Cosmetic Kaolin Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434121 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Cosmetic Kaolin Powder Market Size

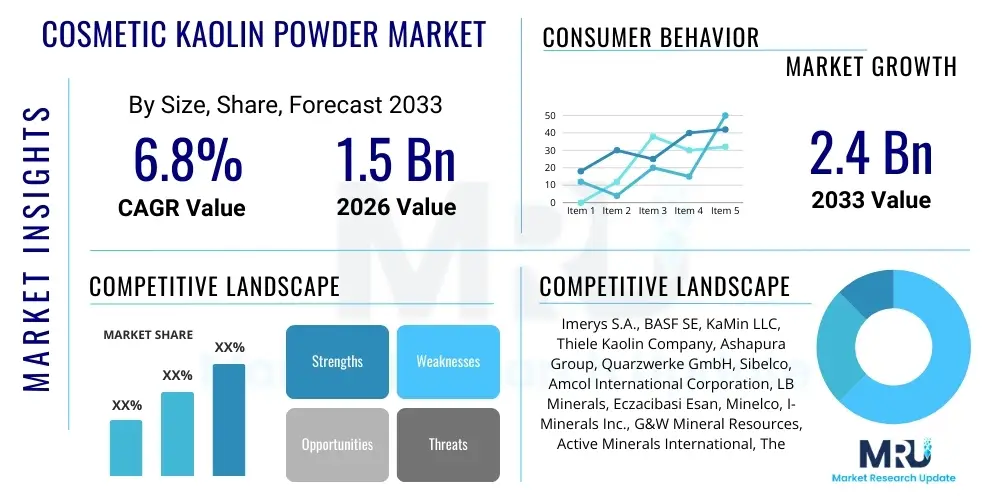

The Cosmetic Kaolin Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

Cosmetic Kaolin Powder Market introduction

The Cosmetic Kaolin Powder Market encompasses the global trade and utilization of refined hydrous aluminum silicate, commonly known as kaolinite clay, specifically processed for application in personal care and beauty formulations. Kaolin, celebrated for its high purity, soft texture, and absorbent properties, serves as a fundamental ingredient across diverse cosmetic products, including facial masks, foundations, powders, soaps, and specialized skincare treatments. The market's growth is fundamentally linked to the enduring consumer preference for natural, mineral-based ingredients that offer functional benefits such as sebum absorption, detoxification, texture enhancement, and improved product adherence.

Product description highlights high-quality cosmetic-grade kaolin, which undergoes stringent purification processes to ensure minimal heavy metal contamination, consistent particle size distribution, and superior whiteness. This grade of kaolin is non-abrasive and chemically inert, making it suitable for sensitive skin applications. Major applications include its role as a filler and pigment extender in makeup, an active ingredient in deep-cleansing masks, and a rheology modifier in emulsions. Its functional versatility, ranging from controlling oiliness in oily skin formulations to providing structure in anhydrous products, firmly positions kaolin as a cornerstone material in the cosmetic industry.

Key benefits driving market adoption include its excellent oil absorption capacity, which is crucial for mattifying products and combating acne; its gentle exfoliating properties; and its ability to soothe irritated skin. Driving factors extend beyond its natural origin to encompass the rapid expansion of the organic and clean beauty movements, particularly in developed economies. Furthermore, technological advancements in micronization and surface treatment techniques are creating enhanced kaolin derivatives that offer improved blendability and sensory profiles, thus continuously widening the application scope within innovative cosmetic product development globally.

Cosmetic Kaolin Powder Market Executive Summary

The global Cosmetic Kaolin Powder Market is experiencing robust expansion, primarily fueled by the accelerating shift towards natural and mineral-based personal care products and the rising prevalence of skin issues requiring specialized absorbent ingredients. Business trends indicate a strong focus on supply chain transparency and sustainable sourcing, pushing manufacturers to invest in environmentally responsible mining and processing techniques to meet rigorous consumer and regulatory demands. Regional trends highlight Asia Pacific as the fastest-growing market, propelled by high consumption rates of facial care products, notably sheet masks and specialized clay masks, alongside significant domestic production capabilities in countries like China and India. The mature markets of North America and Europe maintain a high adoption rate, driven by premium product segments focusing on anti-pollution and detoxifying formulations.

Segments trends reveal that the consumption of calcined kaolin, favored for its superior whiteness and improved oil absorption capacity, is witnessing substantial growth, though hydrous kaolin remains the dominant form due to its lower cost and ease of processing. Within the application segment, facial masks hold the largest market share, leveraging kaolin’s detoxifying and oil-regulating properties. However, significant opportunities are emerging in color cosmetics, where micronized kaolin is increasingly utilized to enhance the finish, texture, and longevity of foundation and pressed powders. The competitive landscape is characterized by moderate fragmentation, with key players focusing on strategic acquisitions, capacity expansion, and securing certifications (e.g., COSMOS, Ecocert) to strengthen market credibility and appeal to conscious consumers.

Overall, the market trajectory is characterized by innovation aimed at enhancing functional performance—specifically, developing ultra-fine particle sizes for seamless integration into light-texture formulations—while adhering to increasing regulatory scrutiny regarding mineral purity and traceability. Investment flows are concentrated on optimizing logistics and refining processes to maintain the high quality required for cosmetic applications, differentiating premium cosmetic-grade kaolin from industrial grades. The market resilience is supported by the staple nature of kaolin in classic beauty routines and its adaptability to emerging beauty trends, ensuring sustained demand throughout the forecast period.

AI Impact Analysis on Cosmetic Kaolin Powder Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Cosmetic Kaolin Powder Market generally revolve around how AI can optimize sourcing and quality control, predict demand spikes based on evolving consumer trends, and streamline formulation development utilizing kaolin. Users are primarily concerned with whether AI tools can ensure consistent mineral purity across batches, given the natural variations in mined materials. They also seek to understand AI's role in accelerating the discovery of new kaolin derivatives or optimizing particle treatment processes (e.g., micronization) to achieve specific sensory attributes required by modern, light-texture cosmetic products. Key themes center on operational efficiency, predictive analytics for supply chain stability, and personalized product formulation driven by machine learning algorithms analyzing vast sets of skin data and material science parameters.

AI's primary influence is manifesting in enhancing operational efficiencies throughout the kaolin supply chain, starting from geological surveys to refined product delivery. Machine learning models are now being deployed to analyze spectroscopic data during the mining and beneficiation phases, allowing processors to rapidly identify and isolate high-purity kaolin deposits suitable for cosmetic grading, thereby reducing waste and ensuring feedstock quality consistency. This application of AI significantly mitigates the risk associated with natural mineral variation, a persistent challenge in the market. Furthermore, AI-driven predictive maintenance in processing plants minimizes downtime and optimizes energy consumption, aligning with the industry's increasing focus on sustainable production practices, which is a major purchasing criterion for large cosmetic manufacturers.

In the realm of formulation and consumer demand, AI algorithms are analyzing social media trends, sales data, and ingredient correlations to predict future demand for specific kaolin applications, such as mattifying agents versus texture enhancers. Cosmetic companies are leveraging AI to simulate the interaction of kaolin powder with other ingredients (e.g., polymers, oils) at a molecular level, enabling the rapid development of innovative cosmetic bases that utilize kaolin more effectively. This dramatically cuts down the time required for R&D trials, allowing manufacturers to quickly adapt kaolin treatments to fit niche market requirements, such as ultra-fine powders for aerosol application or hybrid formulations combining kaolin with botanical extracts, thus driving product innovation and market responsiveness.

- AI optimizes geological sourcing and selection of high-purity kaolin raw materials using spectral analysis.

- Machine learning improves predictive quality control, ensuring consistent particle size and mineral composition in refined powder batches.

- AI algorithms analyze global cosmetic trends to forecast demand for specific kaolin functionalities (e.g., oil absorption, texture).

- Automation and robotics, guided by AI, enhance precision in micronization and surface treatment processes.

- AI-driven simulation tools accelerate R&D by modeling kaolin interaction in complex cosmetic formulations (e.g., emulsions, anhydrous products).

- Predictive analytics optimize inventory management and supply chain logistics, minimizing risks associated with geopolitical disruptions.

- AI supports sustainability initiatives by optimizing energy use during kaolin processing and waste reduction.

DRO & Impact Forces Of Cosmetic Kaolin Powder Market

The Cosmetic Kaolin Powder Market is propelled by several robust drivers, primarily centered around the consumer-led demand for natural, clean-label ingredients and the excellent functional attributes of kaolin in diverse cosmetic applications. Restraints include regulatory complexities concerning mineral sourcing and heavy metal content, which necessitates rigorous and costly purification processes, alongside volatility in energy and transportation costs impacting global supply chains. Opportunities lie in developing specialized, high-performance derivatives of kaolin, such as customized coated powders and ultra-light grades, catering to premium and specialized dermatological segments. These forces interact dynamically: while regulatory restraints raise operational costs, they simultaneously drive opportunities for companies investing in advanced purification technologies, ultimately raising the barriers to entry and consolidating the market around high-quality suppliers.

Key drivers include the global expansion of the skincare market, particularly the increasing popularity of facial masks and deep cleansing products, which heavily rely on kaolin's absorbent and detoxifying properties. The rise of organic and vegan cosmetic brands further cements kaolin’s market position as it is naturally sourced and minimally processed. Conversely, the market faces restraints due to concerns over supply chain ethics and the environmental impact of mining operations, necessitating substantial investments in sustainable practices and land rehabilitation. Furthermore, the availability and competitive pricing of synthetic alternatives, such as specialized silicas or talc replacements, pose a moderate threat, particularly in price-sensitive segments, although kaolin’s specific sensory profile is often difficult to replicate synthetically.

The impact forces are largely shaped by technological innovation and consumer perception. The bargaining power of buyers (large cosmetic houses) is high, driving intense pressure on suppliers for consistent quality, purity certifications, and competitive pricing. The threat of substitutes is moderate, mitigated by the functional superiority of premium kaolin grades. New opportunities stem from utilizing kaolin in innovative applications, such as haircare products (for oil control) and specialized baby care powders, areas where its gentle, absorbent nature provides distinct advantages. Successful market navigation requires suppliers to continuously optimize beneficiation and purification techniques while effectively communicating the sustainability and traceability of their product, turning stringent regulatory requirements into a competitive differentiator.

- Drivers:

- Growing global demand for natural and mineral-based cosmetic ingredients.

- High efficacy of kaolin in sebum absorption, detoxifying masks, and mattifying formulations.

- Expansion of the clean beauty and organic personal care movements globally.

- Versatility as a functional filler, pigment extender, and texture enhancer in color cosmetics.

- Restraints:

- Stringent regulatory requirements regarding heavy metal content and mineral purity (e.g., EU and FDA regulations).

- Supply chain volatility and logistics costs associated with global mineral sourcing and distribution.

- Environmental concerns related to mining operations and the necessity for sustainable reclamation.

- Competitive pressure from synthetic alternatives and other natural clays (e.g., bentonite, illite).

- Opportunities:

- Development of customized, surface-treated kaolin powders for enhanced performance (e.g., hydrophobicity, blendability).

- Expansion into niche markets like specialized dermatological treatments and eco-friendly packaging materials.

- Geographic expansion into rapidly developing economies in Asia Pacific and Latin America.

- Leveraging advanced micronization techniques to create ultra-fine grades suitable for high-end, luxury cosmetics.

- Impact Forces:

- Bargaining Power of Buyers (High) due to large volume procurement by global cosmetic corporations.

- Bargaining Power of Suppliers (Moderate) influenced by the few large players controlling high-quality cosmetic-grade reserves.

- Threat of New Entrants (Low to Moderate) due to high capital investment required for purification technology and regulatory compliance.

- Threat of Substitutes (Moderate) depending on application; lower in high-end masks, higher in basic fillers.

Segmentation Analysis

The Cosmetic Kaolin Powder Market is meticulously segmented based on product type, application, and geography, reflecting the diverse needs of the global personal care industry. Product segmentation typically differentiates between hydrous kaolin, which is the standard purified form, and calcined kaolin, which is heat-treated to improve whiteness, brightness, and oil absorption capacity. The application segment is broad, covering everything from highly functional deep-cleansing facial masks to subtle texture modifiers in color cosmetics and general skincare bases. Analyzing these segments provides crucial insights into product specialization and allows manufacturers to strategically align their offerings with specific, high-growth consumer needs, ensuring market penetration across the entire beauty product lifecycle.

Within the product types, hydrous kaolin currently dominates the market volume due to its natural properties, ease of processing, and cost-effectiveness, making it a staple ingredient in mass-market and mid-range products, particularly powders and standard mask formulations. However, calcined kaolin is exhibiting faster value growth. Its superior performance characteristics, such as increased light scattering and higher chemical inertness, make it indispensable for premium foundations, high-SPF sunscreens, and advanced color cosmetics where whiteness and opacity are crucial. Suppliers are increasingly focusing on offering specialized calcined grades customized for specific performance metrics like reduced density or enhanced pH stability.

Application analysis confirms that facial masks remain the primary consumption driver, leveraging kaolin’s detoxifying abilities. Nevertheless, the fastest emerging application areas are advanced skincare products, including specialized anti-aging and anti-acne spot treatments, and the expansive category of color cosmetics. In color cosmetics, highly micronized kaolin helps in binding pigments, reducing product transfer, and achieving a desirable matte finish without drying the skin. The geographic segmentation confirms the mature consumption patterns in North America and Europe, contrasted by the high-growth, manufacturing-intensive dynamics observed across the Asia Pacific region, particularly for Asian beauty product innovations.

- By Product Type:

- Hydrous Kaolin

- Calcined Kaolin

- Surface-Treated Kaolin Derivatives

- By Application:

- Facial Masks and Cleansers

- Color Cosmetics (Foundations, Powders, Blushes, Eyeshadows)

- Skincare (Lotions, Creams, Specialized Treatments)

- Haircare Products (Dry Shampoos, Scalp Treatments)

- Soaps and Bath Products

- By Grade:

- Standard Cosmetic Grade

- Pharmaceutical Grade (Ultra-High Purity)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, ASEAN Countries)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Cosmetic Kaolin Powder Market

The value chain for the Cosmetic Kaolin Powder Market begins with extensive upstream analysis focused on the extraction and initial processing of kaolin clay. This phase involves geological surveying, mining (typically open-pit), and preliminary beneficiation processes like crushing, washing, and blending to remove initial impurities and ensure compositional consistency of the raw material. Critical factors at this stage include securing high-quality, low-contaminant reserves and managing environmental compliance. The efficiency and environmental impact of the mining operations directly influence the final cost structure and the sustainability profile of the end product, which is a growing concern for downstream cosmetic manufacturers and consumers.

The midstream phase constitutes the crucial refinement and manufacturing steps, where raw kaolin is transformed into cosmetic-grade powder. This involves sophisticated processes such as wet processing (slurry making), ultra-purification (chemical leaching and magnetic separation to remove heavy metals and iron oxides), drying, and micronization to achieve the required particle size distribution (PSD) for aesthetic applications. Calcination, a heat-treatment step, may also be applied here to alter the mineral structure and enhance performance characteristics like whiteness and oil absorption. Investment in advanced processing technology, such as air classification and surface treatment capabilities, dictates the supplier's ability to serve high-end, specialized cosmetic segments demanding ultra-fine and tailored powders.

Downstream analysis involves the distribution channel, which spans direct sales to major cosmetic conglomerates, indirect distribution through specialized chemical and ingredient distributors, and subsequent integration into finished cosmetic products. Direct distribution ensures better control over quality and pricing for high-volume transactions, while distributors offer essential logistical support and market penetration for smaller cosmetic labs and regional manufacturers. Final buyers, the cosmetic companies, then formulate and package the end products. The market’s integrity relies heavily on traceability and certification throughout this chain—from mine to formulation—ensuring compliance with international cosmetic safety standards and facilitating transparent communication regarding ingredient sourcing and purity to the end consumer.

Cosmetic Kaolin Powder Market Potential Customers

Potential customers for cosmetic kaolin powder are primarily situated within the global personal care and beauty manufacturing ecosystem, spanning multinational conglomerates to specialized niche brand developers. The largest volume consumers are major global cosmetic houses that require massive, consistent supplies for their staple product lines, including foundational makeup (powders, liquid foundations) and high-volume cleansing and masking lines. These large buyers prioritize suppliers who can guarantee strict quality control, global logistical capacity, and competitive long-term contracts, often preferring direct procurement relationships to maintain supply chain efficiency and control over intellectual property related to formulation.

A second significant customer segment comprises contract manufacturers and private label companies specializing in producing cosmetics for various brands. These customers require flexibility in purchasing varying grades of kaolin, often needing smaller batch sizes tailored to specific brand requirements, necessitating strong relationships with ingredient distributors rather than direct sourcing. The growth of independent and direct-to-consumer (DTC) beauty brands has amplified the demand from this segment, as these companies seek agile sourcing solutions for innovative or natural product launches, placing a high value on certified organic or sustainably sourced kaolin.

Furthermore, specialized dermatological and pharmaceutical companies represent a niche but high-value customer base. These buyers utilize ultra-high purity, often pharmaceutical-grade, kaolin for medicated skin treatments, specialized topical applications, and baby care products where purity and safety standards are exceptionally stringent. For this segment, compliance with pharmacopeia standards and rigorous testing for microbial and heavy metal contamination is the foremost purchasing criterion, outweighing cost considerations. The expanding wellness and spa industry also serves as a significant buyer, incorporating kaolin into premium, luxury therapeutic treatments and professional-grade body masks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Imerys S.A., BASF SE, KaMin LLC, Thiele Kaolin Company, Ashapura Group, Quarzwerke GmbH, Sibelco, Amcol International Corporation, LB Minerals, Eczacibasi Esan, Minelco, I-Minerals Inc., G&W Mineral Resources, Active Minerals International, The Clay Company, Merck KGaA, Universal Minerals, SCR-Sibelco, Burgess Pigment Company, ECC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Kaolin Powder Market Key Technology Landscape

The technological landscape of the Cosmetic Kaolin Powder Market is continuously evolving, driven by the need for superior purity, enhanced functional performance, and stringent adherence to cosmetic standards. The primary technological focus centers on advanced beneficiation and purification techniques designed to remove trace elements and heavy metals, crucial for meeting international regulatory limits. Technologies such as high-gradient magnetic separation (HGMS) and selective flocculation are essential for improving the whiteness and reducing the iron oxide content in the raw kaolin, thereby elevating its cosmetic grade. Furthermore, sophisticated control systems are integrated into processing lines to monitor particle morphology in real-time, ensuring consistency across large production batches, which is vital for maintaining formulation stability in complex cosmetic products.

A second critical area of innovation involves particle size reduction and surface modification technologies. Micronization, utilizing jet mills and mechanical classifiers, produces ultra-fine kaolin powders (often sub-micron level) that improve texture, blendability, and feel in lightweight cosmetic formulations, particularly foundations and finishing powders. This ultra-fine particle size reduces the gritty texture traditionally associated with clay ingredients and minimizes the 'white cast' effect. Complementary to this is surface treatment technology, where kaolin particles are coated with substances like silanes, silicones, or fatty acids. This treatment enhances hydrophobicity, making the kaolin compatible with oil-based formulations and improving its binding properties in pressed powders, thereby extending wear time and improving moisture resistance.

The latest technological advancements are leaning towards sustainable processing methods, including dry processing techniques that reduce water usage, and energy-efficient calcination processes (if required) that minimize the market’s carbon footprint. The adoption of specialized analytical technologies, such as X-ray fluorescence (XRF) and atomic absorption spectroscopy (AAS), for real-time quality assurance ensures that every batch of cosmetic kaolin meets the required purity and consistency specifications. These technological investments are critical for suppliers aiming to secure long-term contracts with premium cosmetic brands that demand both high-performance ingredients and verifiable sustainability credentials, fundamentally shaping the competitive edge in the high-grade segment of the market.

Regional Highlights

The global Cosmetic Kaolin Powder Market demonstrates significant regional variation in consumption patterns, regulatory environments, and growth trajectories. North America, particularly the United States, represents a mature but highly influential market, characterized by high consumer spending on premium and specialized skincare, including detoxifying masks and professional-grade makeup. The region’s demand is driven by the clean beauty movement, where transparency in ingredient sourcing and stringent quality standards are paramount. North American consumers frequently seek multifunctional products, driving demand for specialized, surface-treated kaolin grades used in advanced formulations that offer both texture enhancement and oil control. The regulatory environment, although generally robust, pushes suppliers toward high-purity, low-heavy-metal kaolin, solidifying the market position of international suppliers capable of providing extensive testing and certification documentation.

Europe mirrors the maturity of North America but is distinguished by even stricter cosmetic regulations, notably under REACH and specific EU directives concerning mineral purity and potential trace contaminants. European demand is robust across both the mass market and luxury sectors. Germany, France, and the UK are major hubs for cosmetic innovation and manufacturing, favoring suppliers who demonstrate sustainable sourcing practices and offer full traceability. The trend here is towards minimalist formulations utilizing highly refined kaolin to achieve maximum efficacy with minimal ingredients, aligning with the growing consumer desire for simple, yet powerful, skincare routines. This regional focus on sustainability and purity necessitates significant investment in advanced European processing facilities or importing certified materials.

Asia Pacific (APAC) stands out as the engine of market growth, exhibiting the highest consumption volume and the most rapid expansion rate, primarily fueled by massive consumer bases in China, India, Japan, and South Korea. This region's demand is characterized by the expansive use of facial masks (wash-off and overnight varieties), significant growth in color cosmetics consumption, and the prevalence of K-beauty and J-beauty trends, which emphasize meticulous skincare routines. APAC is also a major global manufacturing hub, driving internal demand for cost-effective, high-volume kaolin supplies. While purity is important, the competitive landscape often emphasizes supply consistency and competitive pricing, though premium brands in Japan and South Korea demand the highest functional grades for their advanced product lines. The region’s developing economies also offer substantial untapped potential for mass-market penetration.

Latin America and the Middle East & Africa (MEA) represent emerging markets with substantial potential. In Latin America, Brazil is a key market, driven by its large domestic cosmetic industry and strong cultural emphasis on personal grooming. Demand here is increasing for kaolin in makeup and hair care products, often requiring formulations adapted to specific climatic conditions. The MEA region, particularly the GCC countries and South Africa, shows growing demand correlated with increasing disposable income and urbanization. This region is starting to see an influx of international cosmetic brands and local development of beauty products adapted for local preferences, often requiring high-absorbency kaolin due to hot and humid climates. Growth in these regions depends heavily on improving economic stability and the establishment of local manufacturing and distribution networks.

- Asia Pacific (APAC): Dominant in volume and fastest-growing region, driven by mass adoption of facial masks, booming color cosmetics, and K-Beauty/J-Beauty influence. Key countries: China, India, South Korea.

- North America: Mature market focusing on premium, clean label, and specialized functional kaolin (e.g., surface-treated for anti-pollution products). Driven by US demand for high-end skincare.

- Europe: Characterized by highly stringent regulatory standards (REACH). Strong demand for traceable, sustainably sourced kaolin in both luxury and mass markets, particularly in Germany and France.

- Latin America: Emerging growth, led by Brazil's large domestic beauty market. Increasing consumption of kaolin in makeup and localized climate-adapted products.

- Middle East & Africa (MEA): Growth tied to rising disposable income and urbanization. High potential for kaolin in oil-control and climate-adapted formulations in the GCC region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Kaolin Powder Market.- Imerys S.A.

- BASF SE

- KaMin LLC

- Thiele Kaolin Company

- Ashapura Group

- Quarzwerke GmbH

- Sibelco

- Amcol International Corporation (now part of Minerals Technologies Inc.)

- LB Minerals

- Eczacibasi Esan

- Minelco

- I-Minerals Inc.

- G&W Mineral Resources

- Active Minerals International

- The Clay Company

- Merck KGaA (as a distributor and specialty chemical provider)

- Universal Minerals

- SCR-Sibelco

- Burgess Pigment Company

- ECC (English China Clays, historical influence and current operational lineage)

Frequently Asked Questions

Analyze common user questions about the Cosmetic Kaolin Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is cosmetic-grade kaolin and how does it differ from industrial kaolin?

Cosmetic-grade kaolin is highly refined hydrous aluminum silicate clay that undergoes rigorous purification processes, including magnetic separation and chemical leaching, to remove impurities, particularly heavy metals like lead and arsenic, which must meet stringent regulatory limits for safety. It is also characterized by consistent, ultra-fine particle size distribution and high whiteness, essential for seamless integration and aesthetic performance in skincare and makeup formulations, distinguishing it from lower-purity, larger-particle industrial grades.

What are the primary functional benefits of using kaolin powder in beauty products?

The primary functional benefits include superior oil and sebum absorption, which provides an effective mattifying effect crucial for oily skin products and foundations. Kaolin also acts as a detoxifying agent, gently drawing out impurities and reducing inflammation, making it ideal for facial masks. Furthermore, it serves as an excellent functional filler and rheology modifier, improving the texture, bulk, and adherence of color cosmetics like powders and blushes.

Is cosmetic kaolin a sustainable or environmentally friendly ingredient?

Kaolin is a naturally sourced mineral, which contributes to its appeal in the clean beauty movement. However, its sustainability depends heavily on the mining and processing practices employed by the supplier. Leading market players are increasingly adopting sustainable mining techniques, focusing on land reclamation, minimizing water usage (e.g., dry processing), and reducing the energy intensity of purification processes to ensure a lower environmental footprint and maintain ingredient traceability and ethical sourcing certifications.

How do calcined kaolin and hydrous kaolin differ in cosmetic applications?

Hydrous kaolin is the purified, natural form, known for its soft texture and good absorbency, suitable for standard masks and fillers. Calcined kaolin is heat-treated to remove crystalline water, resulting in superior whiteness, increased opacity, and enhanced oil absorption capacity. Calcined kaolin is generally preferred for high-end color cosmetics, especially foundations and sunscreens, where brightness, opacity, and performance longevity are critical factors.

Which regions are driving the growth of the Cosmetic Kaolin Powder Market?

The Asia Pacific (APAC) region is currently the primary driver of market growth, owing to the high consumption of skincare, particularly facial masks, and the expanding manufacturing base in countries like China, India, and South Korea. Mature markets, including North America and Europe, also contribute significantly to market value, driven by demand for premium, high-purity, and specialized kaolin derivatives utilized in advanced clean beauty and anti-pollution formulations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager