Cosmetic Raw Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434641 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cosmetic Raw Materials Market Size

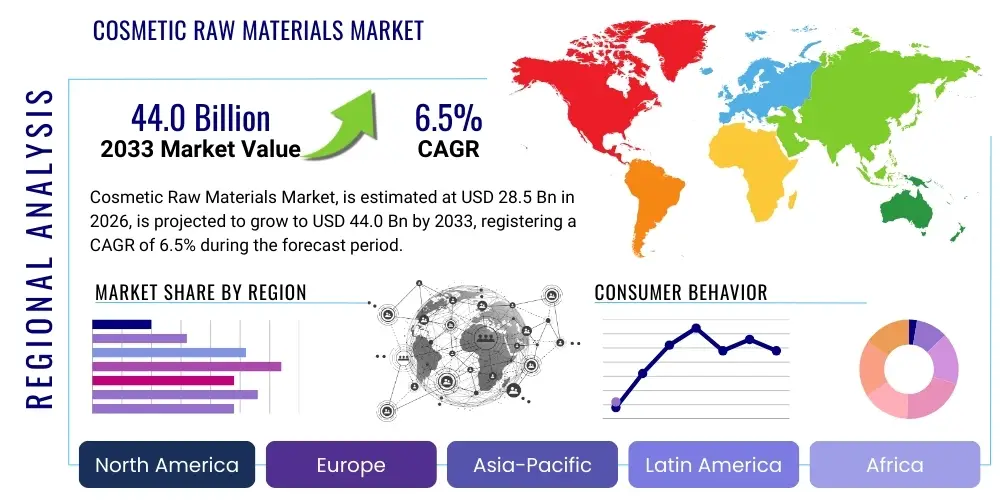

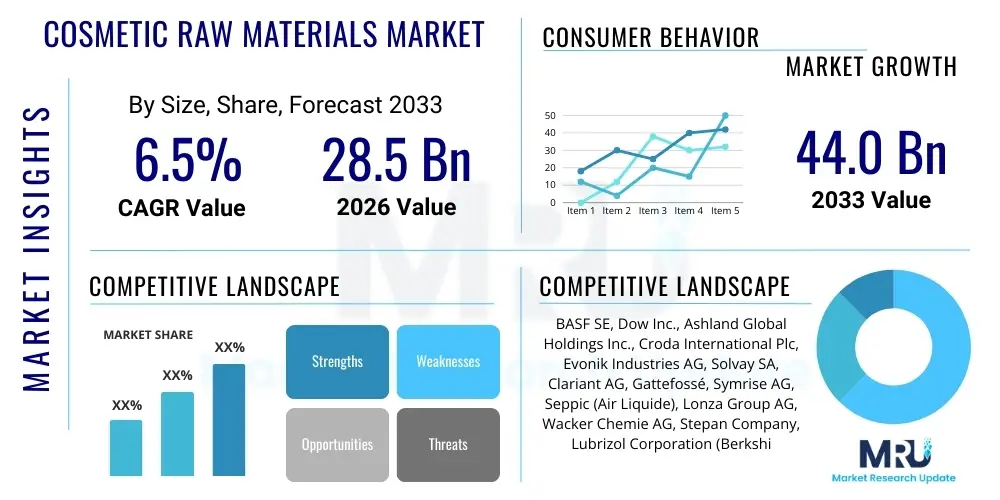

The Cosmetic Raw Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 28.5 Billion in 2026 and is projected to reach USD 44.0 Billion by the end of the forecast period in 2033.

Cosmetic Raw Materials Market introduction

The Cosmetic Raw Materials Market encompasses the supply and trade of specialized chemical compounds, natural extracts, functional ingredients, and active substances essential for the formulation and manufacturing of personal care and beauty products, including skincare, haircare, color cosmetics, and toiletries. These raw materials, ranging from surfactants and emollients to pigments and active pharmaceutical ingredients (APIs), are foundational to product efficacy, texture, stability, and consumer safety. Major applications span across face and body care, oral hygiene, and decorative cosmetics, with a significant trend toward highly functional and natural ingredients driven by consumer demand for clean labels and sustainable sourcing. The primary benefits derived from these materials include moisturizing, UV protection, anti-aging effects, and enhancing product aesthetic properties. Key driving factors fueling market expansion involve the burgeoning global population, increasing consumer awareness regarding health and wellness, significant R&D investments by major manufacturers focused on novel biotechnological ingredients, and the rising penetration of sophisticated skincare regimes in emerging economies.

Cosmetic Raw Materials Market Executive Summary

The market exhibits robust business trends characterized by intense focus on ethical sourcing, green chemistry principles, and the incorporation of advanced biotechnological processes, such as fermentation-derived ingredients and cell culture technology, to replace petrochemical derivatives. Furthermore, strategic partnerships between raw material suppliers and major cosmetic houses are accelerating innovation, particularly in customizing high-performance active ingredients tailored for specific demographic needs or emerging environmental concerns like blue light protection. Regionally, Asia Pacific (APAC) stands as the fastest-growing market, largely due to expanding middle-class disposable incomes, rapid urbanization, and the adoption of multi-step beauty routines in countries like China, South Korea, and India, making it a critical hub for both consumption and localized manufacturing. Segment trends indicate a substantial shift toward natural and organic ingredients, particularly botanical extracts and sustainable oils, alongside a strong performance in the active ingredients segment, driven by demand for scientifically substantiated claims related to anti-aging, hydration, and pollution defense. The market also observes consolidation among specialty chemical producers to gain scale and diversify portfolios, ensuring compliance with stringent global regulatory frameworks such as REACH in Europe and similar evolving standards elsewhere.

AI Impact Analysis on Cosmetic Raw Materials Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the discovery and testing of novel cosmetic raw materials, seeking insights into accelerated formulation optimization and enhanced supply chain transparency. A primary concern revolves around AI’s ability to predict the efficacy and toxicity of untested compounds digitally, significantly reducing the time and cost associated with traditional laboratory trials, thereby democratizing access to complex formulation science. Consumers and industry professionals alike are eager to understand AI’s role in customizing ingredient combinations for personalized beauty solutions at scale and its potential in analyzing vast genomic data to identify highly targeted bioactive molecules derived from sustainable sources. Key expectations center on AI improving predictive modeling for shelf-life stability, ensuring ethical and transparent ingredient sourcing through blockchain-integrated systems managed by AI, and rapidly adapting ingredient portfolios to fast-changing consumer trends and complex regulatory requirements across diverse jurisdictions. The integration of AI tools promises to enhance precision in ingredient development, leading to cleaner, more efficient, and hyper-personalized cosmetic products.

- AI accelerates the discovery of novel raw materials by simulating molecular interactions and predicting biological activity (e.g., anti-inflammatory or anti-oxidant properties).

- Predictive toxicology modeling utilizing machine learning reduces the need for extensive in-vivo testing, aligning with ethical standards and speeding up time-to-market.

- Optimization of formulation efficiency and stability by analyzing large datasets of ingredient compatibility and environmental factors (temperature, light exposure).

- Enhanced supply chain transparency and risk management through AI-driven tracking of raw material provenance, ensuring compliance with sustainability and ethical sourcing mandates.

- Personalized ingredient recommendations based on consumer genomic data, skin microbiome analysis, and external environmental factors, driving hyper-customization in finished products.

- Automation of quality control processes, using computer vision and sensor technology to monitor the purity and consistency of incoming raw materials.

- Rapid market trend analysis, allowing suppliers to proactively synthesize or source ingredients that match emerging consumer demands (e.g., microbiome-friendly ingredients).

DRO & Impact Forces Of Cosmetic Raw Materials Market

The market is predominantly driven by increasing consumer expenditure on premium and functional beauty products, particularly in emerging markets, coupled with continuous innovation focused on sustainable and efficacious ingredients that address specific skin concerns like aging, hydration, and pollution. Restraints primarily involve stringent and fragmented regulatory landscapes across different geographical regions, which necessitate costly and time-consuming approval processes for novel chemical compounds, alongside the volatile pricing and supply chain vulnerabilities associated with natural and specialty raw materials dependent on agricultural production and climate stability. Significant opportunities lie in the expansion of biotechnological ingredients, such as synthetic biology and plant cell culture, which offer scalable, traceable, and sustainable alternatives to traditionally sourced or petrochemical-derived materials, meeting the strong consumer shift toward 'clean beauty' and ethical consumption. The major impact forces shaping the market include rapidly evolving consumer perceptions favoring natural sourcing and ingredient transparency, increasing pressure from NGOs and regulatory bodies to eliminate harmful or controversial chemicals (like certain parabens or microplastics), and the technological capability to produce high-purity, standardized active ingredients through fermentation or synthesis, which ultimately dictates product competitiveness and market entry barriers for new suppliers.

Segmentation Analysis

The Cosmetic Raw Materials Market is intricately segmented based on material type, functional category, and end-user application, reflecting the highly specialized nature of cosmetic formulation. Segmentation by material type distinguishes between natural ingredients, which include botanical extracts, essential oils, and organic butters, and synthetic ingredients, which encompass various polymers, synthetic emollients, and chemical surfactants. This distinction is critical as it reflects the ongoing bifurcation in consumer preference, where natural ingredients command premium pricing but synthetic materials often offer superior stability and performance in highly complex formulations, driving differential growth rates across these sub-segments. The market’s complexity is further evident in the functional classification, separating basic materials like thickeners, preservatives, and solvents, essential for product structure and stability, from high-value active ingredients, which deliver specific biological benefits such as anti-wrinkle, UV filtering, or skin brightening effects, significantly impacting the product’s therapeutic claim and market positioning.

Furthermore, segmentation by application area highlights the differing demands across major cosmetic categories. Skincare applications, covering moisturizers, serums, and sunscreens, consume the largest volume and highest value of active ingredients, especially peptides, vitamins, and high-performance emollients, due to the consumer focus on long-term skin health. In contrast, haircare applications prioritize surfactants, conditioning polymers, and specialized proteins, while color cosmetics focus heavily on high-purity pigments, specialty fillers, and texture modifiers. The detailed analysis of these segments is vital for suppliers to align their R&D and manufacturing capabilities with the most lucrative and rapidly evolving sectors, such as the surging demand for multifunctional ingredients that can serve dual roles, simplifying formulations and enhancing product appeal in a highly competitive retail environment.

The shift towards sustainable chemistry is profoundly influencing segmentation, pushing basic functional ingredients to be replaced by bio-derived or bio-identical alternatives. For instance, traditional preservatives are increasingly being substituted by natural antimicrobial agents or sophisticated blends designed to meet "preservative-free" marketing claims without compromising product safety. Similarly, the drive towards waterless formulations is generating specific demand for solid or highly concentrated raw materials, impacting the supply chain for solvents and carriers. Understanding these granular shifts, driven by both consumer ethics and technological capability, allows market players to accurately forecast ingredient lifecycle and invest strategically in next-generation material science tailored for specialized niches like men's grooming, sensitive skin, or microbiome-friendly cosmetics.

- By Type:

- Natural Ingredients (Botanical Extracts, Essential Oils, Natural Waxes, Butters)

- Synthetic Ingredients (Polymers, Synthetic Pigments, Petrochemical Derivatives)

- Biotechnological Ingredients (Fermentation Products, Cell Culture Extracts, Bio-Identical Molecules)

- By Application:

- Skincare (Facial Care, Body Care, Sun Care)

- Haircare (Shampoos, Conditioners, Styling Products)

- Color Cosmetics (Foundations, Lipsticks, Eye Makeup)

- Fragrances and Perfumes

- Oral Care

- Toiletries (Soaps, Bath Products)

- By Function:

- Active Ingredients (Anti-aging Agents, UV Filters, Vitamins, Peptides, Antioxidants)

- Functional Ingredients (Emollients, Surfactants, Conditioning Agents, Rheology Modifiers, Humectants, Preservatives)

- Colorants and Pigments

- Fragrance Compounds

Value Chain Analysis For Cosmetic Raw Materials Market

The value chain for the Cosmetic Raw Materials Market begins with intensive upstream activities, primarily involving the sourcing and processing of feedstocks. Upstream suppliers include specialty chemical manufacturers that synthesize complex polymers and derivatives, agricultural producers providing natural extracts and raw botanicals, and biotech firms specializing in fermentation or synthesis of active molecules like hyaluronic acid or peptides. Critical steps at this stage involve ensuring the purity, standardization, and sustainability certification of the raw inputs, which is particularly challenging for natural ingredients subject to climate variability and supply chain opacity. Regulatory compliance, including toxicological assessment and documentation, is foundational at the upstream level, as ingredient quality directly dictates the safety and efficacy of the final consumer product, requiring significant investment in quality assurance and traceability systems.

Midstream activities encompass the production and distribution of the finished cosmetic raw materials. This involves complex chemical processing, blending, stabilization, and packaging by dedicated raw material manufacturers. These manufacturers often specialize based on functional categories, such as surfactant providers or active ingredient specialists, and must meet stringent Good Manufacturing Practices (GMP) standards. Distribution channels are highly structured, relying on a mix of direct sales to large, multinational cosmetic companies (ensuring confidentiality and customized supply) and extensive networks of specialized distributors and agents that serve small to mid-sized formulators and private label manufacturers. This indirect route allows wider market penetration and provides localized technical support regarding formulation and regulatory advice.

Downstream analysis focuses on the end-users: the cosmetic product manufacturers, including global giants like L'Oréal and Estée Lauder, as well as niche indie brands and contract manufacturers. The primary interaction involves these downstream users selecting and integrating raw materials based on formulation goals, cost effectiveness, and marketing claims (e.g., natural, cruelty-free). The final stage of the value chain is the retail market, where the end products reach consumers. The efficiency and success of the entire chain are critically dependent on rapid information flow regarding consumer demands, allowing upstream suppliers to quickly innovate and deliver materials that enable successful, trending downstream products, ensuring that the raw materials align with evolving consumer preferences for sustainability and high performance.

Cosmetic Raw Materials Market Potential Customers

The primary consumers and buyers of cosmetic raw materials are large-scale multinational cosmetic and personal care manufacturers who require massive, consistent volumes of standardized ingredients for their global production lines. These customers, including leaders in skincare, haircare, and color cosmetics, often negotiate long-term supply contracts directly with major raw material producers to secure stable pricing, proprietary ingredient access, and customized blends, leveraging their scale to enforce strict quality and sustainability requirements. Their purchasing decisions are heavily influenced by the efficacy data, regulatory compliance documentation (like COSMOS or ECOCERT certifications), and the ingredient's ability to support specific, marketable claims, such as clinically proven anti-aging results or 24-hour hydration, making scientific validation a critical factor in supplier selection.

A second crucial segment consists of contract manufacturing organizations (CMOs) and private label manufacturers, which are experiencing rapid growth as smaller brands increasingly outsource production. These CMOs require a broad portfolio of readily available, versatile raw materials to service numerous diverse clients and manage complex, smaller-batch formulations. They typically purchase through specialized distributors, valuing speed of delivery, access to technical formulation support, and lower minimum order quantities (MOQs). This customer segment is highly sensitive to ingredient cost and availability, as they operate on tight margins and need flexibility to respond rapidly to shifting retail trends and novel product concepts demanded by their brand partners.

Emerging segments include specialty independent or "indie" beauty brands and pharmaceutical companies diversifying into dermocosmetics. Indie brands prioritize niche, high-performance, and often exotic or ethically sourced natural ingredients to establish unique market positioning, often requiring support for small-scale ingredient trials and certification for clean beauty standards. Pharmaceutical companies, conversely, seek highly purified, clinical-grade active raw materials (like high-potency vitamins or purified acids) for medically-oriented skincare lines, demanding exceptional levels of documentation, traceability, and batch consistency, bridging the gap between cosmetic and therapeutic ingredient standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 28.5 Billion |

| Market Forecast in 2033 | USD 44.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Dow Inc., Ashland Global Holdings Inc., Croda International Plc, Evonik Industries AG, Solvay SA, Clariant AG, Gattefossé, Symrise AG, Seppic (Air Liquide), Lonza Group AG, Wacker Chemie AG, Stepan Company, Lubrizol Corporation (Berkshire Hathaway), Kemin Industries, Inc., Kao Corporation, Berg & Schmidt GmbH, Sonneborn, Ajinomoto Co., Inc., Provital Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetic Raw Materials Market Key Technology Landscape

The technological landscape of the cosmetic raw materials market is rapidly evolving, driven primarily by the need for sustainability, enhanced efficacy, and greater formulation stability. Green Chemistry and White Biotechnology stand out as pivotal technologies. Green Chemistry focuses on the design of chemical products and processes that minimize the use and generation of hazardous substances, translating into raw material production that utilizes less energy, minimizes waste, and avoids toxic solvents. This includes employing processes like supercritical fluid extraction, which replaces traditional chemical solvents with pressurized CO2 to extract botanical actives, resulting in cleaner, more concentrated, and environmentally friendly ingredients that align with the rigorous standards of the clean beauty movement and improve the safety profile of the final product.

White Biotechnology, also known as industrial biotechnology, utilizes living cells and enzymes to create bio-based raw materials. This technology allows for the controlled, scalable production of complex molecules that were previously challenging or unsustainable to source, such as specific peptides, high-purity vitamins, and bio-identical versions of natural compounds like squalane (derived from fermentation instead of shark liver). This shift is critical for ensuring supply chain stability and traceability, particularly as ethical sourcing of plant-derived materials becomes increasingly scrutinized. Fermentation technology specifically allows manufacturers to synthesize standardized active ingredients with guaranteed efficacy and purity, addressing key challenges related to batch-to-batch variation inherent in traditional agricultural sourcing.

Furthermore, Nanotechnology and encapsulation techniques are transforming how active ingredients are delivered into the skin. Encapsulation technology, using liposomes, nanosomes, or solid lipid nanoparticles, protects sensitive active ingredients (like retinol or Vitamin C) from degradation due to light or oxidation, significantly extending product shelf-life and enhancing ingredient penetration into deeper skin layers for targeted delivery. While nanotechnology offers superior performance, its application is constantly monitored due to regulatory concerns regarding particle size and long-term health implications, requiring significant R&D investment to develop safe, functional nanomaterials that meet evolving global health standards and consumer acceptance for advanced delivery systems.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for cosmetic raw materials, primarily propelled by high consumer spending in major economies such as China, Japan, and South Korea, which are global trendsetters in both skincare and color cosmetics. The demand is heavily skewed towards high-efficacy active ingredients (e.g., brightening agents, anti-pollution compounds) and traditional natural extracts (TCM derivatives). The region benefits from a robust local manufacturing base and increasing disposable incomes, fueling the adoption of multi-step beauty routines that require diverse specialized ingredients. Furthermore, rising regulatory standards in countries like India and Southeast Asia are increasing the demand for traceable, standardized raw materials.

- Europe: Europe is characterized by a mature market structure and exceptionally stringent regulatory requirements, notably the EU Cosmetics Regulation and REACH, which necessitate high levels of documentation and safety testing for all raw materials. This focus on safety drives demand for bio-derived, highly documented, and sustainable ingredients. The European market leads in the adoption of 'clean beauty' and ethical sourcing standards, prioritizing ingredients with certifications like COSMOS or Fair Trade, making it a key innovation hub for specialty chemicals, natural preservatives, and high-performance emulsifiers that offer stability while meeting stringent clean-label criteria.

- North America: The North American market is driven by rapid innovation, particularly in the premium and professional segments (dermocosmetics and medi-spas). Consumer demand is strongly focused on clinical efficacy, transparency, and wellness-oriented ingredients, leading to robust growth in scientifically proven peptides, cannabinoids (CBD), and advanced microbiome-friendly ingredients. The U.S. market, while less uniformly regulated than Europe, emphasizes self-regulation and brand credibility, pushing suppliers to provide extensive evidence of safety and functional claims to meet consumer expectations and avoid potential litigation related to misleading marketing.

- Latin America (LATAM): LATAM presents significant growth potential, particularly in Brazil and Mexico, fueled by strong demand for haircare and sun care products due to regional climate conditions. The market is highly price-sensitive but shows growing interest in regional biodiversity, leading to increased sourcing and processing of local, exotic botanical extracts. Economic stability and expanding access to global beauty trends are encouraging local manufacturers to upgrade formulation standards, requiring higher quality functional ingredients and preservatives suitable for challenging tropical climates.

- Middle East and Africa (MEA): The MEA market is expanding, driven by urbanization and rising luxury consumption, particularly in the Gulf Cooperation Council (GCC) countries. Demand is high for high-end color cosmetics, premium fragrances, and intensive skincare designed to combat arid climates and high UV exposure. The region increasingly seeks halal-certified ingredients and specialized UV filters, creating a specific niche market requirement for suppliers who can meet both religious compliance and high-performance technical specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetic Raw Materials Market.- BASF SE

- Dow Inc.

- Ashland Global Holdings Inc.

- Croda International Plc

- Evonik Industries AG

- Solvay SA

- Clariant AG

- Gattefossé

- Symrise AG

- Seppic (Air Liquide)

- Lonza Group AG

- Wacker Chemie AG

- Stepan Company

- Lubrizol Corporation (Berkshire Hathaway)

- Kemin Industries, Inc.

- Kao Corporation

- Berg & Schmidt GmbH

- Sonneborn LLC

- Ajinomoto Co., Inc.

- Provital Group

Frequently Asked Questions

Analyze common user questions about the Cosmetic Raw Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the shift toward natural and sustainable cosmetic raw materials?

The shift is driven by heightened consumer awareness regarding ingredient toxicity, ethical sourcing concerns (e.g., palm oil, deforestation), and the global "clean beauty" movement. Regulatory pressures, especially in Europe, further mandate the reduction of petrochemicals and the adoption of biodegradable, traceable, and environmentally friendly raw materials, creating a powerful market incentive for sustainable innovation.

How does biotechnology impact the supply chain security of cosmetic ingredients?

Biotechnology, particularly synthetic biology and fermentation, significantly enhances supply chain security by producing high-purity, bio-identical active ingredients in controlled industrial settings. This process bypasses the inherent volatility and risks associated with agricultural sourcing (weather, political instability), guaranteeing consistent quality, scale, and year-round availability for key compounds like hyaluronic acid and certain vitamins.

Which geographical region exhibits the fastest growth rate in the cosmetic raw materials market?

The Asia Pacific (APAC) region, driven by countries such as China, South Korea, and India, exhibits the fastest growth rate. This rapid expansion is attributed to increasing penetration of sophisticated beauty regimes, rising disposable incomes, and the strong consumer demand for innovative active ingredients, particularly those utilized in anti-aging and skin brightening product categories.

What role do active ingredients play in determining the market value of cosmetic raw materials?

Active ingredients, such as peptides, specialized vitamins, and proprietary botanical complexes, represent the highest-value segment of the market. They are crucial as they confer specific, marketable benefits (efficacy claims) to the final product, directly influencing consumer purchasing decisions and allowing cosmetic brands to command premium pricing, thus driving significant profitability for specialized ingredient suppliers.

What are the major challenges facing the cosmetic raw materials market concerning regulatory compliance?

Major challenges include the fragmented nature of global regulations (e.g., differing rules in the EU, US, and China), the increasing complexity of toxicological data requirements, and the need for costly ingredient registration, particularly for novel materials. Suppliers must invest heavily in documentation and safety testing to ensure ingredients are compliant across all target markets, often delaying product launch timelines.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cosmetic Raw Materials Market Statistics 2025 Analysis By Application (Skin Care, Makeup, Perfume, Sunscreen), By Type (Active Ingredients, Aesthetic Materials, Surfactants And Solvents, Synthetic, Natural), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cosmetic Raw Materials Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Synthetic, Natural), By Application (Skin Care, Makeup, Perfume, Sunscreen, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager