Core Banking Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439014 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Core Banking Systems Market Size

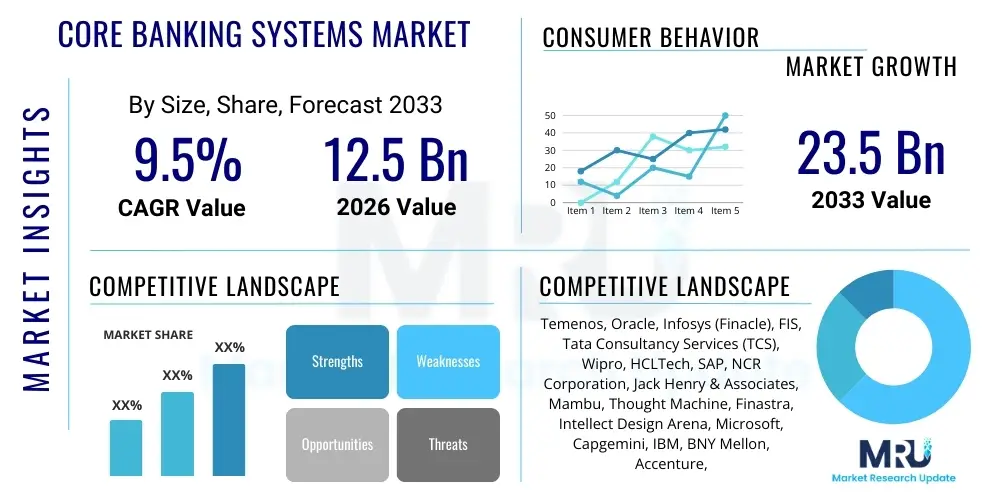

The Core Banking Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $12.5 Billion USD in 2026 and is projected to reach $23.5 Billion USD by the end of the forecast period in 2033.

Core Banking Systems Market introduction

The Core Banking Systems (CBS) market encompasses sophisticated software platforms designed to manage essential banking functions, including ledger maintenance, transaction processing, calculation of interest, customer relationship management, and account administration. These systems serve as the central nervous system for financial institutions, ensuring operational efficiency, regulatory compliance, and a seamless customer experience across all channels. Modern core banking solutions are shifting rapidly from monolithic legacy architectures to agile, modular, and cloud-native platforms, enabling banks to innovate faster and respond dynamically to market pressures.

Product descriptions typically highlight features such as real-time processing capabilities, open APIs for easy integration with third-party fintech applications, and enhanced security protocols. Major applications of CBS span retail banking, corporate banking, treasury operations, and wealth management, fundamentally supporting all services offered by commercial banks, credit unions, and non-bank financial institutions. The primary benefit derived from CBS modernization is the reduction of technical debt, coupled with improved efficiency through automation and personalization capabilities, allowing banks to offer hyper-customized products.

Driving factors propelling this market include the relentless pursuit of digital transformation among financial institutions globally, necessitated by competitive threats from challenger banks and fintech disruptors. Furthermore, stringent global regulatory mandates requiring faster reporting, better risk management, and enhanced customer protection (such as GDPR and Basel IV) necessitate the adoption of flexible, compliant core systems. The growing consumer demand for instant, 24/7 access to banking services delivered through mobile and digital channels further accelerates the need for real-time CBS infrastructure, ensuring market vitality.

Core Banking Systems Market Executive Summary

The Core Banking Systems market is currently defined by disruptive business trends centered on cloud migration and the adoption of API-first architectures, moving away from capital-intensive, on-premise deployments. Financial institutions are prioritizing investments in composable banking solutions, which allow them to mix and match modular components rather than undertaking massive, risky rip-and-replace projects. This trend is driven by the necessity for speed, scalability, and operational flexibility required to compete with agile fintech entities. Furthermore, the integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming processes, enhancing risk management, and enabling unprecedented levels of customer personalization, fundamentally redefining the value proposition of core banking services.

Regionally, the market exhibits vigorous growth across all major geographies, though growth vectors differ. North America and Europe remain the largest markets, characterized by high adoption rates of sophisticated, advanced cloud solutions and compliance-driven modernization initiatives. Asia Pacific (APAC) represents the fastest-growing region, fueled by rapid urbanization, increasing financial inclusion efforts, and governments promoting digital public infrastructure. Latin America and MEA are focused on leveraging mobile-first core banking solutions to serve underbanked populations and streamline domestic transaction capabilities, often skipping traditional technological stages entirely.

Segment trends reveal that the Services component segment, including implementation, integration, and managed services, is expanding rapidly due to the complexity associated with migrating legacy data and integrating new microservices-based architectures. By deployment model, the cloud-based segment, particularly Software-as-a-Service (SaaS) core banking, is witnessing exponential uptake, significantly outpacing traditional on-premise installations. Among end-users, large commercial banks remain the dominant segment by revenue, although credit unions and smaller regional banks are increasingly adopting lower-cost, scalable cloud solutions to maintain competitive parity.

AI Impact Analysis on Core Banking Systems Market

Users frequently inquire about how AI can modernize antiquated core banking functionalities without necessitating full system overhauls, focusing heavily on enhancing security, improving operational efficiency, and enabling deeper personalization. Key concerns revolve around the data governance implications of feeding sensitive customer data into AI models and the complexity of integrating advanced ML algorithms with existing legacy systems. There is high expectation that AI will be the primary catalyst for shifting core banking from reactive transaction processing to proactive, predictive engagement, automating compliance checks, and mitigating fraud in real-time. The overarching theme is the pursuit of 'intelligent core banking' capable of autonomous decision-making.

The core banking industry recognizes AI/ML as critical tools for optimizing internal operations and enriching customer-facing services. AI’s ability to analyze vast streams of transactional data helps in predicting liquidity needs, automating reconciliation processes, and dynamically adjusting interest rates based on real-time market conditions, tasks previously requiring extensive human intervention. This shift not only reduces operational overhead but also dramatically improves the speed and accuracy of financial decision-making within the core system, providing a significant competitive edge to early adopters.

Furthermore, AI plays an indispensable role in strengthening the security framework of core banking systems. Advanced behavioral analytics and machine learning algorithms are utilized to detect subtle anomalies indicative of sophisticated cyber threats or internal fraud, providing a superior layer of protection compared to traditional rule-based systems. As banks transition to open banking models that rely heavily on API communication, AI-driven threat intelligence becomes crucial for monitoring API endpoints and ensuring compliance with data privacy regulations, assuring users that their core infrastructure remains robust and protected amidst heightened interconnectivity.

- AI-powered fraud detection enhances security protocols by analyzing real-time transaction anomalies.

- Machine learning optimizes regulatory reporting by automating data aggregation and compliance checks.

- Predictive analytics enables personalized product recommendations directly within the core customer management module.

- AI facilitates intelligent automation of back-office processes such as loan origination and reconciliation, reducing processing time.

- Natural Language Processing (NLP) improves customer service through sophisticated chatbots integrated with core account information.

- Automated credit scoring and risk assessment using ML models allow for faster and more accurate lending decisions.

DRO & Impact Forces Of Core Banking Systems Market

The Core Banking Systems market is driven primarily by the urgent need for financial institutions to modernize outdated infrastructure to remain competitive in the digital economy, coupled with pervasive regulatory pressures mandating greater transparency and efficiency. Conversely, high initial investment requirements, coupled with the significant operational risks associated with migrating vast amounts of historical data, serve as substantial restraints. The convergence of cloud computing, open APIs, and emerging technologies like blockchain presents immense opportunities for vendors capable of delivering highly scalable and customizable modular solutions. These factors collectively exert powerful impact forces, compelling banks toward strategic rather than incremental changes.

Drivers: The most prominent driver is the global imperative for digital transformation, where banks must integrate seamlessly across multiple channels (mobile, web, branch) and offer real-time service delivery. Legacy core systems, often decades old, lack the flexibility and speed required for modern digital products, making modernization a non-negotiable strategic priority. Secondly, the regulatory landscape, particularly in regions enforcing Open Banking (like PSD2 in Europe) and requiring instant payment capabilities, forces banks to adopt API-enabled core systems that can securely share data and facilitate rapid transactions with third parties.

Restraints: Significant barriers include the substantial financial cost and time required for implementation, often extending over several years and consuming large portions of the IT budget. Furthermore, data migration complexity represents a major hurdle; moving billions of customer records and transactional histories from proprietary legacy databases to new platforms is inherently risky and requires specialized expertise. The scarcity of personnel skilled in implementing and managing modern cloud-native core systems also restricts the pace of adoption, particularly in emerging markets, leading to implementation delays and increased consultancy costs.

Opportunities: The shift towards cloud-native, composable core banking architecture is the leading opportunity, enabling banks to deploy components incrementally and scale resources dynamically, thereby lowering Total Cost of Ownership (TCO) over time. Another significant opportunity lies in offering specialized, vertically integrated core solutions tailored specifically for niche financial segments, such as digital-only banks, Islamic banking, or specialized wealth management firms. Finally, partnerships between traditional CBS providers and disruptive fintech companies focused on technologies like distributed ledger technology (DLT) or advanced AI offer avenues for rapid product innovation.

Segmentation Analysis

The Core Banking Systems market is meticulously segmented based on components (software and services), deployment model (on-premise and cloud), and the type of end-user utilizing the system (banks, credit unions, and other financial institutions). This structure provides a clear picture of where investment flows are concentrated. The components segmentation reflects the ongoing operational needs of financial institutions, with services (like integration, consulting, and maintenance) growing faster than software license sales as banks seek expert help in navigating complex migration paths and hybrid cloud environments. Deployment model segmentation highlights the paradigm shift from CAPEX-heavy on-premise solutions to OPEX-friendly, agile cloud alternatives.

The rapid expansion of the cloud segment is reshaping the competitive landscape. Cloud deployment offers benefits like reduced upfront infrastructure costs, enhanced scalability, and faster time-to-market for new banking products. This deployment strategy particularly appeals to challenger banks and smaller financial institutions that lack the internal resources or capital to maintain extensive proprietary data centers. Conversely, larger Tier 1 banks often adopt a hybrid deployment model, keeping critical, highly sensitive operations on-premise while migrating customer engagement layers and non-essential modules to the cloud, demanding sophisticated integration services from CBS providers.

Analyzing the end-user segmentation reveals a differentiation in technological needs. Large commercial banks require comprehensive, high-volume transactional capabilities with advanced compliance and treasury management modules. Credit unions and community banks, however, prioritize cost-effectiveness, strong member-centric CRM features, and compliance management relevant to local jurisdictions. The 'Other Financial Institutions' segment, including shadow banks, payment providers, and neo-banks, often prefers lightweight, API-driven core systems from niche vendors that facilitate rapid product prototyping and integration with broader fintech ecosystems, propelling the growth of microservices architecture adoption across the board.

- By Component:

- Software (Licenses, Platform Solutions)

- Services (Consulting, Integration, Maintenance, Managed Services)

- By Deployment Model:

- On-Premise

- Cloud (Public Cloud, Private Cloud, Hybrid Cloud)

- By End-User:

- Banks (Tier 1, Tier 2, Tier 3)

- Credit Unions

- Other Financial Institutions (NBFCs, Payment Banks, Neo Banks)

Value Chain Analysis For Core Banking Systems Market

The value chain for the Core Banking Systems market begins with the upstream activities centered around technology research and development, where vendors invest heavily in developing modular, cloud-native architectures, API frameworks, and integrating advanced AI/ML capabilities. Key inputs at this stage include specialized software engineering talent, access to scalable cloud infrastructure providers (like AWS, Azure, Google Cloud), and continuous market intelligence regarding evolving financial regulations. Success in the upstream segment relies on intellectual property development and establishing strategic partnerships with cutting-edge technology firms to ensure the CBS platform remains future-proof and functionally comprehensive.

Midstream activities involve core system design, customization, implementation, and rigorous testing. This is typically executed through a combination of proprietary CBS vendors and specialized system integration partners. The distribution channel predominantly involves direct sales for large, customized contracts with Tier 1 banks, supplemented by indirect channels through global system integrators (GSIs) like Accenture, Deloitte, and major IT service providers. These integrators play a critical role, managing the complex process of data migration, legacy system decommissioning, and ensuring seamless integration with hundreds of peripheral banking applications, thereby adding significant value to the overall deployment.

Downstream activities focus on post-implementation support, maintenance, and continuous optimization services. As banking systems are mission-critical, vendors must provide 24/7 technical support and regular patches for security and regulatory compliance updates. The lifecycle value extends further through ongoing consulting services aimed at helping banks leverage the full capabilities of their modernized core system, such as optimizing AI usage or expanding product offerings through the platform's API gateway. This long-term relationship ensures recurring revenue for CBS providers and maximizes the Return on Investment (ROI) for the end-user financial institution.

Core Banking Systems Market Potential Customers

The primary customers and end-users of Core Banking Systems are global commercial and retail banks, ranging from vast multinational institutions (Tier 1) requiring highly robust, centralized platforms capable of handling diverse international regulatory demands and extremely high transaction volumes, down to smaller regional and community banks (Tier 3) that prioritize cost-effective, scalable, often cloud-based solutions. Tier 1 banks often drive demand for specialized treasury management and corporate banking modules, dictating the evolution of high-end, proprietary CBS features.

A rapidly expanding customer base includes credit unions and building societies, particularly in North America and Europe. These entities require core systems that excel at member relationship management, offering personalized, community-focused services while maintaining operational leaness. Their purchasing decisions are heavily influenced by vendor reputation for service, affordability, and the ease of compliance management specific to credit union governance structures. They often opt for multi-tenant, SaaS core banking models to minimize operational complexity and infrastructure expenditure.

Furthermore, non-bank financial institutions (NBFIs), payment service providers (PSPs), and the burgeoning segment of neo-banks and challenger banks represent a fertile ground for modern, API-driven core banking platforms. These entities often lack any legacy infrastructure and seek 'headless' core banking solutions that prioritize speed, open integration capabilities, and low friction deployment. Their focus is on building highly specialized, often single-product financial offerings, making them ideal customers for modular, composable core banking providers that allow them to consume only the specific components they need (e.g., ledger services, account management).

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $12.5 Billion USD |

| Market Forecast in 2033 | $23.5 Billion USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Temenos, Oracle, Infosys (Finacle), FIS, Tata Consultancy Services (TCS), Wipro, HCLTech, SAP, NCR Corporation, Jack Henry & Associates, Mambu, Thought Machine, Finastra, Intellect Design Arena, Microsoft, Capgemini, IBM, BNY Mellon, Accenture, Diebold Nixdorf. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Core Banking Systems Market Key Technology Landscape

The modern Core Banking Systems market is fundamentally shaped by several converging technologies, chief among them being cloud computing, which facilitates elastic scalability and rapid deployment cycles. Financial institutions are moving decisively towards public, private, or hybrid cloud environments, demanding vendors refactor their proprietary software into cloud-native microservices architectures. This shift allows components of the core system (e.g., loan ledger, savings module) to be developed, deployed, and updated independently, vastly improving system agility and resilience. This modular approach is essential for supporting the 'composable banking' trend, where banks can assemble best-of-breed services rather than relying on a single vendor suite.

Another crucial technology is the implementation of Open Application Programming Interfaces (APIs). These APIs are the backbone of Open Banking initiatives globally, allowing secure, standardized data exchange between the bank's core system and authorized third-party fintech applications. The reliance on robust, secure, and standardized APIs enables banks to rapidly expand their ecosystem, offering integrated services like aggregated financial views, innovative payment methods, and embedded finance products without extensive internal development. Furthermore, security protocols centered around tokenization, encryption, and advanced identity and access management (IAM) are paramount to protecting the high-value data processed by these open architectures.

Beyond cloud and APIs, the core banking landscape is being significantly influenced by Distributed Ledger Technology (DLT) and advanced security frameworks. While full-scale blockchain adoption in core banking is still nascent, DLT is being trialed for specific use cases like cross-border payments, trade finance reconciliation, and digital identity management due to its immutability and enhanced transparency. Additionally, real-time data processing engines and advanced analytics platforms are mandatory components for modern CBS, supporting the instant settlement of payments and enabling AI/ML applications to perform continuous risk scoring and behavioral analysis, moving away from batch processing to continuous, real-time operations.

Regional Highlights

- North America: North America holds a dominant market share driven by the presence of large, technologically advanced financial institutions and a proactive approach to replacing decades-old mainframe core systems. The region is characterized by high investment in modernization, focusing heavily on adopting private and hybrid cloud models due to strict regulatory oversight regarding data residency and security. Demand here is typically driven by the need for superior customer experience platforms, advanced cybersecurity integration, and the implementation of AI for operational efficiency and compliance monitoring. The market is saturated with established vendors but also sees significant activity from innovative niche players focused on specific sectors like credit unions and commercial lending.

- Europe: Europe is a highly dynamic market primarily propelled by regulatory mandates, most notably PSD2 and Open Banking initiatives, which necessitate deep modernization of core systems to expose standardized APIs. European banks are rapidly transitioning towards composable, microservices-based architectures to comply with these regulations and fend off competition from numerous sophisticated neo-banks and payment institutions. Germany, the UK, and the Nordics lead in the adoption of cloud-native core banking solutions, often preferring vendors that offer proven multi-country regulatory compliance capabilities. The emphasis is on seamless digital integration and real-time payment processing infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive financial inclusion initiatives, rapid population growth, and supportive government policies promoting digital banking (e.g., digital bank licenses in Singapore, Hong Kong, and Australia). The region often skips transitional technologies, moving directly to mobile-first, cloud-based core systems, especially in emerging economies like India, Indonesia, and Vietnam. Investment is driven by the need to efficiently serve vast, digitally-savvy populations and manage cross-border complexities. Localized compliance requirements and the heterogeneity of market development necessitate highly flexible and adaptable core platforms.

- Latin America (LATAM): The LATAM core banking market is experiencing substantial growth spurred by high mobile penetration, a shift away from cash transactions, and government-led financial inclusion programs. Banks in this region seek solutions that offer high scalability at a lower operational cost, making public cloud adoption highly attractive. Brazil and Mexico are key markets, focusing on leveraging core banking modernization to improve consumer credit access and streamline local payment systems. Regulatory harmonization across the region is also creating demand for unified core platforms.

- Middle East and Africa (MEA): Growth in MEA is driven by high oil wealth investment in digitalization, particularly in the UAE and Saudi Arabia, alongside significant efforts to expand banking access in African nations. The MEA market sees high demand for specialized core systems tailored for Islamic banking principles, requiring unique ledger and interest calculation functionalities. African countries prioritize lean, mobile-centric core solutions that can operate efficiently with limited physical infrastructure, often relying on partners to implement and manage the platforms as a service.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Core Banking Systems Market.- Temenos

- Oracle

- Infosys (Finacle)

- FIS

- Tata Consultancy Services (TCS)

- Wipro

- HCLTech

- SAP

- NCR Corporation

- Jack Henry & Associates

- Mambu

- Thought Machine

- Finastra

- Intellect Design Arena

- Microsoft

- Capgemini

- IBM

- BNY Mellon

- Accenture

- Diebold Nixdorf

Frequently Asked Questions

Analyze common user questions about the Core Banking Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is composable banking, and how does it relate to Core Banking Systems?

Composable banking is an architectural approach utilizing modular, independent business capabilities (microservices) that can be combined, customized, and continuously rearranged. It relates directly to CBS by replacing monolithic systems with flexible components (e.g., ledger, payments, accounts) accessible via APIs, enabling banks to innovate rapidly and deploy specific features without replacing the entire core infrastructure. This offers greater agility compared to traditional systems.

What are the primary benefits of migrating a Core Banking System to the cloud?

Migrating CBS to the cloud offers several key advantages, including significant reduction in capital expenditure (CAPEX) by shifting to operational expenditure (OPEX), enhanced scalability to handle fluctuating transaction volumes, faster time-to-market for new banking products, and improved system resilience and disaster recovery capabilities. Cloud adoption also facilitates easier integration with external fintech services.

How does regulatory compliance impact the demand for new Core Banking Systems?

Regulatory compliance is a major driver, forcing banks to adopt modern CBS capable of meeting stringent reporting, security, and data privacy standards (like GDPR, Basel IV, and Open Banking mandates). Legacy systems often struggle to adapt quickly to these evolving rules, driving demand for flexible, API-enabled core platforms designed for rapid regulatory updates and transparent data sharing.

Which geographical region shows the fastest growth rate for Core Banking Systems adoption?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate. This accelerated growth is primarily attributed to high rates of financial inclusion initiatives, increasing digitalization across emerging economies, and the rapid deployment of mobile-first and cloud-native core banking solutions, often supported by governmental pushes for digital infrastructure.

What role does Artificial Intelligence play in modern Core Banking Systems?

AI plays a critical role in enhancing efficiency and security within CBS. It enables real-time fraud detection, automates complex back-office processes (like reconciliation and compliance reporting), provides predictive analytics for risk management and liquidity forecasting, and facilitates deep customer personalization by analyzing transactional behaviors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager