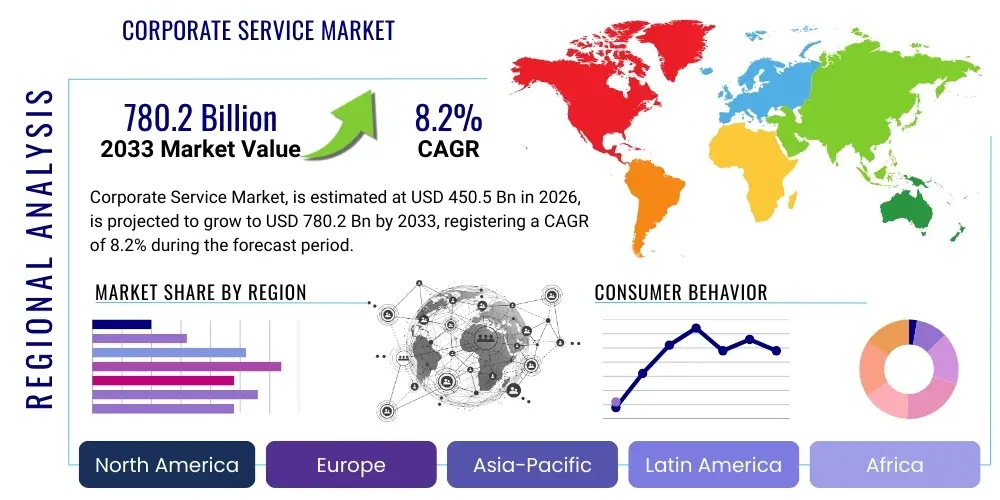

Corporate Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437066 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Corporate Service Market Size

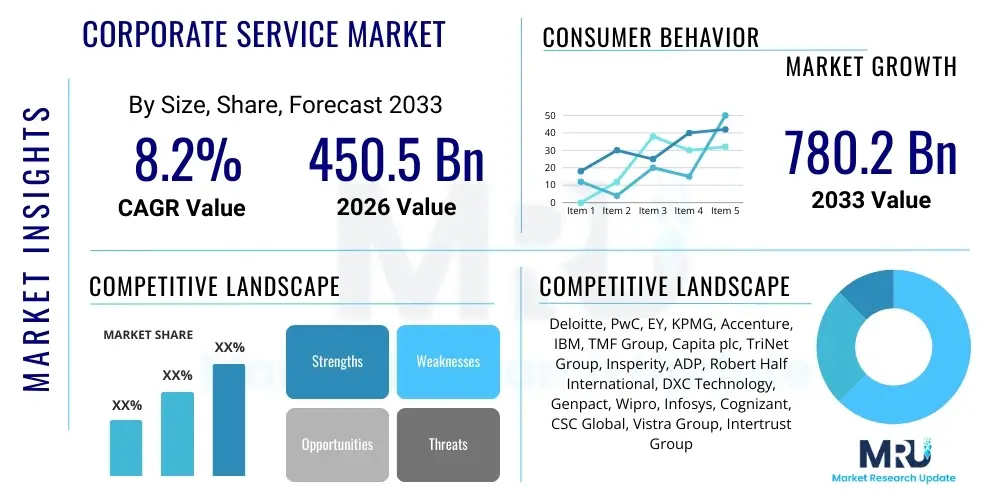

The Corporate Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 450.5 Billion in 2026 and is projected to reach USD 780.2 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the increasing complexity of global regulatory environments, the ongoing trend of outsourcing non-core business functions, and the widespread adoption of digital transformation initiatives across industries. Corporations globally are increasingly seeking specialized expertise and scalable solutions to manage operational efficiency, compliance, and talent management, driving sustained demand in this sector.

Corporate Service Market introduction

The Corporate Service Market encompasses a broad range of professional services essential for the operational health and strategic functioning of businesses, spanning legal, financial, human resources (HR), technological support, and specialized consulting. These services are critical components enabling organizations to manage regulatory compliance, optimize capital structures, mitigate risks, and streamline internal processes, allowing core management to focus on strategic growth and product development. The foundational elements of the market include business process outsourcing (BPO), knowledge process outsourcing (KPO), and integrated digital service delivery platforms designed to handle complex, repetitive, or high-expertise tasks efficiently.

Major applications of corporate services are profoundly concentrated in areas requiring specialized knowledge and continuous adaptation to changing legislation, such as international tax planning, advanced cybersecurity measures, complex litigation support, and managing diverse, globally dispersed workforces. The inherent benefit derived from utilizing corporate services lies in cost reduction through operational efficiency, access to highly specialized, global talent pools that might be inaccessible internally, and enhanced speed-to-market for new ventures by ensuring rapid compliance with local and international standards. Furthermore, these services provide a vital buffer against operational disruptions by transferring certain critical risks to specialized service providers.

Key driving factors accelerating the market’s expansion include the escalating necessity for corporate transparency and rigorous governance frameworks, mandated by international bodies and government regulations like GDPR, anti-money laundering (AML) protocols, and stringent environmental, social, and governance (ESG) standards. Concurrently, technological advancements, particularly in cloud computing, data analytics, and workflow automation, have fundamentally lowered the cost and increased the scalability of service delivery, making sophisticated corporate support accessible even to mid-sized enterprises operating across multiple jurisdictions. The demand for scalable, flexible, and tech-enabled corporate solutions is consistently reshaping service offerings, moving them away from static, retainer-based models toward dynamic, outcome-focused service contracts.

Corporate Service Market Executive Summary

The Corporate Service Market is experiencing significant acceleration driven by concurrent business trends, including globalized supply chains, intensified regulatory oversight, and massive technological integration focused on digital enablement. A dominant trend is the shift from fragmented service delivery to integrated, bundled solutions, where providers offer holistic packages covering legal, HR, and finance management through unified technological platforms. Business leaders are prioritizing resilience and agility, increasing demand for predictive compliance services and sophisticated risk management tools. This strategic transition emphasizes value creation through operational optimization rather than mere cost savings, redefining the service provider as a strategic partner.

Regionally, North America and Europe continue to dominate the market due to the presence of large multinational corporations and mature regulatory environments demanding advanced corporate governance services. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, fueled by rapid industrialization, increasing foreign direct investment, and the subsequent expansion of multinational operations into developing economies like India and Southeast Asia. This growth in APAC is creating strong demand for localized compliance services, market entry consultation, and talent management solutions tailored to dynamic labor markets. Emerging markets are also leveraging technology to leapfrog traditional service models, adopting cloud-native corporate platforms immediately.

Segmentation trends highlight the increasing importance of IT Support and Consulting services, particularly those specializing in data privacy, cybersecurity, and cloud migration governance, reflecting the fundamental digital transformation underway across all industries. Among service types, HR and talent management solutions are witnessing substantial investment, driven by the shift towards remote and hybrid work models necessitating specialized payroll, benefits administration, and global mobility services. Deployment trends confirm a strong market preference for Cloud-Based services over traditional on-premise solutions, as cloud models offer superior scalability, security, and continuous update cycles essential for meeting evolving regulatory demands and technological standards.

AI Impact Analysis on Corporate Service Market

Common user questions regarding AI’s impact on the Corporate Service Market primarily revolve around automation-driven job displacement, the reliability and ethical governance of AI in decision-making processes (especially legal and financial compliance), and the return on investment (ROI) of integrating complex AI platforms. Users are concerned about whether specialized corporate functions, such as tax preparation, basic contract drafting, and payroll processing, will become fully automated, drastically altering the structure of professional firms. Conversely, there is high expectation that AI will enhance accuracy, drastically reduce processing times, and unlock predictive capabilities in risk assessment and market forecasting, allowing human analysts to focus exclusively on strategic, complex problem-solving. The consensus indicates a future where AI serves as a powerful co-pilot, not a complete replacement, requiring significant upskilling across the corporate service sector.

AI is fundamentally reshaping delivery models by integrating machine learning into enterprise resource planning (ERP) systems and dedicated corporate service platforms, automating routine administrative tasks and high-volume data processing. This integration allows firms to transition towards providing value-added advisory services, moving beyond mere execution. In legal services, AI tools are accelerating e-discovery and regulatory monitoring; in finance, robotic process automation (RPA) handles invoicing and ledger reconciliation; and in HR, intelligent chatbots manage employee queries and initial candidate screenings. These applications enhance speed and throughput, which is critical for firms managing large, multinational client portfolios.

The major impact is the democratization of specialized knowledge. AI-powered platforms can synthesize complex regulatory changes across multiple jurisdictions in real-time, providing instant compliance alerts and generating localized policy templates that previously required hours of highly paid human expertise. This capability lowers the barrier for global expansion, particularly for Small and Medium Enterprises (SMEs), who can now access enterprise-grade compliance and operational support without retaining massive internal teams. However, the implementation of AI also introduces new risks related to data security, algorithmic bias, and accountability, necessitating a new generation of corporate services focused specifically on AI governance and ethical auditing.

- Automation of routine compliance checks and regulatory reporting via Natural Language Processing (NLP).

- Enhanced predictive risk modeling for financial stability and operational hazards.

- Implementation of Robotic Process Automation (RPA) for high-volume, repetitive accounting and HR tasks.

- Development of intelligent legal tech for accelerated contract review and litigation support (e-discovery).

- Increased demand for specialized consulting focused on AI governance, ethics, and data security audits.

- Personalization of employee experience and talent acquisition through AI-driven HR analytics.

- Shift in service provider focus from transaction execution to strategic insight generation and interpretation.

DRO & Impact Forces Of Corporate Service Market

The Corporate Service Market's trajectory is primarily driven by the confluence of stringent regulatory requirements and the necessity for global operational efficiency (Drivers). Regulatory complexity, particularly regarding cross-border data management and tax harmonization, forces businesses to engage specialized service providers. Simultaneously, the inherent scalability and cost advantages offered by integrated, cloud-based service platforms accelerate adoption, particularly among rapidly expanding global entities. However, the market faces constraints related to persistent concerns over data security, especially cross-border data flow limitations and the high initial investment required for migrating legacy corporate systems to modern digital service platforms (Restraints). Opportunities abound in specializing in niche areas like ESG reporting frameworks, digital identity management, and catering to the specific compliance needs of emerging technology sectors like blockchain and quantum computing.

Impact forces currently shaping the market are heavily dominated by technological disruption and geopolitical instability. The push for hyper-automation across finance and HR functions acts as a primary transformative force, pressuring traditional BPO providers to significantly upgrade their technological stack. Geopolitical fragmentation and trade disputes increase the operational complexity for multinational corporations, driving specialized demand for legal and tax services capable of navigating fragmented trade environments and conflicting sanctions. Furthermore, the global shortage of highly specialized cyber-security and compliance talent compels corporations to outsource these critical functions to firms that maintain advanced in-house expertise, intensifying market competition and specialization.

These forces collectively elevate the standard for service delivery, moving the industry toward guaranteed, outcome-based contracts linked to measurable efficiency gains or compliance adherence levels. The ongoing evolution of global standards, coupled with rapid technological cycles, ensures that the Corporate Service Market remains highly dynamic, perpetually rewarding firms that invest heavily in both regulatory intelligence and technological platforms. This environment mandates continuous adaptation, transforming restraints—such as the need for robust data localization—into opportunities for providers who can engineer secure, compliant, regionalized cloud service architectures.

Segmentation Analysis

The Corporate Service Market is highly segmented, reflecting the diverse operational needs of modern businesses across varying geographies and industries. Core segmentation revolves around the type of service provided—ranging from foundational operational support like accounting and payroll to high-level strategic guidance such as complex consulting and specialized legal representation. A key insight from segmentation analysis is the disproportionate growth observed in technology-driven segments, especially outsourced IT support and cloud-based HR platforms, which are universally essential for digital transformation initiatives. This market structure allows businesses of all sizes to select customized bundles of services tailored to their specific regulatory landscape and operational complexity, promoting flexibility in procurement.

- By Service Type:

- Legal Services (Corporate Law, Litigation Support, Intellectual Property)

- Consulting Services (Strategy Consulting, Operations Consulting, Risk & Compliance)

- Human Resource (HR) Services (Payroll, Benefits Administration, Global Mobility, Recruitment Process Outsourcing)

- Accounting and Financial Services (Tax Advisory, Auditing, Treasury Management, Financial Planning)

- IT Support Services (Managed IT Services, Cybersecurity, Data Governance, Cloud Management)

- Administrative Support Services (Secretarial Services, Office Management, Procurement)

- By Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Manufacturing and Automotive

- Healthcare and Pharmaceuticals

- Retail and Consumer Goods

- Government and Public Sector

- Energy and Utilities

- By Deployment Model:

- On-Premise

- Cloud-Based

- Hybrid Model

Value Chain Analysis For Corporate Service Market

The value chain for the Corporate Service Market begins upstream with specialized technology providers and knowledge creators, including software vendors offering niche compliance platforms (e.g., RegTech, LegalTech), advanced data analytics tools, and core cloud infrastructure providers (AWS, Azure). These upstream suppliers are critical as they provide the underlying digital architecture and specialized software necessary for scalable, secure service delivery. The primary service providers then integrate these technologies with human expertise, focusing on process optimization, quality assurance, and translating complex regulatory requirements into actionable business processes for the end-client. Efficiency in this segment hinges on high levels of automation and continuous employee training.

The distribution channel is increasingly hybrid, integrating traditional direct engagement models (large consulting contracts and embedded, on-site teams) with sophisticated indirect digital channels. The rapid growth of cloud-based Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) models allows indirect distribution through channel partners, resellers, and digital marketplaces, which is particularly effective for delivering standardized, scalable services to SMEs. Direct engagement remains crucial for highly complex, bespoke projects, such as major mergers and acquisitions (M&A) or large-scale digital transformation initiatives, where deep, personalized client relationship management is paramount. The optimization of this distribution mix is key to maximizing market reach and profitability.

Downstream, the value chain culminates with the end-users—the corporations, governments, and non-profits that consume these services. The value realization at this stage is measured by tangible outcomes such as enhanced regulatory compliance, measurable cost savings, increased organizational efficiency, and reduced operational risk. The movement towards outcome-based pricing models indicates a shift where the service provider's success is directly tied to the client’s long-term strategic benefits, necessitating transparent reporting and continuous performance monitoring throughout the service contract lifecycle.

Corporate Service Market Potential Customers

The primary customers for the Corporate Service Market span a wide spectrum, ranging from multinational conglomerates requiring global, integrated solutions to domestic Small and Medium Enterprises (SMEs) seeking cost-effective, scalable operational support. Large enterprises, particularly those operating across numerous international jurisdictions, represent the most lucrative segment, requiring advanced, high-stakes services such as complex international tax structuring, specialized cross-border legal advice, and comprehensive risk management solutions for geopolitical and cyber threats. These organizations demand providers capable of offering seamless service continuity and unified reporting across diverse regulatory landscapes, often favoring the top-tier global consulting and specialized legal firms.

SMEs constitute a rapidly growing customer base, increasingly utilizing corporate services to professionalize their operations and accelerate growth without incurring the overhead of large, specialized internal departments. For SMEs, potential services often involve outsourced payroll, entry-level legal document preparation, basic cloud IT management, and standardized compliance packages. This segment highly prioritizes affordability, ease of integration, and the accessibility offered by digital, cloud-based service delivery models, driving demand for specialized SaaS platforms and fractional service providers that can scale services up or down based on immediate business volume and growth phase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Billion |

| Market Forecast in 2033 | USD 780.2 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deloitte, PwC, EY, KPMG, Accenture, IBM, TMF Group, Capita plc, TriNet Group, Insperity, ADP, Robert Half International, DXC Technology, Genpact, Wipro, Infosys, Cognizant, CSC Global, Vistra Group, Intertrust Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corporate Service Market Key Technology Landscape

The Corporate Service Market is underpinned by a sophisticated technology landscape characterized by the widespread adoption of integrated cloud platforms and hyper-automation tools. Central to this transformation are robust Enterprise Resource Planning (ERP) systems, often cloud-native (like SAP S/4HANA or Oracle Fusion Cloud), which unify disparate functions such as finance, HR, and supply chain management onto a single, real-time data backbone. This integration allows corporate service providers to offer seamless, data-driven solutions rather than fragmented reports. Furthermore, the deployment of Robotic Process Automation (RPA) and intelligent workflow automation tools across back-office functions is standardizing processes, significantly reducing human error, and ensuring continuous operational compliance across multiple geographies.

Crucially, the rise of specialized vertical technology, often categorized as ‘X-Tech’ (e.g., FinTech, RegTech, LegalTech, HRTech), provides essential niche capabilities. Legal and compliance services are increasingly reliant on RegTech solutions that monitor thousands of regulatory updates concurrently and automatically flag potential compliance breaches in real-time. Similarly, the integration of blockchain technology is emerging for secure, immutable record-keeping, particularly in auditing and supply chain compliance, enhancing transparency and trust. The future technology landscape is heavily invested in predictive analytics, utilizing machine learning algorithms to anticipate cash flow risks, identify potential fraudulent activities, and forecast future staffing needs, moving corporate services from reactive reporting to proactive strategic planning.

Regional Highlights

- North America (U.S. and Canada): Dominates the Corporate Service Market due to the presence of the world’s largest multinational corporations, stringent regulatory environments (e.g., SEC regulations, SOX), and high rates of early adoption of advanced corporate technology, particularly cloud-based and AI-driven compliance and financial services. High maturity in outsourcing practices and the existence of major global service providers drive premium service consumption.

- Europe (Germany, U.K., France): Represents a substantial and complex market characterized by highly diversified and detailed national regulatory systems, magnified by pan-European regulations such as GDPR and complex cross-border VAT frameworks. Demand is strong for legal, consulting, and HR services focused on labor law compliance, data localization, and navigating post-Brexit operational complexities. The region is a leader in ESG-related consulting and reporting services.

- Asia Pacific (APAC) (China, India, Japan, Southeast Asia): Projected as the fastest-growing region, propelled by rapid economic expansion, increasing foreign direct investment, and massive infrastructural development. Growth is concentrated in demand for market entry services, localized regulatory compliance assistance, and high-volume HR services driven by large, growing workforces. India and the Philippines remain pivotal hubs for global delivery of outsourced corporate services (BPO/KPO).

- Latin America (Brazil, Mexico): Exhibits significant growth potential but faces challenges related to economic volatility and complex, frequently changing tax and labor laws. The market requires specialized services focusing on treasury management, anti-corruption compliance, and navigating localized regulatory uncertainty, favoring providers who can offer robust, localized legal and financial expertise.

- Middle East and Africa (MEA): Emerging market driven by governmental diversification efforts away from hydrocarbon dependence, leading to large-scale infrastructure and industrial projects (e.g., Saudi Vision 2030). Demand is focused on financial services consulting, public sector governance, and project management support. Regulatory standardization efforts are slowly increasing demand for advanced compliance and corporate structuring services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corporate Service Market.- Deloitte Touche Tohmatsu Limited

- PricewaterhouseCoopers (PwC)

- Ernst & Young Global Limited (EY)

- KPMG International Limited

- Accenture PLC

- IBM Corporation

- TMF Group B.V.

- Capita plc

- TriNet Group, Inc.

- Insperity, Inc.

- Automatic Data Processing (ADP)

- Robert Half International Inc.

- DXC Technology Company

- Genpact Ltd.

- Wipro Limited

- Infosys Limited

- Cognizant Technology Solutions Corporation

- CSC Global

- Vistra Group

- Intertrust Group

Frequently Asked Questions

Analyze common user questions about the Corporate Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers accelerating growth in the Corporate Service Market?

The primary drivers are the increasing complexity and volume of global regulatory compliance (including ESG mandates), the necessity for multinational corporations to achieve higher operational efficiency through outsourcing, and the pervasive integration of advanced technologies like AI and cloud computing that enable scalable service delivery.

How is AI specifically transforming legal and compliance corporate services?

AI is transforming legal and compliance by automating e-discovery, accelerating contract analysis through NLP, providing real-time regulatory monitoring (RegTech), and generating predictive risk assessments, thereby shifting human expertise towards complex strategic interpretation rather than routine document processing.

Which service segment is predicted to exhibit the highest growth rate during the forecast period?

The IT Support Services segment, particularly services relating to cybersecurity, data governance, and cloud migration management, is predicted to exhibit the highest growth rate, driven by the persistent need for businesses to secure and manage their rapidly expanding digital footprints globally.

What is the most significant restraint challenging market growth in corporate services?

The most significant restraint is navigating escalating data security and privacy concerns, particularly relating to cross-border data transfer limitations (data localization requirements) and the inherent risks associated with integrating sensitive corporate data into multi-tenant cloud and third-party vendor environments.

What role do Small and Medium Enterprises (SMEs) play in the Corporate Service Market?

SMEs represent a high-growth customer segment, driving demand for scalable, affordable, cloud-based services such as outsourced payroll, financial bookkeeping, and standardized legal templates, enabling them to professionalize operations and comply with regulations without excessive capital investment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager