Copper Semi-finished Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437804 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Copper Semi-finished Product Market Size

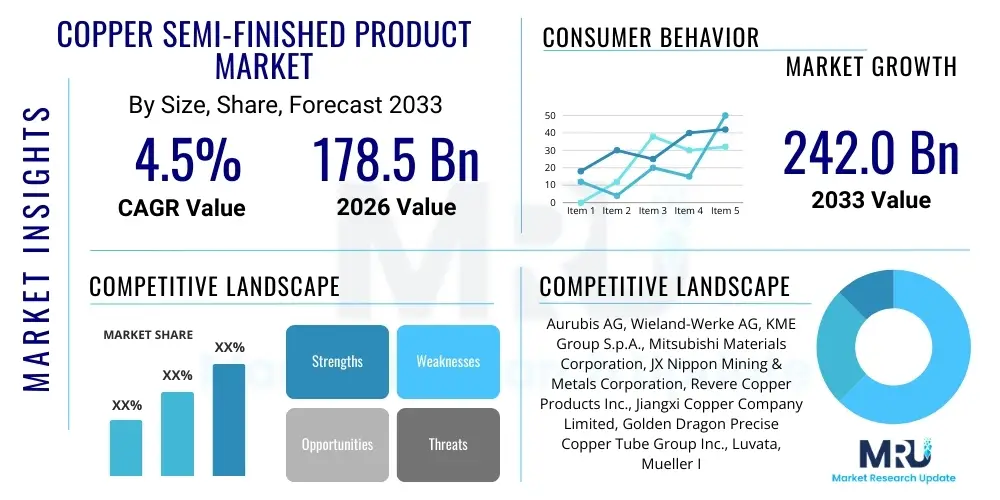

The Copper Semi-finished Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 178.5 Billion in 2026 and is projected to reach USD 242.0 Billion by the end of the forecast period in 2033.

Copper Semi-finished Product Market introduction

The Copper Semi-finished Product Market encompasses a vast array of materials processed from primary copper or copper alloys into standardized forms, ready for further manufacturing or integration into final products. These products, which include tubes, rods, sheets, plates, wires, and coils, are fundamental inputs across numerous global industries due to copper's unparalleled combination of high electrical and thermal conductivity, excellent corrosion resistance, and superior malleability. The processing techniques involved, such as extrusion, rolling, drawing, and casting, ensure that the semi-finished products meet rigorous specifications for consistency and performance required in high-stakes applications like electrical transmission and demanding construction projects. The versatility of copper semi-finished goods makes them indispensable components in the foundational infrastructure of the modern electrified economy.

Major applications of these semi-finished copper goods span critical sectors globally. In the electrical and electronics sector, copper wire and strips are essential for power transmission cables, wiring harnesses, and printed circuit boards, driving efficiency in consumer electronics and industrial machinery. The construction industry utilizes copper tubes for plumbing, HVAC systems, and architectural cladding due to their durability and inherent antimicrobial properties. Furthermore, the automotive and transportation sector relies heavily on copper for radiators, heat exchangers, and increasingly, high-voltage wiring systems in electric vehicles (EVs). These extensive applications highlight the strategic importance of this market as a barometer for global industrial activity and technological advancement, particularly in areas focused on electrification and energy efficiency.

The primary driving factors for sustained market growth include the global push towards renewable energy infrastructure, specifically wind and solar power, which requires substantial volumes of copper wiring and busbars. Additionally, the rapid adoption of electric vehicles mandates significantly higher copper content per unit compared to traditional combustion engine vehicles, fueling demand for specific semi-finished products like high-purity copper rods and specialized wires. Urbanization and associated construction activities, particularly in emerging economies in Asia Pacific, further solidify the demand foundation. Benefits derived from using copper semi-finished products include enhanced longevity of electrical systems, improved energy transfer efficiency, and reduced maintenance costs across various industrial lifecycles, cementing copper's position as a premium material.

Copper Semi-finished Product Market Executive Summary

The Copper Semi-finished Product Market is characterized by robust long-term growth, primarily propelled by global electrification trends and infrastructure spending. Business trends indicate a significant shift towards value-added processing, focusing on producing high-precision, thinner gauge, and specialized alloys tailored for demanding applications such as 5G network components and advanced heat dissipation solutions. Market participants are increasingly investing in sustainable production methods, including enhanced recycling infrastructure (secondary copper production), to mitigate reliance on primary mining and address corporate sustainability mandates. This strategic pivot towards circular economy models is vital for managing volatile copper prices and ensuring supply stability, which are critical operational concerns for major fabricators and end-users.

Regional trends reveal Asia Pacific (APAC) as the dominant market, driven by massive investments in residential construction, electronics manufacturing hubs, and large-scale public infrastructure projects, notably high-speed rail and utility grid modernization in China and India. North America and Europe, while mature markets, are experiencing revitalized demand due to stringent energy efficiency regulations and substantial governmental stimulus packages targeting green infrastructure and EV charging networks. These regions prioritize quality and specialty products, demanding high-specification tubes and precision components for HVAC and aerospace applications. The regulatory landscape across these regions often dictates material specifications, favoring copper for its reliability and environmental profile over alternatives in specific utility and medical applications.

Segment trends underscore the robust performance of the Electrical & Electronics application segment, fueled by the accelerating proliferation of data centers, smart grids, and renewable energy installations. In terms of product type, copper wires and rods continue to represent the largest volume, reflecting their essential nature in current transmission. However, the fastest growth is anticipated in specialized copper tubes and coils designed for efficient heat exchange in high-performance HVAC systems and refrigeration. This segmentation analysis suggests that future profitability will be concentrated not solely on volume, but on the capacity to produce specialized, high-tolerance semi-finished goods that meet the stringent performance requirements of next-generation industrial and electronic systems.

AI Impact Analysis on Copper Semi-finished Product Market

User inquiries regarding AI's influence on the Copper Semi-finished Product Market center predominantly on operational efficiency, predictive maintenance, and strategic sourcing. Key themes include concerns about how AI can stabilize material costs amidst volatility, optimize energy-intensive smelting and fabrication processes, and enhance quality control during high-speed rolling and drawing operations. Users are keenly interested in predictive analytics capabilities to forecast demand accurately across various end-user segments (e.g., anticipating spikes related to specific construction project timelines) and minimizing waste through precise process adjustments. Furthermore, there is significant expectation that AI integration will lead to fully automated or lights-out manufacturing facilities, thereby improving labor productivity and maintaining competitive edge against global rivals.

The implementation of Artificial Intelligence and Machine Learning (ML) algorithms is set to revolutionize manufacturing processes within the copper fabrication industry. AI-driven predictive modeling can analyze complex inputs such as raw material composition, furnace temperature, and roll pressure in real-time to optimize material flow and microstructure development, ensuring higher yield and product consistency, especially for specialized alloys. This capability minimizes material scrap, which is crucial given the high cost of copper, directly impacting the overall profitability of fabricators. Advanced sensors integrated with ML systems are capable of detecting minute defects in sheets or wires during production runs, significantly improving quality assurance beyond traditional manual or semi-automated inspection systems, thus ensuring products meet the ultra-high reliability standards required by industries like aerospace and medical devices.

Beyond the manufacturing floor, AI is transforming supply chain management and logistics. Machine learning models can analyze vast datasets concerning global copper reserves, geopolitical factors, shipping routes, and energy market fluctuations to provide highly accurate price and demand forecasts, allowing procurement teams to make more informed hedging and purchasing decisions. Furthermore, AI optimizes the scheduling and dispatch of finished goods, minimizing transportation costs and carbon footprint, aligning with global sustainability goals. This strategic application of AI moves the industry from reactive operational management to proactive strategic planning, enhancing resilience against market shocks and improving overall supply chain visibility from cathode production to final delivery of semi-finished goods to end-users.

- AI optimizes material yield and reduces scrap rates in rolling and drawing processes through real-time parameter adjustments.

- Machine Learning enhances quality control by automating defect detection using high-resolution sensor data, ensuring product conformity.

- Predictive maintenance schedules equipment upkeep, minimizing unplanned downtime in energy-intensive fabrication facilities.

- AI algorithms improve supply chain forecasting and commodity price hedging, stabilizing input costs for fabricators.

- Automation driven by AI facilitates smarter energy consumption patterns, lowering operational expenditures in smelting and heating steps.

DRO & Impact Forces Of Copper Semi-finished Product Market

The Copper Semi-finished Product Market is characterized by a strong interplay of growth drivers (D), structural restraints (R), and compelling opportunities (O), creating complex impact forces. Primary drivers include rapid global electrification, spurred by the mandatory transition to electric vehicles (EVs) and massive investment in renewable energy infrastructure (solar farms, offshore wind). These developments necessitate high volumes of copper wires, busbars, and specialized connectors. The key restraints primarily revolve around the inherent volatility of primary copper prices, which directly affects the fabrication cost and profitability margins, alongside increasing regulatory pressure concerning environmental impacts of mining and smelting. Opportunities arise from technological advancements in high-performance alloys and the expansion of smart grid technologies, requiring custom, high-efficiency copper components. These factors collectively exert significant impact forces on strategic decision-making, compelling market participants to balance supply chain resilience with innovation and cost control.

Drivers are exerting the strongest positive impact. The regulatory push for energy efficiency standards globally demands superior conductivity materials, strongly favoring copper over substitutes like aluminum in many high-power applications. Furthermore, the sustained global urbanization trend necessitates continuous expansion and upgrading of power transmission and distribution networks, consistently boosting demand for copper conductors and cables. The move towards digitalization and 5G deployment also requires increased copper content in data centers and high-frequency communication equipment, ensuring a stable, high-growth application base. These underlying macroeconomic trends provide a resilient foundation for long-term demand, enabling fabricators to invest confidently in expanding their processing capacities and developing novel product forms to meet evolving engineering specifications in critical infrastructure.

Conversely, restraints require strategic mitigation. The heavy capital expenditure required for establishing and modernizing copper fabrication plants presents a significant barrier to entry, concentrating market power among a few large global players. Furthermore, the global drive towards a low-carbon economy paradoxically places pressure on traditional copper mining and smelting practices, necessitating expensive transitions to greener processing technologies, which can temporarily inflate operational costs. Opportunities, however, allow for differentiation, particularly the development of recycled, or "green," copper products. Fabricators who can secure reliable sources of high-quality copper scrap and implement advanced recycling technologies are poised to capture premium segments of the market driven by corporate ESG (Environmental, Social, and Governance) commitments, thereby transforming a sustainability challenge into a competitive advantage.

Segmentation Analysis

The Copper Semi-finished Product Market is systematically segmented based on product form, application, and processing method, providing a granular view of demand distribution and technological requirements. The diversity in product forms, ranging from precision tubes used in aerospace heat exchangers to large structural rods utilized in heavy machinery, reflects the breadth of industrial consumption. Analyzing these segments is crucial for strategic alignment, as specific end-use sectors, such as Electric Vehicles (EVs), require unique alloy compositions and tighter manufacturing tolerances compared to general construction applications. This detailed segmentation helps market players identify high-growth niches and allocate resources efficiently towards advanced production capabilities like specialized drawing and continuous casting techniques necessary for high-performance applications.

- Product Type:

- Tubes (Seamless, Welded, Finned)

- Rods and Bars (Round, Square, Hexagonal)

- Sheets and Plates (Thin Gauge, Thick Gauge, Strip)

- Wires and Cables (Magnet Wire, Power Cable Conductors)

- Coils and Strips

- Application:

- Electrical and Electronics (Wiring, PCBs, Connectors, Busbars)

- Construction (Plumbing, Roofing, Architectural Cladding, HVAC)

- Industrial Machinery and Equipment (Heat Exchangers, Industrial Motors)

- Automotive and Transportation (Radiators, Wiring Harnesses, EV Batteries)

- Consumer Goods and Others (Coinage, Appliances)

- Process:

- Extrusion

- Rolling

- Drawing

- Casting (Continuous Casting, Upward Casting)

- End-Use Grade:

- High Purity Copper (C10100, Oxygen-Free)

- Copper Alloys (Brass, Bronze, Copper Nickel)

Value Chain Analysis For Copper Semi-finished Product Market

The value chain for copper semi-finished products commences with upstream activities involving the mining and concentration of copper ore, followed by smelting and refining to produce primary copper cathodes (99.99% purity). This upstream segment is highly capital-intensive and geographically concentrated, making the cost and availability of refined copper cathodes the single most significant determinant of downstream profitability. Price volatility in the commodities market profoundly influences the procurement strategies of semi-finished product fabricators. Key upstream risks include geopolitical instability affecting mining operations and regulatory changes impacting environmental compliance in smelting facilities, demanding strong hedging mechanisms and diversified sourcing strategies from downstream players.

Midstream processing involves the transformation of cathodes into semi-finished forms (rods, sheets, tubes) through sophisticated manufacturing processes such as continuous casting, hot rolling, cold drawing, and extrusion. This stage requires specialized machinery, proprietary technical expertise regarding alloy formulation, and significant energy input. Fabricators add substantial value here by meeting exact customer specifications regarding dimensional tolerance, surface finish, and specific metallurgical properties. Downstream distribution involves a complex network, utilizing both direct sales channels to large OEMs (Original Equipment Manufacturers) in the automotive and electrical sectors, and indirect channels through specialized distributors and trading houses that cater to smaller contractors and maintenance markets. Efficient logistics and warehousing are critical to minimize inventory costs and meet just-in-time delivery requirements for construction and manufacturing schedules.

The direct channel, favored by major integrated copper producers, allows for better relationship management, quicker feedback on product performance, and customized product development for strategic partners. Conversely, the indirect channel, managed by specialized metal service centers and distributors, offers inventory management flexibility, smaller batch sizes, and value-added services like cutting and slitting, thereby broadening market reach, especially into fragmented sectors like residential construction and local electronics assembly. The success of the distribution strategy hinges on optimizing the balance between direct control over high-volume sales and leveraging the localized expertise and reach of the indirect distribution network.

Copper Semi-finished Product Market Potential Customers

Potential customers for copper semi-finished products are large-scale industrial entities and manufacturers requiring materials with high electrical and thermal performance, durability, and corrosion resistance. The primary end-users fall within the Electrical & Electronics sector, including power generation companies, grid operators, and manufacturers of high-performance electronic components, who purchase high-purity copper rods and wires for transmission lines, transformers, and intricate circuitry. A significant and rapidly expanding customer segment is the Automotive industry, particularly EV manufacturers and component suppliers, who require specialized copper materials for battery packs, charging infrastructure, and lightweight motor windings, prioritizing products that offer superior current carrying capacity and thermal management properties.

The Construction sector represents another vast customer base, consuming copper tubes for potable water systems, refrigerant lines (HVAC), and fire sprinkler systems, appreciating copper's longevity, antimicrobial characteristics, and ease of installation. Large infrastructure contractors and architectural firms are key decision-makers in this segment. Furthermore, the Industrial Machinery segment, encompassing manufacturers of large heat exchangers, industrial motors, and chemical processing equipment, requires specialized brass and bronze alloys (copper semi-finished products) for components that must withstand harsh operating conditions, mechanical stress, and corrosive environments. These buyers demand certified quality and compliance with stringent material standards.

Finally, smaller but strategically important customers include specialized medical device manufacturers, particularly those creating sophisticated MRI equipment or surgical tools, where specific copper alloys are used for shielding and conductivity due to their precise properties. Defense contractors and aerospace manufacturers also represent high-value customers, purchasing ultra-high-reliability copper products for critical systems, where material failure is unacceptable. Procurement decisions in these sectors are heavily influenced by supplier certification, traceability, and the ability of the fabricator to meet extremely tight tolerances and specialized coating requirements, ensuring that the focus shifts from lowest cost to proven, consistent quality and compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 178.5 Billion |

| Market Forecast in 2033 | USD 242.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Aurubis AG, Wieland-Werke AG, KME Group S.p.A., Mitsubishi Materials Corporation, JX Nippon Mining & Metals Corporation, Revere Copper Products Inc., Jiangxi Copper Company Limited, Golden Dragon Precise Copper Tube Group Inc., Luvata, Mueller Industries Inc., Hitachi Metals Ltd., Southwire Company LLC, Furukawa Electric Co. Ltd., Copper Alliance, MKM Mansfelder Kupfer und Messing GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Copper Semi-finished Product Market Key Technology Landscape

The technological landscape in the Copper Semi-finished Product Market is continuously evolving, focusing heavily on enhancing product purity, improving energy efficiency in fabrication, and developing advanced alloys with superior performance characteristics. Continuous casting technology remains pivotal, allowing for the rapid and economical production of high-quality copper and copper alloy billets and rods with minimal defects. Innovations in continuous casting focus on precise temperature control and electromagnetic stirring mechanisms to ensure uniform microstructure and surface quality, which are crucial for subsequent drawing processes, particularly for ultra-thin wires used in high-frequency electrical applications. Furthermore, the integration of advanced automation and robotics is becoming standard practice in high-volume rolling and drawing lines, reducing human error and boosting production speeds, thereby lowering the cost per ton of finished product.

A major focus area is the development of specialized copper alloys tailored for specific next-generation applications. For instance, high-strength, high-conductivity copper alloys (like C18200 and copper-chromium alloys) are crucial for EV components and high-heat environments, requiring highly precise heat treatment and aging processes that are managed by sophisticated thermal processing equipment. Research and development efforts are also concentrated on creating copper-based materials that offer increased resistance to softening at elevated temperatures, which is essential for components in advanced industrial motors and specific automotive applications where weight reduction and sustained performance under thermal load are paramount. These material science advancements are enabling copper products to maintain their competitive edge against lighter materials in demanding structural and thermal applications.

Sustainability and resource efficiency drive further technological improvements, particularly in secondary copper production (recycling). Modern pyro- and hydrometallurgical recycling facilities utilize advanced separation and refining techniques to process complex scrap mixtures while maintaining the integrity and purity of the recovered copper, reducing the energy intensity and environmental footprint compared to primary mining. Additionally, surface treatment and coating technologies are gaining prominence, where thin layers of protective materials are applied to semi-finished products (especially tubes and strips) to enhance corrosion resistance or facilitate easier joining processes, thereby adding significant functional value downstream. The adoption of Industry 4.0 principles, including pervasive sensor deployment and data analytics throughout the factory, is underpinning these technological shifts, leading to predictive quality management and unprecedented levels of operational control.

Regional Highlights

- Asia Pacific (APAC) dominates the market, primarily driven by China, India, and Southeast Asian nations. This region benefits from rapid urbanization, massive infrastructure projects (including smart cities and high-speed rail), and its status as the world's leading manufacturing hub for electronics and appliances. The significant governmental commitment to renewable energy installation and the localization of electric vehicle production are fueling exponential demand for copper wires and busbars, necessitating continuous expansion of fabrication capacity.

- North America, characterized by stringent quality standards and high technological maturity, focuses heavily on specialty copper products, particularly for aerospace, medical technology, and high-specification HVAC systems. Demand is significantly boosted by governmental infrastructure bills aimed at grid modernization and the aggressive rollout of EV charging networks, which require large volumes of heavy-gauge copper conductors. The region prioritizes recycled and sustainably sourced copper.

- Europe maintains a substantial market share, marked by a strong regulatory framework promoting energy efficiency and sustainable construction. Key demand drivers include the renovation of aging building stock, the proliferation of efficient heat pumps utilizing specialized copper tubes, and the robust presence of the premium automotive manufacturing sector, which is rapidly transitioning to electrified powertrains, demanding complex, high-performance copper wire harnesses and cooling components.

- Latin America is characterized by significant upstream activity, being a major global source of primary copper (Chile, Peru). While regional downstream fabrication is growing, its market consumption is driven largely by mining infrastructure, power generation expansion, and localized construction projects. The region presents opportunities for investment in midstream processing to reduce reliance on imported semi-finished goods and enhance local value addition.

- Middle East and Africa (MEA) exhibit growth tied to large-scale development projects, particularly in the Gulf Cooperation Council (GCC) states. Investments in smart city initiatives (e.g., NEOM), diversification away from hydrocarbon economies, and essential utility network expansion (water and power) necessitate consistent imports of high-quality copper tubes and cables, making this region a crucial net importer in the global market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Copper Semi-finished Product Market.- Aurubis AG

- Wieland-Werke AG

- KME Group S.p.A.

- Mitsubishi Materials Corporation

- JX Nippon Mining & Metals Corporation

- Revere Copper Products Inc.

- Jiangxi Copper Company Limited

- Golden Dragon Precise Copper Tube Group Inc.

- Luvata

- Mueller Industries Inc.

- Hitachi Metals Ltd.

- Southwire Company LLC

- Furukawa Electric Co. Ltd.

- Copper Alliance

- MKM Mansfelder Kupfer und Messing GmbH

- Topy Industries Limited

- Haldyn Glass Limited (Focusing on specific copper alloys)

- Sumitomo Electric Industries, Ltd.

- Seido Chemical Industry Co., Ltd.

- TCF Copper

Frequently Asked Questions

Analyze common user questions about the Copper Semi-finished Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Copper Semi-finished Product Market?

Market growth is predominantly driven by global electrification, rapid adoption of Electric Vehicles (EVs) which utilize significantly more copper than traditional cars, and substantial investments in renewable energy infrastructure and smart grid technologies worldwide. These applications require high volumes of specialized copper wires, rods, and busbars for efficient power transmission.

Which product type segment holds the largest market share in terms of volume?

The Wires and Rods segment consistently holds the largest volume share. Copper rods are the foundational product for drawing into various wire gauges, which are indispensable for power transmission, electrical grounding, telecommunications, and high-volume wiring harnesses in the automotive sector.

How does copper price volatility impact the profitability of semi-finished product manufacturers?

Copper price volatility, tied to global commodity markets, represents a major constraint. High price fluctuations compress the profit margins of fabricators, who often operate on fixed conversion costs. Manufacturers mitigate this risk through strategic hedging, long-term supply contracts, and increasing the integration of recycled copper into their production inputs.

What is the role of specialized copper alloys in the future of this market?

Specialized copper alloys (such as brass, bronze, and copper-nickel) are critical for high-performance applications demanding enhanced properties like greater strength, superior thermal management, or extreme corrosion resistance. The market is seeing increased demand for these alloys in aerospace, complex heat exchangers, and high-voltage EV battery systems, driving growth in the high-value segment.

Which geographic region is projected to exhibit the highest Compound Annual Growth Rate (CAGR)?

Asia Pacific (APAC) is projected to exhibit the highest CAGR due to massive ongoing infrastructure development, rapid industrialization, the booming electronics manufacturing sector, and the immense scale of renewable energy capacity additions, particularly in countries like China, India, and Vietnam.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager