Corded Circular Saw Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431601 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Corded Circular Saw Market Size

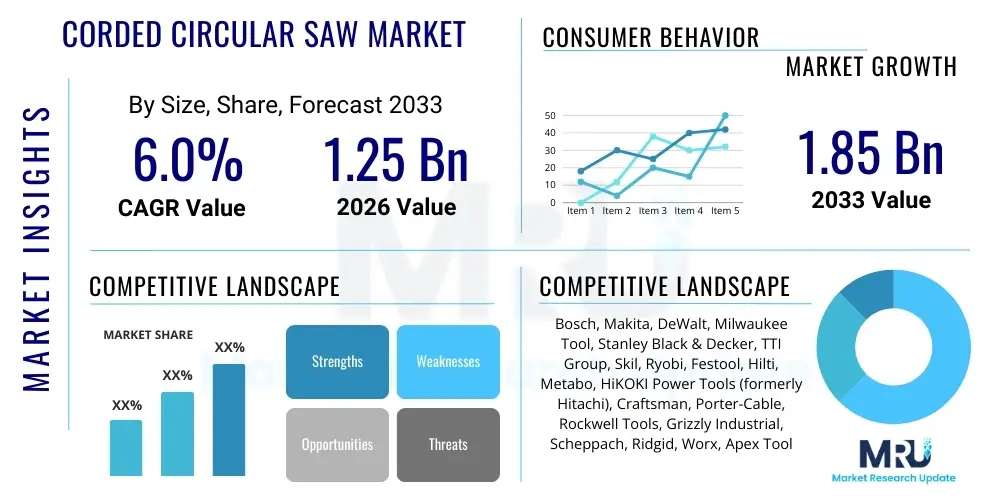

The Corded Circular Saw Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.0% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent growth trajectory is driven primarily by sustained activity in the global construction and renovation sectors, particularly in emerging economies where professional and semi-professional users rely heavily on the continuous power delivery and reliability offered by corded models compared to their cordless counterparts.

Corded Circular Saw Market introduction

The Corded Circular Saw Market encompasses the sale and distribution of electric rotary saws powered by a direct electrical connection, designed for cutting wood, plastic, masonry, or metal using a toothed or abrasive disc. These tools are indispensable in construction, woodworking, and general fabrication industries due to their high power output, consistent performance, and lack of battery dependency, making them suitable for prolonged, heavy-duty applications. Product types range significantly based on blade size, motor output (measured in Amps or Watts), and specific design features such as worm drive or sidewinder configurations, catering to a diverse set of end-users from professional framers and builders to serious DIY enthusiasts requiring reliable cutting precision.

Major applications of corded circular saws include structural framing, decking installation, plywood and OSB cutting, and specialized cutting of dense materials using appropriate blades. Key benefits driving their adoption include superior torque delivery, eliminating downtime associated with battery recharging, and generally lower lifetime ownership costs compared to high-end cordless equivalents, especially in stationary or workshop environments where power access is not a constraint. These saws are highly valued for their robustness and ability to handle the toughest materials encountered in commercial and residential construction projects, ensuring deep and accurate cuts consistently throughout the workday.

Driving factors for this market segment include the ongoing global infrastructural development, a resurgence in residential home building and remodeling activities, and technological advancements focusing on improved motor efficiencies (such as brushed vs. brushless comparisons, even in corded tools), better ergonomic designs to reduce user fatigue, and enhanced safety features like electric brakes and advanced blade guards. Furthermore, the persistent demand for durable and high-amperage tools within industrial maintenance and professional contracting spheres ensures that the corded segment retains a significant and stable market share, even amidst the rapid innovation seen in cordless technology.

Corded Circular Saw Market Executive Summary

The global Corded Circular Saw Market is characterized by mature technology but continuous refinement focused on durability and safety standards. Business trends highlight a strong competitive landscape dominated by established power tool manufacturers who leverage brand recognition, expansive distribution networks, and innovation in materials science, particularly in motor design and blade technology, to maintain market position. A key trend involves manufacturers focusing on high-amperage, heavy-duty models (15 Amps and above) targeted specifically at the professional construction sector, differentiating these offerings through advanced features such as magnesium shoe construction for reduced weight and improved sightlines, further solidifying their advantage over lower-tier brands.

Regionally, North America and Europe remain the largest revenue contributors, supported by stringent building codes necessitating professional-grade tools and significant expenditure on residential renovation projects. However, the Asia Pacific (APAC) region is poised for the highest growth rate, fueled by massive urbanization, infrastructure development in countries like India and China, and the expansion of domestic manufacturing capabilities, leading to increased accessibility and affordability of these essential tools. This shift requires multinational corporations to adapt their product portfolios to meet diverse regional power requirements and price sensitivities, often necessitating localized sourcing and manufacturing strategies.

Segment trends reveal that the 7-1/4 inch blade diameter segment dominates due to its versatility and industry standardization in general construction. Furthermore, the professional end-user segment commands the highest market value, prioritizing factors such as sustained cutting performance, deep cut capacity, and longevity over initial purchase price. Distribution channels are undergoing a transformation, with e-commerce platforms gaining traction by offering broader product selections, competitive pricing, and in-depth product reviews, though traditional brick-and-mortar retailers continue to serve as critical points for immediate purchase, tool demonstrations, and professional consultative sales.

AI Impact Analysis on Corded Circular Saw Market

User queries regarding the impact of Artificial Intelligence on the Corded Circular Saw market primarily revolve around operational integration, predictive maintenance capabilities, and enhancements in job site safety and efficiency, often reflecting a concern that traditional tools might become obsolete. The analysis shows users are seeking clarity on whether AI can optimize cutting paths, monitor tool health proactively, or integrate standard power tools into smart construction ecosystems. The key themes summarized are the expectation of enhanced diagnostic features embedded within the tools or associated platforms, the role of machine learning in optimizing motor performance under varying loads, and the potential for AI-driven safety protocols that go beyond basic mechanical guards, aiming for predictive hazard identification during operation. Although corded saws are conventional tools, AI influence is expected through ancillary services, smart accessories, and digital integration rather than fundamental changes to the core cutting mechanism.

- Enhanced Predictive Maintenance: AI algorithms analyzing motor temperature, vibration patterns, and current draw to predict component failure, alerting users before operational breakdown occurs.

- Optimized Cutting Parameters: Integration of smart sensors providing real-time feedback on material density and optimizing motor speed and torque settings for efficient cutting, reducing kickback risks.

- Inventory and Asset Management: AI-driven tracking systems (enabled by embedded smart tags) improving tool location, usage monitoring, and streamlining professional fleet management on large construction sites.

- Augmented Safety Features: Machine vision integration in next-generation accessories or guards to detect human proximity to the blade zone and trigger instant braking or lockdown mechanisms (leveraging advanced computer vision).

- Supply Chain Optimization: Utilization of AI in forecasting component demand (e.g., motors, casings) based on market trends and ensuring more resilient and cost-effective manufacturing processes for corded tools.

- Quality Control in Manufacturing: AI-based inspection systems rapidly identifying microscopic flaws in blades, bearings, and motor windings during production, ensuring higher product consistency and reliability.

DRO & Impact Forces Of Corded Circular Saw Market

The Corded Circular Saw Market is propelled by strong demand drivers such as the continuous global expenditure on residential and commercial construction, the inherent requirement for robust, high-power cutting solutions in professional environments, and the economic benefit of zero downtime associated with battery charging. However, the market faces significant restraints, primarily the pervasive shift toward high-performance, interchangeable battery systems in the cordless tool sector, which offers unparalleled mobility and convenience, challenging the traditional market dominance of corded tools, particularly for smaller projects or remote job sites. Opportunities emerge in developing specialized saw variants tailored for unique materials (e.g., fiber cement, metal), integrating advanced dust extraction capabilities to meet stricter environmental and health regulations, and focusing on niche markets that prioritize sustained power and deep cutting capability, such as heavy-duty framing and concrete cutting applications where maximum continuous torque is essential.

Impact forces operating within this market are substantial, creating a dynamic competitive environment. The threat of substitutes, particularly high-voltage cordless saws, exerts continuous downward pressure on the market share and pricing power of standard corded models. Meanwhile, the bargaining power of buyers, especially large professional contractors and major retail chains, remains high due to product standardization and the availability of numerous competing brands, necessitating constant innovation in features like electric brakes, durable bases, and extended warranties to secure purchase decisions. Regulatory pressures concerning job site safety (OSHA standards, regional health codes) necessitate manufacturers invest continuously in features such as improved blade guards, dust management systems, and ergonomic designs to comply with evolving standards and maintain market acceptance.

The primary driver remains the indispensable nature of the corded saw for high-volume, repetitive cutting where power interruption is unacceptable. Professionals consistently choose corded tools for the assurance of maximum output required for dense or treated lumber, where battery limitations can significantly impede workflow. Conversely, the main restraint is the logistical hurdle presented by cords (tripping hazards, limited range), which is increasingly seen as a liability on modern, complex construction sites, pushing marginal users towards cordless flexibility. Opportunities lie strongly in improving the cord management ergonomics and integrating smart technology that enhances safety without sacrificing the inherent power advantage of the corded platform, thereby maximizing the tool's appeal in fixed-location professional settings.

Segmentation Analysis

The Corded Circular Saw market is segmented based on several key criteria, allowing manufacturers to tailor products to specific professional and consumer demands. Segmentation by blade diameter is crucial, as it directly correlates with the maximum cutting depth and intended application, ranging from small hobbyist saws to large industrial models. Application-based segmentation distinguishes between the demanding requirements of professional contractors, who prioritize durability, high torque, and continuous performance, and the cost-sensitivity and general utility sought by DIY users. Furthermore, segmentation by sales channel (online versus offline) dictates marketing and distribution strategies, reflecting changing consumer purchasing behaviors and the need for both physical examination and digital convenience in the buying process.

Detailed analysis of the market segments confirms the dominance of the professional end-user segment, which demands premium features, including advanced motor ventilation for prolonged use, highly durable gearing, and specialized protective coatings against harsh job site environments. Within the product type, standard sidewinder circular saws hold a larger volume share due to their affordability and familiarity, while worm drive saws command a significant value share, primarily within North American framing markets, owing to their distinct torque distribution and handling characteristics, which are preferred for intense, repetitive cutting. Manufacturers are continuously introducing hybrid models that attempt to merge the lightweight nature of sidewinders with the torque performance traditionally associated with worm drive mechanisms.

Geographic segmentation is critical for tailoring power requirements (110V/220V) and safety certifications (UL, CE). The emerging markets in APAC are driving growth in the sub-USD 100 price bracket, emphasizing value and essential functionality, whereas mature markets demand premium, feature-rich tools that adhere to strict environmental standards, especially regarding dust control and noise reduction. The increasing complexity of construction materials, such as engineered wood products (LVL, glulam), further necessitates the development of specialized, high-powered corded saws capable of handling these dense materials efficiently and reliably throughout their lifecycle, ensuring the segments remain distinct and relevant despite the rise of alternative tool technologies.

- By Blade Diameter

- 6-1/2 inch and below (Light Duty/Small Projects)

- 7-1/4 inch (Standard Professional and DIY Use)

- 8 inch to 10 inch (Heavy Duty/Specialty Cuts)

- By Application/End-User

- Professional Contractors (Framers, Roofers, Remodelers)

- Industrial Woodworking/Fabrication

- Residential DIY/Hobbyists

- By Drive Type

- Sidewinder (Direct Drive)

- Worm Drive (Gear Drive)

- By Distribution Channel

- Offline Retail (Home Centers, Specialty Stores, Dealer Networks)

- Online Retail (E-commerce Platforms, Company Websites)

Value Chain Analysis For Corded Circular Saw Market

The value chain for the Corded Circular Saw Market begins with the upstream activities involving the sourcing of critical raw materials, primarily steel (for blades and arbor), high-grade plastics (for housing), aluminum and magnesium alloys (for base plates and motor casings), and specialized electronic components (motors, switches, power cords). Manufacturing excellence at this stage is crucial, focusing on precision machining, motor winding efficiency, and stringent quality control of components to ensure tool durability and compliance with electrical safety standards. Strong relationships with suppliers specializing in high-performance tungsten carbide tips for saw blades are vital for maintaining the tool's primary function—cutting performance—thereby optimizing the initial cost structure and the subsequent reliability of the final product.

Mid-stream activities encompass the actual manufacturing, assembly, and rigorous testing of the corded saws. Leading manufacturers often operate specialized assembly lines to achieve high production volumes while adhering to precise tolerances necessary for smooth operation and user safety. Product differentiation often occurs here through proprietary motor technology (e.g., advanced gearing systems for increased torque) and ergonomic design focused on weight balance and reduced vibration. Logistics and warehousing play a critical role, ensuring that the heavy and bulky tools are efficiently managed and distributed to regional hubs globally, accounting for varying inventory demands tied to seasonal construction cycles and promotional activities across different geographical areas.

Downstream analysis focuses on the distribution channels, which are typically bifurcated into direct and indirect routes. Direct sales often involve large-volume contracts with major construction firms or industrial clients, while indirect sales dominate the professional and DIY markets through broad distribution networks. The most common indirect channels are large-scale home improvement retailers (e.g., Home Depot, Lowe’s), specialized tool distributors, and, increasingly, robust e-commerce platforms like Amazon or specialized online tool stores. E-commerce enables manufacturers to bypass some intermediaries, offering competitive pricing and direct consumer engagement, but traditional retail remains essential for hands-on demonstrations, immediate availability, and professional relationship building, particularly within the contractor segment which demands rapid access to tools and replacement parts.

Corded Circular Saw Market Potential Customers

The primary customers for corded circular saws are segmented based on their usage frequency, necessary power requirements, and purchasing priorities. Professional contractors, including framers, residential builders, and commercial remodelers, represent the most valuable customer segment. These buyers prioritize continuous, high-amperage power, durability under heavy use, superior ergonomics for long workdays, and specific features such as powerful electric brakes and robust shoe plates capable of surviving job site abuse. Their purchasing decisions are driven by total cost of ownership (TCO) and tool reliability, often leading them to premium brands known for longevity and strong customer service support, ensuring minimal workflow disruption.

A second major customer group includes dedicated DIY enthusiasts and serious hobbyists who undertake extensive home renovation projects. This segment seeks tools that bridge the gap between professional-grade durability and consumer-friendly pricing. They value performance consistency, easy-to-use safety features, and often gravitate towards mid-range models that offer better power output than entry-level tools but may not require the extreme longevity demanded by daily commercial use. These customers are heavily influenced by online reviews, tutorials, and recommendations from retail staff, leading to strong sales through large home improvement centers that stock a broad range of branded products.

Further potential customers include industrial facilities, educational institutions, and maintenance departments that require reliable cutting tools for ongoing repairs, fabrication, and shop use. Unlike construction professionals who need mobility, these customers typically operate in stationary environments where power access is guaranteed. They prioritize powerful, often specialized saws for unique materials (e.g., cutting metal or plastic piping) and require tools with high capacity and stringent safety certifications suitable for institutional settings. The purchasing criteria here often include long-term parts availability and specific institutional safety mandates, driving demand for heavy-duty, fixed-base saw accessories and models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bosch, Makita, DeWalt, Milwaukee Tool, Stanley Black & Decker, TTI Group, Skil, Ryobi, Festool, Hilti, Metabo, HiKOKI Power Tools (formerly Hitachi), Craftsman, Porter-Cable, Rockwell Tools, Grizzly Industrial, Scheppach, Ridgid, Worx, Apex Tool Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corded Circular Saw Market Key Technology Landscape

The technology landscape for corded circular saws, while fundamentally mature, is seeing persistent innovation focused on enhancing motor performance, improving user safety, and reducing overall tool weight and vibration. A significant technological focus is on optimizing the electric motor itself; this includes utilizing advanced materials in windings and rotors to maximize power density (Amps to output) and thermal management. High-performance models often feature advanced cooling systems and durable gear trains (especially in worm drive configurations) designed to withstand prolonged periods of high load without overheating or premature wear. The integration of electronic controls, such as soft-start mechanisms, is becoming standard, reducing the torque kickback at start-up and increasing the precision and lifespan of the motor components.

Material innovation plays a crucial role in improving tool ergonomics and robustness. The shift towards using lightweight, high-strength alloys such as magnesium for the shoe (base plate) and upper/lower blade guards is a key trend. This reduces the fatigue experienced by the user during extended use while maintaining the structural integrity required for accurate cuts in challenging materials. Furthermore, advancements in blade technology are symbiotic with the saw itself; specialized thin-kerf, anti-friction coated, and complex carbide-tipped blades are designed to enhance cutting speed and efficiency, minimize material waste, and extend the intervals between sharpening or replacement, directly impacting professional productivity and material costs. Manufacturers often bundle these premium blades with their high-end corded saws to showcase optimal performance capabilities.

Safety technology continues to be a high-priority area, driven by regulatory demands and consumer expectations. Key technological implementations include highly responsive electric brakes that stop the blade almost instantaneously upon trigger release, dramatically reducing coasting injuries. Dust management systems are also evolving, with integrated ports designed for compatibility with professional vacuum systems, enhancing job site cleanliness and complying with silica dust exposure limits. Looking ahead, some advanced corded models are incorporating rudimentary smart features, such as integrated LED lighting systems that automatically illuminate the cut line, and electronic overload protection circuits that safeguard the motor against excessive demands, signaling a slow but steady adoption of intelligent design in these traditional tools, further solidifying their place in demanding job environments.

Regional Highlights

The regional analysis reveals distinct market maturity and growth dynamics across the globe, heavily influenced by local construction activity, regulatory standards, and consumer preference for corded versus cordless technology. North America, encompassing the United States and Canada, represents the largest market segment by value, driven by robust residential new construction, a significant remodeling culture, and a long-standing preference for powerful, heavy-duty tools, especially the worm drive circular saw configuration, which is deeply entrenched in the region's framing practices. The high disposable incomes and the prevalence of large professional contracting companies mandate the consistent purchase of premium, high-amperage tools. Regulatory environment focusing on worker safety also drives demand for corded saws equipped with advanced safety features like high-efficiency dust shrouds and instant braking technology, ensuring this region remains a critical testing ground for new product introductions.

Europe constitutes the second largest market, characterized by stringent EU safety and environmental regulations (CE marking) and a strong demand for precision woodworking tools. While professional users are highly receptive to specialized, often higher-priced, systems that prioritize dust extraction and integration with guide rails, the overall preference tends towards smaller, lighter corded models suitable for dense European construction materials and tighter workspaces. Germany, the UK, and France are key contributors, with manufacturers focusing on energy efficiency and low noise emissions. The European market sees strong competition from brands that offer system solutions, where the circular saw is just one component in a comprehensive set of interoperable tools and accessories, driving a preference for specific high-end brands that offer such integration.

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily attributed to unprecedented infrastructural investment, massive urbanization trends in developing economies like China, India, and Southeast Asia, and the consequential demand for reliable, affordable construction equipment. While the market is highly competitive and often price-sensitive, the sheer volume of construction projects ensures massive sales potential. Manufacturers are adapting their portfolios to include both entry-level, durable corded saws for smaller operations and high-performance models for large-scale commercial and industrial construction sites. Local manufacturing and assembly in countries like China are also influencing price points and supply chain dynamics significantly, making the APAC region the engine for future volume growth.

Latin America and the Middle East & Africa (MEA) represent emerging but rapidly developing markets for corded circular saws. Growth in these regions is contingent upon economic stability, investment in infrastructure, and the professionalization of the construction workforce. In Latin America, demand is often tied to resource extraction and housing projects, favoring durable, general-purpose models. The MEA region, particularly the GCC countries, sees high demand driven by mega-projects and commercial development, often relying on imported, high-spec tools that can withstand harsh climatic conditions. Growth hinges on improved distribution infrastructure and the development of local professional training to ensure the safe and effective use of these powerful cutting tools across diverse regional environments.

- North America: Market leader in value, driven by high construction spend, strong preference for high-amperage worm drive saws, and strict safety regulations emphasizing instant braking mechanisms and durable components.

- Europe: High focus on precision, system compatibility, and compliance with stringent environmental standards; key markets include Germany, UK, and Scandinavia, prioritizing dust management and ergonomics.

- Asia Pacific (APAC): Fastest growing market driven by urbanization and infrastructural development; characterized by high volume sales, intense price competition, and growing demand for both professional and cost-effective entry-level models.

- Latin America (LATAM): Growth tied to housing development and industrial projects; focus on robust, reliable general-purpose tools capable of handling varied material types found in regional construction.

- Middle East & Africa (MEA): Demand fueled by large-scale commercial and infrastructure projects (e.g., hospitality, energy); market requires tools engineered for extreme temperature resilience and high durability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corded Circular Saw Market.- Robert Bosch GmbH

- Makita Corporation

- Stanley Black & Decker (DeWalt, Porter-Cable, Craftsman)

- Techtronic Industries Co. Ltd. (TTI Group, owning Milwaukee Tool, Ryobi)

- Hilti Corporation

- Metabo (Koki Holdings Co., Ltd./HiKOKI Power Tools)

- Festool GmbH (TTS Tooltechnic Systems AG & Co. KG)

- Skil Power Tools (Chervon Holdings Limited)

- Ridgid (Emerson Electric Co.)

- Positec Tool Corporation (Worx)

- Grizzly Industrial, Inc.

- Scheppach GmbH

- Apex Tool Group

- Husqvarna Group

- Stihl AG

- Snap-on Incorporated

- Fein Power Tools

- Black+Decker (Stanley Black & Decker subsidiary)

- WEN Products

- Powertec

Frequently Asked Questions

Analyze common user questions about the Corded Circular Saw market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of a corded circular saw over a cordless model for professional use?

The primary advantage of a corded circular saw lies in its ability to deliver continuous, sustained high power and torque (often 15 Amps or more) without battery depletion. This is crucial for prolonged, heavy-duty applications like cutting dense materials, minimizing downtime, and ensuring consistent cutting speed necessary for high-volume professional framing and construction projects.

Which factors most significantly impact the durability and longevity of a corded circular saw?

Durability is most impacted by the quality of the motor components (e.g., copper windings, thermal management), the strength of the gearing mechanism (especially in worm drive models), and the construction materials used for the shoe and guards, such as die-cast aluminum or magnesium alloys, which resist bending and impact damage on job sites.

What are the key differences between a sidewinder and a worm drive circular saw?

Sidewinder (or direct drive) saws are lighter and spin faster, making them suitable for quick, general-purpose cuts. Worm drive saws use a gear set to transfer power, resulting in higher torque and the blade being offset, offering better balance, visibility, and control for repetitive, heavy-duty framing and deep cutting in tough materials, particularly popular in North America.

How is the market addressing safety concerns related to corded circular saws?

The market is prioritizing safety through technological integration, including rapid-response electric brakes that stop the blade upon trigger release, improved lower guard designs for smoother operation, and advanced dust extraction ports compatible with HEPA vacuums, mitigating health and job site hazards efficiently.

Which geographical region is expected to drive the highest growth in the corded circular saw market by volume?

The Asia Pacific (APAC) region, driven by continuous infrastructure investment and large-scale urbanization in countries such as China and India, is expected to drive the highest market volume growth, necessitating a massive supply of construction tools, including affordable and durable corded circular saws, to meet rapidly escalating construction demands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager