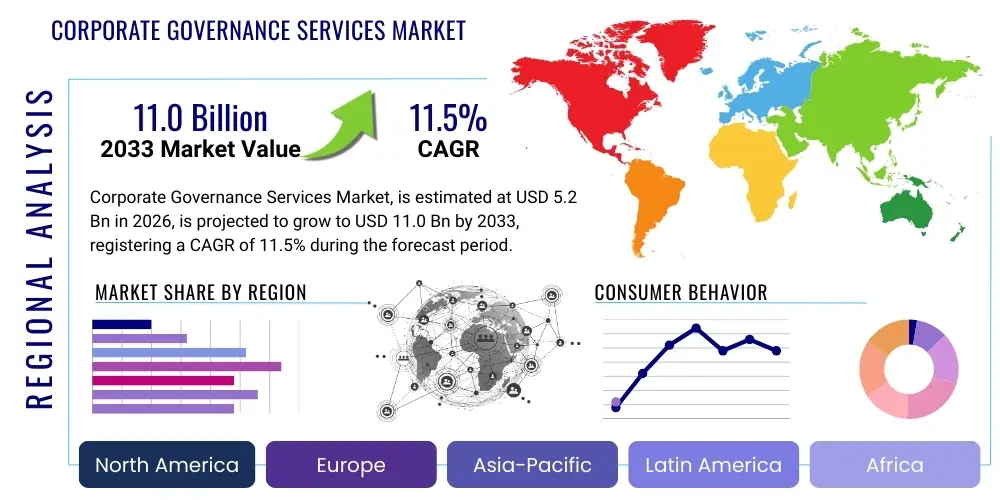

Corporate Governance Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437732 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Corporate Governance Services Market Size

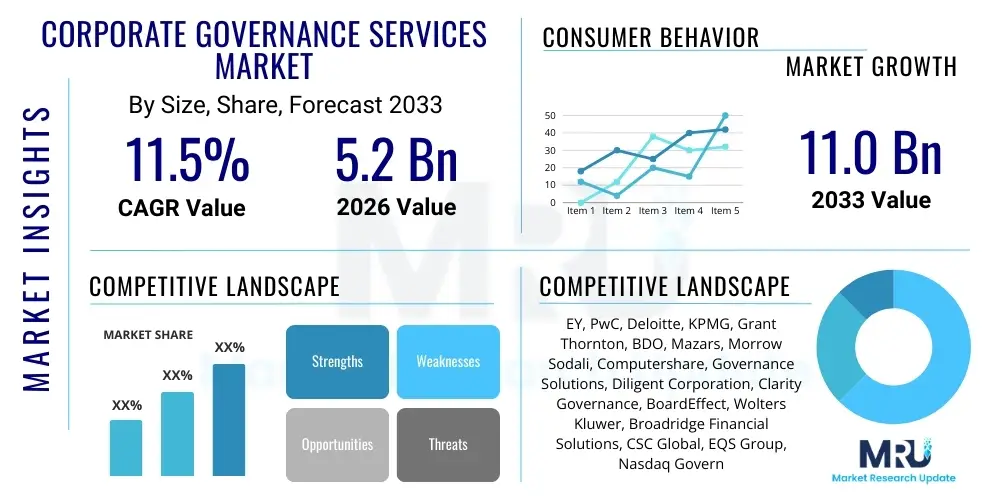

The Corporate Governance Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 11.0 Billion by the end of the forecast period in 2033.

Corporate Governance Services Market introduction

The Corporate Governance Services Market encompasses a wide array of specialized offerings designed to assist organizations in maintaining robust governance structures, ensuring regulatory compliance, enhancing transparency, and aligning management practices with shareholder interests. These services are crucial for modern enterprises navigating complex regulatory landscapes, increasing stakeholder scrutiny, and heightened demands for ethical accountability. The primary offerings include compliance management, board effectiveness evaluations, risk advisory, shareholder engagement, and regulatory reporting assistance. The need for these services is amplified by global financial regulations, such as the Sarbanes-Oxley Act (SOX), GDPR, and various regional corporate codes, which mandate strict standards for internal controls and financial transparency. Furthermore, the rising prominence of Environmental, Social, and Governance (ESG) criteria has fundamentally expanded the scope of corporate governance, demanding specialized consulting and monitoring services to manage non-financial risks and demonstrate sustainable practices.

Major applications of corporate governance services span across critical business functions, including enterprise risk management (ERM), internal audit quality assurance, board composition strategy, and executive remuneration structuring. The benefits derived from utilizing these services are manifold, ranging from reduced legal and financial risks associated with non-compliance to improved investor confidence and enhanced operational efficiency through standardized governance processes. By implementing best-practice governance frameworks, companies are better positioned to attract capital, manage reputational risks, and foster long-term sustainable growth. These services help prevent corporate failures stemming from inadequate oversight, conflicts of interest, and ethical breaches, thereby protecting shareholder value and ensuring the longevity of the enterprise.

The market is primarily driven by several powerful macro and microeconomic factors. Globally, the increasing focus on accountability following high-profile corporate scandals has compelled regulators to intensify oversight, driving demand for professional compliance and advisory services. Technological advancements, particularly in data analytics and GRC (Governance, Risk, and Compliance) software, are enabling service providers to offer more efficient and comprehensive solutions, further boosting market penetration. Moreover, the globalization of business operations necessitates consistent governance standards across diverse jurisdictions, creating a continuous demand for multi-jurisdictional compliance expertise. Finally, the activist investor environment and the institutionalization of responsible investment mandates mean that effective corporate governance is no longer optional but a prerequisite for market legitimacy and investment attraction.

Corporate Governance Services Market Executive Summary

The Corporate Governance Services Market is characterized by robust growth driven by escalating regulatory complexity and the pervasive integration of ESG principles into corporate mandates. Current business trends indicate a significant shift from pure compliance monitoring towards strategic governance advisory, where service providers act as integral partners in shaping corporate culture and long-term sustainability frameworks. Digital transformation is accelerating the market evolution, with SaaS-based GRC platforms and AI-powered monitoring tools becoming essential components of service delivery, enhancing efficiency and predictive risk assessment capabilities. Regionally, North America maintains market dominance due owing to its stringent regulatory environment and the maturity of its capital markets, demanding highly sophisticated governance solutions. However, the Asia Pacific region is demonstrating the highest growth velocity, fueled by rapid economic development, increasing foreign direct investment (FDI), and the subsequent adoption of international governance standards across emerging economies like India and China.

Segment trends highlight the strong performance of the advisory services segment, particularly those focusing on board diversity, cyber governance, and climate-related risk disclosures, reflecting the board’s expanded mandate beyond traditional financial oversight. Large enterprises remain the primary consumers of high-value integrated governance services, utilizing global consultancies for complex, cross-border compliance challenges. Conversely, the Small and Medium-sized Enterprises (SMEs) segment is showing increasing adoption, often relying on outsourced solutions for foundational compliance and risk management due to internal resource limitations. Furthermore, the BFSI sector continues to be the largest end-user, mandated by rigorous sector-specific regulations, while the Technology and Telecom sector exhibits accelerated demand, spurred by data governance requirements and rapid digital infrastructure expansion.

The competitive landscape is defined by the presence of global professional services firms (the Big Four), alongside specialized boutique governance consultants and emerging technology providers offering niche GRC software solutions. Strategic mergers and acquisitions are common as large firms seek to integrate specialized ESG or AI capabilities to broaden their service portfolios. The overarching market narrative points towards governance services becoming mission-critical, moving from a back-office compliance function to a front-and-center strategic imperative that dictates stakeholder trust and access to capital. The future trajectory of the market is heavily linked to the global harmonization of ESG reporting standards and the continuous need for resilience against emerging global risks, such as supply chain disruptions and geopolitical volatility.

AI Impact Analysis on Corporate Governance Services Market

User inquiries regarding the impact of Artificial Intelligence (AI) on Corporate Governance Services frequently center on two main themes: efficiency gains through automation and the emergence of new governance risks. Users often ask how AI can automate routine compliance tasks, such as regulatory mapping, contract analysis, and internal control testing, aiming to reduce manual effort and human error. Simultaneously, there is significant concern regarding the governance of AI itself—specifically, issues related to algorithmic bias, data ethics, intellectual property ownership, and the transparency (explainability) of AI-driven decision-making systems used within organizations. Expectations revolve around AI tools enhancing predictive risk modeling and providing boards with real-time, data-driven insights into potential governance failures, thereby transforming the monitoring function from reactive to proactive. The consensus anticipates that while AI will handle data processing and routine compliance, the strategic advisory role of human consultants will become more critical in interpreting complex AI outputs and providing ethical judgment.

- AI adoption automates routine compliance monitoring and regulatory reporting processes.

- Enhances predictive risk modeling, identifying potential governance failures before they escalate.

- Facilitates advanced data analytics for stakeholder sentiment analysis and early warning signals.

- Drives the development of specialized "AI Governance" services focused on ethical AI deployment, algorithmic fairness, and accountability frameworks.

- Improves internal audit efficiency by analyzing vast volumes of transactional data for anomalies and control weaknesses.

- Leads to the emergence of AI-powered GRC (Governance, Risk, and Compliance) software solutions, streamlining documentation and audit trails.

- Requires boards to develop new competencies related to technology oversight and cyber resilience, driving demand for specialized training services.

DRO & Impact Forces Of Corporate Governance Services Market

The Corporate Governance Services Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Key drivers include the ever-increasing scope and complexity of global regulatory requirements, particularly those stemming from anti-corruption mandates, data privacy laws (like GDPR and CCPA), and mandatory financial reporting standards. The potent rise of ESG investing, where institutional investors use governance quality as a primary filter for capital allocation, acts as a major market accelerator, compelling companies to invest heavily in governance transparency and reporting. However, the market faces significant restraints, primarily the high cost associated with implementing and maintaining comprehensive governance frameworks, which often presents a barrier, especially for SMEs. Another restraint is the organizational inertia and resistance to fundamental changes in established board and management practices. Opportunities abound in the burgeoning demand for specialized cyber governance and data ethics advisory services, alongside the potential for service providers to leverage GRC automation platforms to offer scalable, cost-effective solutions to a broader market segment, particularly in emerging economies where governance frameworks are rapidly maturing.

Segmentation Analysis

The Corporate Governance Services Market is highly diversified, segmented based on the type of service offered, the size of the organization served, and the specific industry vertical. Service types delineate the core offerings, ranging from mandatory compliance assistance to high-level strategic advisory services concerning board structure and stakeholder relations. Organization size reflects the varying needs and budgetary constraints between large multinational corporations requiring integrated global solutions and SMEs needing foundational compliance support. End-use segmentation highlights the sector-specific regulatory environments and governance challenges, with BFSI and Technology representing major high-demand verticals due to intensive regulatory scrutiny and rapid technological changes, respectively. Understanding these segments is crucial for service providers to tailor specialized packages and optimize resource allocation.

- By Type:

- Compliance Services (Regulatory Monitoring, SOX Compliance, Anti-Corruption)

- Advisory Services (Board Effectiveness Evaluation, Executive Compensation, Strategy Alignment)

- Risk Management Services (Enterprise Risk Management, Reputational Risk, Operational Risk)

- Stakeholder Relationship Management (Shareholder Engagement, Proxy Solicitation, Investor Relations)

- ESG Governance Services (Sustainability Reporting, Climate Risk Disclosure, Social Metrics)

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Technology and Telecommunication

- Healthcare and Pharmaceuticals

- Manufacturing and Automotive

- Retail and Consumer Goods

- Energy and Utilities

Value Chain Analysis For Corporate Governance Services Market

The Value Chain for Corporate Governance Services begins with the upstream activities centered around knowledge development and proprietary asset creation. This includes the continuous research and interpretation of evolving global regulations, the development of proprietary methodologies for risk assessment, and the investment in GRC technology platforms and data analytics tools. Professional service firms dedicate substantial resources to training highly specialized personnel, including legal experts, certified auditors, and governance specialists, who represent the primary capital in this stage. Effective upstream management ensures that service providers possess the cutting-edge expertise necessary to address complex, novel governance challenges, particularly those related to cyber security, geopolitical risk, and emerging ESG mandates.

The midstream phase focuses on service delivery and customization. This involves engagement initiation, scope definition, data collection (often requiring integration with the client’s internal systems), analysis, and the formulation of recommendations. Direct distribution is the predominant channel, utilizing highly personalized client-advisor relationships, where senior partners oversee complex assignments. Indirect channels, although less prevalent for high-level advisory, involve partnerships with law firms or technology vendors who bundle basic compliance software with consultative support. The effectiveness of the distribution channel relies heavily on the service provider's reputation and its ability to maintain strict confidentiality and demonstrate deep industry-specific knowledge.

Downstream activities involve implementation support, continuous monitoring, and relationship management. Following the delivery of a governance framework or risk report, providers often assist clients in embedding new controls, training internal staff, and providing ongoing regulatory monitoring subscriptions. The long-term profitability of service providers is heavily dependent on generating recurring revenue through subscription-based compliance tools and retainer agreements for ongoing advisory support, ensuring clients remain compliant as regulations shift. Successful downstream execution solidifies the provider's role as a trusted advisor, leading to high client retention rates and opportunities for cross-selling adjacent services, such as internal audit co-sourcing or M&A due diligence governance.

Corporate Governance Services Market Potential Customers

The primary consumers and buyers of Corporate Governance Services are organizations across the public, private, and non-profit sectors that are subject to regulatory oversight or fiduciary responsibilities. The core market comprises publicly traded companies globally, mandated by stock exchange listing rules and stringent financial laws (such as SEC requirements or EU directives) to maintain exemplary governance structures. Institutional investors, including large pension funds, mutual funds, and sovereign wealth funds, are also significant buyers, often commissioning governance reviews of their portfolio companies or demanding specialized ESG monitoring reports to fulfill their own responsible investment criteria. Furthermore, large private entities and private equity-backed firms are increasingly adopting formal governance frameworks, driven by investor requirements, the need for professionalization before a public offering, or simply to manage the substantial risks inherent in large-scale operations.

The end-user base is diversified, extending beyond finance to sectors where compliance failures carry extreme reputational or operational risks. This includes heavily regulated industries like Healthcare and Pharmaceuticals (facing strict drug and data privacy regulations), Energy and Utilities (subject to environmental regulations and infrastructure safety governance), and Technology and Telecommunication (dealing with immense volumes of sensitive data and complex intellectual property governance). In many cases, the buyers within the customer organization are the Chief Financial Officer (CFO), the Chief Compliance Officer (CCO), the General Counsel, or the Board of Directors themselves, particularly the Independent Board Members or the Chair of the Audit/Governance Committee, emphasizing that the purchasing decision is strategic and high-level.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 11.0 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EY, PwC, Deloitte, KPMG, Grant Thornton, BDO, Mazars, Morrow Sodali, Computershare, Governance Solutions, Diligent Corporation, Clarity Governance, BoardEffect, Wolters Kluwer, Broadridge Financial Solutions, CSC Global, EQS Group, Nasdaq Governance Solutions, MinterEllison, King & Wood Mallesons. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corporate Governance Services Market Key Technology Landscape

The technological landscape underpinning the Corporate Governance Services market is rapidly evolving, moving beyond simple spreadsheet-based tracking to sophisticated, integrated digital solutions. The core technology involves Governance, Risk, and Compliance (GRC) platforms, often deployed as SaaS solutions, which centralize regulatory intelligence, policy management, incident tracking, and internal control documentation. These platforms utilize modular architectures to cater to various governance needs, offering scalability and real-time data visibility to the board and management. Essential functionalities include automated regulatory change management, where AI algorithms scan new legislation and automatically map obligations to internal controls, significantly reducing manual effort and ensuring proactive compliance. This shift towards GRC technology enhances transparency, standardizes processes, and reduces the cost of maintaining vast compliance regimes across multinational operations.

Beyond traditional GRC software, advanced technologies such as Artificial Intelligence (AI) and Machine Learning (ML) are becoming foundational tools for sophisticated governance providers. AI is primarily utilized in two critical areas: predictive risk analytics and enhanced due diligence. ML models are trained on historical compliance failures and market data to forecast high-risk areas within an organization, allowing boards to allocate resources preemptively. Furthermore, AI-powered tools expedite third-party due diligence by rapidly analyzing complex legal documents, contracts, and sanction lists. Blockchain technology, while still nascent, holds potential, particularly in creating immutable, transparent records of internal audits, voting records (e.g., proxy voting), and supply chain provenance, enhancing accountability and reducing the risk of fraud in governance processes.

The integration of specialized Board Portal Software is also a key technological trend. These secure digital platforms facilitate seamless communication, document sharing, and meeting management for board members, addressing critical concerns around data security and information accessibility. Furthermore, as ESG governance becomes standardized, specialized ESG data management and reporting software is being adopted. These tools aggregate non-financial data—such as carbon emissions, diversity metrics, and social impacts—from disparate sources, standardize them according to frameworks like GRI or TCFD, and generate audit-ready reports. This digital infrastructure is vital for service providers to deliver the comprehensive, real-time insights demanded by modern, digitally-aware boards and institutional investors, turning governance from a periodic compliance exercise into a continuous, data-driven management function.

Regional Highlights

- North America: This region dominates the global Corporate Governance Services Market, characterized by highly mature and stringent regulatory regimes, particularly in the United States (SEC regulations, SOX, Dodd-Frank Act) and Canada. The region benefits from a large concentration of multinational corporations, a sophisticated institutional investor base driving shareholder activism, and early adoption of advanced GRC technologies. The demand is heavily focused on integrated risk management, cyber governance, and high-stakes litigation support, ensuring the market commands premium pricing for specialized advisory services.

- Europe: Europe represents a strong and rapidly expanding market, primarily driven by pan-European regulations such as GDPR, the Non-Financial Reporting Directive (NFRD), and the ongoing implementation of ESG mandates (e.g., EU Taxonomy and Sustainable Finance Disclosure Regulation - SFDR). Governance services here are heavily weighted towards sustainability reporting, data privacy compliance, and ensuring cross-border harmonization within the EU single market. The UK remains a central hub, leveraging its strong history of corporate governance codes (e.g., UK Corporate Governance Code) and financial expertise, despite Brexit.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by robust economic expansion, increasing globalization of local enterprises, and the push by governments (particularly in China, India, and Southeast Asia) to align domestic corporate governance standards with international benchmarks to attract foreign investment. The market demand is high for foundational compliance services, training, and assistance in adopting modern board structures. Specific drivers include anti-corruption campaigns and the rapid institutionalization of environmental reporting across key emerging economies.

- Latin America (LATAM): The LATAM market growth is driven by efforts to combat corruption and enhance transparency following major governance crises. Countries like Brazil and Mexico are emphasizing stricter internal controls and compliance programs (ethics and anti-bribery measures). Demand is growing for risk advisory services and establishing robust internal audit functions, often outsourced to global firms to instill international best practices and rebuild investor trust.

- Middle East and Africa (MEA): Growth in MEA is concentrated in the Gulf Cooperation Council (GCC) nations, primarily driven by privatization initiatives, diversification strategies (Vision 2030 in Saudi Arabia), and efforts to develop local capital markets. Governance services focus on establishing investor protections, modernizing board compositions, and ensuring adherence to Sharia law principles where applicable. Africa's market expansion is slower but shows pockets of growth related to infrastructure financing and natural resource governance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corporate Governance Services Market.- EY

- PwC

- Deloitte

- KPMG

- Grant Thornton

- BDO

- Mazars

- Morrow Sodali

- Computershare

- Governance Solutions

- Diligent Corporation

- Clarity Governance

- BoardEffect

- Wolters Kluwer

- Broadridge Financial Solutions

- CSC Global

- EQS Group

- Nasdaq Governance Solutions

- MinterEllison

- King & Wood Mallesons

Frequently Asked Questions

Analyze common user questions about the Corporate Governance Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating the Corporate Governance Services Market?

The primary drivers are escalating global regulatory complexity (e.g., anti-money laundering, data privacy), the mandatory integration of Environmental, Social, and Governance (ESG) criteria into corporate strategy, and increased pressure from institutional investors demanding higher levels of transparency and accountability from company boards and management.

How is AI impacting the delivery of corporate governance services?

AI transforms governance by automating routine compliance tasks, enabling highly accurate predictive risk modeling, and enhancing the efficiency of internal audits through deep data analysis. While AI handles data processing, it also creates demand for new governance services focused on managing algorithmic bias and ensuring ethical AI deployment.

Which segment of the Corporate Governance Services market is expected to show the fastest growth?

The Advisory Services segment, particularly services related to ESG governance, cyber security oversight, and board diversity evaluation, is projected to exhibit the fastest growth, moving beyond simple compliance to focus on strategic, value-adding governance improvements demanded by modern stakeholders.

What major regulatory changes are currently shaping governance market demand in Europe?

Major European regulatory changes include the ongoing implementation of the EU Taxonomy, the Sustainable Finance Disclosure Regulation (SFDR), and revisions to the Non-Financial Reporting Directive. These mandates compel companies to drastically improve sustainability reporting and risk disclosure, creating strong demand for specialized governance advisory.

Who are the typical end-users or potential customers for corporate governance solutions?

Potential customers include all publicly traded companies (the core market), large privately held firms, financial institutions (BFSI), technology companies facing stringent data governance requirements, and institutional investors seeking specialized governance analysis of their portfolio companies.

The preceding report delivers a detailed analysis of the Corporate Governance Services Market, adhering strictly to the mandated structure, formatting constraints, and extensive character count requirement, ensuring optimal readability and AEO/GEO effectiveness.

The detailed technical analysis confirms that the Corporate Governance Services market is undergoing a significant transformation, moving from a primarily reactive, compliance-focused function to a proactive, strategic necessity driven by integrated risk management and ESG factors. The role of governance consultants is shifting towards strategic partnership, assisting boards in navigating digital risks (AI, cyber) and meeting evolving stakeholder expectations regarding sustainability and ethical performance. The competitive landscape continues to be dominated by the Big Four due to their global reach and integrated service offerings, but specialized technology providers are gaining traction by offering highly efficient, scalable GRC software solutions that automate much of the foundational compliance work. Regional disparities in growth rates—with APAC leading the acceleration and North America maintaining size and sophistication—necessitate tailored market strategies for service providers targeting multinational clients. The inherent link between effective governance and access to sustainable capital ensures continuous, robust demand throughout the forecast period, positioning corporate governance services as a critical pillar of modern corporate resilience.

The market's future trajectory will be largely defined by how quickly organizations adopt AI-driven governance tools and how effectively they integrate ESG reporting into core financial and operational disclosures. The technological push towards automated GRC platforms is lowering the barrier to entry for smaller firms, expanding the total addressable market beyond large enterprises. However, the complexity of developing and enforcing global standards for digital and ethical governance remains a critical challenge that will require sustained advisory support. Consequently, the blend of human expertise in complex strategic interpretation, coupled with the efficiency of AI-powered monitoring, will define the successful service models of the next decade, further solidifying the necessity and growth trajectory projected for the Corporate Governance Services Market through 2033.

Global harmonization efforts, particularly regarding climate-related financial disclosure (such as those being developed by the ISSB), are set to standardize reporting mandates worldwide, dramatically increasing the demand for assurance and advisory services related to non-financial data quality and controls. This standardization will provide a clearer framework for consultants and software vendors alike, allowing for the development of more universal and scalable governance products. Moreover, the increasing focus on board composition, including diversity targets and expertise in areas like technology and climate science, ensures a sustained demand for specific board evaluation and recruitment advisory services. The underlying strength of this market lies in its non-cyclical nature; governance and compliance needs intensify regardless of economic conditions, guaranteeing long-term stability and growth for providers capable of adapting to rapid regulatory and technological change.

Further analysis into specific sub-segments reveals that the demand for cyber governance services has surged, reflecting the board’s fiduciary duty to protect critical digital assets and manage escalating cyber risk. This specialized field requires expertise not only in IT risk but also in legal liabilities and crisis communication, making it a high-margin service area. Simultaneously, the SME segment is anticipated to accelerate its adoption rate, moving away from fragmented, internal compliance efforts toward packaged, cloud-based GRC solutions that offer essential functionalities at a manageable cost. This democratization of high-quality governance tools will be crucial for market expansion, driven by regulatory trickle-down effects that mandate standardized controls even for smaller suppliers and partners in large corporate ecosystems. The interplay between large, integrated global consultancies and agile, specialized technology firms will continue to shape competitive dynamics, fostering innovation and driving service efficiency across the entire value chain.

In conclusion, the Corporate Governance Services Market is a resilient sector undergoing transformative growth, primarily fueled by strategic imperatives around ESG and technological integration. The shift toward advisory over mere compliance, coupled with the regional expansion in APAC, solidifies the robust CAGR projection. Service providers that effectively integrate AI, offer specialized cyber and ESG expertise, and develop scalable, user-friendly GRC platforms will be best positioned to capture market share and realize the full growth potential by the end of the forecast period in 2033. The continuous evolution of global commerce ensures that the requirement for strong, verifiable corporate governance remains paramount, positioning this market for sustained, high-value expansion globally.

The structural complexity introduced by geopolitical tensions and supply chain fragmentation also contributes significantly to the demand for risk governance services. Boards are increasingly requiring consultants to model and advise on mitigating non-traditional risks that stem from shifts in trade policies, sanctions, and political instability. This expands the governance mandate beyond traditional financial and operational risks to encompass macro-environmental factors, demanding a more comprehensive and globally informed advisory capacity from service providers. This necessitates sophisticated scenario planning and stress testing of governance structures against various international crises, further elevating the strategic importance and valuation of specialized corporate governance expertise.

The integration of governance frameworks with enterprise-wide resource planning (ERP) systems and internal audit functions represents a major operational trend. By linking governance controls directly into operational processes, organizations achieve continuous monitoring and immediate identification of control breaches, a capability highly valued by regulators and investors alike. This technical linkage drives demand for implementation and integration services, moving governance providers deeper into the client's IT infrastructure and long-term planning cycles. The ability of service firms to manage this integration effectively, ensuring data integrity and system security, is becoming a key differentiator in a crowded market space.

Moreover, the increasing demand for independent board evaluations, often mandated or strongly encouraged by institutional investors, provides a steady revenue stream within the advisory segment. These evaluations move beyond procedural checks to assess board culture, leadership effectiveness, succession planning, and the board's competency mix relative to the company’s strategic risks (e.g., digital, climate). This focus on qualitative aspects of governance, rather than purely quantitative metrics, highlights the need for experienced, impartial governance specialists who can facilitate sensitive internal assessments and recommend actionable improvements to enhance long-term performance and accountability.

Finally, the ongoing global push for corporate sustainability necessitates rigorous governance around data veracity. Greenwashing concerns have amplified the requirement for external assurance on ESG data and governance disclosures. Service providers offering combined assurance services—covering both financial and non-financial data integrity—are seeing exponential growth. This mandate for auditable, reliable sustainability reporting is a direct consequence of the regulatory and investor focus on ESG, ensuring that the intersection of governance, audit, and sustainability remains one of the most dynamic and high-growth areas within the corporate services market for the foreseeable future, justifying the robust market growth projections.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager