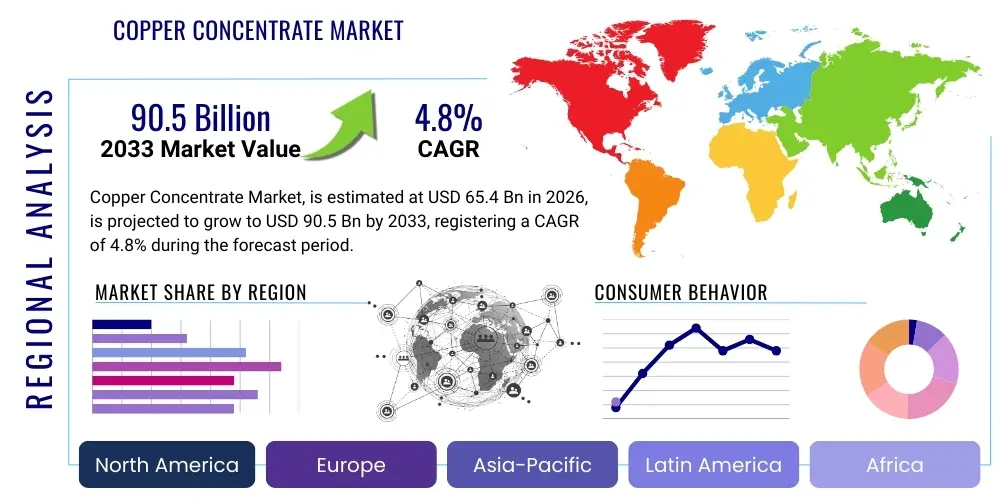

Copper Concentrate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437524 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Copper Concentrate Market Size

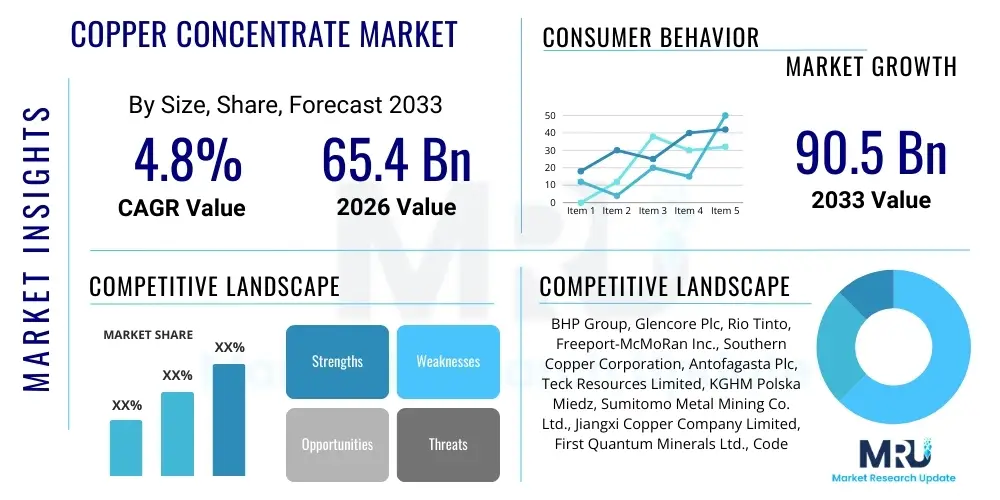

The Copper Concentrate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 90.5 Billion by the end of the forecast period in 2033.

Copper Concentrate Market introduction

Copper concentrate is the intermediate product derived from processing copper ore, typically through crushing, grinding, and flotation processes. This concentrate usually contains 20% to 40% elemental copper, making it a critical feedstock for smelters and refineries globally. Its primary function is to serve as the raw material for producing high-purity refined copper cathodes, which are essential for various industrial and technological applications. The quality of the concentrate, determined by its copper grade and the presence of deleterious elements such as arsenic or mercury, significantly influences smelting charges and transportation costs, thereby impacting its market value.

Major applications of copper concentrate are overwhelmingly concentrated in pyrometallurgical and hydrometallurgical processing routes, leading to the production of refined copper. Refined copper is indispensable in the electrical and electronics sectors due to its exceptional conductivity, making it fundamental for power transmission lines, building wiring, and electronic circuitry. Furthermore, the burgeoning demand stemming from the global energy transition—specifically the proliferation of electric vehicles (EVs), renewable energy infrastructure (solar and wind power systems), and large-scale battery storage—has cemented copper concentrate's position as a strategically vital commodity. Its fungibility and ease of international trade necessitate robust, secure supply chains to meet volatile global manufacturing requirements.

The primary driving factors sustaining the market's growth trajectory include rapid urbanization and industrialization in emerging economies, particularly in Asia Pacific, which demands extensive infrastructural development involving copper. The benefits of using high-grade copper concentrate involve reduced processing costs for smelters, decreased environmental impact compared to processing raw ore, and higher throughput efficiency. However, the market faces structural challenges related to declining ore grades globally, which necessitates greater volumes of material handling and more energy-intensive processing, subtly increasing the cost of producing copper concentrate and impacting global supply dynamics.

Copper Concentrate Market Executive Summary

The Copper Concentrate Market is currently experiencing a period of heightened volatility, driven by complex interplay between diminishing global mining reserves, increasing geopolitical risks impacting major supply jurisdictions (such as Chile and Peru), and unprecedented demand growth fueled by global decarbonization efforts. Business trends indicate a significant push towards vertical integration among major mining houses, aiming to secure downstream refining capacity and mitigate risks associated with fluctuating treatment and refining charges (TC/RCs). Furthermore, there is a pronounced focus on sustainable mining practices and enhanced tailings management, which, while increasing capital expenditure, are becoming prerequisites for securing financing and maintaining social license to operate in mineral-rich regions.

Regionally, the market is structurally divided between primary producers, overwhelmingly situated in Latin America (Chile, Peru) and Southeast Asia (Indonesia), and major consumers, predominantly located in Asia Pacific (China, India), which accounts for the vast majority of global smelting capacity. China's insatiable appetite for copper concentrate, driven by its expansive manufacturing and electric vehicle supply chains, dictates global TC/RC benchmarks. Regional trends also highlight Europe’s increasing reliance on secondary sources (scrap copper) and recycled materials, driven by stringent environmental regulations, while North America focuses on modernizing existing smelters and securing supply chains through strategic partnerships with allied nations, often bypassing traditional spot market dependency.

Segmentation trends reveal a persistent demand premium for high-grade, clean concentrates (those with minimal deleterious elements), reflecting smelters' efforts to maximize efficiency and minimize environmental compliance burdens. Low-grade concentrates, conversely, face lower profitability and higher processing costs, though their market presence is growing due to the necessity of processing lower-quality ores. The application segment continues to be dominated by traditional copper smelting, but electro-refining, particularly for high-purity applications required in advanced electronics and specialized wiring, is showing superior growth rates, indicating a shift towards value-added refined product manufacturing.

AI Impact Analysis on Copper Concentrate Market

Users frequently inquire about how Artificial Intelligence (AI) can stabilize the volatile copper concentrate supply chain, optimize the extraction process amidst falling ore grades, and improve risk management against environmental and regulatory pressures. The core user expectation centers on AI's ability to drive operational efficiencies in mining—specifically, through predictive maintenance, enhanced geological modeling, and autonomous fleet management, which collectively reduce operational expenditure (OPEX) and improve recovery rates of copper from lower-grade ores. Concerns often revolve around the high initial investment required for AI infrastructure and data integration across legacy mining operations, alongside the necessary skilled workforce development. The market views AI as a critical tool for achieving higher sustainability standards, notably through real-time monitoring of energy consumption and waste outputs, directly addressing ESG requirements that now heavily influence investor sentiment and market access.

The implementation of machine learning algorithms in flotation circuits is poised to revolutionize the concentration stage. By continuously analyzing sensor data related to pulp density, reagent dosage, and bubble characteristics, AI systems can dynamically adjust parameters in milliseconds, optimizing mineral recovery rates far beyond human capability. This precision minimizes reagent consumption and maximizes the yield of marketable copper concentrate from a fixed volume of mined ore. Furthermore, AI-driven predictive modeling is being used extensively in logistics and shipping, enabling better forecasting of port congestion, optimizing vessel scheduling, and improving inventory management at both the mine site and the smelter intake facility, thereby smoothing out bottlenecks that frequently disrupt the international flow of this critical commodity and stabilizing market supply expectations.

- AI-driven optimization of flotation processes increases copper recovery rates, mitigating impacts of declining ore grades.

- Predictive maintenance minimizes unscheduled downtime for mining and processing equipment, ensuring consistent concentrate supply.

- Advanced geological modeling using AI enhances exploration targeting, improving reserve estimates and reducing uncertainty in future supply.

- Autonomous haulage systems and remote operations reduce operational risks and labor costs associated with concentrate extraction.

- Machine learning algorithms optimize supply chain logistics, stabilizing shipping schedules and inventory levels for smelters.

- AI aids in ESG compliance by monitoring energy consumption and tailings deposition in real-time, improving sustainability reporting.

DRO & Impact Forces Of Copper Concentrate Market

The Copper Concentrate Market is primarily driven by the exponential global shift towards electrification, which necessitates vast quantities of refined copper for technologies supporting the energy transition, including electric vehicle motors, charging infrastructure, and grid modernization projects. Restraints largely manifest as escalating operational complexities: deep-pit mining leads to higher stripping ratios, political instability in key producer nations imposes regulatory uncertainty, and water scarcity issues in arid mining regions (like the Atacama Desert) constrain production capacity. Opportunities are centered on developing innovative extraction technologies, such as bioleaching for complex ores and utilizing digitalization and automation (AI/IoT) to enhance efficiency across the value chain, coupled with investment in new exploration frontiers outside traditional mining centers to diversify global supply.

Key impact forces shaping this market include stringent environmental, social, and governance (ESG) criteria imposed by institutional investors and global regulatory bodies. ESG compliance directly affects the social license to operate, influencing project financing and operational continuity, thus acting as both a restraint (cost) and a driver (competitive differentiation). Furthermore, the structural impact of declining ore grades forces miners to process more material per unit of copper produced, intensifying energy and water consumption and pressuring OPEX. The cyclical nature of treatment and refining charges (TC/RCs) also represents a significant impact force, determining profitability distribution between miners (who produce the concentrate) and smelters (who process it), often leading to contentious contract negotiations that affect short-term market stability and investment decisions.

The ongoing trade tensions and resource nationalism evident in various countries introduce significant geopolitical risk, potentially leading to supply chain fragmentation and increased reliance on regional trade blocs. This impacts pricing transparency and risk premium calculations. However, the consistent long-term demand outlook, driven by foundational trends such as demographic growth and necessary infrastructure buildout in developing economies, provides a robust structural underpinning that offsets some short-term volatility. Successfully navigating these impact forces requires miners to prioritize capital discipline, invest in high-efficiency, sustainable technologies, and engage proactively with local communities and governments to secure long-term operational viability.

Segmentation Analysis

The Copper Concentrate Market is systematically segmented based on the quality of the raw material (Type) and the industrial endpoint where the concentrate is consumed (Application). This structural segmentation is crucial for understanding pricing dynamics, as the grade and purity define its suitability for different smelting processes and the associated processing costs (treatment and refining charges). High-grade concentrates command a premium due to higher metal recovery and lower energy input required by the smelter, while the increasing availability of medium and low-grade ores necessitates customized processing solutions, influencing capital expenditure and operational complexity throughout the global refining network.

Analysis by Type highlights the persistent pressure exerted by resource scarcity, pushing the industry to increasingly rely on medium and low-grade material. While traditional mining focused on rich porphyry deposits yielding high-grade concentrates, modern mining operations must adapt metallurgical processes, such as increased grinding or specialized flotation chemicals, to economically extract copper from leaner ores. This shift creates a distinct market for processing technologies tailored to complex metallurgy, driving innovation in separation techniques and residue management, particularly for concentrates containing high levels of impurities like arsenic, lead, or zinc, which require specific costly pre-treatment or specialized smelter technology.

In terms of Application, the segment remains dominated by the fundamental requirement for primary copper smelting, which converts concentrate into blister copper and ultimately refined copper cathodes. However, the secondary applications, particularly focused on specialized industrial uses such as custom alloys or niche chemical production, although smaller in volume, represent pockets of higher potential growth driven by innovation in downstream manufacturing. This detailed segmentation allows stakeholders—from miners and traders to smelters and financial institutions—to precisely benchmark their operational efficiency, identify optimal sourcing strategies, and accurately forecast demand across different quality tiers.

- By Type:

- High Grade Copper Concentrate (Typically > 30% Cu)

- Medium Grade Copper Concentrate (Typically 20% - 30% Cu)

- Low Grade Copper Concentrate (Typically < 20% Cu or high impurities)

- By Application:

- Copper Smelting (Pyrometallurgy)

- Electro-refining and Hydrometallurgy

- Other Industrial Uses (Direct leaching, Specialized chemicals)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Copper Concentrate Market

The value chain of the Copper Concentrate Market commences with the highly capital-intensive upstream segment, involving exploration and mining. Exploration requires extensive geological surveys and drilling campaigns to identify viable copper ore bodies, a high-risk activity often undertaken by junior miners or specialized exploration arms of major diversified firms. The subsequent mining operation—whether open-pit or underground—involves massive material movement, followed by comminution (crushing and grinding), which transforms the low-grade ore into a fine powder. This upstream efficiency dictates the volume and quality of the final concentrate, with costs heavily influenced by energy prices, labor availability, and access to water resources, making it the most capital-intensive phase of the entire chain.

The midstream component focuses on concentration, primarily utilizing froth flotation, a chemical-physical separation process that upgrades the ore into copper concentrate, suitable for commercial trade. Following concentration, the product enters the distribution channel, characterized by global trading firms, bulk shipping logistics, and strict quality control measures. Copper concentrate is a globally traded commodity, transported primarily by sea freight from major mining ports (e.g., Chile, Peru, Australia) to major smelting hubs (e.g., China, Japan, South Korea). Distribution complexity arises from managing weight, moisture content, and ensuring security against cargo theft, while direct sales contracts between large miners and integrated smelters often bypass spot market fluctuations, promoting stability.

The downstream segment is dominated by primary copper smelters and refineries. These facilities process the concentrate, first into blister copper through pyrometallurgical methods, and subsequently into high-purity refined copper cathodes (99.99% Cu) through electro-refining. This final product is then sold to end-user manufacturers in the construction, automotive, and electronics industries. Indirect distribution channels often involve specialized commodity brokers and traders who manage hedging and risk exposure across multiple supply contracts, connecting smaller mines or independent smelters. The entire chain is highly sensitive to geopolitical factors and regulatory changes, particularly concerning environmental emissions standards applied to the refining sector.

Copper Concentrate Market Potential Customers

The primary and largest potential customers for copper concentrate are integrated copper smelters and standalone refining operations globally, particularly those clustered in Asia Pacific, where substantial capacity has been built to meet regional manufacturing demands. These customers acquire concentrate as their essential raw input material for the production of refined copper cathodes. Smelters are differentiated by their ability to handle various concentrate grades and impurity levels; for example, modern, technologically advanced smelters often seek high-grade, clean concentrates to optimize energy usage and reduce compliance costs associated with handling sulfur dioxide and harmful deleterious elements.

A secondary, yet rapidly growing, customer segment includes specialized hydrometallurgical processing facilities. While historically less common for primary sulfides (which constitute the majority of concentrates), advances in leaching technologies, such as pressure leaching, enable these facilities to process concentrates, especially those with complex mineralogy that are unsuitable or uneconomical for conventional pyrometallurgical smelting. These customers are driven by the need for customized, high-purity copper outputs often required for specific chemical or electronic applications, demonstrating a strong preference for technical flexibility over sheer volume.

Furthermore, large international commodity trading houses act as crucial intermediaries and buyers, securing significant volumes of concentrate through long-term off-take agreements with mines. These traders aggregate supply, manage logistical risks, and allocate the material to various smelters based on market pricing, location, and specific quality requirements, effectively bridging the geographical gap between mine production and industrial consumption. Their purchasing power and risk management expertise make them essential partners, especially for mid-sized mining operations seeking reliable, high-volume sales agreements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 90.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BHP Group, Glencore Plc, Rio Tinto, Freeport-McMoRan Inc., Southern Copper Corporation, Antofagasta Plc, Teck Resources Limited, KGHM Polska Miedz, Sumitomo Metal Mining Co. Ltd., Jiangxi Copper Company Limited, First Quantum Minerals Ltd., Codelco, Zijin Mining Group Co. Ltd., Vedanta Resources Plc, Vale S.A., MMG Limited, Nevsun Resources Ltd., Trafigura Group Pte. Ltd., Xstrata Copper (acquired by Glencore), Lundin Mining Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Concentrate Market Key Technology Landscape

The technological landscape for copper concentrate production is rapidly evolving, driven primarily by the need to efficiently process increasingly complex and lower-grade ores while adhering to stricter environmental standards. A core area of innovation lies in grinding and comminution circuits, where high-pressure grinding rolls (HPGRs) are increasingly replacing traditional ball mills. HPGR technology offers significant advantages by reducing energy consumption by 30% to 40% compared to conventional methods and enhancing the liberation of copper minerals, which improves subsequent flotation performance. This transition is essential for cost management as mining operations deal with harder, deeper rock formations.

Another crucial technological development involves flotation cell design and automation. Modern concentrators are integrating large volume flotation cells (up to 600m³) to maximize throughput and achieve economies of scale. Critically, these cells are equipped with advanced control systems utilizing sophisticated sensors (e.g., particle size analyzers, froth cameras) and machine learning algorithms (as discussed in the AI analysis). These systems provide real-time optimization of air flow and chemical reagent dosage, such as collectors and frothers, ensuring consistent recovery efficiency even with fluctuating feed quality, directly impacting the final concentrate grade and purity.

Furthermore, addressing the environmental challenges posed by processing complex concentrates—specifically those high in arsenic or other deleterious elements—has spurred the development of advanced metallurgical processes. Technologies like the Albion Process (a combination of fine grinding and oxidative leaching) and conventional pressure oxidation (POX) circuits are being deployed to pre-treat complex concentrates, making the copper accessible for leaching or rendering the impurities inert before the material is shipped to the smelter. This pre-treatment step is vital for meeting the demanding quality specifications of global smelters and ensuring compliance with international hazardous material regulations, thus significantly affecting the tradability of the concentrate.

Regional Highlights

The regional dynamics of the Copper Concentrate Market are fundamentally shaped by the geographical separation between major production centers and consumption hubs. Latin America, particularly Chile and Peru, maintains its dominance as the world's largest production region, benefiting from extensive porphyry copper deposits and established mining infrastructure. However, this dominance is increasingly challenged by operational risks stemming from labor disputes, resource nationalism leading to royalty hikes, and severe water stress, which collectively constrain capital investment and threaten stable output growth, leading buyers to seek diversified supply options.

Asia Pacific (APAC), led overwhelmingly by China, is the paramount consumption region, commanding over half of global refined copper production capacity. China’s demand is driven not only by its massive manufacturing base but critically by its strategic commitment to new energy vehicles (NEVs) and renewable power generation. The region's focus is on securing long-term, high-quality concentrate supply, leading to significant outbound investments by Chinese entities into mining assets across Africa, South America, and Central Asia to ensure feedstock security and mitigate geopolitical supply risks.

Europe and North America represent mature, highly regulated markets characterized by moderate internal production and strategic refining capacity. North America benefits from domestic supply in the U.S. and Canada, often integrating advanced environmental technologies into processing. Europe, while having limited primary mine production, relies heavily on efficient smelting operations that prioritize high environmental performance and are increasingly seeking ethical and sustainably sourced concentrate, often giving preference to suppliers demonstrating robust adherence to strict ESG reporting standards throughout the entire mining value chain.

- Asia Pacific (APAC): Dominates global demand due to China's expansive manufacturing and electric vehicle industries. Focus on securing supply contracts and owning overseas mining assets.

- Latin America (LATAM): The largest global supplier (Chile, Peru), characterized by significant resource potential but facing growing regulatory hurdles, water scarcity issues, and increasing operational costs.

- North America: Stable production market emphasizing technological innovation, automation, and environmental responsibility, serving mostly domestic refining needs and maintaining self-sufficiency.

- Europe: High-value market focused on sustainable sourcing, recycling, and high-purity refined copper production for specialized industrial uses and advanced electronics.

- Middle East and Africa (MEA): Emerging production region (e.g., Democratic Republic of Congo, Zambia) showing high growth potential, though constrained by infrastructural deficits and political instability, often acting as a key source for Asian smelters.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Concentrate Market.- BHP Group

- Glencore Plc

- Rio Tinto

- Freeport-McMoRan Inc.

- Southern Copper Corporation

- Antofagasta Plc

- Teck Resources Limited

- KGHM Polska Miedz

- Sumitomo Metal Mining Co. Ltd.

- Jiangxi Copper Company Limited

- First Quantum Minerals Ltd.

- Codelco

- Zijin Mining Group Co. Ltd.

- Vedanta Resources Plc

- Vale S.A.

- MMG Limited

- Nevsun Resources Ltd.

- Trafigura Group Pte. Ltd.

- Xstrata Copper (acquired by Glencore)

- Lundin Mining Corporation

Frequently Asked Questions

Analyze common user questions about the Copper Concentrate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors primarily drive the pricing and demand for copper concentrate globally?

Pricing for copper concentrate is primarily driven by three interconnected factors: the LME copper price, the level of treatment and refining charges (TC/RCs) negotiated between miners and smelters, and global industrial demand, especially from the energy transition sector (EVs and renewables). Demand is intrinsically linked to infrastructure development and urbanization rates in Asia Pacific.

How do declining copper ore grades impact the future supply of copper concentrate?

Declining copper ore grades necessitate processing larger volumes of raw material, increasing energy and water consumption per unit of copper concentrate produced. This drives up operational costs, pressures global supply stability, and mandates greater investment in advanced, efficient processing technologies like HPGRs and AI-optimized flotation circuits to maintain profitability and output.

What role does ESG compliance play in the copper concentrate value chain?

ESG compliance is becoming critical, impacting market access and investment. Institutional investors prioritize miners demonstrating reduced carbon footprints, effective water stewardship, and positive community relations. Non-compliance can lead to operational shutdowns and difficulty securing project financing, directly affecting long-term concentrate supply.

Which regions are currently leading the production and consumption of copper concentrate?

Latin America, specifically Chile and Peru, leads global production due to significant resource endowment. Asia Pacific, overwhelmingly dominated by China, is the leading consumption hub, driven by its large-scale smelting capacity and high demand for refined copper in manufacturing and electrification projects.

What are the key technological advancements utilized in modern copper concentration processes?

Key technological advancements include the deployment of High-Pressure Grinding Rolls (HPGRs) for energy efficiency in comminution, large-volume flotation cells for higher throughput, and advanced digitalization and AI-driven systems for real-time control and optimization of reagent dosage and mineral recovery rates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager