Cosmetic Grade Kaolin Clay Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436140 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Cosmetic Grade Kaolin Clay Powder Market Size

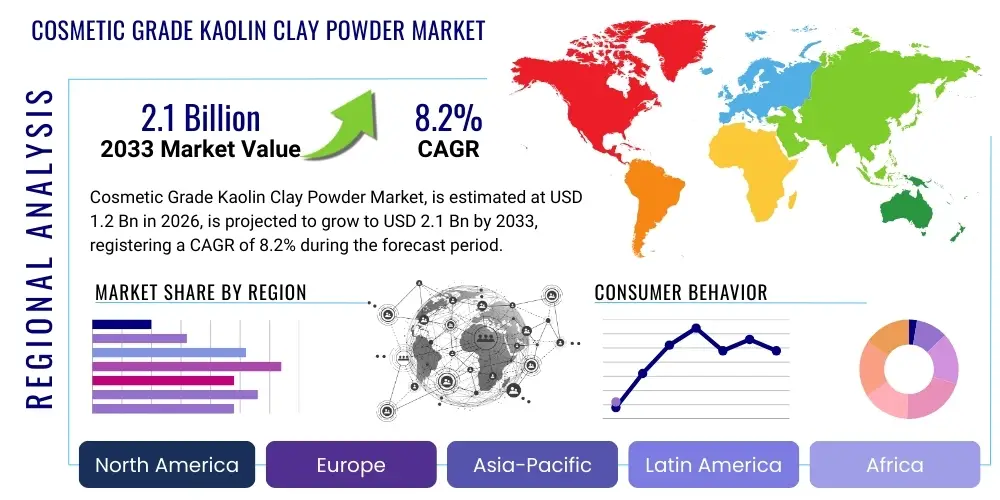

The Cosmetic Grade Kaolin Clay Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.1 Billion by the end of the forecast period in 2033.

Cosmetic Grade Kaolin Clay Powder Market introduction

The Cosmetic Grade Kaolin Clay Powder Market involves the extraction, processing, and distribution of refined kaolinite mineral, specifically tailored for application in skincare, makeup, and hair care products. Kaolin, chemically hydrous aluminum silicate, is prized for its high purity, soft texture, inert nature, and excellent absorption capabilities, making it a foundational ingredient in detoxification masks, foundation bases, and dry shampoos. The cosmetic grade designation ensures stringent particle size distribution, microbial limits, and heavy metal impurity standards are met, crucial for direct contact applications on sensitive skin. Global market expansion is intrinsically linked to rising consumer awareness regarding natural and mineral-based cosmetic formulations, coupled with the increasing trend toward personalized skincare routines that often incorporate clay-based treatments.

The primary applications of cosmetic kaolin clay span across facial masks, where it functions as a potent absorbent of excess sebum and impurities, and in color cosmetics, where it acts as a bulking agent, improves texture, and enhances the longevity of makeup. Furthermore, its inclusion in body powders and deodorants capitalizes on its moisture-absorbing properties, providing a smoothing and mattifying effect. Product efficacy, coupled with the mineral's gentle nature compared to other clays, positions kaolin as a preferred choice for sensitive and dry skin types, broadening its demographic appeal. Innovation in the market often focuses on refining the particle size (micronization) and surface treatment of kaolin to enhance its dispersibility and compatibility within complex cosmetic formulations, thereby improving sensory attributes and application performance.

Driving factors propelling this market include the robust growth of the global beauty and personal care industry, particularly the rise of clean beauty and ‘free-from’ movements, which prioritize naturally derived and minimally processed ingredients. The surge in demand for DIY (Do-It-Yourself) beauty kits and natural mask formulations further boosts consumption. Regulatory environments globally, while demanding high standards of purity, concurrently support the use of established mineral ingredients like kaolin, providing stability to manufacturers. Economic shifts, particularly increasing disposable income in emerging economies such as China and India, enable greater consumer expenditure on premium cosmetic products, many of which utilize high-grade kaolin clay for superior performance and sensory experience.

Cosmetic Grade Kaolin Clay Powder Market Executive Summary

The Cosmetic Grade Kaolin Clay Powder Market is demonstrating robust expansion driven primarily by global shifts toward natural ingredient sourcing and amplified consumer focus on skincare routines, especially facial masks and matte makeup finishes. Business trends indicate a strong move toward supply chain transparency, with major cosmetic manufacturers demanding certified, ethically sourced, and sustainably processed kaolin. Key segment trends show that the Superfine and Calcined kaolin types are experiencing accelerated growth due to their superior performance in premium cosmetic lines, offering enhanced oil absorption and brighter color profiles compared to standard grades. The competitive landscape is characterized by strategic partnerships between raw material suppliers and global cosmetic giants to secure stable, high-purity supply chains, alongside aggressive investment in advanced micronization technologies to improve product functionality and consumer safety compliance.

Regionally, the Asia Pacific (APAC) stands out as the highest growth market, fueled by burgeoning domestic cosmetic industries in China, South Korea, and India, coupled with high consumer adoption rates of elaborate 10-step skincare routines where clay masks are standard. North America and Europe maintain mature, yet consistently growing, markets, heavily focused on clean beauty certifications and premium natural formulations, driving demand for specialized, high-cost grades of kaolin. These mature regions are seeing innovation centered on functionalized kaolin, such as customized colors or modified surfaces, integrated into anti-pollution and detoxifying product lines. Regulatory scrutiny regarding heavy metals remains a constant factor globally, pressuring suppliers to implement stringent quality control measures, which indirectly raises the barrier to entry for smaller, less sophisticated processing entities.

Segment analysis confirms that the Skincare application category, particularly facial care, dominates the market share due to the established efficacy of kaolin as a deep cleansing and detoxifying agent. However, the Color Cosmetics segment is projected to exhibit a faster CAGR, capitalizing on kaolin's versatility as an inert base that improves pigment suspension and wearability in foundations, concealers, and blushes. Small and Medium Enterprises (SMEs) are increasingly entering the market, specializing in niche, organic, and ethically sourced kaolin products, often utilizing e-commerce platforms for direct consumer engagement. This fragmentation at the distribution level, contrasted with consolidation among large raw material mining and refining companies, defines the current competitive structure and future growth trajectories of the cosmetic kaolin supply chain.

AI Impact Analysis on Cosmetic Grade Kaolin Clay Powder Market

User queries regarding AI's impact on the Cosmetic Grade Kaolin Clay Powder Market predominantly center on how artificial intelligence can optimize mineral processing efficiency, enhance quality control for purity standards, and revolutionize new product development tailored to specific consumer needs. Key concerns revolve around the potential for AI-driven automation in mining and refining leading to workforce displacement, and how predictive analytics can influence global sourcing strategies, potentially prioritizing specific geographic regions based on quality and sustainability scores. Users also frequently inquire about the role of AI in analyzing consumer sentiment and ingredient efficacy, expecting AI to recommend optimal kaolin grades (e.g., degree of calcination or particle size) for targeted skin conditions, thereby accelerating market responsiveness and customization in product formulation.

The application of AI and Machine Learning (ML) algorithms is poised to significantly impact the upstream segment of the kaolin market, specifically in geological surveying and mineral quality prediction. By processing vast amounts of seismic data, satellite imagery, and chemical analysis reports, AI models can precisely identify deposits yielding high-purity kaolinite suitable for cosmetic grading, minimizing exploratory waste and enhancing resource efficiency. In the processing phase, AI-powered sorting and milling optimization systems ensure consistent particle size distribution and minimize contamination, providing manufacturers with highly standardized raw materials. This technological advancement addresses one of the primary challenges in the cosmetic market: maintaining unwavering batch-to-batch consistency in terms of texture and color profile, critical for high-end cosmetic brands.

Downstream, AI is transforming research and development (R&D) and consumer interaction. Predictive modeling can forecast the stability and shelf life of kaolin-containing formulations, reducing the time and cost associated with traditional physical testing. Furthermore, AI-driven digital dermatologists and personalized recommendation engines analyze individual skin data (oiliness, sensitivity, pH) and suggest customized face mask formulations, often recommending precise ratios of different kaolin grades blended with other active ingredients. This personalization trend, facilitated by AI, ensures that kaolin remains a highly relevant, customizable, and effective ingredient in the future of precision cosmetics, thereby securing its market value against competing ingredients.

- AI optimizes geological exploration, identifying high-purity kaolinite deposits faster and more efficiently.

- Machine Learning algorithms enhance manufacturing precision, ensuring consistent particle size and contaminant reduction during micronization.

- Predictive analytics aids in supply chain risk management, forecasting material availability and pricing volatility.

- AI-driven automated quality control systems perform real-time purity checks, specifically monitoring heavy metal content compliance (e.g., lead and arsenic).

- Generative AI models accelerate R&D by simulating the performance of novel kaolin-based cosmetic formulations.

- Personalized beauty platforms use AI to recommend optimal kaolin-based products based on individual skin profiles and climate data.

- AI-powered market sentiment analysis guides product iteration and informs decisions on new kaolin grade introductions (e.g., highly detoxifying vs. moisturizing kaolin variants).

DRO & Impact Forces Of Cosmetic Grade Kaolin Clay Powder Market

The Cosmetic Grade Kaolin Clay Powder Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming impactful forces shaping its trajectory. The primary driver is the pervasive consumer demand for natural and mineral-based cosmetic ingredients, particularly in the rapidly growing facial mask and premium makeup segments. This demand is further amplified by social media trends emphasizing self-care and detoxification, positioning kaolin as a staple ingredient. Conversely, significant restraints include the stringent regulatory requirements governing heavy metal contamination (such as lead, mercury, and cadmium), which necessitate expensive and complex purification processes, thereby increasing the final cost of cosmetic-grade material and limiting the pool of eligible suppliers. Opportunities are abundant in the development of specialized, functionalized kaolin—such as colored, surface-modified, or organically certified versions—to cater to niche markets like organic cosmetics and sun care formulations.

Key impact forces include technological advancements in particle engineering, particularly micronization and calcination techniques, which enhance the functional performance of kaolin by improving oil absorption capacity and achieving a silky, non-cakey texture in makeup. Economic factors, notably fluctuating energy costs essential for high-temperature processing like calcination, directly impact production costs and market pricing stability. Furthermore, geopolitical instability in key sourcing regions can disrupt the global supply chain, leading manufacturers to seek diversification of raw material sources, driving investments in less traditional kaolin mining locations. The increasing focus on Environmental, Social, and Governance (ESG) criteria acts as a profound force, pushing companies toward sustainable mining practices, reduced water usage, and responsible waste disposal, ultimately influencing consumer preference and brand loyalty.

The market also faces inherent competitive forces from substitute ingredients. Alternatives like bentonite, montmorillonite, and various synthetic absorbents compete directly with kaolin, especially where cost optimization is paramount. However, kaolin’s superior whiteness, mildness, and ease of formulation generally ensure its dominant position in high-end formulations. The sustained growth of the global spa and wellness industry provides a continuous avenue for market expansion, specifically through professional-grade, high-concentration kaolin treatments. Navigating the balance between meeting high purity standards, maintaining competitive pricing, and embracing sustainable processing methodologies will be critical for stakeholders aiming to capitalize on the sustained growth of the beauty and personal care sector.

Segmentation Analysis

The Cosmetic Grade Kaolin Clay Powder Market is intricately segmented based on Type, Application, and Grade, reflecting the diverse requirements of the beauty industry. Segmentation by Type primarily includes Natural Kaolin and Calcined Kaolin. Natural kaolin (Hydrated Aluminum Silicate) is the most widely used form, valued for its gentle absorbency and opacifying properties. Calcined kaolin, which undergoes high-temperature heating, offers superior whiteness, brightness, and enhanced oil absorption, making it preferred for high-performance makeup and targeted detoxification masks. This differentiation allows formulators to select the optimal grade based on the desired product sensory profile and functionality, often leading to a premium pricing structure for the calcined variant due to the intensive energy consumption during manufacturing.

Segmentation by Application is crucial, classifying usage into Skincare (Facial Masks, Cleansers), Color Cosmetics (Foundations, Powders, Blushes), Hair Care (Dry Shampoos, Scalp Treatments), and others (Body Powders, Deodorants). Skincare currently dominates the market share due to the widespread adoption of clay masks globally, driven by consumer demand for deep cleansing and detoxification products. However, the fastest growth is anticipated in the Color Cosmetics segment, as kaolin is increasingly utilized to improve the mattifying effect and improve the spreadability and coverage of liquid and cream-based foundations, aligning with current trends favoring natural, long-wear makeup formulations.

Further analysis is conducted based on Grade: Standard Cosmetic Grade and Premium/USP Grade. The Premium or USP (United States Pharmacopeia) grade commands a higher price point, characterized by ultra-low heavy metal content, minimal particle variation, and often, specialized treatment (e.g., surface coating) to enhance compatibility with organic formulations. This segmentation emphasizes the industry's polarization: standard grades serve mass-market and lower-cost formulations, while premium grades are essential for high-end, luxury, and certified organic brands that require uncompromising purity and performance, influencing pricing strategies and supply chain management across the sector.

- Type:

- Natural Kaolin (Hydrated)

- Calcined Kaolin (Anhydrous)

- Washed Kaolin

- Application:

- Skincare (Facial Masks, Cleansers, Scrubs)

- Color Cosmetics (Foundations, Face Powders, Blushes, Eyeshadows)

- Hair Care (Dry Shampoos, Scalp Detox Treatments)

- Body Care (Deodorants, Body Powders)

- Grade:

- Standard Cosmetic Grade

- Premium/USP Grade (Ultra-White, Low Impurity)

Value Chain Analysis For Cosmetic Grade Kaolin Clay Powder Market

The value chain for cosmetic grade kaolin clay powder begins with upstream activities, primarily encompassing the geological exploration, mining, and initial beneficiation of crude kaolinite ore. Mining is typically open-pit, followed by crucial initial processing steps like crushing and washing to remove coarser impurities. The critical determinant of value at this stage is the quality of the raw deposit, particularly its natural whiteness and low content of iron and titanium oxides, which are undesirable in cosmetic applications. Major suppliers invest heavily in geological assessment to ensure long-term supply stability of high-quality feedstock, a prerequisite for achieving cosmetic grade certification.

The midstream phase involves complex processing to meet cosmetic specifications, including purification, delamination, and micronization (fine grinding) to achieve the desired particle size—often below 10 micrometers—for optimal sensory feel and application performance. If calcined kaolin is required, this high-energy thermal treatment is performed to enhance brightness and oil absorption. Quality control is paramount in this stage, involving rigorous testing for heavy metals and microbial load. The distribution channel is bifurcated: direct sales are common for large volume buyers (Tier 1 cosmetic manufacturers) utilizing long-term contracts, ensuring stable pricing and tailored product specifications. Indirect channels, involving specialized chemical distributors, serve smaller cosmetic brands and niche formulators, providing smaller batch sizes and extensive technical support regarding formulation compatibility.

Downstream activities involve the final formulation and marketing of consumer products. Cosmetic manufacturers integrate kaolin into their final products (masks, powders, makeup bases). Direct channels here include branded retail outlets and company-owned e-commerce platforms. Indirect channels rely on pharmacies, supermarkets, specialized beauty retailers, and rapidly growing online marketplaces. The final value captured is significantly higher at this stage, driven by brand perception, effective marketing (especially emphasizing the 'natural' and 'detoxifying' properties of clay), and premium pricing. The efficiency of the distribution network, particularly the cold chain requirements for certain sensitive formulations containing kaolin, influences market reach and inventory management costs.

Cosmetic Grade Kaolin Clay Powder Market Potential Customers

The primary customers for Cosmetic Grade Kaolin Clay Powder are large multinational corporations and regional specialty companies operating within the global beauty and personal care industry. These companies require high-volume, consistently high-purity kaolin to formulate a diverse range of products, including flagship facial masks, matte-finish foundations, and specialized hair care products like dry shampoos. Specifically, R&D departments and procurement teams within these organizations seek suppliers capable of providing technical specifications, such as specific whiteness indices (measured by Hunter L, a, b values) and detailed heavy metal certification documentation, to ensure compliance with stringent regulatory standards across various geographic markets like the EU, FDA, and Asian regulations. Consistency in supply and competitive pricing based on long-term contracts are key procurement criteria for this segment.

A rapidly growing segment of potential customers includes Small and Medium Enterprises (SMEs) and independent artisanal cosmetic brands focused on natural, organic, and ethically sourced ingredients. These smaller entities often lack the resources for internal material processing and rely heavily on specialized chemical distributors who can supply smaller quantities of certified USP-grade kaolin. These customers prioritize traceability, sustainable sourcing certifications, and technical support regarding formulation challenges unique to natural ingredients. Their purchasing decisions are often driven by marketing narratives centered around ingredient purity and environmental impact, requiring suppliers to provide comprehensive ESG compliance reports alongside standard technical data sheets.

Furthermore, contract manufacturers (CMOs) and private label manufacturers represent a significant customer base. These organizations produce finished goods for multiple brands simultaneously, requiring versatile and readily available inventory of various kaolin grades. Their purchasing volume can be substantial, bridging the gap between high-volume bulk suppliers and diversified final consumer brands. Additionally, academic research institutions and specialized dermatological testing labs utilize small quantities of highly standardized kaolin powder for ingredient safety assessment, skin compatibility studies, and the development of next-generation cosmetic delivery systems, though their volume contribution is minor compared to large-scale manufacturers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.1 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Imerys S.A., BASF SE, KaMin LLC, Thiele Kaolin Company, Ashapura Group, Sibelco N.V., W. R. Grace & Co., Quarzwerke GmbH, I-Minerals Inc., LB Minerals, Goonvean Aggregates Ltd, Select Clays, Inc., The Clay Company, Mineração Rio do Norte S.A. (MRN), AGSCO Corp., Dry Branch Kaolin Company (DBK), 20 Microns Ltd., Pacer Corporation, Source Clays, Inc., Viaton Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Grade Kaolin Clay Powder Market Key Technology Landscape

The technological landscape in the Cosmetic Grade Kaolin Clay Powder Market is primarily focused on achieving ultra-high purity and modifying the physical structure of the mineral to optimize functional performance in cosmetic formulations. The most critical technologies involve wet processing techniques, such as selective flocculation and froth flotation, which efficiently remove non-kaolinite impurities like mica, quartz, and titania, essential for attaining the desired whiteness and low abrasive texture required for sensitive skin products. Furthermore, advancements in magnetic separation technology are crucial for extracting trace amounts of iron and titanium minerals, which directly impact the final color and stability of the clay powder. Continuous innovation in these purification methods is key to meeting the increasingly strict regulatory standards for heavy metal content imposed by global beauty regulators.

Particle size engineering constitutes another major technological pillar. Micronization, typically achieved through specialized jet milling or air classification, allows manufacturers to precisely control the particle size distribution (PSD). Cosmetic grades generally require extremely fine particles (often below 5 microns) to ensure a smooth, luxurious sensory feel and excellent spreadability, avoiding a grainy texture in finished products like face powders and cream bases. Advanced process control systems utilizing laser diffraction particle size analyzers provide real-time feedback during milling, ensuring batch consistency. The development of customized particle shapes, such as delaminated or structured kaolin platelets, further enhances oil absorption and skin adhesion properties, providing functional benefits beyond simple bulking and improving the performance of high-end mattifying makeup.

Calcination technology is vital for producing high-brightness, anhydrous kaolin, which exhibits superior opacity and oil absorption compared to natural grades. Recent technological evolution focuses on optimizing the energy efficiency of the calcination kilns (e.g., using flash calcination) and precisely controlling the temperature profile (up to 1050°C). This precision ensures the maximum removal of hydroxyl groups and structural water without causing unwanted crystallization, which could compromise the clay's soft texture. Surface modification technologies, involving coating the kaolin particles with specialized agents like silicones or fatty acids, are also gaining traction. These treatments improve hydrophobicity, dispersibility in oil-based cosmetic matrices, and compatibility with specific organic ingredients, thereby expanding kaolin's versatility across a wider range of high-performance and waterproof cosmetic formulations.

Regional Highlights

The market dynamics for Cosmetic Grade Kaolin Clay Powder vary significantly across key geographical regions, driven by localized consumer preferences, production capabilities, and regulatory frameworks. Asia Pacific (APAC) is currently the most dynamic and fastest-growing region. This explosive growth is largely attributable to the massive consumer bases in China, India, and South Korea, where intricate skincare routines and a high prevalence of facial masks drive consumption. The region benefits from both high domestic demand and significant local manufacturing capacity, particularly in the production of mineral-based makeup and Ayurvedic/traditional medicine-inspired cosmetic products. High disposable incomes and increasing beauty penetration in second and third-tier cities further fuel this demand, positioning APAC as the critical future growth engine for kaolin suppliers globally.

North America and Europe represent mature markets characterized by stringent quality controls and a dominant focus on ‘Clean Beauty’ and ‘Natural’ certifications. Consumer preferences here emphasize ethical sourcing, sustainability, and ultra-high purity (USP grade) kaolin, particularly in premium and niche cosmetic brands. While volume growth is steady rather than explosive, the high average selling price (ASP) of premium kaolin grades ensures significant market value. European regulations (REACH) and evolving guidelines from bodies like the FDA in North America continuously pressure suppliers to maintain extremely low levels of heavy metal impurities, driving investment in advanced purification technologies among regional processors. Innovation in these regions often focuses on functionalized kaolin for anti-pollution and sensitive skin formulations.

Latin America and the Middle East & Africa (MEA) are emerging markets exhibiting promising growth potential. Latin American markets, such as Brazil, show strong domestic demand for high-quality cosmetics, particularly sun care and anti-acne products where kaolin is an effective oil-control agent. MEA regions, particularly the GCC countries, demonstrate rising demand fueled by increasing urbanization, Western lifestyle adoption, and strong luxury goods consumption, driving the need for premium cosmetic ingredients. However, logistical challenges and varying local regulatory standards present hurdles that regional suppliers must navigate. Investment in localized distribution networks and production facilities is key to unlocking the full potential of these developing markets.

- North America (NA): Focuses on premium, USP-grade kaolin; strong market for natural and organic certified products; driven by specialized skincare and mattifying makeup.

- Europe: Highly regulated market (REACH); high demand for sustainable and ethically sourced materials; established strong consumption in facial masks and professional spa treatments.

- Asia Pacific (APAC): Fastest growing region; high volume consumption driven by K-beauty and J-beauty trends, extensive use in domestic mass-market and premium skincare; significant local manufacturing base.

- Latin America (LATAM): Emerging growth, particularly in Brazil and Mexico; high usage in oil-control and climate-adapted cosmetic formulations; increasing investment in local processing capabilities.

- Middle East and Africa (MEA): Growth fueled by rising disposable incomes and luxury cosmetic market expansion; potential for use in mineral sunscreens and traditional beauty product derivatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Grade Kaolin Clay Powder Market.- Imerys S.A.

- BASF SE

- KaMin LLC

- Thiele Kaolin Company

- Ashapura Group

- Sibelco N.V.

- W. R. Grace & Co.

- Quarzwerke GmbH

- I-Minerals Inc.

- LB Minerals

- Goonvean Aggregates Ltd

- Select Clays, Inc.

- The Clay Company

- Mineração Rio do Norte S.A. (MRN)

- AGSCO Corp.

- Dry Branch Kaolin Company (DBK)

- 20 Microns Ltd.

- Pacer Corporation

- Source Clays, Inc.

- Viaton Industries

- Rio Tinto Group

Frequently Asked Questions

Analyze common user questions about the Cosmetic Grade Kaolin Clay Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between cosmetic grade and industrial grade kaolin clay?

Cosmetic grade kaolin undergoes significantly more rigorous purification processes, including advanced washing and magnetic separation, to ensure extremely low levels of heavy metal contamination and consistent, fine particle size distribution (typically 5-10 microns), critical for safe skin contact and desirable sensory feel. Industrial grades have lower purity standards and larger particle sizes.

Which application segment drives the highest demand for cosmetic kaolin powder?

The Skincare segment, specifically facial masks and cleansers, currently accounts for the highest volume consumption of cosmetic kaolin clay powder globally. This is driven by its effective oil absorption, detoxifying properties, and widespread integration into routine consumer self-care treatments across all regional markets.

What technological advancements are crucial for maintaining the quality of cosmetic kaolin?

Key technologies include ultra-fine micronization for superior texture, advanced wet purification methods (flocculation and magnetic separation) for heavy metal removal, and precise temperature control in calcination to enhance whiteness and oil absorption capacity without altering the soft texture.

How does the shift toward 'Clean Beauty' affect the market for kaolin clay?

The 'Clean Beauty' trend positively impacts the market by driving demand for natural, mineral-derived ingredients like kaolin. However, it simultaneously imposes stricter requirements on suppliers for sourcing transparency, ethical mining practices, and verifiable documentation proving the absence of contaminants and synthetic additives.

Which geographical region is forecasted to exhibit the fastest growth in kaolin consumption?

The Asia Pacific (APAC) region is projected to register the fastest market growth, primarily due to the vast and rapidly expanding consumer base in countries such as China and India, coupled with high consumer adoption rates for elaborate skincare regimens, including daily or weekly clay mask usage.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager