Corrugated Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434949 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Corrugated Packaging Market Size

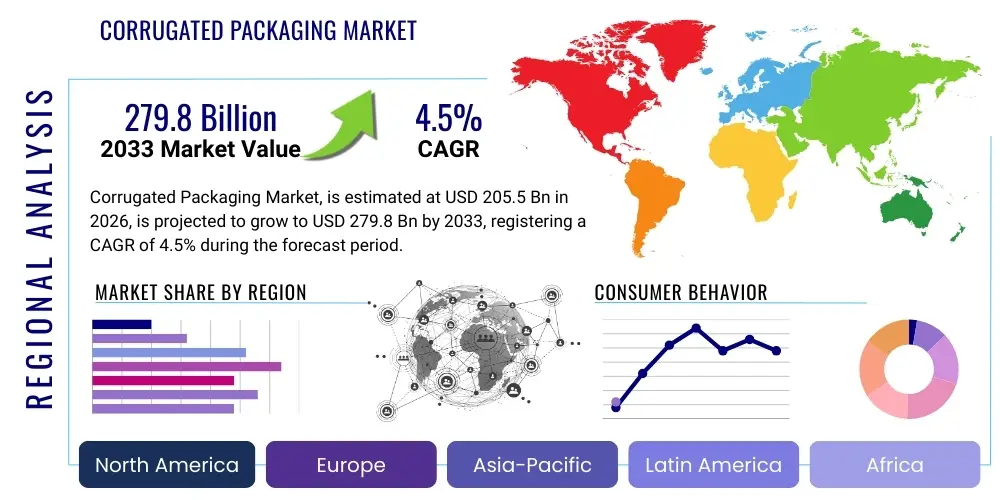

The Corrugated Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at $205.5 Billion USD in 2026 and is projected to reach $279.8 Billion USD by the end of the forecast period in 2033.

Corrugated Packaging Market introduction

The Corrugated Packaging Market encompasses the production and sale of packaging materials made primarily from corrugated fiberboard, often characterized by its fluting structure sandwiched between linerboards. These materials are essential for shipping, storage, and handling across virtually all industrial and consumer sectors due to their superior strength-to-weight ratio, protective qualities, and high degree of recyclability. The product spectrum ranges from simple shipping containers to complex retail-ready packaging (RRP) and heavy-duty industrial boxes. Corrugated boards are differentiated by their flute size (A, B, C, E, F, and combinations thereof) and the number of layers (single wall, double wall, triple wall), determining their compressive strength and suitability for specific applications.

Major applications of corrugated packaging span the food and beverage industry, where they secure perishables and consumer packaged goods (CPG); the booming e-commerce sector, which relies heavily on custom, durable, and lightweight boxes for last-mile delivery; and the industrial segment, including automotive parts, electronics, and construction materials. The inherent benefits of corrugated material—low cost, excellent cushioning capabilities, stacking strength, and ease of disposal—have cemented its position as the preferred packaging medium globally. Furthermore, the material is highly amenable to various printing techniques, facilitating branding and critical information conveyance directly on the box surface, a crucial aspect for modern retail and logistics.

Key factors driving market expansion include the exponential growth of online retail, which necessitates high volumes of secondary packaging for individual shipments; increasing global focus on sustainability, favoring recyclable and biodegradable paper-based solutions over plastics; and rapid industrialization in developing economies, boosting demand for safe and standardized bulk transportation containers. Moreover, advancements in printing technology, particularly digital printing, allow for cost-effective customization and personalization, further enhancing the appeal of corrugated packaging solutions to brands seeking differentiated consumer experiences.

Corrugated Packaging Market Executive Summary

The Corrugated Packaging Market is poised for stable and robust growth, primarily propelled by fundamental shifts in consumer purchasing behavior, notably the persistent migration towards e-commerce platforms globally. Business trends indicate a strong move toward lightweight yet high-strength materials, driven by optimization requirements in logistics and transportation costs. Major packaging corporations are heavily investing in vertical integration, controlling forestry resources and pulp production to mitigate volatility risks associated with raw material procurement. Consolidation activities, including strategic mergers and acquisitions, are common strategies employed by major players to expand geographical footprints, diversify product offerings, and integrate advanced manufacturing technologies like automated box forming and digital printing capabilities, thereby strengthening market competitiveness and operational efficiencies.

Regionally, the Asia Pacific (APAC) market, spearheaded by China and India, represents the most dynamic and fastest-growing segment, underpinned by rapid urbanization, expanding middle-class consumption, and large-scale industrial manufacturing output. North America and Europe, while mature, are characterized by high demand for sophisticated, sustainable, and retail-ready packaging (RRP) formats, driven by stringent recycling targets and consumer preference for eco-friendly products. These developed regions are observing a shift away from traditional brown boxes toward high-graphics and specialized coatings that enhance shelf appeal and overall product presentation, optimizing the role of packaging in the retail environment.

Segment trends demonstrate the double wall and triple wall corrugated board segments experiencing significant growth, predominantly catering to the heavy-duty industrial and burgeoning cross-border e-commerce shipping sectors which require maximum protection. By end-use, the e-commerce sector remains the primary growth engine, demanding flexible, scalable, and high-speed packaging solutions. Concurrently, the Food & Beverages segment maintains the largest market share, requiring specialized packaging that ensures food safety and integrity through robust barrier properties and moisture resistance. Material innovation is focused on enhancing recycled content without compromising performance and developing sustainable alternatives for coatings and inks.

AI Impact Analysis on Corrugated Packaging Market

Common user inquiries regarding AI's influence in the Corrugated Packaging Market frequently revolve around optimizing complex supply chain logistics, minimizing material waste during the conversion process, and predicting volatile raw material prices. Users are particularly concerned with how AI can enhance the precision of packaging design tailored for specific fragility requirements and how predictive maintenance can reduce downtime in high-volume corrugator operations. The core theme is leveraging AI to transition from reactive packaging management to proactive, data-driven optimization across design, production, inventory, and logistics, ultimately driving down costs and improving the sustainability footprint of the packaging industry. Users seek confirmation that AI integration will lead to smarter, more efficient, and more personalized packaging solutions, particularly in high-volume, low-margin manufacturing environments.

AI’s integration is expected to revolutionize corrugated packaging manufacturing by enabling predictive quality control and dynamic production scheduling. Machine learning algorithms analyze vast datasets, including material tensile strength, moisture levels, and machine parameters, to optimize the speed and settings of corrugator machines in real-time. This predictive capability significantly reduces material scrap, ensuring maximum utilization of raw paperboard and consistency in the finished product’s structural integrity. Furthermore, AI-powered visual inspection systems, using high-speed cameras and computer vision, automatically detect microscopic defects or print inconsistencies far quicker and more reliably than human inspectors, guaranteeing high-quality output necessary for high-graphics retail applications.

In the supply chain and design domain, AI tools are used for demand forecasting, which is critical for managing the highly variable nature of e-commerce packaging needs. By analyzing historical order data, seasonal trends, and external economic indicators, AI models provide highly accurate forecasts, allowing converters to optimize inventory levels of different board types and reduce lead times. Moreover, generative design algorithms can instantly assess millions of structural permutations to design the most material-efficient and protective box for a specific product and transportation method, minimizing void fill and reducing overall package dimensions, which translates directly to lower shipping costs and a reduced carbon footprint per shipped unit.

- AI-driven optimization of material utilization and scrap reduction in corrugator production.

- Predictive maintenance schedules for machinery, minimizing operational downtime and maximizing throughput efficiency.

- Enhanced demand forecasting, optimizing inventory management of raw materials (linerboard and fluting).

- Computer vision systems for real-time, high-speed quality control and defect detection during printing and cutting.

- Generative design tools creating structurally optimal and lightweight packaging specific to product fragility and logistical parameters.

- Improved route and load planning for packaging logistics, reducing transportation costs and emissions.

DRO & Impact Forces Of Corrugated Packaging Market

The corrugated packaging market is shaped by a confluence of accelerating drivers, structural restraints, and significant opportunities, with underlying impact forces defining competitive dynamics. The dominant driver is the unprecedented expansion of the e-commerce sector, which necessitates billions of sturdy, cost-effective shipping containers annually. Coupled with this is the powerful mandate for sustainable packaging, as corrugated solutions offer an unparalleled level of recyclability and renewable sourcing compared to plastic alternatives, aligning perfectly with global corporate environmental goals and regulatory pressures. Furthermore, continuous innovation in high-speed manufacturing technologies and digital printing is enhancing the versatility and cost-efficiency of corrugated boards, making them suitable for a wider range of high-value applications, including display packaging and branded secondary containers.

However, the industry faces critical restraints, primarily centered on the volatile pricing of virgin and recycled pulp, the key raw materials. Fluctuations in global pulp markets, driven by energy costs, environmental regulations affecting forestry, and international trade policies, introduce significant instability into manufacturing margins. Another structural challenge is the increasing regulatory scrutiny on food-contact materials and inks, requiring significant investment in compliance and specialized barrier coatings, which can sometimes increase production complexity and costs. Intense competition, particularly in generic brown box manufacturing, keeps price points depressed, requiring constant operational efficiency improvements to maintain profitability across the supply chain.

The foremost opportunities reside in emerging markets, specifically in Southeast Asia and Latin America, where organized retail and modern logistics infrastructure are rapidly developing, creating untapped demand for sophisticated packaging. Further opportunities lie in the commercialization of smart packaging solutions, integrating technologies such as RFID tags, NFC, and QR codes into corrugated structures to enhance supply chain visibility, authenticity tracking, and consumer interaction. The inherent material properties of corrugated packaging position the industry strongly to capitalize on the global shift away from single-use plastics in diverse sectors, requiring specialized, high-performance paper-based substitutes. The combined effect of these forces suggests a period of sustained, innovation-driven growth, heavily focused on optimizing sustainability and digital integration.

Segmentation Analysis

The Corrugated Packaging Market is comprehensively segmented based on the product type (reflecting structural complexity), the material used (linerboard quality and fluting type), and the primary end-use industry (determining functionality and scale of application). This structured segmentation provides a detailed framework for understanding market dynamics, allowing stakeholders to pinpoint specific areas of growth and technological necessity. Analyzing these segments reveals shifting consumer preferences, such as the increasing demand for lighter E-flute boards in retail applications versus the stable demand for heavy-duty double and triple-wall boxes crucial for industrial shipments and overseas logistics. The end-use segmentation highlights the market's dependence on the cyclical trends of major sectors, particularly e-commerce and food production, which command the largest share of packaging volume.

Segmentation by material is critical, as the quality and source (virgin or recycled fiber) of linerboard and medium directly influence the final product’s performance characteristics, including burst strength, edge crush resistance (ECT), and print surface quality. High-growth segments are currently driven by the increasing application of white-top linerboard and pre-print techniques, catering to the need for high-impact graphics required in shelf-ready and retail-display packaging. Simultaneously, the market for packaging made exclusively from recycled fiber continues to expand, driven by circular economy mandates and cost-efficiency, though this often requires specialized additives to maintain necessary strength standards.

The diversity within the end-use segments demonstrates the versatility of corrugated packaging. While Food & Beverages represents a stable, high-volume segment requiring stringent hygiene standards, the E-commerce segment exhibits the highest growth velocity, demanding tailored solutions for variable product sizes and complex returns logistics. Furthermore, the Electronics and Healthcare sectors require specialized packaging engineered to protect sensitive, high-value components from static electricity, shock, and moisture, pushing innovation in barrier coatings and internal fitments. Understanding these segmentation nuances is vital for converters to strategically allocate resources toward capacity expansion and product development initiatives that align with high-growth market demands.

- Type

- Single Wall

- Double Wall

- Triple Wall

- Material

- Linerboard (Kraft, Test/Recycled)

- Medium/Fluting

- Specialty Coatings and Inks

- End-Use Industry

- Food & Beverages (Perishables, Processed Food, Beverages)

- E-commerce (General Shipping, Subscription Boxes)

- Electrical & Electronics (Appliances, Components)

- Healthcare and Pharmaceuticals

- Personal Care and Cosmetics

- Others (Automotive, Building & Construction, Textiles)

Value Chain Analysis For Corrugated Packaging Market

The value chain for the Corrugated Packaging Market is vertically integrated, starting from the upstream procurement of raw materials, primarily wood pulp and recycled fiber. The upstream analysis focuses on pulp and paper manufacturers who produce linerboard and fluting medium. This segment is highly consolidated, with major players often owning vast forest lands and pulp mills, providing significant control over raw material quality and price stability. Supplier bargaining power is moderately high, particularly for virgin fiber, due to the capital-intensive nature of pulp production and the global commodity price dynamics. Converters strive to diversify sources, relying increasingly on recycled fiber to mitigate price volatility and meet sustainability objectives, which involves relationships with large-scale waste management and recovery operations.

The core of the value chain is the converting stage, where integrated and independent corrugated box manufacturers transform paperboard into final corrugated sheets and boxes through processes like fluting, laminating, printing, die-cutting, and gluing. This midstream segment is characterized by high operational complexity and relies heavily on advanced, automated machinery (corrugators). Efficiency in this stage dictates final cost and quality. Technology investments in high-speed, wide-format machinery and digital printing capabilities are crucial competitive differentiators. Vertical integration is common, with large players managing everything from pulp production to final box manufacturing, capturing margin across multiple stages.

Downstream analysis involves the distribution channels and the end-users. Distribution is multifaceted, involving both direct sales and indirect channels. Direct sales are predominant for large-volume customers, such as major CPG companies, automotive manufacturers, and large e-commerce fulfillment centers, often requiring customized just-in-time (JIT) delivery systems. Indirect channels include packaging distributors and brokers, who serve smaller businesses with standardized or lower-volume requirements. The end-user bargaining power is high, especially for major global clients who leverage their scale to negotiate favorable pricing and require stringent performance and sustainability metrics. The increasing adoption of retail-ready packaging (RRP) necessitates close collaboration between converters and retailers to optimize shelf presentation and logistics handling, making the service component of distribution increasingly vital.

Corrugated Packaging Market Potential Customers

Potential customers, or end-users, of the Corrugated Packaging Market represent a broad and diverse spectrum of the global economy, unified by the universal need for protective, logistical, and often branded secondary packaging. The single largest segment of buyers comprises the Fast-Moving Consumer Goods (FMCG) sector, encompassing food processors, beverage bottlers, and manufacturers of household essentials. These customers demand high-volume, standardized, and cost-efficient packaging that ensures product integrity through complex supply chains and must meet strict hygiene and regulatory compliance standards for direct and indirect food contact applications. The rapid turnover and scale of operations in FMCG make this a cornerstone segment for the corrugated market.

The most rapidly expanding customer base is the e-commerce and retail fulfillment industry, including global giants and smaller direct-to-consumer (D2C) brands. These buyers require specialized, variable-sized packaging that optimizes shipping space, minimizes void fill, and provides adequate protection against the rigors of parcel delivery networks. Customization is a key demand, with branding, unique opening experiences, and sustainability claims printed directly onto the box being essential features. E-commerce platforms seek partners capable of providing dynamic, scalable packaging solutions that integrate seamlessly with automated packing processes and offer robust resistance to handling damage.

Beyond consumer-facing sectors, the industrial and durable goods segments constitute significant customers, particularly in automotive, electrical components, and heavy machinery. These applications demand high-strength, often triple-wall corrugated board capable of bearing heavy loads and providing exceptional shock absorption during long-haul transportation. The pharmaceutical and healthcare industries also represent critical buyers, requiring precision-engineered corrugated solutions for temperature-sensitive shipments, medical device protection, and tamper-evident features, where packaging quality is directly linked to patient safety and regulatory adherence.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $205.5 Billion USD |

| Market Forecast in 2033 | $279.8 Billion USD |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | International Paper, WestRock, Smurfit Kappa, DS Smith, Packaging Corporation of America (PCA), Oji Holdings, Nine Dragons Paper, Shanying International, Mondi Group, BillerudKorsnäs, Stora Enso, Rengo Co., Ltd., Georgia-Pacific, KapStone Paper and Packaging, Sonoco Products, Pratt Industries, Progroup AG, Greif, Inc., SAICA, TRICOR Packaging & Logistics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrugated Packaging Market Key Technology Landscape

The technology landscape within the corrugated packaging market is evolving rapidly, driven by the dual needs for customization and operational efficiency. Digital printing technology represents one of the most significant advancements, allowing for high-quality, variable-data printing directly onto corrugated sheets without the need for traditional printing plates. This enables cost-effective production of short runs, personalized packaging, and retail-ready displays with high-impact graphics, meeting the growing demand from D2C e-commerce brands and marketing campaigns. Furthermore, digital printing significantly reduces lead times and setup costs compared to traditional flexography or lithography, providing unprecedented flexibility in inventory management and design iteration for converters.

Another crucial technological area is advanced automation and robotics integrated into the corrugator and converting lines. High-speed automation optimizes material handling, stacking, and palletizing, reducing labor costs and improving consistency. Modern corrugators utilize sophisticated monitoring systems, often incorporating IoT (Internet of Things) sensors and AI, to ensure precise control over flute height, adhesive application, and moisture levels, thereby maximizing board strength and minimizing waste. Robotics are increasingly used for complex tasks such as customized die-cutting and folding, ensuring precise dimensioning required for automated packaging systems used by major e-commerce fulfillment centers.

The emergence of smart packaging technologies is transforming corrugated board from a passive container into an active, connected tool. This includes integrating conductive inks, printed electronics, RFID, and near-field communication (NFC) tags directly into the box structure during the printing or converting phase. These technologies enable real-time tracking of packages, temperature monitoring for perishables, anti-counterfeiting measures, and interactive features that engage the consumer via smartphones. While still nascent in broad application, smart corrugated packaging offers immense opportunities to enhance supply chain visibility and secure high-value products, positioning it as a key competitive advantage in the coming decade.

Regional Highlights

Regional dynamics play a crucial role in shaping the global corrugated packaging landscape, influenced heavily by local economic growth rates, regulatory environments concerning sustainability, and the maturity of logistics and retail infrastructure. Each major region exhibits unique demand patterns, requiring manufacturers to tailor their production capabilities and product portfolios accordingly. The contrast is stark between the high-volume, cost-sensitive demands of developing economies and the high-value, quality-driven needs of established Western markets, leading to differentiated strategies for global companies regarding facility placement and technology investment.

The Asia Pacific (APAC) region stands out as the primary engine for global market expansion, driven by the massive consumer bases and rapid economic development in countries like China, India, and Southeast Asian nations. APAC’s growth is fueled by explosive manufacturing output, increasing disposable incomes boosting consumer packaged goods demand, and the exponential expansion of regional e-commerce giants. This region demands both standardized, cost-effective industrial packaging and increasingly sophisticated retail-ready and transit packaging as modern retail penetration deepens. Investment in new, high-speed corrugating machinery is concentrated here to meet escalating capacity needs.

North America and Europe represent mature, high-value markets defined by stringent environmental standards and a strong consumer focus on brand experience. In North America, the market is highly consolidated, with emphasis placed on innovation in lightweight materials, high-graphics printing, and efficient logistics solutions tailored for high-volume shipping associated with major retail and pharmaceutical clients. Europe is characterized by aggressive sustainability targets, driving intense demand for packaging with maximum recycled content, minimal material usage, and certifications proving responsible forestry, such as FSC. The shift towards circular economy models significantly influences product development and regulatory adherence across the European value chain.

- Asia Pacific (APAC): Highest growth region driven by robust manufacturing, burgeoning e-commerce penetration, and increasing urbanization, demanding large-scale capacity expansion. Key markets include China and India.

- North America: Mature market focused on digital printing, complex retail-ready packaging (RRP), and optimizing packaging for automated e-commerce fulfillment systems to reduce shipping costs.

- Europe: Defined by stringent environmental legislation (e.g., EU Packaging and Packaging Waste Regulation), leading the world in adopting high-recycled content, sustainable inks, and innovative lightweight designs.

- Latin America (LATAM): Exhibits accelerating growth due to developing modern retail channels and infrastructure investment, particularly in Brazil and Mexico, creating demand for both industrial and consumer packaging.

- Middle East and Africa (MEA): Growth driven by increased industrialization and diversification away from oil economies, leading to infrastructure projects and rising demand for packaged food and construction materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrugated Packaging Market.- International Paper

- WestRock

- Smurfit Kappa

- DS Smith

- Packaging Corporation of America (PCA)

- Oji Holdings Corporation

- Nine Dragons Paper (Holdings) Limited

- Shanying International Holdings Co., Ltd.

- Mondi Group

- BillerudKorsnäs AB

- Stora Enso Oyj

- Rengo Co., Ltd.

- Georgia-Pacific LLC

- KapStone Paper and Packaging Corporation (A WestRock Company)

- Sonoco Products Company

- Pratt Industries, Inc.

- Progroup AG

- Greif, Inc.

- SAICA (Sociedad Anónima Industrias Celulosa Aragonesa)

- TRICOR Packaging & Logistics AG

Frequently Asked Questions

Analyze common user questions about the Corrugated Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for sustainable corrugated packaging?

Demand is primarily driven by three key factors: stringent government regulations mandating higher recycling rates and reduced plastic use (especially in Europe), strong corporate sustainability commitments (ESG goals) requiring 100% recyclable or renewable packaging materials, and powerful consumer preference for eco-friendly, fiber-based options, particularly in the e-commerce sector. Corrugated material's high recyclability rate makes it the preferred solution.

How is the growth of e-commerce specifically impacting the corrugated packaging industry?

The e-commerce boom mandates vast volumes of high-performance, single-shipment boxes, significantly boosting market demand. This shift drives innovation toward lighter-weight board grades, variable-size packaging solutions (to reduce dimensional weight costs), and high-quality digital printing for enhanced branding and the "unboxing experience."

What are the primary raw material challenges faced by corrugated box manufacturers?

The primary challenge is the volatile pricing and supply chain instability of virgin and recycled fiber pulp. Global energy costs, logistics bottlenecks, and increasing regulatory constraints on timber harvesting or paper recovery rates contribute to price fluctuations, directly affecting the operational margins of corrugated converters globally.

What role does technology, such as digital printing, play in market transformation?

Digital printing is transformative because it enables cost-effective short runs, rapid prototyping, and personalized packaging without relying on traditional plate setup. This flexibility supports the proliferation of smaller brands and the customization needs of major retailers, allowing for dynamic, targeted marketing directly on the secondary packaging surface, thereby enhancing brand value and reducing time-to-market.

Which region currently offers the highest growth opportunities in the corrugated packaging sector?

The Asia Pacific (APAC) region offers the highest growth opportunities. This is due to rapid industrialization, massive consumption growth driven by rising middle-class disposable income, and the unparalleled expansion of organized retail and e-commerce infrastructure, particularly in emerging economies like India and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager