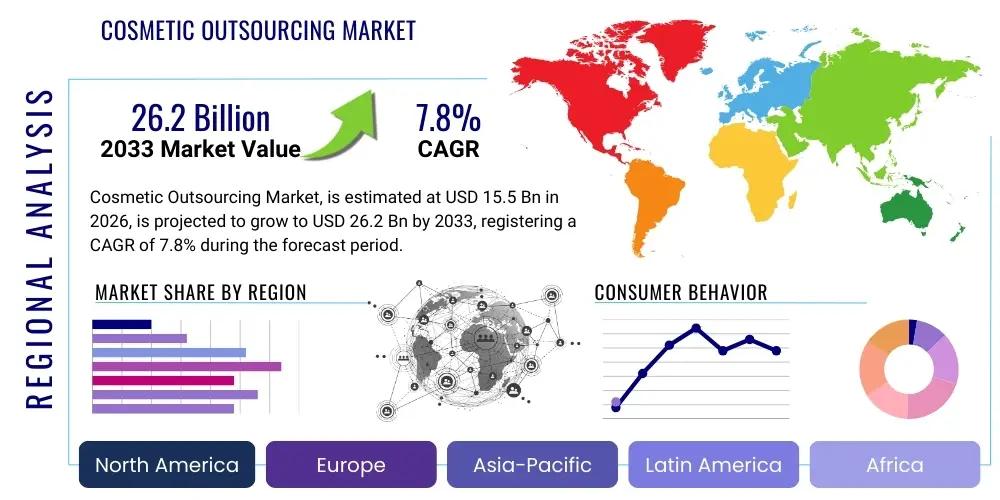

Cosmetic Outsourcing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437582 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cosmetic Outsourcing Market Size

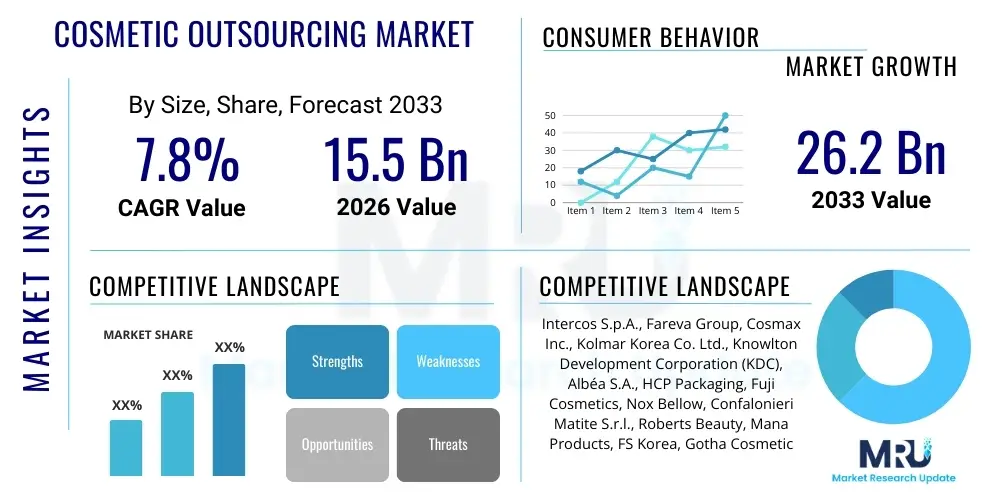

The Cosmetic Outsourcing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 26.2 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increasing complexity of cosmetic formulations, the rapid rise of digitally native and independent beauty brands (Indie Brands), and the persistent need for established multinational corporations (MNCs) to reduce operational expenditures and accelerate time-to-market for innovative products. The competitive landscape mandates flexibility in production capacity, stringent adherence to diverse global regulatory standards (such as EU Cosmetics Regulation 1223/2009 and FDA guidelines), and specialized expertise in sustainable and natural ingredient sourcing, all of which favor outsourcing models.

Market valuation reflects a strategic shift among beauty companies globally, moving away from capital-intensive in-house manufacturing towards more agile contract manufacturing (CM) and private label agreements. Outsourcing partners, often referred to as Contract Development and Manufacturing Organizations (CDMOs), offer economies of scale, access to proprietary R&D insights, and specialized production technologies like microencapsulation or sterile filling, which are critical for high-performance skincare and cosmetic products. Furthermore, the burgeoning demand for tailored and personalized beauty products, often necessitating small-batch production runs, has made the flexible operational models offered by outsourcers indispensable to maintain profitability and consumer relevance.

Cosmetic Outsourcing Market introduction

The Cosmetic Outsourcing Market encompasses the strategic engagement of third-party service providers by cosmetic and personal care companies for functions ranging from product conceptualization and formulation development (Research & Development), through raw material sourcing and manufacturing (Contract Manufacturing), to final packaging, quality control, and supply chain logistics. This market is defined by partnerships designed to enhance efficiency, minimize capital investment, and accelerate the commercialization of new beauty products across diverse categories including skincare, haircare, color cosmetics, and fragrances. The fundamental objective of outsourcing is to allow brand owners to concentrate their core competencies on marketing, brand management, and intellectual property development, while leveraging the specialized production capabilities and regulatory expertise of external partners.

Key applications of cosmetic outsourcing span the entire product lifecycle, critically supporting emerging brands that lack dedicated manufacturing infrastructure and established players seeking rapid geographic expansion or portfolio diversification. The driving factors propelling market growth include escalating consumer demand for natural, clean label, and sustainable cosmetic products, which requires specialized processing capabilities; the globalization of cosmetic supply chains necessitating intricate regulatory navigation; and the financial imperative to operate lean production models. Benefits realized by companies utilizing outsourcing include decreased fixed costs, enhanced manufacturing scalability, faster speed-to-market for trend-driven items, and improved access to cutting-edge formulation technologies, positioning outsourcing as a core element of modern cosmetic business strategy.

Cosmetic Outsourcing Market Executive Summary

The global Cosmetic Outsourcing Market is experiencing robust growth driven by converging business trends, favorable regional expansion, and dynamic segment shifts. Business trends highlight a significant pivot towards full-service outsourcing, encompassing everything from initial concept design to finished goods delivery, particularly favored by indie brands and direct-to-consumer (DTC) focused companies aiming for efficiency and speed. There is a strong emphasis on sustainability compliance within manufacturing practices, with outsourcers investing heavily in certifications, eco-friendly packaging solutions, and traceable ethical sourcing, thereby mitigating reputational risks for brand owners. Furthermore, mergers and acquisitions among CDMOs are reshaping the competitive landscape, creating global giants capable of offering unified regulatory compliance across multiple continents, simplifying operations for large multinational clients.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like South Korea and China, continues to dominate in terms of manufacturing capacity and innovation, especially in advanced skincare and sheet mask technologies, while North America and Europe remain high-value markets focused on premium, scientific-backed formulations and complex packaging solutions. Emerging markets in Latin America and the Middle East offer considerable opportunity due to rising disposable incomes and localizing production needs, necessitating partners capable of adapting to specific cultural and climatic requirements. Segment trends reveal that Contract Manufacturing remains the largest revenue generator, but Research & Development (R&D) outsourcing is the fastest-growing segment, reflecting the premium placed on innovative, patentable formulations. Product-wise, the Skincare category holds the highest market share, fueled by sophisticated anti-aging and dermatological product lines that demand specialized outsourced expertise in active ingredient handling and stability testing.

AI Impact Analysis on Cosmetic Outsourcing Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cosmetic Outsourcing Market primarily revolve around themes of automation efficiency, personalized formulation development, and enhanced supply chain predictability. Users frequently ask if AI will replace human formulators or if it will primarily serve to optimize current manufacturing processes. The consensus expectation is that AI will revolutionize the R&D phase by accelerating the identification of novel ingredients, predicting formula stability and efficacy, and streamlining regulatory documentation, thereby significantly reducing the typical product development timeline, a crucial metric for outsourcing partners. Furthermore, concerns about data security and intellectual property protection when utilizing AI-driven tools provided by third-party manufacturers are also prevalent, demanding robust contractual agreements and technological safeguards from outsourcing vendors. AI’s strategic application is viewed not just as a cost-reduction tool but as a key differentiator for outsourcers offering next-generation predictive services.

- AI-driven Predictive Formulation: Utilizing machine learning algorithms to screen thousands of compounds and predict stability, skin interaction, and efficacy, dramatically accelerating the R&D cycle for contract manufacturers.

- Optimized Manufacturing Automation: Implementing AI and robotics in production lines for precision filling, complex assembly (e.g., dual-chamber products), and automated quality control, reducing error rates and labor costs.

- Personalized Product Scaling: Using AI to manage variable, small-batch production runs necessary for highly customized or micro-targeted cosmetic lines efficiently, a vital service for new beauty brands.

- Enhanced Supply Chain Visibility: Leveraging AI and IoT for real-time tracking of raw materials and finished goods, improving inventory management, reducing waste, and bolstering compliance assurance.

- Regulatory Compliance Acceleration: AI tools automate the complex analysis of international ingredient restrictions and labeling requirements, ensuring outsourced products meet standards faster and minimizing recall risks.

- Demand Forecasting Accuracy: Improved prediction of consumer trends and seasonal spikes allows outsourcers to allocate resources optimally, ensuring client brands maintain adequate stock levels without overproduction.

DRO & Impact Forces Of Cosmetic Outsourcing Market

The dynamics of the Cosmetic Outsourcing Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that determine strategic direction and profitability. Key drivers include the exponential proliferation of independent and startup cosmetic brands globally, which rely exclusively on outsourced manufacturing to enter the market without major capital investment. Concurrently, established major beauty companies are increasingly adopting ‘asset-light’ models to improve shareholder value, focusing on core brand competencies while externalizing manufacturing complexity and variability. This trend is amplified by the continuous pressure to innovate rapidly in response to fleeting consumer trends, making the technical agility and specialized equipment offered by CDMOs essential components of competitive advantage.

Restraints primarily center around safeguarding intellectual property (IP) and maintaining consistent quality control across diverse third-party operations, which presents logistical and legal challenges. Brand owners face risks of formula leakage or genericization, necessitating stringent non-disclosure agreements and thorough auditing. Furthermore, the volatility in raw material pricing and the increasing regulatory scrutiny on ingredient sourcing and environmental claims (Greenwashing laws) add layers of complexity and cost to the outsourcing relationship. These external factors sometimes necessitate dual-sourcing strategies or investment in highly regulated suppliers, potentially eroding the immediate cost benefits of outsourcing. The requirement for regulatory adherence across multiple jurisdictions, especially for specialized products, also serves as a bottleneck for smaller outsourcing providers.

Opportunities are abundant, particularly in the realm of sustainable and specialized ingredient formulation, where outsourcers can become centers of excellence for high-demand areas like microbiome-friendly skincare, ethically sourced vegan products, and complex delivery systems (e.g., liposomes). The ongoing digitalization of the supply chain, facilitating seamless data exchange and traceability, offers outsourcers the chance to provide superior transparency and logistical services. Furthermore, the expansion into niche markets, such as men’s grooming, functional beauty (nutricosmetics), and customized compounding services, represents high-growth revenue streams. By proactively investing in advanced, flexible manufacturing platforms and specialized scientific expertise, CDMOs can solidify their position as indispensable strategic partners rather than mere transactional vendors, thereby maximizing the favorable impact forces.

Segmentation Analysis

The Cosmetic Outsourcing Market segmentation provides a granular view of market dynamics, categorized primarily by the type of service rendered, the cosmetic product category manufactured, and the size of the contracting enterprise. This detailed analysis reveals that while manufacturing remains the bedrock of the market, the fastest expansion is occurring in higher-value services such as specialized Research and Development (R&D) and complex regulatory affairs management. Outsourcing providers are increasingly differentiating themselves based on their technological prowess and ability to handle specialized raw materials required for 'clean beauty' and advanced dermatological segments, leading to a premiumization of service offerings across the value chain.

Analyzing segmentation by product type shows a dominant share held by skincare, a category characterized by complex formulations, high efficacy claims, and stringent stability testing requirements, making outsourced expertise critical. The makeup (color cosmetics) segment also holds substantial weight, primarily driven by rapid trend cycles requiring swift manufacturing scale-up and proficiency in intricate packaging designs. Enterprise size segmentation confirms that Small and Medium-sized Enterprises (SMEs) are the primary drivers of growth volume, as they lack the internal infrastructure, whereas Large Enterprises (MNCs) focus their outsourcing efforts on cost optimization, geographic market entry, and accessing specific cutting-edge technology that is not viable to develop in-house. This segmentation structure highlights the market's adaptability to serve vastly different client needs, from full-service private labeling for startups to specific component manufacturing for global giants.

- By Service Type:

- Manufacturing (Contract Manufacturing, Private Labeling)

- Packaging and Filling Services (Primary and Secondary Packaging)

- Research and Development (R&D)

- Testing and Quality Assurance (QA/QC)

- Supply Chain Management and Logistics

- Regulatory Consulting

- By Product Type:

- Skincare (Moisturizers, Serums, Sunscreens)

- Haircare (Shampoos, Conditioners, Styling Products)

- Makeup / Color Cosmetics (Foundations, Lipsticks, Eyeshadows)

- Fragrances (Perfumes, Body Mists)

- Personal Hygiene (Deodorants, Soaps, Hand Sanitizers)

- By Enterprise Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Cosmetic Outsourcing Market

The Value Chain for the Cosmetic Outsourcing Market begins with upstream activities focused on raw material sourcing and specialized component procurement, where outsourcers establish robust relationships with chemical suppliers, natural ingredient farms, and packaging component manufacturers. Upstream success hinges on the outsourcing partner’s ability to secure high-quality, ethically sourced, and compliant raw materials at competitive prices, managing supply volatility and ensuring ingredient traceability from origin to production line. This phase increasingly involves auditing suppliers for sustainability practices and securing certifications, adding complexity but also intrinsic value to the final outsourced product. The negotiation power of large CDMOs allows them to achieve favorable pricing and priority supply, offering a clear advantage to their brand clients.

The core of the value chain is the transformation phase, encompassing R&D, formulation, manufacturing, and QA/QC. This is where the outsourcing partner's expertise is fully leveraged, utilizing specialized equipment for complex processes like emulsion technology, sterilization, and precision blending. Effective management of this phase involves rigorous process control, adherence to Good Manufacturing Practices (GMP), and meticulous quality assurance protocols, ensuring the manufactured product exactly matches the client's specifications. High investment in technology, such as robotic automation and advanced testing labs, is crucial here, transforming raw inputs into finished cosmetic goods ready for market.

Downstream activities focus on packaging, logistics, and distribution channels. Distribution often employs a mixed model: indirect channels utilize established third-party logistics (3PL) providers and large retailers/e-commerce platforms, leveraging existing market reach. Direct distribution, although less common for outsourcers themselves, is facilitated by the CDMO preparing products for direct shipment to the brand owner's fulfillment centers. The outsourcer’s capability to handle diverse packaging formats (including bespoke, luxury, or sustainable alternatives) and manage the final assembly, labeling, and regulatory clearance process close to the target market adds significant downstream value, completing the full-service offering for many brands.

Cosmetic Outsourcing Market Potential Customers

The primary potential customers and end-users of the Cosmetic Outsourcing Market are categorized broadly into three groups: Emerging/Indie Brands, Established Multinational Corporations (MNCs), and specialized pharmaceutical or dermatological firms. Emerging and digitally-native brands constitute a crucial demand segment, as these companies typically operate with minimal capital expenditure and rely entirely on outsourced services for concept-to-shelf functionality. For these customers, the outsourcing partner acts as the entire R&D and manufacturing department, providing turnkey solutions including formulation, initial batch runs, regulatory filing support, and scalable production capacity, allowing the brand to focus solely on consumer engagement and marketing strategy.

Established Multinational Corporations (MNCs) are strategic customers utilizing outsourcing to achieve specific operational goals. These global players often outsource production to enter new geographical markets quickly without building new facilities or to access specialized manufacturing technologies that would be too costly to integrate internally (e.g., highly complex volatile organic compound (VOC) formulations or specialized sustainable packaging techniques). They use outsourcing to manage cyclical demand fluctuations, reduce inventory risk, and streamline their global manufacturing footprint, focusing their internal factories on high-volume, core product lines, while outsourcing niche or rapidly evolving products.

The third group includes specialized firms, such as pharmaceutical companies developing cosmeceuticals or medical-grade skincare, and retailers seeking private label development. These customers require partners with specialized certifications (e.g., ISO 13485 for medical devices, or pharmaceutical GMPs) and specific technical expertise in active ingredient stability and clinical efficacy testing. The growing convergence between the beauty and wellness sectors is increasingly drawing dietary supplement and functional food companies into cosmetic product development, making CDMOs with cross-industry capabilities highly attractive potential partners for market entry and product diversification.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 26.2 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Intercos S.p.A., Fareva Group, Cosmax Inc., Kolmar Korea Co. Ltd., Knowlton Development Corporation (KDC), Albéa S.A., HCP Packaging, Fuji Cosmetics, Nox Bellow, Confalonieri Matite S.r.l., Roberts Beauty, Mana Products, FS Korea, Gotha Cosmetics, Cofa Group, KIK Custom Products, MilliporeSigma, L'Oréal (Subcontracting Division), Estée Lauder Companies (Selected Outsourced Production), Wella Company (Outsourced Capacity). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Outsourcing Market Key Technology Landscape

The technological landscape within the Cosmetic Outsourcing Market is characterized by significant investment in advanced manufacturing and process optimization tools, essential for meeting the demands of modern cosmetic formulation and production efficiency. Key advancements include the deployment of sophisticated microencapsulation technologies, critical for ensuring the stability and controlled release of sensitive active ingredients like Vitamin C and retinoids in skincare products. Furthermore, CDMOs are adopting high-shear mixing and emulsification equipment capable of producing complex, multi-phase formulations (such as oil-in-water or water-in-silicone emulsions) with superior uniformity and texture, leading to high-quality product sensory profiles that are demanded by premium brands.

In the area of filling and packaging, the reliance on automated and robotic systems has grown exponentially, driven by the need for high-speed precision and sterility, especially in producing unit-dose or airless pump containers that preserve product integrity. Advanced serialization and traceability technologies (e.g., blockchain integration) are also being implemented to enhance supply chain transparency, combat counterfeiting, and ensure compliance with stringent pharmaceutical-grade quality standards often applied to cosmeceuticals. These investments in precise manufacturing and sterile environments allow outsourcers to handle products requiring elevated hygiene standards, such as sterile injectable skincare or preservative-free formulas.

Beyond the physical manufacturing floor, the application of Digital R&D platforms, often powered by AI and bioinformatics, represents a critical technological shift. These platforms enable rapid prototyping, virtual testing of ingredients, and predictive stability analysis, drastically shortening the time required to move from concept to pilot batch. Outsourcing partners leveraging these digital tools can offer clients significant competitive advantages in speed-to-market and cost reduction during the crucial development phase, solidifying technology as the primary differentiator among top-tier Contract Development and Manufacturing Organizations.

Regional Highlights

Regional dynamics play a crucial role in shaping the Cosmetic Outsourcing Market, reflecting differences in consumer preferences, regulatory environments, and manufacturing infrastructure sophistication across major global zones.

- Asia Pacific (APAC) Dominance: APAC, particularly driven by South Korea, Japan, and China, is the leading region in terms of both production volume and technological innovation. South Korea, known for its rapid product innovation cycle (K-Beauty) and full-service CDMOs (like Cosmax and Kolmar), serves as a global hub for manufacturing high-tech skincare and masks. The immense manufacturing capacity and relatively lower operational costs in China, coupled with increasingly stringent localized quality standards, ensure its sustained dominance in volume-driven outsourcing.

- North America Strategic Focus: North America is a high-value market characterized by a strong focus on scientific efficacy, clean beauty formulations, and premium product positioning. Outsourcing activities here are typically driven by niche product requirements, complex regulatory adherence (FDA/Health Canada), and the rapid scaling of independent, venture-backed DTC brands. The region demands specialized expertise in cannabinoid-based cosmetics (CBD) and sustainable packaging solutions.

- Europe's Regulatory Excellence: Europe holds a significant market share, distinguished by its stringent regulatory framework (EU Cosmetics Regulation 1223/2009). European outsourcers specialize in high-quality, complex fragrance manufacturing and ethical/organic certified products (e.g., COSMOS). The emphasis in this region is on supply chain transparency, sustainable sourcing, and proximity to major luxury brand headquarters, making compliance expertise a major outsourcing driver.

- Latin America (LATAM) Potential: LATAM, spearheaded by Brazil and Mexico, presents strong growth opportunities due to rising middle-class consumer demand and the need for localized product formulations tailored to unique climatic conditions (high humidity, solar intensity). Outsourcing is focused on reducing importation costs and developing culturally relevant product lines, often necessitating partners with specialized knowledge in regional ingredient profiles.

- Middle East & Africa (MEA) Development: The MEA region is developing rapidly, particularly in the Gulf Cooperation Council (GCC) countries, driven by high disposable incomes and demand for premium, luxury cosmetics and fragrances. Outsourcing here initially targets localization of filling and packaging, but increasingly seeks partners who can manage compliance with Halal certification standards and manage extreme supply chain temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Outsourcing Market.- Intercos S.p.A.

- Fareva Group

- Cosmax Inc.

- Kolmar Korea Co. Ltd.

- Knowlton Development Corporation (KDC)

- Albéa S.A.

- HCP Packaging

- Fuji Cosmetics

- Nox Bellow

- Confalonieri Matite S.r.l.

- Roberts Beauty

- Mana Products

- FS Korea

- Gotha Cosmetics

- Cofa Group

- KIK Custom Products

- MilliporeSigma (Contract Services)

- Ancorotti Cosmetics S.r.l.

- Boticário Group (Outsourced Manufacturing Services)

- Chromavis Fareva Group

Frequently Asked Questions

Analyze common user questions about the Cosmetic Outsourcing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Cosmetic Outsourcing Market?

The primary driver is the rapid proliferation of emerging and digitally native beauty brands (Indie Brands) globally. These smaller entities lack the capital for in-house manufacturing and require full-service Contract Development and Manufacturing Organizations (CDMOs) for efficient, scalable production and rapid speed-to-market, allowing them to remain agile in a trend-driven industry.

How does AI technology specifically influence cosmetic formulation and manufacturing outsourcing?

AI significantly impacts the R&D phase by accelerating formulation time, utilizing machine learning to predict ingredient stability, efficacy, and regulatory compliance. In manufacturing, AI optimizes supply chain logistics, improves quality control through automated inspection, and enables efficient management of personalized, small-batch production runs, thereby improving the profitability of outsourced services.

Which segment of cosmetic outsourcing services is projected to exhibit the fastest growth rate?

The Research & Development (R&D) and specialized testing services segment is projected to show the fastest growth. This is due to the increasing complexity of active ingredients, high consumer demand for scientific proof of efficacy (cosmeceuticals), and the need for outsourcers to develop unique, proprietary, and patentable formulations for their brand clients.

What are the main risks associated with outsourcing cosmetic manufacturing for established brands?

The main risks include potential breaches of Intellectual Property (IP), challenges in maintaining consistent quality control across different outsourced facilities, and managing supply chain volatility. Established brands must implement rigorous auditing protocols and robust legal agreements to mitigate the risks associated with third-party production variability.

Which geographical region holds the largest market share in cosmetic outsourcing, and why?

The Asia Pacific (APAC) region currently holds the largest market share. This dominance is attributed to the presence of highly innovative and scalable manufacturing hubs, particularly in South Korea and China, which specialize in advanced skincare formulations and offer unparalleled manufacturing capacity, competitive costs, and quick turnarounds for global brands.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager