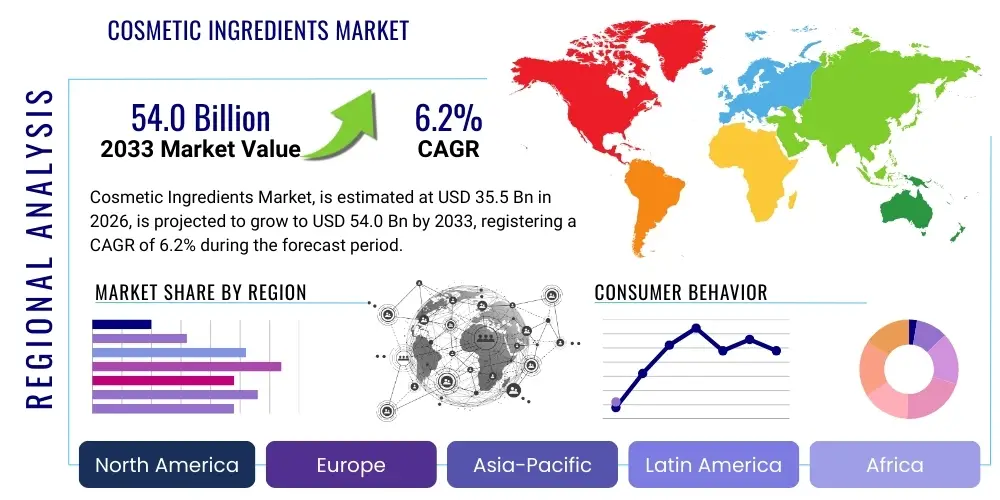

Cosmetic Ingredients Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437833 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Cosmetic Ingredients Market Size

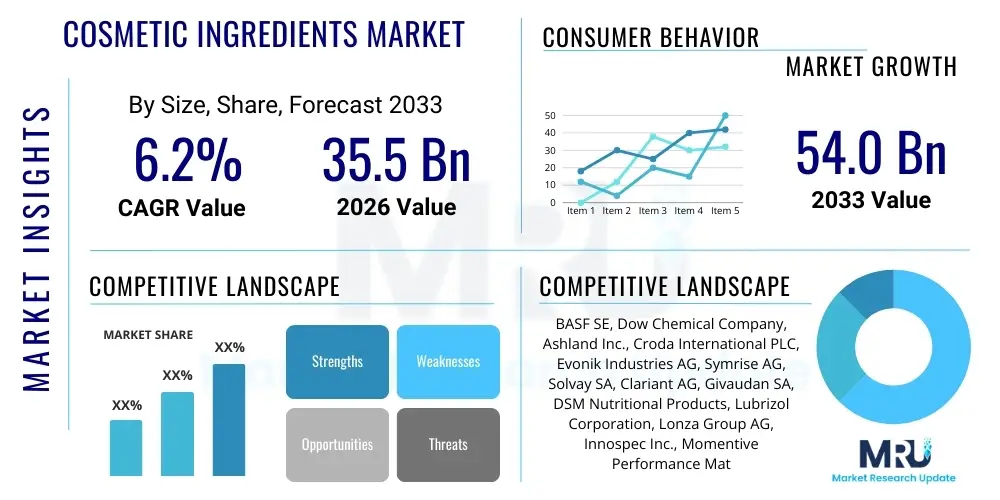

The Cosmetic Ingredients Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 54.0 Billion by the end of the forecast period in 2033.

Cosmetic Ingredients Market introduction

The Cosmetic Ingredients Market encompasses a vast array of chemicals, natural extracts, and biologically derived compounds utilized in the formulation of personal care and cosmetic products. This market is fundamentally driven by sustained global consumer demand for enhanced aesthetics, wellness, and anti-aging solutions. Key product categories include active ingredients such as peptides, vitamins, and hyaluronic acid, which offer targeted functional benefits like hydration, UV protection, and wrinkle reduction. Furthermore, foundational ingredients like emollients, emulsifiers, surfactants, and preservatives ensure product stability, texture, and safety. Major applications span across skincare (creams, lotions, serums), haircare (shampoos, conditioners, styling products), and color cosmetics (makeup foundations, lip products), each category demanding specialized ingredient profiles tailored to specific performance criteria and consumer expectations. The increasing consumer awareness regarding product contents, coupled with the rising focus on clean beauty and sustainability, necessitates continuous innovation within the ingredient supply chain.

The primary benefits derived from high-quality cosmetic ingredients include demonstrable efficacy, improved product sensory characteristics, and consumer safety. Advanced ingredients enable manufacturers to address complex dermatological needs and offer personalized solutions, moving beyond basic hydration to targeted treatments for sensitivity, hyperpigmentation, and signs of aging. Driving factors for market expansion include the rapidly growing middle-class population in emerging economies, increased expenditure on premium beauty products, and the integration of advanced biotechnological processes, such as fermentation and cell culture, for producing highly efficacious and sustainable compounds. The shift towards natural, organic, and plant-derived ingredients is a pervasive trend, pressuring traditional suppliers to reformulate and prioritize green chemistry principles in their manufacturing processes. Regulatory shifts, particularly in regions like the European Union and the US, demanding greater transparency and safety testing, also shape the types of ingredients utilized and their market acceptance.

Product innovation remains central to competitiveness in this market. For instance, the demand for multifunctional ingredients that can serve as both moisturizers and antioxidant protectors is escalating. Ingredient manufacturers are heavily investing in clinical trials and in-vitro studies to substantiate efficacy claims, which is crucial for brand differentiation in a crowded consumer market. The rise of digitalization in cosmetic formulation, allowing for faster prototyping and customization based on large datasets, further accelerates the pace of ingredient adoption. The sustained growth of the e-commerce sector for cosmetic finished goods also creates rapid feedback loops, quickly highlighting ingredients that resonate with consumers, thereby driving supplier focus toward ingredients perceived as novel, safe, and backed by scientific data, ultimately propelling the overall market trajectory toward specialized, high-performance bio-actives.

Cosmetic Ingredients Market Executive Summary

The Cosmetic Ingredients Market is currently characterized by a significant transition toward sustainability and personalization, representing the core business trends defining the competitive landscape. Suppliers are prioritizing the development of bio-based and upcycled ingredients to align with stringent environmental, social, and governance (ESG) standards, driven by both regulatory pressures and sophisticated consumer demand. Strategic mergers, acquisitions, and partnerships are prevalent as companies seek to consolidate expertise in specialized ingredient segments, particularly those related to microbiome science and advanced delivery systems. Regional trends underscore the dominance of the Asia Pacific (APAC) market, primarily fueled by massive consumer bases in China and India exhibiting increasing disposable incomes and a strong cultural affinity for skincare routines, often referred to as 'K-Beauty' and 'J-Beauty' influences. Conversely, Europe and North America maintain high market shares due to established regulatory frameworks and high demand for premium, anti-aging, and functional ingredients, particularly in the active ingredients category.

Segment trends reveal that active ingredients, including peptides, vitamins, and natural extracts, are experiencing the highest growth rates, reflecting the consumer shift from passive cosmetic use to performance-driven, treatment-oriented products. Within the functional ingredients segment, sustainable preservatives and advanced emulsifiers, which can accommodate natural oil-rich formulations without compromising stability, are witnessing robust demand. The increasing prevalence of skin sensitivities and allergies has led to heightened scrutiny of synthetic ingredients, accelerating the substitution of traditional chemical compounds with milder, bio-compatible alternatives derived through green chemistry. Furthermore, the makeup segment, while mature, is driving demand for specialized pigment technologies and long-wear agents that meet the requirements of modern, high-definition cosmetic applications, indicating a continuous need for innovation even in established product lines. This dynamic environment necessitates that ingredient manufacturers maintain agility in R&D and supply chain management to capitalize on rapid shifts in consumer preferences.

Financial performance across the sector is strongly linked to intellectual property and regulatory compliance capabilities. Companies that successfully navigate complex global regulatory landscapes, especially concerning novel ingredients, gain a distinct competitive edge. The shift in manufacturing processes towards circular economy models is not merely a marketing strategy but a financial imperative, as sustainable sourcing often mitigates long-term risks associated with raw material volatility and geopolitical instability. Technology integration, particularly AI and machine learning in formulation development and quality control, is enhancing efficiency and reducing the time-to-market for new ingredients. Overall, the market trajectory is highly positive, driven by non-discretionary consumer spending on personal wellness and beauty, solidifying the market's resilience against broader economic fluctuations, provided ingredient suppliers maintain robust innovation pipelines focusing on validated efficacy, safety, and verifiable sustainability credentials, ensuring long-term profitability and market stability.

AI Impact Analysis on Cosmetic Ingredients Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cosmetic Ingredients Market commonly focus on how AI accelerates the discovery of novel molecules, optimizes formulation processes for personalization, and enhances supply chain transparency and traceability. Key user concerns revolve around the ethical deployment of AI in predicting biological effects, the reliability of AI-generated safety profiles, and the potential displacement of traditional R&D roles. The expectation is that AI will dramatically reduce the time and cost associated with identifying efficacious active ingredients by analyzing vast chemical databases and linking molecular structures to biological functions (e.g., anti-inflammatory, antioxidant activity). Furthermore, consumers and brands anticipate that AI will facilitate truly hyper-personalized ingredient blends based on individual skin microbiome data, genetic predispositions, and environmental factors. Overall, the synthesis of user queries highlights AI as a critical transformative tool moving the industry toward data-driven, precision ingredient development, requiring substantial investment in computational infrastructure and specialized data science talent to fully unlock its potential across the value chain, from raw material selection to final product efficacy validation.

- AI accelerates the identification and screening of novel compounds, predicting efficacy and toxicity profiles rapidly.

- Machine learning optimizes complex formulation parameters, balancing sensory attributes, stability, and ingredient compatibility.

- Predictive analytics enables hyper-personalization of ingredient blends tailored to individual consumer genomic or environmental data.

- AI enhances quality control and traceability by monitoring ingredient sourcing and supply chain integrity in real-time.

- Computational chemistry tools aid in designing more sustainable and bio-compatible ingredients, adhering to green chemistry principles.

DRO & Impact Forces Of Cosmetic Ingredients Market

The Cosmetic Ingredients Market is propelled by several robust drivers, primarily the surging global consumer demand for high-performance, active ingredients offering anti-aging, hydration, and skin protection benefits, coupled with the profound shift toward natural, organic, and ethically sourced compounds derived through sustainable processes like green chemistry and biotechnology. Opportunities lie in the unmet demand for highly specific treatments, especially in microbiome-friendly formulations and advanced delivery systems like liposomes and nanoparticles that enhance ingredient penetration and stability. Conversely, market growth is significantly restrained by stringent and continuously evolving global regulatory frameworks (e.g., EU regulations on certain preservatives and UV filters), which necessitate costly re-formulation and lengthy approval processes. Furthermore, volatility in the pricing and supply of natural raw materials, often subject to climate change and geopolitical factors, presents a substantial challenge. The combined impact forces reveal a moderately competitive environment characterized by high bargaining power of suppliers (especially those with proprietary biotech ingredients) and moderate bargaining power of buyers (large CPG companies), emphasizing the need for robust intellectual property protection and diverse sourcing strategies to maintain profitability.

Segmentation Analysis

The Cosmetic Ingredients Market is segmented comprehensively based on the function the ingredient performs, its source (natural vs. synthetic), and the primary application in which it is utilized. Functional segmentation is crucial as it dictates performance and regulatory classification, ranging from basic formulation aids like emollients and thickeners to high-value active ingredients. Source segmentation reflects the dominant market trend favoring natural and organic origins, which impacts pricing and processing methods. Application segmentation highlights the concentration of demand across skincare, haircare, and color cosmetics, with skincare historically dominating the market share and simultaneously driving the highest investment in novel active ingredients due to high consumer spending on treatment-oriented products. Understanding these segmentations is vital for strategic positioning, enabling ingredient manufacturers to target high-growth areas such as sustainable surfactants and biotech-derived peptides.

- By Ingredient Type:

- Active Ingredients (e.g., Anti-aging Agents, UV Filters, Conditioning Agents, Anti-inflammatory Agents, Peptides, Hyaluronic Acid, Vitamins)

- Functional Ingredients (e.g., Surfactants, Emollients, Thickeners, Rheology Modifiers, Colorants, Preservatives, Solvents, pH Adjusters)

- By Source:

- Natural/Herbal Ingredients (e.g., Plant Extracts, Essential Oils, Marine Extracts)

- Synthetic Ingredients (e.g., Petroleum Derivatives, Synthetic Polymers)

- Bio-based/Biotechnology-derived Ingredients (e.g., Fermentation products, Microbiome actives)

- By Application:

- Skincare (e.g., Face care, Body care, Sun care)

- Haircare (e.g., Shampoos, Conditioners, Styling products)

- Color Cosmetics (e.g., Foundations, Lipsticks, Eye makeup)

- Oral Care

- Fragrances

Value Chain Analysis For Cosmetic Ingredients Market

The value chain for the Cosmetic Ingredients Market begins with Upstream Analysis, involving the sourcing and processing of fundamental raw materials. This includes petrochemical derivatives, agricultural raw materials (plants, oils), and increasingly, microorganisms and biotech platforms. R&D facilities dedicated to discovering, synthesizing, and validating novel ingredients are central to this stage. The ingredient suppliers then manufacture and purify these materials, often requiring specialized chemical or biotechnological processes to ensure high purity and efficacy. The middle tier of the chain involves the ingredient distribution network, which includes large-scale international distributors and specialized regional agents. These intermediaries manage logistics, warehousing, regulatory documentation, and provide technical support to finished product manufacturers, handling both high-volume commodities and low-volume, high-value specialty actives. Distribution channels are shifting, with some large ingredient suppliers opting for Direct sales to major multinational cosmetic firms, ensuring proprietary knowledge transfer and stronger supply agreements, while smaller brands rely heavily on Indirect distribution through established chemical distributors.

The Downstream Analysis focuses on the formulators and the finished goods manufacturers—the primary customers for cosmetic ingredients. These companies integrate the purchased ingredients into complex formulations, balancing efficacy, sensory appeal, stability, and cost. This stage involves rigorous testing, quality assurance, and regulatory filing specific to the target market. Increasingly, the downstream segment includes contract manufacturers (CMs) and private label developers who utilize ingredients to create bespoke product lines for smaller, fast-growing brands. The final end of the chain is the retail channel (e-commerce, specialty stores, mass retail, spas), which brings the finished product to the consumer, generating vital feedback that influences future ingredient demand. The effectiveness of the value chain is increasingly dependent on transparency and sustainability claims, linking the consumer back to the ethical sourcing practices implemented upstream. Therefore, successful companies manage the entire chain by investing in digital tracking and certification systems to verify claims regarding natural origin, fair trade, and carbon footprint reduction.

Cosmetic Ingredients Market Potential Customers

The primary potential customers and end-users of cosmetic ingredients are major multinational Fast-Moving Consumer Goods (FMCG) corporations specializing in beauty and personal care, specialized cosmetic manufacturers focused on niche markets (e.g., dermatological, organic, or professional salon products), and contract development and manufacturing organizations (CDMOs). Large corporations like L’Oréal, Estée Lauder, and Unilever represent massive volume buyers, demanding ingredient consistency, scalability, and robust regulatory documentation. Niche brands, driven by consumer trends in clean beauty and personalized wellness, prioritize innovative, highly concentrated active ingredients, often demanding traceable, sustainable, and certified organic sourcing, even if at a premium price point. CDMOs are significant consumers, as they serve as the operational backbone for hundreds of emerging private labels, requiring a broad portfolio of readily available, compliant ingredients for diverse formulation requests. Furthermore, pharmaceutical companies entering the cosmeceutical space also constitute a growing customer base, demanding ingredients with clinically proven efficacy that bridge the gap between cosmetics and medical treatments, highlighting a sophisticated need for ingredients backed by rigorous scientific evidence and clinical data.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 54.0 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Chemical Company, Ashland Inc., Croda International PLC, Evonik Industries AG, Symrise AG, Solvay SA, Clariant AG, Givaudan SA, DSM Nutritional Products, Lubrizol Corporation, Lonza Group AG, Innospec Inc., Momentive Performance Materials Inc., Galaxy Surfactants Ltd., KCC Corporation, Sensient Technologies Corporation, Vantage Specialty Chemicals, Adeka Corporation, Wacker Chemie AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Ingredients Market Key Technology Landscape

The technology landscape for the Cosmetic Ingredients Market is rapidly evolving, driven by the need for enhanced efficacy, sustainability, and consumer safety. Green Chemistry principles are fundamental, focusing on designing chemical products and processes that minimize or eliminate the use and generation of hazardous substances, leading to the adoption of bio-solvents and waste reduction technologies in extraction processes. Biotechnology and Fermentation represent a crucial breakthrough, enabling the scalable and sustainable production of high-value active ingredients, such as specialized peptides, recombinant proteins, and hyaluronic acid, often with greater purity and lower environmental impact compared to traditional sourcing. This technology is particularly favored for producing microbiome-friendly ingredients. Furthermore, Nanotechnology and Advanced Delivery Systems, including liposomes, solid lipid nanoparticles (SLNs), and microencapsulation, are vital for protecting sensitive active ingredients (like Vitamin C or retinol) from degradation and ensuring their targeted, controlled release deep within the skin layers, significantly enhancing product performance and stability, justifying premium pricing and driving R&D focus in specialized segments.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is transforming the R&D pipeline. AI-driven formulation platforms can simulate millions of ingredient combinations and predict the stability, sensory profile, and potential biological activity of new compounds far faster than conventional laboratory methods. This computational approach allows for rapid prototyping and personalization, minimizing resource wastage during the development cycle. Additionally, the increasing reliance on in vitro and ex vivo testing models, including 3D skin models and organ-on-a-chip technology, is replacing traditional animal testing, aligning with global regulatory bans and ethical consumer demands. These advanced testing technologies provide more biologically relevant data on ingredient safety and efficacy, enhancing consumer confidence and regulatory compliance. Collectively, these technologies are moving the industry towards precision cosmetic science, where ingredients are sourced, developed, and formulated with unprecedented speed and accuracy, maintaining high levels of regulatory compliance and meeting the complex demands of the modern consumer base across all regional markets.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, driven by high population density, rising disposable incomes, and cultural emphasis on comprehensive multi-step skincare routines in countries like South Korea, Japan, and China. APAC is the primary hub for the adoption of natural extracts, fermentation-derived ingredients, and advanced sun protection agents, owing to strong local innovative ecosystems and rapid urbanization, necessitating pollution-protection ingredients.

- Europe: Characterized by stringent regulatory oversight (EU Cosmetic Regulation), which drives innovation toward safer, compliant, and sustainable ingredients. Europe holds a leading position in the clean beauty movement and sustainable sourcing, with high demand for certified organic ingredients and ethically produced specialty chemicals. High consumer awareness dictates preference for transparency and scientifically backed claims, supporting growth in anti-aging actives and bio-based alternatives.

- North America: A mature market defined by rapid adoption of technology, particularly in personalized beauty and cosmeceuticals. High R&D spending supports the development of advanced delivery systems and functional actives, especially those targeting specific dermatological conditions. The US market exhibits strong demand for high-end, efficacious ingredients supported by clinical data and transparent labeling, often setting global trends in ingredient acceptance.

- Latin America (LATAM): Exhibits significant growth potential, particularly in Brazil and Mexico, fueled by a young, urban population and high demand for haircare and sun care products due to climatic factors. The market is increasingly shifting towards premium and natural ingredients, mirroring global trends but often favoring locally sourced botanical extracts.

- Middle East and Africa (MEA): Emerging markets showing high growth, driven by increasing affluence and Westernization of beauty standards. Demand is rising for premium color cosmetics, high-performance sun protection, and specialized halal-certified ingredients to meet regional cultural and religious requirements, presenting unique opportunities for specialized ingredient suppliers capable of catering to specific compliance needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Ingredients Market.- BASF SE

- Dow Chemical Company

- Ashland Inc.

- Croda International PLC

- Evonik Industries AG

- Symrise AG

- Solvay SA

- Clariant AG

- Givaudan SA

- DSM Nutritional Products

- Lubrizol Corporation

- Lonza Group AG

- Innospec Inc.

- Momentive Performance Materials Inc.

- Galaxy Surfactants Ltd.

- KCC Corporation

- Sensient Technologies Corporation

- Vantage Specialty Chemicals

- Adeka Corporation

- Wacker Chemie AG

Frequently Asked Questions

Analyze common user questions about the Cosmetic Ingredients market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for growth in the Cosmetic Ingredients Market?

The primary driver is the accelerating consumer demand for high-efficacy, active ingredients, particularly anti-aging agents, peptides, and advanced hydration compounds. This trend is amplified by the simultaneous global shift toward verifiable sustainability, clean beauty, and naturally sourced ingredients derived through advanced biotechnology.

How is biotechnology influencing the sourcing of cosmetic ingredients?

Biotechnology, including fermentation and synthetic biology, enables the sustainable and highly scalable production of complex active ingredients (like specialized proteins or hyaluronic acid) with guaranteed purity and consistency, reducing reliance on environmentally taxing conventional sourcing methods.

Which regional market segment holds the highest growth potential?

The Asia Pacific (APAC) region is projected to hold the highest growth potential, fueled by massive consumer bases in China and India, expanding middle classes, and a deep cultural focus on skincare health and beauty regimes, leading to high consumption of both basic and premium active ingredients.

What are the key regulatory challenges facing ingredient manufacturers?

Key regulatory challenges involve navigating divergent global regulations, such as the stringent EU chemical safety standards and product registration requirements in Asia. Continuous updates and bans on certain legacy preservatives and UV filters necessitate expensive and time-consuming reformulation and regulatory compliance testing globally.

What role does Artificial Intelligence play in ingredient development?

AI is crucial for accelerating R&D by predicting molecular efficacy, optimizing complex formulation matrices, and ensuring quality control. It significantly reduces the time-to-market for novel ingredients by analyzing vast datasets and simulating biological activity, moving the industry toward precision formulation.

The substantial growth in the Cosmetic Ingredients Market is inextricably linked to technological advances that support the core consumer shift toward transparent, high-performance, and environmentally responsible products. The demand for bio-based and multifunctional ingredients is not a transient trend but a fundamental restructuring of the supply chain, demanding significant capital investment in green chemistry and advanced biological synthesis platforms. Ingredient suppliers must focus on securing intellectual property related to novel actives and establishing robust, verifiable supply chain traceability to meet the rigorous demands of both regulators and ethically conscious consumers. Failure to adapt to these sustainability metrics and transparency requirements will likely lead to market stagnation for traditional synthetic suppliers. The overall market landscape suggests a future dominated by specialized ingredients offering clinically validated benefits, reinforcing the high value placed on scientific rigor and ethical sourcing throughout the global cosmetic ecosystem.

Furthermore, the competitive intensity among the top-tier ingredient providers continues to rise, necessitating strategic mergers and acquisitions aimed at capturing niche technologies, such as advanced delivery systems or proprietary fermentation strains. This consolidation is a direct response to the pressure from large cosmetic brands seeking comprehensive solution providers capable of handling global supply chains and complex regulatory submissions. Small and medium enterprises (SMEs) can differentiate themselves by focusing on ultra-specialized botanical extracts or unique bio-actives that appeal to the rapidly growing indie beauty segment, which values novelty and local sourcing. Success in this environment requires not only technical excellence but also sophisticated digital engagement to communicate the complex science and sustainability story of ingredients directly to the downstream consumers, thereby influencing brand preference and ingredient demand from the ground up, a strategy known as ingredient branding.

Future projections for the market highlight the increasing importance of personalized medicine approaches transitioning into cosmetic science, driving demand for ingredients that can be customized based on genetic markers or localized environmental exposure data. This move toward precision cosmetology relies heavily on the aforementioned AI capabilities for rapid formulation adjustments. Moreover, the focus on the skin microbiome, which treats the skin not just as a barrier but as a complex ecosystem, is creating entirely new ingredient segments, specifically postbiotics and prebiotics, designed to support microbial balance. Ingredient manufacturers prepared to invest in these emerging scientific domains—microbiome, personalized formulation, and advanced sustainable chemistry—are best positioned to capture the highest market growth and secure long-term profitability within the dynamic global Cosmetic Ingredients Market over the forecast period of 2026–2033, ensuring the market maintains its positive growth momentum despite intermittent economic headwinds.

The regulatory environment in regions like North America, while less prescriptive than the EU, is moving towards increased oversight, particularly regarding ingredient safety and labeling claims. The Modernization of Cosmetics Regulation Act (MoCRA) in the United States signals a shift toward mandatory registration, facility reporting, and stricter safety substantiation, which requires ingredient suppliers to provide comprehensive toxicology data to their customers. This harmonization, though gradual, adds complexity but also provides a level playing field for companies committed to safety and compliance, driving out non-compliant or questionable ingredients from the supply chain. For global players, maintaining a master regulatory file that meets the strictest common denominator among key regions (EU, US, China) becomes a strategic necessity for market access and efficiency. This constant regulatory evolution ensures that ingredient innovation is inherently linked to safety and sustainability standards, further validating the premium placed on high-quality, fully documented raw materials, thereby reinforcing barriers to entry for new, smaller suppliers lacking comprehensive compliance infrastructure.

Analyzing the competitive landscape reveals that large chemical conglomerates leverage their extensive portfolio of commodity ingredients (like surfactants and basic emollients) to cross-subsidize their specialty active ingredients business, where margins are significantly higher. Mid-sized specialty ingredient companies, often focused solely on bio-actives or specialized delivery technologies, rely heavily on intellectual property protection and proprietary manufacturing processes to maintain their competitive edge against these larger entities. The acquisition strategy focuses on companies possessing unique extraction technologies, novel fermentation platforms, or established clinical data on next-generation ingredients. For instance, companies that possess proven expertise in marine biotechnology or specific plant cell culture techniques are highly valued targets, as these technologies represent the frontier of sustainable ingredient sourcing and development. The pressure on pricing remains acute in the functional ingredients segment (e.g., standard preservatives and emulsifiers), where global sourcing and manufacturing efficiency are critical, while price inelasticity is observed in the high-performance active ingredient segment, reflecting the scarcity and scientific complexity of these compounds.

The technological adoption rate is fastest in the research phase, where high-throughput screening and AI modeling rapidly identify promising candidates. However, the scale-up and commercialization phase often faces bottlenecks related to compliance and Good Manufacturing Practice (GMP) requirements, especially for complex biological ingredients. The industry is responding by investing heavily in modular and flexible manufacturing plants that can quickly switch between producing different bio-based ingredients, enhancing supply chain responsiveness to fluctuating consumer trends. Furthermore, the push for circularity means incorporating ingredients derived from waste streams (upcycled ingredients), requiring novel processing technologies to ensure safety and performance standardization. This dedication to incorporating circular economy principles is not just an environmental obligation but also a crucial risk mitigation strategy against raw material scarcity and price inflation, driving further technological investment into waste valorization techniques. These dynamics highlight the critical role of technology and robust R&D infrastructure in shaping market dominance and long-term viability in the highly competitive and innovation-driven cosmetic ingredients sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager