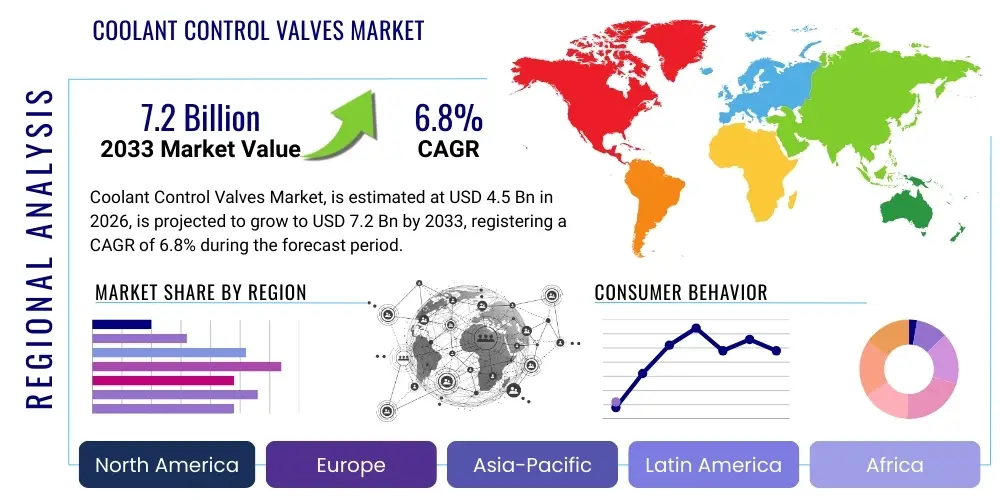

Coolant Control Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436893 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Coolant Control Valves Market Size

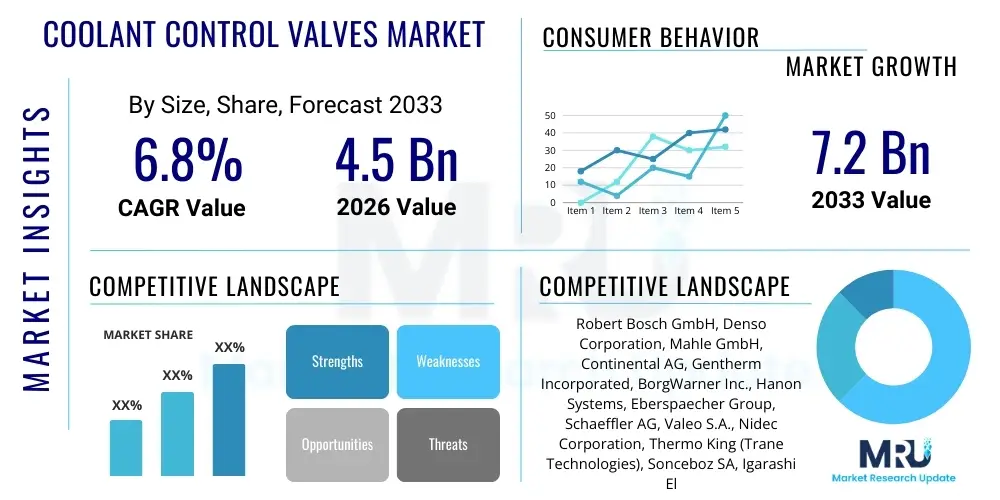

The Coolant Control Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Coolant Control Valves Market introduction

The Coolant Control Valves Market is central to the modern efficiency and reliability of thermal management systems across the automotive, industrial, and specialized machinery sectors. These components are meticulously engineered mechanical or electromechanical devices responsible for governing the distribution, flow rate, and directional routing of thermal transfer fluids, typically glycol-based coolants or specialized dielectric fluids. In contemporary vehicles, particularly those adopting electrification, the functionality of these valves has expanded far beyond simple engine temperature regulation. They now manage intricate thermal loops that concurrently service multiple critical components, including the internal combustion engine (where applicable), the high-voltage battery pack, power electronics such as inverters and converters, and the electric motor itself. This precise control is crucial to ensure that all vehicle subsystems operate within their tightly defined optimal thermal windows, thereby maximizing energy efficiency, ensuring component longevity, and fulfilling stringent performance criteria.

Coolant control valves come in diverse configurations, ranging from traditional thermostatic valves, which operate based on passive temperature sensing, to highly sophisticated electronic coolant control valves (ECCVs). The latter utilize stepper motors or solenoid actuation and are governed by algorithms embedded within the vehicle's electronic control unit (ECU) or a dedicated Thermal Management Control Unit (TMCU). ECCVs are indispensable for hybrid and electric vehicles, enabling dynamic switching between cooling and heating modes, and diverting flow based on complex real-time operational metrics, such as ambient temperature, driver demands (e.g., climate control setting), and the battery’s state-of-charge. The primary applications span across light-duty and heavy-duty passenger vehicles, commercial fleets, and advanced industrial processes where precise temperature stabilization is non-negotiable for system performance and safety. Benefits derived from advanced control valves include reduced fuel consumption in ICE vehicles due to accelerated warm-up phases, enhanced power output stability, and, critically for EVs, optimized battery charging and discharging cycles, extending the overall usable range.

Market expansion is fundamentally driven by two macro trends: the inexorable global pursuit of lower carbon emissions and the parallel revolution in electric mobility. Regulatory bodies globally continue to intensify pressure on Original Equipment Manufacturers (OEMs) through initiatives like the European Union's ambitious emission reduction targets and the US CAFE standards, mandating higher levels of thermal efficiency in all new vehicle designs. Moreover, the inherent thermal challenges presented by high-density lithium-ion battery packs in BEVs—requiring rapid heating in cold weather and intense cooling during fast charging—have cemented the role of sophisticated, multi-port coolant control valves as indispensable system components. This technological push compels manufacturers to abandon simpler thermostatic solutions in favor of modular, electronically integrated thermal control systems capable of handling complex fluid dynamics across multi-zone architectures, thereby acting as a powerful stimulant for demand throughout the forecast period and beyond.

Coolant Control Valves Market Executive Summary

The Coolant Control Valves Market is experiencing a rapid technological pivot, characterized by intense investment in electrification-enabling components and system integration capabilities. Business trends highlight a significant shift in manufacturing priorities toward developing integrated thermal modules that combine the valve, pump, and sensing elements into a unified system, reducing component count and simplifying assembly for OEMs. Key players are forming strategic partnerships with specialized software providers to enhance the intelligence and connectivity of their valves, ensuring seamless communication within the broader vehicle network architecture. Furthermore, material science innovation is a high-priority trend, focusing on lighter, more durable, and chemically inert polymers and composites capable of withstanding the corrosive and thermal demands of specialized EV coolants, thereby improving long-term reliability and reducing overall vehicle weight, which is critical for EV range maximization.

Regionally, the market exhibits sharp contrasts driven by disparate stages of EV maturity. Asia Pacific, led by China, not only maintains the largest consumption volume due to its unparalleled scale of vehicle production but also acts as a crucial technological hub for high-volume, cost-competitive manufacturing of electronic thermal components. European markets, however, lead in the adoption of complex, high-performance valves required for premium EV platforms and sophisticated heat pump systems, necessitated by severe regulatory constraints and the need to maintain efficiency in diverse temperate zones. North America is rapidly accelerating its adoption curve, supported by massive investments in domestic EV manufacturing capacity and the increasing popularity of electrified light trucks and SUVs, demanding robust and high-capacity coolant management systems capable of handling significant thermal loads under varying driving conditions. These regional differences underscore the necessity for localized production and customization capabilities among global suppliers.

Analysis of segment trends confirms the overwhelming dominance of the Electronic Coolant Control Valve (ECCV) segment in terms of revenue growth rate, significantly outpacing traditional mechanical valves, which are slowly being phased out of complex powertrain applications. Within the vehicle application segmentation, Battery Electric Vehicles (BEVs) are the primary engine of market expansion, demanding between two to four sophisticated control valves per vehicle, compared to often just one or two simpler valves in a conventional ICE vehicle. This multiplier effect translates directly into increased market value. Moreover, there is a pronounced trend toward multi-port valves (three-way and four-way configurations) which allow for greater directional control of coolant flow within intricate thermal circuits, enabling highly optimized operational strategies that are crucial for managing concurrent heating and cooling requirements of the battery pack, motor, and cabin air conditioning systems efficiently and dynamically.

AI Impact Analysis on Coolant Control Valves Market

User inquiries surrounding the integration of Artificial Intelligence (AI) often focus on its transformative capacity to enhance the operational lifespan and dynamic precision of coolant control valves. A key thematic concern for end-users and manufacturers alike is shifting from scheduled maintenance to true predictive maintenance (PdM). Users are keen to understand how AI can analyze the vibrational signatures, actuation times, and deviation from nominal temperature curves—data streams generated by smart valves—to proactively identify incipient failures, such as minor leaks, sticking actuators, or sensor drift, thereby minimizing costly vehicle downtime and maximizing operational reliability. This shift promises significant reductions in warranty costs for OEMs and increased reliability for consumers, particularly in commercial fleet operations where uptime is paramount.

Furthermore, AI is instrumental in achieving ultra-optimized thermal energy efficiency within complex vehicle systems, a critical factor for extending the range of BEVs. Traditional thermal management relied on predefined, static control maps, but AI, through continuous reinforcement learning, enables truly dynamic optimization. Algorithms analyze vast, heterogeneous datasets—including real-time external weather patterns, road topology, traffic flow, anticipated driving behavior (via navigation data), and component degradation status—to make instantaneous, micro-adjustments to valve positioning. This level of granular control ensures that the minimal energy necessary is diverted for thermal management, conserving battery power. This optimization applies not only during standard driving but also during high-stress activities like uphill climbs or fast-charging sessions, where precise temperature regulation is essential for safety and performance.

The implementation of edge AI processing capabilities directly within the vehicle’s thermal control unit is also shaping the demand for control valves compatible with rapid, sophisticated commands. By enabling localized machine learning decision-making, latency is significantly reduced, allowing the valve to respond almost instantaneously to changing thermal requirements. This is particularly vital for safety-critical components and high-performance applications. The future trajectory involves AI not just controlling individual valves but holistically managing the entire thermal ecosystem, including heat pumps, pumps, and fans, via centralized, AI-driven coordination systems. This requires control valves that are not only robust mechanically but also feature highly reliable digital interfaces and robust onboard diagnostics capabilities to feed the AI system accurate and timely operational status data, thus transforming them from simple mechanical components into intelligent network endpoints.

- AI enables predictive maintenance, forecasting valve degradation and failure probability based on operational data signatures and long-term usage patterns.

- Machine learning algorithms optimize coolant flow dynamically, improving vehicle energy efficiency and range extension in EVs by reducing parasitic losses from cooling circuits.

- AI supports sophisticated thermal mapping, coordinating multiple valves and thermal sources (e.g., waste heat recovery) to manage heterogeneous heating and cooling demands simultaneously with maximum efficiency.

- Integration of edge AI accelerates local processing of thermal data, reducing latency in valve response critical for high-performance driving and high-speed charging scenarios.

- AI-driven optimization allows for personalized thermal profiles based on ambient conditions, driver behavior, component stress levels, and navigation data, ensuring proactive temperature control.

- AI assists manufacturers in designing more efficient valve geometries and fluid dynamic pathways through simulation and iterative optimization processes.

DRO & Impact Forces Of Coolant Control Valves Market

The market trajectory for Coolant Control Valves is significantly influenced by a synergistic interplay of powerful drivers, structural restraints, and evolving opportunities, all shaped by overarching impact forces related to environmental mandates and technological progress. Primary drivers include the aggressive global push towards vehicle electrification and the subsequent need for highly complex and precise Battery Thermal Management Systems (BTMS), alongside stricter regulatory requirements worldwide concerning fleet average fuel economy and mandated reductions in NOx and CO2 emissions, particularly affecting ICE platforms. Furthermore, the rapid advancements in power electronics and engine turbocharging necessitate finer thermal control than traditional systems could offer, pushing OEMs toward high-precision electronic valves to ensure component longevity and optimal operational performance under stress.

Restraints primarily revolve around the high initial cost associated with manufacturing and integrating advanced electronic coolant control valves (ECCVs) compared to simpler traditional thermostats. This cost differential creates price pressure, especially in mass-market vehicle segments where cost sensitivity is paramount. Furthermore, the inherent system integration complexity, requiring seamless and secure communication between the valve, numerous sensors, and the vehicle's central electronic control unit (ECU), presents a substantial technical barrier. This integration demands specialized software development and rigorous validation protocols to ensure functional safety. Additionally, the need for materials compatible with new, highly specialized coolants, such as dielectric fluids used in immersion cooling, introduces material science restraints and potential supply chain vulnerabilities that must be carefully managed by Tier 1 suppliers.

Opportunities stem from the development of highly efficient, multi-port valves and the creation of comprehensive integrated thermal modules that simplify installation and validation for OEMs, addressing the complexity restraint directly. The increasing penetration of heat pump technology in cold-climate EVs also creates a substantial opportunity, as heat pumps require multiple highly sophisticated control valves to manage refrigerant and coolant flow simultaneously. Moreover, market expansion into specialized industrial applications beyond automotive, such such as liquid cooling for large-scale renewable energy storage systems (BESS) and high-density computing centers, presents a lucrative diversification path. The primary impact forces remain stringent regulatory pressure and rapid technological acceleration in electrification, which together force constant innovation in valve response time, robustness, and capability to handle increasingly complex fluid dynamic requirements.

Segmentation Analysis

The Coolant Control Valves Market segmentation reveals a dynamic landscape where growth is fundamentally decoupled from the historical reliance on mechanical actuation, driven instead by the rising demand for electronic control across diverse thermal zones. The segmentation by Actuation Type clearly illustrates this transformation, with Electronic Coolant Control Valves (ECCVs) being the critical high-growth segment, characterized by their superior precision, ability to integrate with complex control algorithms, and rapid response times—attributes mandatory for optimizing battery performance and managing the heterogeneous thermal demands within electrified platforms. Mechanical valves, while retaining a strong presence in the aftermarket and certain lower-cost ICE platforms, are decreasing in market influence due to their limited functionality and lack of dynamic adaptability required by modern energy efficiency standards.

Segmentation by Vehicle Type is the most indicative of future market potential, identifying Battery Electric Vehicles (BEVs) as the undisputed champion of demand growth. BEVs require sophisticated multi-circuit thermal management systems (BTMS) that utilize multiple highly functional ECCVs, dramatically increasing the component volume per vehicle compared to hybrid or purely ICE vehicles. This segment’s rapid expansion is driving the entire market's value proposition. Concurrently, the segmentation by Application highlights that while Passenger Vehicles remain the largest end-user, the Commercial Vehicle segment is increasingly important, driven by the electrification of city buses and heavy-duty trucks, which utilize high-capacity, heavy-duty control valves to manage extensive thermal loads generated by large battery packs and high-power charging systems.

Further granularity is provided by segmenting by Component/Design, emphasizing the industry preference for Multi-Port Valves (e.g., 3-way, 4-way valves) and Integrated Modules. Multi-port configurations facilitate complex fluid routing within compact spaces, essential for simultaneous heating and cooling operations (e.g., diverting waste heat from the inverter to warm the battery). The trend towards Integrated Modules, which bundle the valve, pump, and sensing elements, addresses OEM demand for simplified assembly, reduced weight, and enhanced reliability by minimizing potential leak points and simplifying the electronic interface, demonstrating the market's focus on system-level thermal solutions rather than isolated components.

- By Actuation Type:

- Mechanical Coolant Control Valves (Thermostatic): Predominantly used in older ICE vehicles and the aftermarket; declining volume share in new vehicles.

- Electronic Coolant Control Valves (ECCVs): Fastest growing segment; essential for precise, dynamic thermal regulation in HEVs and BEVs; high integration capability.

- By Vehicle Type:

- Internal Combustion Engine (ICE) Vehicles: Steady demand, mainly for engine temperature regulation and cabin heating; typically uses mechanical or simple electronic valves.

- Hybrid Electric Vehicles (HEVs): Medium complexity thermal demands; uses electronic valves for managing interplay between engine and electric components.

- Battery Electric Vehicles (BEVs): Highest growth segment; requires multiple complex ECCVs for Battery Thermal Management Systems (BTMS) and cabin climate control.

- By Application:

- Passenger Vehicles: Largest market share; highly sensitive to noise, vibration, and harshness (NVH) requirements.

- Commercial Vehicles (Light and Heavy-Duty): Focus on robustness, durability, and high flow rates for large thermal loops; rapid growth driven by fleet electrification.

- Industrial Machinery and Equipment: Specialized demand for heavy-duty, reliable valves in construction, agricultural, and stationary power applications.

- By Sales Channel:

- Original Equipment Manufacturer (OEM): Dominant channel; requires high technical compliance, quality control, and long-term supply agreements.

- Aftermarket: Stable channel for replacement and repair parts; increasing complexity poses challenges for independent workshops.

- By Component/Design:

- Multi-Port Valves: Increasing popularity for complex fluid routing; critical for managing heat pump systems and simultaneous battery/cabin thermal needs.

- Single-Port Valves: Standard for basic on/off coolant control or simple diversion.

- Integrated Modules (Valve + Pump + Sensor): High-value segment addressing OEM needs for simplified, lightweight, and pre-validated thermal assemblies.

Value Chain Analysis For Coolant Control Valves Market

The value chain begins rigorously at the upstream raw materials procurement stage, requiring specialized high-performance engineering plastics (like PPS or PEEK for lightweight housing), durable elastomers (for sealing integrity against specialized coolants), and corrosion-resistant metals (such as specialized aluminum alloys or stainless steel for internal components). Sourcing high-quality electrical components—specifically stepper motors, solenoids, and high-precision temperature/pressure sensors—is critical for electronic valve production. Manufacturers must manage complex global supply chains, often facing volatility in commodity pricing and requiring strict supplier adherence to automotive grade certifications (e.g., IATF 16949) due to the safety-critical nature of thermal components. Upstream efficiency, particularly in materials substitution to achieve lower weight without compromising structural integrity or chemical resistance, directly impacts the final product competitiveness and the longevity guarantee provided to OEMs, necessitating careful material selection and procurement strategies.

The mid-stream manufacturing process is highly capital-intensive, involving precision injection molding, advanced assembly automation, and sophisticated end-of-line testing. Leading manufacturers invest heavily in proprietary manufacturing techniques to ensure precise tolerances for the actuation mechanisms and zero-defect sealing capabilities, as leaks or flow inconsistencies can lead to catastrophic engine failure or battery thermal runaway. Crucial mid-stream activities include the integration of electronics and software flashing, ensuring the control valve communicates correctly with vehicle ECUs using standard protocols like CAN bus. The trend towards modularity requires manufacturers to develop flexible assembly lines capable of producing highly customized integrated modules on demand, adapting quickly to evolving OEM thermal architecture designs which vary significantly between different vehicle models and powertrain types, while maintaining extremely high quality control standards crucial for automotive supply chains.

The downstream analysis focuses on distribution channels and end-user delivery. The market is primarily dominated by the Original Equipment Manufacturer (OEM) channel, constituting the vast majority of volume and revenue. Sales to OEMs involve direct, long-term contractual relationships, often necessitating global production footprints to support synchronized assembly across different continents (Just-In-Time delivery). The aftermarket channel, although smaller, provides crucial revenue stability through the sale of replacement parts, which is steadily becoming more complex due to the advanced nature of ECCVs requiring specialized diagnostics and installation procedures. Indirect distribution plays a role in the aftermarket, utilizing global automotive parts distributors and franchised service networks. Strategic efforts are focused on providing robust technical documentation and training to the aftermarket to ensure proper maintenance and replacement of sophisticated electronic thermal management components, sustaining long-term brand reputation and product viability.

Coolant Control Valves Market Potential Customers

The primary potential customers and end-users of Coolant Control Valves are globally dispersed Original Equipment Manufacturers (OEMs) within the automotive sector, encompassing producers of light-duty passenger vehicles, heavy-duty trucks, and buses. Within this segment, the highest growth potential resides with OEMs actively engaged in large-scale platform electrification, specifically those designing and launching new generations of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs). These customers require sophisticated electronic valves that offer precise fluid routing to manage the complex, multi-zone heating and cooling demands of high-voltage battery packs, electric motors, and power electronics, prioritizing suppliers who can integrate these components into modular, lightweight thermal solutions that contribute positively to overall vehicle efficiency and range performance.

Secondary high-potential customers include manufacturers of specialized off-highway and heavy industrial equipment, such as construction machinery, agricultural tractors, and mining vehicles. These applications require extremely robust, high-durability coolant control valves capable of operating reliably under continuous, high-vibration, and high-temperature conditions. Their demand is focused on longevity and resistance to contaminants rather than purely on lightweight design. Furthermore, a rapidly expanding customer base is emerging in the non-automotive high-tech sector: providers of Battery Energy Storage Systems (BESS) for grid stabilization, which require highly reliable thermal management to prevent thermal runaway in large battery installations, and manufacturers of liquid cooling solutions for hyperscale data centers, where precision fluid temperature regulation is vital for server performance and energy conservation. These industrial applications often mandate higher flow rates and enhanced durability specifications.

Finally, the independent aftermarket (IAM) serves as a stable customer base, comprising thousands of garages, repair shops, and parts wholesalers globally. While the components sold here are often simpler mechanical valves or replacement electronic units for aging vehicle fleets, this segment requires efficient distribution logistics and cost-competitive products. As the population of advanced EVs on the road grows, the aftermarket will increasingly demand complex, high-value ECCV units, necessitating better technical support and training for repair technicians to handle these advanced systems accurately and safely, representing a long-term shift in the required capabilities of aftermarket suppliers and distributors worldwide.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robert Bosch GmbH, Denso Corporation, Mahle GmbH, Continental AG, Gentherm Incorporated, BorgWarner Inc., Hanon Systems, Eberspaecher Group, Schaeffler AG, Valeo S.A., Nidec Corporation, Thermo King (Trane Technologies), Sonceboz SA, Igarashi Electric Works, Mikuni Corporation, Röchling Automotive, Tenneco Inc. (DRiV), Modine Manufacturing Company, VOSS Automotive GmbH, Sanoh Industrial Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coolant Control Valves Market Key Technology Landscape

The core technological evolution in the Coolant Control Valves Market is the pervasive adoption of sophisticated electronic actuation systems, moving away from passive thermal elements towards dynamic control nodes. Modern Electronic Coolant Control Valves (ECCVs) integrate high-precision stepper or brushless DC motors, which allow for continuous, infinitely variable modulation of coolant flow, far surpassing the simple on/off or two-position switching capabilities of older solenoid or wax-element valves. This precise modulation is foundational for achieving the fine thermal balance required in multi-zone systems, such as those that simultaneously require battery cooling and cabin heating. Innovation is focused on enhancing the durability and reducing the power consumption of these actuators, ensuring reliable operation over the vehicle's lifespan while minimizing parasitic load on the battery, which is crucial for maximizing EV driving range and meeting stringent energy consumption standards.

A second critical technology thrust involves the trend toward modularization and integration, epitomized by the development of Integrated Thermal Management Modules. These modules incorporate multiple coolant control valves, electronic pumps, expansion reservoirs, and various sensors into a single, pre-tested assembly. This integration reduces the number of interfaces, dramatically lowering the risk of leaks and simplifying the OEM assembly process, offering significant cost and weight advantages. Furthermore, the communication technology used is paramount; advanced valves are not merely passive recipients of commands but are intelligent nodes equipped with robust electronic interfaces, often utilizing Controller Area Network (CAN) bus or specialized automotive Ethernet protocols, allowing for complex, high-speed data exchange with the central Thermal Management Control Unit (TMCU) and enabling sophisticated diagnostics and firmware updates remotely, aligning with the rise of Software-Defined Vehicles (SDVs).

Finally, material science and fluid compatibility form a crucial part of the technical landscape, especially given the introduction of new battery chemistries and the adoption of specialized dielectric coolants for immersion cooling systems. Control valves must now be constructed from high-performance polymers and specialized elastomers that exhibit superior chemical resistance to these fluids, ensuring long-term structural integrity and sealing performance under high pressure and rapid thermal cycling. Research is also accelerating in developing more compact valve designs and flow optimization techniques, utilizing computational fluid dynamics (CFD) to design internal geometries that minimize pressure drop and turbulence, thereby improving overall fluidic efficiency and contributing further to the energy efficiency targets demanded by the market, solidifying the valve's role as a high-tech component rather than a simple mechanical fitting.

Regional Highlights

The regional market for Coolant Control Valves is characterized by its high concentration of demand in Asia Pacific (APAC), which is overwhelmingly driven by the colossal manufacturing scale and rapid consumer adoption of new energy vehicles (NEVs), particularly in China. The Chinese market operates under aggressive state-level mandates favoring electrification, resulting in massive production volumes of BEVs and HEVs, thereby generating unparalleled demand for electronic coolant control valves, multi-port routing modules, and related thermal components. APAC suppliers are focused on scalability and cost-optimization, providing high-volume, reliable components essential for mass-market vehicle production, while regional governments continue to support localized research into next-generation battery thermal management solutions and the optimization of supply chains to reduce reliance on external component sources.

Europe holds a distinct position as a premium technology hub, where demand is characterized by high complexity and innovation due to stringent environmental regulations and a strong consumer preference for sophisticated vehicle features, including advanced cabin climate control utilizing heat pump technology. Heat pump integration necessitates highly specialized coolant control valves capable of precise and frequent flow switching to manage the thermodynamic cycle efficiently. This region drives demand for miniaturized, low-noise, and ultra-reliable ECCVs that seamlessly interface with highly sophisticated vehicle architectures. Furthermore, European vehicle fleets often utilize more advanced materials for durability in diverse weather conditions, requiring suppliers to meet elevated standards for material purity and resistance to corrosion, positioning quality and integration expertise as key competitive factors.

North America is experiencing accelerated growth, particularly in the BEV segment, fueled by significant domestic manufacturing incentives and corporate commitments from major domestic OEMs to transition their portfolios towards electrification. The demand is strong for robust, high-capacity valves capable of managing the thermal needs of large electric trucks and SUVs. The increasing prevalence of high-speed charging infrastructure (DC fast charging) also dictates the need for highly responsive and resilient control valves to manage the significant and sudden heat loads generated during these high-power transfer events, positioning reliability and thermal capacity as key performance indicators for suppliers in this region. Latin America and the Middle East & Africa (MEA) currently maintain a slower growth trajectory, largely dependent on the aftermarket segment and traditional ICE applications, although localized government mandates and emerging public transit electrification projects are beginning to stimulate foundational demand for entry-level electronic thermal components in key economic centers.

- Asia Pacific (APAC): Dominates market volume; driven by China's EV leadership, massive production scale, and localized component manufacturing; focus on cost-competitive, high-volume ECCVs.

- Europe: High-value market focused on technical innovation; accelerated adoption due to stringent Euro 7 emission norms; strong penetration of high-efficiency heat pump thermal systems demanding complex, multi-functional valves.

- North America: Rapid growth fueled by massive investment in domestic EV production capacity (particularly trucks and large SUVs); high demand for high-reliability, high-flow integrated thermal modules necessary for high-speed charging thermal management.

- Latin America (LATAM): Growth centered around replacement demand (aftermarket) and gradual uptake of hybrid vehicles; increasing governmental focus on public transit electrification offering future opportunities for commercial vehicle valves.

- Middle East & Africa (MEA): Smallest market share; growth linked to expansion of cooling systems in harsh desert climates, requiring specialized robust materials, and emerging governmental interest in fleet electrification and renewable energy projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coolant Control Valves Market.- Robert Bosch GmbH

- Denso Corporation

- Mahle GmbH

- Continental AG

- Gentherm Incorporated

- BorgWarner Inc.

- Hanon Systems

- Eberspaecher Group

- Schaeffler AG

- Valeo S.A.

- Nidec Corporation

- Thermo King (Trane Technologies)

- Sonceboz SA

- Igarashi Electric Works

- Mikuni Corporation

- Röchling Automotive

- Tenneco Inc. (DRiV)

- Modine Manufacturing Company

- VOSS Automotive GmbH

- Sanoh Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Coolant Control Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from mechanical to electronic coolant control valves?

The primary driver is the necessity for precise, dynamic thermal regulation in hybrid and electric vehicles (EVs). Electronic valves enable complex fluid routing required for Battery Thermal Management Systems (BTMS) and optimizing energy usage, which mechanical thermostats cannot efficiently provide.

How does the coolant control valve market benefit from the growth of electric vehicles (EVs)?

EVs mandate the use of multiple high-value electronic coolant control valves (ECCVs) per vehicle to manage several thermal circuits (battery, motor, inverter, cabin). This multiplier effect drives significantly higher component volume and market revenue compared to conventional powertrains.

What are the primary restraints hindering the rapid adoption of advanced control valves?

Key restraints include the high initial manufacturing cost of complex Electronic Coolant Control Valves (ECCVs), coupled with the significant technical challenge and cost associated with integrating these smart components seamlessly into the vehicle's electronic control architecture and software systems.

Which geographical region holds the largest market share for coolant control valves?

Asia Pacific, specifically due to the massive scale of electric vehicle production and supportive regulatory framework in China, currently holds the largest market share and leads the world in volume consumption of both mechanical and electronic thermal components.

How is AI impacting the functionality and maintenance of coolant control valves?

AI enables predictive maintenance by analyzing operational data from smart valves to forecast potential failures, and also facilitates dynamic optimization of valve positioning in real-time, improving overall system energy efficiency and extending vehicle range.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager