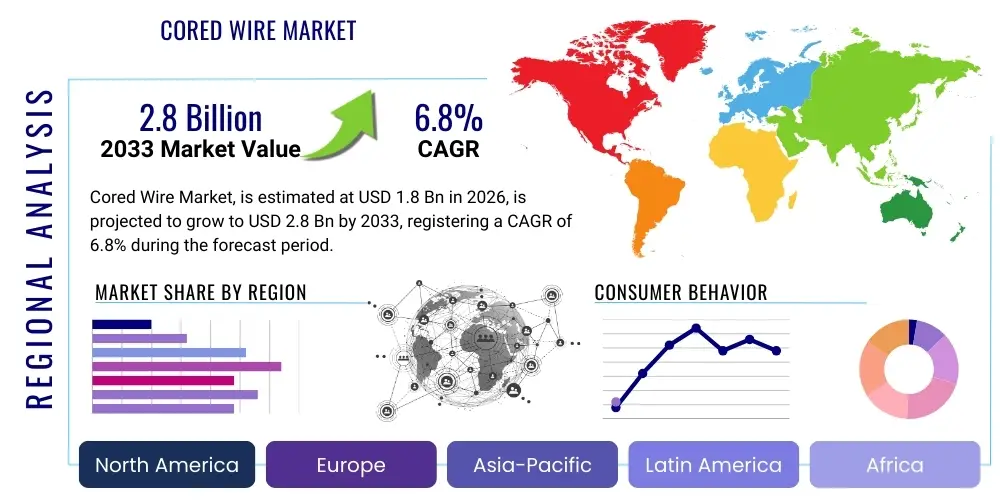

Cored Wire Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437085 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cored Wire Market Size

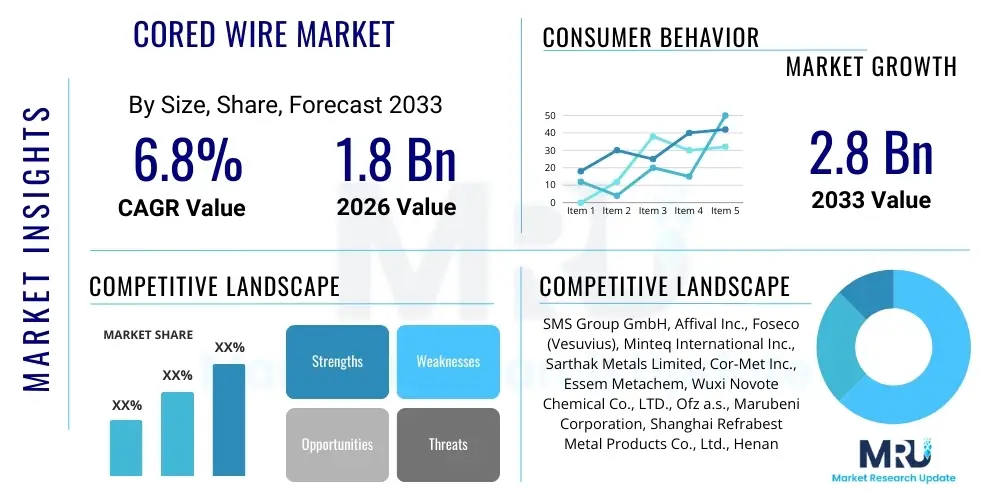

The Cored Wire Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 2.8 Billion by the end of the forecast period in 2033.

Cored Wire Market introduction

The Cored Wire Market encompasses the production and distribution of composite metallurgical products used primarily in secondary steelmaking and foundry applications to precisely control the chemical composition of molten metal. These wires, typically constructed with a steel sheath encapsulating various powder ingredients—such as calcium silicon, pure calcium, ferroalloys, carbon, or specific flux combinations—are instrumental in enhancing metal purity, improving mechanical properties, and optimizing energy consumption during refining processes. The specialized nature of cored wire allows for deep injection into the melt, ensuring high yield rates and superior homogenization compared to traditional bulk addition methods, thereby reducing material consumption and processing time.

The primary applications of cored wire are predominantly centered around ladle metallurgy operations, including desulfurization, deoxidation, modification of non-metallic inclusions, and controlled micro-alloying. The ability of cored wire to introduce reactive elements deep into the melt, bypassing surface oxidation losses, makes it indispensable for manufacturing high-quality specialized steel grades, such as high-strength low-alloy (HSLA) steels, automotive sheet metal, and stainless steels. Furthermore, in the foundry industry, cored wire is utilized for magnesium treatment of ductile iron, offering a safer and more efficient alternative to conventional methods of spheroidization.

Key driving factors propelling market expansion include the global increase in crude steel production, particularly in emerging economies, the stringent regulatory requirements for cleaner steel (low sulfur and phosphorus content), and the growing demand from end-use industries like automotive and construction for advanced, higher-performance steel alloys. The benefits derived from using cored wire—such as superior process control, enhanced elemental recovery, reduced slag formation, and improved overall operational efficiency—cement its role as a critical input in modern metallurgy, ensuring sustained demand throughout the forecast period.

Cored Wire Market Executive Summary

The Cored Wire Market exhibits robust expansion driven primarily by escalating demand from the global steel industry, which is continuously shifting towards high-purity and advanced specialty grades necessary for infrastructure development and sophisticated manufacturing sectors. Business trends indicate a strong focus on automation and precision feeding systems integrated with cored wire consumption, allowing steel mills to achieve tighter chemical specifications with minimized variability. Strategic mergers, acquisitions, and technological partnerships among key manufacturers are reshaping the competitive landscape, aiming for vertical integration and enhanced supply chain resilience to cater to fluctuating raw material prices and logistics challenges globally.

Regionally, Asia Pacific maintains its dominance, largely attributable to the massive crude steel output from China and India, coupled with rapid industrialization and governmental emphasis on infrastructure projects that require large volumes of quality steel. Europe and North America, while having slower growth rates in primary steel production, emphasize the adoption of premium cored wire products like CaSi and pure Calcium for producing high-end automotive and aerospace steel, prioritizing efficiency and environmental compliance. The Middle East and Africa (MEA) are emerging as significant growth pockets, supported by substantial investments in local steel manufacturing capacity and diversification away from solely relying on imported steel products, thus driving localized demand for specialized secondary metallurgy consumables.

Segmentation analysis reveals that the calcium-silicon cored wire segment continues to hold the largest market share due to its widespread efficacy in desulfurization and deoxidation across various steel grades. However, segments focusing on specialized alloying elements, such as those containing rare earth metals or specific flux formulations for inclusion modification, are anticipated to register the highest Compound Annual Growth Rates (CAGR). The steel making application segment remains the primary consumer, although the foundry sector, driven by the increasing production of high-quality ductile iron components for wind energy and automotive applications, presents significant incremental opportunities for tailored cored wire products designed for specific casting requirements and metallurgical treatments.

AI Impact Analysis on Cored Wire Market

Analysis of common user questions regarding the impact of Artificial Intelligence (AI) on the Cored Wire Market reveals core themes centered on optimizing consumption rates, predicting steel quality outcomes, and automating inventory management. Users frequently inquire about how AI can minimize the waste associated with cored wire usage, considering its high cost, and whether machine learning algorithms can provide real-time adjustments to feeding parameters based on fluctuating melt conditions. Key concerns revolve around the integration cost of AI-powered systems within existing legacy infrastructure in steel plants and the required standardization of data input to ensure accurate predictive modeling for metallurgical processes. Expectations are high regarding AI's ability to drive 'zero-defect' steel production and enhance supply chain visibility for essential consumables like cored wire.

AI's influence is primarily felt in the realm of advanced process control and operational efficiency. By utilizing deep learning models to analyze vast datasets encompassing ladle temperature, slag composition, vacuum pressure, and initial melt chemistry, AI systems can calculate the precise amount, type, and feeding velocity of cored wire required for a targeted final composition. This minimizes over-treatment or under-treatment, significantly reducing cored wire consumption per ton of steel produced while ensuring exceptional consistency. Furthermore, predictive maintenance powered by AI monitors the performance and wear of cored wire feeding equipment, mitigating costly unplanned downtime and improving overall refractory life within the ladle.

Beyond the immediate operational environment, AI algorithms are being deployed to optimize the cored wire supply chain. Demand forecasting models, incorporating variables such as forecasted steel orders, historical consumption patterns, and raw material availability (e.g., calcium, silicon), enable manufacturers to optimize their production schedules and inventory levels. This strategic application of AI ensures manufacturers maintain just-in-time inventory for high-demand wire types, reducing capital tied up in stock and improving responsiveness to market shifts, thereby introducing a new level of efficiency from the material procurement stage to final use in the steel mill.

- Process Optimization: AI enables real-time, data-driven adjustment of cored wire feeding speed and quantity, optimizing elemental recovery and minimizing consumption waste.

- Quality Prediction: Machine learning models predict final steel purity and inclusion characteristics based on cored wire treatment data, reducing the need for costly rework and rejection.

- Supply Chain Efficiency: AI-driven demand forecasting optimizes inventory levels of various cored wire types, improving manufacturing resource planning and reducing storage costs.

- Equipment Maintenance: Predictive analytics monitors cored wire feeder performance, anticipating mechanical failures and scheduling preventative maintenance, ensuring consistent operation.

- Data Standardization: Increased need for standardized, high-frequency data collection within steel plants to feed sophisticated AI models accurately.

DRO & Impact Forces Of Cored Wire Market

The Cored Wire Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and competitive dynamics. Primary drivers include the global mandate for producing cleaner, higher-quality steel grades required for demanding applications in automotive lightweighting and renewable energy infrastructure. The necessity for precise metallurgical control, which cored wire inherently provides through targeted deep-melt injection, far outweighs traditional bulk additions, cementing its indispensable role. However, the market faces significant restraints, chiefly volatile prices of key raw materials such as calcium and ferroalloys, which directly impact the final cost of the product. Furthermore, the high capital expenditure required for adopting automated cored wire injection systems in smaller or older steel mills acts as a barrier to entry for some potential users.

Key opportunities for growth emerge from the rapid expansion of electric arc furnace (EAF) steelmaking, which demands highly efficient secondary metallurgy treatments to manage impurity levels derived from scrap input. The development of next-generation cored wires, incorporating novel composite materials or nano-structured powders, offers enhanced recovery rates and specialized functionality, opening up niche markets within aerospace and advanced manufacturing. Furthermore, geographical market penetration into rapidly industrializing regions of Southeast Asia and Africa, where domestic steel production is scaling up and modernizing secondary treatment processes, represents substantial untapped potential for manufacturers capable of offering localized supply chain support and technical expertise.

The combined impact of these forces suggests a sustained expansion phase, particularly as global steel production stabilizes and increasingly focuses on product quality rather than sheer volume. While raw material cost volatility remains a persistent challenge, the superior operational benefits—including reduced energy consumption, higher yield, and improved safety—ensure that cored wire remains a cost-effective solution for steel producers aiming for competitive advantage. The long-term trajectory is heavily influenced by the speed of technological adoption in emerging markets and the continued innovation in cored wire formulation designed to meet the evolving demands of advanced metallurgy.

- Drivers: Growing global demand for high-quality, low-impurity steel; stringent regulations requiring precise control over alloy compositions; superior efficiency of deep injection technology compared to bulk additions; expansion of secondary steelmaking capacity (EAFs).

- Restraints: High volatility and cost of critical raw materials (e.g., pure calcium, magnesium); significant initial capital investment required for automated cored wire feeding systems; intense competitive pressure leading to price sensitivities in mature markets.

- Opportunities: Increased focus on advanced, specialized alloy steels (e.g., micro-alloyed, stainless steel); technological advancements leading to new composite cored wire formulations; untapped potential in developing economies upgrading their steel production technology; market integration with AI and industrial IoT for process optimization.

- Impact Forces: Technological adoption accelerates efficiency gains; supply chain stability dictates pricing power; regulatory environment reinforces demand for premium, low-impurity products; competitive rivalry pushes innovation and cost management.

Segmentation Analysis

The segmentation analysis of the Cored Wire Market provides a granular understanding of the dynamics across different product compositions, application areas, and geographical locations. Segmentation by type is crucial, as the chemical composition of the core dictates its function, ranging from desulfurization agents like calcium and calcium silicon (CaSi) to alloying elements such as carbon, titanium, and specialized fluxes. The primary function of these products is to provide precise, rapid treatment of molten metal, meaning different steel grades and foundry requirements necessitate a varied portfolio of cored wire types, with CaSi dominating volume sales due to its versatility in impurity removal.

Segmentation by application highlights the clear dominance of the steel making industry, particularly within ladle metallurgy furnaces (LMF) where final chemistry adjustments are executed. Within steelmaking, segments include treatment for carbon steel, stainless steel, and specialized alloy steel, each requiring tailored wire specifications. The secondary, but rapidly growing, application segment is the foundry industry, focusing specifically on the production of high-grade ductile iron where magnesium cored wire is essential for spheroidization. This segment demands stringent quality control and customized solutions designed to minimize emissions and maximize magnesium yield during the treatment process.

Geographical segmentation remains paramount, reflecting the localized nature of steel production. Asia Pacific leads due to sheer volume, but North America and Europe lead in terms of technological adoption and demand for premium, high-value wire types necessary for automotive and aerospace applications. Analyzing these segments helps stakeholders identify market niches, prioritize R&D investments toward high-growth product categories (like specialized micro-alloying wires), and strategically position their offerings to align with regional industrial priorities and quality standards.

- By Type:

- Calcium Silicon (CaSi) Cored Wire

- Calcium Metal Cored Wire

- Carbon/Graphite Cored Wire

- Ferro Titanium (FeTi) Cored Wire

- Ferro Boron (FeB) Cored Wire

- Magnesium (Mg) Cored Wire

- Rare Earth Metals (REM) Cored Wire

- Pure Aluminum Cored Wire

- Specialized Flux & Desulfurizer Wires

- By Application:

- Steel Making

- Deoxidation

- Desulfurization

- Micro-alloying

- Inclusion Modification

- Foundry (Ductile Iron Spheroidization)

- Others (Non-ferrous metal treatment)

- By Sheath Material:

- Low Carbon Steel Sheath

- Stainless Steel Sheath

- By Diameter/Size:

- 9 mm

- 13 mm

- 16 mm

Value Chain Analysis For Cored Wire Market

The value chain for the Cored Wire Market is initiated with the upstream procurement of critical raw materials, which represents a significant determinant of final product cost and market competitiveness. Upstream activities involve sourcing high-ppurity calcium metal, silicon, various ferroalloys (such as ferrotitanium, ferromanganese), carbon, and low-carbon steel strip necessary for the sheath. The stability of supply and the geopolitical dynamics affecting these raw material markets directly influence the profitability of cored wire manufacturers. Specialized processing of these raw materials, including precise sizing, drying, and blending of the powdered core components, is a crucial step that ensures the metallurgical efficacy and shelf stability of the final cored wire product.

The core manufacturing process, involving the formation of the steel sheath, accurate filling of the powder core, and final sealing and spooling of the wire, forms the midstream segment of the value chain. Efficiency in manufacturing relies heavily on highly sophisticated, high-speed machinery capable of maintaining consistent diameter, density, and core-to-sheath ratio. Direct and indirect distribution channels then move the finished product. Direct channels involve manufacturers selling directly to large, integrated steel mills or specialized EAF operations, often accompanied by technical support and customized logistical solutions (such as dedicated storage and feeding equipment). Indirect channels typically involve regional distributors or agents who manage inventory and sales to smaller foundries or specialized alloy producers, providing localized service and credit facilities.

Downstream analysis focuses on the end-user application within secondary metallurgy operations, primarily steelmaking and casting. The effective use of cored wire requires robust cored wire feeding machines and trained personnel to ensure optimal injection parameters (depth, speed). The value generated at this stage is measured by improved metal quality, reduced energy expenditure, and maximized elemental recovery. Continuous feedback from downstream users regarding performance, breakage rates, and effectiveness of inclusion modification drives innovation back up the value chain, pushing manufacturers to develop more specialized and robust wire products tailored to complex operational environments and achieving stringent quality specifications.

Cored Wire Market Potential Customers

Potential customers for cored wire are predominantly large-scale industrial entities engaged in high-temperature material processing, where precision in chemical composition is critical. The primary consumer group comprises integrated steel manufacturers utilizing basic oxygen furnaces (BOF) and electric arc furnace (EAF) operators. These steel mills consume cored wire extensively in their ladle metallurgy facilities (LMF) and vacuum degassing units (VD), requiring materials primarily for rigorous desulfurization, deoxidation, and micro-alloying treatments necessary for producing high-grade flat products, automotive components, and structural steel. The decision-makers in this segment are typically procurement managers, metallurgical engineers, and heads of steelmaking operations, focusing intensely on price stability, product consistency, and technical support from the supplier.

The secondary, yet rapidly expanding, customer base includes specialized foundry operations, particularly those involved in the production of ductile iron (also known as spheroidal graphite iron). These foundries rely on cored wire, specifically magnesium and related alloys, for the efficient and safe spheroidization of graphite within the molten iron matrix. The superior process control offered by cored wire in magnesium addition helps these foundries meet strict mechanical property requirements for high-stress components used in wind turbine hubs, automotive powertrain systems, and heavy machinery. For foundries, the key purchasing criteria include minimizing magnesium fume emissions, maximizing elemental yield, and ensuring batch-to-batch consistency in casting quality, often prioritizing specialized wire diameters and formulations.

Further potential customers include specialized alloy producers focusing on high-performance metals like nickel-based superalloys or non-ferrous metals where ultra-low impurity levels are mandatory. These customers utilize cored wire for injecting trace elements or purifying agents in extremely controlled environments. Additionally, trading companies and bulk material distributors specializing in metallurgical consumables often purchase cored wire in large volumes to supply smaller, decentralized metal processors who cannot manage direct supplier contracts. This diverse customer landscape necessitates that cored wire manufacturers maintain flexible packaging, technical service offerings, and quality certifications appropriate for each distinct end-use application and regulatory environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SMS Group GmbH, Affival Inc., Foseco (Vesuvius), Minteq International Inc., Sarthak Metals Limited, Cor-Met Inc., Essem Metachem, Wuxi Novote Chemical Co., LTD., Ofz a.s., Marubeni Corporation, Shanghai Refrabest Metal Products Co., Ltd., Henan Huaru Metals Co., Ltd., Anyang Huahang Metallurgical Refractory Co., Ltd., TUROMET SA, Shaanxi Jiade Petrochemical and Metallurgical Co., Ltd., China Minmetals Corporation, D&D Metallurgical Co., Ltd., Shandong Huixin Metallurgy, Shanxi Lixin Refractory, Calderys India. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cored Wire Market Key Technology Landscape

The Cored Wire Market is characterized by continuous technological refinement focused on maximizing core material stability, enhancing feeding precision, and improving overall metallurgical efficiency. Key manufacturing technology involves sophisticated roll-forming and sealing equipment designed to produce wires with extremely uniform diameter and consistent core filling density, which is critical for predictable dissolution rates in molten metal. Advancements in powder handling systems, including vacuum drying and inert gas storage, are vital for moisture-sensitive core materials like pure calcium, ensuring the wire maintains its metallurgical efficacy and minimizes potentially hazardous reactions upon injection. The ability to manufacture specialized, thin-walled sheaths and intricate composite cores with multiple layers represents a technological edge, allowing for controlled release kinetics of alloying agents.

In terms of application technology, the focus has shifted toward fully automated, high-precision cored wire feeding systems. Modern feeders are equipped with advanced sensors, variable speed drives, and integrated load cells that monitor and adjust injection parameters—such as feeding speed and exact consumption—in real-time, often interfaced directly with the steel plant’s Level 2 automation system. This integration ensures highly accurate dosage control, which is essential for achieving ultra-low tolerance in steel chemistry and minimizing treatment costs. Furthermore, specialized multi-strand feeders capable of injecting two or more different cored wire types simultaneously or sequentially provide maximum flexibility for complex secondary metallurgy regimes, particularly those involving sequential desulfurization and subsequent inclusion shape control.

Emerging technological innovations are centering on developing 'smart' cored wires and sustainable production methods. Research is underway to incorporate biodegradable or rapidly dissolving sheath materials that further reduce slag formation and environmental impact. Moreover, the integration of Industrial Internet of Things (IIoT) sensors directly into feeding equipment allows for remote diagnostics and predictive failure analysis, improving operational reliability. The adoption of advanced spectroscopic analysis tools combined with AI allows for immediate assessment of molten metal chemistry, enabling a tight feedback loop that further refines the automated cored wire addition process, solidifying the trend toward highly efficient, data-driven secondary metallurgy operations globally.

Regional Highlights

Regional dynamics play a crucial role in shaping the Cored Wire Market, primarily mirroring global crude steel production trends and the maturity level of the regional metallurgical industries. Asia Pacific (APAC) dominates the global market, both in terms terms of volume consumption and production capacity. This supremacy is largely driven by China, the world's largest steel producer, and supported by significant contributions from India, Japan, and South Korea, where sustained infrastructure growth and robust manufacturing sectors necessitate continuous demand for high-quality, treated steel. The APAC region sees heavy utilization of CaSi and carbon cored wires, though there is a discernible trend toward adopting specialized wires for higher-end applications like automotive steel as regulatory standards tighten across the region.

Europe represents a mature market characterized by stringent quality standards and a high degree of technological sophistication. Steel producers in countries like Germany, Italy, and Russia prioritize efficiency and environmental compliance, driving demand for premium, high-yield cored wires, particularly those used for complex inclusion engineering and micro-alloying for specialized steel grades required by the automotive and aerospace industries. Although crude steel output growth is moderate compared to APAC, the average selling price and value-per-ton of cored wire consumed are significantly higher in Europe due to the complexity and specialization of the products utilized. The focus here is less on volume and more on precision, automation, and minimizing environmental footprint through efficient process management.

North America (NA) exhibits stable demand, driven by the strong presence of EAF steelmaking, which relies heavily on cored wire for chemistry control due to variable scrap quality inputs. The continuous modernization of steel plants, coupled with increasing investments in infrastructure projects, sustains consumption. Meanwhile, the Middle East and Africa (MEA) and Latin America (LATAM) are poised for substantial future growth. MEA, particularly the GCC countries, is investing heavily in establishing self-sufficient, high-tech steel production capabilities, creating new demand centers for cored wire technology and consumables as they adopt state-of-the-art secondary metallurgy practices to meet rising domestic construction needs and diversify their industrial base.

- Asia Pacific (APAC): Dominant market share due to high crude steel production (especially China and India); rapid industrialization; increasing adoption of specialized cored wire for high-end applications like automotive steel.

- Europe: High technological maturity; strong emphasis on premium, specialized wires for aerospace and automotive sectors; stringent quality and environmental regulations driving demand for high-efficiency products.

- North America: Stable demand driven by EAF dominance and infrastructural investment; focus on automation and integration of advanced feeding systems for consistent output.

- Latin America (LATAM): Growth driven by regional infrastructure projects and modernization of existing steel plants; increasing shift from commodity grades to specialty steel demanding cored wire treatments.

- Middle East and Africa (MEA): High growth potential due to investments in establishing new, technologically advanced domestic steel capacities; increasing localized demand for construction and industrial steel.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cored Wire Market.- SMS Group GmbH

- Affival Inc.

- Foseco (Vesuvius)

- Minteq International Inc.

- Sarthak Metals Limited

- Cor-Met Inc.

- Essem Metachem

- Wuxi Novote Chemical Co., LTD.

- Ofz a.s.

- Marubeni Corporation

- Shanghai Refrabest Metal Products Co., Ltd.

- Henan Huaru Metals Co., Ltd.

- Anyang Huahang Metallurgical Refractory Co., Ltd.

- TUROMET SA

- Shaanxi Jiade Petrochemical and Metallurgical Co., Ltd.

- China Minmetals Corporation

- D&D Metallurgical Co., Ltd.

- Shandong Huixin Metallurgy

- Shanxi Lixin Refractory

- Calderys India

- Anyang Kairun Chemical Co., Ltd.

- Anyang Xinyu Metallurgy Refractories Co., Ltd.

- Incomet AS

Frequently Asked Questions

Analyze common user questions about the Cored Wire market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of cored wire in secondary metallurgy?

The primary function of cored wire is to introduce precise quantities of specific treatment agents (like calcium, silicon, or alloys) deep into molten metal during secondary steelmaking or casting. This deep injection ensures high elemental recovery, efficient impurity removal (like desulfurization), and accurate chemical composition control, leading to higher quality final metal products with minimal environmental impact.

Which type of cored wire holds the largest market share?

Calcium Silicon (CaSi) cored wire typically holds the largest market share. This is due to its dual efficacy as both a deoxidizer and a powerful desulfurization agent, making it highly versatile and essential across a wide range of carbon and alloy steel production processes globally, particularly in ladle metallurgy treatments.

How does the use of cored wire compare to traditional bulk addition methods?

Cored wire offers significantly superior performance over traditional bulk additions because it allows for controlled, deep injection, bypassing surface oxidation and slag interference. This results in higher elemental yield, reduced material consumption, safer operation, faster treatment times, and a highly consistent final metal chemistry, which is crucial for specialty steel grades.

What factors restrain growth in the Cored Wire Market?

The most significant restraints include the high volatility and increasing cost of key raw materials, such as pure calcium metal and ferroalloys, which directly affect manufacturing costs. Additionally, the substantial capital investment required for adopting modern, automated cored wire feeding equipment can limit adoption among smaller steel producers and foundries.

Which region is expected to demonstrate the fastest growth in cored wire consumption?

While Asia Pacific currently holds the largest volume share, emerging economies within the Middle East and Africa (MEA) are projected to show the fastest incremental growth rate. This acceleration is driven by major governmental investments in establishing modern, integrated steel production facilities and expanding infrastructure, necessitating the adoption of advanced secondary metallurgy techniques like cored wire usage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cored Wire Market Size Report By Type (Calcium Silicide Cored Wire (CaSi), Calcium Solid Cored Wire (Ca), Pure Carbon Cored Wire (C), Ferro Calcium Cored Wire (CaFe), Others), By Application (Steelmaking, Iron Casting, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Cored Wire Market Statistics 2025 Analysis By Application (Steelmaking, Iron Casting), By Type (Calcium Silicide Cored Wire (CaSi), Calcium Solid Cored Wire (Ca), Pure Carbon Cored Wire (C), Ferro Calcium Cored Wire (CaFe)), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager