Cosmetic Medical Absorbent Cotton Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433037 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Cosmetic Medical Absorbent Cotton Market Size

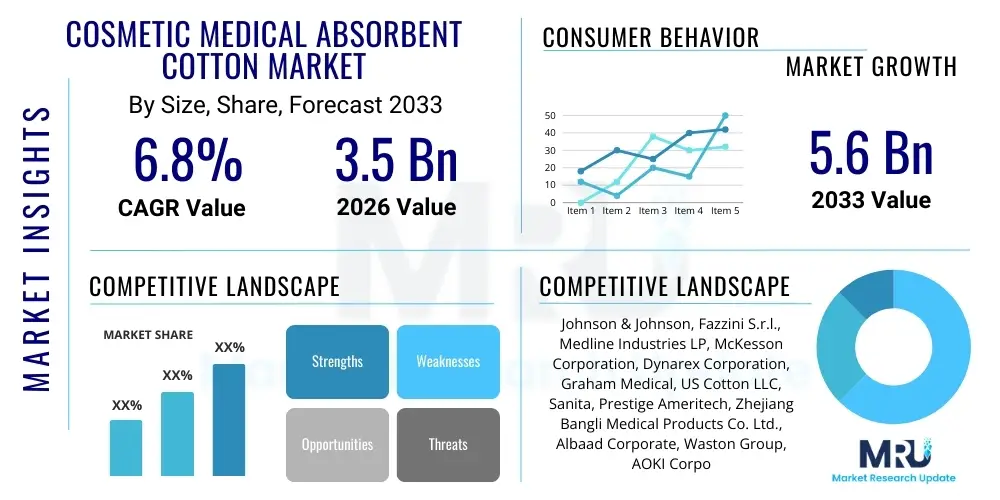

The Cosmetic Medical Absorbent Cotton Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

The robust growth trajectory is primarily fueled by the escalating demand for high-quality, sterile absorbent materials used in professional cosmetic procedures and routine medical applications. Increased disposable income across emerging economies, coupled with heightened awareness regarding skin health and aesthetic treatments, drives consistent uptake of premium absorbent cotton products. Furthermore, the expansion of beauty clinics, dermatology centers, and surgical facilities globally necessitates a reliable supply chain for medical-grade consumables, positioning absorbent cotton as a fundamental component of the healthcare and beauty industries.

Technological advancements in cotton processing, sterilization techniques, and product form factor—such as the development of highly customized, lint-free cotton pads and swabs—further contribute to market expansion. Consumers and medical professionals are increasingly prioritizing products that offer superior absorption, softness, and purity, particularly in sensitive cosmetic applications like toner application, makeup removal, and post-procedure wound care. The shift towards sustainable and organic cotton sources also presents a significant growth avenue, appealing to environmentally conscious brands and consumers, thereby supporting both volume and value growth throughout the forecast period.

Cosmetic Medical Absorbent Cotton Market introduction

The Cosmetic Medical Absorbent Cotton Market encompasses the global production and distribution of purified cotton materials specifically engineered for medical procedures, cosmetic applications, and personal hygiene. These products are crucial for cleansing, absorbing exudates, applying topical agents, and protecting minor wounds. The classification of the cotton material as "medical" implies adherence to stringent purity, sterility, and absorption standards mandated by regulatory bodies like the FDA and EMA, ensuring safety and efficacy when used in clinical or post-procedure environments. Cosmetic absorbent cotton, while often meeting similar purity levels, is tailored for aesthetic purposes, such as precise makeup application, removal of nail polish, and facial toning.

Key products within this sector include cotton balls, cotton pads (round and rectangular), surgical cotton rolls, cotton swabs, and specialty dental rolls. Major applications span professional settings—including hospitals, specialized clinics (dermatology, plastic surgery), and aesthetic centers—as well as the substantial consumer segment focused on at-home beauty and first- aid routines. The core benefit of these materials is their high absorbency, non-irritating texture, and ability to deliver active ingredients effectively or efficiently remove impurities. This dual-market function, serving both critical medical needs and pervasive cosmetic demands, ensures stable market relevance.

Driving factors for the market’s growth are multifaceted, rooted in demographic shifts and healthcare infrastructure expansion. An aging global population increases demand for medical procedures, while the rising popularity of non-invasive cosmetic treatments fuels the consumption of high-quality cosmetic consumables. Furthermore, increased focus on sanitation and infection control in both developed and developing regions mandates the use of disposable, sterile absorbent materials, cementing the market’s positive trajectory. Product innovation focusing on enhanced softness, biodegradability, and lint-free properties also continues to stimulate demand.

Cosmetic Medical Absorbent Cotton Market Executive Summary

The Cosmetic Medical Absorbent Cotton Market is characterized by steady expansion driven by escalating global healthcare expenditure, the burgeoning aesthetic medicine industry, and robust consumer reliance on personal care products. Business trends indicate a strong move toward vertical integration among key manufacturers, aiming to secure raw material supply (cotton cultivation) and control quality from fiber processing to final sterilization. There is a marked trend towards premiumization, where consumers and medical institutions are willing to pay higher prices for certified organic, hypoallergenic, and technologically advanced products, such as those treated for enhanced structural integrity or specific absorption rates. Furthermore, sustainability has emerged as a critical business imperative, pushing companies to invest in biodegradable packaging and ethically sourced cotton, thus influencing procurement decisions across institutional buyers.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, underpinned by rapidly expanding economies, increased urbanization, and the associated growth in the healthcare and personal grooming sectors, particularly in China and India. North America and Europe, while mature markets, maintain high revenue shares due to established regulatory frameworks mandating high-quality medical consumables and a strong prevalence of advanced cosmetic procedures. Regional trends also reflect variations in product preference; for instance, Europe shows higher adoption of specialized cotton pads for facial care, while developing nations often see higher volume consumption of basic cotton rolls and balls for generalized first-aid and hygiene purposes. Regulatory harmonization efforts across regions are streamlining market entry for international players, but local certifications remain crucial for penetrating specific national healthcare systems.

Segment trends highlight the dominance of the Hospitals and Clinics application segment, driven by large-scale procurement of surgical and medical cotton for wound dressing and clinical preparation. However, the Cosmetic Centers and At-Home Care segments are exhibiting faster growth rates, catalyzed by social media influence, self-care trends, and the availability of sophisticated, consumer-friendly absorbent products. In terms of material, conventional cotton still holds the largest share due to cost efficiency, but the organic cotton sub-segment is demonstrating the highest CAGR, spurred by growing consumer preference for natural, chemical-free products, particularly for sensitive skin applications. Companies focusing on sterile packaging and customizable product shapes are best positioned to capture market share within the competitive landscape.

AI Impact Analysis on Cosmetic Medical Absorbent Cotton Market

Common user questions regarding AI's impact on the Cosmetic Medical Absorbent Cotton Market frequently revolve around efficiency gains in manufacturing, optimization of supply chain logistics, and AI’s role in material quality assessment. Users inquire whether AI can predict demand fluctuations more accurately to prevent stockouts in high-demand surgical settings or overstocking of seasonal cosmetic lines. Significant concerns center on the potential for AI-driven automation to disrupt traditional manufacturing employment and how machine learning algorithms can ensure the sterility and structural integrity of absorbent materials post-processing. Key expectations include AI integrating into quality control systems (visual inspection for contaminants, automated defect detection) and using predictive analytics to optimize cotton source selection based on environmental factors and sustainability metrics. The collective theme underscores a desire for AI to elevate product quality, streamline complex supply chains, and reduce operational costs without compromising the strict safety standards required for medical consumables.

The integration of Artificial Intelligence and machine learning (ML) is fundamentally changing the operational landscape of absorbent cotton manufacturing. AI-powered visual inspection systems, leveraging high-resolution cameras and deep learning models, are now capable of detecting microscopic imperfections, contamination, or structural inconsistencies in cotton pads and rolls far more accurately and rapidly than human operators. This level of automated quality control ensures that only medical-grade compliant materials proceed to sterilization, significantly reducing batch failure rates and enhancing overall product reliability, which is paramount for clinical applications. Furthermore, ML algorithms are being deployed to optimize machinery parameters, such as blending ratios, temperature controls during purification, and cutting speeds, leading to increased output efficiency and decreased energy consumption per unit.

Beyond the manufacturing floor, AI is revolutionizing supply chain management for raw cotton procurement and finished product distribution. Predictive analytics models analyze diverse data sets—including historical sales data, seasonal variations in cosmetic procedure volumes, regional climate patterns affecting cotton yield, and logistics costs—to create highly accurate demand forecasts. This allows manufacturers to implement just-in-time inventory systems for volatile products and establish optimized storage and transport routes. Such optimization minimizes waste, improves responsiveness to market changes (like sudden regulatory shifts), and ensures the timely delivery of sterile products to hospitals and distributors, contributing to better healthcare outcomes and improved customer service levels.

- AI-Driven Quality Control: Automated visual inspection systems detect material defects and contamination at the microscopic level, ensuring medical-grade compliance and reducing recalls.

- Predictive Demand Forecasting: Machine learning models optimize inventory levels for both raw materials and finished products based on real-time healthcare utilization and cosmetic trend data.

- Supply Chain Optimization: AI algorithms streamline logistics, warehousing, and distribution channels, minimizing transit times for sterile goods and lowering operational expenditure.

- Manufacturing Process Efficiency: Use of robotics and AI to adjust purification parameters, improving material consistency, absorption capacity, and reducing energy use.

- Sustainable Sourcing Decisions: ML models evaluate cotton source quality and sustainability certifications, guiding procurement towards environmentally responsible suppliers.

- Customer Interaction and Personalization: AI chatbots and data analytics enhance post-sale service and inform product development by analyzing consumer feedback on texture, size, and packaging preferences.

DRO & Impact Forces Of Cosmetic Medical Absorbent Cotton Market

The dynamics of the Cosmetic Medical Absorbent Cotton Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The core driving force is the global rise in healthcare spending and the associated expansion of the cosmetic and aesthetic industry, which consistently demands sterile, high-purity consumables. However, the market faces significant restraints, primarily stemming from volatility in raw cotton prices, which are susceptible to climatic changes and global commodity market fluctuations, impacting manufacturing margins. Opportunities arise from technological innovation in material science, focusing on creating sustainable, organic, and ultra-soft products, alongside untapped potential in developing rural markets where hygiene awareness is rapidly increasing. These forces collectively dictate investment strategies, pricing structures, and product development cycles within the industry, influencing the competitive landscape.

The market is strongly impacted by increasing consumer awareness regarding personal hygiene and the growing preference for high-end cosmetic procedures, which necessitate professional-grade absorbent materials. The development of advanced, non-surgical cosmetic treatments, such as chemical peels, microneedling, and laser therapy, all require specialized, gentle absorbent pads and swabs for preparation and post-treatment care, directly driving high-value product sales. Regulatory Impact Forces are also critical; stringent safety and quality mandates enforced by global health organizations compel manufacturers to adhere to high sterilization standards (e.g., gamma irradiation or EO sterilization), thereby acting as both a barrier to entry for smaller players and a driver for technological investment among established firms.

Conversely, environmental concerns represent a major constraint and opportunity. The traditional use of non-biodegradable packaging and chemically treated cotton fibers is increasingly criticized, forcing manufacturers to innovate. While this adds initial production costs (restraint), the shift towards 100% organic, ethically sourced, and plastic-free packaging presents a massive market opportunity (Opportunity). Furthermore, intense competition among regional and international players leads to frequent price wars, particularly in the bulk product segment, pressuring profit margins. Successfully navigating these impact forces requires strategic sourcing, investment in advanced automation to maintain quality consistency, and robust regulatory compliance infrastructure to safeguard market position.

Segmentation Analysis

The Cosmetic Medical Absorbent Cotton Market is comprehensively segmented based on product type, application, material, and distribution channel, providing granular insight into consumer behavior and industry procurement patterns. Understanding these segments is vital for businesses to tailor their production, marketing, and sales strategies effectively. The type segmentation highlights the diverse functional needs of end-users, ranging from large, bulk rolls used in surgical environments to precision-engineered, lint-free pads utilized in high-end cosmetic facilities. Analyzing the application segments helps differentiate between the stable, high-volume demand from hospitals versus the faster-growing, value-added demand from cosmetic and direct-to-consumer channels.

Material segmentation, particularly the distinction between conventional and organic cotton, reflects shifting consumer preferences toward sustainability and hypoallergenic properties. While conventional cotton offers cost advantages, organic and certified medical-grade cotton attracts premium pricing and satisfies the ethical sourcing requirements of modern businesses and consumers. Distribution channel analysis confirms the importance of wholesale medical distributors for clinical sales and the rising influence of e-commerce platforms for consumer-facing products. These distinct market segments exhibit varied growth rates and profitability profiles, requiring nuanced strategic focus from market participants.

The dominance of the pads and swabs segment within the type category is noteworthy, driven by the explosive growth of the cosmetic industry globally, where these products are indispensable for skin preparation and product application. Simultaneously, the material shift towards bamboo and other cellulose alternatives, while small, represents an emerging segment seeking to address environmental concerns associated with traditional cotton farming and disposal, offering high absorbency and enhanced biodegradability, promising future growth opportunities.

- By Product Type:

- Cotton Rolls and Balls (Bulk, high absorbency)

- Cotton Pads (Round, square, specialized shapes, lint-free)

- Cotton Swabs and Tipped Applicators (Precision application, single-use)

- Surgical Cotton (Highly sterile, specialized absorbency levels)

- By Application:

- Hospitals and Clinics (Wound care, surgical preparation)

- Cosmetic Centers and Dermatology Clinics (Aesthetic treatments, post-procedure care)

- At-Home/Consumer Care (Makeup removal, personal hygiene, first aid)

- By Material:

- Conventional Cotton

- Organic Cotton (Certified, chemical-free)

- Recycled/Blended Cellulose Fibers

- By Distribution Channel:

- Wholesale Distributors (Medical and Pharmacy chains)

- Retail Stores (Supermarkets, Drugstores)

- E-commerce (Online retail, direct-to-consumer platforms)

Value Chain Analysis For Cosmetic Medical Absorbent Cotton Market

The value chain for the Cosmetic Medical Absorbent Cotton Market starts with the cultivation and harvesting of raw cotton, which constitutes the upstream segment. This stage is critical as the quality (fiber length, purity, absence of pesticides) directly dictates the suitability for medical or cosmetic grading. Major activities include ginning, cleaning, and baling. Upstream risks involve price volatility, weather dependence, and the need for certified organic sourcing. Securing sustainable and high-quality raw material supply through long-term contracts or vertical integration is a key strategic imperative for market leaders to maintain margin stability and product consistency across their diverse portfolio of medical and cosmetic goods.

The middle segment involves complex manufacturing and processing, including purification, bleaching (using hydrogen peroxide or other non-toxic agents to ensure whiteness and purity), carding, sterilization, and converting the purified cotton into final forms (rolls, pads, swabs). Sterilization—often conducted using Ethylene Oxide (EO) or irradiation—is highly regulated and represents a significant cost and compliance checkpoint. Efficiency in this stage relies on advanced automation and stringent quality assurance protocols to maintain the medical-grade standard required for hospital procurement. Companies invest heavily in advanced machinery to minimize lint shedding and maximize absorption rates.

The downstream segment focuses on distribution and sales. The distribution channel is bifurcated into direct sales (for large hospital networks or private label cosmetic brands) and indirect sales through wholesale medical supply distributors and retail channels. Medical-grade products rely heavily on specialized distributors who can handle complex regulatory documentation and rapid delivery requirements. Conversely, cosmetic and consumer products utilize extensive retail networks, including pharmacies, supermarkets, and increasingly, direct-to-consumer e-commerce platforms. Successful downstream operations require highly efficient logistics and strong brand marketing to differentiate consumer products in a crowded retail space, particularly highlighting hypoallergenic and sustainability features.

Cosmetic Medical Absorbent Cotton Market Potential Customers

The primary customers for Cosmetic Medical Absorbent Cotton fall into institutional and consumer categories, each with distinct purchasing criteria and volume demands. Institutional customers, comprising hospitals, surgical centers, and dedicated clinics (e.g., plastic surgery, dermatology), represent the highest volume buyers, prioritizing sterile, high-absorption, bulk cotton rolls and swabs for critical medical applications like wound care, surgical preparation, and infection control procedures. Their purchasing decisions are heavily influenced by regulatory compliance, bulk pricing, certified quality management systems, and reliability of supply, often locking into multi-year contracts with certified medical suppliers.

The second major customer segment consists of professional cosmetic users, including aesthetic practitioners, beauty salons, medispas, and high-end makeup artists. These buyers demand specialized products such as lint-free cotton pads, precision-tipped applicators, and organic cotton variants. Their focus is on product softness, structural integrity (preventing fiber shedding during application), and the ability of the material to work seamlessly with expensive cosmetic formulations. Although their volume is lower than hospitals, their tolerance for higher prices is greater, driving demand for premium, branded, and specialized product lines.

The third, and fastest-growing, customer base is the individual consumer procuring products for at-home use, encompassing personal hygiene, makeup application, removal, and minor first aid. These consumers purchase through retail channels and e-commerce, prioritizing convenience, brand recognition, competitive pricing, and increasingly, environmentally friendly or organic certifications. This segment’s purchasing behavior is highly sensitive to marketing trends, social media endorsements, and perceived value, leading to high turnover in product preferences and emphasizing the need for robust retail presence and effective digital marketing strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Johnson & Johnson, Fazzini S.r.l., Medline Industries LP, McKesson Corporation, Dynarex Corporation, Graham Medical, US Cotton LLC, Sanita, Prestige Ameritech, Zhejiang Bangli Medical Products Co. Ltd., Albaad Corporate, Waston Group, AOKI Corporation, Sateri, Rauscher Consumer Products GmbH, Premier Healthcare, Cotton Club, RNB Medical. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Medical Absorbent Cotton Market Key Technology Landscape

The technological landscape in the Cosmetic Medical Absorbent Cotton Market is centered on optimizing material purity, enhancing product functionality, and ensuring high-volume sterility compliance. Key technologies involve advanced purification processes, such as improved hydrogen peroxide bleaching methods that eliminate impurities and heavy metals without compromising fiber structure, ensuring superior absorbency and hypoallergenic qualities essential for medical use. Automation plays a critical role, utilizing high-speed carding and cutting machinery with integrated vision systems (often AI-enhanced) to maintain strict product shape consistency and detect flaws, minimizing human contact and maximizing throughput while maintaining pristine conditions.

Another crucial technological area is sterilization technology. While Ethylene Oxide (EO) sterilization remains common, manufacturers are increasingly adopting Gamma Irradiation and E-beam sterilization, particularly for products requiring high-level sterility assurance (SAL 10⁻⁶) and faster turnaround times. These methods reduce residual chemical concerns associated with EO and are preferred for exporting to regions with stringent regulatory requirements. Furthermore, materials science innovation focuses on developing bio-based polymers and specialized treatments to create lint-free surfaces and enhanced wet strength, ensuring the cotton does not shed fibers when used with liquid cosmetics or in delicate wound cleansing procedures.

Packaging technology is also evolving, driven by AEO mandates and consumer demands for sustainability. Manufacturers are implementing advanced hermetic sealing techniques to maintain the sterile barrier for extended periods, coupled with the shift to recyclable, biodegradable, or compostable packaging films and pouches. Track-and-trace technologies, incorporating RFID tags or QR codes, are becoming standard for high-value medical cotton lots, enabling precise inventory management, anti-counterfeiting measures, and enhanced supply chain transparency, particularly vital for regulated healthcare systems to ensure immediate traceability in case of quality issues.

Regional Highlights

The global Cosmetic Medical Absorbent Cotton market demonstrates significant regional variations in terms of growth drivers, regulatory complexity, and consumer preferences. North America, led by the United States, represents a mature but high-value market characterized by stringent medical device regulations, high per capita expenditure on aesthetic medicine, and a strong preference for branded, specialty cotton products (e.g., highly absorbent surgical cotton and organic cotton pads). The demand here is stable, fueled by a sophisticated healthcare infrastructure and consistent innovation in cosmetic dermatology procedures.

Europe mirrors North America in terms of quality demands but shows greater emphasis on sustainability and organic sourcing, particularly in markets like Germany and the Scandinavian countries. The European Union's Medical Device Regulation (MDR) necessitates continuous investment in compliance and quality documentation, impacting manufacturers operating in this region. The market is fragmented, with numerous regional suppliers competing on niche product specifications and sustainability certifications, driving product differentiation away from bulk commodity pricing.

Asia Pacific (APAC) is projected to be the fastest-growing region, dominated by high volume consumption in China, India, and Southeast Asian nations. This explosive growth is driven by rapidly expanding healthcare access, increasing disposable incomes boosting aesthetic procedure rates, and massive urbanization leading to heightened personal hygiene awareness. While cost remains a significant factor, leading to high consumption of basic cotton rolls, there is a parallel surge in demand for affordable, yet certified, cosmetic absorbent products, making it a critical region for both bulk and value-added market expansion strategies.

- North America: High revenue share, driven by advanced aesthetic procedures, high regulatory standards (FDA compliance), and strong consumer preference for sterile, premium-quality cotton pads and specialty surgical rolls.

- Europe: Focus on sustainability and organic materials; growth linked to stringent EU MDR compliance and high penetration of private aesthetic clinics; strong demand for environmentally friendly packaging solutions.

- Asia Pacific (APAC): Highest CAGR, fueled by rapid healthcare infrastructure development, growing middle-class population, urbanization, and rising popularity of K-Beauty and similar cosmetic trends, driving bulk and retail consumption.

- Latin America (LATAM): Emerging market characterized by increasing healthcare investments and a growing beauty industry, particularly in Brazil and Mexico; growth focused on accessible, quality medical cotton for public health initiatives.

- Middle East and Africa (MEA): Market growth underpinned by expanding medical tourism sectors and increasing governmental spending on healthcare infrastructure; demand is bifurcated between high-end hospital supplies in the Gulf Cooperation Council (GCC) states and basic hygiene products in Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Medical Absorbent Cotton Market.- Johnson & Johnson

- Fazzini S.r.l.

- Medline Industries LP

- McKesson Corporation

- Dynarex Corporation

- Graham Medical

- US Cotton LLC

- Sanita

- Prestige Ameritech

- Zhejiang Bangli Medical Products Co. Ltd.

- Albaad Corporate

- Waston Group

- AOKI Corporation

- Sateri

- Rauscher Consumer Products GmbH

- Premier Healthcare

- Cotton Club

- RNB Medical

- Pudumjee Hygiene Products

- Cardinal Health

Frequently Asked Questions

Analyze common user questions about the Cosmetic Medical Absorbent Cotton market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards organic cosmetic absorbent cotton?

The primary driver is heightened consumer awareness regarding environmental sustainability, skin sensitivity, and concerns over chemical residues (pesticides, bleaches) found in conventional cotton. Organic absorbent cotton is perceived as hypoallergenic and aligns with green beauty trends, commanding a significant price premium in high-growth cosmetic segments.

How do sterilization techniques impact the quality and cost of medical absorbent cotton?

Sterilization techniques (Ethylene Oxide, Gamma Irradiation, E-beam) are mandatory for medical-grade cotton, significantly increasing production costs due to regulatory compliance and specialized equipment. Quality is impacted positively, ensuring a minimum sterility assurance level (SAL), crucial for preventing post-operative infections and meeting hospital procurement requirements globally.

Which regional market offers the highest growth potential for cosmetic absorbent cotton manufacturers?

Asia Pacific (APAC) offers the highest growth potential, driven by rapid urbanization, increasing accessibility to aesthetic treatments, and the expansion of middle-class populations with greater disposable income for personal care products. Key markets like China and India are rapidly increasing their consumption volume, offering substantial opportunity for market entry and expansion.

What are the key differences between cosmetic and medical grade absorbent cotton products?

Medical-grade cotton must meet rigorous regulatory standards for purity, absorbency rate, and guaranteed sterility (often requiring specific certifications like ISO 13485 or FDA clearance) for use in wound care and surgical settings. Cosmetic cotton focuses more on softness, lint-free properties, and specific shapes (pads, specialized tips) optimized for makeup application and skin cleansing, though high-end cosmetic products often aim for near-medical purity.

How is AI influencing quality control within absorbent cotton manufacturing?

AI utilizes sophisticated visual inspection systems and machine learning algorithms to autonomously detect microscopic defects, inconsistencies in fiber blending, and potential contaminants at high speed during processing. This ensures superior product uniformity, minimizes waste, and guarantees that products meet the stringent structural and purity specifications required for medical and high-end cosmetic applications, surpassing manual inspection capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager