Cotton Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432158 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cotton Fabric Market Size

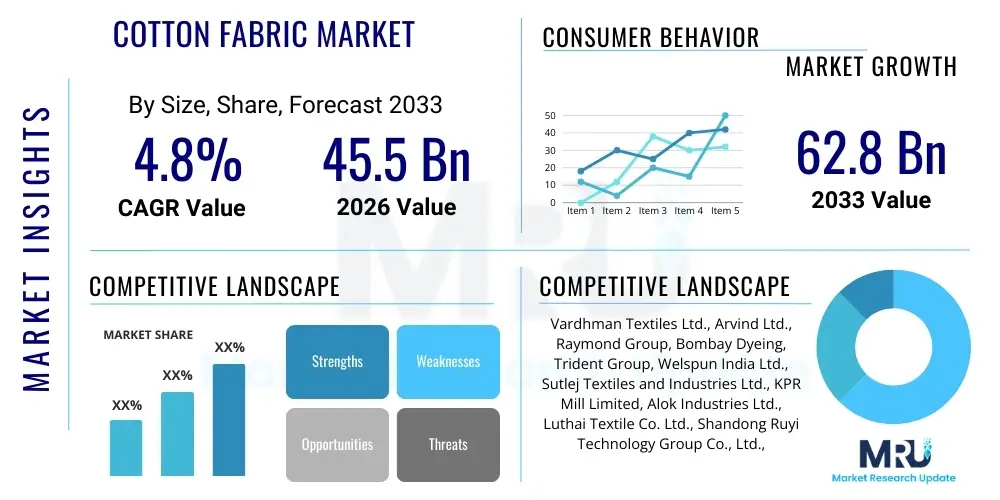

The Cotton Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 62.8 Billion by the end of the forecast period in 2033.

Cotton Fabric Market introduction

The Cotton Fabric Market is defined by the production, distribution, and consumption of textiles manufactured primarily from cotton fibers. This natural cellulosic fiber forms the backbone of a vast segment of the global textile industry, valued for its inherent softness, breathability, strength, and biodegradability. Key products range from basic woven materials like sheeting and denim to complex knitted structures used in performance wear and specialized technical textiles. Major applications span across apparel (casual wear, professional clothing), home furnishings (bedding, towels, upholstery), and industrial uses (filtration media, medical gauze). The inherent benefits of cotton fabric, including its hypoallergenic nature and superior moisture management capabilities, ensure sustained consumer demand despite competitive pressure from synthetic alternatives. Market growth is primarily driven by increasing global population, rising disposable incomes in Asia Pacific economies, and the accelerating consumer movement towards sustainable and natural fibers, compelling manufacturers to invest in environmentally friendly cultivation and processing techniques.

Cotton fabric production involves several complex stages, starting from raw cotton harvesting, followed by ginning (separation of fiber from seed), spinning (converting fibers into yarn), and finally weaving or knitting the yarn into fabric. Technological advancements in spinning and weaving machinery have significantly boosted production efficiency and reduced defect rates. The primary driving factors for market expansion include the consistent requirement for comfortable and durable clothing across all demographics and the growing adoption of cotton blends in high-end fashion and technical applications. Furthermore, regulatory support in various regions promoting the use of sustainable and organic textiles provides a strong impetus for market players focusing on certified cotton products. The market structure is highly fragmented, featuring large integrated mills and numerous smaller specialized weaving units, all competing based on quality, price, and supply chain efficiency.

Cotton Fabric Market Executive Summary

The global Cotton Fabric Market demonstrates robust resilience characterized by continuous innovation in sustainable sourcing and technical finishes. Business trends indicate a strong shift towards vertically integrated supply chains, allowing major players to control quality from farm to finished textile, mitigating risks associated with volatile raw material prices. Furthermore, the rise of circular economy models is influencing product design, favoring fabrics optimized for recycling and longevity. Regionally, Asia Pacific maintains its dominance in manufacturing and consumption, driven by massive production capabilities in China, India, and Vietnam, coupled with expanding domestic consumer bases. North America and Europe, while being slower in manufacturing growth, lead in the adoption of premium organic and specialty cotton fabrics, reflecting high consumer purchasing power and stringent environmental regulations. Segment trends highlight accelerating demand for knitted cotton fabric dueors use in athleisure and comfortable casual wear, significantly outpacing the traditional growth rate of woven cotton, although denim and sheeting remain foundational segments. The overarching theme across all segments is the increasing requirement for transparency and traceability, facilitated by digital tools and certifications ensuring ethical and sustainable practices throughout the value chain.

The market faces structural challenges, primarily revolving around the environmental footprint of conventional cotton farming, notably water consumption and pesticide use, leading manufacturers to heavily invest in organic and Better Cotton Initiative (BCI) compliant sourcing. Corporate strategies are focused on differentiation through innovation, such as developing cotton fabrics with performance characteristics typically associated with synthetics, including enhanced stretch, quick-drying properties, and UV resistance. Financially, market stability is tied to global economic health; however, the essential nature of apparel ensures continuous, albeit cyclically fluctuating, demand. Strategic mergers and acquisitions are common among large players seeking to consolidate weaving capacity, acquire patented finishing technologies, or expand geographical reach, particularly into rapidly industrializing regions. Overall market health is positive, underpinned by consumer preference for natural fibers and sustained efforts by the industry to address long-standing sustainability concerns.

AI Impact Analysis on Cotton Fabric Market

User questions related to the impact of Artificial Intelligence (AI) on the Cotton Fabric Market frequently center on themes of operational efficiency, supply chain vulnerability reduction, and enhanced sustainability reporting. Consumers and businesses are keenly interested in how AI tools can predict volatile raw cotton commodity prices with greater accuracy, thereby optimizing procurement strategies and reducing manufacturing cost risks. Furthermore, there is significant inquiry into AI’s role in precise demand forecasting, which is critical for reducing textile waste generated by fast fashion cycles and overproduction. Key concerns also address the application of machine learning in optimizing energy and water usage during high-impact processes like dyeing and finishing, ensuring compliance with evolving environmental standards, and facilitating the complex task of tracing sustainable cotton origins through global supply chains.

AI technologies are fundamentally transforming how cotton fabric is produced, distributed, and consumed. In manufacturing, AI-powered predictive maintenance systems minimize downtime on complex weaving and knitting machinery, drastically increasing overall equipment effectiveness (OEE). Logistics optimization, handled by sophisticated algorithms, ensures that raw materials and finished goods are moved efficiently, reducing transportation costs and carbon emissions. On the consumer-facing side, AI drives personalized product recommendations and aids retailers in managing inventory levels based on real-time market signals, minimizing obsolete stock. These implementations are not just cost-saving measures but are crucial steps toward establishing a truly intelligent and resilient textile manufacturing ecosystem capable of adapting quickly to environmental regulations and consumer behavioral changes.

- AI-driven Predictive Analytics for Raw Cotton Price Volatility Mitigation.

- Optimization of Manufacturing Parameters (e.g., tension, speed, chemical dosing) via Machine Learning for reduced waste.

- Enhanced Supply Chain Traceability and Transparency using AI coupled with Blockchain Technology.

- Advanced Demand Forecasting to minimize inventory risks and prevent overproduction.

- Automated Quality Control Systems utilizing computer vision to detect fabric defects instantly.

- Robotics and AI integration in textile processing for improved labor efficiency and precision.

- AI assistance in designing sustainable and recyclable cotton textile compositions.

DRO & Impact Forces Of Cotton Fabric Market

The Cotton Fabric Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by various impact forces stemming from regulatory changes, technological advancements, and evolving consumer ethics. A primary driver is the pervasive consumer preference for natural, breathable, and comfortable textiles, especially in tropical and subtropical regions. This is compounded by the rising global momentum behind sustainability, favoring cotton over petroleum-derived synthetics, particularly organic and certified sustainable cotton variants. However, these drivers face significant restraints, notably the intense volatility and high cost of raw cotton commodities, which often fluctuate based on climatic conditions and geopolitical stability. Furthermore, the substantial water footprint of conventional cotton cultivation, along with regulatory pressure to reduce chemical use, poses operational constraints for conventional producers. Opportunities for market expansion reside primarily in the development and scaling of specialized technical cotton fabrics for medical and industrial niche applications, alongside innovative textile finishing technologies that impart performance properties without compromising the natural fiber integrity. The overall impact forces push the industry toward vertical integration and technological modernization, favoring manufacturers capable of demonstrating environmental stewardship and efficiency.

Technological advancement serves as a pivotal impact force, addressing restraints such as production inefficiency and environmental impact. Innovations in wastewater treatment, closed-loop dyeing processes, and precision agriculture (using IoT sensors for water optimization in fields) are making cotton production incrementally more sustainable. Regulatory impact forces, particularly those originating from the European Union and North America regarding chemical substance restrictions (like REACH), compel global suppliers to adhere to higher environmental safety standards. Economically, the market is highly sensitive to fluctuations in global energy costs, which directly affect transportation and processing expenses. Social impact forces, driven by consumer activism and ethical sourcing demands, necessitate verifiable transparency in labor practices and raw material origin, pushing companies toward certifications like GOTS (Global Organic Textile Standard) and Fair Trade. These combined forces mandate a shift from purely cost-focused production to a value-added approach centered on sustainability and verifiable quality.

Market growth is also significantly propelled by urbanization and rising disposable income in economies like India, Brazil, and parts of Southeast Asia, translating into increased demand for both high-volume basic wear and premium textile products. The inherent biodegradability of cotton provides a strategic advantage in an era where microplastic pollution from synthetic fibers is a major environmental concern, fueling opportunity for market positioning based on ecological benefits. However, competition from highly durable and low-cost synthetic blends remains a constant restraint, requiring cotton producers to continuously innovate to maintain relevance in price-sensitive segments. The net impact of these forces is the acceleration of research into bio-engineered and recycled cotton fibers, creating a competitive environment focused on closed-loop manufacturing processes.

Segmentation Analysis

The Cotton Fabric Market is primarily segmented based on the structural type of the fabric (Woven vs. Knitted), the end-use application (Apparel, Home Textiles, Industrial), and the specific type of cotton used (Organic, Conventional, Recycled). The segmentation provides critical insight into demand patterns, revealing that the Apparel segment remains the largest consumer, dominating volume sales globally. However, the Knitted Fabric segment is exhibiting the highest growth rate, primarily due to the global trends in casualization of clothing and the expansion of the athleisure market, which favors the comfort and stretch inherent in knitted structures. Geographically, manufacturing intensity and consumption patterns differ significantly, with Asia Pacific driving volume production, while Europe and North America command premium pricing for specialty and organic cotton products, emphasizing sustainable sourcing and high-quality finishing treatments across all segments.

- By Type:

- Woven Cotton Fabric (Denim, Poplin, Canvas, Sheeting)

- Knitted Cotton Fabric (Jersey, Fleece, Rib Knit)

- By Application:

- Apparel (Outerwear, Undergarments, Casual Wear)

- Home Textiles (Bedding, Towels, Drapery)

- Industrial/Technical Textiles (Filtration Media, Medical Supplies, Tarpaulins)

- By Sourcing/Grade:

- Conventional Cotton Fabric

- Organic Cotton Fabric

- Recycled Cotton Fabric

- BCI Cotton Fabric

- By End-Use Industry:

- Fashion Industry

- Interior Design and Furnishing

- Medical and Healthcare Sector

- Automotive Industry

Value Chain Analysis For Cotton Fabric Market

The value chain for the Cotton Fabric Market is extensive, starting from highly decentralized agricultural inputs (upstream) and culminating in complex, multi-channel retail distribution (downstream). Upstream analysis involves raw cotton cultivation, heavily influenced by global climate patterns, commodity pricing, and agricultural technology. Key upstream players include large-scale commercial farms and ginning operations responsible for processing raw cotton into lint. Efficiency at this stage determines the quality and cost base of the subsequent textile manufacturing processes. Midstream activities, involving spinning (converting lint into yarn), weaving/knitting (creating the gray fabric), and essential preparatory processes like scouring and bleaching, are highly capital-intensive and concentrated in key manufacturing hubs, requiring significant energy and water resources. Direct and indirect distribution channels then move the finished fabric toward garment makers or directly to retail.

Downstream analysis focuses on fabric finishing, cut-and-sew operations (garment manufacturing), branding, and final distribution. Finishing processes (dyeing, printing, special chemical treatments for wrinkle resistance or waterproofing) add significant value and are often the most environmentally sensitive stages. The distribution landscape is complex, utilizing both direct channels where large textile mills supply high-volume apparel brands directly, and indirect channels involving agents, wholesalers, and fabric distributors who cater to smaller designers and tailors. E-commerce platforms are increasingly serving as a significant indirect channel for technical and custom fabric sales, offering greater market reach but requiring robust logistics integration.

Effective management of the value chain is critical for mitigating supply risk and ensuring transparency, particularly concerning sustainable sourcing. Upstream security involves long-term contracts with BCI or organic certified farms. Downstream efficiency relies on modern inventory management systems and robust logistics networks capable of handling global shipping demands. The increasing trend of vertical integration, where large corporations own and control operations from spinning through to finishing, aims to maximize control over quality, speed up lead times, and enhance traceability to meet stringent consumer and regulatory demands.

Cotton Fabric Market Potential Customers

The potential customers for the Cotton Fabric Market are incredibly diverse, reflecting the material’s ubiquitous presence across various sectors. The primary customer segment consists of large-scale apparel manufacturers and Fast Fashion retailers who require vast volumes of standardized cotton fabrics (e.g., denim, jersey, poplin) quickly and affordably. These buyers prioritize reliable supply, competitive pricing, and certified compliance with chemical and ethical standards. Another significant customer base includes high-end designer labels and luxury brands who demand specialized, often organic or rare long-staple cottons, placing emphasis on superior finishing quality, unique textures, and exclusive supply agreements that guarantee material provenance.

Beyond the fashion industry, institutional buyers form a crucial segment, including hospitals, hotels, and military organizations. Hospitals require durable, easily sanitized cotton fabrics for bedding, uniforms, and medical gauze, where anti-microbial treatments are often necessary. Hotels demand high-quality, high-thread-count cotton linens and towels known for comfort and longevity. Industrial customers purchase technical cotton fabrics for specific applications such as conveyor belts, heavy-duty protective clothing, and filtration systems, requiring compliance with stringent industry performance specifications like fire resistance or high tensile strength. This segment values durability and technical compliance over aesthetic appeal.

Finally, smaller businesses, including independent tailoring shops, craft retailers, and specialized interior decorators, procure cotton fabrics through indirect distribution channels (wholesalers and distributors). The growing popularity of Do-It-Yourself (DIY) crafting and small-batch custom apparel manufacturing also defines a rapidly expanding segment of individual consumers and small-batch buyers who utilize online fabric retail platforms. Targeting these diverse segments requires manufacturers to offer a wide range of products, from commodity fabrics to highly engineered technical textiles, supported by varied pricing and logistics models to suit differing volume requirements and quality expectations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 62.8 Billion |

| Growth Rate | CAGR 4.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vardhman Textiles Ltd., Arvind Ltd., Raymond Group, Bombay Dyeing, Trident Group, Welspun India Ltd., Sutlej Textiles and Industries Ltd., KPR Mill Limited, Alok Industries Ltd., Luthai Textile Co. Ltd., Shandong Ruyi Technology Group Co., Ltd., China Textile Group Co., Ltd., Parkdale Mills Inc., Unifi Inc., Indorama Ventures PCL, Weiqiao Textile Company Limited, Huafu Fashion Co., Ltd., Olam International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cotton Fabric Market Key Technology Landscape

The technology landscape in the Cotton Fabric Market is rapidly evolving, driven primarily by the need for speed, efficiency, and sustainability improvements. Modern textile mills rely heavily on automated high-speed weaving and knitting machines, such as air-jet and rapier looms, which significantly boost output while maintaining fabric consistency and minimizing human error. The integration of Industry 4.0 principles, including IoT sensors and Big Data analytics, allows for real-time monitoring of machine performance and predictive maintenance, ensuring high operational uptime. A major technological focus is on optimizing water usage during the dyeing and finishing stages, leading to the adoption of advanced techniques like digital printing, foam dyeing, and supercritical CO2 dyeing, which drastically reduce or eliminate water requirements and chemical effluents. These process innovations are critical for adhering to stricter global environmental regulations and addressing the industry’s historical high water consumption issues.

Furthermore, technology is playing a crucial role in creating value-added cotton fabrics. Research and development are focused on innovative chemical finishes that impart performance characteristics previously exclusive to synthetic fibers. Examples include durable water repellency (DWR) treatments that are PFC-free, wrinkle-free finishes that use less formaldehyde, and anti-microbial treatments essential for medical and hygiene textiles. Material science advancements also facilitate the integration of recycled and post-consumer cotton fibers back into the supply chain. New techniques for mechanically or chemically recycling cotton textiles address the industry's waste problem, moving the entire ecosystem closer to a circular model, which is a major technological and strategic objective for large manufacturers.

The rise of digital technology also impacts the entire traceability structure. Utilizing blockchain technology in conjunction with AI-based authentication is becoming standard practice for verifying the origin of organic and certified sustainable cotton. This assures both B2B customers and end consumers of the ethical and environmental claims made about the fabric, enhancing brand trust and premium positioning. In terms of fiber production itself, advancements in genomic research are yielding cotton varieties that are more drought-resistant and pest-resistant, reducing the reliance on irrigation and chemical pesticides, thereby future-proofing the raw material supply chain against escalating climate challenges.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market in terms of production volume and accounts for the largest share of consumption, led by major manufacturing hubs in China, India, and Vietnam. The region benefits from lower labor costs, extensive vertical integration capabilities, and robust domestic demand driven by population growth and rising middle-class income. Innovation in sustainable textile production, particularly in India, is rapidly accelerating to meet export requirements.

- North America: Characterized by high per capita consumption of premium and specialized cotton fabrics, particularly organic and performance-treated textiles. Manufacturing focuses on high-tech, small-batch, and technical applications. The region is a key adopter of supply chain transparency technologies (like blockchain) and sustainable sourcing initiatives (BCI and organic certifications).

- Europe: A major importer and key market for high-value cotton textiles, emphasizing environmental standards (REACH) and ethical sourcing. European consumers show a strong preference for durable, high-quality, and traceable organic cotton products. The region leads in textile innovation, especially in functional finishes and textile recycling research, driving demand for recycled cotton fibers.

- Latin America (LATAM): Exhibits steady growth driven by expanding domestic apparel industries, particularly in countries like Brazil and Mexico. The region is self-sufficient in raw cotton production to some extent but also relies on imports for specialized yarns. Market growth is closely tied to economic stability and export opportunities to North American markets.

- Middle East and Africa (MEA): Key growth potential exists in textile manufacturing expansion in Turkey and certain African nations (e.g., Egypt), which possess natural cotton resources. Demand in the Middle East is centered around high-end luxury textiles and institutional uniforms. Infrastructure investment in spinning and weaving capabilities is crucial for realizing full regional market potential.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cotton Fabric Market.- Vardhman Textiles Ltd.

- Arvind Ltd.

- Raymond Group

- Bombay Dyeing

- Trident Group

- Welspun India Ltd.

- Sutlej Textiles and Industries Ltd.

- KPR Mill Limited

- Alok Industries Ltd.

- Luthai Textile Co. Ltd.

- Shandong Ruyi Technology Group Co., Ltd.

- China Textile Group Co., Ltd.

- Parkdale Mills Inc.

- Unifi Inc.

- Indorama Ventures PCL

- Weiqiao Textile Company Limited

- Huafu Fashion Co., Ltd.

- Olam International

Frequently Asked Questions

Analyze common user questions about the Cotton Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for sustainable cotton fabrics?

Demand is driven by heightened consumer awareness regarding environmental impact, regulatory mandates limiting chemical use, and corporate commitments towards ethical sourcing and reducing the water footprint associated with conventional cotton cultivation.

How are volatile raw cotton prices managed in the manufacturing sector?

Manufacturers mitigate volatility through future hedging contracts, vertical integration to control initial sourcing costs, strategic inventory management using predictive AI, and diversifying fiber inputs by utilizing recycled or blended materials.

Which geographic region dominates the global production of cotton fabric?

The Asia Pacific region, specifically countries like China, India, and Pakistan, dominates global cotton fabric production due to established infrastructure, substantial labor availability, and comprehensive vertical integration across the textile supply chain.

What are the fastest-growing application segments in the Cotton Fabric Market?

The fastest-growing application segments are athleisure and technical textiles (e.g., medical and performance wear), primarily driving demand for knitted cotton structures and cotton fabrics enhanced with specialty performance finishes.

What technological advancements are critical for the future of cotton textile manufacturing?

Critical advancements include the adoption of Industry 4.0 automation (IoT, AI), closed-loop waterless dyeing technologies, and the scaling of chemical and mechanical recycling processes for post-consumer cotton waste to ensure circularity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager