Cooking Class Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438580 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Cooking Class Market Size

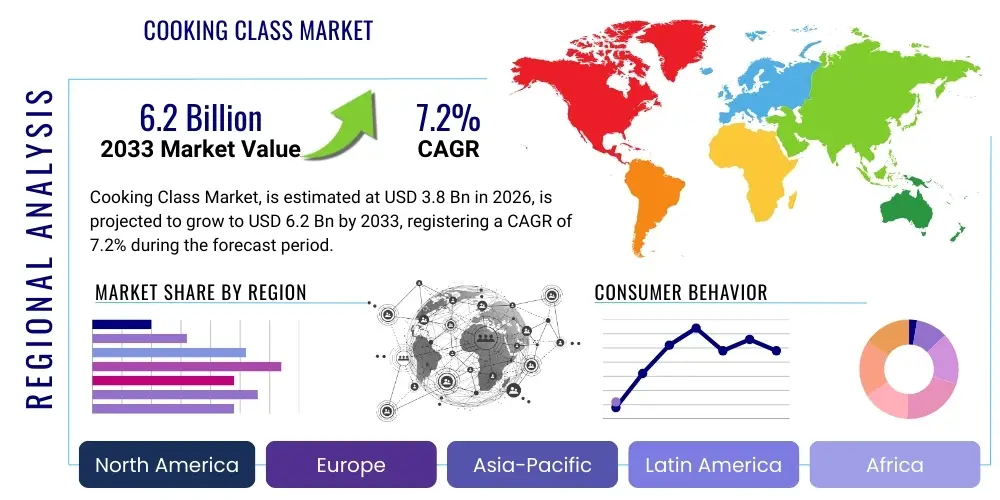

The Cooking Class Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Cooking Class Market introduction

The Cooking Class Market encompasses services offering culinary education, ranging from basic skill development to advanced professional techniques, delivered through physical locations (studios, restaurants) or digital platforms (live streams, on-demand videos). This industry is characterized by a strong consumer desire for experiential learning, cultural immersion, and practical skill acquisition, catering to both amateur home cooks seeking improved meal preparation capabilities and serious enthusiasts pursuing specialized culinary interests. Key product offerings include hands-on classes, demonstration classes, private events, team building sessions, and subscription-based online courses, all designed to enhance culinary literacy and proficiency.

Major applications of cooking classes span across leisure and hobby enhancement, professional development for aspiring chefs, nutritional education, and corporate wellness programs. The increasing global focus on healthy eating, dietary restrictions (such as vegan, gluten-free, or keto diets), and food sustainability significantly drives market demand. Moreover, cooking classes serve as valuable tourist attractions, offering authentic local food experiences, thereby integrating with the growing culinary tourism sector. This diversification of applications ensures broad market penetration across different demographic and psychographic segments globally.

The primary benefits driving market expansion include the immediate, practical application of learned skills, the social aspect of group instruction, and the personalized feedback received in structured learning environments. Furthermore, the accessibility provided by digital formats has democratized culinary education, allowing consumers in geographically isolated areas or with constrained schedules to participate. Driving factors include rising disposable incomes, increased consumer interest in home cooking spurred by media and celebrity chefs, and technological advancements enabling high-quality, interactive virtual learning experiences. The shift towards healthier lifestyles and the pursuit of enjoyable, skill-based hobbies continue to fuel sustained market growth.

Cooking Class Market Executive Summary

The global Cooking Class Market is currently undergoing significant transformation, driven primarily by evolving business models transitioning from traditional brick-and-mortar operations to highly sophisticated hybrid platforms integrating physical immersion with digital scalability. Key business trends include the proliferation of personalized instruction, the integration of meal kit delivery services paired with virtual classes, and strategic partnerships between culinary schools and established food brands to enhance visibility and curriculum relevance. The post-pandemic environment has cemented the necessity of robust digital offerings, leading to increased investment in interactive online tools and superior video content production, ensuring continuity and expanding market reach beyond local constraints. Profitability is increasingly tied to effective management of cohort sizes, instructor specialization, and the establishment of powerful brand presence through engaging social media strategies and user-generated content.

Regionally, North America and Europe remain mature markets characterized by high consumer spending on leisure and a strong culture of health and wellness, driving demand for specialized classes focusing on specific cuisines or complex techniques. However, the Asia Pacific (APAC) region is demonstrating the most accelerated growth trajectory, fueled by rapid urbanization, rising middle-class disposable incomes, and immense cultural diversity that promotes interest in both local and international culinary arts. Countries like China and India are seeing a surge in demand for professional baking and patisserie courses, while Japan and South Korea leverage their deep-rooted food traditions for culinary tourism offerings. The Middle East and Africa (MEA) market, while nascent, shows strong potential, particularly in high-income Gulf states, focusing on luxury, high-end private classes and corporate team-building events.

Segment trends highlight the dominance of the online segment, particularly those offering flexible, self-paced learning combined with live Q&A sessions, appealing strongly to working professionals. Based on cuisine type, the market sees high volatility, with increasing demand for ethnic and fusion cuisine instruction, such as authentic Thai, Peruvian, or Mediterranean cooking, outpacing traditional Western European classes. Furthermore, the professional segment, including culinary certifications and career-focused training, maintains stable growth, reflecting continuous demand for skilled labor in the global hospitality sector. The corporate segment is also experiencing a renaissance, utilizing cooking classes as engaging, low-stress team development tools, positioning experiential learning as a valuable component of organizational culture initiatives.

AI Impact Analysis on Cooking Class Market

User queries regarding the impact of Artificial Intelligence on the Cooking Class Market overwhelmingly focus on personalized learning, automated feedback mechanisms, and the potential for AI-driven recipe generation. Consumers are highly interested in how AI can tailor learning paths based on existing skill levels and dietary preferences, moving beyond standardized curriculum. Key themes revolve around the fear of losing the "human touch" of instruction versus the expectation of hyper-efficient, instantaneous support, such as real-time error correction during cooking practice. Concerns often center on data privacy regarding user culinary habits and the ethical implications of using celebrity chef voices or likenesses for virtual instruction. The consensus view anticipates AI primarily augmenting, rather than replacing, the instructor role, focusing on administrative efficiency and enhancing student engagement through adaptive content delivery.

AI's role is rapidly evolving from simple recommendation engines to complex instructional assistants. Machine learning algorithms are now being deployed to analyze student performance metrics, identifying common mistakes in technique—such as incorrect chopping methods or imprecise temperature control—and providing immediate, customized video snippets or written corrections. This capability significantly improves the efficacy of self-paced virtual courses, addressing a major limitation of traditional online education. Furthermore, AI-powered chatbots integrated into learning platforms offer 24/7 support, answering common ingredient substitution questions or troubleshooting issues, thus freeing up human instructors to focus on complex, high-touch culinary concepts and creative development.

Another crucial area is content optimization and curriculum development. AI tools analyze global food trends, ingredient availability, and popular search queries to help cooking schools rapidly update and localize their course offerings, ensuring maximum market relevance and enrollment rates. This predictive analytics capability allows businesses to invest resources strategically, anticipating demand for emerging cuisines or specialized equipment instruction. While human culinary expertise remains irreplaceable for demonstrating complex flair and imparting cultural nuance, AI handles the data-intensive tasks of personalization and operational management, ultimately increasing the scalability and profitability of both physical and virtual cooking class operations across diverse markets.

- AI-driven personalized curriculum recommendations based on user history and skill assessment.

- Real-time automated feedback and technique correction using visual recognition systems in virtual classes.

- Development of adaptive difficulty levels for virtual cooking simulations and recipe adjustments.

- Optimization of class scheduling and resource allocation through predictive enrollment analytics.

- Enhanced customer service via AI chatbots for instantaneous Q&A regarding ingredients and preparatory steps.

- Content localization and trend identification for timely curriculum updates globally.

- Creation of immersive virtual reality cooking environments utilizing generative AI for scene realism.

DRO & Impact Forces Of Cooking Class Market

The Cooking Class Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive cultural shift toward healthy eating and wellness, spurring demand for specialized dietary instruction (e.g., plant-based, fermentation, functional foods). Concurrently, the proliferation of high-quality digital educational platforms and the global reach of celebrity chefs acting as market influencers significantly increase consumer engagement. Restraints include the high initial capital investment required for equipping physical kitchens, the inherent challenge of ensuring quality and consistency across decentralized teaching models, and the logistical difficulties associated with sourcing specialized ingredients for niche classes. These restraints particularly affect smaller, independent cooking schools attempting to compete with globally scaled online providers.

Key opportunities center on leveraging technological innovation, specifically Augmented Reality (AR) and Virtual Reality (VR), to create highly immersive and interactive online learning experiences that bridge the gap between virtual and hands-on instruction. Strategic diversification into niche markets, such as culinary team building for corporate clients or specialized classes focused on sustainability and zero-waste cooking techniques, presents significant avenues for revenue growth and market differentiation. Furthermore, geographical expansion into rapidly developing economies like Southeast Asia and Latin America, where interest in Western and fusion cuisines is surging, offers untapped potential for global cooking school franchises and online platforms seeking new subscriber bases.

The cumulative Impact Forces governing the market demonstrate high momentum. The bargaining power of buyers is moderate to high, as the market is flooded with diverse providers—from free YouTube content to high-end professional academies—forcing established schools to constantly innovate on price, quality, and unique selling propositions. The threat of new entrants is moderate, lowered by the high barrier to entry for physical space but heightened by the ease of launching low-cost, high-reach virtual platforms. The primary competitive rivalry is intense, focused heavily on brand reputation, instructor quality, and the ability to deliver exceptional experiential value. Supplier power is generally low, as most ingredients are commodities, but specialized equipment and proprietary online learning management systems can introduce moderate supplier leverage in specific segments.

Segmentation Analysis

The Cooking Class Market is comprehensively segmented based on format, cuisine type, end-user, and professional status, reflecting the diversity of consumer needs and preferences. Analyzing these segments is crucial for market participants to identify lucrative niches and tailor marketing strategies effectively. The segmentation framework highlights the contrast between the highly personalized, localized delivery of physical classes and the scalable, accessible nature of online platforms, which have seen exponential growth since 2020. This structure allows businesses to position themselves optimally, whether targeting corporate clients with team-building events or catering to individual consumers seeking career development or hobby enhancement.

Based on format, the market clearly differentiates between traditional In-Person Classes, which emphasize sensory experience and direct interaction, and Online Classes, which prioritize flexibility and cost-effectiveness. End-user segmentation distinguishes between Individual Consumers, who form the largest volume base, and Corporate Clients, who provide high-value, recurring contracts. Furthermore, professional certification courses represent a distinct segment within the end-user landscape, catering specifically to individuals seeking accredited qualifications necessary for entry or advancement within the food service industry, often demanding premium pricing and extensive curriculum content.

The geographic segmentation is pivotal, showcasing regional maturity levels and cultural culinary specialization. While North America and Europe lead in terms of market value due to high adoption rates of leisure classes and established culinary tourism, the APAC region dominates in terms of growth potential due to expanding middle-class populations and high interest in international culinary trends. Segmentation allows for targeted content creation; for instance, online platforms might focus on basic meal preparation in emerging markets and highly specialized advanced techniques in established markets, optimizing content delivery to maximize regional relevance and engagement.

- By Format:

- In-Person Classes (Hands-on, Demonstration)

- Online Classes (Live Streaming, On-Demand Videos, Hybrid Models)

- By Cuisine Type:

- Ethnic/Regional (Italian, Asian, Mediterranean, French, Mexican, Indian)

- Specialized (Baking & Pastry, Molecular Gastronomy, Vegan/Vegetarian, Gluten-Free)

- By End User:

- Individual Consumers (Hobbyists, Beginners)

- Corporate Clients (Team Building, Wellness Programs)

- By Professional Status:

- Amateur/Leisure Classes

- Professional Certification and Skill Development

- By Pricing Model:

- Subscription-Based (Online Platforms)

- Per-Class Fee (In-Person Studios)

- Packaged/Bundled Courses

Value Chain Analysis For Cooking Class Market

The value chain for the Cooking Class Market begins with upstream activities centered on curriculum development and ingredient sourcing. Upstream analysis involves the selection and training of qualified culinary instructors, a crucial process as instructor reputation often directly impacts class enrollment. It also includes the procurement of high-quality, often specialized, ingredients and kitchen equipment necessary to conduct effective classes, whether in a physical studio or via coordinated meal kit delivery for online participants. Efficiency at this stage is paramount; managing supplier relationships for consistency and competitive pricing directly affects the profitability and perceived quality of the final consumer experience. Furthermore, the development of proprietary content, including specialized recipes and supporting educational materials, constitutes a key upstream value-add.

Midstream activities focus on the actual delivery of the class, encompassing the operational logistics of the cooking facility, the management of the learning management system (LMS) for online platforms, and the execution of the marketing and sales process. For physical studios, maintaining state-of-the-art facilities and ensuring compliance with stringent food safety and hygiene standards are critical operational tasks. For online providers, the midstream focus shifts to high-fidelity video production, seamless user interface design, and robust server infrastructure to support live, interactive sessions globally. Effective scheduling, customer relationship management (CRM), and ensuring a smooth booking experience are essential components of optimizing this segment of the value chain.

Downstream analysis primarily involves the distribution channels and post-class engagement. Direct channels, such as proprietary studio locations or direct-to-consumer online platform subscriptions, provide maximum control over the customer experience and allow for higher profit margins. Indirect channels involve partnerships with aggregators (e.g., experience booking websites like Airbnb Experiences, ClassPass), travel agencies specializing in culinary tourism, or corporate brokers who facilitate team-building events. Post-class activities, including alumni engagement, providing digital recipe archives, issuing certificates, and soliciting detailed feedback, are crucial for fostering loyalty and generating positive word-of-mouth referrals, which are vital for sustained growth in this experience-driven market.

Cooking Class Market Potential Customers

The Cooking Class Market targets a broad spectrum of end-users, primarily categorized into individual hobbyists, professional aspirants, and corporate entities. Individual Consumers constitute the core market segment, generally comprising affluent millennials and Gen Z seeking experiential consumption and skill development, as well as retirees looking for engaging leisure activities. These buyers are typically motivated by the desire to improve home cooking efficiency, master specialized dietary needs (e.g., mastering fermentation or plant-based cuisine), or immerse themselves in cultural culinary traditions, making them susceptible to highly targeted marketing based on specific cuisine interests or health goals.

A second major segment comprises professional end-users, including aspiring chefs, current hospitality staff seeking to upskill, and career changers looking to enter the food industry. These buyers prioritize accredited certifications, intensive curriculum structure, and mentorship opportunities from established culinary experts. Their purchasing decisions are heavily influenced by the reputation of the school, the practical relevance of the skills taught, and the employment placement rates following course completion. These consumers represent a high-value segment, often enrolling in longer, more expensive programs delivered through dedicated culinary academies.

The third substantial segment involves Corporate and Institutional Buyers. Companies increasingly utilize cooking classes for employee engagement, team bonding exercises, and corporate wellness initiatives, viewing them as effective, non-traditional professional development tools. These buyers value logistical ease, scalability, and the ability to customize the class experience to align with corporate culture or specific group sizes. Furthermore, educational institutions and healthcare providers represent potential buyers for classes focused on basic nutrition and practical cooking skills, often seeking B2B partnerships with established culinary educators to deliver community outreach or specialized academic programs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sur La Table, Institute of Culinary Education (ICE), Le Cordon Bleu, MasterClass, Cozymeal, The Culinary Institute of America (CIA), TASTE, Culinary Schools of America, Zingerman's Delicatessen, Haven's Kitchen, Cook Street School of Fine Cooking, Online Cooking School Platform X, Local Culinary Academy Y, Future Foodies Institute, Culinary Arts School Z, The Food Network Kitchen, Rouxbe Online Culinary School, Kitchn Cooking School, America's Test Kitchen Online, Culinary Solutions Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cooking Class Market Key Technology Landscape

The technology landscape supporting the Cooking Class Market is rapidly evolving, driven by the need for enhanced interactivity, scalability, and seamless user experiences, particularly in the online segment. Key technological adoption centers on advanced Learning Management Systems (LMS) tailored for culinary instruction, integrating features like high-definition multi-camera views, synchronized instruction timers, and interactive chat functionalities. These platforms often leverage cloud computing to manage large volumes of on-demand content and handle high-traffic live streaming events. Furthermore, the use of sophisticated e-commerce solutions is crucial for managing meal kit subscriptions, ingredient tracking, and personalized course bundling, ensuring the operational efficiency that underpins profitable online business models.

Augmented Reality (AR) and Virtual Reality (VR) technologies are emerging as transformative elements, moving beyond traditional video instruction to offer immersive culinary simulations. AR overlays, delivered via smartphone or tablet, can provide real-time visual feedback on knife skills or ingredient measurements, mimicking the physical guidance of an instructor. VR environments, conversely, allow users to practice complex kitchen procedures in a zero-risk virtual setting, often used for training professionals on expensive equipment or specialized techniques like butchery. While still in early adoption phases, these technologies are crucial for attracting younger, tech-savvy demographics and differentiating premium online offerings from standard video content.

Beyond instructional technology, operational efficiencies are being driven by backend innovations. Data analytics and business intelligence tools are essential for tracking student engagement, assessing curriculum effectiveness, and forecasting ingredient needs, reducing waste and optimizing procurement. Payment technology integration, including mobile payment options and secure subscription management systems, streamlines the enrollment process, enhancing customer convenience. The reliance on high-speed internet infrastructure (5G) is also a crucial technological prerequisite, especially for delivering high-quality, latency-free live classes that demand simultaneous, bidirectional interaction between instructor and student across global locations.

Regional Highlights

- North America (NA): Characterized by high market maturity, strong disposable incomes, and a cultural emphasis on personalized health and nutrition. The region leads in corporate culinary team building and the adoption of hybrid learning models, integrating online platforms with occasional physical workshops. Key markets include the US, which heavily influences global culinary trends, and Canada, showing strong demand for ethnic and specialized dietary classes.

- Europe: This region boasts a rich culinary heritage, making it a primary hub for culinary tourism and professional culinary academies (e.g., France, Italy). The market is stable, with strong demand for accredited professional training and authentic regional cuisine instruction. Focus areas include sustainable cooking practices and farm-to-table workshops, particularly popular in Scandinavian and Western European countries.

- Asia Pacific (APAC): The fastest-growing region, driven by urbanization and the rapid expansion of the middle class, which exhibits high curiosity for international cuisines (especially Western baking and fusion dishes). Countries like China, India, and South Korea are key drivers, where growth is supported by large populations, increasing discretionary spending on leisure, and a quick adoption of mobile-first online education platforms.

- Latin America (LATAM): Marked by emerging growth and a strong emphasis on preserving and teaching indigenous culinary traditions. The market shows solid potential, particularly in Brazil and Mexico, driven by culinary tourism and local government initiatives promoting culinary arts as cultural heritage. Growth is constrained somewhat by infrastructure limitations in certain areas but driven by the high engagement in social, in-person classes.

- Middle East and Africa (MEA): A nascent but high-potential market, particularly in the GCC states (UAE, Saudi Arabia). Demand is concentrated in luxury segments—high-end private classes and exclusive corporate events. The African market is primarily driven by skill development programs focusing on hospitality management and basic food preparation techniques essential for employment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cooking Class Market.- Sur La Table

- Institute of Culinary Education (ICE)

- Le Cordon Bleu

- MasterClass

- Cozymeal

- The Culinary Institute of America (CIA)

- Rouxbe Online Culinary School

- TASTE

- Culinary Schools of America

- Zingerman's Delicatessen

- Haven's Kitchen

- Cook Street School of Fine Cooking

- Future Foodies Institute

- The Food Network Kitchen

- America's Test Kitchen Online

- Culinary Solutions Group

- The Kitchen Table Culinary Arts

- KitchenAid Experience Centers (Operating Classes)

- Online Cooking School Platform X (Placeholder)

- Global Culinary Academy Z (Placeholder)

Frequently Asked Questions

Analyze common user questions about the Cooking Class market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth of the Cooking Class Market?

The market is primarily driven by increased consumer interest in experiential learning, a widespread focus on health and personalized dietary requirements (like plant-based and specialized nutrition), and the enhanced accessibility and flexibility offered by robust online learning platforms leveraging high-quality video and interactive tools. The rise of culinary tourism also acts as a significant contributor.

How is technology impacting the delivery of culinary education?

Technology is revolutionizing delivery through high-fidelity live streaming, on-demand content libraries, and the adoption of AI for personalized feedback and curriculum adaptation. Emerging technologies like Augmented Reality (AR) are beginning to provide real-time technique correction and immersive virtual reality experiences, enhancing engagement in remote learning environments.

Which segment holds the largest share in the Cooking Class Market?

The Online Classes segment, categorized by Format, currently dominates the market share due to its superior scalability, global reach, and cost-effectiveness compared to traditional in-person sessions. This segment is highly favored by individual consumers seeking flexible, self-paced learning options without geographic constraints.

What challenges do cooking class providers face in the current market?

Providers face challenges related to maintaining consistency and high quality of instruction across decentralized online platforms. Furthermore, high operational and regulatory costs associated with maintaining commercial kitchen facilities for in-person classes, along with intense competition from both specialized culinary schools and generalized content platforms (e.g., YouTube), pose significant restraints on profitability and growth.

What is the role of specialization in the future of the Cooking Class Market?

Specialization is critical for differentiation and future growth. Demand is shifting rapidly toward highly niche areas such as advanced bread making, regional fermentation techniques, molecular gastronomy, and courses focused exclusively on sustainability and zero-waste cooking. Providers that successfully target these specialized segments can command higher prices and secure loyal student bases.

Are corporate team-building events a significant revenue stream for the market?

Yes, the corporate segment represents a substantial and growing high-value revenue stream. Companies increasingly invest in hands-on cooking classes as engaging, effective tools for team cohesion, stress reduction, and non-traditional professional development. Providers offering customized, scalable packages for large groups benefit significantly from this trend.

How does the value chain manage ingredient sourcing for online classes?

For online classes, providers increasingly manage ingredient sourcing through partnerships with specialized meal kit delivery services. This strategy ensures that all remote participants receive standardized, pre-portioned, and high-quality ingredients concurrently, guaranteeing a consistent learning experience and overcoming the logistical hurdle of remote ingredient procurement.

Which geographical region exhibits the highest growth potential?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential, driven by rapid economic development, expanding middle-class demographics, increased discretionary spending on education and leisure, and a high cultural affinity for culinary exploration and international food trends.

Do professional culinary certifications follow the same trends as amateur classes?

While amateur classes follow leisure and hobby trends, professional certifications are driven primarily by workforce demand, accreditation standards, and the need for recognized skill credentials in the competitive global hospitality sector. Professional courses maintain stable, steady growth, often requiring significant time investment and higher tuition fees compared to amateur workshops.

What impact does social media have on cooking class enrollment?

Social media platforms are critical marketing and enrollment drivers, enabling providers to showcase high-quality visual content, feature celebrity instructors, run targeted advertising campaigns, and leverage user-generated content (UGC) like successful student recipes. Influencer collaborations and visually appealing class demonstrations directly translate into higher conversion rates.

What is the current trend regarding class duration and format?

There is a dual trend: a move toward shorter, highly specific virtual "micro-classes" that cater to busy schedules, alongside continued demand for intensive, multi-week professional boot camps. Hybrid models combining short online modules with intensive in-person final exams or practical sessions are also gaining popularity for optimized learning efficiency.

How are providers ensuring the quality of instruction in online formats?

Quality assurance in online formats is achieved through rigorous instructor training in virtual presentation techniques, the use of professional-grade video equipment and multiple camera angles for clarity, and mandatory post-class feedback mechanisms. Many platforms also employ dedicated technical assistants during live sessions to manage technological issues, allowing the instructor to focus purely on culinary pedagogy.

Is culinary tourism still a significant driver post-global health crises?

Yes, culinary tourism is experiencing a robust recovery and remains a significant driver, with tourists increasingly seeking authentic, immersive local food experiences over traditional sightseeing. Cooking classes offer this unique cultural immersion, leading to strategic partnerships between culinary schools and local tourism boards or high-end travel operators.

What specific type of cuisine instruction is seeing the fastest growth?

Specialized cuisine classes focused on health, wellness, and dietary restrictions are experiencing rapid growth. This includes plant-based, gluten-free, fermentation, and functional foods cooking, driven by rising consumer awareness of the link between diet and long-term health outcomes.

How do pricing models differ between online and in-person classes?

In-person classes typically use a premium, per-class fee structure reflecting high overhead costs (ingredients, facilities). Online classes generally favor subscription-based models or bundled course packages, emphasizing continuous access and high content volume at a lower entry price point, capitalizing on the scalability of digital delivery.

What role does sustainability play in modern cooking class curricula?

Sustainability is becoming a core theme, driven by ethical consumer demand. Classes are increasingly incorporating instruction on waste reduction techniques, seasonal and local sourcing, nose-to-tail cooking, and minimizing environmental impact. This focus helps providers appeal to environmentally conscious millennials and Gen Z consumers.

Are independent studios able to compete with global online platforms?

Independent studios compete effectively by leveraging hyper-localization, offering unique cultural immersion unavailable digitally, and specializing in niche, high-touch instruction (e.g., regional specific cuisine or master classes with renowned local chefs). They focus on quality of experience and community building rather than volume scalability.

What is the significance of the instructor’s reputation in market success?

Instructor reputation is arguably the single most important factor for enrollment, especially in high-end or professional segments. Celebrity chef instructors or those with verified industry credentials lend immense credibility and marketing power to both physical schools and online masterclass platforms, driving premium pricing and brand loyalty.

How is data analytics being used to improve class offerings?

Data analytics tracks student drop-off points, completion rates, most frequently asked questions, and ingredient preferences. This intelligence allows providers to continually refine curriculum content, adjust class pacing, optimize ingredient sourcing, and develop new course topics that directly address verifiable consumer demand and learning gaps.

What is the primary motivation for consumers enrolling in cooking classes?

While motivations vary, the primary driving force for most individual consumers is the practical acquisition of a tangible, life-enhancing skill, combined with the desire for enjoyable, social, and cultural immersion experiences that extend beyond passive consumption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager