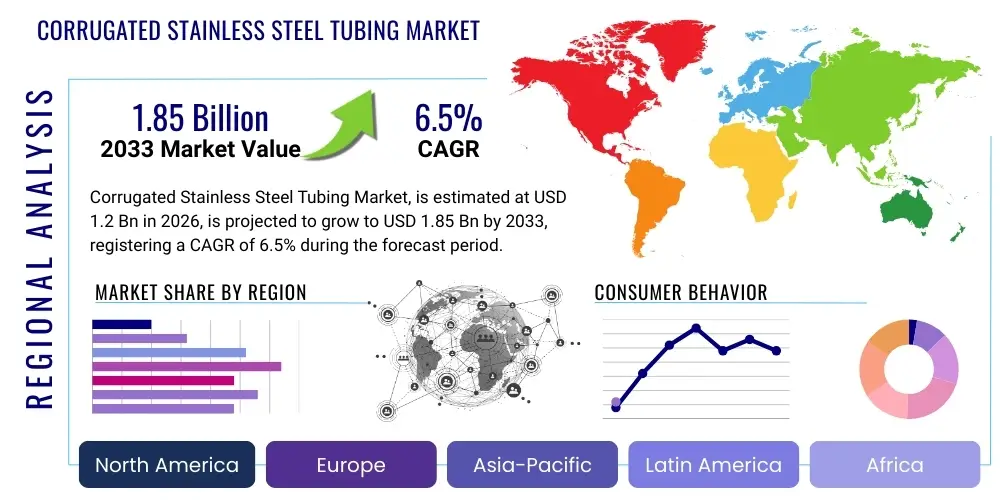

Corrugated Stainless Steel Tubing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436153 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Corrugated Stainless Steel Tubing Market Size

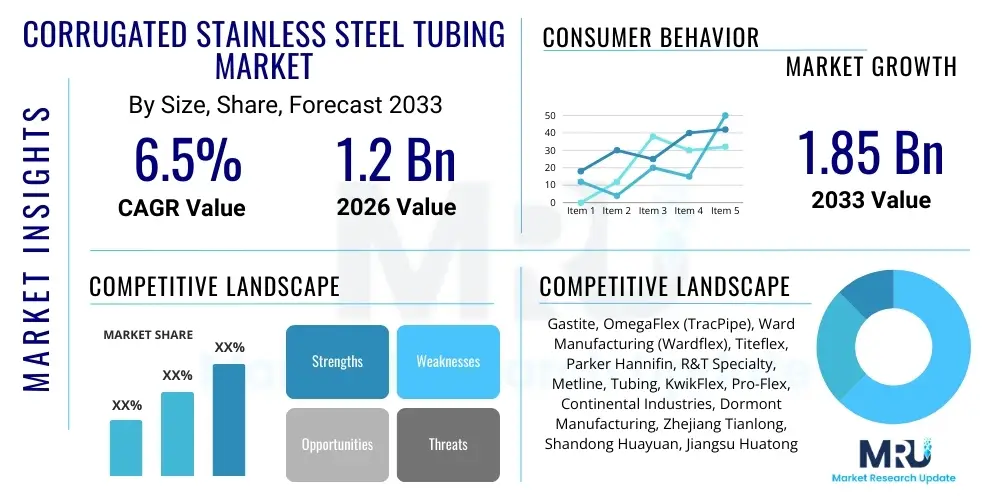

The Corrugated Stainless Steel Tubing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Corrugated Stainless Steel Tubing Market introduction

The Corrugated Stainless Steel Tubing (CSST) market encompasses the manufacturing, distribution, and installation of flexible, semi-rigid piping systems predominantly used for the conveyance of natural gas and propane, and increasingly for water and solar thermal applications. CSST is constructed from stainless steel that has been helically or annularly corrugated, allowing for significant flexibility and ease of installation compared to traditional rigid black iron pipe or copper tubing. This flexibility reduces the need for numerous joints and fittings, substantially lowering installation time and costs in residential, commercial, and industrial settings. The tubing is typically covered with a protective polymer jacketing, enhancing its durability and resistance to abrasion and environmental factors.

Corrugated Stainless Steel Tubing serves as a modern, efficient, and safer alternative in fluid and gas handling systems. Its primary application lies in the distribution of fuel gas within structures, connecting gas appliances such as furnaces, water heaters, and ranges to the main supply line. The major benefits driving market adoption include its superior resistance to seismic movement, high corrosion resistance inherent to stainless steel, and its significantly quicker installation process—often cutting labor time by 50% or more compared to conventional materials. Furthermore, the seamless nature of CSST minimizes potential leak points, contributing to enhanced system safety and reliability, a critical factor mandated by stringent building codes across developed economies.

The market growth is primarily propelled by the continuous expansion of infrastructure, particularly in the housing and commercial construction sectors globally, coupled with increasing regulatory acceptance of CSST as a safe and reliable gas conveyance system. Driving factors also include heightened awareness regarding seismic safety and the need for flexible infrastructure in earthquake-prone regions, alongside technological advancements in material science leading to improved jacketing and connection technologies. The product’s versatility has also opened opportunities in niche markets such as solar thermal heating systems, where its high temperature tolerance and corrosion resistance are highly valued assets.

Corrugated Stainless Steel Tubing Market Executive Summary

The Corrugated Stainless Steel Tubing (CSST) market is poised for robust expansion, driven by the persistent global emphasis on installation efficiency, system safety, and sustainable construction practices. Key business trends indicate a strong move toward product standardization and regulatory convergence, particularly in North America and Europe, which accelerates market penetration. Manufacturers are focusing on developing high-performance polymer coatings that improve resistance to mechanical damage and UV exposure, alongside innovative, tool-less fitting systems that further simplify field installation. Supply chain resilience, specifically managing the fluctuating costs of stainless steel raw materials, remains a critical operational challenge for industry stakeholders.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market segment, fueled by rapid urbanization, massive infrastructure projects, and increasing adoption of Western building standards, particularly in China and India. North America maintains market leadership, heavily influenced by strict safety regulations (e.g., required bonding and grounding to mitigate lightning strike risks) and the widespread acceptance by major utility providers and code bodies (like the International Code Council). European market growth is steady, largely supported by regulations promoting energy efficiency and the integration of CSST in solar thermal and high-efficiency HVAC systems. Segment trends show that the natural gas application segment retains the largest share, although the solar thermal and water conveyance segments are exhibiting the highest Compound Annual Growth Rate (CAGR), reflecting a broader application diversification strategy by market leaders.

Regarding segmentation, the residential end-user category remains the dominant revenue generator, reflecting the high volume of new housing starts and retrofit projects incorporating modern gas delivery systems. However, the commercial and industrial segments are growing rapidly due to the requirement for large-diameter CSST in expansive facilities, offering significant cost savings over traditional welded steel piping for long runs. Furthermore, technological improvements related to fitting integrity and long-term durability are mitigating previous concerns, fostering greater trust among professional engineers and architects, thereby accelerating adoption rates in high-specification commercial environments.

AI Impact Analysis on Corrugated Stainless Steel Tubing Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Corrugated Stainless Steel Tubing market primarily revolve around optimizing highly technical manufacturing processes, predicting volatile stainless steel raw material pricing, enhancing quality control for safety-critical components, and improving supply chain logistics. Common questions focus on how AI-driven predictive maintenance can reduce machine downtime in the corrugation and jacketing phases, and whether computer vision systems are being deployed for real-time defect detection in the thin-walled tubing and intricate fitting connections. Users also express interest in AI’s role in managing complex, global supply chains to ensure a stable supply of specialized stainless steel alloys and polymer resins while minimizing inventory holding costs.

AI's primary influence centers on operational excellence and material science advancement. By deploying machine learning models, manufacturers can predict ideal operational parameters for hydroforming and welding processes, leading to tighter tolerances and reduced scrap rates. Furthermore, AI analytics are crucial for integrating market demand signals with production schedules, optimizing batch sizes and minimizing lead times, thereby improving responsiveness to fluctuating construction timelines. In the domain of safety, AI algorithms can process vast amounts of sensor data collected during pressure testing and installation, identifying subtle patterns that indicate potential failure points, thus enhancing the overall safety profile of CSST systems and bolstering confidence among regulators and installers.

- AI-driven optimization of material cutting and corrugation processes, minimizing waste and ensuring precise specifications.

- Predictive maintenance analytics applied to manufacturing machinery, reducing unplanned downtime for high-speed tubing lines.

- Computer vision systems utilizing deep learning for real-time quality inspection of polymer jacketing integrity and weld seams.

- Machine learning models forecasting stainless steel (e.g., 304/316 grade) price volatility to optimize procurement strategies.

- AI enhancement of supply chain logistics, improving route planning and inventory management for global distribution networks.

- Analysis of field failure data to inform product design improvements and enhance long-term system reliability and safety standards.

DRO & Impact Forces Of Corrugated Stainless Steel Tubing Market

The market for Corrugated Stainless Steel Tubing is shaped by a dynamic interplay of propelling drivers, systemic constraints, and emerging opportunities, all magnified by significant external impact forces such as regulatory shifts and global construction cycles. The overarching driver is the inherent efficiency and safety advantage of CSST over traditional rigid piping, specifically the significant reduction in installation labor time and the enhanced resilience against seismic activity and differential structural settlement. Simultaneously, the market is restrained by the high initial material cost of stainless steel compared to alternative materials like PEX or standard copper, along with complex, often localized, regulatory requirements concerning grounding and bonding procedures necessary to mitigate risks associated with lightning strikes, which can occasionally lead to installer confusion or resistance in specific regions. The impact forces are predominantly centered on the cyclical nature of the global construction industry and increasing regulatory mandates for energy-efficient building standards, which indirectly favor CSST adoption in high-efficiency systems.

Key drivers stimulating demand include increasing global awareness of fire safety and gas leak prevention, especially in densely populated urban centers, alongside mandatory building code updates that recognize and promote the use of flexible piping systems. Furthermore, the operational simplicity of CSST—requiring fewer fittings and specialized tools—makes it highly attractive in fast-paced construction environments. Conversely, a major restraint is the lack of standardized global training and certification programs for CSST installation, occasionally resulting in improper installation practices that generate negative publicity and regulatory skepticism. Another constraint involves intense competition from established alternatives and the need for continuous public and professional education campaigns regarding the correct installation and safety protocols (such as adherence to ANSI LC 1/CSA 6.26 standards).

Opportunities for market expansion are abundant, particularly in diversifying CSST applications beyond gas delivery into residential and commercial potable water systems, radiant heating, and highly efficient solar thermal collector loops, where the material’s corrosion resistance and temperature tolerance offer superior performance. The emergence of smart home technologies and interconnected building management systems also presents an opportunity, as flexible, modular piping aligns well with dynamic infrastructure needs. Strategic investments in new product development, such as specialized CSST systems optimized for hydrogen fuel delivery (a nascent but promising market), will be critical for long-term growth. The primary impact forces affecting future trajectory will be environmental regulations pushing for sustainable materials and manufacturing processes, and the rate of adoption of standardized safety regulations across developing economies, directly influencing market acceptance and scaling potential.

Segmentation Analysis

The Corrugated Stainless Steel Tubing (CSST) market is comprehensively segmented based on material type, product diameter, key application, and end-user vertical to accurately reflect market dynamics and consumer behavior across different regions. Segmentation by material grade typically distinguishes between 304 and 316 stainless steel, reflecting varying levels of corrosion resistance suitable for different environments and fluid types. Diameter segmentation is crucial as it dictates flow capacity and application suitability, ranging from small residential lines (e.g., 1/2 inch) to large commercial or industrial runs (e.g., 2 inches or more). The primary functional segmentation revolves around the conveyed medium, notably natural gas, propane, potable water, and solar thermal fluids, with natural gas consistently holding the largest market share globally due to regulatory acceptance and widespread residential use.

Furthermore, end-user segmentation provides critical insights into demand patterns, distinguishing between Residential, Commercial, and Industrial sectors. The Residential segment accounts for the bulk of unit volume, driven by the continuous replacement of rigid piping in existing homes and its installation in new construction projects seeking rapid build times. The Commercial sector, including office buildings, retail spaces, and hospitals, requires larger diameters and specialized fittings, driving higher revenue per project. Geographic segmentation remains essential, highlighting distinct regulatory environments and adoption maturity in regions like North America (mature, high adoption), Europe (stable growth, strong in solar thermal), and Asia Pacific (rapid emergence, infrastructure investment).

- By Material Grade:

- Stainless Steel 304 (Most common for standard gas lines)

- Stainless Steel 316 (Used for high-corrosion environments or aggressive fluids)

- By Diameter Size:

- Up to 1 Inch (Primarily Residential and small Commercial)

- 1 Inch to 2 Inches (Commercial and Light Industrial)

- Above 2 Inches (Heavy Industrial and Utility Distribution)

- By Application:

- Natural Gas and Propane Distribution (Fuel Gas)

- Potable Water Systems (Piping)

- Solar Thermal Systems (Collector Loops)

- Hydronic Heating and Cooling

- By End-User:

- Residential (Single-family homes, Multi-family dwellings)

- Commercial (Hotels, Offices, Retail Centers, Schools)

- Industrial (Manufacturing facilities, Refineries, Processing plants)

- By Coating Type:

- Polyethylene (PE) Jacketing

- Fire-Resistant Jacketing (FR-CSST)

Value Chain Analysis For Corrugated Stainless Steel Tubing Market

The value chain for the Corrugated Stainless Steel Tubing market begins with the upstream procurement of high-grade stainless steel coils (primarily 300 series) and specialized polymer resins used for the protective jacketing. This stage is characterized by high capital intensity and susceptibility to global commodity price fluctuations. Key activities involve strategic sourcing and material specification, ensuring compliance with strict mechanical and chemical standards required for safety-critical piping. Manufacturers then transform these raw materials through complex, high-precision processes including forming, welding, corrugation (using hydroforming or mechanical methods), annealing, and the final application of the protective polyethylene or fire-resistant coating. Efficiency gains at this manufacturing stage, often involving proprietary tooling and high-speed production lines, are critical for maintaining competitive pricing and product quality.

The midstream involves the distribution and logistics network, which is pivotal given the bulky nature of the coiled tubing. Distribution channels are typically a mix of direct sales to large utility companies or major commercial developers, and indirect sales through specialized industrial distributors, wholesale plumbing supply houses, and large-scale retail home improvement centers. Efficient warehousing and rapid delivery capabilities are essential to meet the immediate demands of construction sites. Training and certification of installers—often facilitated by the manufacturers or their primary distributors—form an integral part of this stage, ensuring compliance and system safety, thereby directly impacting brand reputation and liability.

The downstream segment focuses on the installation and integration of CSST systems into the final application—residential, commercial, or industrial buildings. End-users or buyers include general contractors, specialized HVAC and plumbing contractors, and large-scale developers. After installation, the system undergoes rigorous testing and inspection mandated by local building codes. The indirect value chain also involves regulators, code officials, and insurance providers, whose acceptance and mandates significantly influence market pull. The trend toward proprietary, labor-saving fittings drives downstream revenue, as installers prefer systems that offer speed and reliability, even if they represent a premium cost. Maintenance requirements are minimal, contributing to a high lifecycle value proposition for the end-user.

Corrugated Stainless Steel Tubing Market Potential Customers

The primary consumers and buyers in the Corrugated Stainless Steel Tubing market are specialized trade professionals and large-scale organizations involved in construction, infrastructure development, and utility management. These potential customers seek products that offer certified safety, labor efficiency, and long-term reliability. The largest segment of customers comprises residential plumbing and HVAC contractors who utilize CSST daily for connecting natural gas and propane appliances in both new construction and retrofit projects. These professionals value the product's flexibility, which drastically reduces the number of required joints and the time spent measuring and cutting rigid pipe, translating directly into enhanced profitability per job.

Another significant customer base includes large residential and commercial developers and general contractors. These entities often procure CSST in bulk for multi-unit housing complexes, hotels, and office buildings where standardized, rapid installation across numerous units yields substantial time and cost savings. Utility companies, particularly those involved in gas transmission and distribution, represent institutional buyers that may specify CSST for final connections or localized network upgrades, prioritizing strict adherence to safety standards and resilience against environmental factors. Finally, specialized contractors focused on solar thermal installations constitute a growing niche, seeking CSST for its ability to withstand the high temperatures and corrosive glycol mixtures typical of these energy systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gastite, OmegaFlex (TracPipe), Ward Manufacturing (Wardflex), Titeflex, Parker Hannifin, R&T Specialty, Metline, Tubing, KwikFlex, Pro-Flex, Continental Industries, Dormont Manufacturing, Zhejiang Tianlong, Shandong Huayuan, Jiangsu Huatong |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrugated Stainless Steel Tubing Market Key Technology Landscape

The technological landscape of the Corrugated Stainless Steel Tubing market is continuously evolving, focusing primarily on enhancing product safety, installation speed, and long-term durability. A foundational technology is the precision manufacturing process, specifically hydroforming or roll-forming techniques used to create uniform corrugations in thin-walled stainless steel strips. This corrugation is crucial for flexibility and maintaining flow integrity. Advances in welding technology, such as automated laser or plasma welding, ensure the longitudinal seam is highly durable and leak-proof, meeting rigorous pressure test standards. The selection and application of the outer protective jacketing, traditionally polyethylene, is also a key technological area, with increasing adoption of fire-resistant (FR) and UV-stabilized materials to meet stringent fire codes and exterior installation requirements, representing a significant safety innovation.

Fittings technology represents one of the most competitive and dynamic segments within the market's technological landscape. Traditional fittings required specific tools and precise torquing, but the industry has shifted significantly toward proprietary, self-flaring, and tool-less mechanical fittings. These new designs simplify the connection process, drastically reduce the potential for installation errors, and provide superior sealing integrity, often verified by visual indicators or audible clicks. The focus on fittings innovation is directly linked to AEO principles, addressing user pain points related to installation complexity and reliability concerns. Advanced materials testing technologies, including non-destructive testing (NDT) methods like eddy current and ultrasonic testing, are now routinely integrated into production lines to ensure zero-defect output for this safety-critical product.

Beyond core manufacturing, emerging technologies are focused on corrosion mitigation and system integration. Enhanced polymer formulations offer superior resistance to chemicals and environmental stress cracking, extending the product’s lifecycle, especially in harsh conditions or when buried underground. Furthermore, there is growing technological development concerning the integration of CSST systems with smart building control platforms. This involves embedding sensors or compatibility features that allow for remote monitoring of gas pressure, leak detection, and system status, supporting the shift towards predictive maintenance and enhancing overall safety management in commercial and industrial applications. Future technology roadmaps include research into flexible metal alloys that offer enhanced material properties while maintaining cost competitiveness against rigid pipe alternatives.

Regional Highlights

Regional dynamics significantly influence the Corrugated Stainless Steel Tubing market, driven by varying building codes, climate conditions, and construction activity levels. North America (NA) represents the most established and largest market segment. Adoption rates are exceptionally high in the United States and Canada, primarily driven by regulatory acceptance (enforcement of ANSI LC 1/CSA 6.26 standards) and the product’s recognized seismic resistance capabilities. The prevalence of natural gas heating in residential properties, combined with highly efficient installation practices favored by union and non-union contractors alike, ensures steady demand. However, NA also sees intense scrutiny regarding proper electrical bonding and grounding procedures to prevent tubing damage from lightning, leading to ongoing education and product specialization (such as protective jacketings with enhanced dielectric strength).

Europe demonstrates stable growth, with market penetration driven more by energy efficiency mandates and the adoption of renewable energy technologies. CSST is extensively utilized in modern condensing boiler installations and, critically, dominates the solar thermal collector market due to its ability to handle high temperatures and inhibit corrosion when transporting thermal transfer fluids. Countries like Germany, France, and the UK have mature building standards that favor high-quality, durable materials. The European market tends to prioritize sustainable sourcing and advanced polymer jacketing that meets strict low-smoke, zero-halogen (LSZH) requirements in certain commercial applications, reflecting a focus on advanced building material specifications and environmental compliance.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period. This rapid expansion is attributable to massive government investment in urban infrastructure, a surge in residential and commercial construction in rapidly developing economies like China, India, and Southeast Asia, and the increasing convergence toward international safety standards. As these nations modernize their gas and utility distribution networks, CSST offers a compelling combination of speed, cost-effectiveness, and reliability compared to outdated conventional piping methods. The region’s vulnerability to seismic activity (e.g., Japan, Indonesia) further fuels the demand for flexible piping systems. Conversely, market growth in Latin America and the Middle East & Africa (MEA) is more nascent, dependent largely on volatile commodity prices and the pace of regulatory adoption and enforcement concerning gas safety standards.

- North America (US & Canada): Market leader, high regulatory compliance, strong adoption in residential natural gas lines, emphasis on lightning strike protection (bonding/grounding).

- Europe (Germany, UK, France): Stable growth, significant use in solar thermal and high-efficiency hydronic systems, driven by energy performance directives and demand for specialized fire-resistant coatings.

- Asia Pacific (China, India, Japan): Highest growth trajectory, driven by rapid urbanization, infrastructure modernization, and increased focus on seismic resilience.

- Latin America: Emerging market, growth tied to infrastructure spending, increasing awareness of construction efficiency benefits, but hindered by fluctuating regulatory environment.

- Middle East and Africa (MEA): Growth concentrated in commercial energy projects and new smart city developments, requiring durable materials resistant to extreme temperatures and corrosive environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrugated Stainless Steel Tubing Market.- OmegaFlex (TracPipe)

- Gastite (Division of Titeflex Commercial)

- Ward Manufacturing (Wardflex)

- Titeflex Corporation

- Parker Hannifin Corporation

- Dormont Manufacturing Company

- Continental Industries, Inc.

- Pro-Flex, LLC

- KwikFlex

- Metline Industries

- Zhejiang Tianlong Copper Tube Co., Ltd.

- Shandong Huayuan Pipeline Co., Ltd.

- Jiangsu Huatong Wire & Cable Co., Ltd.

- R&T Specialty, Inc.

- TUBING S.A.

Frequently Asked Questions

Analyze common user questions about the Corrugated Stainless Steel Tubing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary safety considerations for installing Corrugated Stainless Steel Tubing (CSST)?

The most critical safety consideration is proper electrical bonding and grounding, mandatory in most jurisdictions (especially North America) to mitigate the risks of tube damage or gas leaks resulting from lightning strikes or electrical surges, ensuring compliance with ANSI LC 1/CSA 6.26 standards.

How does the installation cost of CSST compare to traditional black iron pipe?

While the initial material cost of CSST per linear foot may be higher, the overall installed cost is generally lower than black iron pipe due to the significant reduction in labor time and the need for fewer costly fittings, often resulting in installation time savings of 50% or more.

Which applications beyond natural gas offer the highest growth potential for CSST?

The solar thermal application segment is exhibiting high growth potential, utilizing CSST for flexible collector loops due to its superior high-temperature tolerance and inherent corrosion resistance against glycol-based heat transfer fluids, alongside increasing adoption in potable water systems.

What is the regulatory outlook for CSST in emerging markets like Asia Pacific?

The regulatory outlook in APAC is highly positive, driven by urbanization and the rapid adoption of international building standards. As countries modernize infrastructure, CSST is favored for its seismic resilience and rapid deployment capabilities, leading to accelerating regulatory acceptance across major construction hubs.

What are the key differences between CSST and conventional corrugated flexible metal tubing?

CSST is specifically engineered and certified (e.g., ANSI/CSA) for building gas distribution systems, featuring specialized protective polymer jacketing and proprietary safety-tested fittings designed for gas tightness, distinguishing it from general-purpose corrugated flexible metal tubing used for ventilation or low-pressure applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager