Corrosion Resistant Rebar Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432484 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Corrosion Resistant Rebar Market Size

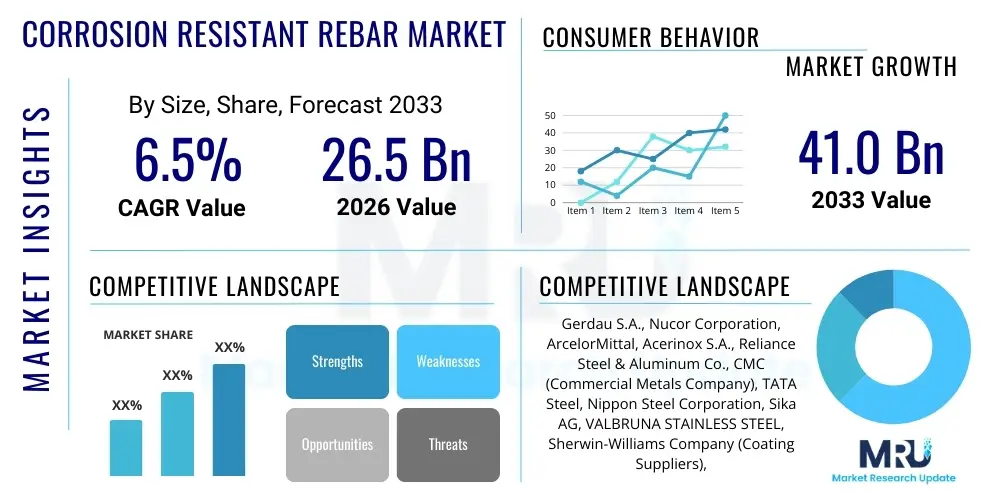

The Corrosion Resistant Rebar Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 26.5 Billion in 2026 and is projected to reach USD 41.0 Billion by the end of the forecast period in 2033.

Corrosion Resistant Rebar Market introduction

The Corrosion Resistant Rebar Market encompasses specialized reinforcement steel products designed to mitigate structural degradation caused by environmental factors, primarily chloride ingress and carbonation. These rebars, including materials such as Epoxy Coated Rebar (ECR), Galvanized Rebar, Stainless Steel Rebar, and Fiber-Reinforced Polymer (FRP) Rebar, are essential components in modern infrastructure projects where longevity and minimal maintenance are critical requirements. The primary function is to extend the service life of concrete structures, thereby reducing lifecycle costs associated with repair and replacement, particularly in harsh environments like coastal zones, bridges, highways exposed to de-icing salts, and wastewater treatment facilities. The utilization of corrosion-resistant alternatives is rapidly becoming standard practice, driven by stricter governmental regulations concerning infrastructure durability and public safety mandates across developed and developing economies.

Product descriptions within this market vary significantly based on material composition and application suitability. Epoxy-coated rebar, for example, offers a cost-effective barrier protection system, widely adopted in road infrastructure. Conversely, Stainless Steel Rebar (SSR) provides superior corrosion resistance and mechanical properties, making it the preferred choice for highly demanding, mission-critical structures such as nuclear facilities and specialized marine structures, despite its higher initial cost. Fiber-Reinforced Polymer rebar, predominantly Glass Fiber Reinforced Polymer (GFRP), represents a growing segment, offering complete immunity to electrochemical corrosion and significant advantages in weight reduction, ease of handling, and non-magnetic properties, which are crucial for medical or sensitive electrical applications. This diversity in product offerings allows engineers to tailor material selection precisely to the anticipated exposure level and required service life of the concrete structure.

Major applications driving market growth include large-scale public infrastructure projects, such as the construction and refurbishment of bridges, coastal defenses, and tunnels, where exposure to aggressive agents is inevitable. Furthermore, the residential and commercial construction sectors are increasingly adopting these rebars in basement foundations and parking structures to prevent premature failure. The fundamental benefits—enhanced structural integrity, reduced maintenance cycles, and significantly extended service life (often doubling or tripling the lifespan compared to conventional carbon steel rebar)—are the primary driving factors. These technical advantages, coupled with increasing environmental awareness and the economic imperative to minimize infrastructure downtime, establish the Corrosion Resistant Rebar Market as a critical and high-growth segment within the global construction materials industry, supported by global trends toward resilient and sustainable construction practices.

Corrosion Resistant Rebar Market Executive Summary

The global Corrosion Resistant Rebar Market is characterized by robust investment driven primarily by accelerating governmental spending on aging infrastructure revitalization and the rapid urbanization across Asia Pacific. Business trends indicate a shift towards high-performance materials; specifically, Stainless Steel Rebar and FRP composites are gaining market share due to their superior lifecycle performance, moving beyond the traditional reliance on Epoxy Coated Rebar. Key industry participants are focusing on strategic vertical integration and expanding their specialized coating capabilities to ensure compliance with increasingly stringent ASTM and ISO standards for protective materials. Furthermore, there is a distinct competitive trend involving product innovation focused on hybridization, where manufacturers are developing advanced surface treatment technologies and incorporating nanotechnology to enhance the adhesive properties and resistance of coatings, thereby improving overall product reliability and reducing installation susceptibility to damage.

Regional trends exhibit significant divergence in adoption patterns and regulatory impetus. North America and Europe, characterized by established infrastructure and high labor costs, prioritize long-term durability, making Stainless Steel and advanced GFRP rebars dominant in critical bridge and marine applications. These regions benefit from stringent, well-enforced building codes that mandate extended structural lifespans. Conversely, the Asia Pacific region, led by China and India, represents the highest volume growth due to extensive new construction of metropolitan infrastructure and coastal projects. While the APAC market still heavily utilizes cost-effective Epoxy Coated Rebar, there is rapid growth in the adoption of higher-grade alternatives as construction quality standards rise. The Middle East and Africa (MEA) market shows specialized demand, driven by desalination plants and oil and gas facilities, necessitating high chemical resistance and thermal stability in their reinforcing materials.

Segment trends underscore the evolving material landscape. By Type, the Stainless Steel Rebar segment, particularly duplex grades, commands the highest average selling price and is experiencing accelerated growth owing to its unchallenged performance in hostile environments. The FRP Rebar segment is the fastest growing, propelled by advantages in electromagnetic transparency and lightweight handling, which positions it favorably in sensitive military and communication infrastructure. By Application, the Bridge and Highway Construction segment remains the largest consumer globally, given its constant exposure to chloride attack from de-icing salts and sea spray. However, the Marine and Ports segment is demonstrating the highest intensity of demand for premium corrosion resistance, resulting in a concentration of high-value projects utilizing specialized stainless steel and advanced FRP derivatives to ensure mandated 100-year lifespans.

AI Impact Analysis on Corrosion Resistant Rebar Market

User inquiries regarding the impact of Artificial Intelligence on the Corrosion Resistant Rebar Market frequently center on three core areas: the optimization of coating processes, the development of next-generation corrosion-resistant materials, and the enhancement of structural integrity monitoring. Users are keen to understand how AI can improve the notoriously variable quality control associated with epoxy coatings, ensuring uniform thickness and adhesion across large batches. There is significant interest in AI's role in computational materials science, particularly in simulating atomic interactions and predicting the performance of novel alloy compositions or composite matrices (like hybrid GFRP/Carbon Fiber) before costly physical testing. Furthermore, a major concern involves leveraging machine learning algorithms to analyze sensor data from smart infrastructure (e.g., embedded cathodic protection systems) to predict the exact time and location of potential corrosion initiation, thus moving from reactive maintenance to highly precise, predictive structural lifecycle management.

- AI-driven optimization of material formulations, reducing the time required for developing new corrosion-resistant alloys (e.g., specialized duplex stainless steels).

- Predictive maintenance scheduling for existing infrastructure based on machine learning analysis of environmental sensor data, optimizing rebar replacement cycles.

- Enhanced quality control systems utilizing computer vision and deep learning to inspect rebar coatings (epoxy, galvanization) for uniformity, thickness defects, and adhesion inconsistencies during the manufacturing process.

- Optimization of supply chain and logistics for specialized, high-cost materials like Stainless Steel Rebar, utilizing AI to forecast demand variability in large infrastructure projects.

- Simulation and modeling of concrete microenvironments using AI to precisely determine the long-term interaction between the rebar surface and the surrounding concrete matrix under varied chloride and carbonation conditions.

- Robotic welding and fabrication of rebar cages guided by AI algorithms to minimize thermal stresses and ensure the integrity of protective coatings at critical connection points, maintaining corrosion resistance effectiveness.

- Improved resource allocation in construction planning by utilizing generative AI to design reinforcement layouts that maximize structural integrity while minimizing material waste of high-cost corrosion-resistant products.

- Development of smart rebars embedded with micro-sensors, where AI interprets complex electrochemical data streams to provide real-time assessment of corrosive activity and structural health metrics.

DRO & Impact Forces Of Corrosion Resistant Rebar Market

The market for corrosion resistant rebar is fundamentally shaped by powerful drivers, systemic restraints, emerging opportunities, and pervasive impact forces, collectively summarized as the DRO framework. A primary driver is the demonstrable failure rate and high repair costs associated with conventional carbon steel reinforcement in infrastructure built decades ago, necessitating a global shift towards resilient materials with lower lifecycle costs. Restraints primarily involve the high initial capital expenditure of advanced alternatives like Stainless Steel and FRP rebars, which often face resistance in developing markets where short-term project budgets dictate material choice. Opportunities are heavily concentrated in retrofitting existing, structurally sound but deteriorating assets, such as elevated highway decks and marine jetties, alongside the continuous technological refinement of cost-competitive high-performance coatings, moving beyond standard epoxy to include polyurethane and zinc-alloy formulations. The predominant impact forces include stringent regulatory tightening (e.g., new Eurocodes mandating specific design lifecycles) and the competitive landscape being intensified by large-scale Chinese manufacturers entering the global supply chain, altering pricing dynamics.

Delving deeper into drivers, the increasing adoption of public-private partnerships (PPPs) globally significantly accelerates the use of corrosion-resistant rebar. PPP models inherently focus on total cost of ownership over 30 to 50 years, making the long-term investment in durable materials economically favorable compared to low upfront cost, high-maintenance solutions. Furthermore, the global trend towards sustainable construction practices (Green Building initiatives) indirectly promotes corrosion resistance, as materials that enhance structural longevity and reduce the need for maintenance repairs align perfectly with circular economy principles and minimized resource consumption over a structure’s life. The demonstrable success stories of structures built with these materials, such as specific bridges in Florida or maritime structures in Scandinavia, provide critical validation for future engineering specifications and governmental procurement policies, further solidifying market expansion and material standardization.

Despite these accelerants, the market faces constraints related to standardization and quality assurance. Specifically, the field installation of epoxy-coated rebar remains a significant challenge, as minor damage to the coating during transport, cutting, or tying can create localized corrosion initiation points, compromising the entire barrier system. This susceptibility requires rigorous, costly on-site inspection protocols, which adds complexity and cost, acting as a restraint. Market opportunities are vast, particularly in leveraging additive manufacturing techniques for customized rebar shapes that minimize cutting and handling damage, and exploring hybrid reinforcement systems that combine high-strength carbon fiber inserts with corrosion-resistant sheathing. The key impact forces, beyond regulatory pressure, include the volatile pricing of nickel and chromium, essential raw materials for stainless steel, which introduces significant supply chain risk and necessitates advanced hedging strategies for manufacturers and large construction firms relying on these specialized alloys.

Segmentation Analysis

The Corrosion Resistant Rebar Market is extensively segmented across multiple dimensions, including the type of material utilized, the coating process applied, the application sector (end-use), and the geographical region. Material segmentation is critical, reflecting differences in performance, cost structure, and longevity, encompassing traditional options like Epoxy Coated and Galvanized Rebar, and advanced solutions such as Stainless Steel and Fiber-Reinforced Polymer (FRP) alternatives. Application segmentation reveals the infrastructure sectors driving demand, with transportation infrastructure (bridges and highways) historically dominating due to acute exposure to de-icing chemicals and environmental severity. The evolution of this market is evidenced by the increasing diversification of specialized segments, including wastewater treatment facilities and nuclear power plants, which require materials with specific chemical and thermal resistance profiles, further fragmenting the competitive landscape and necessitating highly specialized manufacturing processes to meet bespoke customer requirements.

- By Type:

- Epoxy Coated Rebar (ECR)

- Galvanized Rebar

- Stainless Steel Rebar (304, 316, Duplex Grades)

- Fiber-Reinforced Polymer (FRP) Rebar

- Glass Fiber Reinforced Polymer (GFRP)

- Carbon Fiber Reinforced Polymer (CFRP)

- By Application:

- Bridge & Highway Construction (Transportation Infrastructure)

- Marine Structures & Coastal Applications (Piers, Jetties, Sea Walls)

- Residential & Commercial Buildings (Parking Garages, Basements)

- Water & Wastewater Treatment Plants

- Industrial Structures (Chemical Plants, Oil & Gas Facilities)

- Tunnels & Underground Infrastructure

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Southeast Asia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (Saudi Arabia, UAE, South Africa, Rest of MEA)

Value Chain Analysis For Corrosion Resistant Rebar Market

The value chain for corrosion resistant rebar begins with the upstream procurement of specialized raw materials. For traditional rebar, this involves iron ore and scrap steel, but for advanced segments, it includes high-grade nickel and chromium alloys for stainless steel, or sophisticated petrochemical resins and glass/carbon fibers for FRP rebars. Upstream analysis focuses intensely on managing the volatility and purity of these specialized inputs, as material integrity directly impacts the final corrosion performance. Major manufacturers often establish long-term supply contracts with key metal and chemical suppliers to stabilize pricing and ensure quality compliance. The primary transformation stage involves melting, casting, and rolling, followed by the crucial surface treatment process—either hot-dip galvanization, electrostatic epoxy coating, or the pultrusion process for FRP composites—which adds the definitive corrosion resistance characteristic, representing the highest value-addition step in the entire chain.

The downstream analysis focuses on the distribution channels and end-user engagement. Due to the specialized nature and often higher cost, corrosion-resistant rebars are rarely stocked by general construction material retailers. Instead, they flow through specialized distribution networks, involving dedicated steel service centers or engineering consultants who manage project-specific procurement. Direct sales models are prevalent for large, high-value infrastructure projects (e.g., government bridge contracts) where manufacturers engage directly with prime contractors or governmental agencies to provide technical consulting and material specification support. The logistical challenge in the downstream segment involves minimizing handling damage, particularly for brittle epoxy coatings, necessitating specialized packaging and transportation protocols to maintain product integrity until installation.

Distribution channels are broadly segmented into direct and indirect routes. Direct channels are utilized for highly customized or large volume orders, allowing for specialized customer service, faster feedback loops for quality issues, and better technical support regarding welding or bending guidelines for the specific corrosion-resistant material. Indirect channels typically involve authorized regional distributors or agents who manage inventory and deliver to smaller or mid-sized construction projects, providing necessary material availability in diverse geographic locations. A key trend in the distribution landscape is the integration of digital tools for traceability, allowing customers to verify the material certification and quality checks (especially for critical stainless steel grades) via QR codes or blockchain technology, enhancing transparency and mitigating the risk of counterfeit materials in sensitive infrastructure applications.

Corrosion Resistant Rebar Market Potential Customers

The primary potential customers for corrosion resistant rebar are large governmental and quasi-governmental bodies responsible for national infrastructure development and maintenance. This includes national departments of transportation, state highway agencies, and public works ministries. These entities are the largest volume buyers, driven by mandatory standards for infrastructure durability and the necessity to minimize traffic disruption associated with frequent repairs. Their purchasing decisions are heavily influenced by life-cycle cost analysis (LCCA), where the higher initial investment in corrosion-resistant materials is justified by the savings accrued over decades of extended, maintenance-free service life. Additionally, military engineering commands and port authorities represent specialized governmental customers requiring materials capable of withstanding extreme environmental loads and aggressive chemical exposure typical of coastal and strategic facilities, often specifying high-grade duplex stainless steel or advanced fiber composites.

A secondary, yet rapidly growing, customer segment includes private developers and construction firms engaged in large-scale commercial and residential projects, particularly those involving underground structures, parking garages, and luxury residential complexes near coastal areas. For these private customers, the motivation shifts slightly from public safety mandates to long-term asset protection, enhanced property valuation, and reduced liability exposure. Using corrosion-resistant rebar offers a significant competitive advantage in marketing premium properties, guaranteeing protection against chloride attack from de-icing salts or marine air, which is a common failure point in conventional concrete structures. Demand is also notable from specialized industrial contractors building critical infrastructure such as desalination plants, chemical processing facilities, and storage terminals, where chemical corrosion is a greater threat than atmospheric elements, requiring materials like specialized GFRP rebars for chemical inertness.

Furthermore, major international engineering, procurement, and construction (EPC) firms act as critical intermediaries and specifiers. These firms, often contracted for megaprojects across various continents, significantly influence material selection. They prioritize suppliers who can ensure reliable global delivery, consistent quality control across batches, and comprehensive technical certification documentation. Finally, utilities and energy sectors represent niche but high-value customers. Specifically, nuclear power generation facilities mandate the use of the highest grade corrosion-resistant materials to ensure structural integrity over exceptionally long operational periods (often 60+ years), leading to strict preference for highly certified stainless steel rebar. Wastewater treatment municipalities represent continuous buyers due to the constant presence of corrosive sulfides and biological acids that necessitate robust, long-lasting reinforcement solutions in settling tanks and piping structures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 26.5 Billion |

| Market Forecast in 2033 | USD 41.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerdau S.A., Nucor Corporation, ArcelorMittal, Acerinox S.A., Reliance Steel & Aluminum Co., CMC (Commercial Metals Company), TATA Steel, Nippon Steel Corporation, Sika AG, VALBRUNA STAINLESS STEEL, Sherwin-Williams Company (Coating Suppliers), Fusco Rebar, Owens Corning, Pultron Composites, Schoeck International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrosion Resistant Rebar Market Key Technology Landscape

The technological landscape of the Corrosion Resistant Rebar market is defined by continuous innovation across material science, coating application, and non-destructive testing methodologies. In the material domain, the primary focus is on developing advanced stainless steel grades, moving beyond standard 304 and 316 specifications to utilize lean duplex stainless steels (like 2101 or 2304) that offer comparable corrosion resistance to higher-nickel grades but at a significantly reduced cost, optimizing the value proposition for large-scale public works. Similarly, within the FRP segment, manufacturers are increasingly using advanced thermoset resins (such as vinyl ester or polyurethane) in the pultrusion process to enhance the alkali resistance of GFRP rebar, making it more compatible with highly alkaline concrete environments and ensuring long-term bond strength and structural reliability, addressing a critical historical limitation of composite reinforcement systems.

Coating technology represents another pivotal area of advancement. While Fusion Bonded Epoxy (FBE) remains the dominant technology, manufacturers are investing heavily in applying specialized, multi-layer coating systems. This includes incorporating zinc powder primers under the epoxy layer for cathodic protection (a form of galvannealed or duplex coating) or integrating micro- and nanotechnology additives into the polymer matrix. These nano-fillers, often utilizing graphene or ceramic particles, serve to block pathways for moisture and chloride ions, enhancing the barrier protection and significantly improving the abrasion resistance of the coating during handling and installation. This focus on improving robustness is a direct response to the market restraint concerning on-site coating damage, aiming to deliver a more resilient and fault-tolerant product to the construction site, thereby safeguarding the intended design life of the structure.

Furthermore, technology related to manufacturing and quality assurance is evolving rapidly. Automated and robotic handling systems are being deployed to minimize human error and mechanical damage during the coating and curing processes, ensuring uniform application thickness and high bond strength across the entire length of the bar. Crucially, the rise of non-destructive evaluation (NDE) techniques—including advanced ultrasonic testing and electromagnetic inspection—is enabling manufacturers and project engineers to verify the quality and integrity of the reinforcement both before and after installation within the concrete structure. The development of 'smart rebar' embedded with passive fiber optic sensors (FOS) is gaining traction, allowing for continuous, real-time monitoring of strain, temperature, and corrosion potential within the concrete, providing unprecedented insights into structural health and validating the long-term performance claims of these specialized corrosion-resistant materials, thereby fostering greater confidence in their adoption for critical infrastructure projects.

Regional Highlights

- North America: This region is a mature market driven primarily by replacement and rehabilitation projects concerning aging public infrastructure, especially bridges and highways exposed to severe winter weather and de-icing salts. Regulatory mandates, particularly those involving federal funding for infrastructure (e.g., the Infrastructure Investment and Jobs Act in the U.S.), increasingly specify the use of corrosion-resistant materials to achieve extended design lifecycles (75-100 years). The U.S. is a major consumer of both Epoxy Coated Rebar (for volume projects) and high-performance Stainless Steel Rebar (for critical coastal and structural components). Canada shows high adoption rates of GFRP, particularly in provinces prone to freeze-thaw cycles.

- Europe: Characterized by stringent Eurocodes and a strong focus on sustainability, Europe exhibits high penetration of premium corrosion-resistant materials. Nordic countries and the UK have been early adopters of duplex stainless steel and high-specification galvanized rebar for severe marine and highly trafficked road structures. Germany and France drive demand in wastewater treatment and specialized industrial construction, prioritizing chemical inertness. The market growth here is relatively steady, focusing on quality over volume, with a clear trend toward materials offering the lowest environmental footprint and maximum lifecycle longevity.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, fueled by massive infrastructure expansion, rapid urbanization, and extensive coastal development projects (ports, sea walls). China and India are the dominant volume markets. While cost sensitivity favors Epoxy Coated and basic galvanized rebars in many sectors, high-profile mega-projects in Japan, South Korea, and Singapore are rapidly adopting Stainless Steel Rebar and high-strength FRP composites to ensure the durability of critical economic assets. The region is quickly improving material specifications to match international durability standards, resulting in significant demand acceleration across all material types.

- Latin America: This region presents significant growth potential, particularly in Brazil, Mexico, and Chile, driven by mining infrastructure and coastal oil and gas exploration facilities that require robust corrosion protection. While economic volatility can restrain immediate adoption of higher-cost materials, long-term investments in public transit systems (e.g., subway extensions) and port development are slowly mandating corrosion-resistant solutions, primarily galvanized and standard epoxy-coated options, with niche demand for stainless steel in high-exposure industrial zones.

- Middle East and Africa (MEA): The MEA market is highly specialized, dominated by construction in harsh desert and marine environments. High temperatures and high chloride concentrations necessitate the use of premium solutions. The Gulf Cooperation Council (GCC) countries, especially the UAE and Saudi Arabia, are significant users of stainless steel and high-grade galvanized rebar for iconic structures, desalination plants, and massive coastal residential developments, ensuring resistance against highly saline ground conditions and extreme humidity. Africa's market remains nascent but shows localized demand related to mineral processing and new port construction initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrosion Resistant Rebar Market.- Gerdau S.A.

- Nucor Corporation

- ArcelorMittal

- Acerinox S.A.

- Reliance Steel & Aluminum Co.

- CMC (Commercial Metals Company)

- TATA Steel

- Nippon Steel Corporation

- Sika AG

- VALBRUNA STAINLESS STEEL

- Sherwin-Williams Company (Major Coating Supplier)

- BASF SE (Chemical Coatings Division)

- Kloeckner Metals

- Schmolz + Bickenbach AG

- Vandop Steel

- Hughes Brothers Inc.

- Pultron Composites

- Owens Corning (FRP Material Supplier)

- A. Zahner Co.

- Schoeck International

Frequently Asked Questions

Analyze common user questions about the Corrosion Resistant Rebar market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Epoxy Coated Rebar and Stainless Steel Rebar in terms of performance?

Epoxy Coated Rebar (ECR) provides passive barrier protection against chloride intrusion, but its effectiveness is compromised by installation damage or scratches. Stainless Steel Rebar (SSR) offers active corrosion resistance due to its metallurgical composition (chromium content), providing superior, long-term durability and self-healing properties in aggressive environments, justifying its higher initial cost for critical infrastructure.

Which application segment drives the highest volume demand for corrosion-resistant rebar globally?

The Bridge and Highway Construction segment drives the highest volume demand globally. This is primarily due to the constant exposure of road infrastructure to chloride ions from de-icing salts in temperate climates and continuous moisture/saline spray in coastal regions, necessitating high-volume use of resilient reinforcing materials to prevent premature structural failure and costly maintenance.

How does Fiber-Reinforced Polymer (FRP) rebar compare to traditional steel rebar?

FRP rebar, typically GFRP, is completely immune to electrochemical corrosion, is significantly lighter than steel (reducing transportation costs), and is non-magnetic, making it ideal for specialized applications like MRI facilities and electrical substations. While it has lower ductility and different thermal expansion characteristics than steel, ongoing technological improvements are rapidly enhancing its compatibility and acceptance in large structural projects.

What are the key restraints affecting the wider adoption of premium corrosion-resistant rebar?

The key restraint is the high initial capital cost associated with premium materials like duplex stainless steel and high-grade FRP. This poses a challenge, particularly in public works projects governed by strict upfront budget constraints, often leading to specifications that favor lower-cost, shorter-lifecycle alternatives, despite superior long-term economic benefits.

What role does machine learning (AI) play in the manufacturing quality control of coated rebars?

Machine learning and computer vision are increasingly utilized in manufacturing quality control to instantly scan and analyze rebar coatings (such as FBE) for defects, inconsistent thickness, or holidays (pinholes). AI algorithms provide real-time, automated inspection feedback, significantly improving the consistency and integrity of the corrosion barrier layer compared to manual or conventional sampling methods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager