Cosmetics OEM and ODM Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431727 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cosmetics OEM and ODM Market Size

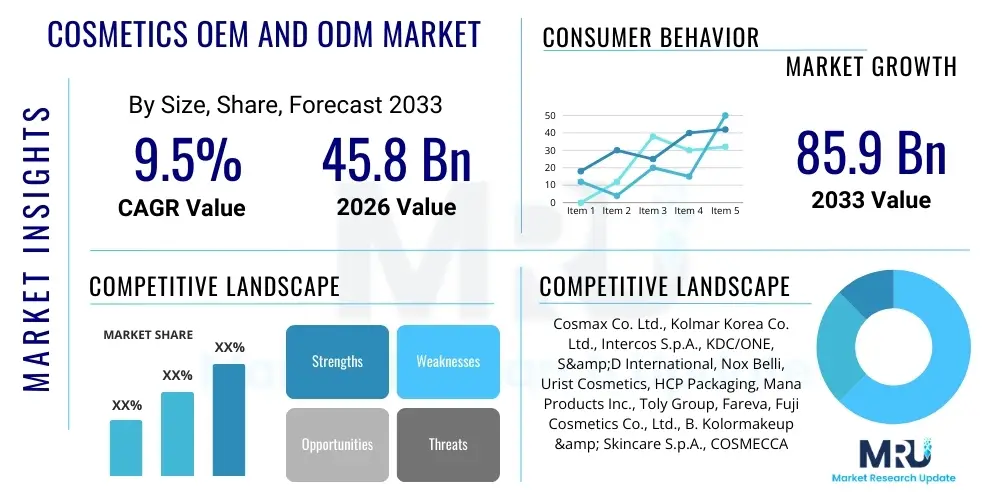

The Cosmetics OEM and ODM Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 45.8 Billion in 2026 and is projected to reach USD 85.9 Billion by the end of the forecast period in 2033.

Cosmetics OEM and ODM Market introduction

The Cosmetics Original Equipment Manufacturer (OEM) and Original Design Manufacturer (ODM) market encompasses specialized third-party providers responsible for the formulation, manufacturing, packaging, and sometimes even the design and intellectual property development of cosmetic and personal care products for brand owners. OEM services primarily focus on manufacturing products based on specifications provided by the client, utilizing standardized or slightly customized processes. In contrast, ODM services offer a comprehensive, turnkey solution, handling everything from market research and initial concept development to final product formulation and pilot testing, allowing brand owners, particularly small and medium enterprises (SMEs) and direct-to-consumer (DTC) startups, to rapidly enter the market without significant capital investment in production facilities or R&D infrastructure.

The primary applications of OEM and ODM services span the entire spectrum of the beauty industry, including skincare (creams, serums, cleansers), color cosmetics (lipsticks, foundations, eyeshadows), haircare (shampoos, conditioners, styling products), and fragrances. The increasing demand for novel, specialized, and clean label formulations, coupled with the necessity for quicker time-to-market, drives brand owners to leverage the expertise and scalable manufacturing capabilities offered by these third-party partners. This reliance allows brands to focus their internal resources on core competencies such as marketing, distribution, and brand building, fostering a more agile and competitive global beauty ecosystem.

The major benefits derived from utilizing OEM and ODM services include substantial cost efficiencies, access to cutting-edge research and development (R&D) without internal expenditure, flexible production scales, and compliance with stringent international regulatory standards. Key driving factors propelling market growth include the proliferation of small, innovative digital-native beauty brands seeking rapid scaling, the rising consumer appetite for personalized and niche cosmetic products, and the globalization of supply chains that favor specialized manufacturing hubs, particularly in the Asia-Pacific region. Furthermore, the accelerating trend of outsourcing production to meet environmental, social, and governance (ESG) standards, relying on manufacturers already invested in sustainable processes, is enhancing the attractiveness of OEM/ODM partnerships.

Cosmetics OEM and ODM Market Executive Summary

The Cosmetics OEM and ODM market is characterized by robust growth, driven primarily by the shifting dynamics in the global beauty industry, emphasizing speed-to-market and product innovation. Business trends show a significant move towards full-service ODM providers, as emerging brands require comprehensive support, from initial concept validation to finished goods production and regulatory filing. There is also a pronounced trend toward consolidation among leading manufacturers, aiming to acquire specialized R&D capabilities or expand geographical footprints, particularly in segments focused on specialized ingredients like probiotics, customized skincare actives, and sustainable packaging solutions. Technological adoption, including the integration of AI for trend forecasting and manufacturing process optimization, is becoming a key differentiator among leading firms.

Regionally, the Asia Pacific (APAC) continues its dominance, acting as the global manufacturing powerhouse due to its established infrastructure, competitive operational costs, and proximity to key raw material suppliers. However, North America and Europe are experiencing accelerated growth in high-value, niche ODM services, focusing on complex regulatory compliance (such as the EU’s strict ingredient standards) and advanced formulation techniques like 'clean beauty' and waterless cosmetics. Brands in these regions increasingly seek local or near-shore partners to reduce supply chain fragility and enhance responsiveness to rapidly changing consumer preferences, leading to strategic investment in sophisticated, smaller-scale flexible manufacturing units across the Western world.

Segment trends highlight the substantial market share held by the Skincare segment, fueled by the persistent consumer focus on health and wellness, driving demand for specialized serums, protective barriers, and anti-aging solutions. The shift toward sustainable and ethical practices is profoundly impacting both manufacturing (process improvements, reduced waste) and product formulation (natural, organic, cruelty-free). The ODM sub-segment is outpacing OEM growth, reflecting the industry's pivot toward partnership models where manufacturers contribute significant intellectual property and innovation, rather than simply executing pre-defined specifications. This complexity demands highly skilled partners capable of managing intricate supply chains and ensuring traceability from raw material sourcing to final product delivery.

AI Impact Analysis on Cosmetics OEM and ODM Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cosmetics OEM and ODM market frequently center on three critical areas: enhanced personalized product development, optimization of complex manufacturing supply chains, and predictive trend forecasting for ingredient selection. Users are particularly concerned about how AI tools can reduce R&D timelines, minimize batch waste through advanced predictive maintenance, and facilitate hyper-customization at scale—a necessity for modern DTC brands. Expectations are high that AI will democratize sophisticated formulation development, making niche and highly specialized products accessible to smaller brands, thus leveling the competitive field. Concerns often relate to the initial investment required for AI infrastructure and the need for specialized data science expertise within traditionally manufacturing-focused organizations, requiring OEMs/ODMs to rapidly upskill their workforce or acquire specialized technology firms.

The integration of AI into formulation science is revolutionizing product development by enabling manufacturers to analyze vast datasets of consumer feedback, ingredient efficacy, and stability test results simultaneously. Machine learning algorithms can predict the stability and compatibility of novel ingredient combinations with far greater accuracy and speed than traditional laboratory methods, drastically cutting down the typical R&D cycle from months to weeks. This capability is paramount for OEMs and ODMs striving to stay ahead in the fast-paced beauty industry, allowing them to offer proprietary, optimized formulations tailored precisely to emerging consumer demands, such as microbiome-friendly products or personalized genetic-based skincare regimes.

Furthermore, AI significantly enhances operational efficiencies within the production environment. AI-powered predictive maintenance systems monitor equipment performance in real-time, anticipating failures before they occur, thus minimizing costly downtime and improving overall yield rates, which is crucial for high-volume contract manufacturers. Supply chain logistics are also optimized through AI, which can forecast demand fluctuations and external risks (like geopolitical instability or raw material shortages) to ensure optimal inventory levels and efficient procurement strategies. This comprehensive analytical capability allows OEM/ODM providers to offer superior service levels, characterized by reliability, quality consistency, and cost-effective production, reinforcing their value proposition to major and emerging brand clients globally.

- AI-driven trend forecasting accelerates new product development cycles by predicting popular ingredient profiles and consumer aesthetic preferences.

- Machine learning optimizes formulation chemistry, predicting ingredient stability and efficacy, minimizing R&D failure rates.

- AI enhances supply chain resilience and traceability, improving transparency in raw material sourcing and logistics management.

- Implementation of predictive maintenance reduces operational downtime and increases manufacturing efficiency and yield rates.

- Personalized manufacturing facilitated by AI allows for cost-effective production of small, highly customized batches (Mass Customization).

DRO & Impact Forces Of Cosmetics OEM and ODM Market

The Cosmetics OEM and ODM market is primarily driven by the escalating demand for outsourced manufacturing services stemming from the rapid proliferation of digital-native beauty brands and the increasing complexity of product formulation, particularly within the 'clean beauty' and advanced scientific skincare segments. Outsourcing allows brands to achieve speed-to-market without large capital expenditures, leveraging the manufacturers’ specialized equipment and regulatory expertise. However, the market faces significant restraints, most notably stringent global regulatory standards (e.g., EU, FDA, China NMPA) that require sophisticated compliance mechanisms, as well as the inherent risk of intellectual property (IP) theft and safeguarding proprietary formulas when collaborating with external manufacturers. These factors necessitate robust legal frameworks and trust-based partnerships.

Significant opportunities exist in meeting the escalating consumer preference for sustainable and ethical products. ODMs that invest heavily in eco-friendly packaging solutions, sustainable raw material sourcing, and energy-efficient manufacturing processes stand to capture premium clientele seeking to meet strict ESG mandates. Furthermore, the advancement of personalized cosmetics, utilizing data analytics and genomic insights, presents a lucrative niche for ODMs capable of producing highly individualized, small-batch products. The strategic expansion into emerging markets, such as Southeast Asia and Latin America, where local manufacturing expertise is still maturing, also offers substantial avenues for established global OEM/ODM players seeking geographic diversification and new client bases.

The impact forces within this market are substantial, defined by intense competitive rivalry among Asian mega-manufacturers and sophisticated Western niche players, driving constant innovation in service offerings and pricing. Buyer power is generally moderate, as large established cosmetic brands have strong negotiating leverage, while emerging DTC brands are often dependent on the unique R&D capabilities of ODMs. Supplier power is increasing, particularly for proprietary, high-efficacy, or sustainably certified raw materials, leading to vertical integration trends among top manufacturers to secure critical inputs. Technological advancements, particularly automation and AI in quality control and process management, are high-impact forces that continually redefine operational benchmarks and compliance capabilities within the contract manufacturing space.

Segmentation Analysis

The Cosmetics OEM and ODM market is comprehensively segmented based on service type, product type, and geographical region, reflecting the diverse operational and specialization models within the industry. Understanding these segmentations is critical for market participants, as specialization allows manufacturers to cater effectively to specific brand needs, whether focused on high-volume production efficiency or niche, innovative formulation development. The segmentation framework reveals varying growth rates and competitive dynamics across different product categories, with skincare currently exhibiting the most significant traction due to sustained consumer investment in daily wellness routines and specialized treatment products.

- Service Type:

- Original Equipment Manufacturer (OEM)

- Original Design Manufacturer (ODM)

- Product Type:

- Skincare (Moisturizers, Serums, Cleansers, Masks)

- Color Cosmetics (Lip Products, Eye Makeup, Face Makeup)

- Haircare (Shampoos, Conditioners, Styling Products, Treatments)

- Fragrances

- Others (Bath & Body, Oral Care)

- Geographical Regions:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Cosmetics OEM and ODM Market

The value chain for the Cosmetics OEM and ODM market is a complex network, starting with upstream activities involving the sourcing and processing of raw materials, ranging from basic chemicals and emollients to highly specialized active ingredients, botanicals, and functional additives. Upstream supplier power is critical, especially for patented or rare natural ingredients, necessitating strong strategic relationships or direct vertical integration by large ODMs. Efficient management of quality control and regulatory compliance at this stage is essential, as the integrity of the final product hinges on the quality and ethical sourcing of initial components. Furthermore, sustainable sourcing practices are increasingly mandated, adding layers of complexity and specialized certification requirements to the initial procurement phase.

The core of the value chain lies in the manufacturing and development phase (the OEM/ODM service itself), which includes R&D, formulation, pilot batch testing, scaling up production, filling, and final packaging. This stage is highly capital-intensive and requires constant technological upgrades, particularly in automation and sterile manufacturing environments. Direct internal operations involve significant overhead related to maintaining compliance with Good Manufacturing Practices (GMP) and adhering to diverse international chemical safety regulations. ODMs add value through proprietary intellectual property (formula libraries) and offering end-to-end services, which reduces the complexity burden on the brand owner.

The downstream analysis focuses on the distribution channels used to move the finished goods from the OEM/ODM facilities to the brand owner's distribution network or directly to the retailer/consumer (in dropshipping models). Distribution channels can be direct (e.g., manufacturers shipping directly to a brand's centralized warehouse) or indirect, utilizing specialized third-party logistics (3PL) providers adept at handling temperature-sensitive or fragile cosmetic goods. The rise of e-commerce and direct-to-consumer (DTC) models has heavily influenced downstream logistics, demanding rapid fulfillment and highly responsive supply chain management. The final stage involves the brand’s marketing and sales efforts, where the product’s success validates the OEM/ODM partnership, often leading to long-term collaborative agreements and further R&D investments.

Cosmetics OEM and ODM Market Potential Customers

Potential customers for Cosmetics OEM and ODM services are incredibly diverse, spanning the entire spectrum of the beauty and personal care industry. The primary category includes emerging and startup beauty brands, often digitally native and focused on niche markets (e.g., clean beauty, vegan, hyper-personalized skincare). These customers rely heavily on ODMs for complete, turnkey solutions, as they lack the internal R&D capabilities, manufacturing infrastructure, and regulatory expertise required to bring sophisticated products to market quickly. Their focus is rapid scaling, demanding flexible batch sizes and low minimum order quantities (MOQs), which ODMs increasingly cater to.

A second major customer group consists of established, large-scale beauty corporations (e.g., Estée Lauder, L’Oréal, Coty). While these entities maintain significant internal production capacities, they utilize OEMs and specialized ODMs for strategic purposes: capacity expansion during peak seasons, outsourcing production of specific, technically complex product lines (like specialized clinical serums or complex color cosmetics), or rapidly accessing innovative technologies developed externally by the contract manufacturer. This segment requires stringent quality assurance, high-volume consistency, and robust confidentiality agreements, driving demand for Tier 1 global manufacturers with proven track records.

The third significant group includes non-traditional beauty market entrants, such as fashion houses, celebrity-backed ventures, retailers developing private label lines, and pharmaceutical companies diversifying into cosmeceuticals. These customers require manufacturers capable of ensuring regulatory compliance tailored to the specific functional claims of the product (e.g., medical device classification vs. cosmetic classification) and maintaining brand integrity synonymous with luxury or medical-grade quality. Retailers, in particular, seek high-quality private label production from OEMs to maximize margin control and offer competitive alternatives to branded products, necessitating efficiency and highly competitive cost structures from their chosen manufacturing partners.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.8 Billion |

| Market Forecast in 2033 | USD 85.9 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cosmax Co. Ltd., Kolmar Korea Co. Ltd., Intercos S.p.A., KDC/ONE, S&D International, Nox Belli, Urist Cosmetics, HCP Packaging, Mana Products Inc., Toly Group, Fareva, Fuji Cosmetics Co., Ltd., B. Kolormakeup & Skincare S.p.A., COSMECCA KOREA Co., Ltd., Albéa S.A., Swallowfield Plc, Zschimmer & Schwarz GmbH & Co KG, AFS Cosmetic Co., Ltd., General Cosmetics Co., Ltd., Orient Express Fragrances Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cosmetics OEM and ODM Market Key Technology Landscape

The key technology landscape in the Cosmetics OEM and ODM market is centered on enhancing precision, scalability, and sustainability throughout the manufacturing process. Advanced automation, specifically utilizing robotics in filling, capping, and packaging lines, is crucial for maintaining high volumes while ensuring precision and hygiene, thereby reducing human error and contamination risks. Sophisticated Enterprise Resource Planning (ERP) systems, integrated with Manufacturing Execution Systems (MES), are essential for real-time tracking of raw materials, ensuring full traceability from procurement to finished product, a non-negotiable requirement for regulatory bodies in major markets like the EU and US. These integrated platforms are fundamental to managing complex multi-market product lines and diverse regulatory requirements efficiently.

Furthermore, technology focused on product innovation and safety is highly prioritized. Microencapsulation technology is widely utilized by ODMs to stabilize sensitive active ingredients (such as Vitamin C or retinol) and ensure controlled release onto the skin, thereby maximizing efficacy and shelf-life. In formulation R&D, high-throughput screening (HTS) technologies allow manufacturers to rapidly test thousands of ingredient combinations for compatibility, stability, and desired functional attributes, dramatically accelerating the time taken to perfect a formula. This technological advantage is a core value proposition for ODMs, enabling them to offer unique, scientifically validated formulations to their brand partners, especially in the competitive cosmeceutical space.

Digital technologies, including 3D printing and virtual prototyping, are gaining traction, particularly in the rapid development of custom packaging components and mold design, speeding up the pre-production timeline. Sustainability technology is another major focus; this involves investing in closed-loop water systems, optimizing energy consumption through smart factory sensors, and developing innovative material science for eco-friendly packaging alternatives (e.g., bio-degradable plastics or refillable systems). Compliance and quality assurance are increasingly handled by digitized systems using vision inspection technology and blockchain for supply chain ledger integrity, providing transparency and verifiable proof of ethical sourcing and regulatory adherence across the entire manufacturing pipeline, which significantly strengthens the OEM/ODM relationship with increasingly demanding brand owners.

Regional Highlights

Geographical analysis reveals significant disparities in market maturity, growth dynamics, and technological adoption across key regions. The Asia Pacific (APAC) region stands out as the global nucleus for Cosmetics OEM and ODM activity, predominantly driven by manufacturing giants in South Korea, China, and Japan. South Korea, in particular, is renowned globally for its advanced R&D and rapid innovation capabilities, establishing the "K-Beauty" trend and specializing in high-demand segments like sheet masks, sophisticated color cosmetics, and highly efficacious skincare actives. APAC benefits from vast production capacity, competitive pricing, and efficient supply chain integration, making it the primary sourcing region for high-volume and innovative products worldwide.

North America and Europe represent mature markets characterized by stringent regulatory environments and a strong emphasis on 'clean beauty,' sustainability, and localized production (near-shoring). Manufacturers in these regions often specialize in premium, smaller-batch, high-value ODM services, catering to luxury and niche brand segments that prioritize ethical sourcing, high-quality certification (e.g., COSMOS organic), and rapid, responsive logistics. While operating costs are higher, the regional demand for reduced carbon footprint associated with long-distance shipping and the desire for enhanced supply chain control drives large brands to maintain a significant manufacturing presence within these geographies, focusing on specialized and technologically advanced product lines.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging as high-growth potential regions. LATAM is characterized by strong internal demand for personal care products and a nascent, but growing, local manufacturing base. International OEM/ODM players are strategically entering markets like Brazil and Mexico to capitalize on local trends and avoid high import duties, often focusing on color cosmetics and localized fragrance formulations. The MEA region, particularly the GCC countries, shows high consumption of luxury cosmetics and perfumes, leading to increasing investment in localized high-end manufacturing capabilities, often through joint ventures with established European partners, focusing on halal certification and region-specific product development to meet local religious and cultural demands effectively.

- Asia Pacific (APAC): Dominates the market due to South Korea's R&D leadership (K-Beauty), China's scalable capacity, and competitive pricing; focus on mass-market efficiency and rapid innovation.

- North America: Strong demand for clean formulations, customized skincare, and near-shoring for supply chain security; concentration of specialized, high-value ODM services.

- Europe: Highly regulated market driving expertise in compliance (EU Cosmetics Regulation); emphasis on sustainability, organic certification, and premium cosmetic manufacturing.

- Latin America (LATAM): High growth potential driven by domestic consumer demand and increasing focus on localized color palettes and tropical-climate formulations.

- Middle East & Africa (MEA): Emerging market focused on luxury beauty, fragrance manufacturing, and compliance with Halal certification standards.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cosmetics OEM and ODM Market.- Cosmax Co. Ltd.

- Kolmar Korea Co. Ltd.

- Intercos S.p.A.

- KDC/ONE (Knowlton Development Corporation)

- S&D International Co. Ltd.

- Nox Belli

- Urist Cosmetics Co., Ltd.

- HCP Packaging

- Mana Products Inc.

- Toly Group

- Fareva Group

- Fuji Cosmetics Co., Ltd.

- B. Kolormakeup & Skincare S.p.A.

- COSMECCA KOREA Co., Ltd.

- Albéa S.A.

- Swallowfield Plc

- Zschimmer & Schwarz GmbH & Co KG

- AFS Cosmetic Co., Ltd.

- General Cosmetics Co., Ltd.

- Orient Express Fragrances Ltd.

- Italia Independent Group S.p.A.

- Tongyu Cosmetics

Frequently Asked Questions

Analyze common user questions about the Cosmetics OEM and ODM market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between OEM and ODM services in the cosmetics industry?

Original Equipment Manufacturing (OEM) involves the manufacturer producing a product strictly based on the client's existing formulation and specifications, focusing solely on production efficiency and scale. Conversely, Original Design Manufacturing (ODM) offers a comprehensive, turnkey solution where the manufacturer provides the R&D, formulation, regulatory expertise, and packaging design, allowing the client to select from proprietary ready-made concepts, thus providing maximum speed-to-market for brands lacking internal innovation capabilities.

How is regulatory compliance managed by cosmetics OEM/ODM partners in major global markets?

Leading OEM/ODM partners maintain specialized regulatory affairs departments to navigate the stringent compliance requirements of major markets, including the EU (Cosmetics Regulation 1223/2009), the US (FDA MoCRA), and China (CSAR). They ensure all ingredients, manufacturing processes (GMP), and labeling meet regional standards, often providing required safety data and dossiers, thus mitigating compliance risks for brand owners operating internationally and facilitating smoother market entry.

Which product segment is expected to drive the highest growth in the Cosmetics OEM and ODM market?

The Skincare segment is anticipated to exhibit the highest sustained growth. This is driven by persistent consumer prioritization of wellness, coupled with the increasing demand for specialized, scientific, and functional products such as advanced serums, barrier repair creams, and personalized anti-aging solutions. The complexity of formulating these active-heavy products necessitates reliance on the sophisticated R&D and specialized manufacturing capabilities offered by ODMs.

What role does sustainability play in selecting an OEM or ODM partner?

Sustainability has become a critical selection criterion. Brands increasingly require OEM/ODM partners to demonstrate commitments to Environmental, Social, and Governance (ESG) criteria, including using certified sustainable raw materials, implementing energy-efficient manufacturing processes (green factories), minimizing waste, and offering innovative eco-friendly and refillable packaging options. Manufacturers that provide verified traceability and clear sustainability certifications gain significant competitive advantage and attract premium clientele.

How do advancements in AI technology affect cost structures for cosmetics manufacturers?

AI significantly optimizes cost structures by increasing operational efficiency and reducing waste. AI-powered tools optimize formulation costs by predicting stability and efficacy with fewer prototype iterations, thus saving R&D expenditure. Furthermore, AI-driven predictive maintenance minimizes unplanned downtime and optimizes inventory management across the complex supply chain, leading to reduced operational overhead and allowing OEMs/ODMs to offer more competitive pricing structures while maintaining high product quality and consistency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager