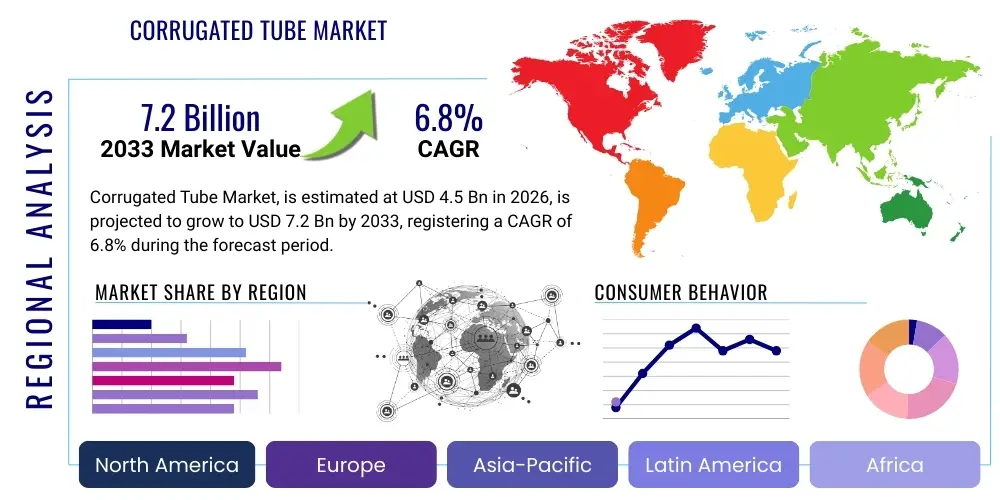

Corrugated Tube Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434625 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Corrugated Tube Market Size

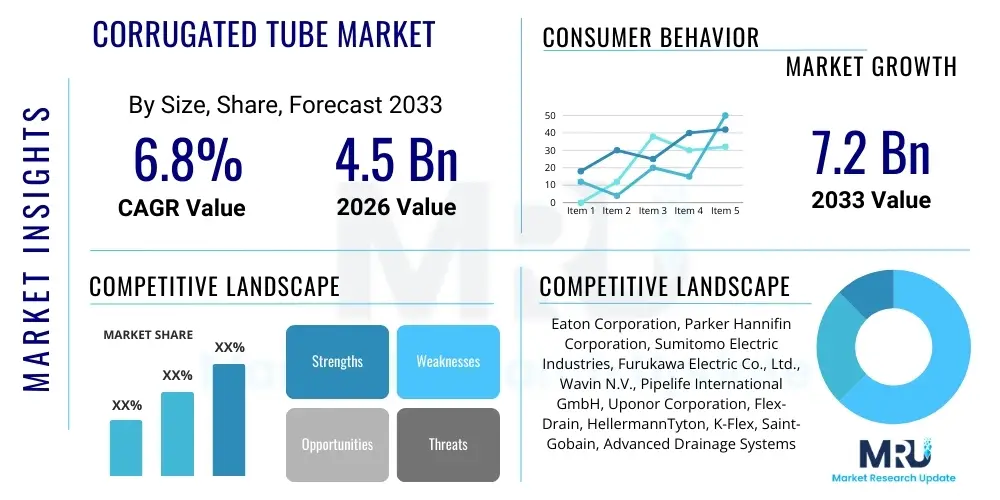

The Corrugated Tube Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Corrugated Tube Market introduction

Corrugated tubes, characterized by their helical or parallel convolutions, are essential components designed to provide superior flexibility, protection, and insulation across numerous demanding industrial applications. These tubes are primarily used for managing, routing, and shielding cables, wires, and fluids against physical abrasion, moisture, extreme temperatures, and chemical exposure. Key applications span the automotive sector, particularly for engine harnesses and chassis wiring; the construction industry for drainage and conduit systems; and the electrical and telecommunications fields for robust cable protection. The primary benefit of using corrugated tubes lies in their excellent flexibility combined with high compressive strength, making installation simpler and improving the longevity and reliability of protected systems. The market is fundamentally driven by the escalating demand for advanced wiring harness protection in electric vehicles (EVs) and the global infrastructure push, especially in emerging economies where construction activities are booming, necessitating durable and efficient fluid and cable management solutions.

Corrugated Tube Market Executive Summary

The Corrugated Tube Market is currently characterized by strong business trends centered around material innovation, specifically the increasing adoption of bio-based and recycled polymers to meet stringent environmental regulations and corporate sustainability goals. Technological advancements focus on developing highly flame-retardant and high-temperature resistant materials suitable for challenging environments like aerospace and high-performance automotive systems. Regionally, the Asia Pacific (APAC) dominates the market due to rapid industrialization, large-scale infrastructure projects, and the establishment of global manufacturing hubs, especially in China and India. North America and Europe show steady growth, driven by stringent safety standards and the high penetration of electric vehicle manufacturing. Segment trends indicate a significant preference for plastic corrugated tubes (polyethylene, polypropylene, PA/Nylon) due to their light weight and cost-effectiveness, while the automotive and construction segments remain the largest application areas, continually demanding specialized tubes for vibration damping and structural integrity in critical systems.

AI Impact Analysis on Corrugated Tube Market

Users frequently inquire how Artificial Intelligence (AI) and machine learning (ML) technologies are transforming traditional tube manufacturing and application processes. Common questions center on the feasibility of integrating predictive maintenance in tube-based systems, optimizing complex production lines for bespoke tube designs, and using AI for real-time quality assurance of corrugated profiles. Based on these concerns, key themes emerging are the expectation that AI will dramatically reduce material waste and energy consumption in extrusion processes through dynamic parameter adjustments. Furthermore, there is significant interest in how AI can enhance the supply chain by predicting demand fluctuations across diverse end-use sectors, ensuring faster delivery of specialized tube specifications required by modern modular construction or advanced automotive platforms. Users anticipate that AI-driven inspection systems will replace manual quality checks, leading to tubes with significantly fewer defects and higher compliance with strict regulatory standards.

The implementation of AI algorithms in the Corrugated Tube Market is transitioning from theoretical application to practical deployment, primarily impacting manufacturing efficiency and product lifecycle management. AI is crucial for optimizing the complex geometries of corrugated profiles, where minute changes in extrusion temperature, speed, or pressure can drastically affect flexibility and durability. By employing machine learning models, manufacturers can analyze vast datasets from production lines to identify optimal operating parameters, thus minimizing setup time and reducing scrap material. This optimization capability is particularly valuable for producing high-specification tubes used in demanding sectors such as aerospace and medical devices, where material integrity and dimensional accuracy are paramount.

Beyond the factory floor, AI profoundly influences the downstream application and maintenance phases. Predictive maintenance models, leveraging sensor data collected from systems protected by corrugated tubes (e.g., fluid transport in heavy machinery or wiring harnesses in industrial robotics), can detect early signs of material fatigue or abrasion failure. This capability allows end-users to schedule replacements proactively, preventing catastrophic failures and minimizing operational downtime. For original equipment manufacturers (OEMs), AI facilitates the design of next-generation tubes by simulating performance under various stress conditions, accelerating the development of highly specialized, application-specific protection solutions that meet evolving industry standards, particularly those related to electromagnetic compatibility (EMC) and fire safety.

- AI-driven Predictive Maintenance: Enhancing tube lifespan analysis and preventing failure in critical infrastructure.

- Manufacturing Optimization: Machine learning algorithms refine extrusion parameters, reducing waste and energy consumption.

- Automated Quality Control: AI vision systems detect minute surface defects and dimensional inconsistencies in real-time.

- Supply Chain Forecasting: ML models accurately predict regional demand for specific tube materials and sizes, improving inventory management.

- Material Innovation Simulation: AI accelerates the development of new high-performance polymer blends for extreme conditions.

DRO & Impact Forces Of Corrugated Tube Market

The market dynamics are defined by robust drivers, structural restraints, and significant opportunities, which collectively determine the market's growth trajectory and resilience. Primary drivers include the global expansion of the automotive industry, particularly the transition to Electric Vehicles (EVs) which require extensive and robust wiring protection, and massive government investment in infrastructure development, including smart cities and specialized drainage systems. Restraints often revolve around the volatility of raw material prices, specifically petrochemical-derived polymers, and the increasing stringency of regulatory standards regarding material fire safety and chemical leaching, necessitating costly R&D. Opportunities are significant in emerging markets for specialized materials such as PEEK and PTFE corrugated tubes for high-performance applications, and the growing demand for tubes made from sustainable and recyclable materials. These forces create a compelling environment where innovation in material science and efficient production techniques are essential for competitive advantage.

The key driving forces include technological advancements in extrusion machinery, allowing manufacturers to produce tubes with superior wall uniformity and specific material characteristics, such as enhanced flexibility or abrasion resistance, at higher speeds. Furthermore, the proliferation of data centers and telecommunication networks globally necessitates reliable cable management solutions, boosting demand for large-diameter corrugated tubes and related accessories. However, the market faces notable structural challenges. One significant restraint is the commoditization pressure in standard polyethylene (PE) and polypropylene (PP) tubes, leading to intense price competition among regional players. Additionally, the lack of standardized global regulations concerning recycled plastic content and end-of-life disposal creates complexity for international manufacturers attempting to harmonize production lines.

Opportunities for high-growth are abundant, particularly within the medical device and aerospace sectors, which demand extremely high-purity, lightweight, and custom-engineered corrugated solutions capable of withstanding sterilization processes or extreme temperature fluctuations. The burgeoning trend towards automation and robotics in manufacturing worldwide further opens avenues for specialized corrugated conduits that can withstand continuous flexing and high mechanical stress. The critical impact forces influencing market share include the ability of companies to secure long-term contracts with major automotive OEMs and large infrastructure developers, and the capacity to efficiently scale sustainable production practices to meet green procurement policies mandated by large corporations and governmental agencies.

Segmentation Analysis

The Corrugated Tube Market is meticulously segmented based on material composition, diameter specifications, and distinct application areas, providing a clear framework for market analysis and strategic decision-making. Material segmentation, covering plastics (PE, PP, PA/Nylon, PVC, PTFE) and metals (Stainless Steel, Galvanized Steel), reflects the fundamental trade-offs between cost, flexibility, temperature tolerance, and chemical resistance required for diverse end-use environments. Diameter segmentation (Small, Medium, Large) directly correlates with the scale and type of protection required, ranging from fine wiring in electronics to massive drainage systems in civil engineering. The application segmentation, which includes Automotive, Construction, Electrical & Telecommunication, and Industrial Machinery, highlights the primary demand centers and the specialized functional requirements that drive product innovation within each vertical.

- By Material:

- Plastic Corrugated Tubes (Polyethylene, Polypropylene, Polyamide/Nylon, PTFE, PVC)

- Metal Corrugated Tubes (Stainless Steel, Galvanized Steel, Aluminum)

- By Diameter:

- Small Diameter (Under 10 mm)

- Medium Diameter (10 mm to 50 mm)

- Large Diameter (Over 50 mm)

- By Application:

- Automotive (Wiring Harness Protection, Fluid Transfer)

- Construction (Drainage, Conduit, HVAC)

- Electrical & Telecommunication (Cable Management, Data Centers)

- Industrial Machinery & Equipment (Robotics, Hydraulics)

- Aerospace & Defense

- Medical Devices

- By Flexibility Type:

- Flexible Corrugated Tubes

- Semi-Rigid Corrugated Tubes

Value Chain Analysis For Corrugated Tube Market

The value chain for the Corrugated Tube Market begins with upstream activities, predominantly involving raw material suppliers who provide specialized polymers, resins, and metal alloys. The quality and stable pricing of these inputs, particularly engineering plastics like Nylon 6 and PTFE, directly influence the final product's cost structure and performance characteristics. The core manufacturing process involves highly specialized extrusion and molding technologies to create the corrugated profile, where energy efficiency and precision engineering are key differentiators. Downstream activities involve distribution, which is bifurcated into direct channels (selling directly to large automotive OEMs or major construction firms) and indirect channels (utilizing wholesalers, distributors, and retailers). The efficiency of this distribution network is crucial, especially for the fragmented maintenance, repair, and overhaul (MRO) market, where product availability and quick fulfillment are paramount. Strategic partnerships between manufacturers and large-scale industrial distributors are essential for comprehensive regional market penetration and maximizing profit margins across diverse application sectors.

Corrugated Tube Market Potential Customers

The primary consumers and end-users of corrugated tubes span various heavy industries where protection, insulation, and flexible conveyance are critical operational necessities. In the automotive sector, major car manufacturers (OEMs) and Tier 1 suppliers are significant buyers, utilizing specialized tubes for engine compartment wiring harnesses, fuel lines, and brake system protection. The construction industry forms another massive customer base, where civil engineering firms and specialized contractors procure large-diameter tubes for foundation drainage, sewer systems, and electrical conduits within commercial and residential structures. Furthermore, industrial equipment manufacturers, particularly those in robotics and automated production lines, rely on highly flexible and durable corrugated tubes to protect signal and power cables subjected to continuous movement and mechanical stress. The growing utility and infrastructure sectors, including power generation and telecommunications companies, purchase fire-retardant and robust tubes for complex cable routing and long-term asset protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Eaton Corporation, Parker Hannifin Corporation, Sumitomo Electric Industries, Furukawa Electric Co., Ltd., Wavin N.V., Pipelife International GmbH, Uponor Corporation, Flex-Drain, HellermannTyton, K-Flex, Saint-Gobain, Advanced Drainage Systems (ADS), Polyhose, Fraenkische Industrial Pipes, Atkore International Group Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Corrugated Tube Market Key Technology Landscape

The manufacturing technology landscape for corrugated tubes is dominated by specialized extrusion and blow molding techniques designed to create the characteristic convoluted profile while maintaining precise wall thickness and material integrity. The primary technology utilized is continuous extrusion, often involving a corrugator block system where the extruded molten polymer or metal strip is formed by rapidly moving mold blocks. Recent advancements focus heavily on co-extrusion technologies, which allow for the creation of multi-layered corrugated tubes (e.g., combining a highly resistant outer layer with a specialized inner layer), optimizing properties such as chemical resistance and flexibility simultaneously. Furthermore, in the realm of metal corrugated tubes, hydroforming and mechanical forming processes are critical for achieving high-pressure resistance and superior cyclic durability, particularly required for expansion joints and fluid transfer systems in demanding industrial processes.

A key technological focus driving market evolution is the development of next-generation manufacturing systems integrated with Industry 4.0 principles. This includes the use of highly sophisticated sensors for real-time monitoring of temperature and pressure throughout the extrusion process, facilitating proactive adjustments to minimize dimensional variability. High-speed laser cutting and welding technologies are also being integrated for efficient post-processing and customized length cutting, crucial for just-in-time delivery to large OEM clients. The material science aspect involves leveraging nanotechnology and compounding techniques to enhance existing polymers, introducing specific functional features such as antimicrobial properties for medical applications or superior electromagnetic interference (EMI) shielding capabilities for sensitive electronic equipment.

The shift towards Electric Vehicles (EVs) has spurred significant investment in materials and technology capable of handling extremely high temperatures and providing superior flame retardancy (meeting standards like UL 94 V-0). Research efforts are concentrated on advanced Polyamide (PA) and Polypropylene (PP) compounds, often reinforced with specific fillers, to ensure long-term reliability under severe thermal cycling in battery housing and engine systems. Furthermore, additive manufacturing (3D printing) is beginning to play a niche role, particularly in prototyping custom connectors and complex end-fittings for corrugated tube assemblies, allowing for rapid iteration and tailored solutions previously unattainable through conventional molding techniques.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily fueled by massive infrastructure development programs (e.g., China's Belt and Road Initiative, India's smart city projects) and the region's dominance in global automotive and electronics manufacturing. Countries like China, India, and South Korea are seeing exceptionally high demand for both standard construction-grade tubes and high-performance tubes for advanced electronics and EV production lines.

- North America: Characterized by mature markets and stringent quality regulations, North America shows steady demand driven by the robust construction sector, significant expenditure in telecommunications infrastructure upgrades (5G rollouts), and the accelerating domestic production of Electric Vehicles, particularly requiring specialized high-flexibility Nylon and PTFE tubes.

- Europe: The European market is highly focused on sustainability and regulatory compliance. Demand is strong for corrugated tubes made from recycled and bio-based polymers to align with the European Green Deal objectives. The region leads in industrial automation, boosting the need for highly durable corrugated conduits in robotics and machinery, especially in Germany and the Nordic countries.

- Latin America (LATAM): Growth in LATAM is driven largely by urbanization and public works investments in Brazil and Mexico. The market often favors cost-effective polyethylene tubes for water management and drainage, with increasing penetration of higher-specification tubes in the growing regional automotive assembly plants.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries due to massive construction projects (residential, commercial, and industrial facilities) and significant investment in oil and gas infrastructure, which necessitates high-pressure, heat-resistant metal corrugated tubing for fluid transport and protection in harsh desert environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Corrugated Tube Market.- Eaton Corporation

- Parker Hannifin Corporation

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- Wavin N.V.

- Pipelife International GmbH

- Uponor Corporation

- Flex-Drain

- HellermannTyton

- K-Flex

- Saint-Gobain

- Advanced Drainage Systems (ADS)

- Polyhose

- Fraenkische Industrial Pipes

- Atkore International Group Inc.

- Teaflex

- Reiku GmbH & Co. KG

- Shah Plastics

- Merlett Tecnoplastic S.p.A.

- Titeflex Corporation

Frequently Asked Questions

Analyze common user questions about the Corrugated Tube market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are driving the demand for corrugated tubes in the automotive industry?

The primary driver is the increasing complexity of wiring harnesses in modern vehicles, especially Electric Vehicles (EVs). Corrugated tubes provide essential lightweight protection against heat, abrasion, fluids, and mechanical stress, ensuring the reliability and safety of critical electrical systems and fluid lines. Regulatory requirements for vehicle safety and durability further enhance this demand.

What are the key material types used and their primary applications?

The key materials include plastics such as Polyethylene (PE) and Polypropylene (PP) for drainage and general electrical conduit (low cost, good flexibility), and specialty polymers like Polyamide (PA/Nylon) and PTFE for high-temperature and high-abrasion resistance required in automotive engines, aerospace, and chemical processing environments. Metal tubes (stainless steel) are used where high pressure and extreme thermal resistance are critical.

How does sustainability influence manufacturing in the Corrugated Tube Market?

Sustainability is a major market influence, prompting manufacturers to invest in processes utilizing recycled plastics (PCR) and bio-based polymers to reduce their environmental footprint. This shift is driven by stringent governmental green procurement policies in regions like Europe and the increasing demand from corporate clients for sustainable supply chain solutions.

Which region currently holds the largest market share for corrugated tubes?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to rapid urbanization, massive government investment in infrastructure projects, and the region's prominent position as a global manufacturing hub for electronics, automotive components, and industrial machinery.

What technological advancements are impacting the manufacturing process?

Key technological advancements include the adoption of co-extrusion for multi-layer tube production, allowing tailored functional properties; the integration of Industry 4.0 principles (sensors and AI) for optimizing extrusion parameters; and the development of specialized materials that meet increasingly demanding standards for flame retardancy and electromagnetic compatibility (EMC).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager