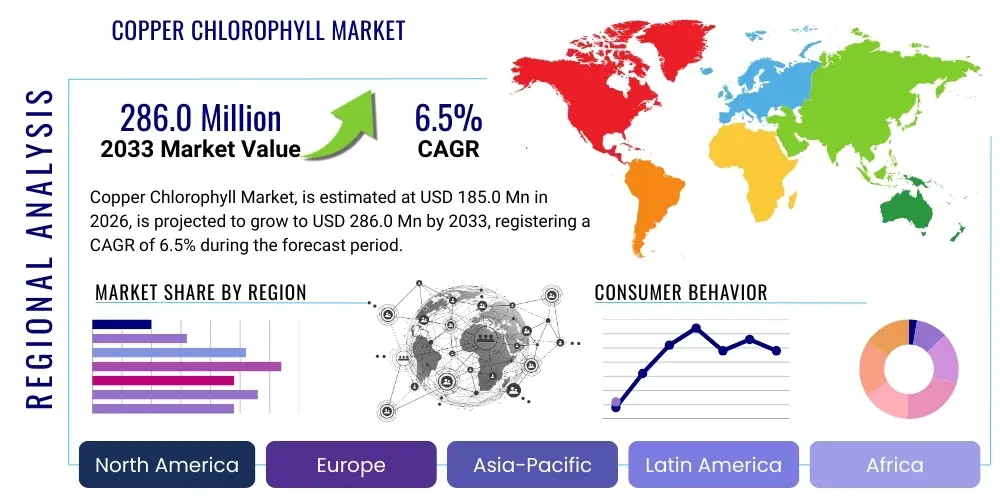

Copper Chlorophyll Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434616 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Copper Chlorophyll Market Size

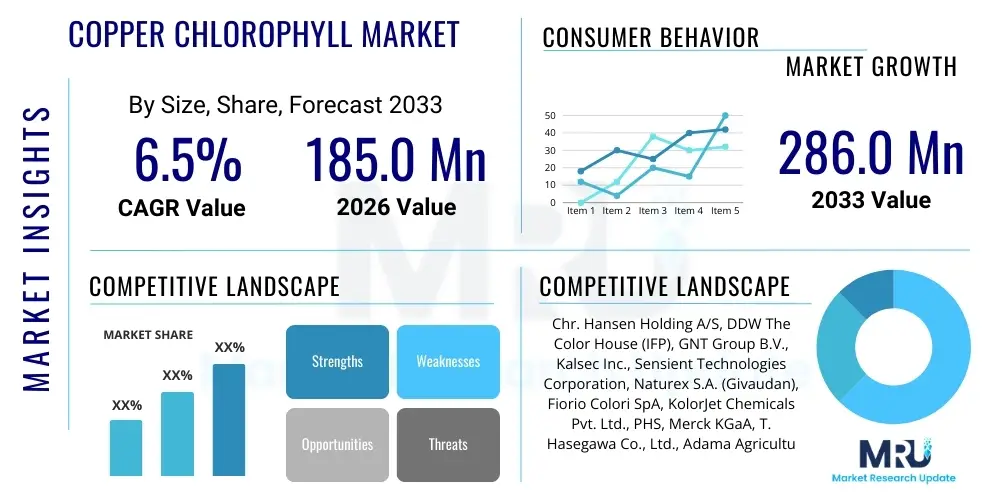

The Copper Chlorophyll Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $185.0 Million in 2026 and is projected to reach $286.0 Million by the end of the forecast period in 2033.

Copper Chlorophyll Market introduction

The Copper Chlorophyll Market encompasses the production, distribution, and consumption of E141, a synthetic green colorant derived from natural chlorophyll extracted from plants, primarily alfalfa, spinach, and nettles. This compound is stabilized by replacing the central magnesium atom with copper, enhancing its light and heat stability compared to native chlorophyll. Known scientifically as Chlorophyllin Copper Complex, its deep green hue makes it highly desirable across various industries, offering a natural-looking alternative to synthetic dyes while meeting rigorous quality and stability requirements for mass-market products. The product's inherent properties, including its vibrant color and recognized safety profile, establish it as a foundational ingredient in modern formulation sciences.

Major applications of copper chlorophyll span the food and beverage industry, where it is used in confectionery, dairy products, beverages, and sauces to impart a stable green color. Furthermore, its inclusion in the cosmetic sector is driven by its function as a coloring agent in soaps, creams, and makeup, often marketed for its natural derivation appeal. The nutraceutical and pharmaceutical sectors also utilize copper chlorophyll extensively, primarily in capsules, tablets, and liquid supplements due to its potential antioxidant properties and its function as a natural-source visual marker. This widespread utility across high-growth consumer segments is fueling consistent market expansion.

The primary driving factors sustaining market growth include the global clean label movement, where consumers increasingly demand ingredients derived from natural sources, even if chemically stabilized. Strict regulatory approval by bodies like the FDA (as a color additive exempt from certification) and EFSA further solidifies its market position. Additionally, increasing awareness regarding the health benefits potentially associated with chlorophyll derivatives, such as detoxification and deodorant effects, particularly in functional food and dietary supplements, contributes significantly to sustained demand and market valuation throughout the forecast period.

Copper Chlorophyll Market Executive Summary

The Copper Chlorophyll Market exhibits robust growth driven by irreversible shifts towards natural and clean-label ingredients across North America and Europe, supported by advanced extraction technologies and stabilization processes ensuring product integrity. Business trends indicate a focus on vertical integration among key players, securing raw material supply chains (primarily alfalfa and stinging nettle) and optimizing extraction efficiency to manage fluctuating raw material costs. Strategic mergers, acquisitions, and partnerships aimed at expanding geographical reach and diversifying application portfolios, particularly into complex functional foods and high-end cosmetics, are prominent features defining the competitive landscape.

Regionally, Asia Pacific (APAC) is projected to emerge as the fastest-growing market, primarily due to expanding consumer bases adopting Western dietary and cosmetic habits, coupled with regulatory liberalization facilitating the use of approved colorants in emerging economies like India and China. North America and Europe currently dominate market revenue share, maintaining strong positions due to stringent quality standards, high consumer expenditure on nutraceuticals, and the established presence of leading food and flavor manufacturers who are significant end-users of copper chlorophyll. Latin America and MEA are focused on gradual market development, driven by localized food processing enhancements.

Segment trends reveal that the Food & Beverages application segment retains the largest market share, with sustained growth anticipated specifically within the functional beverages and bakery sectors, demanding high stability colorants. By form, the powder segment is experiencing increasing adoption due to logistical benefits, including ease of storage, reduced transportation weight, and extended shelf life, making it preferable for industrial formulations compared to liquid forms. Source analysis highlights that commercially viable copper chlorophyll is predominantly produced synthetically from natural plant extracts, satisfying industrial demand for consistency and cost-effectiveness, although 'natural source' marketing remains a core value proposition.

AI Impact Analysis on Copper Chlorophyll Market

Common user questions regarding AI's impact on the Copper Chlorophyll Market center on optimizing raw material sourcing, enhancing extraction yield, predicting consumer demand for specific color shades (AEO concern), and ensuring regulatory compliance through automated data monitoring. Users are particularly interested in how Artificial Intelligence and Machine Learning (ML) can refine the stability and solubility characteristics of E141 formulations, reducing batch-to-batch variation—a perennial challenge in natural extract processing. Furthermore, there is significant query volume related to utilizing AI for sustainable farming practices of source crops (alfalfa, spinach) and for rapid quality control testing that minimizes wastage and shortens lead times, aligning with Generative Engine Optimization principles by focusing on efficiency and quality improvement.

The implementation of AI/ML is revolutionizing the upstream segment of the value chain. Predictive analytics are being employed to optimize agricultural input usage, forecast crop yields with greater accuracy, and manage the timing of harvests to maximize chlorophyll concentration, thereby directly lowering the unit cost of raw materials for extraction. In the manufacturing phase, advanced neural networks analyze real-time processing data (temperature, pH, solvent concentration) within bioreactors and purification systems to dynamically adjust parameters, leading to optimized copper stabilization and significantly higher extraction yields and purity levels of the final product.

Downstream, AI tools are enhancing market responsiveness and competitive strategy. ML algorithms analyze vast datasets of consumer preferences, regulatory changes across jurisdictions, and competitor pricing, allowing manufacturers to tailor product offerings (e.g., liquid concentration, shade variations) and inventory levels precisely to anticipated demand spikes. This optimization minimizes spoilage, particularly crucial for food-grade ingredients, and ensures compliance documentation is automatically flagged for necessary updates, mitigating potential regulatory hurdles and accelerating speed-to-market for copper chlorophyll based products.

- AI-driven optimization of crop cultivation and harvest scheduling for maximizing chlorophyll content in raw materials.

- Machine learning models deployed for real-time process control in extraction and copper stabilization, boosting yield rates by 10-15%.

- Predictive analytics enhancing supply chain resilience, forecasting demand fluctuations across food, cosmetic, and nutraceutical sectors.

- Automated quality control systems utilizing computer vision and spectral analysis for instant, non-destructive purity testing of final copper chlorophyll powder.

- AI tools assisting in regulatory mapping and compliance checks across different international food and drug agencies (FDA, EFSA, CFIA).

- Optimized formulation design using ML to predict stability and solubility in various end-product matrices (e.g., acidic beverages, high-fat foods).

DRO & Impact Forces Of Copper Chlorophyll Market

The Copper Chlorophyll Market dynamics are shaped by strong drivers emphasizing health and naturalness, moderated by stringent regulatory oversight and cost volatility in raw materials, while technological opportunities offer avenues for market penetration. Drivers primarily revolve around the widespread adoption of 'green' food and supplement ingredients globally, reflecting consumer desire for products perceived as healthier or more natural than synthetic azo dyes. Restraints include the inherent sensitivity of natural extracts to processing conditions, leading to batch inconsistency, and competitive pressure from highly stable, cost-effective artificial green dyes, despite the clean label movement. Opportunities lie in developing specialized, highly concentrated liquid forms for the booming functional beverage market and expanding applications in sustainable textiles and innovative medical diagnostics.

Key drivers center on the global shift away from synthetic food coloring, such as certain FD&C dyes, due to perceived health risks and consumer pressure, compelling major food manufacturers to reformulate products using approved natural alternatives like copper chlorophyll (E141). Furthermore, the expanding nutraceutical industry, fueled by aging populations and increased focus on preventive health, heavily utilizes E141 as a safe, natural-source coloring agent for supplements and health drinks. The stabilizing impact of copper substitution makes E141 a premium choice, offering superior pH and light stability compared to native, unstable chlorophyll extracts, justifying its moderate price premium.

Conversely, significant restraints hinder uniform market growth. The fluctuating costs and seasonality of key agricultural inputs (alfalfa, nettles) directly impact production economics, creating price volatility for the final ingredient. Moreover, regulatory disparities across different regions regarding permitted concentration limits and application scope for E141 can complicate global expansion strategies for manufacturers. Impact forces, which dictate the market trajectory, are high on consumer preference shifts and moderate on technological substitution risks. Regulatory harmonization remains a major influence, determining the scale and ease of cross-border trade and application development, making compliance management a critical factor.

Segmentation Analysis

The Copper Chlorophyll Market segmentation provides a granular view of demand across various product forms, raw material sources, and end-use applications, allowing stakeholders to identify high-growth niches. The market is primarily segmented by Application (Food & Beverages, Cosmetics, Pharmaceuticals, Nutraceuticals), Form (Liquid, Powder), and Source (Natural Extracts, Synthetic Preparation). Analyzing these segments reveals that consumer goods sectors—specifically Food & Beverages and Nutraceuticals—are the primary revenue generators, driven by large volume requirements for coloring mass-produced consumer goods, while the choice between liquid and powder forms is dictated by the specific formulation requirements of the end-product matrix.

The segmentation by Application is critical as it highlights the diverse functionality of copper chlorophyll. The Food & Beverages segment dominates due to the necessity of color stability in processed foods and beverages, especially for maintaining visual appeal in long shelf-life items. The Nutraceuticals segment is the fastest growing, reflecting the incorporation of E141 into health supplements, capitalizing on the compound’s perceived health benefits and clean-label status. Cosmetic applications, though smaller, offer high-value sales, focusing on premium skincare and makeup products where natural sourcing is a major differentiator, contributing to a diverse demand profile.

Segmentation by Form emphasizes the industrial necessity for efficient handling and incorporation. Powdered copper chlorophyll holds a significant share due to its excellent stability, reduced shipping costs, and ease of dosage standardization in dry mixes and tablet manufacturing. Conversely, the Liquid form, preferred in large-scale beverage manufacturing and certain dairy applications, offers superior dispersibility and homogeneity but requires more specialized storage and handling due to its volume and stability profile. Strategic analysis across these dimensions is crucial for manufacturers in optimizing product offerings and maximizing market penetration.

- Application:

- Food & Beverages (Confectionery, Dairy, Bakery, Beverages, Sauces)

- Nutraceuticals (Dietary Supplements, Functional Foods)

- Cosmetics (Skincare, Haircare, Makeup)

- Pharmaceuticals (Tablet Coatings, Liquid Medications)

- Form:

- Liquid

- Powder

- Source:

- Natural Extracts (Alfalfa, Spinach, Nettle)

- Synthetic Preparation (Refined and Stabilized E141)

Value Chain Analysis For Copper Chlorophyll Market

The value chain for Copper Chlorophyll begins with upstream raw material sourcing and proceeds through complex extraction and stabilization processes, culminating in diverse downstream applications and distribution channels. Upstream analysis focuses heavily on the procurement of chlorophyll-rich biomass, primarily alfalfa and spinach. Efficiency in this stage is determined by sustainable farming practices, optimized harvesting techniques to maximize chlorophyll yield, and the logistical challenges of transporting large volumes of perishable plant material to extraction facilities. Key players often engage in long-term contracts or vertical integration to mitigate price volatility and ensure a consistent supply of high-quality raw material necessary for stable production of E141.

The midstream process involves the chemical transformation of natural chlorophyll into copper chlorophyllin. This manufacturing stage includes solvent extraction, saponification to remove phytol, and subsequent treatment with copper salts to achieve the required stabilization (copper substitution). This process demands high levels of technical expertise and specialized equipment to ensure the final product meets stringent food-grade or pharmaceutical standards regarding purity, heavy metal content, and color consistency. Quality control checkpoints at this stage are paramount, impacting the usability and regulatory compliance of the final ingredient.

Downstream market penetration is achieved through both direct and indirect distribution channels. Large multinational food, beverage, and cosmetic manufacturers typically engage in direct procurement agreements with major copper chlorophyll producers, often requiring customized specifications (e.g., specific concentrations or particle sizes). Indirect channels involve specialized chemical distributors and ingredient brokers who serve smaller-to-mid-sized enterprises and regional manufacturers, providing technical support and managing smaller inventory requirements. The choice of channel is critical; direct sales offer higher margins and closer customer relationships, while indirect channels provide wider market coverage and logistical efficiency for fragmented markets.

Copper Chlorophyll Market Potential Customers

The potential customer base for Copper Chlorophyll is highly diversified, encompassing industrial processors seeking natural coloring solutions across multiple high-volume consumer product categories. The largest segment of end-users are Food & Beverage manufacturing companies, ranging from global conglomerates producing soft drinks and confectionery to regional producers of baked goods and sauces. These buyers prioritize color stability, regulatory compliance (especially E141 approval), and competitive pricing in bulk quantities to ensure visual appeal and consistent branding across their product lines.

A rapidly growing customer segment comprises Nutraceutical and Dietary Supplement manufacturers. These companies integrate copper chlorophyll into tablets, capsules, and health drinks, often marketing the product based on its natural derivation and purported detoxifying properties. This segment demands stringent purity standards (low heavy metal contamination) and traceability of source materials, aligning with the premium nature of health and wellness products. Furthermore, the pharmaceutical industry utilizes E141 for coloring medicinal syrups and tablet coatings, where color consistency is essential for drug identification and patient compliance.

The third major group includes Cosmetics and Personal Care product manufacturers. Customers in this sector utilize copper chlorophyll for tinting soaps, shampoos, lotions, and color cosmetics (e.g., eye shadows). Driven by the clean beauty trend, these buyers are increasingly seeking stable, plant-derived colorants to replace traditional synthetic pigments. Their purchasing decisions are often influenced by the ingredient's marketing appeal (natural origin) and its compatibility with complex cosmetic formulations, requiring suppliers to offer technical assistance and specialized product grades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185.0 Million |

| Market Forecast in 2033 | $286.0 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Chr. Hansen Holding A/S, DDW The Color House (IFP), GNT Group B.V., Kalsec Inc., Sensient Technologies Corporation, Naturex S.A. (Givaudan), Fiorio Colori SpA, KolorJet Chemicals Pvt. Ltd., PHS, Merck KGaA, T. Hasegawa Co., Ltd., Adama Agricultural Solutions Ltd., ROHA Dyechem Pvt. Ltd., LycoRed Corp., Folei Chemical Industry Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Chlorophyll Market Key Technology Landscape

The core technological landscape of the Copper Chlorophyll Market centers on advanced extraction, purification, and stabilization techniques crucial for producing high-quality, regulatory-compliant E141. Traditional methods rely on solvent extraction (using acetone or ethanol) followed by saponification. However, modern technological advancements emphasize environmentally friendlier and more efficient extraction technologies, such as Supercritical Fluid Extraction (SFE) using CO2, which minimizes the use of harsh chemical solvents, reduces waste, and often results in higher purity chlorophyll extracts suitable for premium food and pharmaceutical grades. This shift towards sustainable processing aligns with industry and consumer demand for eco-friendly ingredient manufacturing.

A critical technological focus lies in improving the copper stabilization process, which involves substituting the magnesium ion with a copper ion to enhance light and heat stability. Researchers are developing microencapsulation and nano-emulsification techniques to further protect the E141 molecule, particularly when incorporated into challenging matrices like high-acidity beverages or products undergoing high-temperature processing. These sophisticated formulation technologies ensure that the intended green color persists throughout the product's shelf life, providing a reliable coloring solution that addresses the instability inherent in many natural pigments, thereby unlocking new application possibilities in complex formulations.

Furthermore, technology investment is heavily directed towards quality assurance and safety testing. High-Performance Liquid Chromatography (HPLC) and Mass Spectrometry (MS) are standard technologies used to monitor residual solvents, heavy metal contamination (critical due to the copper component), and ensure exact standardization of color value (tinting strength). Integrating automation and sensor technology in processing lines provides real-time data capture, enabling instantaneous adjustments that maintain batch consistency and significantly reduce the likelihood of contamination or non-compliance, solidifying the market's reliance on technologically rigorous manufacturing practices.

Regional Highlights

The Copper Chlorophyll Market exhibits distinct regional consumption patterns and growth trajectories, heavily influenced by local regulatory environments, consumer purchasing power, and the maturity of the food and beverage industry.

- North America: This region holds a significant revenue share, driven by a mature market for packaged foods, high disposable income facilitating extensive consumption of functional foods and nutraceuticals, and the pervasive clean label movement. U.S. and Canadian food manufacturers are highly motivated to replace synthetic dyes to meet consumer demands for natural ingredients. The presence of major flavor houses and ingredient suppliers, coupled with relatively clear regulatory guidelines from the FDA (allowing E141 use), reinforces its leading position. The region is characterized by high demand for both powdered E141 for supplements and liquid forms for health beverages, focusing on high-purity, standardized products.

- Europe: Europe is a dominant force in the market, largely due to stringent EU regulations that heavily restrict or ban several synthetic colorants, thus naturally boosting demand for approved alternatives like E141 (authorized as E141(i) and E141(ii)). The strong focus on organic and natural product certification across countries like Germany, France, and the UK ensures sustained growth in the food processing and high-end cosmetic sectors. However, the market here is highly competitive, requiring suppliers to navigate complex national interpretations of EU directives and emphasize sustainability credentials in their production processes.

- Asia Pacific (APAC): APAC is poised to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily attributed to rapid urbanization, increasing middle-class populations, and the Westernization of diets leading to high consumption of processed foods and soft drinks in countries such as China, India, and Southeast Asia. While regulatory frameworks are still evolving and often fragmented, increasing domestic production capabilities and growing consumer awareness of natural ingredients are creating massive demand. Expansion into local traditional medicinal and supplement markets further contributes to this steep growth trajectory.

- Latin America (LATAM): The LATAM market represents a developing but important opportunity, particularly in high-volume food processing sectors in Brazil and Mexico. Market growth is sustained by population expansion and the gradual modernization of local food production standards. Challenges include economic instability and fragmented distribution networks, but the underlying demand for stable colorants in regional beverages and confectionery remains robust. Investment focuses on cost-effective bulk supply and managing local currency fluctuations.

- Middle East and Africa (MEA): This region is characterized by steady, moderate growth, primarily centered around Gulf Cooperation Council (GCC) countries which have relatively high standards for imported food ingredients and a growing consumer interest in premium, high-quality products. Usage in MEA is concentrated in specialized Halal-certified food products and imported cosmetic brands. Market expansion is dependent on infrastructure development and overcoming logistical hurdles associated with ingredient supply across diverse geopolitical landscapes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Chlorophyll Market.- Chr. Hansen Holding A/S

- DDW The Color House (IFP)

- GNT Group B.V.

- Kalsec Inc.

- Sensient Technologies Corporation

- Naturex S.A. (Givaudan)

- Fiorio Colori SpA

- KolorJet Chemicals Pvt. Ltd.

- PHS (Pure Health Solutions)

- Merck KGaA

- T. Hasegawa Co., Ltd.

- Adama Agricultural Solutions Ltd.

- ROHA Dyechem Pvt. Ltd.

- LycoRed Corp.

- Folei Chemical Industry Co., Ltd.

- Aarkay Food Products Ltd.

- Apollo Colors Inc.

- Brenntag AG

- Sethness Products Company

- Bioconutrients Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the Copper Chlorophyll market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Copper Chlorophyll and what are its primary uses in the food industry?

Copper Chlorophyll (E141) is a semi-synthetic, water-soluble green colorant derived from natural chlorophyll (extracted from plants like alfalfa) where the central magnesium ion is replaced by copper for enhanced stability against heat and light. Its primary use in the food industry is as a safe, green coloring agent in confectionery, dairy products, beverages, and canned goods, marketed often as a natural-source colorant.

Is Copper Chlorophyll considered a natural ingredient by regulatory bodies like the FDA or EFSA?

The regulatory status of Copper Chlorophyll varies. While it is derived from natural chlorophyll, the copper stabilization process classifies it as a nature-identical or processed color additive (E141) by EFSA, and as a color additive exempt from certification by the FDA. It is generally accepted as a stable, natural-source alternative to purely synthetic dyes, satisfying clean-label demands while ensuring industrial stability.

Which application segment drives the highest demand for Copper Chlorophyll globally?

The Food & Beverages segment currently drives the highest volume demand for Copper Chlorophyll due to its essential use in coloring mass-produced consumer goods and packaged foods. However, the Nutraceuticals segment, driven by the expanding dietary supplements market and the ingredient's purported health benefits, is projected to exhibit the fastest growth rate during the forecast period.

What technological advancements are impacting the production efficiency of E141?

Key technological advancements include the adoption of Supercritical Fluid Extraction (SFE) for cleaner, solvent-free chlorophyll extraction and the deployment of Machine Learning (ML) algorithms for real-time process control. These technologies significantly improve raw material yield, ensure higher purity levels, and enhance batch consistency during the critical copper stabilization phase.

How does the powder form of Copper Chlorophyll compare to the liquid form in market preference?

The powder form holds a strong market position due to superior stability, extended shelf life, and logistical advantages (reduced weight and volume for shipping). It is preferred in dry mixes, supplements, and tablet manufacturing. The liquid form is used where rapid dispersion is needed, such as in large-scale beverage manufacturing, but requires specialized storage and handling.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager