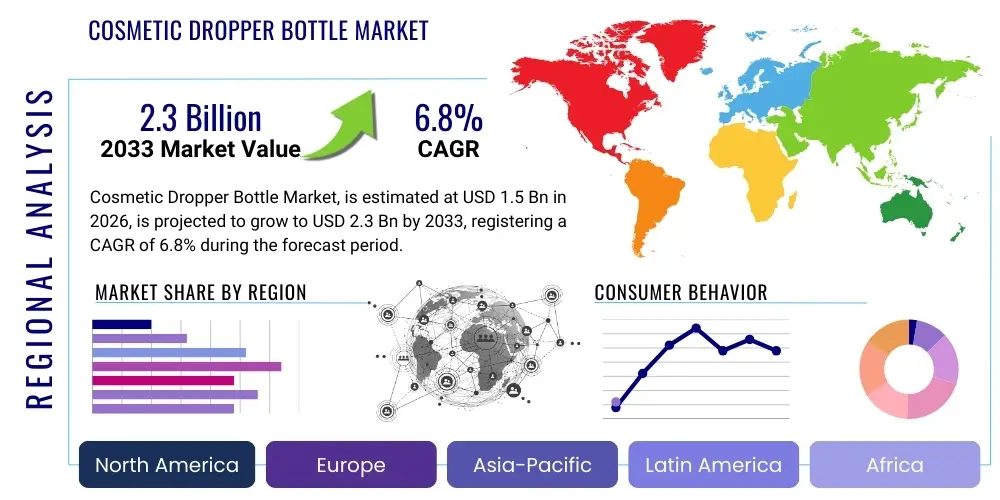

Cosmetic Dropper Bottle Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436014 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cosmetic Dropper Bottle Market Size

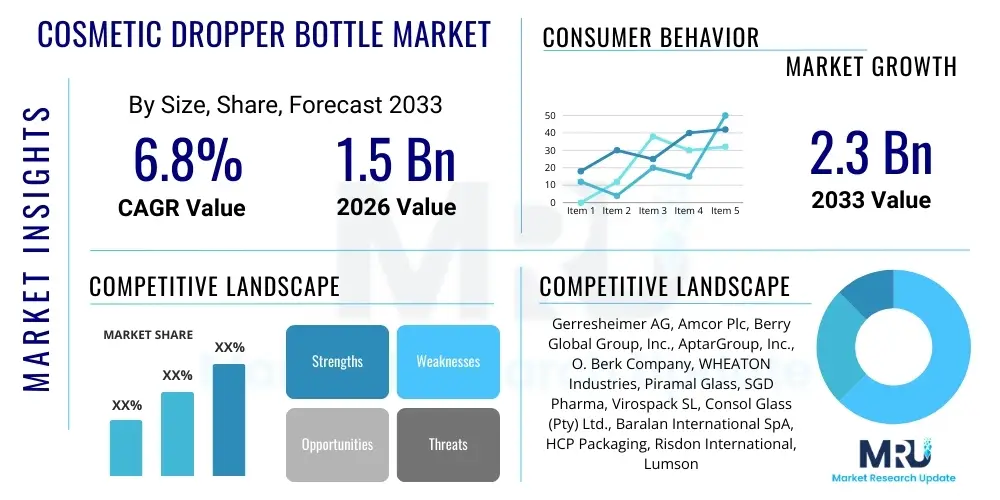

The Cosmetic Dropper Bottle Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033.

Cosmetic Dropper Bottle Market introduction

The Cosmetic Dropper Bottle Market encompasses the manufacturing, distribution, and utilization of specialized packaging solutions featuring a dropper mechanism, predominantly used for liquid cosmetic formulations requiring precise dosage and protection from contamination. This packaging format has become indispensable for high-value products such as facial serums, essential oils, potent active ingredient treatments, and targeted skin boosters, primarily due to its combination of aesthetic appeal, functional superiority, and inherent hygiene benefits. The primary materials used are high-quality glass (clear or frosted) and various plastics (like PET and HDPE), depending on cost considerations, product compatibility, and desired sustainability profile. The increasing consumer sophistication regarding skincare routines, particularly the widespread adoption of multi-step regimens that prioritize concentrated serums, directly drives the demand for these specialized containers, positioning them as a critical element in the premium segment of cosmetic packaging.

Major applications of cosmetic dropper bottles span across premium skincare, therapeutic aromatherapy, and high-precision makeup products, such as liquid foundations or illuminating drops. The functional benefits of dropper bottles extend beyond mere storage; they provide controlled dispensing, ensuring that highly concentrated or expensive formulations are used sparingly and effectively. Furthermore, the dark or opaque glass options offer superior UV protection, crucial for maintaining the efficacy and stability of sensitive ingredients like Vitamin C, retinol, or natural botanical extracts, thereby extending the product's shelf life and performance guarantee. The visual association of the dropper format with clinical efficacy and luxury presentation reinforces its adoption among upscale and niche cosmetic brands seeking to convey purity and scientific reliability.

The driving factors propelling this market growth include the global shift towards specialized skincare regimes and the 'skinification' of makeup, where consumers prioritize product benefits delivered through concentrated formats. Concurrently, advancements in packaging technology, particularly in sustainable material development such as Post-Consumer Recycled (PCR) glass and plastic, are fueling adoption among environmentally conscious brands and consumers. The robust expansion of the e-commerce sector for cosmetics further strengthens the demand, as dropper bottles, especially those made of durable materials, are perceived as offering better protection during transit compared to traditional jars or tubes, thus reducing breakage and spillage risks and enhancing the overall customer unboxing experience and satisfaction.

Cosmetic Dropper Bottle Market Executive Summary

The Cosmetic Dropper Bottle Market is exhibiting robust growth, driven primarily by the global surge in demand for high-efficacy, precision-dosed skincare products, particularly serums and specialized treatments. Key business trends underscore a strong focus on sustainable packaging solutions, with manufacturers increasingly investing in PCR materials and lightweight glass alternatives to meet corporate environmental mandates and evolving consumer expectations for eco-friendly products. Mergers and acquisitions are concentrating capabilities, particularly in automated glass molding and plastic injection technologies, to enhance supply chain resilience and scale production capacity, especially for high-volume markets. Furthermore, the integration of smart packaging features, such as QR codes for supply chain transparency and consumer engagement, is emerging as a significant differentiator, influencing purchasing decisions at the brand level.

Regionally, the Asia Pacific (APAC) market is projected to be the fastest-growing segment, propelled by rising disposable incomes, rapid urbanization, and the increasing adoption of multi-step Korean and Japanese beauty routines that heavily rely on serum application. China, India, and South Korea are central to this expansion, demanding both mass-market and luxury dropper bottle solutions. North America and Europe, while mature, continue to hold significant market share, driven by strong consumer preference for established premium brands and strict adherence to regulatory standards regarding material safety and chemical leaching, pushing manufacturers toward inert and high-barrier materials like Type III glass. European market growth is particularly sensitive to stringent EU packaging waste directives, accelerating the pivot toward circular economy models and reusable components within the dropper system.

Segment trends reveal that the Glass material segment retains dominance due to its chemical inertness, premium perception, and recyclability, despite the higher cost and fragility compared to plastic alternatives. Within the application segment, facial serums remain the highest consumer of dropper bottles, followed closely by essential oils utilized in the expanding aromatherapy and wellness industries. Demand for capacities ranging from 15 ml to 30 ml is consistently high, balancing product volume with portability and shelf appeal. Manufacturers are optimizing dropper assemblies, focusing on features like tamper-evident seals and improved bulb elasticity and material compatibility to ensure product integrity and dispense consistency, which are critical performance attributes demanded by formulators.

AI Impact Analysis on Cosmetic Dropper Bottle Market

User queries regarding AI's impact on the Cosmetic Dropper Bottle Market frequently center on themes of operational efficiency, supply chain predictability, and customization possibilities. Consumers and industry stakeholders are keen to understand how AI can optimize complex glass manufacturing processes, minimize material waste, and forecast demand for specific dropper designs (e.g., curved tip vs. straight tip) and volumes across different regional markets. Key concerns revolve around the ethical deployment of AI in automating packaging line quality control (QC) and ensuring that predictive maintenance algorithms effectively reduce costly downtime associated with high-speed filling and capping machinery. Furthermore, interest is high in utilizing AI-driven design tools to rapidly prototype aesthetically optimized and structurally sound bottle shapes that meet both premium branding requirements and functional stability mandates.

The adoption of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the manufacturing and logistics aspects of the cosmetic packaging industry. In production, AI-powered visual inspection systems are achieving near-perfect quality control by rapidly identifying minute defects in glass formation, neck finishing, and calibration of the dropper pipette assembly—a level of precision unattainable through traditional manual inspection. This reduction in defect rates directly improves operational throughput and minimizes losses associated with premium, high-cost materials. Moreover, ML models are being deployed to optimize oven temperatures and cooling cycles in glass production, dynamically adjusting parameters based on real-time sensor data to enhance material strength and consistency, particularly for unique or complex bottle geometries preferred by luxury brands.

On the supply chain and commercial side, AI algorithms significantly enhance demand forecasting, a critical function given the long lead times often associated with custom glass production. By analyzing historical sales data, seasonal trends, social media sentiment, and upcoming product launch schedules of major cosmetic houses, AI provides highly accurate predictions for material requirements (silica, plastic resins) and required inventory levels of finished components. This predictive capability allows packaging manufacturers to implement just-in-time inventory strategies, reducing warehousing costs and mitigating risks associated with supply chain disruptions, a scenario that has become particularly relevant in the post-pandemic manufacturing environment. The implementation of AI is thus moving the industry toward a highly responsive, waste-minimizing, and data-driven ecosystem.

- AI-driven visual inspection systems enhance quality control for complex bottle geometries and dropper components.

- Machine Learning algorithms optimize manufacturing parameters (e.g., temperature control in glass molding) to reduce defects and improve material integrity.

- Predictive demand forecasting, leveraging AI, minimizes inventory holding costs and improves lead-time management for customized orders.

- Robotic process automation (RPA), guided by AI, speeds up sterile filling and assembly processes, crucial for maintaining product hygiene.

- AI models are used to analyze consumer preferences, guiding the rapid iteration and design of aesthetically appealing and ergonomic dropper bottle systems.

- Predictive maintenance schedules for high-speed filling lines are established using ML, drastically reducing unexpected operational downtime.

DRO & Impact Forces Of Cosmetic Dropper Bottle Market

The dynamic landscape of the Cosmetic Dropper Bottle Market is shaped by a confluence of powerful drivers, significant restraints, and emerging opportunities, collectively analyzed through the lens of critical impact forces. The primary driving force remains the increasing consumer adoption of high-concentration liquid formulations, such as serums and essences, which mandate precise dosing mechanisms to ensure efficacy and reduce waste. This premiumization trend is intrinsically linked to the perceived luxury and therapeutic association of glass dropper bottles, enhancing the product's market positioning. However, the market faces constraints primarily related to the susceptibility of traditional glass to breakage during transport and use, alongside the escalating costs associated with sourcing high-quality, sustainable materials like Post-Consumer Recycled (PCR) glass. Opportunities are abundant in the development of lightweight, shatter-resistant glass alternatives and the innovation of multi-material solutions that combine the chemical inertness of glass with the durability of specific polymers, specifically targeting the growing e-commerce channel where packaging robustness is paramount for customer satisfaction and brand reputation.

The critical impact forces influencing the market trajectory include technological advancements in manufacturing precision, particularly related to the complex neck finish and sealing capabilities required for highly volatile or expensive formulations. Economic forces dictate material choices, often leading smaller brands to adopt plastic alternatives, though the persistent desire for a premium aesthetic maintains strong demand for sophisticated glass designs. Environmental impact forces are perhaps the most transformative, pressuring the industry toward holistic sustainability solutions, demanding not just recyclable materials but also reusable and refillable dropper systems that minimize overall lifecycle waste. Regulatory forces, especially in regions like the European Union, impose strict requirements on heavy metal content and leaching potential, necessitating rigorous testing and material sourcing protocols that ensure product safety and compliance, driving specialized manufacturers to maintain high operational standards and certifications.

In essence, the market operates under a dual pressure: satisfying the consumer's demand for high-end, efficacious products (drivers) while navigating material complexity, cost pressures, and environmental accountability (restraints). The strategic opportunities lie in leveraging cutting-edge material science to offer solutions that are both luxurious and environmentally sound. For instance, manufacturers are exploring the integration of bamboo or recycled paper elements into the outer packaging and dropper components to enhance the green credentials of the final product. Addressing the logistical challenge of breakage through innovative protective sleeves or optimized secondary packaging represents a significant avenue for manufacturers to capture greater market share, particularly among brands that rely heavily on international distribution and the unpredictable rigors of global shipping networks. Ultimately, successful market players will be those who can harmoniously balance premium aesthetics with cost-effective sustainability and structural integrity in their dropper bottle offerings.

- Drivers:

- Global surge in demand for concentrated facial serums and high-efficacy liquid treatments.

- Consumer preference for precision dosing and hygienic product application offered by the dropper mechanism.

- Aesthetic appeal and association of glass dropper bottles with premium and luxury cosmetics.

- Expansion of the aromatherapy and essential oils markets requiring protective, calibrated packaging.

- Restraints:

- High risk of glass breakage during transport and consumer use, leading to product loss and logistical costs.

- Elevated production costs associated with high-quality, chemically inert glass materials.

- Environmental pressure regarding the weight and energy consumption involved in glass manufacturing.

- Compatibility challenges between certain highly reactive cosmetic formulations and standard plastic dropper materials.

- Opportunity:

- Development and adoption of advanced sustainable materials, including PCR plastics and lightweight PCR glass.

- Innovation in functional packaging, such as airless dropper systems and self-filling pipettes, to enhance product preservation.

- Focus on specialized dropper designs for viscosity control, catering to thick oils or thin aqueous solutions.

- Expanding market penetration through strategic partnerships with burgeoning direct-to-consumer (D2C) cosmetic brands.

- Impact Forces:

- Technological Force: High investment in automation for precision manufacturing and quality control.

- Environmental Force: Strong regulatory and consumer mandates pushing for circular economy packaging solutions.

- Economic Force: Fluctuations in raw material costs (e.g., silica, polymers) directly impacting profit margins and final product pricing.

- Competitive Force: Intense competition driving continuous innovation in design, material durability, and functional improvements.

Segmentation Analysis

The Cosmetic Dropper Bottle Market is rigorously segmented based on material type, capacity, application, and end-use, allowing for a detailed analysis of specific growth pockets and market dynamics within specialized cosmetic niches. The material segmentation highlights the long-standing preference for glass due to its chemical stability and luxury perception, contrasted with the flexibility and cost-efficiency offered by various plastic polymers, each chosen based on specific product compatibility needs (e.g., PET for general use, HDPE for higher barrier requirements). Capacity segmentation is critical, ranging from micro-dose bottles (under 15 ml) favored by high-concentration actives or luxury samples, to larger 30 ml sizes that represent the standard commercial volume for daily serums and face oils, reflecting varying usage patterns and price points established across the global consumer base.

Application segmentation distinctly showcases the dominance of specialized skincare products, particularly facial serums and highly concentrated essences, as the primary drivers of demand, underscoring the shift towards targeted treatments. Essential oils and aromatherapy products also constitute a significant and rapidly expanding application segment, requiring specific packaging features like UV protection (often achieved through amber or cobalt blue glass) to maintain therapeutic potency and chemical integrity. The end-use segmentation differentiates between products targeting general skincare, sophisticated makeup formulations (like highlighters or liquid bronzers), and niche areas such as hair treatment oils and pharmaceutical-grade beauty supplements, each requiring unique specifications regarding bottle neck size, dropper length, and bulb material (e.g., pharmaceutical-grade rubber). This granular segmentation is essential for manufacturers to align their production capabilities with precise industry requirements and anticipate emerging consumer demands effectively.

The evolution of the segmentation landscape is strongly influenced by sustainability metrics, with a growing sub-segment dedicated to products incorporating Post-Consumer Recycled (PCR) content, regardless of the base material (glass or plastic). This shift mandates that segmentation analysis now must incorporate material source alongside material type. Furthermore, the rise of custom and artisanal cosmetic production has boosted the demand within the smaller capacity segments, requiring more flexible, low-minimum order quantity manufacturing capabilities. Understanding these intertwined segments allows market participants to tailor their innovation pipeline—whether focusing on developing chemically inert internal coatings for plastic bottles to challenge glass dominance, or perfecting tamper-evident dropper closures that cater specifically to high-value, high-regulation applications like professional-grade aesthetic treatments.

- By Material:

- Glass (Type I, Type II, Type III, Colored, Frosted, PCR Glass)

- Plastic (PET, PP, HDPE, LDPE, PCR Plastic)

- Other Materials (Bamboo Caps, Aluminum Collars, Bio-plastics)

- By Capacity:

- Up to 15 ml (Trial sizes, potent treatments)

- 15 ml – 30 ml (Standard commercial serums)

- Above 30 ml (Large format facial oils, body treatments)

- By Application:

- Facial Serums and Essences

- Essential Oils and Aromatherapy Products

- Liquid Foundations and Highlighters

- Hair and Scalp Treatment Oils

- Fragrances and Perfume Oils

- By End-Use:

- Skincare Industry

- Makeup and Color Cosmetics

- Hair Care Industry

- Wellness and Spa (Aromatherapy)

Value Chain Analysis For Cosmetic Dropper Bottle Market

The value chain for the Cosmetic Dropper Bottle Market is intricate, starting from raw material sourcing (upstream) through manufacturing and conversion (midstream), culminating in distribution and final usage (downstream). Upstream analysis reveals that the primary materials—silica sand and recycled cullet for glass, and petroleum-derived polymers for plastic—dictate the initial cost and environmental footprint. Suppliers of these raw materials, alongside specialized providers of dropper components such as rubber bulbs (typically nitrile or silicone) and plastic or metallic collars, hold significant bargaining power, especially when specific certifications (e.g., pharmaceutical grade or FDA compliant) are required. Supply chain stability in this phase is crucial, as any fluctuation in the availability or cost of these fundamental elements directly impacts the pricing structure of the finished packaging unit.

The midstream phase involves complex, high-precision manufacturing processes. For glass bottles, this includes highly automated forming and annealing (toughening) processes, while plastic bottles involve injection molding or blow molding. Dropper assembly manufacturing is highly specialized, ensuring the pipette length, tip style (straight, bent, calibrated), and the sealing cap mechanism integrate flawlessly. Quality control during this phase is paramount, involving stringent checks for dimensional accuracy, chemical resistance, and air-tightness, which are non-negotiable requirements for high-value cosmetic formulations. Manufacturers often specialize in either glass or plastic production, though large, integrated packaging conglomerates frequently offer comprehensive solutions, utilizing advanced automation and robotics to handle the fragile components and high-volume demand efficiently.

The downstream distribution channels are diverse, encompassing direct sales to large multinational cosmetic corporations (often through long-term exclusive contracts), distribution via specialized packaging distributors targeting smaller, niche brands, and increasingly, direct-to-brand online sales platforms facilitated by e-commerce. Direct channels allow for customized consultation and tailored production runs, ensuring compliance with strict branding and technical specifications. Indirect channels, through regional distributors, provide accessibility to small and medium enterprises (SMEs) globally, offering lower minimum order quantities and faster delivery of standardized products. The final consumer—the cosmetic brand—then incorporates the bottle into their own filling and logistics network before the product reaches the end consumer. The efficiency of the downstream logistics, particularly regarding safe, bulk transport of fragile glass items, remains a key factor in overall value delivery and cost management within the entire ecosystem.

Cosmetic Dropper Bottle Market Potential Customers

The primary potential customers and end-users of cosmetic dropper bottles span a broad spectrum of the beauty, wellness, and pharmaceutical-grade cosmetics industries, unified by the requirement for precise, hygienic, and aesthetically superior liquid dispensing. Leading multinational cosmetic corporations specializing in high-end skincare, such as those formulating anti-aging serums, potent vitamin concentrates, and advanced night repair treatments, represent the largest and most demanding customer segment, often requiring custom molds, specialized glass treatments (e.g., UV protective coatings), and highly integrated supply chain solutions. These customers prioritize consistency, regulatory compliance, and a strong brand image conveyed through premium packaging materials, driving demand for Type I and Type III glass solutions and sophisticated closure mechanisms.

A second major customer segment consists of artisanal and niche beauty brands, including certified organic and 'clean beauty' companies, along with small-batch essential oil producers. This segment typically purchases smaller volumes but demands packaging that aligns perfectly with their natural or sustainable ethos, leading to high demand for options such as Post-Consumer Recycled (PCR) materials, bamboo collars, or uncoated, minimalist glass designs. For these customers, the supplier's ability to offer low Minimum Order Quantities (MOQs) and flexible customization options at competitive price points is paramount. The rapid proliferation of these D2C (Direct-to-Consumer) and indie brands globally ensures continued diversification of customer needs and packaging trends.

Furthermore, the convergence of beauty and wellness—the 'nutraceutical' and 'dermocosmetic' spaces—presents an emerging customer base that often operates under quasi-pharmaceutical regulatory standards. These customers, including specialized hair growth treatment providers and medical-grade skincare lines, require the highest level of material inertness, often opting for pharmaceutical-grade borosilicate glass (Type I) and specialized, tamper-proof dropper assemblies. Their purchasing decisions are heavily influenced by technical documentation, sterilization protocols, and verifiable material sourcing, indicating a strong preference for suppliers capable of providing extensive compliance certifications and technical support throughout the product development and regulatory approval phases.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gerresheimer AG, Amcor Plc, Berry Global Group, Inc., AptarGroup, Inc., O. Berk Company, WHEATON Industries, Piramal Glass, SGD Pharma, Virospack SL, Consol Glass (Pty) Ltd., Baralan International SpA, HCP Packaging, Risdon International, Lumson SpA, Raepak Ltd., Kaufman Container, Cospak International, Premi S.p.A., Essel Propack (EPL Limited), Albea S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Dropper Bottle Market Key Technology Landscape

The technological landscape of the Cosmetic Dropper Bottle Market is characterized by continuous advancements aimed at enhancing packaging efficiency, integrity, and sustainability while preserving the product's premium aesthetic. A cornerstone of this innovation is the increasing sophistication of automated glass forming and molding technologies, which utilize high-speed, precision machinery to create complex bottle shapes with impeccable neck finish accuracy, critical for achieving a perfect, leak-proof seal with the dropper assembly. Manufacturers are leveraging advanced robotics for the handling of hot glass and subsequent inspection, minimizing defects and improving overall throughput. Furthermore, chemical strengthening processes, such as ion exchange treatments for glass surfaces, are being researched and deployed to enhance the bottle's mechanical resistance against impacts and thermal shock, directly addressing the key restraint of fragility and reducing transportation losses, a pivotal concern for international logistics.

In the realm of material science, significant technological strides are being made, particularly in the utilization and processing of Post-Consumer Recycled (PCR) materials. For glass, this involves advanced sorting and cleaning techniques for cullet to ensure the highest purity and minimal color variation, thus making PCR glass suitable for premium cosmetic applications where clarity is crucial. For plastic components like caps and collars, multilayer barrier technologies are being developed. These advanced polymer structures incorporate high-barrier layers (e.g., EVOH) to prevent oxygen permeation and ingredient degradation, allowing plastic dropper bottles to safely house sensitive formulations traditionally restricted to glass. This technological push for advanced barrier properties in plastic is a critical enabler for brands seeking lightweight and shatter-proof sustainable packaging options without compromising product stability or shelf life.

Beyond material and formation technologies, the functional performance of the dropper assembly itself is undergoing significant technological refinement. This includes the development of calibrated pipettes that ensure accurate volume measurement, essential for clinical or high-potency products. Self-filling or auto-dosing dropper mechanisms are emerging, simplifying the user experience by automatically drawing up a predetermined amount of product when the cap is opened or closed, ensuring standardized application. Furthermore, the integration of smart technology components, albeit nascent, involves embedding near-field communication (NFC) tags or specialized inks for anti-counterfeiting measures and providing consumers with product traceability data. These technological developments collectively position the dropper bottle not just as a container, but as a high-performance delivery system critical to the user experience and brand integrity.

Regional Highlights

- North America: This region is characterized by a high demand for premium and luxury packaging, driven by the strong presence of established international cosmetic brands and a highly engaged consumer base willing to pay a premium for high-quality, scientifically backed serums. North America dominates the market share in terms of value, with a pronounced focus on sustainable sourcing, particularly for PCR content validation, reflecting stringent corporate sustainability goals and proactive consumer advocacy. The regulatory environment (e.g., FDA standards) encourages sophisticated manufacturing quality control, resulting in a preference for suppliers capable of providing extensive material safety documentation and long-term reliability. The robust e-commerce sector in the US and Canada further accelerates the adoption of robust, dropper-based packaging formats suitable for safe shipping.

- Europe: Europe represents a sophisticated and highly sustainability-conscious market, with growth primarily dictated by strict regional regulations, particularly those originating from the European Union (EU) regarding packaging waste and recycling targets. The continent is a key manufacturing hub for high-end glass packaging, emphasizing circular economy models, reusable systems, and lightweighting initiatives to minimize environmental impact. Countries like France, Germany, and Italy, being centers for luxury cosmetics and fragrance production, demand aesthetically flawless, custom-designed dropper bottles, particularly those made of high-clarity, pharmaceutical-grade glass. The clean beauty movement is especially strong here, fostering innovation in materials such as bamboo closures and bio-based plastics.

- Asia Pacific (APAC): APAC is the fastest-growing market, experiencing exponential expansion fueled by rapidly growing economies, rising middle-class disposable income, and the widespread popularity of multi-step skincare routines originating in markets like South Korea and Japan. The demand here is dual-tiered: a massive need for affordable, high-volume plastic dropper bottles for mass-market products, coupled with a surging luxury segment demanding ultra-premium, customized glass packaging. China and India are critical growth drivers, characterized by a rapid adoption of localized D2C beauty brands. Local manufacturers are heavily investing in automation to meet this scale, focusing on optimizing supply chains to deliver customized products with shorter lead times, often incorporating culturally specific aesthetic elements into the packaging design.

- Latin America (LATAM): The LATAM market, while smaller, shows steady growth driven by the expansion of local cosmetic players and increasing consumer access to global beauty trends. Brazil and Mexico are key contributors. Market preference often leans toward cost-effective yet visually appealing packaging. Challenges include economic volatility and complex logistics, which drive demand for robust, potentially shatter-proof materials like PET or specialized treated glass that can withstand varied transit conditions. Opportunities exist in catering to the rising demand for natural ingredients and localized skincare solutions, requiring adaptable and accessible packaging solutions.

- Middle East and Africa (MEA): The MEA region is characterized by high consumption of luxury cosmetics, particularly fragrances and essential oils, driving strong demand for premium, decorative glass dropper bottles often featuring metallic finishes and elaborate detailing. The Middle East, in particular, exhibits high purchasing power for exclusive, large-format packaging. In Africa, growth is more segmented, focusing on affordable entry-level products and indigenous wellness formulations. Key requirements across the region include effective temperature resistance and stability features due to the demanding climatic conditions, necessitating high-barrier properties in both glass and plastic containers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Dropper Bottle Market.- Gerresheimer AG

- Amcor Plc

- Berry Global Group, Inc.

- AptarGroup, Inc.

- O. Berk Company

- WHEATON Industries

- Piramal Glass (Piramal Enterprises Ltd.)

- SGD Pharma

- Virospack SL

- Consol Glass (Pty) Ltd.

- Baralan International SpA

- HCP Packaging

- Risdon International

- Lumson SpA

- Raepak Ltd.

- Kaufman Container

- Cospak International

- Premi S.p.A.

- Essel Propack (EPL Limited)

- Albea S.A.

Frequently Asked Questions

Analyze common user questions about the Cosmetic Dropper Bottle market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the current growth of the Cosmetic Dropper Bottle Market?

The market growth is primarily driven by the increasing global consumer preference for high-efficacy facial serums and concentrated liquid cosmetic treatments that necessitate precise, hygienic dosing. The aesthetic association of dropper bottles with premiumization and luxury skincare also significantly contributes to sustained demand, especially in high-value segments.

How is sustainability impacting the material choices for cosmetic dropper bottles?

Sustainability mandates are profoundly shifting material choices toward Post-Consumer Recycled (PCR) glass and plastics, as well as bio-based polymers. Manufacturers are prioritizing lightweighting technologies and designing components (like bulbs and collars) to be easily disassembled for simplified end-of-life recycling and promotion of refillable systems in line with circular economy objectives.

Which material segment, glass or plastic, holds the dominant market share and why?

The Glass segment currently holds the dominant market share in terms of value due to its superior chemical inertness, which ensures product integrity for sensitive formulations, and its strong perception of luxury and quality among consumers and premium brands. However, the Plastic segment is growing rapidly due to cost-efficiency and durability benefits for mass-market and e-commerce applications.

What role does Artificial Intelligence play in the manufacturing of dropper bottles?

AI is increasingly used to optimize manufacturing processes by deploying high-speed visual inspection systems for quality control, ensuring zero defects in glass molding and assembly. AI also significantly enhances supply chain operations through advanced predictive demand forecasting, thereby improving inventory management and reducing production lead times for customized packaging.

What are the key technological innovations expected to transform the dropper bottle design?

Future innovations will focus on airless dropper systems to enhance product preservation, the development of lightweight and shatter-resistant glass alternatives, and the integration of smart features like NFC tags for anti-counterfeiting. Additionally, self-filling or auto-dosing pipettes that guarantee standardized application volume are becoming increasingly important for clinical cosmetic formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager