Cosmetic Active Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432764 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Cosmetic Active Ingredients Market Size

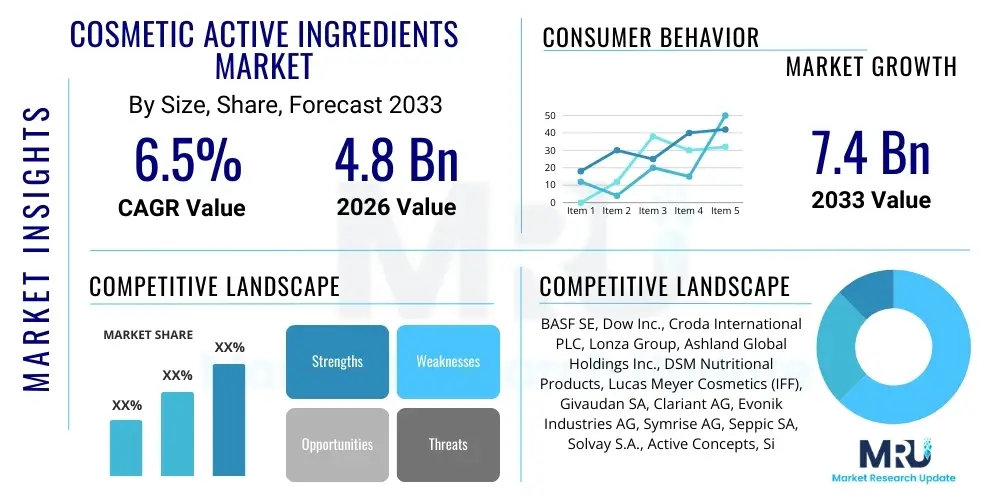

The Cosmetic Active Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.4 Billion by the end of the forecast period in 2033.

Cosmetic Active Ingredients Market introduction

The Cosmetic Active Ingredients Market encompasses specialized chemical compounds and biological extracts formulated to deliver specific, measurable physiological effects to the skin, hair, and nails, moving beyond simple aesthetic appeal. These ingredients are the functional backbone of high-performance cosmetic products, driving efficacy claims such as anti-aging, hydration, UV protection, skin brightening, and pollution defense. The foundational products in this category include vitamins, proteins, peptides, botanical extracts, bio-fermented ingredients, and advanced delivery systems like encapsulated actives. The growing consumer demand for 'cosmeceuticals'—products bridging the gap between cosmetics and pharmaceuticals—is the primary application catalyst, shifting focus from traditional beauty to health and wellness, demanding scientifically proven results and ingredient transparency. This emphasis on functional performance requires continuous innovation in molecular biology and sustainable chemistry to meet evolving consumer expectations globally.

Major applications span across high-growth cosmetic sectors, including premium skincare such as moisturizers, highly concentrated serums, and toners designed for targeted treatment. The market also heavily influences hair care, particularly specialized scalp treatments and anti-hair loss formulations, reflecting a holistic view of beauty and wellness. Furthermore, active ingredients are essential in sun care, providing broad-spectrum UV filters and reparative components, and in specialized color cosmetics that incorporate added skin benefits (e.g., foundations with hyaluronic acid or Vitamin C). The inherent benefits derived from using sophisticated active ingredients involve scientifically proven results, enhanced product stability, and the ability for personalized formulation tailored to specific complex skin concerns such as sensitive skin, chronic acne, or persistent hyperpigmentation, driving consumer adoption of higher-value products.

Key driving factors propelling this market include shifting demographic trends, particularly the aging global population actively seeking effective and preventative anti-aging solutions, alongside the increased health consciousness among Millennials and Generation Z who prioritize ingredient transparency, sustainability, and ethical sourcing (the pervasive Clean Beauty movement). Technological advancements in green chemistry, advanced biotechnology (specifically fermentation for synthetic biology ingredients and microbial actives), and cutting-edge microencapsulation techniques are facilitating the creation of highly potent, stable, and bioavailable active substances that address multiple skin concerns simultaneously. Additionally, strict regulatory standards in major markets, notably the European Union, often necessitate the use of well-documented, safe, and effective ingredients, which subsequently professionalizes the supply chain and drives continuous innovation toward naturally derived, traceable, and environmentally compliant components.

Cosmetic Active Ingredients Market Executive Summary

The Cosmetic Active Ingredients Market is currently characterized by intense innovation driven by the convergence of personalized beauty trends, stringent sustainability mandates, and rapid advancements in biotechnology. Key business trends indicate a significant strategic pivot towards natural, organic, and ethically sourced actives, compelling specialty chemical manufacturers to invest substantially in traceable supply chains and certified sustainable production methods, adhering to standards like COSMOS and ECOCERT. The corporate landscape is marked by frequent mergers and acquisitions, as established market leaders seek to swiftly integrate specialized biotech start-ups or unique botanical extract suppliers to expand their intellectual property portfolios and gain a competitive edge in novel ingredient discovery. The emergence of successful direct-to-consumer (DTC) brands specializing in 'single-ingredient focus' products is fundamentally disrupting the traditional B2B model, forcing suppliers to provide extensive scientific validation and transparent marketing claims that resonate directly with the end consumer.

From a regional perspective, Asia Pacific (APAC) continues to assert itself as the highest-growth and volume market globally. This exponential growth is primarily fueled by the massive cultural adoption of rigorous multi-step skincare routines (promoted by K-Beauty and J-Beauty trends) and substantial growth in disposable income across key economies like China, South Korea, and Japan. Consumers in these regions demonstrate a strong, culturally ingrained preference for advanced skin brightening agents, high-performance specialized UV protection, and sophisticated traditional herbal extracts validated through modern scientific techniques. Conversely, Europe remains a robust, established market defined by its unparalleled leadership in setting global clean label requirements, strict regulatory oversight, and advanced sustainable and eco-friendly ingredient innovation. North America is a crucial hub for premium, high-tech ingredients, benefiting from strong medical aesthetics trends and the rapid consumer assimilation of advanced therapeutic ingredients such as high-strength retinoids, complex peptides, and sophisticated hyaluronic acid derivatives, frequently driven and endorsed by dermatological professionals and media influence.

Analysis of segment trends highlights the continuing functional dominance of anti-aging and moisturizing agents, which collectively command the largest segment share due to their universal necessity across all demographics and product lines. However, the market’s dynamism is best reflected in the fastest-growing segments: namely, highly specialized skin brightening/whitening compounds, particularly dominant in Asian markets, and high-quality broad-spectrum UV filters, which are seeing global resurgence due to climate change awareness. Furthermore, there is a burgeoning and high-potential segment dedicated to specialized hair active ingredients, focusing on scalp health enhancers, targeted anti-dandruff solutions, and specialized keratin treatments. Crucially, biotechnology-derived ingredients, such as bio-fermented peptides and cultivated cell cultures, are actively displacing conventionally extracted components. They offer superior purity, stability, and crucial scalability while simultaneously addressing ethical and environmental sourcing concerns, firmly establishing this segment as a critical investment priority for sustained long-term market growth and differentiation.

AI Impact Analysis on Cosmetic Active Ingredients Market

Common user inquiries regarding the profound impact of Artificial Intelligence (AI) on the Cosmetic Active Ingredients Market intensely focus on three interconnected areas: the drastic acceleration of R&D cycles, the potential for true hyper-personalized product formulation, and the optimization of complex regulatory and quality assurance processes. Users frequently pose questions concerning how sophisticated AI tools, specifically machine learning algorithms, are being deployed to rapidly identify and validate novel molecular structures derived from exotic natural sources or synthetic biology libraries, effectively speeding up the traditionally slow time-to-market for effective active compounds. A recurrent theme of concern relates to the reliability and ethical implications of using predictive toxicology modeling via machine learning as a replacement or supplement for traditional, resource-intensive wet lab testing. Furthermore, there is significant, pervasive interest in understanding how advanced AI platforms can precisely match complex active ingredient profiles with granular individual genomic data, unique skin microbiome signatures, or personalized lifestyle factors, thereby facilitating the next generation of highly efficacious, targeted products that transcend generic demographic segmentation.

The application of sophisticated Artificial Intelligence and Machine Learning (ML) techniques is fundamentally transforming both the discovery phase and the subsequent formulation phases of active ingredient development. AI algorithms possess the capacity to analyze exponentially vast chemical and biological databases, effectively predicting critical metrics such as compound efficacy, long-term stability under various conditions, and potential toxicological profiles, thereby dramatically circumventing the time-consuming and expensive bottlenecks associated with traditional high-throughput screening. This predictive analytical capability allows researchers and chemists to focus their limited resources exclusively on the most promising candidates, substantially accelerating the invention and refinement of novel peptides, powerful anti-oxidants, and cutting-edge bio-fermented molecules. Moreover, beyond the laboratory, AI is proving indispensable in managing highly complex and often volatile supply chain dynamics, accurately predicting minute fluctuations in ingredient demand based on real-time analysis of dynamic social media trends, regional climatic shifts, and localized consumer sentiment analysis, ultimately optimizing inventory levels and drastically reducing material waste, especially for sensitive natural extracts.

Moving past initial discovery, AI actively facilitates the process of precise cosmetic formulation by utilizing advanced simulation technologies to model the complex physicochemical interaction between multiple distinct active ingredients within a comprehensive finished product matrix. This ensures optimized stability, mitigates potential incompatibility issues, and critically, maximizes any potential synergistic effects among the combined ingredients. In the rapidly emerging context of cosmetic personalization, sophisticated AI platforms are now employed by specialized, cutting-edge cosmetic brands to analyze multi-modal individual skin biometric data—often captured via integrated diagnostic devices or mobile applications—to recommend the precise, individualized concentrations and optimal combinations of high-performing active ingredients. This unprecedented level of data-driven, tailored formulation not only significantly enhances measurable product efficacy but also fosters strong, enduring consumer loyalty and creates crucial market differentiation. However, the regulatory landscape globally is progressing cautiously, slowly adapting to the need for transparent validation procedures and rigorous scientific evidence to support AI-generated or AI-assisted efficacy claims, making regulatory compliance a continuously evolving technical challenge for innovative manufacturers.

- AI accelerates novel active ingredient discovery by predicting efficacy, molecular mechanism of action, and initial safety profiles from extensive chemical and biological libraries.

- Machine learning algorithms optimize formulation chemistry by accurately predicting ingredient-to-ingredient interaction, solubility, and long-term stability within complex cosmetic bases under varying environmental stresses.

- AI-driven personalized beauty platforms match specific active ingredients (e.g., highly concentrated retinoids, new-generation peptides) and their required dosages to individual consumer biometric data, genomic predispositions, and specific skin needs.

- Predictive analytics and neural networks are utilized for robust demand forecasting and complex risk management, ensuring the stable sourcing of volatile natural and bio-based raw materials globally.

- Automated image analysis, coupled with advanced spectroscopy and deep learning, significantly enhances quality control processes and ensures meticulous batch consistency of high-purity, high-value active raw materials entering the supply chain.

DRO & Impact Forces Of Cosmetic Active Ingredients Market

The Cosmetic Active Ingredients Market trajectory is overwhelmingly driven by increasing consumer sophistication and awareness regarding product ingredients, coupled with sustained growth in disposable incomes globally that facilitates robust investment in premium, efficacy-driven products categorized as cosmeceuticals. A major restraint on market expansion often centers on the extremely high capital cost, inherent time consumption, and severe regulatory complexity associated with the development of novel ingredients, requiring meticulous adherence to stringent global requirements for proving clinical efficacy and long-term safety, epitomized by regulations such as REACH in Europe and similar compliance frameworks elsewhere. Significant, high-value opportunities are consistently emerging from the synergistic convergence of biotechnology, synthetic biology, and green chemistry, which together enable the scalable, sustainable, and customizable production of highly sought-after active ingredients, particularly those targeting complex biological functions like the skin microbiome and protection against pervasive environmental pollution. These intertwined forces collectively define and shape the fiercely competitive landscape, relentlessly pushing manufacturers towards verifiable scientific evidence, robust clinical data, and unimpeachable sustainable sourcing practices throughout the value chain.

Drivers: The global shift towards the Clean Beauty paradigm, emphasizing sustainability and ethical sourcing, serves as a paramount catalyst, compelling ingredient companies to proactively substitute traditional synthetic actives with innovative natural or bio-fermented alternatives that impeccably meet consumer demands for ingredient transparency and stringent environmental stewardship. The increasing global prevalence of various chronic skin conditions exacerbated by modern environmental factors—such as pervasive air pollution, intense solar UV radiation, and chronic lifestyle stress—drives continuous, rapid innovation in specialized protective and reparative ingredients, including sophisticated anti-pollution shields, verified blue light filters, and potent DNA repair enzymes. Furthermore, breakthrough technological advancements in sophisticated delivery systems, particularly liposomal encapsulation and advanced micronization techniques, significantly enhance the ability of delicate active ingredients to penetrate the skin barrier more effectively and critically, remain chemically stable within complex formulation matrices. This unlocks greater performance potential and fundamentally expands the addressable market for previously unstable or rapidly degrading active compounds.

Restraints: One pervasive and substantial restraint is the prohibitive financial cost and extended, multi-year development cycle required for establishing a novel, proprietary active ingredient, a process which necessitates extensive, documented clinical trials, comprehensive toxicological testing, and subsequent global regulatory approval before commercial viability. The industry simultaneously confronts complex challenges related to the industrial scalability and essential standardization of natural botanical extracts, as unavoidable geographical variations, specific harvesting techniques, and processing methods can drastically impact the purity, concentration, and batch-to-batch consistency of the desired active compounds. Moreover, significant consumer confusion stemming from ambiguous or outright misleading product labeling and the rampant proliferation of low-efficacy imitations or 'dupes' pose a material threat to the brand integrity and market differentiation of genuine innovators, requiring substantial and continuous investment in robust consumer education campaigns underpinned by strong scientific validation and clinical data.

Opportunities: The explosive growth of specialized markets such as professional male grooming, targeted therapeutic scalp care, and intimate wellness product categories presents new, high-margin niches for the application of advanced active ingredients, moving beyond conventional face and body care applications. The increasing viability of manufacturing bio-identical ingredients—produced sustainably through advanced synthetic biology or precision fermentation—offers critical opportunities to produce highly pure, chemically consistent, and environmentally responsible alternatives to traditional animal- or plant-derived materials. This addresses pressing ethical and sustainability concerns while ensuring consistently high efficacy standards. Furthermore, strategic expansion into dynamic emerging economies with rapidly modernizing regulatory frameworks and burgeoning, increasingly affluent middle-class populations offers vast untapped market potential, particularly favoring high-performance, multifunctional ingredients that allow consumers to simplify and streamline their comprehensive product routines without sacrificing noticeable results.

Segmentation Analysis

The Cosmetic Active Ingredients Market is meticulously segmented across multiple dimensions, including functionality, original source material, target application, and ultimate end-use product format. Functionality remains the arguably most critical segmentation axis, as it defines the ingredient's primary biological or physicochemical action, such as measurable anti-aging effects, verified UV protection capabilities, or intense hydration delivery mechanisms. Source segmentation is crucial because it directly reflects the industry's strategic pivot toward natural, sustainably sourced, and biotech-derived ingredients, aligning directly with escalating global consumer preferences for clean, ethical, and sustainable product solutions. Application analysis comprehensively details the primary areas of usage, with sophisticated skincare maintaining its historical dominance, while highly specialized sectors such as sun care, therapeutic hair care, and functional color cosmetics demonstrate highly accelerated growth trajectories driven by targeted product innovation and specific, unmet consumer needs. This complex, multi-layered segmentation framework allows ingredient manufacturers to precisely tailor their substantial R&D investments toward high-growth segments, optimize their comprehensive product portfolios, and strategically cater to the distinct quality and cost requirements of both the highly competitive mass market and the premium prestige cosmetic sectors.

- By Functionality:

- Anti-Aging Agents (Advanced Peptides, Stable Retinoids, Epidermal Growth Factors, Nootropics for skin)

- UV Filters (Organic/Chemical Filters, Inorganic/Physical Filters like Zinc Oxide, Specialty Boosters)

- Moisturizing Agents (High and Low Molecular Weight Hyaluronic Acid, Ceramides, Natural Moisturizing Factors - NMFs, Advanced Occlusives)

- Skin Lightening/Whitening Agents (Kojic Acid, Arbutin, High-Potency Vitamin C Derivatives, Licorice Root Extract)

- Anti-Inflammatory/Soothing Agents (Niacinamide/Vitamin B3, Cannabis Derivatives, Specialized Botanical Extracts like Chamomile and Green Tea)

- Conditioning and Restructuring Agents (Hydrolyzed Proteins, Silicone Alternatives, Specialized Polysaccharides)

- Anti-Pollution and Blue Light Protection Actives (Exopolysaccharides, Specific Antioxidant Blends)

- By Source:

- Natural/Botanical Extracts (Plant Cells, Essential Oils, Algae)

- Synthetic Ingredients (Lab-Synthesized Vitamins, UV Absorbers, Synthetic Peptides)

- Biotechnology-Derived Ingredients (Microbial Fermentation, Plant Cell Culture, Genetic Engineering Products)

- Marine Derived Ingredients (Seaweed Extracts, Marine Collagen, Deep-Sea Microorganisms)

- By Application:

- Skincare (Facial Creams, Body Lotions, Specialized Serums, Targeted Treatments, Masks)

- Hair Care (Shampoos, Conditioners, Intensive Scalp Treatments, Anti-Hair Loss Formulas, Hair Masks)

- Sun Care (Broad-Spectrum Sunscreens, Daily Moisturizers with SPF, After-Sun Repair Products)

- Color Cosmetics (Foundations, Lipsticks, Blushes with integrated active benefits like hydration and SPF)

- Toiletries (Specialized Soaps, Body Washes, Hand Sanitizers with active moisturizing and protective ingredients)

- By End-Use Product Type:

- Creams, Lotions, and Balms (Standard moisturizers and protective barriers)

- Serums, Concentrates, and Ampoules (High-potency, targeted treatments)

- Masks, Peel-Off Formulas, and Exfoliants (Periodic, intensive treatments)

- Oils, Butters, and Solid Formats (Waterless and anhydrous formulations)

Value Chain Analysis For Cosmetic Active Ingredients Market

The highly complex value chain for cosmetic active ingredients is structurally defined by several specialized tiers, beginning with the meticulous sourcing of highly specific raw materials, progressing through advanced synthesis or intricate extraction and purification processes, and ultimately culminating in the final integration and delivery to cosmetic formulators and subsequently, the global consumer. The upstream phase necessitates either the sustainable cultivation and extraction of botanical raw materials, responsible marine bio-sourcing, or highly specialized chemical synthesis, all of which often demand substantial initial capital investment in cutting-edge biotech laboratories, precision fermentation facilities, and certified sustainable cultivation programs. Key stakeholders in this foundational phase include highly specialized fine chemical companies and exclusive botanical extract suppliers who dedicate significant resources to protecting intellectual property that covers novel extraction, synthesis, or bio-processing methods, ensuring the maximum purity, stability, and crucial standardization of the core ingredients. The increasingly rigorous quality control and compliance management standards demanded by downstream cosmetic formulators require extensive testing and validation processes implemented rigorously from the earliest stages of the supply chain.

The midstream segment of the chain primarily involves the core ingredient manufacturers who expertly process the sourced raw materials into commercially viable, market-ready active ingredients. This often entails utilizing advanced stabilization and sophisticated delivery systems, such as proprietary encapsulation techniques (e.g., liposomes, SLNs) to enhance the bioavailability and maximize the shelf stability of highly sensitive actives like vitamins and peptides. This stage is absolutely critical for definitively establishing and rigorously substantiating the active ingredient's functional properties and all associated marketing claims, utilizing compelling efficacy data derived from extensive in vitro and clinical in vivo human testing. Distribution channels serving the cosmetic industry are highly nuanced, relying on a balanced mix of direct sales teams dedicated to major multinational cosmetic house clients for high-volume transactions, alongside specialized regional and local distributors who efficiently service smaller, innovative boutique cosmetic brands. Indirect distribution via third-party specialized chemical distributors often ensures broader, more efficient market penetration, especially crucial in rapidly expanding emerging markets where a direct operational presence may still be logistically challenging or cost-prohibitive.

Downstream analysis focuses explicitly on the cosmetic formulators and final product manufacturers (the essential end-users) who strategically procure the optimized active ingredients and integrate them into their final consumer products. Major multinational beauty conglomerates typically bypass distributors due to their enormous procurement volume, negotiating bespoke, direct supply agreements and often engaging in collaborative R&D efforts with suppliers for custom-developed, patented ingredients. Conversely, smaller clean beauty or niche brands frequently rely heavily on distributors, requiring flexible small-batch ordering, rapid technical support regarding complex formulation integration, and comprehensive regulatory documentation assistance for rapid product scaling, especially vital for maintaining competitive velocity in the fast-paced e-commerce environment. The value chain concludes effectively at the point of sale—including specialized pharmacies, high-end luxury department stores, mass market retail chains, and powerful digital e-commerce platforms—where strategic consumer marketing heavily emphasizes the rigorous scientific backing, clinical efficacy, and clean label credentials of the integrated active components to strongly influence and drive ultimate purchasing decisions.

Cosmetic Active Ingredients Market Potential Customers

The largest and most important cohort of customers for cosmetic active ingredients consists of major multinational beauty corporations (including market leaders such as L’Oréal, Estée Lauder Companies, Shiseido, and Unilever) and established mid-sized specialty cosmetic firms that require consistent, certified, and high-volume quantities of validated materials for their expansive global product lines. These substantial buyers typically require comprehensive, globally aligned regulatory documentation packages, extremely stringent quality control certifications (e.g., ISO, GMP), and often prefer to enter into exclusive, long-term supply contracts for patented, high-value ingredients such as advanced bio-fermented peptides or proprietary growth factor complexes. Their complex purchasing decisions are predominantly influenced by two critical factors: the active ingredient's verifiable ability to support bold, clinically proven marketing claims (e.g., "reduces the appearance of fine lines by 30% in four weeks") and its ability to integrate efficiently and stably into diverse, high-performance formulation bases across different geographic markets.

A rapidly evolving and strategically vital segment of potential customers includes specialized, digitally native, and pioneering clean beauty brands that have built their entire market premise on ingredient transparency, ethical sourcing, and demonstrable sustainability. These customers, often targeting high-margin niche markets (e.g., professional medical-grade skincare, certified vegan beauty products, or customized wellness regimens), specifically seek certified natural, sustainably harvested, organic, and ethically sourced active ingredients. Although their individual purchase volumes are generally lower than those of the major multinational conglomerates, this segment offers significantly higher profit margins and demonstrates exceptional receptivity to truly novel, scientifically compelling, and story-rich ingredients, such as rare exotic botanical extracts or highly effective microbiome-balancing prebiotics. These smaller, agile brands highly value strategic supplier partnership in co-developing compelling consumer marketing narratives and require readily accessible, high-quality technical support for small-batch manufacturing and effective rapid product scaling, particularly essential for aggressive e-commerce growth strategies.

Other economically significant customers include specialized private label manufacturers and Contract Development and Manufacturing Organizations (CDMOs) who specialize in producing comprehensive white-label cosmetic products for a vast array of global brands, from start-ups to established retailers. These organizations demand a broad, versatile, and highly cost-effective portfolio of readily available, validated active ingredients to quickly service diverse client requirements and turnaround projects rapidly. Finally, specialized dermatological clinics, high-end medical spas, and aesthetic surgery chains represent a highly discerning, high-value customer base, particularly for clinical-grade or therapeutic cosmeceutical actives like high-concentration L-Ascorbic Acid (Vitamin C), pharmaceutical-strength retinoids, and tissue growth factors. In this environment, verifiable product performance is paramount, efficacy is non-negotiable, and the underlying regulatory standards and purity requirements are often held to near-pharmaceutical grade specifications, demanding the highest quality raw materials and rigorous scientific substantiation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., Croda International PLC, Lonza Group, Ashland Global Holdings Inc., DSM Nutritional Products, Lucas Meyer Cosmetics (IFF), Givaudan SA, Clariant AG, Evonik Industries AG, Symrise AG, Seppic SA, Solvay S.A., Active Concepts, Silab, Sederma (Croda), Mibelle Biochemistry, Indena S.p.A., Greentech SA, Chemyunion S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Active Ingredients Market Key Technology Landscape

The dynamic technology landscape governing the cosmetic active ingredients market is rapidly and continuously transforming, primarily propelled by three core industrial requirements: the critical need for significantly enhanced ingredient efficacy, maximizing formulation stability over prolonged periods, and the urgent adoption of sustainable and environmentally compliant production methodologies. A foundational and major technological focus revolves around the deployment of Advanced Delivery Systems (ADS), which encompass sophisticated techniques such as microencapsulation (including liposomes, nanosomes, and robust solid lipid nanoparticles - SLN). These advanced systems serve the vital function of protecting highly sensitive active ingredients (such as inherently unstable Vitamin C, delicate Retinol, or fragile peptides) from rapid degradation induced by external stressors like light exposure, oxygenation, or thermal fluctuations. Crucially, these systems guarantee the targeted, controlled, and time-released delivery of the active ingredient deep within the desired skin layers, resulting in profound improvements in measured performance and substantially mitigating the potential risk of topical irritation. Furthermore, the mandatory adoption of green chemistry principles in extraction technologies (e.g., highly efficient supercritical fluid extraction, ultrasound-assisted extraction) dramatically minimizes the reliance on hazardous solvents and simultaneously maximizes the purity and concentration of valuable botanical compounds, robustly aligning with the cosmetic industry's aggressive sustainability and safety targets.

Biotechnology and its cutting-edge derivative, Synthetic Biology, represent the most profoundly disruptive technologies currently redefining ingredient sourcing and production methods. Advanced techniques such as precision microbial fermentation and sophisticated plant cell culture platforms facilitate the consistent, highly scalable, and environmentally responsible production of extremely high-value components, including complex, specific peptides, vital tissue growth factors, and highly sought-after bio-identical hyaluronic acids. These components historically relied upon resource-intensive, unpredictable plant sourcing or controversial animal-derived materials. This technological evolution provides a superior ethical and sustainable solution to effectively sourcing ingredients that are inherently rare, ecologically threatened, or subject to seasonal volatility, while simultaneously guaranteeing chemical uniformity and superior compositional purity across large-scale industrial batches. The strategic focus is progressively shifting towards employing synthetic biology tools to meticulously "design" entirely new molecular entities with pre-determined, optimized functionalities, moving beyond simple raw material extraction towards sophisticated, engineering-driven efficacy.

Moreover, the seamless integration of high-throughput screening technologies and advanced functional genomics is fundamentally revolutionizing the process of active ingredient discovery and mechanistic validation. Researchers now strategically leverage vast genomic data, advanced transcriptomic analysis, and proteomic profiling to precisely understand how specific active ingredients interact with and modulate human skin cells at a complex molecular level. This capability enables the development of truly targeted, evidence-based compounds (e.g., actives specifically designed to positively modulate the skin's complex microbial balance or selectively activate specific anti-aging gene pathways). This data-intensive, analytical approach, frequently enhanced and processed by integrated AI platforms, ensures that new active substances are developed with an absolutely clear, substantiated biological mechanism of action, thereby significantly strengthening efficacy claims and robustly supporting the industry's pronounced shift towards scientifically rigorous, 'science-backed beauty' products. The convergence of these advanced biological, chemical engineering, and computational technologies defines the essential competitive advantage and the future trajectory of innovation within the high-performance cosmetic ingredients market.

Regional Highlights

- Asia Pacific (APAC): APAC is emphatically the fastest-growing and currently the largest market globally for cosmetic active ingredients, primarily driven by the colossal consumer base, rapid and continuous urbanization across emerging economies, and the high cultural acceptance of sophisticated, multi-step skincare routines deeply ingrained in countries such as South Korea, mainland China, and Japan. Key ingredient demands are strategically focused on highly effective skin brightening agents, robust, next-generation UV filters (driven by the cultural pervasive sun avoidance ethos), and innovative encapsulation and delivery systems often derived from adapting traditional medicine principles into modern cosmetic applications. Regulatory standardization across the diverse region, while still complex and fragmented, is gradually moving towards harmonization, strongly encouraging substantial, long-term investment in localized production hubs and regional R&D centers dedicated to leveraging endemic local flora and addressing specific regional consumer preferences and climate challenges.

- Europe: Europe represents a mature, highly sophisticated, and highly regulated market, consistently establishing global benchmarks for consumer safety, end-to-end ingredient traceability, and rigorous sustainability standards (enforced by the stringent EU Cosmetic Regulation and REACH guidelines). The market's demand structure is dominated by the powerful Clean Beauty movement, resulting in exceptionally strong demand for certified natural, high-purity organic, and ethically sourced active ingredients. Innovation in Europe is intensely concentrated around developing advanced anti-pollution compounds, pioneering microbiome health actives (including advanced prebiotics, postbiotics, and specialized fermented lysates), and sustainable, circular economy-driven bio-based alternatives. This innovation is largely driven by environmentally conscious and affluent consumers who are unequivocally willing to pay a substantial premium for products that are demonstrably eco-friendly and robustly scientifically validated.

- North America: North America is defined by high consumer awareness regarding ingredient performance, a strong and influential partnership with dermatology and medical aesthetics, and the rapid, widespread adoption of high-tech and clinical-grade active ingredients. The demand profile is heavily biased towards aggressive anti-aging agents (including high-potency retinoids, next-generation signal peptides, and scientifically engineered growth factors) and advanced, repair-focused moisturizing compounds (such as stabilized hyaluronic acid and high-purity ceramides). The market readily embraces novel, disruptive technologies, especially those that directly link active ingredient performance to personalized diagnostic results and customized, on-demand formulation kits, securely positioning the region as a global leader in high-performance cosmeceuticals and their integration with professional aesthetic medicine practices.

- Latin America (LATAM): The LATAM market, while currently smaller in absolute terms, exhibits exceptional and sustained growth potential, fueled by a continuously expanding middle class and strong consumer interest, particularly in sophisticated hair care and high-performance sun protection products, which are critically necessitated by the intense regional climate. Brazil, specifically, remains a central powerhouse in the global beauty industry, demonstrating significant and localized demand for natural ingredients derived from the region's unique and rich Amazonian biodiversity. This demand necessitates the rapid development of specialized local supply chains and certified sustainable sourcing practices to ethically procure these unique and highly valuable botanical actives.

- Middle East and Africa (MEA): This region is an emerging but rapidly premiumizing market for cosmetic active ingredients, characterized by high-end luxury consumption patterns and very specific dermatological needs dictated by the harsh local climates, such as the critical need for intense, prolonged hydration and effective protection against high heat and dust exposure. Demand is robustly rising for premium anti-aging, highly effective skin brightening products, and oil-control actives. However, strategic market expansion often relies heavily on the importation of highly stable, technologically advanced active compounds, largely due to the varying levels of maturity in local manufacturing infrastructure and the highly varied and fragmented regulatory landscapes across the numerous individual nations within the MEA bloc.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Active Ingredients Market.- BASF SE

- Dow Inc.

- Croda International PLC

- Lonza Group

- Ashland Global Holdings Inc.

- DSM Nutritional Products

- Lucas Meyer Cosmetics (IFF)

- Givaudan SA

- Clariant AG

- Evonik Industries AG

- Symrise AG

- Seppic SA

- Solvay S.A.

- Active Concepts

- Silab

- Sederma (Croda Subsidiary)

- Mibelle Biochemistry

- Indena S.p.A.

- Greentech SA

- Chemyunion S.A.

- Wacker Chemie AG

- Alban Muller International

- Berg + Schmidt GmbH & Co. KG

- Provital S.A.

Frequently Asked Questions

Analyze common user questions about the Cosmetic Active Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the fastest-growing segments in the Cosmetic Active Ingredients Market?

The fastest-growing segments are biotechnology-derived ingredients (especially bio-fermented peptides, sustainable growth factors, and enzyme-based actives), anti-pollution shields, and microbiome modulators (prebiotics and postbiotics). This accelerated growth is driven by consumer demand for high, clinically verified efficacy, environmental sustainability, and advanced science-backed product validation.

How is the 'Clean Beauty' trend impacting active ingredient formulation?

The Clean Beauty trend compels formulators to strategically prioritize natural, organic, verifiable, and non-toxic sourcing paths. This results in significantly increased market demand for certified botanical extracts, traceable sustainable marine ingredients, and advanced fermentation-derived actives, simultaneously creating intense pressure on manufacturers to actively phase out certain synthetic preservatives and controversial chemical UV filters.

What role does Artificial Intelligence play in active ingredient discovery?

AI drastically accelerates ingredient discovery by analyzing massive chemical and genomic datasets to precisely predict the efficacy profile, molecular stability, and initial toxicological risk of novel compounds. This computational approach minimizes the requirement for resource-intensive, traditional lab screening, significantly optimizing the commercial pathway to market for new actives.

Which geographical region leads the Cosmetic Active Ingredients Market?

The Asia Pacific (APAC) region currently dominates the global market in terms of both absolute market size and the highest recorded growth rate. This is primarily attributed to the region’s immense consumer adoption of advanced, multi-step skincare routines, specifically driving strong demand for specialized sun care and high-efficacy skin brightening agents in major countries like China, Japan, and South Korea.

What is the primary function of Advanced Delivery Systems in cosmetic actives?

Advanced Delivery Systems (e.g., liposomes, SLN encapsulation, nanosomes) are critically employed to chemically protect highly sensitive active ingredients from environmental degradation (light, heat, oxidation) and to dramatically enhance their skin bioavailability. They ensure the precise, targeted, and controlled release of the active compound deep within the intended dermal layers for maximum biological and therapeutic effect over time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager