sales often utilize indirect channels, such as authorized distributors or specialized industrial supply houses for commodity items like standard rollers and small parts. The successful completion of the value chain is measured by key performance indicators (KPIs) such as asset uptime, Mean Time Between Failures (MTBF), and operational safety compliance, establishing a direct link between high-quality maintenance and end-user profitability.

Conveyor Maintenance Market Potential Customers

Potential customers for conveyor maintenance services span any organization relying on material handling systems to move, sort, or process goods efficiently within their operations. The primary end-users are large industrial conglomerates and infrastructure operators whose profitability is intrinsically tied to the continuous functioning of their logistical backbone. These customers prioritize service providers who can offer fixed-price, long-term contracts that guarantee specific uptime metrics, thereby transferring the operational risk associated with system failure. These enterprises are the most receptive to advanced, high-cost predictive maintenance solutions, as the economic impact of their downtime is significant, often measured in hundreds of thousands of dollars per hour of stoppage.

Within the logistics and e-commerce sectors, potential customers include global parcel delivery services, massive distribution centers, and fulfillment warehouses. For these clients, conveyor systems are high-speed, highly integrated assets crucial for daily throughput volumes. Maintenance needs here are characterized by demands for rapid response times, specialized knowledge in complex sortation equipment (e.g., cross-belt sorters, tilt-tray sorters), and expertise in maintaining high sensor density environments. Their buying decisions are driven by the need for peak performance, scalability, and seamless integration with warehouse management systems (WMS).

The mining and heavy industry sectors represent another robust segment of potential customers, including coal, iron ore, and aggregate processing plants. Maintenance here is focused on durability and mitigating extreme wear caused by abrasive materials and harsh environmental conditions. Customers in this domain require expertise in robust belting repairs (e.g., vulcanization and splicing), structural integrity inspection, and specialized components like heavy-duty idlers and impact beds. These customers are more likely to invest in ruggedized condition monitoring solutions and favor service providers with a proven safety record and deep mechanical expertise in heavy-load applications. Their purchasing criteria often emphasize regulatory compliance and system longevity in demanding environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, SKF, Schaefer Systems International, BEUMER Group, Vanderlande Industries, Tsubaki Co., Ltd., Continental AG, Fenner Conveyor Belting, Metso Outotec, FLSmidth, Sandvik AB, Konecranes, Interroll, Honeywell Intelligrated, Rexnord Corporation, Applied Industrial Technologies, Martin Engineering, Joy Global (Komatsu), Conveyor Belt Service, Inc., Dematic (KION Group) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Conveyor Maintenance Market Key Technology Landscape

The technology landscape of the Conveyor Maintenance Market is dominated by the rapid integration of advanced sensing technologies and data analytics platforms, fundamentally changing how assets are monitored and serviced. The migration to Industry 4.0 standards necessitates the deployment of IoT sensors across critical conveyor components—specifically rollers, bearings, and drive systems—to capture real-time data on vibration, temperature, and acoustic signatures. Wireless sensor networks are becoming prevalent as they reduce the complexity and cost of installation in existing infrastructure. Furthermore, advanced diagnostic tools, such as infrared cameras for thermal monitoring of belt stress and motor health, and ultrasonic detectors for early bearing wear detection, are standard features in high-end service packages. The key technological shift is moving from passive data collection to active, automated data interpretation using cloud-based platforms and edge computing, ensuring immediate failure alerts.

Another crucial technological advancement is the use of automated inspection systems, significantly enhancing safety and efficiency, particularly in hazardous or hard-to-reach industrial environments like mining tunnels or elevated structures. Drones and robotic crawlers equipped with high-resolution cameras, LiDAR, and specialized Nondestructive Testing (NDT) sensors are increasingly employed for routine visual and structural inspections, detecting subtle signs of belt damage, frame misalignment, or component fatigue that human inspectors might miss. These automated systems generate highly precise digital reports, often integrated directly into the client's CMMS, creating a digital record of asset health over time. This technology minimizes human exposure to dangerous machinery and accelerates the overall inspection cycle, ensuring regulatory compliance is met more efficiently.

Software and platform technologies form the backbone of modern conveyor maintenance. The evolution of Computerized Maintenance Management Systems (CMMS) and Enterprise Asset Management (EAM) suites now includes modules specifically designed for conveyor health monitoring, capable of processing large streams of IoT data. These platforms often integrate machine learning (ML) modules to refine predictive models and optimize maintenance scheduling based on dynamic operating conditions. Furthermore, the adoption of Augmented Reality (AR) and Virtual Reality (VR) tools is improving technician training and field service delivery. AR overlays on mobile devices allow field technicians to visualize internal component schematics, access maintenance history, and receive step-by-step repair guidance remotely, significantly boosting diagnostic speed and first-time fix rates, a critical measure of service quality in the competitive market.

Regional Highlights

- North America (United States, Canada, Mexico): North America is characterized by high adoption rates of automated logistics and material handling systems, particularly driven by the massive scale of e-commerce operations in the United States. This region leads in the application of sophisticated predictive maintenance technologies, leveraging AI and IoT to maximize efficiency and mitigate high labor costs. The market is mature, emphasizing contractual service agreements that guarantee specific operational uptimes (uptime-as-a-service models). Strict Occupational Safety and Health Administration (OSHA) regulations necessitate frequent and comprehensive maintenance inspections, driving demand for specialized compliance services. Investment is heavily focused on retrofitting existing older industrial assets with modern digital diagnostic capabilities rather than greenfield expansion, making system modernization a major market driver in both the automotive and food processing sectors.

- Europe (Germany, UK, France, Italy): European countries maintain a strong focus on engineering quality, energy efficiency, and stringent environmental standards, heavily influencing the conveyor maintenance approach. Germany, in particular, showcases high demand due to its advanced manufacturing base (Industry 4.0 implementation) and strong regulatory environment regarding machine safety (CE marking compliance). The European market exhibits a preference for high-quality, long-life components and highly skilled, localized maintenance services. The region is pioneering maintenance strategies focused on Circular Economy principles, encouraging repair and refurbishment over replacement, thereby emphasizing specialized overhaul and component restoration services to extend the operational lifespan of conveyor assets.

- Asia Pacific (APAC) (China, India, Japan, South Korea): APAC is the fastest-growing region, propelled by rapid industrialization, massive infrastructure projects (e.g., ports, mines), and the unprecedented expansion of the middle class driving consumer logistics demand. China and India are major hubs for both manufacturing output and e-commerce growth, resulting in massive demand for new conveyor systems and subsequently, maintenance services. While cost-sensitivity remains a factor, particularly in developing economies within the region, there is a growing trend among multinational corporations operating in APAC to implement global best practices, including sophisticated predictive maintenance programs, accelerating the technology adoption curve. The sheer volume of new installations drives a substantial market for initial warranty and preventive maintenance contracts.

- Latin America (Brazil, Argentina, Chile): The Latin American market is heavily influenced by the robust mining sector (copper, iron ore) and agricultural processing industries. Maintenance requirements are often focused on heavy-duty, bulk material handling conveyors operating in remote and challenging geographical conditions. The market demand is characterized by cyclical economic performance; however, there is stable, high demand for component replacement (belts, idlers) due to the demanding operating environment. Outsourcing is common, with large regional and international firms providing specialized maintenance teams tailored for remote site logistics and rapid deployment capabilities to minimize production losses in high-value resource extraction operations.

- Middle East and Africa (MEA) (Saudi Arabia, UAE, South Africa): The MEA region's market is driven by large-scale public investment in infrastructure, logistics hubs (ports, airports), and the ongoing oil & gas and petrochemical industries. The extreme heat and dusty operating conditions necessitate specialized maintenance protocols focusing on mitigating thermal stress on components and minimizing dust-related wear and fire risks. South Africa remains a key market due to its mature mining sector. In the GCC countries, the focus on developing sophisticated smart cities and logistics corridors (e.g., Dubai's logistics parks) is fostering growth in demand for high-tech, digitally-enabled maintenance solutions for automated sorting systems, often procured through high-value service level agreements with international vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Conveyor Maintenance Market.- Siemens AG

- SKF

- Schaefer Systems International

- BEUMER Group

- Vanderlande Industries

- Tsubaki Co., Ltd.

- Continental AG

- Fenner Conveyor Belting (Michelin Group)

- Metso Outotec

- FLSmidth

- Sandvik AB

- Konecranes

- Interroll

- Honeywell Intelligrated

- Rexnord Corporation

- Applied Industrial Technologies

- Martin Engineering

- Joy Global (Komatsu)

- Conveyor Belt Service, Inc.

- Dematic (KION Group)

Frequently Asked Questions

Analyze common user questions about the Conveyor Maintenance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Preventive and Predictive Conveyor Maintenance?

Preventive Maintenance (PM) is time-based or usage-based, performed on a fixed schedule (e.g., quarterly lubrication or annual inspection) to prevent expected degradation. Predictive Maintenance (PdM) uses real-time condition monitoring data (from sensors, AI) to determine the exact optimal moment for maintenance intervention, maximizing component life and minimizing unplanned downtime.

How is Industry 4.0 influencing the economic model of conveyor maintenance?

Industry 4.0, characterized by IoT and AI integration, is shifting the economic model from transactional repair services to performance-based contracts, often termed 'Uptime as a Service.' This model guarantees operational availability, allowing providers to charge premium prices based on sustained performance and efficiency improvements, lowering the Total Cost of Ownership (TCO) for the end-user.

Which end-use industry is driving the highest demand for advanced conveyor maintenance technologies?

The Logistics and E-commerce sector is currently driving the highest demand for advanced, high-speed conveyor maintenance technologies. This is due to the imperative need for near-zero downtime in automated fulfillment centers and sortation hubs, requiring immediate investment in AI-driven predictive diagnostics and robotic inspection systems.

What are the greatest challenges limiting the widespread adoption of AI in conveyor maintenance?

The greatest challenges include the substantial upfront investment required for installing complex sensor infrastructure (retrofitting legacy systems), the difficulty in integrating new AI platforms with outdated legacy CMMS/ERP systems, and the severe shortage of specialized technicians capable of interpreting and acting upon sophisticated data analytics and machine learning insights.

What are the critical components requiring specialized maintenance attention in bulk material handling?

In bulk material handling (e.g., mining), critical components requiring specialized attention are the conveyor belts themselves (requiring skilled vulcanization and splicing), heavy-duty idlers and rollers (prone to accelerated wear and misalignment), and large drive pulleys and gearboxes (requiring high-precision vibration analysis and lubrication management to prevent catastrophic failure).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager