Corrugated Pallets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438089 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Corrugated Pallets Market Size

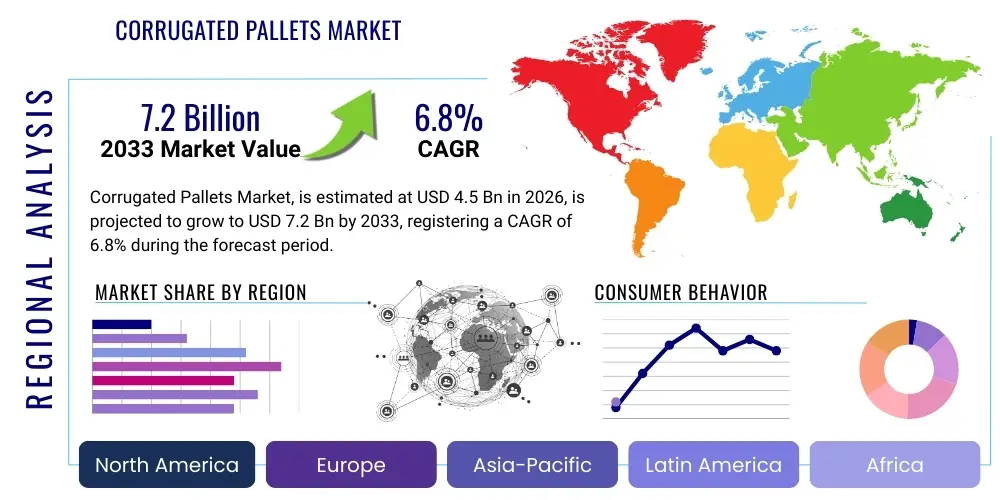

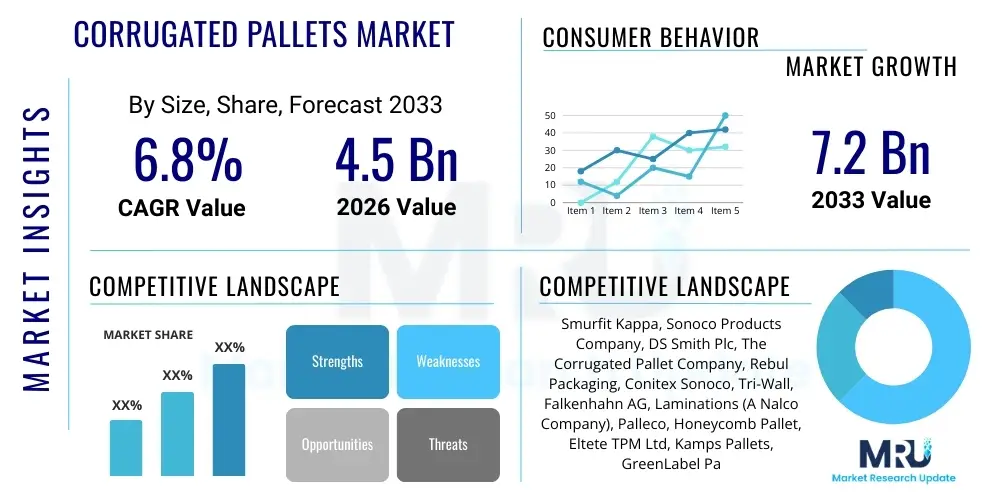

The Corrugated Pallets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Corrugated Pallets Market introduction

The Corrugated Pallets Market encompasses the manufacturing, distribution, and utilization of shipping platforms constructed primarily from high-strength corrugated cardboard or paperboard. These pallets are designed as lightweight, sustainable, and cost-effective alternatives to traditional wooden or plastic pallets, offering equivalent load-bearing capacity for numerous applications, particularly in closed-loop systems and air freight. The inherent material properties of corrugated paperboard, such as recyclability and low tare weight, align perfectly with increasing global regulatory pressures and corporate sustainability goals, positioning corrugated pallets as a critical component in modern, eco-conscious supply chain logistics. Their structure often incorporates features like specialized stacking feet and reinforced decking to ensure structural integrity during transit and storage.

Corrugated pallets serve a diverse range of major applications, predominantly centered on industries prioritizing hygiene, weight reduction, and reverse logistics efficiency. Key sectors driving demand include pharmaceuticals, food and beverages, consumer packaged goods (CPG), and electronics manufacturing. In the pharmaceutical sector, the sterile nature and absence of wood-related contamination risks make them highly desirable. For air freight operations, the significant weight savings compared to traditional materials directly translates into reduced fuel costs and increased cargo capacity, providing a strong economic incentive for adoption. Furthermore, the ease of disposal and lower risk of manual handling injuries contribute to their growing acceptance across automated warehousing environments.

The market growth is primarily driven by escalating global focus on environmental sustainability, necessitating the adoption of fully recyclable packaging and logistics materials. The shift towards optimizing global supply chains for speed and cost efficiency further fuels demand, as corrugated pallets mitigate the need for complex and expensive ISPM-15 treatment protocols required for international wood shipments. Additionally, continuous innovation in paperboard engineering, leading to pallets with enhanced moisture resistance and superior stacking strength, expands their viability into previously underserved heavy-duty applications, cementing their role as an indispensable element of future sustainable logistics infrastructure.

Corrugated Pallets Market Executive Summary

The global Corrugated Pallets Market exhibits robust growth, underpinned by significant macroeconomic trends favoring lightweight, recyclable logistics solutions. Key business trends indicate a strong move toward customization, where manufacturers leverage advanced folding and layering techniques to produce application-specific pallets tailored to precise load specifications and automation compatibility. Strategic partnerships between corrugated pallet producers and third-party logistics (3PL) providers are becoming standard, aiming to integrate sustainable pallet solutions directly into enterprise supply chain management systems, thereby streamlining adoption and disposal processes. Furthermore, the ongoing digitalization of supply chains encourages the use of materials like corrugated pallets that are easily integrated into track-and-trace systems, enhancing inventory visibility and accountability.

Regionally, the market is highly dynamic. North America and Europe represent mature markets characterized by stringent environmental regulations and high labor costs, making the adoption of lightweight, disposable, and easily handled corrugated solutions economically viable. The Asia Pacific (APAC) region, however, is emerging as the fastest-growing market segment, fueled by rapid industrialization, massive growth in e-commerce, and expanding manufacturing bases, particularly in China and India. These economies are increasingly adopting modern warehousing and logistics standards, moving away from conventional wood pallets due to concerns over availability, quality variability, and international shipping standards compliance. This rapid transition positions APAC as the primary engine for future market expansion.

Segment trends reveal a concentrated demand based on load-bearing capacity and application type. The light-to-medium-duty segment (up to 500 kg static load) continues to dominate due to high demand from the CPG and e-commerce fulfillment sectors, which require frequent, high-volume shipping of smaller, standardized loads. Material-wise, high-performance corrugated grades utilizing virgin fibers or advanced recycled content are gaining traction, providing the necessary strength while maintaining low material weight. The distribution channel analysis shows a strong reliance on direct sales to large manufacturing clients and specialized packaging distributors who can provide integration and consulting services related to sustainable logistics packaging.

AI Impact Analysis on Corrugated Pallets Market

User queries regarding the impact of Artificial Intelligence (AI) on the Corrugated Pallets Market frequently revolve around optimizing manufacturing efficiency, improving supply chain prediction, and enhancing structural design integrity. Common concerns include how AI can reduce material waste during production (cutting optimization), whether predictive algorithms can forecast demand spikes requiring specific pallet types, and the feasibility of using machine learning (ML) to analyze stress points in custom corrugated designs before physical prototyping. Users seek confirmation on AI's role in shifting pallet usage from traditional materials to corrugated options by proving superior cost-effectiveness and performance through data-driven simulations. The overarching expectation is that AI will accelerate the adoption of corrugated pallets by minimizing design risks and maximizing operational efficiencies within sophisticated logistics networks.

The initial impact of AI is most evident in the manufacturing process itself. AI-driven algorithms are being deployed to optimize the cutting and assembly of complex corrugated structures, minimizing material scrap rates and improving throughput. By analyzing variables such as sheet size, flute configuration, and required structural features, machine learning models can generate highly efficient nested layouts for die-cutting, resulting in significant cost savings for manufacturers. This precision allows for the production of geometrically complex and structurally sound pallets that were previously economically or technically challenging to mass-produce, thus broadening the range of applications where corrugated pallets can replace heavier alternatives.

Furthermore, AI is transformative in demand forecasting and inventory management within the pallet supply chain. By analyzing real-time data from end-user logistics systems, including seasonality, regional economic indicators, and specific product shipment volumes, AI models provide highly accurate predictions for corrugated pallet requirements. This allows manufacturers to implement just-in-time production schedules, reducing warehousing costs and mitigating supply bottlenecks. This predictive capability ensures that specialized corrugated pallets, which often require longer lead times than standard wood pallets, are available exactly when and where they are needed, enhancing supply chain reliability and facilitating the continued market penetration of corrugated solutions.

- AI-driven optimization of corrugated board cutting patterns reduces material waste by up to 15%.

- Machine learning algorithms simulate pallet performance under dynamic load conditions, accelerating structural design verification.

- Predictive maintenance analytics applied to converting machinery ensure high uptime for corrugated pallet manufacturing lines.

- AI enhances logistics planning by forecasting regional demand for specific pallet sizes, optimizing inventory placement.

- Automation integration, facilitated by AI vision systems, ensures corrugated pallets meet precise tolerance requirements for automated material handling equipment.

- Data analytics platforms utilize AI to compare total cost of ownership (TCO) of corrugated versus wood/plastic pallets, supporting conversion decisions.

DRO & Impact Forces Of Corrugated Pallets Market

The Corrugated Pallets Market dynamics are dictated by a balanced interplay of environmental mandates, economic efficiency, and inherent material limitations. The primary Drivers revolve around the global imperative for sustainable packaging solutions, the economic benefits of reduced air freight costs due to low pallet weight, and the elimination of complex phytosanitary regulations (ISPM-15). Restraints include the perception of lower durability compared to heavy-duty plastic or wood pallets, vulnerability to excessive moisture and humidity, and the higher unit cost relative to cheap, low-grade disposable wood pallets in certain developing regions. Opportunities are vast, focusing on innovative product development, such as water-resistant coatings and modular designs for heavy machinery transport, alongside rapid expansion into the booming e-commerce and pharmaceutical cold chain logistics sectors. These factors collectively exert significant Impact Forces on market evolution, driving manufacturers towards constant material science improvement and supply chain integration.

Key drivers creating momentum in the corrugated pallet sector include the stringent corporate sustainability commitments adopted by multinational corporations, which necessitate the replacement of traditional materials with fully recyclable alternatives. The pressure from consumers and regulators to reduce carbon footprint makes the lightweight and disposable nature of corrugated pallets highly attractive. Economic drivers are equally potent; the significant reduction in shipping weight, especially in costly air and long-haul transportation, provides substantial, quantifiable savings that justify the initial investment. Furthermore, the increasing global trade mandates, particularly concerning hygiene and contamination control in the food and medical supply chains, favor sterile, single-use corrugated options over reusable materials that require complex cleaning protocols.

However, the market faces crucial structural restraints. The foremost concern is the perceived and actual limitation of corrugated materials when subjected to high-humidity environments or prolonged exposure to precipitation, which compromises structural integrity. While advancements in coatings mitigate this risk, it remains a critical barrier in certain outdoor storage or unrefrigerated logistics scenarios. Another restraint is the capital intensity required for automated corrugated converting machinery, which restricts the entry of smaller producers. The Impact Forces resulting from these dynamics push the industry toward specialized solutions: focusing on high-value, closed-loop applications where durability concerns are minimal, and investing heavily in R&D for advanced moisture barrier technologies to overcome current material limitations and expand market penetration into more challenging logistics environments.

Segmentation Analysis

The Corrugated Pallets Market is meticulously segmented based on key functional attributes and application demands, allowing for targeted product development and marketing strategies. The primary segmentation centers on structure type, which dictates the manufacturing complexity and resultant load-bearing capacity; end-use industry, reflecting sector-specific regulatory and handling requirements; and material type, addressing sustainability goals and performance under varied conditions. This detailed segmentation aids stakeholders in understanding the nuanced requirements of diverse market niches, from light-duty retail display applications to robust logistics platforms used in manufacturing and distribution centers. The overall market trajectory is influenced heavily by the shifting dominance among these segments, with light-to-medium-duty applications showing the fastest growth due to the expansion of e-commerce fulfillment operations globally.

The segmentation by structure type, including block, stringer, and presswood composite structures, provides insights into manufacturing technology maturity and cost profiles. Block pallets, which utilize corrugated feet or blocks for four-way entry, generally command a premium due to superior handling flexibility. The End-Use segmentation is particularly critical, as sectors like Food & Beverage and Pharmaceuticals require materials that meet strict hygiene standards, directly benefiting corrugated options over wood. The geographic segmentation highlights regional variations in adoption rates, driven by differences in environmental policy, labor costs for manual handling, and the prevalence of automated material handling systems across various logistics hubs.

Further analysis of the segmentation by material, specifically between virgin kraft paper and high-quality recycled content, reflects a trade-off between ultimate strength and cost-effectiveness. While virgin fiber offers superior predictable performance for heavy loads, the sustainability mandate favors increasing utilization of high-grade recycled content, provided structural integrity is maintained through advanced engineering and adhesives. Understanding these segmental dynamics is essential for market players to prioritize investment in manufacturing capacity, focusing on high-growth segments like customizable, lightweight solutions tailored for automated storage and retrieval systems (AS/RS).

- By Type:

- Corrugated Block Pallets

- Corrugated Stringer Pallets

- Custom Hybrid Pallets (Corrugated Deck with Reinforced Feet)

- By End-Use Industry:

- Food and Beverage

- Pharmaceuticals and Healthcare

- Cosmetics and Personal Care

- Consumer Packaged Goods (CPG)

- Electronics and Electricals

- E-commerce and Retail Logistics

- Automotive and Industrial Manufacturing (Light Components)

- By Application/Load Capacity:

- Light Duty (Static Load up to 300 kg)

- Medium Duty (Static Load 301–700 kg)

- Heavy Duty (Static Load above 700 kg)

- By Material Grade:

- Virgin Fiber Corrugated Board

- Recycled Content Corrugated Board

Value Chain Analysis For Corrugated Pallets Market

The value chain for the Corrugated Pallets Market commences with the upstream sourcing and production of raw materials, primarily pulp and paperboard, which are capital-intensive operations reliant on sustainable forestry practices and large-scale paper mills. The critical phase involves the manufacturing of high-strength corrugated board using sophisticated corrugating machines, followed by conversion and fabrication, where sheets are cut, laminated, folded, and assembled into the final pallet structure. Efficiency at this stage relies heavily on minimizing material waste and optimizing adhesive usage. Downstream activities involve distribution, encompassing warehousing, logistics, and delivery to end-users, followed by the crucial reverse logistics cycle focused on maximizing the recovery and recycling rate of the used corrugated material, ensuring the sustainability loop is closed.

Upstream analysis highlights the sensitivity of the market to global pulp and paper prices, energy costs required for corrugation, and chemical inputs (adhesives and moisture barriers). Suppliers are consolidating to achieve economies of scale and control the quality of the linerboard and medium used, as performance specifications for pallets are much higher than those for standard shipping boxes. Key strategic dependencies exist on pulp suppliers capable of delivering high-quality, long-fiber virgin kraft paper necessary for superior structural integrity, especially in heavy-duty applications. Manufacturers are increasingly focused on vertical integration, acquiring or partnering with large paper mills to secure reliable material supply and cost stability, mitigating risks associated with commodity price volatility.

The downstream sector is characterized by both direct and indirect distribution channels. Direct sales dominate transactions with large, multinational CPG companies or 3PL providers that require high-volume, standardized orders and bespoke design services. These direct relationships often involve customized supply contracts covering design, quality assurance, and end-of-life recycling services. Indirect channels involve packaging distributors and wholesalers who service smaller businesses and varied geographical markets, offering a wider range of standard-sized corrugated pallets and acting as a bridge between specialized manufacturers and diverse industrial buyers. The success of the downstream operation is intrinsically linked to efficient logistics networks capable of handling the bulky nature of pallets, emphasizing regional manufacturing footprints to minimize transportation costs to end-user facilities.

Corrugated Pallets Market Potential Customers

The primary customer base for Corrugated Pallets consists of large-scale manufacturing and distribution operations that benefit significantly from weight reduction, hygiene, and sustainable material use in their logistics processes. End-users fall into distinct categories, including global pharmaceutical companies requiring sterile, certified packaging materials; major food and beverage producers focused on minimizing cross-contamination risks and optimizing transportation for sensitive goods; and electronics manufacturers who utilize lightweight pallets to protect high-value, fragile components during transit and reduce overall shipping costs, particularly for air freight. Additionally, the rapid expansion of e-commerce fulfillment centers represents a massive growth area, as these facilities prioritize speed, standardization, and easy, one-time disposal of packaging materials.

Specific buyer attributes often include companies with high international shipping volume, subjecting them to complex ISPM-15 regulations (which corrugated pallets bypass), or those utilizing automated storage and retrieval systems (AS/RS) where pallet dimension consistency and low tare weight are critical for system efficiency. These customers seek suppliers who offer not just the product, but a fully integrated solution, including design consultation to ensure the corrugated pallet meets specific static and dynamic load requirements, racking standards, and insurance criteria. The shift toward sustainable procurement policies across most Fortune 500 companies has further cemented these enterprises as core potential customers, as they actively seek verifiable reductions in packaging waste and carbon emissions traceable to logistics operations.

The market also sees significant traction among co-packers and third-party logistics (3PL) providers. 3PLs, acting as outsourced supply chain managers, often recommend or mandate the use of corrugated pallets to their clients to optimize overall operational cost, especially when managing complex multi-modal transportation or short-term warehousing requirements where managing wood pallet inventories and repairs is burdensome. For co-packers, the ease of handling and the integration of corrugated pallets into display-ready packaging designs offers a streamlined approach to retail preparation. Ultimately, the ideal customer is an organization prioritizing supply chain visibility, environmental stewardship, and quantifiable operational cost savings derived from lighter, easily handled, and fully recyclable unit loads.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smurfit Kappa, Sonoco Products Company, DS Smith Plc, The Corrugated Pallet Company, Rebul Packaging, Conitex Sonoco, Tri-Wall, Falkenhahn AG, Laminations (A Nalco Company), Palleco, Honeycomb Pallet, Eltete TPM Ltd, Kamps Pallets, GreenLabel Pallet, Twinplast, KraftPal Technologies, Ox Box Pallets, Australian Cardboard Pallets, Corrupal, The Alternative Pallet Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrugated Pallets Market Key Technology Landscape

The technological evolution of the Corrugated Pallets Market centers on three main pillars: enhancing structural integrity through advanced engineering, improving material performance via specialized coatings and treatments, and optimizing manufacturing efficiency using automation and digital design tools. Traditional corrugated structures have evolved significantly, moving beyond simple layering to incorporate high-density paper honeycomb core materials and structural adhesives that dramatically increase compression and shear strength without adding significant weight. This engineering focus allows corrugated pallets to perform comparably to their wooden counterparts in standardized logistics settings. The development of finite element analysis (FEA) software tailored for fiber-based materials is critical, allowing designers to virtually test load distribution and dynamic handling stress, reducing the need for expensive, time-consuming physical prototypes.

Material science is driving substantial changes, addressing the primary vulnerability of corrugated structures: susceptibility to moisture. Key technological advancements include the application of wax-free, water-resistant coatings and specialized laminates that provide effective moisture barriers without compromising recyclability. These barriers, often derived from sustainable biopolymers or advanced synthetic chemistries, allow corrugated pallets to maintain their structural integrity in humid environments or even short periods of exposure to direct moisture, thereby expanding their use into refrigerated and frozen logistics chains, which were previously dominated by plastic or treated wood. Furthermore, the development of specialized, high-performance structural adhesives ensures that the different components of the pallet (deck, feet, stringers) remain fused even under extreme stress and temperature variations.

Manufacturing technology has shifted towards high-speed, fully automated converting lines capable of precision cutting, scoring, and automated assembly of complex pallet designs. Robotics and advanced sensor technologies ensure millimeter accuracy, which is non-negotiable for integration with modern automated storage and retrieval systems (AS/RS) and automated guided vehicles (AGVs). The integration of digital printing and RFID tagging capabilities directly into the pallet manufacturing process further enhances supply chain visibility. This technological confluence—from superior material engineering and moisture protection to high-precision robotic assembly—is fundamentally transforming corrugated pallets from a simple packaging accessory into a sophisticated, high-performance logistics tool capable of competing across all major segments of the material handling market.

Regional Highlights

The global distribution and growth trajectory of the Corrugated Pallets Market reveal distinct regional characteristics driven by differing regulatory environments, logistics maturity, and economic growth patterns. North America, led by the United States, represents a significant and mature market characterized by large, centralized distribution centers and a strong emphasis on operational efficiency and worker safety. The adoption is driven primarily by multinational corporations seeking lightweight solutions for air freight and companies committed to ambitious corporate sustainability reporting. The region also benefits from advanced infrastructure supporting high-speed recycling programs, which enhances the appeal of disposable corrugated options.

Europe stands out due to its stringent environmental legislation, notably the high standards set by the EU's Packaging and Packaging Waste Directive. This regulatory environment acts as a powerful catalyst for the adoption of highly recyclable packaging materials like corrugated paperboard. Countries such as Germany, the UK, and the Netherlands lead the adoption curve, especially within the pharmaceutical and CPG sectors where closed-loop logistics systems are prevalent. Furthermore, the high cost of manual labor in many Western European nations makes the lightweight nature and easy handling of corrugated pallets economically beneficial, reducing injury risks and speeding up warehousing processes.

Asia Pacific (APAC) is currently the fastest-growing market globally. This exponential growth is fueled by massive expansion in manufacturing output, rapid urbanization, and an explosive rise in e-commerce activity, particularly in China, India, and Southeast Asia. As these regions modernize their logistics infrastructure, they often leapfrog older technologies, directly adopting advanced, sustainable solutions. The APAC region sees corrugated pallets as a solution to inconsistent quality and availability of locally sourced wooden pallets, providing a standardized, lightweight alternative essential for managing cross-border e-commerce logistics. Investment in new, high-capacity corrugated manufacturing plants across APAC is a major trend supporting this growth.

Latin America and the Middle East & Africa (MEA) represent emerging markets for corrugated pallets. In Latin America, economic volatility and logistics complexities necessitate cost-effective, adaptable solutions, driving interest in lightweight options for internal supply chains. The MEA region, particularly the Gulf Cooperation Council (GCC) states, is investing heavily in modern infrastructure and supply chain diversification, creating new opportunities. However, challenges related to high ambient temperatures and limited large-scale recycling infrastructure currently restrict more widespread adoption, although specialized applications in non-food manufacturing and pharmaceuticals are gaining traction.

- North America: Focus on air freight optimization, pharmaceutical logistics, and compliance with corporate zero-waste initiatives. High adoption in large-scale automated warehousing.

- Europe: Driven by strict EU environmental mandates and high labor costs; strong penetration in food, pharma, and retail sectors due to excellent recyclability.

- Asia Pacific (APAC): Highest growth rate due to booming e-commerce, industrialization, and modernization of fragmented logistics infrastructure; strong manufacturing base expansion.

- Latin America: Growing adoption driven by standardization requirements in multinational supply chains and improving regional recycling capabilities.

- Middle East & Africa (MEA): Niche adoption in high-value logistics (e.g., electronics, aviation components); limited by infrastructure maturity and climatic challenges requiring specialized moisture-resistant products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrugated Pallets Market.- Smurfit Kappa

- DS Smith Plc

- Sonoco Products Company

- Tri-Wall

- The Corrugated Pallet Company

- Rebul Packaging

- Conitex Sonoco

- Falkenhahn AG

- Laminations (A Nalco Company)

- Palleco

- Honeycomb Pallet

- Eltete TPM Ltd

- Kamps Pallets

- GreenLabel Pallet

- Twinplast

- KraftPal Technologies

- Ox Box Pallets

- Australian Cardboard Pallets

- Corrupal

- The Alternative Pallet Company

Frequently Asked Questions

Analyze common user questions about the Corrugated Pallets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of using corrugated pallets over traditional wood pallets?

The primary advantage is the significantly reduced tare weight (up to 80% lighter than wood), which dramatically lowers air and ground freight costs. Additionally, corrugated pallets are 100% recyclable, exempt from ISPM-15 phytosanitary regulations for international shipping, and reduce workplace injuries due to their lighter weight and lack of sharp edges or splinters.

Are corrugated pallets durable enough for heavy-duty warehousing and shipping applications?

Yes, modern corrugated pallets are engineered using high-strength fiberboard and advanced structural techniques (like honeycomb cores or hybrid designs) to handle static loads exceeding 1,500 kg. While they are typically preferred for closed-loop systems and single-use applications, they are increasingly viable for medium to heavy dynamic loads, particularly when incorporating specialized moisture barriers.

How does the sustainability factor influence the Corrugated Pallets Market growth?

Sustainability is a major driver, as corporations worldwide prioritize reducing their carbon footprint and achieving zero-waste goals. Corrugated pallets, being fully recyclable and made often from recycled content, directly support these objectives, offering a demonstrable advantage in corporate environmental, social, and governance (ESG) reporting compared to non-recyclable plastic or chemically treated wood alternatives.

What industries are leading the adoption of corrugated pallets globally?

The leading industries include Pharmaceuticals and Healthcare (due to hygiene requirements and air freight needs), Food and Beverage (for cross-contamination avoidance), and the E-commerce/CPG sector, which relies on lightweight, fast, and easily disposable packaging solutions to optimize fulfillment and last-mile logistics efficiency.

How do manufacturers mitigate the structural risks associated with moisture exposure in corrugated pallets?

Manufacturers utilize advanced material science solutions, including specialized wax-free, water-resistant coatings and laminated barriers applied during the conversion process. These treatments significantly enhance resistance to humidity and minor liquid exposure, extending the viability of corrugated pallets into challenging logistics environments such as cold chain and refrigerated storage facilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Corrugated Pallets Market Size Report By Type (Less than 3 Layers, 3-5 Layers, Others), By Application (FMCG and Food, Pharmaceutical Industry, Electronic and Automotive, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Corrugated Pallets Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Angle board, Corrugated sheet, Others), By Application (Logistics, Storage, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Pallet Boxes Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Reusable Corrugated Pallets Boxes, Plastic Boxes, Corrugated Pallets Sheets, Twin Sheets), By Application (Automotive, Agriculture & Allied Industries, Building & Construction, Chemical & Pharmaceutical, Food & Beverages, Engineering Products, Textile & Handicraft), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager