Cordless Planer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431887 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cordless Planer Market Size

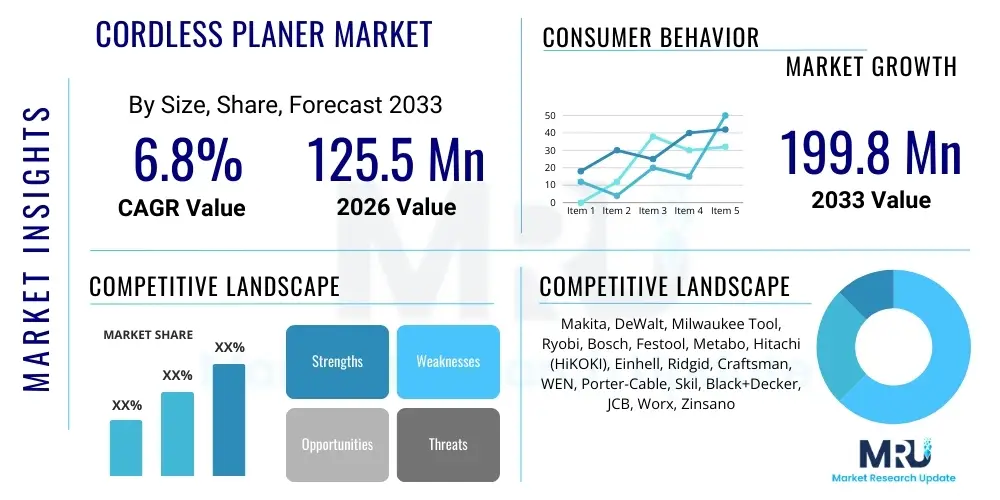

The Cordless Planer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 125.5 million in 2026 and is projected to reach USD 199.8 million by the end of the forecast period in 2033. This consistent expansion is predominantly fueled by the increasing demand for high-performance, portable woodworking tools across professional construction, renovation, and dedicated DIY sectors. The fundamental shift away from corded tools, driven by enhanced battery efficiency and power output, solidifies the market's upward trajectory.

Cordless Planer Market introduction

The Cordless Planer Market encompasses the global sale and distribution of portable electric planes powered by rechargeable lithium-ion battery technology. These devices are essential for surfacing, smoothing, and precise material removal in various woodworking applications, offering significant advantages in mobility and job site flexibility compared to their corded counterparts. Major applications span professional carpentry, cabinet making, structural construction, door installation, and advanced DIY projects requiring precise wood finishing. The primary benefits include increased worker productivity due to freedom from electrical outlets, reduction of trip hazards, and quick deployment across diverse work environments. Key driving factors accelerating market adoption involve continuous innovation in battery density, the widespread acceptance of brushless motor technology, which extends run time and tool life, and the general global trend toward power tool electrification across industrial and consumer segments. Furthermore, the rising investment in infrastructure and housing projects globally significantly contributes to the demand for efficient, high-performance cordless wood preparation tools.

Cordless Planer Market Executive Summary

The Cordless Planer Market demonstrates robust growth, underpinned by significant technological advancements and favorable business trends across global construction and woodworking industries. Key business trends include aggressive expansion strategies by major manufacturers focusing on multi-tool battery platforms (e.g., 18V/20V and 40V/60V systems), strategic mergers and acquisitions aimed at capturing niche market technologies, and a growing emphasis on sustainability through extended tool longevity and recyclable battery components. Manufacturers are increasingly integrating smart technology features, such as Bluetooth connectivity and app-based monitoring, to track usage and facilitate predictive maintenance, thereby improving overall user experience and professional adoption rates. This shift toward high-performance, data-enabled tools is reshaping competitive dynamics.

Regionally, Asia Pacific (APAC) is emerging as the fastest-growing market, driven by massive infrastructure development projects, rapid urbanization, and the expanding industrial base in countries like China and India. North America and Europe, while mature markets, continue to lead in terms of technology adoption, particularly in premium, high-voltage segment trends targeting professional contractors who prioritize power equal to corded versions. Segment trends indicate a substantial preference for brushless DC (BLDC) motor technology across all voltage categories due to superior power-to-weight ratio and enhanced energy efficiency. Additionally, demand is skewing towards higher voltage systems (36V and 40V equivalents) as battery costs decline and professionals seek tools capable of heavy-duty, continuous operation without frequent recharging, pushing the boundaries of what cordless tools can achieve in demanding applications.

The market structure is characterized by intense competition among global power tool giants, who leverage established distribution channels and brand loyalty. Success in this environment is dictated by battery system interoperability and the ability to deliver tools that balance ergonomic design with high material removal rates. Future growth is strongly linked to the DIY segment, which increasingly seeks professional-grade tools for home renovation projects, driven by readily available online tutorials and a cultural shift towards home improvement. Manufacturers are thus tailoring models to meet both stringent professional requirements and the evolving needs of advanced consumers, ensuring market penetration across the entire spectrum of woodworking enthusiasts.

AI Impact Analysis on Cordless Planer Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Cordless Planer Market primarily center on enhancing operational efficiency, predictive maintenance capabilities, and optimizing the design and manufacturing processes. Users are concerned about how AI can extend battery life by intelligently managing power output based on load demand, whether integrated sensors can provide real-time feedback on material density and cutter head sharpness, and how AI-driven analytics can optimize supply chain logistics to ensure timely availability of specialized planer blades and accessories. Expectations are high for AI to facilitate superior quality control during manufacturing, minimizing defects, and enabling advanced remote diagnostics for complex tool failures, thereby significantly reducing downtime for professional users. This focus highlights a desire for smarter, self-monitoring tools that integrate seamlessly into modern, data-driven construction workflows.

- AI-driven Predictive Maintenance: Analyzing tool usage patterns (vibration, temperature, current draw) to forecast potential failures of bearings or motors, signaling maintenance needs before catastrophic failure occurs, thus maximizing tool lifespan and minimizing professional downtime.

- Optimized Battery Management Systems (BMS): Utilizing machine learning algorithms to precisely manage charging cycles, temperature control, and discharge rates, significantly extending the overall cycle life and daily run time of high-capacity lithium-ion batteries under varying load conditions.

- Manufacturing and Quality Control Automation: Employing computer vision and AI analytics in the production line to instantaneously detect micro-defects in planer blade alignment or housing assembly, ensuring consistent quality and adherence to stringent performance standards.

- Ergonomic Design Optimization: Using AI to analyze user feedback and biomechanical data to iteratively refine tool shape, weight distribution, and handle vibration dampening, leading to more comfortable and safer tools for extended use.

- Supply Chain and Inventory Prediction: Implementing sophisticated AI models to predict regional demand fluctuations for specific planer models and accessories, ensuring efficient distribution and inventory levels across global markets, reducing lead times.

DRO & Impact Forces Of Cordless Planer Market

The dynamics of the Cordless Planer Market are shaped by a complex interplay of drivers, restraints, and opportunities (DRO), which collectively constitute the critical impact forces steering market growth. The primary drivers include the exponential maturation of lithium-ion battery technology, offering unparalleled energy density and faster charging capabilities, which successfully eliminates range anxiety associated with cordless tools. Furthermore, the global proliferation of sophisticated brushless motor technology ensures that cordless planers can now match the power and endurance of traditional corded units, making them a viable, high-performance option for demanding professional environments. The continuous expansion of the construction and renovation sectors worldwide, especially in developing economies, provides a vast and growing end-user base demanding portable efficiency. However, these positive drivers are moderated by significant restraints, predominantly the higher initial capital investment required for professional-grade cordless systems compared to basic corded alternatives, alongside the perpetual challenge of ensuring adequate run time for extremely heavy-duty, continuous surfacing tasks. The necessity for tool-specific battery compatibility within proprietary platforms also presents a limitation for consumers looking for flexibility, creating friction in the adoption process across multi-brand workshops.

Opportunities for market acceleration reside in the untapped potential of smart tool integration, leveraging IoT and connectivity features to provide value-added services such as geo-location tracking, utilization reporting, and integrated diagnostics for large contracting firms. The market is also presented with a substantial opportunity in catering to specialized applications, such as planing difficult or exotic hardwoods, through innovative blade materials and high-torque motor configurations. Strategic global expansion into emerging markets, where construction practices are rapidly modernizing and adopting high-efficiency tools, represents a critical avenue for long-term revenue growth. The impact forces are characterized by strong competitive pressure driving rapid innovation cycles, where manufacturers must constantly upgrade battery systems and motor performance to stay relevant. Regulatory standards concerning dust extraction and worker safety also act as impactful forces, necessitating continuous engineering investment in compliant dust management systems and ergonomic improvements. Ultimately, the market trajectory is heavily dependent on manufacturers' abilities to reduce system costs while simultaneously increasing the power and duration of battery life, directly addressing the key restraints faced by professional users globally.

Segmentation Analysis

The Cordless Planer Market is meticulously segmented based on several critical factors, enabling precise market analysis and targeted strategic planning. Key segmentation variables include the power requirement (voltage), the specific motor architecture employed, the primary application environment, and the sales distribution channel. Analyzing these segments helps stakeholders understand market preferences, identify high-growth niches, and tailor product development to meet specialized user needs. The rapid evolution of battery technology heavily influences the voltage segmentation, with professional users migrating toward higher-power platforms to maximize efficiency on job sites. Similarly, motor technology segmentation highlights the increasing dominance of brushless designs, which offer superior durability and efficiency compared to older brushed systems, fundamentally altering the performance benchmarks across all tool categories.

- By Voltage:

- 12V/18V (Light to Medium Duty, DIY and Small Carpentry)

- 20V/36V (Standard Professional Use, General Construction)

- 40V/60V and Above (Heavy-Duty Industrial Applications, High Material Removal Rate)

- By Motor Type:

- Brushed Motors (Cost-Effective, Entry Level)

- Brushless Motors (High Efficiency, Extended Life, Professional Grade)

- By Application:

- Professional/Commercial (Carpentry, Construction, Renovation)

- Do-It-Yourself (DIY) / Consumer (Home Improvement, Hobbyist Woodworking)

- By Distribution Channel:

- Online Retail/E-commerce

- Offline Retail (Home Improvement Stores, Specialized Tool Dealers)

Value Chain Analysis For Cordless Planer Market

The value chain for the Cordless Planer Market is characterized by a complex, multi-tiered structure beginning with raw material extraction and culminating in end-user application. Upstream analysis focuses intensely on the procurement of critical components, particularly high-performance lithium-ion battery cells (often sourced from specialized Asian manufacturers), robust plastic resins for housing (ABS and composites), and precision-machined steel and carbide for blade assembly and internal gearing. The stability of these upstream inputs, especially the fluctuating cost and availability of raw materials like cobalt and nickel essential for battery chemistry, directly influences manufacturing costs and final product pricing. Efficient supplier relationships and robust quality control at this stage are crucial for maintaining tool reliability and competitive pricing strategies in the global marketplace. The manufacturing stage involves complex assembly, integration of sophisticated electronics (Battery Management Systems or BMS), and stringent quality testing to meet professional standards, requiring significant capital investment in automation and engineering expertise.

The downstream analysis highlights the critical role of distribution and sales channels in reaching diverse end-user segments. Distribution channels are bifurcated into direct and indirect methods. Direct distribution typically involves large B2B sales to major construction companies and industrial clients, often supported by dedicated sales engineers and customized fleet management programs. Indirect distribution is far broader, utilizing a dense network of major retail outlets (big-box home improvement chains), specialized industrial distributors, and the rapidly growing sphere of e-commerce platforms. E-commerce has gained significant traction by offering detailed product comparisons, user reviews, and convenient shipping, particularly appealing to the DIY and smaller contractor segments. Effective channel management requires sophisticated inventory planning and marketing strategies tailored to each specific sales environment to ensure optimal market coverage and efficient delivery logistics, especially for bulky power tools and associated proprietary accessories.

The overall efficiency of the value chain is increasingly being enhanced by digitalization, enabling seamless communication between component suppliers, manufacturers, and final retailers. Key value additions occur through advanced R&D, focusing on ergonomic design and integration of advanced features like dust management and vibration reduction. Furthermore, post-sale service and support, including warranty provisions and accessible parts replacement networks, contribute significantly to perceived product value and brand loyalty. Optimizing this chain involves minimizing lead times, ensuring regulatory compliance across multiple jurisdictions, and strategically localizing assembly or distribution centers to mitigate tariff risks and reduce shipping costs, thereby maximizing margin capture throughout the entire process from material sourcing to final purchase by the professional or consumer end-user.

Cordless Planer Market Potential Customers

The primary customer base for the Cordless Planer Market spans a diverse array of professionals and consumers involved in construction, renovation, and woodworking. Core potential customers are skilled carpenters and joiners who rely on planers for precise fitting of doors, windows, and trim work, demanding tools with exceptional accuracy, high material removal capacity, and extended run time essential for continuous job site activity. General construction contractors, particularly those involved in residential framing and commercial interior fit-outs, constitute another major segment, valuing the mobility and speed that cordless planers offer for on-the-fly adjustments and finishing work in environments where power access might be limited or inconvenient. These professional end-users consistently prioritize performance metrics such as cut depth capacity, rebate capability, and ergonomic design that minimizes fatigue during prolonged operation.

Beyond the core professional sector, the growing market of home renovation enthusiasts and serious DIYers represents a substantial and increasingly sophisticated buyer segment. Driven by media tutorials and readily accessible professional-grade tools, this group seeks high-quality, user-friendly cordless planers for personal projects, furniture restoration, and substantial home improvements. While these users may not require the continuous run time demanded by professionals, they prioritize ease of use, safety features, and reliability, often opting for mid-range voltage platforms (18V/20V). Manufacturers are effectively segmenting their offerings to cater to this group by providing complete kits that include necessary batteries and chargers, bundled with introductory guides and expanded warranty programs, which lowers the barrier to entry for advanced tool usage in the consumer sphere.

Furthermore, educational institutions, vocational schools, and specialized furniture manufacturing shops represent institutional buyers with distinct needs. Vocational centers purchase planers for student training, prioritizing durability and safety, often in bulk orders. Specialized manufacturers, particularly those focusing on custom cabinetry and architectural woodwork, demand planers optimized for fine finishing and specific material handling characteristics. Effective engagement with these potential customers requires manufacturers to offer specialized training, robust maintenance support, and tools that integrate seamlessly with professional dust collection systems and workshop infrastructure, ensuring compliance with strict industrial health and safety standards. The segmentation of potential buyers necessitates a multi-faceted marketing approach that highlights tool longevity for professionals and accessibility for advanced consumers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 million |

| Market Forecast in 2033 | USD 199.8 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Makita, DeWalt, Milwaukee Tool, Ryobi, Bosch, Festool, Metabo, Hitachi (HiKOKI), Einhell, Ridgid, Craftsman, WEN, Porter-Cable, Skil, Black+Decker, JCB, Worx, Zinsano |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cordless Planer Market Key Technology Landscape

The technology landscape of the Cordless Planer Market is defined by continuous innovation across three primary areas: motor efficiency, power storage, and ergonomic design. The most significant technological driver is the widespread adoption of Brushless Direct Current (BLDC) motors. These motors eliminate physical carbon brushes, leading to dramatically reduced friction, increased power transmission efficiency, and extended tool life. BLDC technology allows planers to adjust torque and speed instantaneously based on the load detected during planing, ensuring consistent material removal rates even in difficult woods, thereby closing the performance gap traditionally seen between corded and cordless tools. This efficiency gain is crucial as it directly translates into longer run times per battery charge, which is the paramount concern for professional users, enabling full-day use in many standard applications.

Power storage technology, specifically advanced lithium-ion battery architectures, forms the backbone of the cordless revolution. Modern battery packs feature sophisticated Battery Management Systems (BMS) that monitor cell health, temperature, and current flow, preventing overheating and deep discharge, which are critical for safety and longevity. Innovations such as high-density cells and rapid-charging capabilities are pivotal, allowing batteries to reach 80% charge in minutes, minimizing job site delays. Furthermore, manufacturers are increasingly developing proprietary battery chemistries and cooling technologies (e.g., specialized thermal dissipation materials and air-flow designs) to sustain high power output required for continuous, heavy material removal, particularly in 40V and 60V systems aimed at the industrial and demanding construction sectors.

Beyond internal mechanics and power systems, technological advancements in dust extraction and user interface are vital. Cordless planers increasingly integrate high-efficiency particle filtering systems and adaptors for connecting to portable vacuum extractors, ensuring compliance with strict occupational health and safety regulations concerning airborne wood dust. Ergonomic engineering utilizes advanced computer modeling to optimize tool balance and reduce vibration transmission to the operator. Features such as electronic soft start mechanisms, depth-adjustment locks with micro-adjustments, and reversible carbide blades enhance user control, precision, and efficiency. The ongoing integration of IoT capabilities, allowing tools to communicate diagnostics and utilization data via Bluetooth, represents the next frontier, positioning the planer as a smart component within a wider connected job site ecosystem.

Regional Highlights

- North America: Representing a significant portion of the global market, North America is characterized by high adoption rates of premium, professional-grade cordless tools, driven by a strong culture of home renovation and a large, well-established residential and commercial construction sector. The market here is highly competitive, dominated by manufacturers focusing on 20V and 60V platforms and prioritizing robust performance, comprehensive warranty support, and interoperability across extensive tool ecosystems. Advanced consumer DIY spending also drives substantial demand for mid-range products.

- Europe: The European market exhibits strong demand, particularly for tools that comply with stringent environmental and safety regulations (e.g., comprehensive dust management). Western European countries prioritize quality, durability, and ergonomic design, often leading to higher average selling prices. The professional sector values high precision and efficiency, with manufacturers like Bosch and Festool holding significant market share, focusing on systems integration and connectivity across workshops and construction sites.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region due to explosive infrastructure development, rapid urbanization, and rising disposable incomes leading to increased private investment in construction and specialized woodworking trades. Countries like China and India are experiencing a rapid shift from basic corded tools to more efficient cordless solutions. This region is critical for high-volume sales, with manufacturers focusing on balancing quality and affordability for both emerging professional tradesmen and large-scale industrial users.

- Latin America (LATAM): Growth in LATAM is steady, driven by urbanization and expanding construction activities, though adoption rates can be volatile due to economic instability in certain countries. The market is highly price-sensitive, often favoring mid-tier brands and efficient, durable tools that can withstand harsh operating conditions, prioritizing ease of maintenance and local distribution support.

- Middle East and Africa (MEA): This region is characterized by substantial infrastructure investments, particularly in the Gulf Cooperation Council (GCC) states. The demand is strong in commercial construction, requiring heavy-duty, high-performance cordless systems capable of operating reliably in extreme temperatures. The market for basic professional tools is expanding across African nations as construction sectors modernize and improve operational efficiency through electrification.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cordless Planer Market.- Makita

- DeWalt

- Milwaukee Tool

- Ryobi

- Bosch

- Festool

- Metabo

- Hitachi (HiKOKI)

- Einhell

- Ridgid

- Craftsman

- WEN

- Porter-Cable

- Skil

- Black+Decker

- JCB

- Worx

- Zinsano

Frequently Asked Questions

Analyze common user questions about the Cordless Planer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of choosing a brushless cordless planer over a brushed model?

Brushless cordless planers offer significantly higher efficiency, translating into longer run time per charge and superior power output. They also have a longer operational lifespan and require less maintenance because they eliminate the friction and wear associated with carbon brushes, making them the preferred choice for professional and heavy-duty applications.

Which voltage platform is most suitable for professional carpentry work requiring extended use?

For professional carpentry demanding extended run time and high material removal rates, the 36V, 40V, or 60V platforms are most suitable. These higher-voltage systems deliver the sustained power necessary to handle challenging hardwoods and continuous surfacing tasks, matching the performance traditionally expected of corded tools.

How do advancements in battery technology drive growth in the cordless planer market?

Advancements in lithium-ion energy density and sophisticated Battery Management Systems (BMS) are the core drivers. These innovations enhance power output, extend overall battery life, reduce charging times, and improve safety, making cordless planers practical substitutes for corded versions in all demanding construction environments.

What are the most crucial ergonomic factors to consider when selecting a cordless planer?

Crucial ergonomic factors include the tool's weight distribution, especially with the battery attached, vibration dampening mechanisms, and the design of the handle grip. Optimal ergonomics minimize user fatigue during prolonged use, enhancing safety and overall working efficiency on large projects.

What role does dust management play in the regulatory environment for cordless planers?

Dust management is critical due to stringent occupational health regulations worldwide (especially in North America and Europe) concerning airborne fine wood dust. Manufacturers must integrate highly effective dust extraction ports and compatible collection systems to ensure user safety and compliance, driving innovation in dust chute and bag design.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager