Corrugated Aluminum Sheath Cable Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433913 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Corrugated Aluminum Sheath Cable Market Size

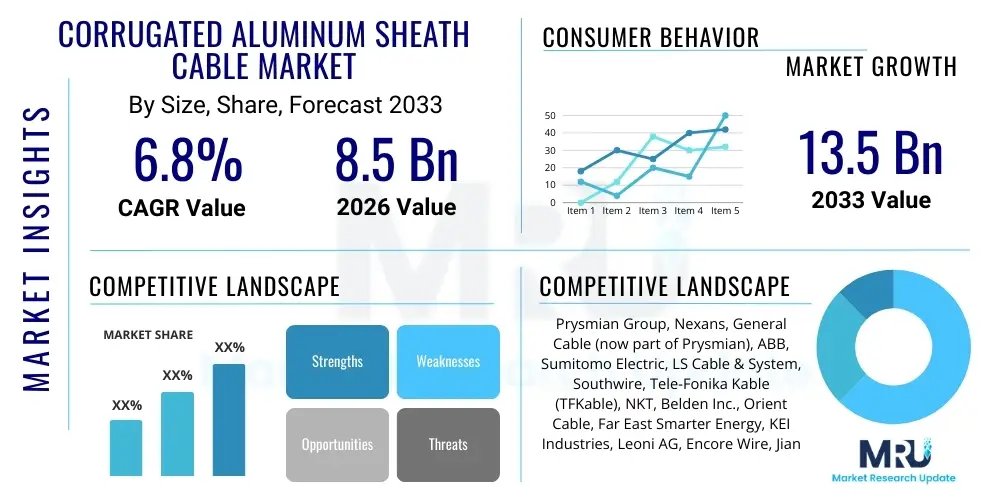

The Corrugated Aluminum Sheath Cable Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by accelerating investments in critical electrical infrastructure modernization, particularly across high-voltage transmission and distribution networks globally. The inherent mechanical robustness and superior electromagnetic shielding provided by corrugated aluminum sheathing make these cables indispensable in harsh industrial environments and large-scale power projects where reliability and protection against external interference are paramount.

The market valuation reflects the increasing preference for aluminum-sheathed cables over traditional lead or steel options due to aluminum’s significant weight advantage and improved corrosion resistance, translating into reduced installation costs and enhanced operational longevity. Moreover, the stringent safety regulations being implemented across sectors such as oil and gas, mining, and nuclear power generation necessitate the use of highly durable cable systems, further solidifying the demand trajectory. Geographic expansion, particularly rapid urbanization and industrial capacity additions in emerging economies, contributes a substantial impetus to the overall market size growth throughout the forecast timeframe.

Corrugated Aluminum Sheath Cable Market introduction

The Corrugated Aluminum Sheath (CAS) Cable Market encompasses specialized electrical conductors protected by a continuous, non-welded, highly flexible aluminum jacket that has been mechanically corrugated to enhance its flexibility, tensile strength, and resistance to radial compression. These sophisticated cables are primarily utilized in demanding environments requiring exceptional moisture ingress protection, superior mechanical armor, and effective electromagnetic and radio-frequency shielding. The primary product characteristic that differentiates CAS cables is the combination of the lightweight nature of aluminum with the structural integrity provided by the corrugation process, making installation simpler while maintaining performance integrity in challenging conditions.

Major applications for CAS cables span critical infrastructure sectors including high-voltage power transmission, distribution feeder lines, complex industrial wiring (e.g., petrochemical plants, heavy manufacturing facilities), and specialized environments like railway signaling and underground tunnels. Key benefits derived from utilizing these cables include enhanced fire safety characteristics due to the robust metallic sheath, increased protection against chemical solvents and UV exposure, and long service life with minimal maintenance requirements. The superior heat dissipation capability of the aluminum sheath also allows for higher current carrying capacities compared to standard armored cables, contributing to overall system efficiency and reliability.

The primary driving factors propelling this market include the global transition towards smart grid technologies, which demand reliable, interference-free power delivery systems, and the ongoing massive investment cycles in renewable energy projects (wind farms, solar installations) requiring robust interconnections. Furthermore, the persistent need for replacing aging infrastructure in developed nations and the rapid pace of electrification and industrialization in the Asia-Pacific region are consistently generating high demand for premium, durable cable solutions like those featuring corrugated aluminum sheathing. Regulatory mandates emphasizing operational safety and network resilience further underpin the stable growth trajectory of the market.

Corrugated Aluminum Sheath Cable Market Executive Summary

The Corrugated Aluminum Sheath Cable Market is experiencing robust growth driven by accelerating industrialization and major global infrastructure modernization initiatives. Key business trends include a notable shift towards specialized, high-voltage CAS cables engineered for Extra High Voltage (EHV) transmission projects and a sustained demand surge from the mining and oil & gas sectors where mechanical protection is non-negotiable. Strategic mergers and acquisitions among major cable manufacturers focused on expanding production capacity for customized sheathing solutions, particularly those utilizing advanced corrosion-resistant aluminum alloys, are defining the competitive landscape. Furthermore, manufacturers are increasingly integrating advanced monitoring capabilities (e.g., fiber optics) within the cable structure itself, catering to the growing need for intelligent network management and predictive maintenance.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by extensive government spending on new power generation facilities, urban smart city development projects, and the rapid expansion of industrial zones in countries like China, India, and Southeast Asia. North America and Europe maintain strong market shares, predominantly driven by the replacement cycle of legacy infrastructure and the integration of substantial renewable energy capacity into existing grids, necessitating high-performance transmission cables. These developed regions are also leaders in adopting specialized, fire-resistant CAS variants used in critical transportation and data center infrastructure, ensuring sustained, high-value demand.

Segment trends indicate that the High Voltage (HV) and Extra High Voltage (EHV) cable segments, defined by voltages above 69 kV, are demonstrating the fastest growth rate, reflecting the global focus on efficient, long-distance power transfer. By insulation type, cross-linked polyethylene (XLPE) insulated CAS cables dominate the market due to their superior thermal and electrical properties compared to traditional paper-insulated cables. In terms of application, the Utility and Power Generation segment remains the largest consumer, although significant growth is also observed in niche industrial sectors such as rail transit systems and specialized mining operations that demand cables capable of withstanding extreme abrasive and flexing conditions.

AI Impact Analysis on Corrugated Aluminum Sheath Cable Market

Common user questions regarding AI's influence on the Corrugated Aluminum Sheath Cable Market primarily revolve around how AI can enhance the manufacturing process, optimize cable network deployment, and prolong asset lifespan in smart grid systems. Users seek understanding on topics such as AI-driven predictive failure analysis, quality assurance using machine vision during corrugation and sheathing, and the potential for AI algorithms to design optimal cable routing and sizing for complex urban infrastructure projects. A key concern frequently raised is whether the increased complexity and data generated by smart grid technologies will necessitate even higher levels of electromagnetic shielding, potentially increasing demand for CAS cable specifications.

Based on this analysis, the key themes summarize that AI is fundamentally viewed as an enabler for both the demand side and supply side of the CAS cable industry. On the demand side, AI supports the development of smart grids and optimized power flow, requiring more reliable, robust, and data-enabled cables. On the supply side, AI integration in manufacturing promises improvements in material efficiency, reduction in production defects (especially critical for continuous sheathing processes), and highly optimized inventory and supply chain management. The overarching expectation is that AI will drive standards toward zero-defect manufacturing and ultra-high reliability specifications, reinforcing the market position of premium armored cables like those featuring corrugated aluminum sheaths.

AI's influence is also projected to significantly impact the operations and maintenance (O&M) lifecycle of installed CAS cable systems. By utilizing machine learning algorithms to analyze real-time data from embedded sensors (temperature, partial discharge, vibration), utilities can predict potential mechanical stress failures or insulation degradation long before they become critical. This shift from reactive to predictive maintenance optimizes network uptime and reduces the total cost of ownership (TCO) for large-scale cable deployments, further incentivizing investment in high-durability products like CAS cables designed to integrate sophisticated monitoring technologies.

- AI enhances quality control in manufacturing through machine vision systems, ensuring uniform corrugation and defect detection in the aluminum sheath.

- Predictive maintenance analytics, powered by AI, optimize the lifespan and reliability of installed CAS cable networks, minimizing costly downtime for utilities.

- AI algorithms assist in optimizing the design and routing of complex high-voltage CAS cable systems, especially in dense urban and subterranean environments.

- Increased data generation from smart grids, managed by AI, necessitates superior electromagnetic shielding, driving higher demand for robust CAS cable properties.

- AI-driven supply chain optimization improves the sourcing and inventory management of raw materials (aluminum, insulation compounds), stabilizing production costs.

DRO & Impact Forces Of Corrugated Aluminum Sheath Cable Market

The dynamics of the Corrugated Aluminum Sheath Cable Market are fundamentally shaped by a confluence of influential forces categorized as Drivers, Restraints, and Opportunities (DRO). A primary driver is the global commitment to sustainable energy sources, necessitating extensive grid infrastructure upgrades and long-distance transmission lines to integrate remote renewable generation sites, where the durability and shielding of CAS cables are essential. This is coupled with escalating regulatory mandates across developed and developing regions focusing on enhancing electrical safety, fire resistance, and overall grid resilience against environmental and mechanical hazards. However, the market faces significant restraints, chiefly stemming from the volatility in aluminum prices and the high initial capital investment required for specialized manufacturing equipment. The complex installation procedures associated with high-voltage CAS cables, often requiring specialized jointing and termination techniques, also act as a constraint, particularly in price-sensitive markets.

Conversely, immense opportunities are emerging from the conceptualization and execution of smart city initiatives worldwide, which require highly robust and future-proof underground cabling infrastructure capable of handling high data transmission alongside power delivery, a niche perfectly served by integrated CAS cable designs. Furthermore, the rising demand for fire-resistant and low-smoke, zero-halogen (LSZH) sheathing compounds, especially in confined spaces such as transit systems, high-rise buildings, and data centers, opens profitable avenues for premium CAS cable variants. These market forces collectively dictate the adoption rate, pricing strategies, and technological innovation within the sector, pushing manufacturers towards continuous improvement in material science and installation efficiency.

The impact forces influencing the CAS market extend beyond immediate supply and demand to include substitution threats and technological shifts. While traditional lead-sheathed cables present a historical substitution threat, environmental regulations are rapidly diminishing their usage. The emergence of specialized polymer-based or fiber-reinforced composite sheathing represents a modern, albeit currently limited, alternative that needs constant monitoring. The dominant impact force, however, remains technological acceleration in ultra-high voltage (UHV) transmission, where efficient and durable shielding becomes critical. Successfully navigating the high cost of raw materials and complex regulatory frameworks while capitalizing on the infrastructure modernization wave is key to sustainable growth in this specialized segment.

Segmentation Analysis

The Corrugated Aluminum Sheath Cable Market is intricately segmented based on core criteria including Voltage Level, Insulation Material, End-Use Application, and Manufacturing Structure. Analyzing these segments provides a granular view of market dynamics, revealing specific high-growth niches and mature, stable revenue streams. The dominance of the high-voltage segment underscores the global trend towards larger, more efficient power grids, while the utility sector remains the anchor application, demanding large volumes of standardized products for transmission and distribution. Continuous innovation in insulation materials, particularly the increasing reliance on XLPE over older alternatives, drives the technological segmentation, enhancing cable performance and lifespan under stress.

Segmentation by manufacturing structure (e.g., product design, single core vs. multi-core) allows manufacturers to cater to specific project requirements, such as enhanced flexibility for mining applications or extreme rigidity for direct burial in harsh environments. The increasing complexity of industrial projects, including offshore oil platforms and nuclear facilities, necessitates tailored product specifications, further fragmenting the application segmentation. This detailed segmentation analysis is crucial for stakeholders to identify optimal geographic and product penetration strategies, focusing R&D efforts where future returns are maximized based on projected infrastructural needs.

- By Voltage Level:

- Low Voltage (Below 1 kV)

- Medium Voltage (1 kV to 35 kV)

- High Voltage (36 kV to 230 kV)

- Extra High Voltage (Above 230 kV)

- By Insulation Material:

- Cross-Linked Polyethylene (XLPE)

- Ethylene Propylene Rubber (EPR)

- Paper Insulated Cable (PIC)

- By End-Use Application:

- Utilities and Power Generation

- Oil and Gas

- Mining

- Heavy Industrial

- Transportation (Rail, Metro)

- Infrastructure and Construction

- By Structure Type:

- Single Core

- Multi Core

Value Chain Analysis For Corrugated Aluminum Sheath Cable Market

The value chain of the Corrugated Aluminum Sheath Cable Market starts with upstream analysis, focusing on the sourcing and processing of core raw materials, primarily high-purity aluminum ingots for the sheath and specialized polymers (XLPE, PVC) for insulation and jacketing. Volatility in global aluminum commodity markets directly impacts the cost structure for manufacturers. Effective supply chain management at this stage involves strategic long-term contracts and hedging to mitigate price risks. Key upstream suppliers are aluminum smelters and chemical companies providing advanced polymer compounds essential for high-performance insulation required in HV/EHV applications. The quality and purity of these raw inputs are critical determinants of the final cable’s electrical integrity and mechanical resilience.

The central phase involves specialized manufacturing processes, including conductor stranding, insulation extrusion, and the complex, continuous corrugation and application of the aluminum sheath, often under rigorous quality control standards. Manufacturers in this intermediate stage invest heavily in advanced machinery and proprietary processes to achieve defect-free sheathing, which is the primary value proposition of CAS cables. Following manufacturing, the distribution channel plays a vital role. Distribution is characterized by a mix of direct sales to large utilities and Engineering, Procurement, and Construction (EPC) firms involved in major infrastructure projects, and indirect sales through specialized industrial distributors and wholesalers who maintain local inventories and provide installation support to smaller end-users across various industrial sectors.

Downstream analysis focuses on installation, commissioning, and end-user consumption. EPC contractors and specialized cable installers constitute the immediate buyers, responsible for implementing the cables in complex environments like subterranean tunnels or petrochemical plants. The final customers (utilities, mining companies, transportation authorities) are highly focused on the total cost of ownership, reliability, and regulatory compliance. The direct channel is preferred for custom, high-voltage projects where technical consultation is mandatory, while the indirect channel serves the medium and low-voltage industrial replacement and expansion markets, ensuring broad market reach and localized service provision.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans, General Cable (now part of Prysmian), ABB, Sumitomo Electric, LS Cable & System, Southwire, Tele-Fonika Kable (TFKable), NKT, Belden Inc., Orient Cable, Far East Smarter Energy, KEI Industries, Leoni AG, Encore Wire, Jiangnan Cable, ZTT, Shandong Kerui Cable, Tianjin Huacheng Wire and Cable, Hefei Smarter Cable. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrugated Aluminum Sheath Cable Market Potential Customers

The primary potential customers for Corrugated Aluminum Sheath Cable Market products are organizations that own, operate, or construct large-scale electrical infrastructure systems requiring high reliability, mechanical protection, and interference shielding. The most significant buying group comprises electric utilities and power generation companies, ranging from large public-sector transmission system operators (TSOs) to independent power producers (IPPs), particularly those focused on integrating renewable energy sources. These customers require CAS cables for long-distance power transmission lines, crucial underground distribution feeders in urban centers, and interconnections within power substations, prioritizing lifespan, load capacity, and conformance to stringent national electrical codes.

Another major segment of potential customers includes heavy industrial end-users, such as companies operating in the mining, petrochemical, oil and gas, and metallurgical sectors. In these environments, cables are constantly exposed to abrasion, corrosive chemicals, high temperatures, and potential mechanical impacts from heavy machinery. Mining operations, in particular, rely heavily on CAS cables due to their superior resistance to crushing and ingress, essential for powering continuous miners and complex conveyor systems in deep shafts. These industrial buyers often seek specialized CAS cables with enhanced chemical resistance and flexibility tailored for dynamic application settings.

Furthermore, large transportation authorities and infrastructure development firms represent a growing customer base. This includes operators of metro rail systems, high-speed rail lines, and tunnel construction projects where fire safety (using LSZH variants) and effective electromagnetic shielding against signaling interference are critical operational requirements. Finally, major Engineering, Procurement, and Construction (EPC) firms act as indirect customers, purchasing CAS cables in bulk for integration into large, turnkey power and industrial projects globally, requiring comprehensive technical support and standardized product quality from cable manufacturers.

Corrugated Aluminum Sheath Cable Market Key Technology Landscape

The technological landscape of the Corrugated Aluminum Sheath Cable Market is defined by continuous advancements aimed at improving cable durability, electrical performance, ease of installation, and environmental compliance. A key area of innovation involves the metallurgy of the sheathing material, moving towards lighter, higher-strength aluminum alloys that offer enhanced corrosion resistance without compromising mechanical protection. Manufacturers are developing sophisticated corrugation techniques that maximize flexibility and bending radius, making the bulky cables easier to handle and install in confined spaces, a crucial factor for urban underground deployments. The goal is to achieve a balance between robust armoring and necessary maneuverability, often utilizing interlocked aluminum strip technology alongside continuous sheath processes.

On the electrical side, the integration of advanced insulation materials, particularly high-performance Cross-Linked Polyethylene (XLPE), continues to dominate the HV and EHV segments. Research focuses on improving XLPE compounds to reduce dielectric losses and enhance resistance to water treeing, thus extending the operational life of cables carrying extremely high voltages. Furthermore, the development of specialized fire-retardant and Low-Smoke, Zero-Halogen (LSZH) jacketing materials applied over the corrugated aluminum sheath is vital for compliance in sensitive applications such as passenger rail tunnels and critical government facilities, driving a distinct technological sub-segment focusing on safety standards.

A burgeoning technological trend involves integrating monitoring capabilities directly into the CAS cable structure. This includes the incorporation of distributed temperature sensing (DTS) fiber optic cables within the sheath or core to allow for real-time thermal profiling and immediate fault detection, which is integral to smart grid functionality. The manufacturing technology itself is also evolving, with greater automation and precision control over the extrusion and welding/forming processes of the aluminum sheath, ensuring uniform wall thickness and complete hermetic sealing against moisture, thus guaranteeing the long-term operational integrity and reliability expected from premium armored cable solutions.

Regional Highlights

The global Corrugated Aluminum Sheath Cable Market exhibits significant regional disparities in terms of growth rate, market maturity, and technological adoption, reflecting varying levels of infrastructural development and regulatory environments across continents. Asia Pacific (APAC) currently holds the dominant position and is projected to be the fastest-growing region, driven by unparalleled levels of investment in new power generation (especially coal, hydro, and solar), rapid urbanization, and massive expansions of industrial capacity in nations like China, India, and Indonesia. The need to establish efficient long-distance transmission corridors for power distribution across vast geographical areas fuels the high demand for robust, high-voltage CAS cables. Additionally, government initiatives focused on smart grid deployment in emerging APAC economies necessitate the use of reliable, shielded cabling solutions.

North America (US and Canada) represents a mature, high-value market characterized primarily by infrastructure replacement and modernization programs. Demand is stable and concentrated in the HV and EHV segments, focusing on improving grid resilience against extreme weather events and integrating decentralized power sources. Stringent safety and environmental regulations compel utilities to opt for premium CAS cables, particularly those offering superior fire resistance and extended service life. The market here is driven by technological advancements, with significant emphasis on adopting cables integrated with advanced monitoring and sensing technologies to support smart grid operations and preventative maintenance strategies.

Europe mirrors North America in its focus on grid modernization and renewables integration, with demand specifically high in offshore wind farm connections and cross-border interconnectors. Strict European Union (EU) environmental directives, particularly regarding cable sheathing materials and fire performance (CPR compliance), shape product demand, favoring advanced LSZH corrugated aluminum sheath cables. Latin America and the Middle East & Africa (MEA) are emerging regions showing substantial growth potential. MEA investment in oil & gas infrastructure and large-scale utility projects (especially in Saudi Arabia and the UAE) drives industrial demand, while Latin America's increasing focus on renewable energy and electrification projects, particularly in Brazil and Chile, promises future market expansion.

- Asia Pacific (APAC): Dominates the market share due to rapid industrialization, large-scale utility infrastructure projects, and massive investments in smart city development across China and India.

- North America: High demand driven by the modernization of aging transmission and distribution infrastructure and the integration of substantial renewable energy capacity. Focus on high-value, EHV-rated CAS cables.

- Europe: Growth fueled by stringent environmental regulations (CPR compliance) and significant investments in cross-border interconnectors and offshore wind power transmission requiring high-performance, fire-safe CAS cables.

- Middle East & Africa (MEA): Emerging market growth tied to extensive investments in oil & gas exploration, petrochemical facilities, and rapid expansion of power infrastructure, particularly in the Gulf Cooperation Council (GCC) countries.

- Latin America: Increasing market penetration supported by new power generation projects, particularly hydroelectric and solar, and the ongoing need for improved regional grid reliability and expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrugated Aluminum Sheath Cable Market.- Prysmian Group

- Nexans

- Sumitomo Electric Industries, Ltd.

- LS Cable & System Ltd.

- Southwire Company, LLC

- Tele-Fonika Kable S.A. (TFKable)

- NKT A/S

- General Cable (now part of Prysmian)

- ABB Ltd.

- Furukawa Electric Co., Ltd.

- Belden Inc.

- Orient Cable Co., Ltd.

- Far East Smarter Energy Co., Ltd.

- KEI Industries Limited

- Leoni AG

- Encore Wire Corporation

- Jiangnan Cable Co., Ltd.

- ZTT Group

- Shandong Kerui Cable Co., Ltd.

- Tianjin Huacheng Wire and Cable Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Corrugated Aluminum Sheath Cable market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using a corrugated aluminum sheath over traditional steel or lead sheathing?

The primary advantage of corrugated aluminum sheathing is the combination of significantly reduced weight compared to lead or steel, improved flexibility, and superior electromagnetic shielding. This results in easier installation, enhanced cable lifespan, and higher current capacity due to better heat dissipation.

Which end-use application segment drives the highest demand for Corrugated Aluminum Sheath Cables?

The Utilities and Power Generation segment consistently drives the highest demand. This sector utilizes CAS cables extensively for high-voltage transmission, crucial distribution feeders, and interconnections in substations, prioritizing the cable's reliability and mechanical protection for long-term grid stability.

How does the volatile price of aluminum impact the profitability of Corrugated Aluminum Sheath Cable manufacturers?

Aluminum price volatility directly increases the cost of raw materials, posing a significant challenge to manufacturer profitability. Companies often mitigate this through strategic commodity hedging, long-term procurement contracts, and focusing on high-margin, specialized HV/EHV products where the sheath cost is a smaller percentage of the total project value.

What role does Cross-Linked Polyethylene (XLPE) play in the Corrugated Aluminum Sheath Cable Market?

XLPE is the dominant insulation material, especially in the High Voltage and Extra High Voltage segments. Its superior thermal resistance, low dielectric losses, and resistance to chemical corrosion make it essential for optimizing the performance and lifespan of CAS cables under continuous operational stress.

Is the Corrugated Aluminum Sheath Cable Market expected to grow faster in developed or developing regions?

The market is expected to experience faster growth rates in developing regions, particularly Asia Pacific, due to massive governmental investments in new grid infrastructure, rapid urbanization, and industrial expansion, whereas developed regions primarily drive demand through infrastructure replacement and technological upgrades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager