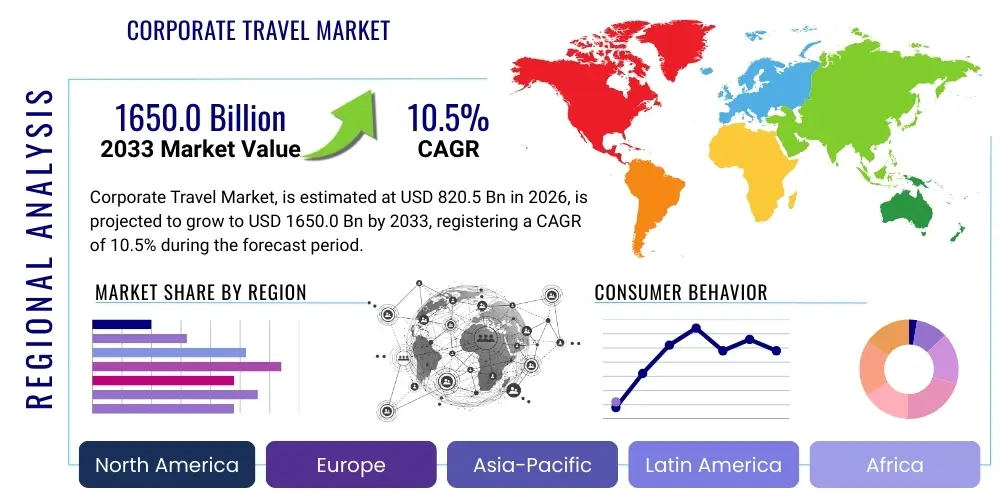

Corporate Travel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437472 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Corporate Travel Market Size

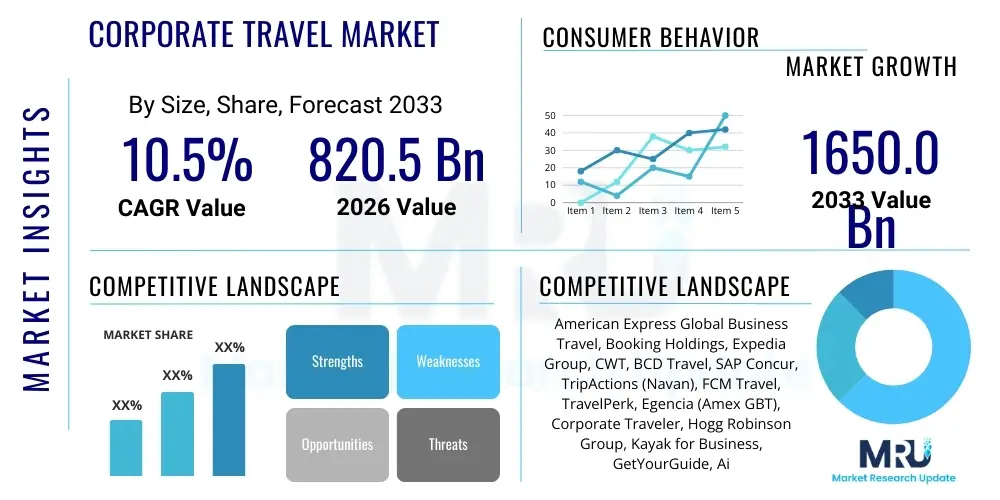

The Corporate Travel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at USD 820.5 Billion in 2026 and is projected to reach USD 1650.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the continued globalization of businesses, the necessity for face-to-face interactions in high-value sales, and the recovery and subsequent expansion of international trade lanes following recent economic disruptions.

Corporate Travel Market introduction

The Corporate Travel Market encompasses services and products dedicated to facilitating business-related mobility, including air travel, accommodation, ground transportation, expense management, and meeting planning, utilized by employees of companies ranging from small and medium enterprises (SMEs) to multinational corporations (MNCs). The foundational structure of this market involves intricate booking systems, policy compliance mechanisms, and sophisticated expense reporting platforms designed to maximize efficiency and minimize leakage. Product offerings have evolved significantly from simple booking agencies to comprehensive Travel Management Companies (TMCs) offering end-to-end digital solutions that integrate seamlessly with enterprise resource planning (ERP) and human resources (HR) systems.

Major applications of corporate travel services span critical business functions such as sales and client acquisition, internal training and team collaboration, participation in industry conferences and trade shows, and necessary maintenance and installation services requiring physical presence. The intrinsic benefits of effective corporate travel management include significant cost savings through negotiated rates and policy adherence, enhanced employee productivity due to streamlined booking processes, and improved duty of care implementation through real-time traveler tracking and risk mitigation tools. Furthermore, modern corporate travel strategies increasingly prioritize traveler well-being, acknowledging its direct correlation with performance and retention.

Driving factors propelling market expansion include the aggressive expansion strategies of companies into emerging economies, leading to increased cross-border travel requirements, and the necessity for global supply chain oversight which demands frequent executive and operational team mobility. Technological advancements, particularly in mobile applications and cloud-based platforms, have made travel planning more accessible, faster, and more compliant, thereby reducing friction and increasing overall business travel frequency. Additionally, the shift towards personalized and sustainable travel options, often driven by younger business travelers, pushes service providers to innovate and expand their portfolio.

Corporate Travel Market Executive Summary

The Corporate Travel Market is poised for substantial growth, driven fundamentally by the imperative for companies to expand globally and the resurgence of high-touch sales strategies that require in-person engagement. Key business trends indicate a pivot towards managed travel programs that utilize advanced analytics to control spending and ensure policy compliance, often leveraging integrated platforms that unify booking, expense, and risk management functions. There is a clear market segmentation emerging based on technological adoption, where firms embracing AI-driven personalization and automation are gaining a competitive edge by offering superior traveler experience and enhanced policy controls. Furthermore, sustainability is rapidly transitioning from a niche concern to a core mandate for major corporate travel procurement departments, influencing carrier and accommodation choices.

Regionally, the Asia Pacific (APAC) area is anticipated to exhibit the fastest growth, fueled by rapid industrialization, burgeoning middle-class consumer bases, and extensive infrastructure investments facilitating greater domestic and international business movement, particularly within China and India. North America and Europe, while representing mature markets, are focusing on technological refinement, consolidation among TMCs, and the implementation of sophisticated data governance and privacy standards related to traveler information. The Middle East and Africa (MEA) region is witnessing significant infrastructural development in aviation hubs, positioning it as a critical transit and business destination, leading to accelerated demand for structured corporate travel services.

Segment trends highlight the dominance of the Managed Business Travel segment due to its inherent efficiency and compliance benefits, although the Unmanaged Business Travel segment, particularly among SMEs, is increasingly adopting self-service digital tools. Within travel components, air travel remains the largest expense category, but ground transportation, especially ride-sharing services and car rentals integrated into centralized booking tools, is seeing rapid digital innovation. The accommodation segment is diversifying, with significant corporate uptake of alternative lodging (e.g., apartments, extended stays) alongside traditional hotel bookings, catering to the demand for flexibility and local experience while maintaining duty of care standards.

AI Impact Analysis on Corporate Travel Market

User inquiries about AI's influence in the Corporate Travel Market overwhelmingly center on its potential to revolutionize efficiency, cost control, and personalization while raising concerns about job displacement and data security. Common questions explore how AI can automate routine booking and expense reporting tasks, whether predictive analytics can accurately forecast price volatility for optimal procurement, and how generative AI tools might enhance travel policy compliance checks and personalized itinerary generation. Users are keen to understand the shift from traditional booking agents to AI-powered virtual assistants, evaluating the trade-off between human expertise and machine speed. Additionally, concerns are prominent regarding the ethical use of traveler data collected by AI systems and ensuring algorithmic fairness in recommended travel options, alongside the expectation that AI should significantly improve risk management and traveler safety monitoring.

- AI-powered dynamic policy enforcement reduces compliance leakage by analyzing booking requests against corporate rules in real-time.

- Predictive pricing algorithms utilize historical data and current market variables to secure optimal flight and accommodation rates, driving down overall travel spend.

- Enhanced personalization through AI analyzes traveler preferences, loyalty status, and past behavior to suggest tailored, compliant itineraries automatically.

- Automation of expense management via machine learning accelerates receipt processing, categorization, and fraud detection, minimizing manual administrative effort.

- Generative AI supports the creation of customized, detailed pre-trip risk assessments and destination guides for improved traveler safety and preparedness.

- Virtual travel assistants (chatbots) provide instant, 24/7 support for itinerary changes, cancellations, and frequently asked questions, improving traveler experience and reducing call center load.

- AI tools optimize resource allocation within Travel Management Companies (TMCs) by predicting future demand and managing agent workloads efficiently.

DRO & Impact Forces Of Corporate Travel Market

The Corporate Travel Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its Impact Forces. Key drivers include the acceleration of global economic interdependence, necessitating face-to-face engagements across continents, and the persistent technological innovation, particularly the integration of mobile and cloud technologies, which streamlines the entire travel lifecycle from planning to expense submission. These drivers create a continuous upward pressure on travel volumes and encourage investment in integrated travel technology platforms. The primary restraining factors, however, center around persistent global geopolitical instability, leading to unpredictable travel restrictions and safety concerns, and the rising corporate commitment to sustainability, which prompts businesses to scrutinize non-essential air travel, often favoring digital communication alternatives.

Opportunities within the market largely revolve around the untapped potential of emerging markets, especially the expansion of corporate activities in Southeast Asia and Africa, and the development of niche service offerings tailored to specific industry verticals (e.g., energy, pharmaceuticals) that have unique regulatory and risk requirements. Furthermore, the convergence of Business Travel and Meetings, Incentives, Conferences, and Exhibitions (MICE) sector management under integrated platforms presents a substantial opportunity for TMCs to capture a broader scope of corporate spending. Effective navigation of these opportunities requires robust data analytics capabilities and highly flexible service models that can adapt quickly to changing global dynamics and client sustainability mandates.

The impact forces driving change are predominantly technological and environmental. The force of digital transformation mandates that market participants continually upgrade their platforms to offer seamless, highly compliant, and user-friendly mobile experiences, moving away from legacy systems. Simultaneously, the increasing environmental, social, and governance (ESG) pressure exerts a significant influence, forcing airlines, hotels, and ground transport providers to offer verifiable low-carbon options, which in turn affects corporate procurement decisions. The successful execution of corporate travel strategy is increasingly dependent on balancing the cost-efficiency imperative with the enhanced duty of care and sustainability obligations, creating a highly regulated and rapidly evolving operational landscape.

Segmentation Analysis

The Corporate Travel Market is highly heterogeneous, requiring segmentation based on fundamental attributes such as service offering, industry vertical, traveller type, and booking channel to accurately assess market dynamics and competitive positioning. Segmentation allows vendors to tailor their technology solutions and service delivery models to the specific compliance needs, spending patterns, and traveler behaviors characteristic of each subgroup. Detailed analysis reveals a clear stratification in technological sophistication, with larger corporations demanding fully integrated, customizable platforms, while smaller businesses often prefer straightforward, cost-effective self-service tools, reflecting distinct demand elasticities across the market.

- By Service:

- Transportation (Air, Rail, Road)

- Accommodation (Hotels, Alternative Lodging)

- Food and Beverage

- Support Services (Insurance, Visa Processing)

- Technology Solutions (Expense Management, Booking Platforms)

- By Type of Travel:

- Managed Business Travel (Utilizing TMCs or in-house policy management)

- Unmanaged Business Travel (Ad hoc bookings, mostly used by SMEs)

- By End User Industry:

- Financial Services (Banking, Insurance, Investment)

- Manufacturing and Automotive

- IT and Telecommunication

- Healthcare and Pharmaceuticals

- Energy and Mining

- Government and Defense

- By Traveler Type:

- Frequent Business Travelers (Executives, Sales Teams)

- Infrequent Business Travelers (Project Teams, Training Attendees)

Value Chain Analysis For Corporate Travel Market

The Corporate Travel market value chain is extensive, commencing with the upstream suppliers and culminating in the end-user traveler experience and subsequent expense reconciliation. The upstream segment involves core providers such as global distribution systems (GDSs), airline carriers, hotel chains, and major car rental agencies. These entities establish the foundational inventory and pricing structures, heavily influenced by dynamic revenue management strategies. Effective negotiation and aggregation power at this stage are critical for Travel Management Companies (TMCs) to secure favorable corporate rates, forming the primary source of value capture through preferred supplier agreements and volume discounts.

The midstream component is dominated by the TMCs, both large global players and niche regional firms, along with technology providers like online booking tools (OBTs) and expense management software vendors. TMCs act as integrators, leveraging technology to combine inventory, enforce corporate policies, manage risk, and provide 24/7 support. The shift towards cloud-based, integrated platforms (often termed 'ecosystems') has blurred the lines between technology vendors and traditional TMCs, emphasizing seamless data flow and compliance automation as the core value proposition. Distribution channels are twofold: direct sales through corporate contracts managed by TMCs, and indirect sales involving third-party travel consultants or proprietary enterprise software marketplaces.

Downstream analysis focuses on the corporate client base—the buyers and end-users. The value delivered at this stage includes optimized travel spend, accurate expense reporting, superior duty of care implementation, and enhanced traveler satisfaction. The integration of expense management systems with corporate finance platforms (e.g., SAP, Oracle) ensures the timely and compliant processing of expenditures, completing the financial lifecycle. The efficiency of the downstream process is a crucial metric for corporate procurement departments, making user experience and data integrity non-negotiable requirements for service providers.

Corporate Travel Market Potential Customers

Potential customers for corporate travel services are universally categorized as any organization requiring employee mobility for business objectives, but their needs vary drastically based on size, industry, and global footprint. Multinational Corporations (MNCs) represent the highest value segment, demanding sophisticated, centralized, globally consistent managed travel programs, integrated technology stacks (including ERP connectivity), and highly detailed reporting capabilities for cost allocation and sustainability metrics. Their procurement focus is on risk management, discounted volume rates, and ensuring strict adherence to global policy variations.

Small and Medium Enterprises (SMEs), conversely, often prefer modular, flexible, and scalable travel solutions, primarily seeking ease of use, self-service capabilities, and transparent pricing rather than complex, tailored account management. The rapid growth and internationalization of SMEs, particularly those in the technology sector, make this an increasingly fertile ground for targeted digital platforms offering simplified booking and expense tools. These customers are more likely to adopt solutions that merge booking and payment directly, minimizing friction for infrequent travelers.

Furthermore, specialized industry verticals, such as pharmaceuticals (requiring compliance with strict regulatory reporting standards), energy (demanding travel to remote, high-risk locations), and professional services (requiring last-minute, flexible travel), represent premium customer segments. These sectors prioritize providers capable of handling complex logistics, ensuring stringent compliance, and offering specialized risk assessment and mitigation services tailored to their unique operational environments, often justifying higher service fees for specialized expertise and guaranteed safety protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 820.5 Billion |

| Market Forecast in 2033 | USD 1650.0 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Express Global Business Travel, Booking Holdings, Expedia Group, CWT, BCD Travel, SAP Concur, TripActions (Navan), FCM Travel, TravelPerk, Egencia (Amex GBT), Corporate Traveler, Hogg Robinson Group, Kayak for Business, GetYourGuide, Airbnb for Work, HRS Global Hotel Solutions, Sabre Corporation, Travelport, Certify, Coupa Software. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corporate Travel Market Key Technology Landscape

The technology landscape of the Corporate Travel Market is characterized by a rapid migration from fragmented legacy systems to integrated, cloud-native platforms that prioritize connectivity and data intelligence. Central to this evolution are Online Booking Tools (OBTs) which have matured from simple reservation interfaces to comprehensive trip management dashboards, offering policy compliance checks and personalized recommendations driven by AI. The key focus areas for technology investment include enhancing mobile capabilities, ensuring travelers can manage their entire journey, from booking to reimbursement, securely on a smartphone, and integrating these tools seamlessly with supplier ecosystems like GDSs and direct connect APIs to ensure access to real-time, competitive inventory.

Crucially, the convergence of booking and expense management software (known as Travel and Expense, or T&E solutions) is a definitive technological trend. Platforms like SAP Concur and Navan exemplify this integration, offering unified workflows that reduce the administrative burden on both the traveler and the finance department. This integration relies heavily on sophisticated optical character recognition (OCR) for receipt scanning, machine learning for expense categorization, and robotic process automation (RPA) for rapid reconciliation, significantly improving audit trails and reducing processing cycles. Data security and adherence to global privacy regulations, such as GDPR, are paramount, driving the adoption of robust encryption and secure cloud architectures.

Furthermore, technology is redefining duty of care. Advanced risk management platforms utilize geo-location data, flight tracking APIs, and global intelligence feeds to monitor traveler safety in real-time, providing immediate alerts and communication channels during critical incidents. The application of blockchain technology is also being explored, primarily for securing traveler identity data and streamlining inter-company payments, promising increased transparency and efficiency in cross-border transactions. The technology landscape is moving towards an open architecture model, allowing corporations to select and integrate best-of-breed specialized tools for specific needs, such as virtual payment solutions or carbon tracking software, alongside their core T&E platform.

Regional Highlights

- North America: This region maintains its position as the largest corporate travel market globally, characterized by high average trip expenditure, early and deep adoption of integrated T&E technology solutions, and intense competition among major TMCs. Growth here is steady, driven primarily by technological refinement, sophisticated data analytics usage for cost control, and a strong emphasis on compliance and traveler well-being programs. The US, in particular, dictates global trends in corporate policy innovation and sustainable travel initiatives.

- Europe: Europe is a mature and highly fragmented market, significantly influenced by varying national regulations, strong sustainability mandates, and the widespread use of high-speed rail for inter-city business travel, especially within the EU Schengen Area. The demand for localized service delivery, multilingual support, and adherence to strict data privacy laws (GDPR) forces providers to maintain highly flexible and compliant technology platforms.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to accelerating urbanization, increased intra-regional trade, and the expansion of domestic business travel markets in countries like China, India, and Southeast Asian nations. Market maturity is highly variable; while technologically advanced centers like Singapore and Japan demand sophisticated digital platforms, emerging economies often rely on hybrid managed/unmanaged models. Localization of payment methods and mobile-first strategies are crucial for success.

- Latin America (LATAM): This region faces challenges related to economic volatility and currency fluctuation, leading corporations to prioritize strong cost control mechanisms and flexible booking policies. The market is developing, with increasing adoption of localized TMC services and a growing necessity for technology solutions that can seamlessly handle complex tax and regulatory environments across different countries within the continent.

- Middle East and Africa (MEA): Growth in MEA is concentrated around major business hubs like Dubai, Riyadh, and Johannesburg, fueled by large-scale infrastructure projects, energy sector requirements, and the region's emergence as a global aviation crossroads. The demand is often focused on premium services, rigorous security protocols, and specialized logistics management due to the nature of business operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corporate Travel Market.- American Express Global Business Travel

- Booking Holdings (Booking.com, Priceline, Agoda)

- Expedia Group (Egencia)

- CWT (Carlson Wagonlit Travel)

- BCD Travel

- SAP Concur

- TripActions (Navan)

- FCM Travel

- TravelPerk

- Corporate Traveler

- Hogg Robinson Group

- Kayak for Business

- Airbnb for Work

- HRS Global Hotel Solutions

- Sabre Corporation

- Travelport

- Coupa Software

- Certify (by Emburse)

- Serko Limited

- GetYourGuide

Frequently Asked Questions

Analyze common user questions about the Corporate Travel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Corporate Travel Market?

The market growth is fundamentally driven by the accelerated pace of globalization, requiring increased cross-border business interactions, the resurgence of in-person sales and client acquisition strategies post-pandemic, and continuous technological advancements that streamline booking, expense, and risk management processes. The expansion of multinational corporations into high-growth emerging economies also significantly contributes to rising travel volumes and expenditure.

How does AI technology affect corporate travel expense management and compliance?

AI significantly enhances expense management by automating receipt processing through OCR, utilizing machine learning for precise categorization, and flagging potential policy breaches or fraudulent activity in real-time. This automation ensures higher compliance rates, reduces manual auditing effort, and accelerates the entire reimbursement cycle, leading to substantial administrative efficiency gains for finance departments.

Which regional market is anticipated to exhibit the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This rapid expansion is attributed to the region's dynamic economic development, substantial infrastructure investments, rapid urbanization, and the increasing volume of both domestic and international business activities, particularly originating from major economies like China and India.

What role does sustainability play in corporate travel procurement decisions?

Sustainability has become a critical evaluation criterion, moving beyond simple preference to a core mandate driven by ESG goals. Corporations are increasingly integrating carbon footprint tracking into their travel platforms and prioritizing suppliers (airlines, hotels) that offer verifiable low-emission or sustainable options, directly influencing vendor selection and overall travel policy design.

What is the current trend regarding the integration of booking and expense solutions?

The clear prevailing trend is the convergence of Online Booking Tools (OBTs) with Expense Management Software into unified Travel and Expense (T&E) platforms. This integration eliminates data silos, improves data accuracy, ensures instant policy compliance checks at the point of booking, and provides a seamless, end-to-end digital experience for the business traveler, thereby reducing both time and complexity for all stakeholders.

What are the key differences between managed and unmanaged business travel?

Managed business travel involves strict adherence to corporate policies, centralized booking through a dedicated Travel Management Company (TMC) or internal team, and comprehensive duty of care protocols. Unmanaged travel, conversely, involves employees booking independently using public platforms, typically lacks centralized oversight, and is often preferred by Small and Medium Enterprises (SMEs) seeking flexibility, although it inherently presents higher risk and lower compliance rates.

How are geopolitical risks managed within corporate travel programs?

Geopolitical risks are managed through sophisticated risk management platforms and duty of care solutions integrated with booking systems. These systems utilize real-time global intelligence feeds, track traveler location (with consent), provide immediate communication channels during crises, and automate alerts related to security threats, ensuring compliance with organizational responsibilities for employee safety during international travel.

Which industry vertical is a dominant consumer of specialized corporate travel services?

The Financial Services sector remains a dominant consumer, characterized by high-frequency executive travel, the need for stringent regulatory compliance, and a preference for premium, flexible services due to the demanding nature of client-facing roles. Technology and Pharmaceuticals sectors also drive substantial demand, focusing heavily on technology integration and specialized compliance protocols respectively.

What technological innovations are redefining ground transportation in corporate travel?

Technological innovations in ground transportation center on deep integration of ride-sharing services and car rental platforms directly into OBTs, allowing for centralized booking and payment within the corporate ecosystem. Furthermore, predictive routing, digital fleet management, and the increasing corporate adoption of electric vehicle fleets (driven by sustainability mandates) are key areas of technological focus.

What is the estimated Compound Annual Growth Rate (CAGR) for the Corporate Travel Market through 2033?

The Corporate Travel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033, indicating a robust and accelerating recovery trend supported by global economic expansion and increased reliance on face-to-face commercial activities across various sectors and geographical boundaries.

How do large MNCs typically structure their corporate travel procurement?

Large Multinational Corporations (MNCs) typically employ a highly centralized procurement strategy, negotiating global contracts directly with major airlines, hotel chains, and a limited number of global Travel Management Companies (TMCs). Their focus is on volume discounts, unified technology platforms for global visibility, and sophisticated Service Level Agreements (SLAs) covering support, policy enforcement, and reporting integrity across all operational regions.

What challenges do TMCs face regarding data integration and connectivity?

TMCs face significant challenges in integrating data from diverse sources, including multiple Global Distribution Systems (GDSs), direct supplier APIs, alternative lodging platforms, and specialized ground transportation providers. Ensuring seamless, real-time data flow is essential for accurate inventory display, instant price comparison, and comprehensive travel risk monitoring, often requiring substantial investment in API management and middleware solutions.

Why is the quality of the traveler experience becoming a critical metric for corporations?

The quality of the traveler experience is now a critical metric because it directly impacts employee retention, productivity, and adherence to travel policy. Companies recognize that friction in the travel process leads to traveler burnout and non-compliant bookings. Consequently, user-friendly booking tools, personalized itineraries, and responsive support services are highly valued to enhance overall employee satisfaction and minimize downtime.

What regulatory frameworks significantly impact European corporate travel operations?

The primary regulatory framework impacting European corporate travel is the General Data Protection Regulation (GDPR), which imposes strict requirements on the collection, processing, and storage of traveler personal data, necessitating robust compliance mechanisms within TMC technology platforms. Additionally, evolving tax regulations and specific airline compensation rules within the EU influence financial and legal compliance for business trips.

How are alternative accommodations, such as Airbnb, integrating into corporate travel programs?

Alternative accommodations are integrating through dedicated business platforms (like Airbnb for Work) that offer enhanced security features, corporate billing capabilities, and integration with major T&E systems. These options are increasingly used for extended stays or project-based travel, providing cost savings and a localized experience, provided they meet specific corporate safety and insurance standards.

What are the major restraints limiting accelerated growth in the corporate travel sector?

Major restraints include lingering global economic uncertainty and inflation, which lead to tighter corporate budgets and reduced discretionary spending, prompting companies to implement stricter travel policies. Furthermore, environmental consciousness and the push towards sustainable business practices encourage the substitution of certain trips with virtual meetings, placing inherent limitations on travel volume growth.

Explain the concept of leakage in corporate travel and how technology addresses it.

Leakage refers to travel expenditure that occurs outside the managed travel program and policy framework (e.g., employees booking directly with suppliers instead of the approved TMC). Technology, specifically integrated online booking tools and automated policy enforcement, addresses leakage by making the compliant booking path the easiest and most appealing option, often blocking non-compliant choices instantly.

How is the MICE (Meetings, Incentives, Conferences, and Exhibitions) sector related to corporate travel?

The MICE sector is intrinsically linked, as MICE events constitute large group movements and significant corporate expenditures often managed by the same travel and event planning departments. There is a growing trend for TMCs and technology vendors to offer integrated platforms that manage both individual business trips and complex MICE logistics, consolidating data and achieving better rate negotiations.

What is the significance of the shift towards direct connect APIs in corporate travel?

Direct connect APIs (Application Programming Interfaces) allow suppliers, particularly airlines, to bypass Global Distribution Systems (GDSs) and offer real-time, dynamic content, including exclusive ancillary services and customized fares, directly to corporate booking tools. This shift enhances inventory access, improves pricing transparency, and drives greater customization capabilities for airlines, although it adds complexity to TMC integration efforts.

What distinguishes travel services required by the Energy and Mining sectors?

Travel services for the Energy and Mining sectors are distinguished by the frequent requirement for logistics to remote, often high-risk, locations; specialized charter and helicopter arrangements; extended stay accommodation needs; and extremely rigorous safety and security protocols, necessitating providers with specialized operational risk management expertise and 24/7 dedicated support.

How does centralized payment technology benefit corporate travelers and finance teams?

Centralized payment technology, often utilizing virtual cards or integrated corporate credit card programs, benefits travelers by eliminating the need for personal payments for core expenses, simplifying the front-end process. For finance teams, it provides superior reconciliation, reduces manual expense report submissions, and offers real-time visibility into spending, significantly improving cash flow management and auditability.

What is the expected trajectory of business class and premium travel expenditure?

Expenditure on business class and premium travel is expected to recover steadily, particularly for long-haul routes and executive travel, as companies prioritize productivity and comfort for high-value employees. While cost control remains important, the strategic need for executives to arrive rested and ready for critical meetings often outweighs the savings associated with economy class travel, maintaining demand for premium cabins.

How are travel providers adapting to the increasing demand for bleisure travel?

Travel providers are adapting to the bleisure (business combined with leisure) trend by offering flexible booking tools that allow seamless personal extensions to business trips, providing better rates for family members, and curating local experiences or vacation packages that can be easily added to the official itinerary, improving traveler morale while maintaining corporate oversight of the business portion.

What are the main security concerns associated with cloud-based corporate travel platforms?

Main security concerns involve protecting highly sensitive traveler data, including passport information, payment details, and real-time location. Mitigation requires platforms to implement multi-factor authentication, robust encryption both in transit and at rest, regular penetration testing, and compliance with global data privacy standards like SOC 2 and ISO 27001 to ensure the integrity and confidentiality of corporate and personal information.

Why is the role of the Travel Management Company (TMC) shifting towards consultancy?

The TMC role is shifting towards consultancy because automation handles most transactional booking tasks. Corporations now seek strategic partners who can provide high-level spend analytics, optimize policy structures, negotiate favorable supplier contracts, advise on global compliance issues, and offer sophisticated risk intelligence, transforming the TMC from a booking agent to a strategic expense management consultant.

How do currency fluctuations impact corporate travel budgeting in global companies?

Currency fluctuations create significant volatility in corporate travel budgets, making accurate forecasting challenging. Global companies mitigate this risk by utilizing centralized booking systems that can track expenditure in multiple currencies, employing hedging strategies for major spending streams, and relying on integrated expense tools that apply real-time or predetermined exchange rates for consistent reporting.

What technologies are essential for effective corporate duty of care implementation?

Essential technologies for duty of care include real-time traveler tracking (integrated with booking data), automated risk alerts based on geo-fencing and global security intelligence, two-way communication tools (mobile apps for check-ins), and integrated emergency contact mechanisms. These tools allow companies to locate, communicate with, and assist employees rapidly during unforeseen events or crises globally.

How does personalization using machine learning enhance the booking experience?

Machine learning uses historical data on traveler preferences, past bookings, policy behavior, and loyalty status to offer highly relevant and compliant suggestions for flights, hotels, and seating preferences. This personalization accelerates the decision-making process, increases traveler satisfaction, and subtly steers the user toward preferred suppliers or policy-compliant choices, enhancing efficiency.

What challenges exist in measuring the Return on Investment (ROI) of business travel?

Measuring the ROI of business travel is challenging because benefits (e.g., successful client relationship building, deal closure) are often qualitative and indirect. Companies address this by correlating travel spending data with CRM system metrics (sales cycle acceleration, revenue generated by traveling teams) and using surveys to quantify the perceived value and impact of face-to-face interactions versus virtual alternatives.

How is the IT and Telecommunication sector driving innovation in corporate travel demand?

The IT and Telecommunication sector drives innovation by demanding highly flexible travel policies to support globally distributed project teams and rapid deployment needs. Furthermore, they are often early adopters of cutting-edge travel technology, favoring open APIs, specialized software integrations, and data-driven solutions for managing complex, non-traditional travel patterns, pushing TMCs to modernize their technical capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Corporate Travel Market Statistics 2025 Analysis By Application (Group, Solo), By Type (Transportation, Food & Lodging, Recreation Activity), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Corporate Travel Security Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On-call Emergency Response Service, Evacuation Service, Medical Repatriation, 24 Hours Medical Helpline, Executive & Personal Protection, Ground Transportation, Secure Aviation, Meetings & Events, Low Profile Security Operations, Others), By Application (IT/ITES, Media Journalism, Healthcare, Legal, Banking, and Financial Services, Consumer & Retail, Aerospace, Defense, and Security, Construction & Engineering, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager