Cooling Water Treatment Chemicals Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439235 | Date : Jan, 2026 | Pages : 248 | Region : Global | Publisher : MRU

Cooling Water Treatment Chemicals Market Size

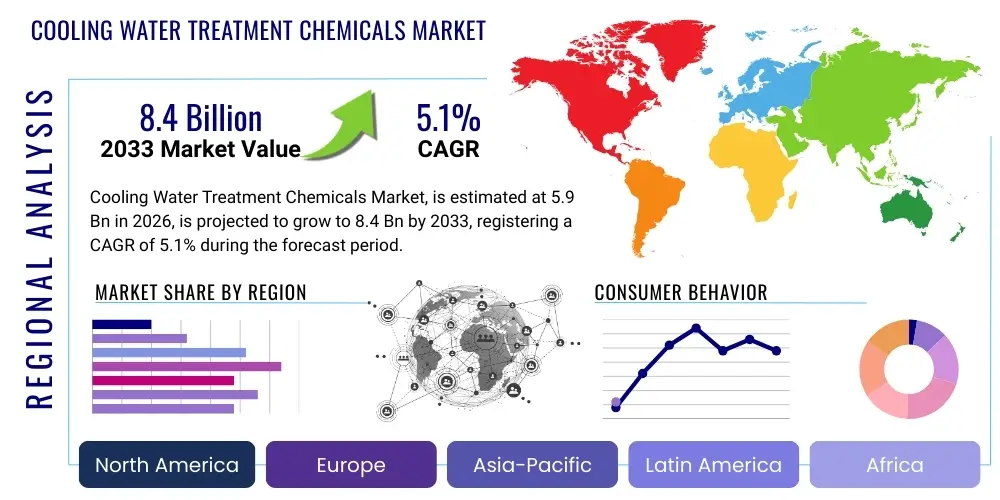

The Cooling Water Treatment Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.1% between 2026 and 2033. The market is estimated at USD 5.9 Billion in 2026 and is projected to reach USD 8.4 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by escalating industrial activities, increasing global demand for energy, and the critical need to optimize water usage amidst growing scarcity concerns. The intricate balance between industrial efficiency and environmental stewardship continues to shape the trajectory of this essential market, fostering innovation in chemical formulations and application methodologies to meet diverse operational demands and stringent regulatory requirements across various sectors.

Cooling Water Treatment Chemicals Market introduction

The Cooling Water Treatment Chemicals Market encompasses a vital array of specialized chemical solutions designed to optimize the performance, extend the lifespan, and maintain the efficiency of industrial and commercial cooling systems. These systems are indispensable across a multitude of sectors, facilitating heat exchange processes critical for power generation, manufacturing, chemical processing, oil and gas refining, and even large-scale HVAC operations. The core objective of these chemicals is to prevent and mitigate common issues that plague cooling water systems, including corrosion, scaling, microbial growth (biofouling), and fouling by suspended solids. By effectively addressing these challenges, cooling water treatment chemicals ensure uninterrupted operations, reduce maintenance costs, and enhance the overall energy efficiency of cooling infrastructure.

The product portfolio within this market is diverse, primarily categorized into corrosion inhibitors, scale inhibitors, biocides and dispersants, and other specialty chemicals like defoamers and pH adjusters. Corrosion inhibitors protect metallic surfaces from degradation, while scale inhibitors prevent the precipitation and accumulation of mineral deposits that impede heat transfer. Biocides control the growth of bacteria, algae, and fungi that can lead to biofouling and system inefficiencies, and dispersants help maintain suspended solids, preventing their accumulation. Major applications span industrial cooling towers, closed-loop systems, and once-through cooling configurations in sectors such as power generation (thermal and nuclear), petrochemicals, food and beverage processing, pharmaceuticals, pulp and paper, and various manufacturing industries.

The benefits derived from effective cooling water treatment are multifaceted, including significant improvements in operational reliability, reduced downtime, extended equipment life, and substantial energy savings due to optimized heat transfer. Furthermore, these chemicals play a crucial role in environmental compliance by enabling more efficient water use, reducing the discharge of untreated water, and often facilitating adherence to stringent effluent quality standards. The market's growth is predominantly driven by factors such as rapid industrialization, particularly in emerging economies, increasing awareness of water conservation, the escalating demand for energy and industrial output, and the continuous tightening of environmental regulations concerning industrial water discharge and chemical usage. The imperative to maintain optimal system performance and minimize operational expenditures in critical infrastructure further bolsters the demand for advanced cooling water treatment solutions globally.

Cooling Water Treatment Chemicals Market Executive Summary

The Cooling Water Treatment Chemicals Market is experiencing dynamic shifts, characterized by evolving business trends, distinct regional growth patterns, and specific segmental developments. Environmentally sustainable solutions are emerging as a dominant business trend, with a strong industry push towards green chemistry, bio-based products, and technologies that minimize ecological impact while maintaining high performance. Digitalization and automation are also transforming operational aspects, allowing for more precise chemical dosing, real-time monitoring, and predictive maintenance strategies. Companies are increasingly offering integrated water management solutions rather than just standalone chemical products, focusing on a holistic approach to address client needs for efficiency and compliance.

Regionally, Asia Pacific continues to assert its dominance, propelled by rapid industrial expansion, significant investments in power generation, and burgeoning manufacturing sectors in countries like China, India, and Southeast Asia. North America and Europe, while mature markets, are characterized by stringent environmental regulations, driving demand for advanced and eco-friendly treatment solutions, alongside a focus on upgrading aging industrial infrastructure. Latin America and the Middle East & Africa regions present substantial growth opportunities, spurred by developing industrial bases, increasing urbanization, and the critical need for efficient water management in water-scarce areas, particularly within the oil and gas and mining industries.

Segment-wise, corrosion inhibitors remain a cornerstone of the market, essential for protecting critical metal components in cooling systems. However, biocides and dispersants are witnessing accelerated demand due to heightened concerns over microbial contamination, biofouling, and the need to maintain pristine heat exchange surfaces. The trend towards customized chemical formulations, tailored to specific water chemistries and operational parameters of individual facilities, is also gaining traction, enhancing efficacy and cost-effectiveness. The power generation and chemical & petrochemical industries represent the largest end-use segments, driven by the sheer scale of their cooling operations and the critical nature of uninterrupted processes, underscoring the indispensable role of effective cooling water treatment in global industrial infrastructure.

AI Impact Analysis on Cooling Water Treatment Chemicals Market

User inquiries concerning AI's influence on the Cooling Water Treatment Chemicals Market frequently center on its potential to revolutionize operational efficiency, chemical management, and predictive maintenance. Common questions explore how AI can optimize chemical dosage, predict system failures, enhance water quality monitoring, and ultimately reduce operational costs while improving environmental compliance. Users are keen to understand the practical applications of AI-driven analytics for real-time data interpretation, the integration of machine learning algorithms for pattern recognition in water chemistry, and the development of intelligent control systems that automate treatment processes. The overarching theme is an expectation that AI will usher in a new era of precision, sustainability, and economic advantage in industrial water treatment, moving from reactive problem-solving to proactive management. Concerns also include data security, implementation costs, and the need for skilled personnel to manage AI-powered systems.

- AI-powered predictive analytics enable real-time monitoring of cooling water parameters, anticipating potential issues like scaling or corrosion before they manifest, thereby facilitating proactive intervention and preventing costly downtime.

- Machine learning algorithms optimize chemical dosage based on dynamic operational conditions, water quality fluctuations, and historical data, leading to significant reductions in chemical consumption and improved treatment efficacy.

- Automated intelligent control systems integrate AI to manage and adjust chemical feeding, blowdown rates, and filtration processes autonomously, ensuring optimal system performance and resource utilization without constant human oversight.

- Enhanced sensor networks combined with AI interpret vast amounts of data, identifying subtle trends and correlations that are imperceptible to human analysis, thus providing deeper insights into system health and potential risks.

- AI supports the development of digital twins for cooling systems, simulating various operational scenarios and treatment strategies to identify the most efficient and cost-effective approaches before real-world implementation.

- Predictive maintenance schedules, informed by AI analysis of equipment performance and water quality data, minimize unexpected failures, extend the asset lifespan, and optimize maintenance resource allocation.

- AI contributes to sustainability efforts by optimizing water reuse and recycling processes, reducing overall water consumption, and ensuring discharge compliance through precise treatment and monitoring.

- Remote monitoring and diagnostic capabilities, powered by AI, allow operators to oversee multiple sites from a central location, facilitating rapid response to anomalies and reducing the need for on-site inspections.

- Supply chain optimization for chemical procurement benefits from AI, which can forecast demand more accurately, manage inventory levels, and identify cost-effective purchasing opportunities, reducing operational overheads.

- AI-driven anomaly detection systems provide early warnings for unusual operational patterns or deviations in water chemistry, enabling swift corrective actions that prevent major system damage or environmental excursions.

- Advanced data visualization tools, integrated with AI, transform complex operational data into easily understandable insights, empowering decision-makers with clear, actionable intelligence for strategic planning and optimization.

- Customized treatment strategies are developed with AI by analyzing specific facility requirements, water sources, and regulatory landscapes, leading to highly effective and tailored chemical programs.

DRO & Impact Forces Of Cooling Water Treatment Chemicals Market

The Cooling Water Treatment Chemicals Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces that shape its growth trajectory. Key drivers include the relentless pace of industrialization and urbanization globally, particularly in emerging economies, which necessitates an expansion of power generation, manufacturing, and processing capacities—all highly dependent on efficient cooling systems. Additionally, increasing concerns over water scarcity and the imperative for water conservation compel industries to adopt advanced treatment solutions that facilitate water reuse and minimize discharge. Stringent environmental regulations aimed at controlling industrial effluent quality and promoting sustainable chemical usage further stimulate demand for effective, compliant, and often greener cooling water treatment options. The continuous need for energy efficiency in industrial operations, where optimal heat transfer is crucial, also drives the adoption of advanced chemicals to prevent fouling and scaling, which otherwise would significantly increase energy consumption and operational costs. Moreover, the aging infrastructure in many developed economies necessitates robust chemical treatment programs to extend the life of existing cooling systems and prevent premature capital expenditures, thereby acting as a significant market driver.

However, the market also faces notable restraints. The high capital investment initially required for advanced treatment technologies and monitoring systems can be a barrier for smaller enterprises or those with limited budgets. Environmental concerns surrounding the toxicity and persistence of certain conventional treatment chemicals present a continuous challenge, pushing manufacturers towards developing safer, more biodegradable alternatives but also leading to potential regulatory hurdles for existing products. Volatility in the prices of key raw materials, such as phosphates, chlorine, and various polymers, can impact production costs and subsequently affect the market pricing of cooling water treatment chemicals, creating uncertainty for both producers and end-users. Additionally, the lack of awareness regarding the long-term benefits of comprehensive cooling water treatment, especially in less developed regions, can hinder market penetration. The complexity involved in selecting the appropriate chemical program for diverse water chemistries and system designs also poses a challenge, requiring specialized expertise that may not always be readily available.

Opportunities for growth are abundant, particularly in the development and adoption of green and sustainable chemistry solutions, including bio-based chemicals and non-toxic alternatives that align with stringent environmental mandates and corporate sustainability goals. The proliferation of smart water treatment technologies, integrating IoT, advanced sensors, and AI for real-time monitoring and predictive analytics, presents a significant avenue for innovation and market expansion. Emerging economies, with their rapid industrial growth and developing infrastructure, offer substantial untapped market potential as industries seek efficient and reliable cooling solutions. Furthermore, the retrofitting and upgrading of existing industrial facilities with more advanced and environmentally friendly treatment systems, driven by performance enhancement and regulatory compliance, provide continuous opportunities. The increasing emphasis on total cost of ownership and integrated water management solutions, rather than just chemical supply, also creates opportunities for service providers offering comprehensive, value-added packages that address the entire water lifecycle within industrial operations.

Segmentation Analysis

The Cooling Water Treatment Chemicals Market is meticulously segmented to provide a granular understanding of its diverse components and dynamics. This segmentation helps in identifying key market drivers, regional influences, and end-user preferences across various product types, applications, and industries. The primary segments include categorization by product type, which details the specific chemical formulations used; by end-use industry, illustrating the diverse sectors reliant on these treatments; by form, delineating liquid versus solid chemical applications; and by application type, distinguishing between different cooling system configurations. This comprehensive breakdown allows for a nuanced analysis of market trends, competitive landscapes, and future growth prospects within each specific niche of the cooling water treatment chemicals sector.

- By Product Type:

- Corrosion Inhibitors: Chemicals designed to reduce the rate of corrosion on metallic surfaces in cooling systems, often including chromates, nitrites, phosphates, molybdates, and organic compounds like azoles.

- Scale Inhibitors: Compounds used to prevent the formation and deposition of mineral scales (e.g., calcium carbonate, calcium phosphate, silica) on heat exchange surfaces, enhancing thermal efficiency; examples include phosphonates, polyacrylates, and polymers.

- Biocides & Dispersants:

- Biocides: Chemical agents employed to control and eliminate microbial growth (bacteria, algae, fungi) that causes biofouling, which can degrade heat transfer efficiency and contribute to equipment deterioration; includes oxidizing biocides (chlorine, bromine) and non-oxidizing biocides (isothiazolones, quaternary ammonium compounds).

- Dispersants: Chemicals that keep suspended solids, silt, and other particulate matter in cooling water dispersed, preventing their agglomeration and deposition on system surfaces, often polymeric in nature.

- Other Chemicals: This category includes a range of specialized chemicals such as defoamers (to control foaming), pH adjusters (acids or bases to maintain optimal pH levels), oxygen scavengers, and antifoulants.

- By End-Use Industry:

- Power Generation: Crucial for thermal power plants (coal, gas, nuclear) and renewable energy facilities, where efficient cooling of turbines, condensers, and other equipment is paramount.

- Oil & Gas: Essential in refineries, petrochemical plants, and offshore platforms for cooling processes during extraction, refining, and processing of hydrocarbons.

- Chemicals & Petrochemicals: Utilized extensively in chemical manufacturing for reaction cooling, distillation processes, and equipment temperature control.

- Food & Beverage: Applied in processing plants for cooling machinery, refrigeration systems, and ensuring product safety and quality.

- Manufacturing: Encompasses a broad range of industries including automotive, metals and mining, electronics, textiles, and pulp and paper, all requiring precise temperature control for various processes.

- HVAC (Heating, Ventilation, and Air Conditioning): Used in commercial buildings, data centers, and institutional facilities for maintaining optimal environmental conditions and equipment performance.

- Metals & Mining: Critical for cooling furnaces, rolling mills, and processing equipment, as well as in mineral processing and effluent treatment.

- Pharmaceuticals: Employed in drug manufacturing for process cooling, maintaining sterile environments, and equipment heat management.

- Textiles: Important for various stages of fabric processing, dyeing, and finishing where temperature control is essential.

- Pulp & Paper: Utilized for cooling machinery in paper mills, especially in the digester and dryer sections, and in effluent treatment.

- Other Industrial Applications: Includes diverse smaller industries requiring cooling water systems, such as plastics, rubber, and general fabrication.

- By Form:

- Liquid: The most common form, offering ease of handling, accurate dosing, and often ready-to-use formulations.

- Powder/Solid: Concentrated forms that can be more cost-effective for transportation and storage, often requiring dissolution before application.

- By Application:

- Open Recirculating Cooling Systems: Typically cooling towers, where water is exposed to the atmosphere, leading to evaporation and concentration of dissolved solids, requiring continuous treatment.

- Once-Through Cooling Systems: Water is drawn from a source, passed through heat exchangers once, and then discharged, requiring minimal but critical treatment to prevent fouling and environmental impact.

- Closed-Loop Cooling Systems: Water recirculates within a closed system, minimizing evaporation losses and external contamination, requiring less frequent but essential treatment to prevent corrosion and micro-fouling.

Value Chain Analysis For Cooling Water Treatment Chemicals Market

The value chain for the Cooling Water Treatment Chemicals Market is a complex network spanning raw material sourcing to end-user application, involving multiple stages and stakeholders crucial for product delivery and market dynamics. The upstream segment of the value chain is dominated by the suppliers of critical raw materials, which include a wide array of chemical intermediates such as phosphates, phosphonates, polymers (e.g., polyacrylates), amines, biocidal active ingredients (e.g., chlorine derivatives, isothiazolones), and other specialty organic and inorganic compounds. These raw material producers, often large chemical manufacturers, provide the foundational components that form the basis of all cooling water treatment formulations. The quality, availability, and pricing volatility of these raw materials significantly influence the production costs and competitiveness of finished cooling water treatment chemicals, making strong supplier relationships and diverse sourcing strategies vital for market participants.

Moving downstream, the value chain encompasses the manufacturing and formulation of these raw materials into specific cooling water treatment chemical products. This stage involves sophisticated chemical synthesis, blending, and packaging processes undertaken by specialized chemical companies. These manufacturers invest heavily in research and development to create advanced formulations that address specific challenges like harsh water conditions, stringent environmental regulations, and unique industrial requirements. Following manufacturing, these products reach the end-users through various distribution channels. Direct sales channels are often employed for large industrial clients, such as major power plants, refineries, or chemical complexes, where specialized technical expertise and customized solutions are required. This direct approach allows manufacturers to build strong relationships, provide tailored advice, and offer comprehensive service contracts, including ongoing monitoring and optimization.

Conversely, indirect distribution channels involve a network of distributors, wholesalers, and local chemical suppliers who cater to smaller industrial facilities, commercial buildings, and diversified manufacturing sectors. These intermediaries play a crucial role in market penetration, particularly in fragmented markets or regions where direct sales may not be economically viable. They often stock a broader range of products, provide localized support, and manage logistics for numerous clients. The selection of distribution channels is strategic, balancing the need for direct customer engagement and technical support with the efficiency and reach offered by indirect networks. Ultimately, the effectiveness of the entire value chain hinges on seamless coordination between raw material suppliers, chemical formulators, and distributors to ensure timely delivery of high-quality, effective, and environmentally compliant cooling water treatment solutions to a diverse global industrial base, ensuring the optimal performance and longevity of critical cooling infrastructure.

Cooling Water Treatment Chemicals Market Potential Customers

The potential customers for Cooling Water Treatment Chemicals span a vast and diverse spectrum of industries, primarily any entity that operates cooling systems as an integral part of its processes or infrastructure. At the forefront are large industrial facilities such as power generation plants, including thermal, nuclear, and concentrated solar power facilities, where efficient cooling of turbines and condensers is absolutely critical for continuous electricity production. Oil and gas refineries and petrochemical complexes represent another significant customer segment, relying heavily on cooling systems for various processes including distillation, cracking, and gas compression, where uninterrupted operation is paramount to avoid massive financial losses and safety hazards. Chemical manufacturing plants, from basic chemicals to specialty and fine chemicals, also constitute a core customer base, utilizing cooling water for reaction temperature control, heat removal from equipment, and overall process stability.

Beyond these heavy industries, the Food and Beverage sector presents a substantial customer base, with cooling water treatment chemicals essential for chilling, refrigeration, and maintaining hygiene in processing plants, breweries, dairies, and bottling facilities. The Manufacturing industry, broadly encompassing automotive, metals and mining, electronics, pulp and paper, and textiles, requires effective cooling for machinery, process lines, and facility climate control to ensure product quality, operational efficiency, and equipment longevity. Commercial and institutional facilities, particularly those with extensive Heating, Ventilation, and Air Conditioning (HVAC) systems like hospitals, universities, data centers, and large office complexes, are also significant end-users, as effective cooling water treatment prolongs the life of HVAC equipment, reduces energy consumption, and maintains comfortable indoor environments. The municipal sector also occasionally features as a customer, particularly for cooling equipment within water treatment plants themselves or other public utilities.

In essence, any industrial or commercial operation that utilizes water-based cooling systems, whether open recirculating towers, closed-loop systems, or once-through configurations, is a potential customer for cooling water treatment chemicals. These customers prioritize solutions that enhance operational reliability, reduce maintenance costs, improve energy efficiency, extend asset life, and ensure compliance with ever-tightening environmental regulations regarding water discharge and chemical usage. The decision-makers within these organizations, including plant managers, environmental health and safety officers, maintenance engineers, and procurement specialists, seek partners who can provide not only effective chemical products but also comprehensive technical support, monitoring services, and sustainable water management strategies to optimize their cooling processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.9 Billion |

| Market Forecast in 2033 | USD 8.4 Billion |

| Growth Rate | 5.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ecolab Inc., SUEZ Water Technologies & Solutions, Veolia Water Technologies, BWA Water Additives UK Limited, Solenis LLC, Kemira Oyj, Kurita Water Industries Ltd., Thermax Limited, SNF Floerger, Buckman Laboratories International, Inc., Chemtreat, Inc. (Danaher Corporation), GE Water & Process Technologies (now SUEZ), Chembond Chemicals Limited, Akzo Nobel N.V. (Nouryon), Arkema S.A., BASF SE, Lonza Group Ltd., Albemarle Corporation, Clariant AG, Dow Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cooling Water Treatment Chemicals Market Key Technology Landscape

The technological landscape of the Cooling Water Treatment Chemicals Market is rapidly evolving, driven by the imperative for greater efficiency, sustainability, and real-time operational control. A significant shift is observed towards advanced monitoring and control systems that integrate IoT (Internet of Things) devices and sophisticated sensor technologies. These systems enable continuous, real-time measurement of critical water parameters such as pH, conductivity, dissolved oxygen, corrosion rates, and biocide levels, moving away from periodic manual testing. This granular data is then fed into centralized control platforms, often cloud-based, allowing for immediate adjustments to chemical dosing and system operations, thereby ensuring optimal performance and preventing potential issues before they escalate. The advent of remote monitoring capabilities, often accessible via mobile applications, further enhances responsiveness and operational flexibility for facility managers.

Another prominent technological advancement is the widespread adoption of automation and digitalization, particularly through the application of artificial intelligence (AI) and machine learning (ML) algorithms. These advanced analytical tools process vast datasets from sensors and operational histories to identify patterns, predict future trends, and optimize chemical usage with unparalleled precision. AI-driven systems can, for instance, forecast scaling or corrosion potential based on water chemistry changes, weather patterns, and operational loads, then recommend or automatically implement corrective measures. This not only minimizes chemical waste but also significantly reduces labor costs associated with manual monitoring and adjustments. The integration of digital twin technology, where virtual models of cooling systems simulate real-world conditions, also aids in predictive maintenance planning and process optimization, allowing for scenario testing without impacting live operations.

Beyond digital technologies, innovation in green chemistry and sustainable formulations is reshaping the chemical product landscape itself. Research and development efforts are focused on creating more environmentally benign and biodegradable chemicals that are less harmful to aquatic ecosystems upon discharge and pose fewer risks to human health. This includes the development of bio-based corrosion and scale inhibitors, non-oxidizing biocides with shorter environmental persistence, and advanced polymeric dispersants that enhance efficiency at lower concentrations. Furthermore, technologies like membrane filtration (e.g., reverse osmosis, ultrafiltration) are increasingly being integrated upstream of cooling systems, necessitating treatment chemicals that are compatible with these membrane processes, preventing fouling and extending membrane life. The synergy between advanced chemical formulations and intelligent digital platforms represents the future of cooling water treatment, delivering enhanced performance, sustainability, and economic benefits to diverse industrial and commercial end-users globally.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by rapid industrialization, particularly in China, India, and Southeast Asian countries. Substantial investments in power generation, manufacturing, and petrochemical industries, coupled with growing water scarcity challenges, fuel demand for efficient cooling water treatment solutions. Stringent environmental regulations are also emerging, pushing for more advanced and sustainable chemical formulations.

- North America: A mature market characterized by a strong focus on advanced technologies, environmental compliance, and the modernization of existing industrial infrastructure. The region benefits from robust R&D activities, leading to innovative and high-performance chemical solutions. The oil & gas, power generation, and chemical sectors are key contributors, with emphasis on operational efficiency and sustainable water management.

- Europe: Exhibits a strong market driven by stringent environmental regulations, a high degree of industrial automation, and an emphasis on green chemistry and sustainable practices. Countries like Germany, France, and the UK lead in adopting advanced and eco-friendly treatment solutions. The region's aging industrial infrastructure also creates demand for chemicals that extend equipment lifespan and optimize performance.

- Latin America: Expected to show significant growth, spurred by expanding industrial bases in countries like Brazil, Mexico, and Argentina. Growth in mining, food & beverage, and power generation sectors, coupled with increasing awareness of water management and environmental impact, drives the demand for cooling water treatment chemicals. Investment in new industrial projects further bolsters market expansion.

- Middle East & Africa (MEA): Emerging as a high-growth region, particularly due to large-scale investments in the oil & gas, petrochemicals, power generation, and desalination industries. Water scarcity issues are paramount in this region, leading to an increased focus on water reuse and efficient cooling water management. Infrastructure development projects across the region also contribute to market demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cooling Water Treatment Chemicals Market.- Ecolab Inc.

- SUEZ Water Technologies & Solutions (a subsidiary of Veolia)

- Veolia Water Technologies

- BWA Water Additives UK Limited

- Solenis LLC

- Kemira Oyj

- Kurita Water Industries Ltd.

- Thermax Limited

- SNF Floerger

- Buckman Laboratories International, Inc.

- Chemtreat, Inc. (a Danaher Corporation Company)

- GE Water & Process Technologies (now part of SUEZ)

- Chembond Chemicals Limited

- Akzo Nobel N.V. (with its specialty chemicals business Nouryon)

- Arkema S.A.

- BASF SE

- Lonza Group Ltd.

- Albemarle Corporation

- Clariant AG

- Dow Inc.

Frequently Asked Questions

Analyze common user questions about the Cooling Water Treatment Chemicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are cooling water treatment chemicals and why are they essential?

Cooling water treatment chemicals are specialized formulations designed to manage and prevent problems like corrosion, scaling, biofouling, and suspended solids accumulation within industrial and commercial cooling systems. They are essential because without proper treatment, cooling systems can suffer from reduced heat transfer efficiency, increased energy consumption, premature equipment failure, and costly downtime, significantly impacting operational reliability and profitability. These chemicals ensure optimal system performance, extend asset lifespan, and aid in compliance with environmental regulations by maintaining water quality and minimizing discharge issues.

How large is the global Cooling Water Treatment Chemicals Market expected to grow?

The global Cooling Water Treatment Chemicals Market is projected for substantial growth, estimated to reach approximately USD 8.4 Billion by the end of 2033. This expansion is driven by a Compound Annual Growth Rate (CAGR) of 5.1% from 2026. Key factors contributing to this robust growth include increasing industrialization, particularly in emerging economies, rising concerns over water scarcity leading to greater demand for water reuse, and increasingly stringent environmental regulations mandating efficient and responsible water management practices across diverse industrial sectors globally.

Which factors are primarily driving the growth of this market?

The primary drivers for the Cooling Water Treatment Chemicals Market include rapid global industrialization and urbanization, which necessitate increased industrial output and power generation capacity, both reliant on efficient cooling systems. Escalating water scarcity concerns compel industries to adopt advanced water treatment for conservation and reuse. Furthermore, stringent environmental regulations regarding industrial wastewater discharge and chemical usage propel the demand for effective and eco-friendly treatment solutions. The continuous need for enhancing energy efficiency in industrial operations and protecting aging infrastructure also significantly boosts market demand by preventing system degradation and optimizing performance.

What role does AI play in modern cooling water treatment?

AI is revolutionizing modern cooling water treatment by enabling advanced predictive analytics, real-time monitoring, and optimized chemical dosing. AI-powered systems can analyze vast amounts of data from sensors to predict issues like corrosion or scaling before they occur, allowing for proactive interventions. Machine learning algorithms precisely adjust chemical dosages based on dynamic operational conditions, reducing chemical consumption and improving efficacy. This integration of AI leads to significant improvements in operational efficiency, reduced maintenance costs, enhanced system reliability, and better environmental compliance through smarter, more sustainable water management practices.

What are the key challenges faced by the Cooling Water Treatment Chemicals Market?

The Cooling Water Treatment Chemicals Market faces several key challenges, including the high initial capital investment required for advanced treatment technologies and monitoring systems, which can deter some potential adopters. Environmental concerns surrounding the toxicity and persistence of certain conventional chemicals are pushing for more sustainable alternatives, posing regulatory challenges for existing products. Additionally, volatility in raw material prices affects production costs and market pricing. The complexity of selecting and implementing optimal chemical programs for diverse water chemistries and system designs also presents a hurdle, requiring specialized expertise and continuous innovation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager