Corporate Owned Life Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433226 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Corporate Owned Life Insurance Market Size

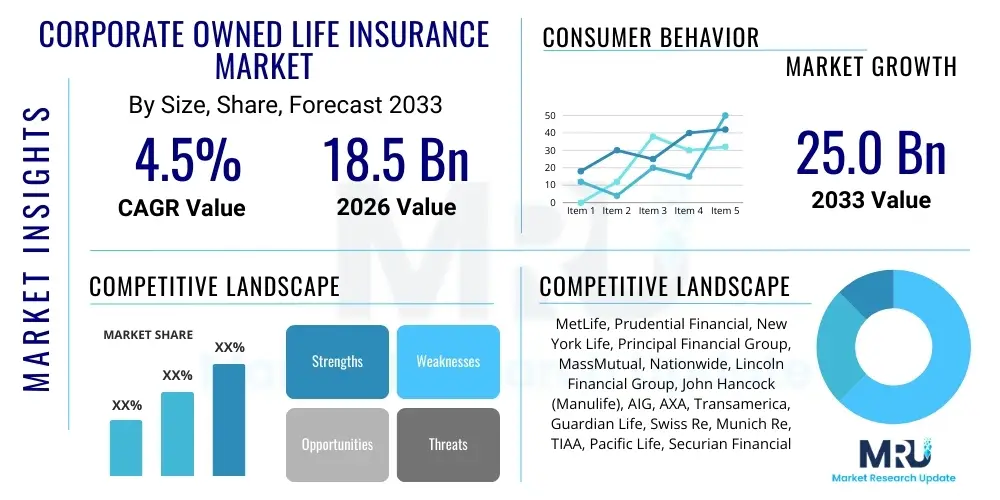

The Corporate Owned Life Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 25.0 Billion by the end of the forecast period in 2033.

Corporate Owned Life Insurance Market introduction

The Corporate Owned Life Insurance (COLI) market encompasses life insurance policies purchased by corporations on the lives of their key employees, executives, or a large pool of general employees, where the corporation is the sole or partial beneficiary. This sophisticated financial instrument serves multiple strategic purposes, primarily providing funding for employee benefit obligations, hedging against the loss of key personnel (key-person insurance), and supplementing non-qualified deferred compensation (NQDC) plans. The core objective of COLI is to offer a tax-advantaged mechanism for internal financing of future liabilities, ensuring business continuity, and enhancing executive retention strategies.

The product description for COLI involves various policy types, predominantly Universal Life (UL) and Variable Universal Life (VUL), which offer flexibility in premium payments and investment components. The key applications center around funding post-retirement benefits (such as Supplemental Executive Retirement Plans – SERPs) and financing the costs associated with company-provided healthcare or death benefits. COLI offers significant benefits, including tax-deferred growth of cash value, potential tax-free access to policy cash value through loans and withdrawals (subject to policy structure), and the receipt of death benefits, which are generally tax-free to the corporation under specific regulatory guidelines (such as those outlined in the Pension Protection Act of 2006).

Major driving factors fueling the expansion of the COLI market include the increasing complexity of executive compensation packages requiring sophisticated funding mechanisms, the rising trend of companies using captive insurance strategies, and favorable regulatory environments that, while strictly controlling usage, permit its application for legitimate business purposes. Furthermore, corporations are increasingly recognizing the need to formally protect against human capital risk, making key-person coverage a standard component of enterprise risk management. Economic stability and the growth of large publicly traded and privately held enterprises further solidify the demand base for COLI products.

Corporate Owned Life Insurance Market Executive Summary

The Corporate Owned Life Insurance (COLI) market exhibits robust stability, driven by enduring business trends focused on executive retention, sophisticated financial planning, and liability mitigation. A primary business trend observed is the shift toward VUL products within COLI portfolios, favoring investment flexibility and higher growth potential tied to market performance, particularly among larger financial institutions and Fortune 500 companies. Regulatory scrutiny, while a restraint, has simultaneously institutionalized best practices, leading to greater transparency and standardized product offerings, which builds corporate trust and encourages broader adoption within compliant frameworks. The strategic use of COLI to offset increasing employee benefit costs remains a fundamental driver influencing business decision-making.

Regionally, North America, particularly the United States, dominates the COLI landscape due to its highly developed financial services sector, established tax codes favoring corporate insurance assets, and high prevalence of large multinational corporations. However, Asia Pacific is emerging as the fastest-growing region, fueled by rapid economic expansion, increasing corporate sophistication, and the establishment of stringent corporate governance standards in economies like China and Japan. European markets demonstrate steady, albeit slower, growth, influenced by varied national insurance and tax regulations. The trend globally points towards integrated risk management solutions where COLI is packaged with other enterprise risk instruments.

Segment trends indicate strong growth in policies specifically designed for Non-Qualified Deferred Compensation (NQDC) funding, reflecting the intense competition for high-level executive talent requiring substantial retirement supplements. By policy type, Universal Life (UL) remains the bedrock of the market due to its predictability, though Variable Universal Life (VUL) is gaining momentum among corporations with higher risk appetites seeking market upside. The market is also seeing specialized product development focusing on small to medium-sized enterprises (SMEs) via streamlined COLI structures, though large corporations remain the primary customers, dictating pricing and innovation cycles.

AI Impact Analysis on Corporate Owned Life Insurance Market

User inquiries regarding AI's impact on the Corporate Owned Life Insurance (COLI) market frequently center on three main areas: efficiency gains in underwriting and administration, the potential for personalized risk assessment, and concerns surrounding data privacy and regulatory compliance. Users are keen to understand how AI tools, particularly machine learning and predictive analytics, can drastically reduce the complex and lengthy underwriting process typical for high-value COLI policies, thereby lowering frictional costs. There is significant expectation that AI will standardize policy administration and enhance compliance monitoring, especially regarding the strict IRS rules governing COLI beneficiaries and employee consent. Conversely, concerns revolve around algorithmic bias in risk assessment for key executives and the security of sensitive corporate and executive medical data when managed by automated systems.

The integration of Artificial Intelligence is transforming operational aspects of the COLI market from initial consultation to claims processing. AI algorithms are now being utilized to analyze vast datasets of corporate financials, executive health records, and industry-specific risks to provide more accurate and expedited underwriting decisions, moving away from time-consuming manual procedures. This allows carriers to offer more competitive pricing and quicker policy issuance, crucial factors in competitive executive benefit environments. Furthermore, AI-powered compliance systems are monitoring policy structures in real-time, ensuring adherence to complex federal regulations like IRC Section 101(j), which governs the tax treatment of death benefits from COLI policies.

Beyond operational improvements, AI is influencing product design and distribution. Predictive analytics help insurers forecast lapse rates and cash flow needs more accurately, enabling better asset-liability matching for COLI portfolios held on the insurers’ books. For corporate clients, AI tools can simulate various financial scenarios—such as changes in tax law or shifts in NQDC liabilities—to optimize the policy structure and premium schedule. The goal is to maximize the long-term internal rate of return (IRR) on the COLI asset while minimizing regulatory risk, transforming COLI from a simple insurance product into a highly sophisticated financial modeling tool.

- Expedited Underwriting: AI accelerates risk assessment for high-net-worth executives, reducing policy issuance time.

- Enhanced Compliance Monitoring: Machine learning algorithms ensure adherence to strict federal tax rules (e.g., IRC 101(j)) regarding corporate beneficiary rights and employee notification.

- Fraud Detection: Sophisticated AI models improve the identification of fraudulent claims or misrepresentations in corporate financial reporting.

- Personalized Policy Structuring: Predictive analytics optimize policy parameters (premium funding, investment allocation) based on the corporation’s specific long-term liability profile.

- Automated Administration: AI streamlines policy servicing, billing, and regulatory reporting, lowering operational overhead for carriers.

- Risk Modeling Accuracy: Advanced AI techniques provide superior forecasting of mortality and morbidity trends within key executive cohorts.

DRO & Impact Forces Of Corporate Owned Life Insurance Market

The Corporate Owned Life Insurance (COLI) market dynamics are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful external Impact Forces. A key Driver is the persistent need for companies to fund non-qualified benefit plans and secure key-person risk, coupled with the tax efficiency of COLI cash value accumulation. However, the market faces significant Restraints, primarily stemming from stringent regulatory requirements, particularly in the U.S., which mandate explicit employee consent and detailed reporting, making policy administration complex and costly. Opportunities lie in expanding COLI use among mid-sized companies and integrating policies with broader enterprise risk management frameworks, utilizing new technologies for simplified compliance.

The major Impact Forces influencing the COLI landscape include fluctuating interest rates, changes in corporate tax legislation, and general economic volatility. Low-interest-rate environments historically challenge the guaranteed returns and product design of permanent life insurance products, potentially suppressing demand for certain COLI structures like Whole Life. Conversely, changes in corporate tax rates (e.g., reductions) can diminish the relative attractiveness of tax-advantaged instruments like COLI, shifting the cost-benefit analysis for corporate treasurers. Economic growth, however, generally increases corporate profitability and the desire to invest in executive retention and liability funding, acting as a positive catalyst.

The regulatory environment remains the most critical external force. Past legislative actions, such as the Pension Protection Act (PPA) of 2006, drastically curtailed abuses and established clear boundaries for COLI usage, ultimately professionalizing the industry. Future regulatory shifts, particularly concerning the taxation of cash value accumulation or death benefits, could profoundly alter market demand. Carriers must constantly adapt their product offerings to ensure absolute compliance, driving significant investment in legal and administrative infrastructure. The continuous evolution of accounting standards (like FASB/IASB changes) also influences how COLI assets are reported on corporate balance sheets, directly affecting corporate adoption rates.

Segmentation Analysis

The Corporate Owned Life Insurance (COLI) market is segmented primarily based on the Type of Policy, the Application of the Policy, and the Size of the Corporation utilizing the insurance. Understanding these segments is crucial for analyzing market dynamics and targeting specific customer needs. The segmentation by policy type reflects the structural preferences of corporate finance departments, balancing risk tolerance with desired returns and financial statement reporting requirements. The Application segmentation highlights the specific strategic financial goal the COLI policy is intended to fulfill, which ranges from protecting against the loss of key talent to funding substantial future employee liabilities.

Within the policy type segment, Universal Life (UL) and Variable Universal Life (VUL) policies dominate, offering flexibility in premium payments and varying degrees of investment risk. Whole Life (WL), while less common in modern COLI structures, still exists, particularly where guaranteed cash value accumulation is paramount. The application segmentation is pivotal; Key Person Insurance focuses on the mortality risk of essential employees, while NQDC (Non-Qualified Deferred Compensation) funding is a mechanism to hedge the long-term liability associated with executive retirement plans. General COLI, often referred to as "Jumbo COLI," covers large pools of employees to fund general corporate employee benefits, though this structure is highly regulated.

Geographically, market penetration varies significantly. North America, with its mature executive benefits landscape and complex tax code, is the largest segment. The Asia Pacific market, however, offers the highest growth potential, driven by the institutionalization of corporate benefits and risk management in emerging economies. Analyzing segmentation allows insurers to develop tailored products—such as specialized VUL products for large financial institutions or simplified UL products marketed to mid-market companies funding modest benefit plans—optimizing market share and profitability across diverse corporate client needs.

- By Policy Type

- Universal Life (UL)

- Variable Universal Life (VUL)

- Whole Life (WL)

- By Application

- Key Person Insurance

- Non-Qualified Deferred Compensation (NQDC) Funding

- Supplemental Executive Retirement Plan (SERP) Funding

- General Employee Benefit Funding

- By Enterprise Size

- Large Enterprises (Revenue > $1 Billion)

- Medium Enterprises (Revenue $50 Million - $1 Billion)

- By Distribution Channel

- Direct Sales

- Brokers and Agents (Independent and Captive)

- Consulting Firms (Benefits Consultants)

Value Chain Analysis For Corporate Owned Life Insurance Market

The value chain for the Corporate Owned Life Insurance (COLI) market is highly specialized, moving from initial policy design and risk modeling (upstream) through to distribution and long-term policy servicing (downstream). Upstream activities involve specialized life insurers who design complex permanent life insurance products suitable for corporate ownership, requiring deep actuarial expertise to model mortality, interest rate risk, and tax implications. This phase includes the critical underwriting process for key executives and the legal drafting of policy endorsements to ensure compliance with PPA regulations and corporate governance standards. Strategic partnerships with reinsurance providers are also essential in the upstream segment to manage large-scale corporate mortality risk exposure.

The downstream component of the value chain focuses heavily on distribution and post-sale servicing. Distribution is predominantly executed through specialized channels, primarily benefits consulting firms, large national brokerages, and sophisticated independent agents who possess expertise in executive compensation and corporate finance. Direct sales from insurers are less common due to the need for third-party financial planning integration. Post-sale activities are critical and include meticulous policy administration, tracking employee consent forms (a regulatory necessity), managing cash value investments, processing loans/withdrawals, and regular financial reporting to the corporate treasurer or CFO, ensuring the COLI asset meets long-term liability hedging objectives.

Distribution channels in the COLI market are characterized by a high degree of advisory service, reflecting the product's complexity. Indirect distribution through specialized benefits consultants acts as the dominant path, as these consultants advise corporations on broader executive compensation strategy, naturally integrating COLI as a funding solution. Direct distribution is limited, usually confined to captive agents of insurers handling general employee benefits who then escalate COLI discussions to specialized internal teams. The integration of technology in the distribution and servicing phases is increasing, allowing for better policy performance tracking and streamlined compliance documentation, thereby enhancing transparency and operational efficiency across the entire value chain.

Corporate Owned Life Insurance Market Potential Customers

The primary end-users and buyers in the Corporate Owned Life Insurance market are large corporations, multinational organizations, and significant privately held companies, particularly those with complex executive compensation and non-qualified benefit structures. These entities utilize COLI as a core financial strategy, not merely an insurance product. Buyers are typically corporate financial departments, including the Chief Financial Officer (CFO), Treasurer, and heads of Human Resources or Compensation Committees, who are responsible for managing long-term corporate liabilities and ensuring executive retention.

Industries with high demand for COLI include Financial Services (banking, insurance, asset management), Healthcare, Technology, and large Manufacturing organizations. These sectors often rely heavily on highly compensated executives whose retention is critical to business success, necessitating robust NQDC and SERP plans that COLI is designed to fund. Furthermore, organizations undergoing mergers, acquisitions, or significant strategic transformations often use COLI to protect human capital during periods of transition or to fund expected termination benefits.

While historically dominated by large publicly traded entities (Fortune 1000), there is a growing, yet nascent, interest from upper mid-market companies (typically those with annual revenues between $50 million and $1 billion). These smaller buyers are motivated by similar key-person risk concerns but require simpler, more cost-effective COLI solutions that are easier to administer than the complex jumbo policies favored by mega-corporations. The willingness of the buyer to engage highly specialized benefits and tax consultants is a key indicator of potential COLI adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 25.0 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | MetLife, Prudential Financial, New York Life, Principal Financial Group, MassMutual, Nationwide, Lincoln Financial Group, John Hancock (Manulife), AIG, AXA, Transamerica, Guardian Life, Swiss Re, Munich Re, TIAA, Pacific Life, Securian Financial, Penn Mutual, Thrivent, OneAmerica |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corporate Owned Life Insurance Market Key Technology Landscape

The technology landscape supporting the Corporate Owned Life Insurance (COLI) market is centered on enhancing data management, compliance tracking, and financial modeling capabilities, rather than revolutionary consumer-facing innovations. A primary technology involves advanced Policy Administration Systems (PAS) specifically customized to handle the intricacies of corporate-owned policies, which include managing multiple lives under one policy structure, tracking premiums against liability funding targets, and integrating with corporate accounting systems (ERP and general ledger). These systems must provide robust audit trails to satisfy the intense regulatory scrutiny associated with COLI, particularly concerning the tracking of employee consent and notification requirements necessary to maintain tax-advantaged status.

Furthermore, predictive analytics and artificial intelligence (AI) are rapidly being deployed, primarily in the upstream segment. AI facilitates accelerated underwriting (AU) for executive coverage, leveraging non-medical data sources, health databases, and public records to quickly assess mortality risk, significantly reducing the turnaround time for policy issuance, which is a major pain point for corporate buyers. Financial modeling software is another critical technology, utilized by carriers and benefits consultants alike to perform sophisticated scenario analysis, projecting policy cash value performance under various interest rate and tax change environments, ensuring the COLI asset remains optimally aligned with long-term corporate obligations.

The integration of distributed ledger technology (DLT), or blockchain, is also being explored, particularly for streamlining compliance and enhancing security. DLT offers an immutable and transparent record of policyholder consent, premium payments, and policy changes, which can substantially simplify the required regulatory reporting and mitigate the risk of compliance failures. Secure data exchange platforms and sophisticated cybersecurity measures are paramount, given the high-value nature of the policies and the sensitive personal and financial data of corporate executives involved. The technological focus is strictly on precision, compliance, and efficiency throughout the policy lifecycle.

Regional Highlights

The global Corporate Owned Life Insurance (COLI) market exhibits distinct regional dynamics driven by local regulatory environments, economic maturity, and prevailing corporate governance practices. North America, especially the United States, represents the largest and most mature market. This dominance is attributable to the widespread adoption of complex executive compensation plans, favorable historical tax treatments for life insurance cash value, and the significant number of large, publicly traded companies that use COLI to fund defined benefit obligations and non-qualified retirement plans. The stringent but clear regulatory framework (PPA compliance) provides a stable foundation, though innovation often centers on optimizing tax efficiency and investment performance within existing rules.

Europe constitutes a significant, yet fragmented, market. Adoption rates vary considerably across countries, heavily influenced by national tax laws governing corporate assets and the deductibility of premiums. The United Kingdom and Germany show higher adoption, often using COLI structures for pension funding and key-person coverage. However, tighter regulatory oversight by institutions like EIOPA and the less standardized approach to executive benefits compared to the U.S. means that product growth is steady but slower. The European focus is often on risk mitigation and solvency management, integrated into broader corporate financial reporting.

The Asia Pacific (APAC) region is projected to be the fastest-growing market segment. This growth is spurred by rapid wealth accumulation, increased corporate sophistication in countries like China, India, and Australia, and the burgeoning demand for standardized, sophisticated executive retention tools. As APAC companies transition from family-owned structures to professionally managed corporations, the need for formal key-person protection and robust NQDC funding mechanisms drives COLI uptake. The market in APAC is characterized by high potential, coupled with the need for insurers to navigate diverse and evolving regulatory landscapes specific to each national jurisdiction.

- United States: Market leader; driven by NQDC funding, established tax laws, and presence of large multinational corporations. Focus on VUL policies for cash accumulation.

- Canada: Stable market focused on private placement COLI and executive carve-out plans, characterized by prudent regulation and high corporate financial maturity.

- Western Europe (UK, Germany): Key markets driven by sophisticated pension liability hedging and key-person risk management, influenced by Solvency II regulations.

- China: Fastest-growing region, fueled by rising corporate wealth and the increasing adoption of Western-style executive benefit packages. High potential for general employee benefit funding.

- Japan: Mature APAC segment, where COLI is often used within strict corporate tax guidelines to manage employee benefits and ensure business continuity.

- Australia: Strong adoption of specialized COLI structures integrated with superannuation funds and executive retirement vehicles.

- Latin America (Brazil, Mexico): Emerging markets where COLI adoption is accelerating, driven by the need for financial stability tools and protection against economic volatility.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corporate Owned Life Insurance Market.- MetLife

- Prudential Financial

- New York Life Insurance Company

- Principal Financial Group

- Massachusetts Mutual Life Insurance Company (MassMutual)

- Nationwide Mutual Insurance Company

- Lincoln Financial Group

- John Hancock (Manulife Financial Corporation)

- American International Group (AIG)

- AXA

- Transamerica (Aegon)

- Guardian Life Insurance Company

- Swiss Re

- Munich Re

- TIAA-CREF

- Pacific Life

- Securian Financial

- Penn Mutual Life Insurance Company

- Thrivent Financial

- OneAmerica Financial Partners

Frequently Asked Questions

Analyze common user questions about the Corporate Owned Life Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of Corporate Owned Life Insurance (COLI)?

The primary function of COLI is to provide a tax-efficient funding mechanism for corporate liabilities, most commonly Non-Qualified Deferred Compensation (NQDC) plans and Supplemental Executive Retirement Plans (SERPs), while simultaneously protecting the company against the financial loss incurred by the death of key personnel.

How does the Pension Protection Act (PPA) affect COLI policies?

The Pension Protection Act of 2006 (IRC Section 101(j)) strictly regulates COLI policies by requiring mandatory employee notice and written consent for the corporation to receive the death benefit tax-free. Policies failing this requirement typically lose the tax-exempt status of the death benefit proceeds.

What are the key policy types used in the COLI market?

The key policy types are Universal Life (UL) and Variable Universal Life (VUL). UL offers stable cash value growth and flexible premiums, while VUL offers greater growth potential linked to investment performance, though carrying higher risk exposure for the corporate owner.

Is COLI only used by Fortune 500 companies?

While COLI is predominantly utilized by large enterprises due to the complexity and scale of NQDC liabilities, there is increasing adoption among medium-sized enterprises (MMEs) and successful privately held companies seeking similar benefits for key-person risk mitigation and executive retention.

How is AI impacting COLI underwriting and administration?

AI is significantly impacting COLI by enabling accelerated underwriting (AU) for executives, using advanced analytics to assess risk quicker and streamline the complex administrative tracking required for regulatory compliance, thereby reducing policy issuance time and lowering operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager