Copper Graphite Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432790 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Copper Graphite Materials Market Size

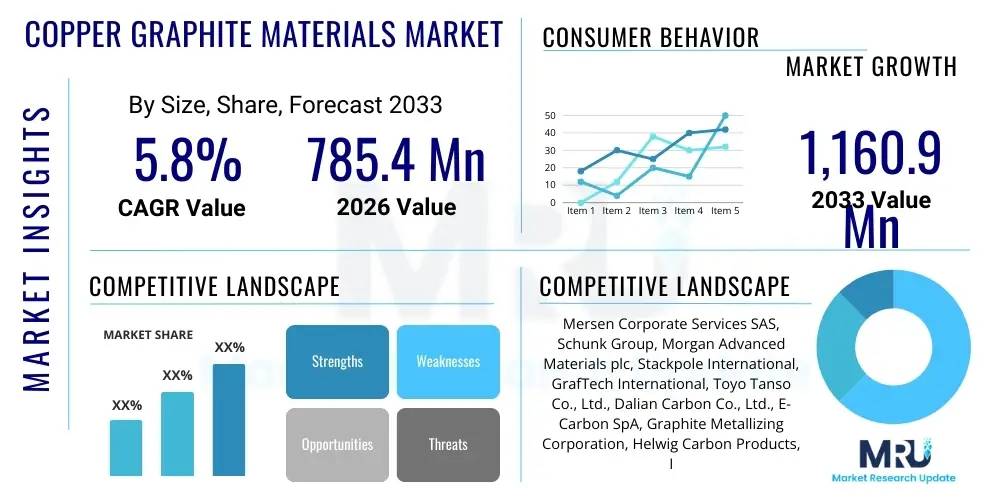

The Copper Graphite Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $785.4 Million in 2026 and is projected to reach $1,160.9 Million by the end of the forecast period in 2033.

Copper Graphite Materials Market introduction

The Copper Graphite Materials market encompasses advanced composite materials engineered primarily through powder metallurgy techniques, blending the high electrical and thermal conductivity inherent to copper with the superior lubricity and self-lubricating properties of graphite. These unique characteristics make copper graphite composites indispensable in applications requiring exceptional sliding contact performance, minimized wear, and efficient heat dissipation under high-current density or demanding operational environments. The market is fundamentally driven by the materials' ability to offer superior arc resistance and reduced contact resistance compared to pure metals, thereby extending the operational lifespan of critical electrical and mechanical components.

Major applications of copper graphite materials are concentrated in electrical engineering, particularly in the manufacturing of electrical contacts, brush assemblies for motors and generators, and sliding bearings. In the automotive sector, they are crucial for starter motors, braking systems, and various switches. Furthermore, industrial machinery relies on these composites for sealing rings and heavy-duty sliding contacts where extreme temperatures and mechanical stress are prevalent. The primary benefits driving adoption include significantly enhanced wear resistance, low coefficient of friction, high thermal stability, and customizable conductivity levels achieved through precise control over the ratio and dispersion of copper and graphite phases during the manufacturing process.

Driving factors propelling market expansion include the global surge in demand for high-efficiency electric motors across industrial automation and consumer electronics, coupled with the rapid transition towards electric vehicles (EVs), which utilize specialized conductive and durable contacts in their powertrain systems. Moreover, the increased need for reliable power transmission and distribution infrastructure necessitates materials that can withstand frequent switching cycles and high current loads, placing copper graphite materials at the forefront of solutions for electrical contact applications. Continuous advancements in powder metallurgy techniques, such as hot isostatic pressing and rapid solidification, are further enabling the production of composites with finely tuned microstructures, optimizing performance and expanding the material's potential application scope.

Copper Graphite Materials Market Executive Summary

The Copper Graphite Materials market is exhibiting robust growth, propelled by sustained global electrification efforts and technological advancements within the automotive and aerospace sectors. Current business trends indicate a significant shift toward specialized, custom-engineered formulations that address specific performance requirements in extreme operating environments, particularly those encountered in high-voltage DC systems prevalent in renewable energy infrastructure and high-power density electric vehicles. Manufacturers are increasingly investing in sophisticated material characterization and process control to ensure homogeneous dispersion of graphite particles within the copper matrix, leading to optimized material properties such as reduced contact bounce and improved commutation efficiency in rotating electrical machinery. Pricing pressures remain a strategic consideration, necessitating efficiency improvements across the value chain, especially in sourcing high-purity copper powders and various graphite grades.

Regionally, the Asia Pacific (APAC) region dominates the market, largely due to its concentrated presence of major automotive manufacturing hubs, extensive growth in industrial motor production, and massive investments in power generation and transmission infrastructure, particularly in China and India. North America and Europe demonstrate mature markets characterized by stringent quality standards, driving demand for premium, high-reliability copper graphite components, especially in aerospace and defense applications. These Western regions are focal points for innovation related to next-generation brush materials designed for high-altitude or vacuum environments. The regional trends highlight a global bifurcation: high-volume, cost-competitive manufacturing predominantly in APAC, contrasting with high-specification, niche product development in North America and Europe.

Segmentation trends reveal that the application segment dominated by electrical contacts and brushes remains the largest consumer, driven by replacement cycles and new motor installations. However, the segment related to self-lubricating bearings and bushings is experiencing the fastest growth rate, fueled by demand for maintenance-free components in industrial machinery and consumer durables. Segmentation by composition shows a strong trajectory for materials incorporating advanced additives or nano-scale reinforcements, aiming to further reduce friction and enhance mechanical strength without compromising electrical performance. Suppliers are thus specializing their product portfolios based on the percentage composition of graphite, tailoring products for either heavy-duty mechanical applications (lower graphite content) or highly conductive electrical sliding applications (optimized graphite content for lubricity).

AI Impact Analysis on Copper Graphite Materials Market

User queries regarding the impact of Artificial Intelligence (AI) on the Copper Graphite Materials Market center predominantly around two core themes: optimizing material synthesis and enhancing predictive maintenance for components utilizing these materials. Users frequently inquire about how machine learning algorithms can rapidly screen potential alloy compositions, predict the resulting electrical and thermal properties based on powder size distribution and sintering parameters, and ultimately shorten the materials development lifecycle. A major concern is how AI can standardize quality control in high-volume powder metallurgy operations, where microstructural variations can severely impact component lifespan. Furthermore, there is significant interest in utilizing AI-driven sensor data analytics in end-use applications (like large generators or EV motors) to predict the wear rate of copper graphite brushes and contacts, thereby transitioning maintenance strategies from scheduled downtime to condition-based, predictive interventions, maximizing uptime and component longevity.

- AI-driven optimization of sintering temperatures and pressures, leading to enhanced material density and uniformity.

- Machine learning algorithms accelerating the discovery of novel copper-graphite composite formulations and additive materials.

- Predictive quality control utilizing image recognition for microstructural analysis during manufacturing, reducing defects.

- AI-powered sensor integration in motors for real-time monitoring of brush wear and contact resistance, enabling predictive maintenance.

- Enhanced supply chain forecasting and raw material procurement optimization using AI to manage volatile copper prices and graphite supply.

DRO & Impact Forces Of Copper Graphite Materials Market

The Copper Graphite Materials market is influenced by a complex interplay of internal and external forces, summarizing key Drivers (D), Restraints (R), and Opportunities (O). Primary drivers include the global push towards higher-efficiency electrical machinery, where the low-friction and high-conductivity characteristics of copper graphite composites are essential for minimizing energy losses and heat generation. The expanding electrification of the transportation sector, especially the surging production of hybrid and battery electric vehicles (BEVs), significantly bolsters demand for robust, high-performance contacts and braking materials. Furthermore, the reliance on stable power generation systems (wind turbines, industrial generators) necessitates reliable brush and collector ring systems that depend heavily on copper graphite formulations for continuous operation under varying load conditions, acting as a structural market pillar.

However, significant restraints temper market expansion. The high volatility and fluctuating cost of primary raw materials, specifically high-ppurity copper powder and various grades of natural and synthetic graphite, introduce considerable unpredictability in manufacturing costs and final product pricing, making long-term procurement challenging for smaller players. Additionally, the inherent complexity of the powder metallurgy manufacturing process—ensuring uniform material distribution and consistent microstructure across large production batches—presents technical hurdles and requires substantial capital investment in specialized equipment. Furthermore, in certain high-specification applications, competition from alternative materials like silver-graphite or specialized carbon brushes, particularly where extreme environment tolerance is required, limits market penetration for standard copper-graphite composites.

Opportunities for profound growth lie primarily in the development of advanced composites tailored for extreme conditions, specifically targeting the burgeoning high-voltage direct current (HVDC) power transmission market and aerospace applications where reliability in vacuum or harsh temperature cycles is paramount. The increasing miniaturization of electronic devices and electromechanical systems creates demand for micro-sized copper graphite components, opening niche manufacturing opportunities. Moreover, embracing sustainable manufacturing practices and utilizing recycled copper inputs could mitigate raw material cost volatility and enhance the market's environmental profile, addressing growing regulatory and consumer preference for sustainability. These opportunities require substantial R&D expenditure focused on nanoscale material integration and additive manufacturing techniques to fully capitalize on future demand cycles.

Segmentation Analysis

The Copper Graphite Materials market is rigorously segmented based on material composition, manufacturing process, and diverse end-use applications, providing a granular view of market dynamics and specialized demand areas. Segmentation by composition typically differentiates between high-copper content materials, favored for highly conductive electrical contacts and components, and high-graphite content materials, which are utilized where superior self-lubrication and low friction are the primary requirements, such as in bushings and sliding mechanical parts. The manufacturing technology is also a crucial segmenting factor, separating products made via traditional sintering from those produced through advanced techniques like specialized hot pressing or infiltration methods, which yield different performance metrics crucial for high-stress environments. This structure allows suppliers to target specific industry needs with highly optimized product lines, ensuring performance alignment with critical application specifications.

- By Type/Composition:

- Standard Copper Graphite (typically 60-90% Copper)

- High Graphite Content Composites (for enhanced lubricity)

- Copper Graphite with Metallic Additives (e.g., Tin, Lead, Silver)

- Infiltrated Copper Graphite

- By Process:

- Powder Metallurgy and Sintering

- Hot Pressing/Hot Isostatic Pressing (HIP)

- Casting and Infiltration

- By Application:

- Electrical Brushes and Contacts (Motors, Generators, Slip Rings)

- Self-Lubricating Bearings and Bushings

- Braking Components (Railway, Aerospace)

- Sealing Rings and Gaskets

- Switchgear and Current Collectors

- By End-Use Industry:

- Automotive (Starters, Alternators, EV Traction Motors)

- Industrial Machinery and Equipment

- Aerospace and Defense

- Power Generation and Distribution (Generators, Substations)

- Consumer Electronics and Appliances

Value Chain Analysis For Copper Graphite Materials Market

The value chain for Copper Graphite Materials is intricate, starting with the procurement of high-purity raw materials. The upstream segment involves mining, processing, and supplying electrolytic copper powder, along with various grades of natural, synthetic, or expanded graphite powder. The quality and particle size distribution of these precursor materials are crucial, as they dictate the final composite microstructure and performance characteristics. Key suppliers in this segment include major metal powder manufacturers and specialized graphite processors. The efficient management of this upstream segment is vital, as fluctuations in global commodity prices for copper directly impact the final product cost, requiring robust inventory and hedging strategies by composite manufacturers.

The midstream stage constitutes the core manufacturing process, primarily involving powder mixing, compaction, sintering (or hot pressing), and final machining/finishing of the components. Copper graphite composite producers invest heavily in proprietary processing techniques to control porosity, density, and the homogeneity of the graphite distribution within the copper matrix. Direct distribution channels are often favored for large-volume industrial clients, such as major motor manufacturers or automotive Tier 1 suppliers, facilitating technical collaboration and customization of material specifications. Indirect distribution, leveraging specialized industrial distributors and trading houses, typically serves smaller end-users and the aftermarket component replacement sector, providing localized support and rapid availability of standard products.

Downstream analysis focuses on the integration of these components into complex end-user systems across diverse industries. The end-users, including major OEMs in the automotive, aerospace, and industrial machinery sectors, place high demands on component reliability and longevity, making technical specifications and certification critical differentiating factors. The ability to provide comprehensive technical support and failure analysis services strengthens a manufacturer's position in the downstream market. The value chain is inherently driven by performance; therefore, continuous improvement in material science and adherence to rigorous quality standards, such as ISO and industry-specific certifications, are paramount for maintaining competitive advantage and ensuring component acceptance in mission-critical applications.

Copper Graphite Materials Market Potential Customers

Potential customers for Copper Graphite Materials span several high-value industrial sectors requiring components that reliably combine excellent electrical conductivity with enhanced wear resistance and self-lubricating characteristics. The automotive industry represents a foundational customer base, particularly manufacturers of starter motors, alternators, and increasingly, specialized high-voltage contacts and cooling systems within electric vehicle drivetrains. These components are essential for the efficient and reliable functioning of vehicle electrical systems, driving continuous bulk demand, both from OEM production lines and the aftermarket service sector for replacement parts, which often utilize standard copper graphite brush grades designed for durability and cost-effectiveness.

Another critical customer segment is the industrial machinery and heavy equipment manufacturing sector, encompassing producers of large-scale generators, electric motors, and specialized pumps and compressors. These industrial applications demand robust, high-current-carrying capabilities often found in copper graphite slip rings and heavy-duty commutator brushes designed to operate continuously under extreme mechanical loads and elevated temperatures. Furthermore, the burgeoning power generation industry, including wind turbine manufacturers and utility companies operating conventional and renewable power plants, are essential buyers, utilizing these materials in high-integrity collector systems where component failure is not tolerable and maintenance downtime must be minimized, placing a premium on high-specification, custom-engineered grades of copper graphite composites.

The aerospace and defense sector represents a specialized, high-tier customer group focused on components for aircraft starter-generators, landing gear systems (braking), and actuation mechanisms. These applications mandate materials with exceptional performance consistency, lightweight properties, and reliability across wide temperature fluctuations and high-altitude/vacuum environments. While volume demand may be lower compared to the automotive sector, the pricing power and margins within aerospace are significantly higher, driven by stringent certification requirements and long qualification processes. Additionally, manufacturers of specialized electronics, robotics, and medical devices requiring miniature, high-performance sliding contacts also contribute to the diverse customer portfolio, seeking custom formulations tailored for precision and minimal electrical noise generation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $785.4 Million |

| Market Forecast in 2033 | $1,160.9 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mersen Corporate Services SAS, Schunk Group, Morgan Advanced Materials plc, Stackpole International, GrafTech International, Toyo Tanso Co., Ltd., Dalian Carbon Co., Ltd., E-Carbon SpA, Graphite Metallizing Corporation, Helwig Carbon Products, Inc., Elektrokontakt-Gruppe, Gerken Group, SGL Carbon SE, Fuji Carbon Manufacturing Co., Ltd., Sinosteel Advanced Material Co., Ltd., Jiangsu Guangwei Precision Manufacturing Co., Ltd., L.D. Kichler Co., Inc., Electro-Nite Company, Becker Mining Systems AG, Elmetec GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Graphite Materials Market Key Technology Landscape

The technological backbone of the Copper Graphite Materials market is firmly rooted in advanced powder metallurgy (PM), which remains the dominant and most flexible manufacturing technique. This technology allows for the precise control of the microstructure, density, and porosity of the final composite, critical factors determining the electrical conductivity and mechanical wear properties. Key processes within PM include the selection and preparation of ultra-fine copper and graphite powders, followed by controlled mixing to ensure homogeneity. The subsequent compaction phase, utilizing high-pressure hydraulic presses, forms the green compact. The sintering process, often carried out in controlled atmospheres (e.g., hydrogen or inert gas) and at temperatures below copper's melting point, binds the particles together, achieving the desired strength and electrical connectivity. Recent technological innovations focus on improving powder packing efficiency and achieving nano-scale uniformity to enhance performance in demanding high-frequency and high-temperature applications, necessitating sophisticated thermal and kinetic control systems in the furnace environments.

Beyond conventional sintering, the market leverages specialized advanced processing techniques, such as Hot Isostatic Pressing (HIP) and melt infiltration, to create composites with superior mechanical strength and minimal porosity, essential for aerospace braking components and high-stress industrial bearings. HIP involves subjecting the material to elevated temperature and high inert gas pressure simultaneously, effectively eliminating internal voids and drastically improving density and fatigue resistance. Melt infiltration, conversely, utilizes molten copper to fill the porous network of a pre-formed graphite skeleton, resulting in a composite with high thermal shock resistance and near-zero porosity. The adoption of these advanced methods is driven by the need to develop materials capable of withstanding the increasingly severe operating conditions associated with modern high-power density electric motors and high-speed rail braking systems, where material failure can lead to catastrophic system breakdown.

Furthermore, the incorporation of secondary additives and nanotechnology represents a significant technological trend. Manufacturers are experimenting with ceramic fillers (like silicon carbide or alumina) or metal oxides to enhance wear resistance and mechanical hardness without excessive compromise to conductivity. The use of carbon nanotubes (CNTs) or graphene as reinforcing agents is currently under extensive research. These carbon allotropes offer superior mechanical strength and improved tribological properties, potentially leading to brushes and contacts with dramatically extended service lives and further reduced friction coefficients. Digital manufacturing integration, including process simulation software and real-time monitoring of particle characteristics during mixing and sintering, is also becoming standard practice. This data-driven approach, often leveraging AI analytics, optimizes yield rates, ensures batch consistency, and significantly reduces the time required for new material formulation development, thereby accelerating innovation within the competitive landscape.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: The APAC region, led by China, Japan, South Korea, and India, represents the largest and fastest-growing market for Copper Graphite Materials. This dominance is directly attributable to the region's massive manufacturing capacity in the automotive sector, particularly in electric and hybrid vehicle production, coupled with extensive growth in industrial automation and power infrastructure. China’s relentless investment in high-speed rail and utility-scale power transmission (including HVDC projects) creates a constant, high-volume demand for reliable current collectors, brushes, and specialized contacts. The regional market is characterized by intense price competition but also rapidly increasing standards as local manufacturers strive to meet global quality specifications, particularly in export-oriented automotive components.

- North American Market Focus on High Specification: North America maintains a mature, technology-intensive market, with primary demand focused on high-specification, high-reliability applications, particularly in the aerospace, defense, and heavy industrial machinery sectors. The U.S. remains a key driver due to strict regulations mandating long component lifecycles and performance consistency in mission-critical applications. The adoption of advanced, lead-free copper graphite compositions is prominent here, driven by environmental compliance standards. The region also acts as a significant hub for technological innovation, with close collaboration between material suppliers and Tier 1 automotive and aerospace system developers focused on advanced thermal management and high-frequency electrical system components.

- European Market for Sustainability and Rail: The European market is characterized by robust demand stemming from its well-established railway network and a strong industrial base focused on precision engineering and machine tools. Europe’s stringent environmental regulations, driven by initiatives like REACH, foster demand for sustainable and non-toxic compositions, leading to high adoption rates of lead-free and cadmium-free copper graphite materials, often produced using advanced powder metallurgy techniques. Germany, France, and the UK are key markets, with particular emphasis on energy-efficient motors and generator systems complying with EU efficiency directives. Furthermore, Europe is a leader in offshore wind energy, creating consistent demand for specialized slip rings and brush gear designed for harsh maritime environments.

- Latin America and MEA Emerging Opportunities: The markets in Latin America (LATAM) and the Middle East and Africa (MEA) are characterized as emerging, driven by increasing industrialization, infrastructure development, and growing energy needs. LATAM, particularly Brazil and Mexico, sees demand linked to domestic automotive manufacturing and mining operations. MEA market growth is heavily dependent on oil and gas infrastructure expansion (requiring heavy-duty industrial motors and components) and ambitious national diversification plans involving large-scale power generation and transport projects, offering long-term growth potential for basic and standard-grade copper graphite materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Graphite Materials Market.- Mersen Corporate Services SAS

- Schunk Group

- Morgan Advanced Materials plc

- Stackpole International

- GrafTech International

- Toyo Tanso Co., Ltd.

- Dalian Carbon Co., Ltd.

- E-Carbon SpA

- Graphite Metallizing Corporation

- Helwig Carbon Products, Inc.

- Elektrokontakt-Gruppe

- Gerken Group

- SGL Carbon SE

- Fuji Carbon Manufacturing Co., Ltd.

- Sinosteel Advanced Material Co., Ltd.

- Jiangsu Guangwei Precision Manufacturing Co., Ltd.

- L.D. Kichler Co., Inc.

- Electro-Nite Company

- Becker Mining Systems AG

- Elmetec GmbH

Frequently Asked Questions

Analyze common user questions about the Copper Graphite Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of graphite in copper graphite composites?

The primary function of graphite is to provide internal lubrication, which significantly lowers the coefficient of friction and minimizes wear on mating surfaces, such as commutators or slip rings. This self-lubricating property is crucial for components operating in sliding contact, ensuring low resistance, reduced heat generation, and extended operational lifespan without external lubrication.

Which key industries are driving the demand for advanced copper graphite materials?

Demand is fundamentally driven by the automotive industry, specifically the rapid expansion of Electric Vehicles (EVs) requiring high-performance contacts and braking systems, and the power generation sector, which needs reliable, high-current brushes and slip rings for industrial motors and utility-scale generators.

How does the manufacturing process, such as sintering, impact the material's properties?

Sintering controls the density, porosity, and microstructure homogeneity of the final composite. Precise temperature and atmosphere control during sintering ensure strong metallurgical bonding between copper particles while maintaining the distribution of graphite particles, optimizing the balance between electrical conductivity and mechanical wear resistance.

What are the main performance benefits of using copper graphite over traditional carbon brushes?

Copper graphite materials offer significantly higher electrical conductivity and superior thermal dissipation capabilities compared to traditional carbon brushes. This makes them ideal for high-current applications where heat buildup is a critical concern, leading to higher efficiency and reduced material degradation under heavy loads.

What are the technological opportunities shaping the future of copper graphite composites?

Future opportunities are concentrated in nanoscale material integration, specifically incorporating carbon nanotubes and graphene to enhance mechanical strength and reduce friction further. Additionally, process innovation through Artificial Intelligence (AI) and advanced powder metallurgy techniques (like HIP) aims to produce ultra-dense, high-reliability materials for extreme high-voltage applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager