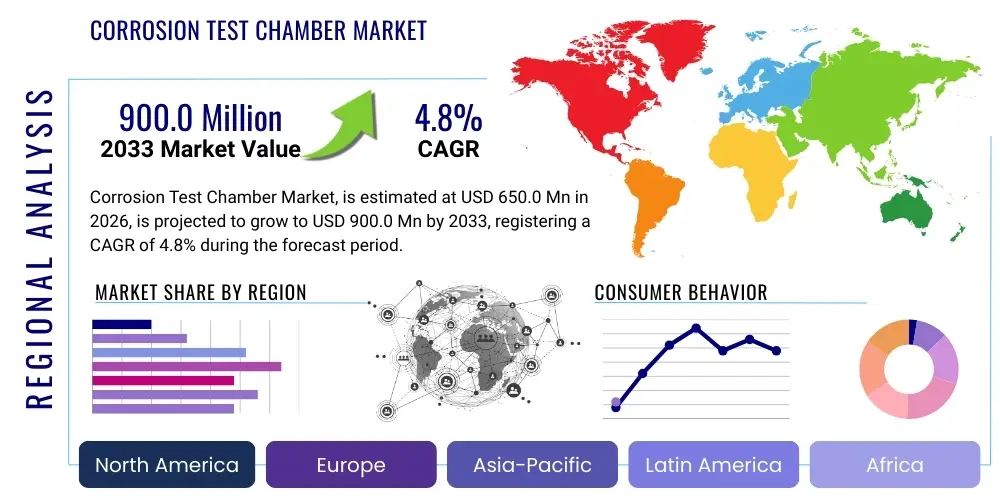

Corrosion Test Chamber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432204 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Corrosion Test Chamber Market Size

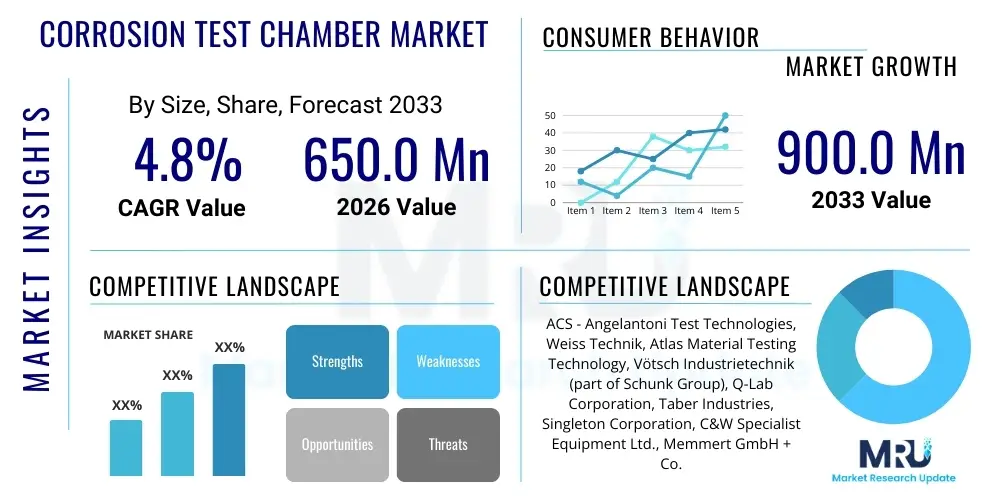

The Corrosion Test Chamber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 650.0 million in 2026 and is projected to reach USD 900.0 million by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by stringent regulatory requirements across critical sectors like automotive, aerospace, and defense, which mandate rigorous testing of materials and coatings to ensure long-term durability and safety performance. The increasing complexity of modern materials, coupled with the global expansion of infrastructure projects, necessitates advanced testing solutions capable of simulating diverse environmental conditions accurately. Furthermore, the push towards electrification in the automotive sector introduces new material combinations and stress factors, thereby accelerating the demand for highly specialized cyclic corrosion chambers that can replicate real-world operational environments more precisely than traditional static salt spray methods.

The market expansion is also significantly influenced by technological advancements, particularly the integration of Internet of Things (IoT) sensors and sophisticated control systems into modern chambers. These integrations allow for precise monitoring, real-time data logging, and remote diagnostics, enhancing the efficiency and reproducibility of corrosion testing procedures. Geographically, Asia Pacific (APAC) stands out as a critical growth engine, driven by massive manufacturing capacities in electronics and automotive components, particularly in countries like China, India, and South Korea, which are increasingly adopting international quality and corrosion resistance standards. However, North America and Europe continue to dominate in terms of high-end, customized cyclic chambers used primarily for R&D and meeting highly specialized military and aerospace specifications.

Corrosion Test Chamber Market introduction

Corrosion Test Chambers are specialized industrial instruments designed to simulate accelerated corrosive environments to evaluate the performance, reliability, and lifespan of materials, coatings, and components under harsh conditions. These chambers artificially create controlled atmospheres, typically involving salt spray (neutral, acidic, or basic), humidity, temperature cycling, and dry-out phases, mimicking the long-term effects of exposure to outdoor weathering or specific industrial environments in a matter of hours or weeks. Key products within this market include traditional salt spray cabinets, specialized cyclic corrosion chambers (which offer superior simulation fidelity), humidity chambers, and combined environmental testing systems. Major applications span across almost every manufacturing sector, ensuring quality control and adherence to global testing standards such as ASTM B117, ISO 9227, and various automotive specifications (e.g., JASO, VDA).

The primary benefits derived from the utilization of these chambers include significant reduction in product development time, minimization of warranty costs associated with premature material failure, and verification of compliance with mandatory industry standards. By accelerating the corrosive aging process, manufacturers can rapidly compare different coating chemistries, material alloys, and fabrication techniques, allowing for informed material selection that optimizes performance while controlling costs. The driving factors behind continuous market demand are the unrelenting pressure on industries to enhance product quality, the proliferation of electric vehicles (EVs) requiring new anti-corrosion strategies for battery components and light-weighting materials, and the increasing global adoption of stringent environmental testing protocols.

Corrosion Test Chamber Market Executive Summary

The global Corrosion Test Chamber Market is characterized by a definitive shift towards advanced cyclic corrosion testing systems, moving away from simple static salt spray cabinets, driven by the need for test results that more closely correlate with real-world atmospheric exposure. Business trends indicate strong investment in automation and software integration, facilitating complex testing sequences and comprehensive data analysis, which is crucial for modern R&D laboratories. Competition is intensifying, focusing on the ability of manufacturers to deliver precise environmental control, robust chamber construction, and user-friendly integrated control software compliant with multiple international standards. Strategic alliances and acquisitions among solution providers are becoming common as companies seek to expand their geographic footprint and technological portfolio, especially in the realm of advanced climate control and combined testing capabilities.

Regionally, Asia Pacific (APAC) is forecast to exhibit the fastest growth rate due to its position as the global manufacturing epicenter for automotive parts, consumer electronics, and renewable energy components, necessitating large-scale quality assurance testing. North America and Europe, while demonstrating slower volume growth, maintain market leadership in terms of value, owing to high adoption rates of premium, highly customized chambers utilized by aerospace, defense, and pharmaceutical packaging industries where regulatory scrutiny is highest. Segment trends highlight that the cyclic corrosion chambers segment is gaining significant market share over traditional types, reflecting the industry's pivot toward highly realistic accelerated testing methodologies. Furthermore, end-user segmentation shows that the automotive industry remains the largest consumer, driven by ever-increasing requirements for vehicle longevity and protection against diverse climatic conditions encountered globally.

AI Impact Analysis on Corrosion Test Chamber Market

Common user questions regarding AI's impact on the Corrosion Test Chamber Market frequently revolve around optimizing test duration, predicting failure points, and automating data interpretation. Users are keen to know if AI can reduce the inherently long testing cycles without sacrificing accuracy, how machine learning algorithms can analyze vast datasets generated by IoT-enabled chambers to predict corrosion kinetics, and whether AI tools can streamline compliance reporting. This collective interest summarizes a market expectation where AI transitions the chamber from a simple environmental simulator to a sophisticated, predictive testing tool. The integration of AI aims to improve testing efficiency, enhance the fidelity of accelerated tests, and provide deeper insights into material degradation mechanisms, ultimately reducing R&D costs and accelerating time-to-market for new corrosion-resistant products.

- AI algorithms optimize test protocols by dynamically adjusting cycles (temperature, humidity, pH) based on historical material response data, reducing overall test duration while maintaining relevance.

- Machine Learning (ML) models analyze sensor data (temperature uniformity, contaminant levels, pressure fluctuations) to predict equipment failure and enable proactive maintenance, minimizing chamber downtime.

- AI enhances data analytics by identifying subtle correlation patterns between material composition, coating thickness, and observed corrosion rates, leading to predictive failure modeling.

- Natural Language Processing (NLP) aids in automating comprehensive test reports, summarizing complex data outputs, and ensuring compliance with specific regulatory standards documentation.

- Predictive simulation using AI allows manufacturers to conduct virtual pre-testing, reducing the need for extensive physical testing and speeding up the initial material selection phase.

DRO & Impact Forces Of Corrosion Test Chamber Market

The market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and internal/external Impact Forces. Key drivers include the globalization of manufacturing, which necessitates adherence to uniform international standards (ISO, ASTM), and the sustained growth of the automotive sector, particularly the rapid adoption of electric vehicles (EVs), which require stringent corrosion resistance for battery packs and structural components. Additionally, stricter environmental regulations concerning material lifecycle and durability in infrastructure projects worldwide mandate rigorous testing protocols. These forces collectively push manufacturers to invest in high-precision, repeatable testing equipment.

Conversely, significant restraints hinder market growth, primarily the high capital investment required for purchasing advanced cyclic corrosion chambers and the associated maintenance and calibration costs. Furthermore, the complexity of operating advanced chambers, which require highly skilled technicians to program sophisticated test profiles and accurately interpret results, poses a barrier to entry, particularly for smaller enterprises in developing regions. Another critical challenge is the inherent difficulty in achieving perfect correlation between accelerated lab tests and actual long-term field performance, occasionally leading to skepticism regarding test validity.

Opportunities for expansion are centered on the integration of IoT and Industry 4.0 capabilities, enabling remote monitoring and enhanced diagnostic services. The emergence of new materials, such as advanced composite coatings and specialized alloys for high-stress environments (e.g., offshore energy, hydrogen fuel cells), creates a continuous demand for customized testing solutions. The rising demand from the aerospace and defense sectors for chambers that can simulate extreme conditions (salt fog, high altitude, thermal shock) presents lucrative specialization opportunities. Impact forces driving market evolution include technological advancements in control systems and standardization bodies continuously updating test methodologies to reflect modern environmental stresses, thereby compelling organizations to upgrade their testing apparatus frequently.

Segmentation Analysis

The Corrosion Test Chamber Market is meticulously segmented across various parameters including product type, test method, capacity, and end-use application, providing a granular view of demand patterns and market penetration. The overall segmentation reflects the diverse needs of end-user industries, ranging from large-scale manufacturers requiring high-throughput chambers to specialized R&D labs needing small, highly precise bench-top units. Understanding these segment dynamics is critical for market players to tailor their product offerings, particularly as the market leans increasingly towards specialized testing methodologies like CASS (Copper Accelerated Acetic Acid Salt Spray) and specific automotive standards such as Volvo VCS 1027, 149 (ACT-I/ACT-II).

- By Product Type:

- Salt Spray Chambers (Conventional)

- Cyclic Corrosion Test Chambers (CCT)

- Humidity Chambers

- CASS/Acidified Salt Fog Chambers

- Combined Environmental Chambers (Corrosion + UV/Temperature)

- By Test Method:

- ASTM B117 (Standard Salt Spray)

- ISO 9227

- Automotive Standards (e.g., JASO, VDA, GMW)

- Customized/Proprietary Methods

- By Capacity:

- Benchtop/Small Scale Chambers (Under 500 Liters)

- Medium Capacity Chambers (500 L – 1,500 Liters)

- Large Scale/Walk-in Chambers (Over 1,500 Liters)

- By End-Use Industry:

- Automotive and Transportation

- Aerospace and Defense

- Electronics and Electricals

- Paints and Coatings

- Building and Construction

- Industrial Manufacturing

Value Chain Analysis For Corrosion Test Chamber Market

The value chain for the Corrosion Test Chamber Market begins with the sourcing of specialized raw materials, primarily high-grade stainless steel, fiberglass reinforced plastic (FRP), or specialized polymers resistant to corrosive media and high temperatures, along with complex electronic components such as microprocessors, sensors, and PLC controllers. Upstream activities involve specialized component manufacturing, focusing on precision nozzles, heating elements, and sophisticated refrigeration units necessary for maintaining precise internal conditions and temperature cycling. The manufacturing stage is highly complex, requiring specialized engineering expertise in sealing technology and environmental control systems to ensure chamber integrity and test accuracy.

Midstream activities involve the integration and assembly of these components into the final chamber product, followed by rigorous quality assurance and calibration to meet international standards (e.g., ISO 17025 certification). Key value addition at this stage comes from integrating advanced control software and developing user interfaces that facilitate complex test programming. Downstream, the distribution channel primarily utilizes a dual approach: direct sales for large, customized, and high-value orders (especially for aerospace and defense clients) requiring detailed technical consultation, and indirect sales through specialized technical distributors and authorized regional agents who handle installation, localized support, and after-sales services for standard model chambers. The final link involves comprehensive post-sales support, including calibration, maintenance contracts, and spare parts supply, which constitutes a significant recurring revenue stream for key market players.

Corrosion Test Chamber Market Potential Customers

Potential customers for Corrosion Test Chambers are organizations heavily invested in product quality, material durability, and compliance with long-term performance standards, spanning governmental bodies, large multinational corporations, and specialized testing service providers. The primary buyers are the Quality Assurance (QA) and Research & Development (R&D) departments within manufacturing enterprises that produce items exposed to atmospheric stress, such as vehicles, aircraft, marine equipment, or construction materials. Specifically, automotive OEMs and their Tier 1 suppliers are paramount customers, continuously purchasing cyclic corrosion chambers to validate new body materials, paints, and protective coatings required for vehicle longevity and safety recalls prevention. Similarly, companies specializing in paints, lacquers, and metal finishing heavily rely on these chambers to benchmark and certify their product specifications against competitor offerings.

Beyond traditional manufacturing, independent contract testing laboratories and third-party certification bodies represent a crucial customer segment, as they provide testing services to companies unable or unwilling to invest in their own high-cost equipment. These labs require versatile, multi-standard compliant chambers capable of running diverse protocols for various industries. Furthermore, defense contractors and national laboratories focused on developing mission-critical equipment, where failure due to corrosion is unacceptable, are significant buyers of highly customized, large-capacity, and military-specification chambers. The shift towards sustainable infrastructure and renewable energy also introduces new buyers in the solar panel, wind turbine component manufacturing, and specialized battery manufacturing sectors, all of whom need to ensure material integrity under extreme weather exposure over decades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 million |

| Market Forecast in 2033 | USD 900.0 million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ACS - Angelantoni Test Technologies, Weiss Technik, Atlas Material Testing Technology, Vötsch Industrietechnik (part of Schunk Group), Q-Lab Corporation, Taber Industries, Singleton Corporation, C&W Specialist Equipment Ltd., Memmert GmbH + Co. KG, ESPEC CORP., SMM - Shinwa Measuring Machines, TestEquity LLC, Thermotron Industries, CSZ (Cincinnati Sub-Zero), TIRA GmbH, Presto Group, Hastest Solutions Inc., FDM - Fine Dust Measurement, HASTE Chamber Technology, Binder GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrosion Test Chamber Market Key Technology Landscape

The technological landscape of the Corrosion Test Chamber market is rapidly evolving, moving away from purely mechanical systems toward sophisticated electro-mechanical and software-integrated solutions. A major trend involves the migration from traditional pneumatic and manually controlled systems to advanced Programmable Logic Controllers (PLCs) and HMI (Human Machine Interface) touchscreen controls, providing precise and repeatable control over complex test parameters like temperature ramps, humidity levels, and salt fog dosage. This shift allows chambers to execute highly complex, multi-stage cyclic corrosion tests (CCT) that are crucial for simulating realistic weathering conditions encountered by modern vehicles and infrastructure, meeting standards like ISO 14993 and SAE J2334. The core technological innovation lies in maintaining tight uniformity across the entire test volume, which is achieved through optimized air flow distribution and intelligent monitoring systems to prevent localized thermal or salt concentration gradients, thus ensuring accurate and comparable test results.

Furthermore, the integration of Industry 4.0 principles, notably through the implementation of IoT sensors and remote connectivity, is transforming how these chambers are operated and maintained. Modern chambers are equipped with embedded data logging capabilities and network interfaces, allowing users to monitor test status, adjust parameters, and download extensive data remotely via cloud platforms. This capability is paramount for global manufacturers managing R&D and QA processes across different continents. Another significant area of development is the incorporation of non-destructive testing (NDT) capabilities directly within the chamber environment. Although still nascent, integrating sensors or probes that can perform real-time measurements of coating thickness or material impedance changes without interrupting the corrosion cycle offers unparalleled advantages for understanding corrosion kinetics and validating predictive modeling, positioning these chambers as true analytical instruments rather than just environmental simulators.

The continuous push towards energy efficiency and sustainability also drives technological development. Manufacturers are adopting better insulation materials, optimizing spray systems to minimize brine consumption, and implementing variable-speed drive compressors for climate control, reducing the operational footprint and cost associated with running long-duration tests. This focus on efficiency, combined with advancements in chamber construction materials (e.g., highly corrosion-resistant composite plastics) that offer lighter weight and longer service life than traditional stainless steel, contributes significantly to the total value proposition for end-users, especially those in high-utilization environments like contract testing laboratories. The competitive advantage is increasingly held by companies that can offer fully validated, globally certified systems with robust data handling and reporting features.

Regional Highlights

The market for corrosion test chambers exhibits distinct characteristics and growth drivers across major global regions, reflecting variations in industrial concentration, regulatory stringency, and R&D investment levels. North America, encompassing the United States and Canada, represents a mature and high-value market segment. Growth in this region is primarily driven by the robust presence of the aerospace, defense, and high-tech automotive sectors, especially concerning the development of advanced materials for electric and autonomous vehicles. The demand here focuses heavily on highly customized, large-capacity chambers capable of meeting rigorous military (MIL-STD) and proprietary industry specifications. The emphasis is on quality, repeatability, and software integration for complex data logging, translating to a higher average selling price for equipment in this region. Regulatory pressures from bodies like the EPA regarding material durability and the high volume of critical infrastructure projects further solidify North America's position as a dominant consumer of premium corrosion testing equipment.

Europe stands as a key market defined by stringent environmental protection and material safety standards imposed by the European Union (EU). Countries like Germany, France, and Italy, with their strong automotive and precision engineering bases, drive demand for cyclic corrosion chambers adhering strictly to pan-European and international standards (e.g., DIN, BSI, ISO). The European market is characterized by a strong focus on compliance, sustainability, and long-term product reliability, often utilizing advanced testing protocols that integrate thermal, humidity, and UV exposure alongside salt spray to achieve the highest possible fidelity in accelerated weathering simulation. The replacement cycle for older, less sophisticated chambers is relatively stable, fueled by the continuous introduction of new, complex test methods that require updated equipment. The region is also home to several key manufacturers, contributing significantly to both demand and supply of advanced testing technology.

Asia Pacific (APAC) is unequivocally the fastest-growing region globally, propelled by rapid industrialization, massive production volumes, and the increasing adoption of global quality standards across manufacturing hubs in China, India, Japan, and South Korea. The explosive growth of automotive manufacturing, particularly the push for EVs and battery component testing, necessitates substantial investment in large-scale corrosion testing infrastructure. While price sensitivity remains a factor in certain sub-regions, the overall shift is towards acquiring advanced cyclic chambers to meet export requirements to North America and Europe. Government initiatives aimed at boosting local R&D capabilities and improving domestic product quality further stimulate market expansion. APAC accounts for a majority of new installations, driven by greenfield manufacturing projects and capacity expansion across electronics, shipbuilding, and construction industries.

- North America: Market leader in value, driven by aerospace, defense, and high-end EV R&D; high demand for complex, customized chambers meeting MIL-STD specifications.

- Europe: Characterized by stringent compliance requirements (EU regulations); strong adoption of complex CCT protocols in automotive and precision industries; focus on replacement and technological upgrade cycles.

- Asia Pacific (APAC): Highest volume growth region; driven by mass manufacturing in automotive and electronics; increasing adoption of international standards and significant investment in new capacity, particularly in China and India.

- Latin America (LATAM): Emerging market primarily driven by local automotive assembly and basic manufacturing needs; strong demand for standard salt spray cabinets, but slowly transitioning to medium-capacity cyclic testing solutions.

- Middle East and Africa (MEA): Growth tied to oil and gas, infrastructure development, and specialized coating applications in harsh coastal environments; increasing need for accelerated weathering chambers specifically designed for high-heat and salinity conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrosion Test Chamber Market.- ACS - Angelantoni Test Technologies

- Weiss Technik

- Atlas Material Testing Technology

- Vötsch Industrietechnik (part of Schunk Group)

- Q-Lab Corporation

- Taber Industries

- Singleton Corporation

- C&W Specialist Equipment Ltd.

- Memmert GmbH + Co. KG

- ESPEC CORP.

- SMM - Shinwa Measuring Machines

- TestEquity LLC

- Thermotron Industries

- CSZ (Cincinnati Sub-Zero)

- TIRA GmbH

- Presto Group

- Hastest Solutions Inc.

- FDM - Fine Dust Measurement

- HASTE Chamber Technology

- Binder GmbH

Frequently Asked Questions

Analyze common user questions about the Corrosion Test Chamber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Salt Spray Chamber and a Cyclic Corrosion Chamber (CCT)?

A Salt Spray Chamber maintains a static, continuous corrosive environment (salt fog) primarily meeting ASTM B117. A Cyclic Corrosion Chamber (CCT) simulates real-world conditions more accurately by cycling through varying environments, including salt fog, humidity, temperature changes, and dry-off phases, adhering to complex automotive and advanced standards like SAE J2334.

Which industry segment drives the highest demand for corrosion testing equipment globally?

The Automotive and Transportation industry is the largest consumer segment, driven by strict standards for vehicle longevity, warranty reduction goals, and the specialized need for testing new materials used in electric vehicle battery enclosures and chassis components.

How does the integration of IoT technology improve chamber performance and data integrity?

IoT integration allows for real-time remote monitoring of test parameters, automated data logging, cloud-based data storage for audit trails, and predictive maintenance alerts. This significantly enhances test repeatability, reduces manual error, and improves data integrity for compliance reporting.

What are the key barriers restraining the growth of the Corrosion Test Chamber Market?

The primary restraints include the high initial capital investment required for purchasing advanced, large-capacity cyclic chambers, and the operational requirement for highly skilled technical personnel capable of programming complex test profiles and interpreting specialized results accurately.

Is the market leaning more towards large, centralized chambers or smaller, distributed benchtop models?

The market demonstrates dual growth: large, walk-in, and medium-capacity cyclic chambers are favored in large manufacturing and contract testing facilities for high-volume QA, while smaller, benchtop models are experiencing growth in academic research and specialized R&D departments requiring precise control over limited samples.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager