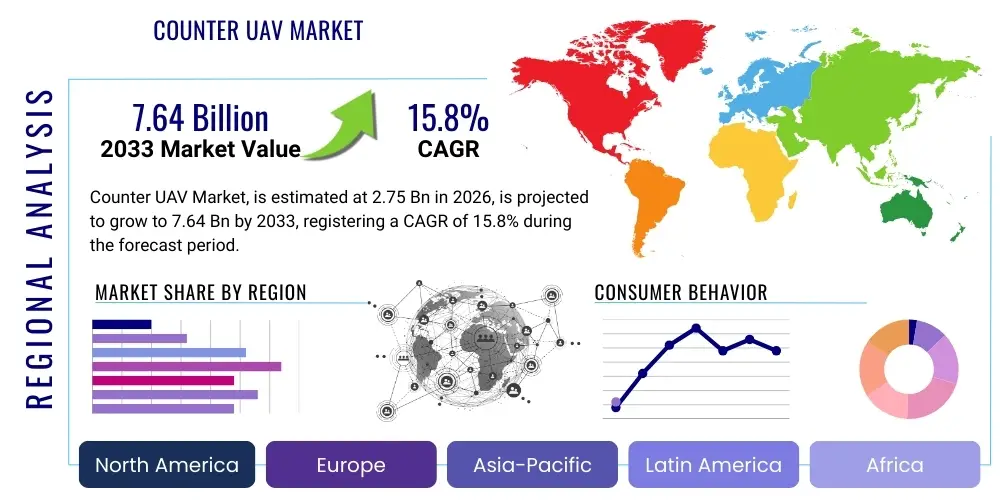

Counter UAV Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439352 | Date : Jan, 2026 | Pages : 258 | Region : Global | Publisher : MRU

Counter UAV Market Size

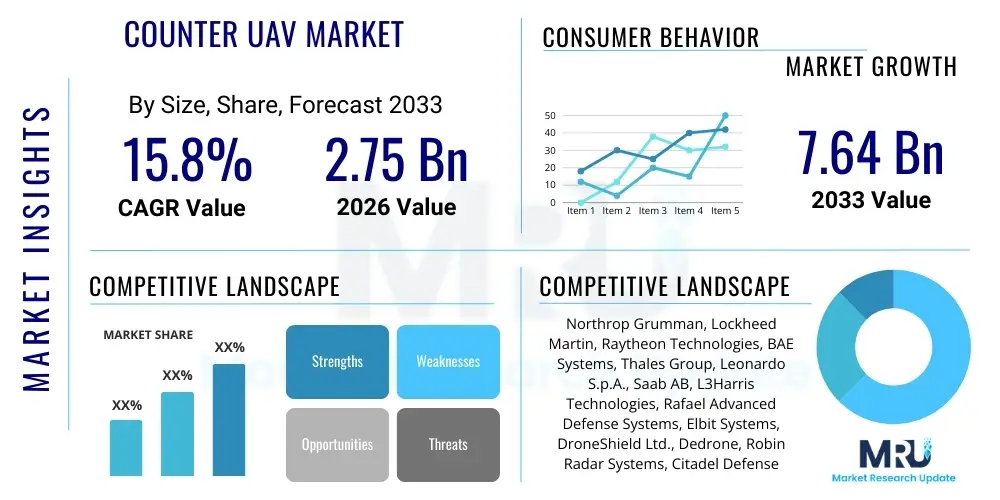

The Counter UAV Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 2.75 billion in 2026 and is projected to reach USD 7.64 billion by the end of the forecast period in 2033. This substantial growth trajectory reflects the escalating global security concerns regarding unauthorized drone activities and the continuous innovation in defense and surveillance technologies. The increasing proliferation of commercial and consumer drones, coupled with their potential misuse by hostile actors for surveillance, espionage, or kinetic attacks, is a primary catalyst driving the market expansion. Governments and defense organizations worldwide are investing heavily in robust counter-UAV (C-UAV) solutions to protect critical infrastructure, military assets, and national borders from these evolving threats.

The market's expansion is also underpinned by rapid technological advancements, including the integration of artificial intelligence (AI), machine learning (ML), and sophisticated electronic warfare (EW) capabilities into C-UAV systems. These technologies enhance the detection, classification, tracking, and neutralization capabilities of counter-drone platforms, making them more effective against increasingly complex and autonomous threats. Furthermore, the growing demand from homeland security agencies for protecting public events, airports, and other sensitive civilian areas contributes significantly to market size. The global landscape of asymmetric warfare and terrorism mandates continuous upgrades and deployment of advanced C-UAV systems, ensuring a consistent upward trend in market valuation over the forecast period.

Counter UAV Market introduction

The Counter UAV (C-UAV) Market encompasses a diverse range of systems and technologies designed to detect, track, identify, and neutralize unauthorized or hostile unmanned aerial vehicles (UAVs), commonly known as drones. These systems are critical for safeguarding national security, protecting critical infrastructure, and ensuring public safety against the escalating threat posed by malicious drone activities. The market includes various product categories such as kinetic kill systems, electronic warfare (EW) jammers, directed energy weapons (DEW) like lasers, and sophisticated sensor arrays for detection and tracking. Major applications span military and defense operations, homeland security, critical infrastructure protection, and commercial security scenarios, offering comprehensive solutions against both conventional and asymmetric drone threats. The primary benefits derived from these systems include enhanced airspace security, deterrence of illicit activities, and the prevention of potential damage or loss of life, making them indispensable in modern security frameworks. Driving factors such as increasing geopolitical instability, the rapid proliferation of drone technology, and the imperative for robust security measures globally continue to fuel sustained market growth and innovation.

The product description for C-UAV solutions varies widely depending on their operational mechanism and intended use. From handheld drone guns capable of jamming control signals to large-scale integrated air defense systems that can detect and neutralize multiple threats simultaneously, the spectrum is broad. These systems often combine radar, radio frequency (RF) sensors, electro-optical/infrared (EO/IR) cameras, and acoustic sensors for multi-layered detection. Once a threat is identified, various neutralization methods can be employed, ranging from non-kinetic options like jamming GPS or control links, to more aggressive kinetic solutions involving projectiles, or high-energy lasers. The sophistication of these systems is constantly evolving, with a strong emphasis on automation, artificial intelligence, and network integration to provide timely and effective responses to rapidly emerging drone threats.

The major applications of Counter UAV technologies are predominantly found within the defense and security sectors. Military forces deploy C-UAV systems to protect forward operating bases, naval vessels, and high-value assets from enemy surveillance or attack drones. Homeland security agencies utilize them for border patrol, protection of government buildings, correctional facilities, and large public gatherings such as sporting events or concerts. Critical infrastructure, including power plants, airports, oil and gas facilities, and nuclear sites, represents another significant application area, demanding stringent security measures against potential drone-borne sabotage or reconnaissance. Beyond these, emerging commercial applications include protecting private estates, corporate campuses, and sensitive industrial sites, indicating a broadening scope for C-UAV technologies as drone proliferation extends into civilian airspace. The benefits, beyond direct threat neutralization, also include providing valuable intelligence on drone flight patterns and origins, enabling proactive security strategies.

Counter UAV Market Executive Summary

The Counter UAV market is experiencing robust expansion driven by escalating global security threats and rapid technological advancements. Business trends highlight increased R&D investments by key players to integrate AI, machine learning, and advanced sensor fusion for enhanced detection and neutralization capabilities. Partnerships between defense contractors and specialized C-UAV technology firms are becoming common, fostering innovation and broadening market offerings. Regional trends show North America and Europe as dominant markets due to high defense spending and significant R&D infrastructure, while the Asia Pacific is emerging rapidly driven by increasing defense modernization efforts and heightened geopolitical tensions. Segment trends indicate a growing demand for portable and vehicle-mounted systems for tactical operations, alongside sophisticated integrated solutions for strategic asset protection, with electronic warfare and directed energy technologies gaining significant traction due to their precision and non-kinetic advantages. The market is poised for sustained growth as countries prioritize comprehensive layered defenses against evolving aerial threats.

Key business trends in the Counter UAV market reflect a strategic shift towards integrated, multi-layered defense architectures. Companies are moving beyond standalone solutions to offer comprehensive suites that combine various detection and neutralization technologies, ensuring greater resilience against sophisticated drone attacks. This includes the development of 'system of systems' approaches where C-UAV capabilities are seamlessly integrated with existing air defense networks. Furthermore, there is a clear trend towards miniaturization and modularity, making C-UAV systems more adaptable for diverse operational environments, from urban settings to remote border regions. The competitive landscape is also witnessing consolidation, with larger defense primes acquiring smaller, innovative C-UAV specialists to incorporate cutting-edge technologies and expand their product portfolios. Emphasis is also placed on developing autonomous and semi-autonomous systems, reducing operator workload and enhancing response times.

From a regional perspective, North America continues to lead the market, fueled by substantial defense budgets, ongoing military modernization programs, and a proactive stance against drone threats, particularly from government agencies and border security forces in the United States. Europe closely follows, driven by concerns over terror threats and illegal drone activities, with countries like the UK, France, and Germany investing in advanced C-UAV solutions for both military and civilian applications. The Asia Pacific region is rapidly ascending as a key growth market, attributed to rising defense expenditures in countries such as China, India, and South Korea, coupled with significant cross-border tensions and the need to secure critical national infrastructure. Latin America and the Middle East & Africa regions are also showing increasing adoption, primarily in response to internal security challenges and regional conflicts, necessitating robust C-UAV defenses. Each region's unique security landscape and regulatory environment significantly influence the types of C-UAV solutions being prioritized and adopted.

Segmentation trends reveal a strong inclination towards advanced technological solutions. The electronic warfare segment, including RF jammers and spoofing technologies, remains dominant due to its non-kinetic nature and ability to disable drones without physical damage, making it suitable for civilian applications. Directed energy weapons (DEW), particularly high-energy lasers, are gaining significant traction for their precision, speed-of-light engagement, and cost-effectiveness per engagement compared to traditional munitions. Kinetic solutions, while still relevant for military applications, are often integrated into broader systems to offer a comprehensive range of neutralization options. Moreover, the end-user segmentation shows sustained growth in military and defense applications, alongside increasing demand from homeland security, critical infrastructure protection, and event security, indicating a diversifying client base for C-UAV technologies. Portable and vehicle-mounted systems are seeing increased adoption for tactical flexibility, while fixed-site installations continue to be essential for perimeter protection of high-value assets. This multi-faceted growth across different segments underscores the dynamic and evolving nature of the Counter UAV market.

AI Impact Analysis on Counter UAV Market

Users frequently inquire about how artificial intelligence is transforming the Counter UAV market, with key themes revolving around enhanced detection accuracy, autonomous threat response, data fusion capabilities, and the implications for ethical considerations in autonomous systems. Concerns often focus on the reliability of AI in critical defense scenarios, the potential for algorithmic bias, and the cybersecurity vulnerabilities associated with highly integrated AI systems. Expectations are high for AI to significantly improve the speed and effectiveness of C-UAV operations, reduce operator workload, and enable proactive threat neutralization through predictive analytics. There is also considerable interest in how AI will facilitate the integration of diverse sensor data, making C-UAV systems more intelligent and adaptable against sophisticated and swarm-based drone attacks. The overarching sentiment points towards AI as a pivotal technology for the future of counter-drone warfare, promising unprecedented levels of automation and threat mitigation, while also necessitating robust ethical guidelines and secure implementation practices.

- AI-driven sensor fusion enhances the accuracy and speed of drone detection and classification, differentiating between authorized and unauthorized aerial vehicles in complex environments.

- Machine learning algorithms enable C-UAV systems to analyze vast amounts of data from radar, RF, EO/IR, and acoustic sensors, improving threat identification and reducing false positives.

- Predictive analytics powered by AI allows for the anticipation of drone attack vectors and behaviors, facilitating proactive defensive measures and strategic asset protection.

- Autonomous threat response mechanisms, guided by AI, can rapidly engage and neutralize threats without constant human intervention, significantly reducing reaction times in critical situations.

- AI facilitates the development of intelligent jamming and spoofing techniques, adapting to various drone communication protocols and frequencies in real-time for more effective electronic warfare.

- Enhanced decision support systems for operators, leveraging AI to present critical information and recommended actions, thereby optimizing human-in-the-loop control.

- Swarm drone defense capabilities are significantly bolstered by AI, enabling C-UAV systems to manage and counteract multiple simultaneous threats through coordinated responses.

- AI contributes to the development of self-learning systems that continuously improve their performance based on new threat data and operational experiences, adapting to evolving drone technologies.

- The integration of AI into C-UAV platforms supports mission planning, resource allocation, and post-engagement analysis, leading to more efficient and effective counter-drone operations.

- Ethical AI frameworks are increasingly being developed to ensure responsible deployment of autonomous C-UAV systems, addressing concerns related to target discrimination and collateral damage.

DRO & Impact Forces Of Counter UAV Market

The Counter UAV Market is profoundly shaped by a confluence of Drivers, Restraints, and Opportunities, collectively influenced by various Impact Forces. Key drivers include the pervasive growth in malicious drone activities, the increasing proliferation of commercially available UAVs, and the escalating demand for robust security measures across military, homeland security, and critical infrastructure sectors. Restraints encompass the high initial acquisition and operational costs of advanced C-UAV systems, stringent regulatory frameworks concerning electronic warfare and kinetic solutions, and potential risks of collateral damage or electromagnetic interference. Significant opportunities lie in the integration of artificial intelligence and machine learning for enhanced automation, the development of multi-domain and layered defense systems, and expansion into emerging commercial applications like event security and private property protection. These dynamics are further amplified by impact forces such as geopolitical tensions, rapid technological innovation, evolving threat landscapes, and increasing public awareness regarding drone threats, collectively dictating the market's trajectory and growth potential. The continuous interplay between these elements necessitates agile strategic responses from market participants to capitalize on growth avenues while mitigating inherent challenges.

Delving deeper into the drivers, the sheer accessibility and affordability of drones have inadvertently led to their misuse by terrorist organizations, criminal syndicates, and adversarial state actors for purposes ranging from intelligence gathering to direct attacks. This 'democratization' of aerial threat capabilities has compelled governments and private entities to invest significantly in defensive countermeasures. Additionally, the heightened awareness of national security threats, particularly in volatile regions, pushes defense budgets towards acquiring advanced C-UAV technologies. Furthermore, technological advancements in radar, RF sensing, electro-optical/infrared (EO/IR) systems, and acoustic detection have improved the efficacy of C-UAV platforms, making them more attractive for comprehensive security solutions. The demand for sophisticated, integrated systems that can detect, track, identify, and neutralize various drone types across different operational environments continues to be a primary driver, fostering innovation and rapid deployment. The increasing complexity of drone swarms and autonomous UAVs further mandates sophisticated counter-measures, compelling market growth.

However, several restraints temper the market's unchecked expansion. The substantial capital investment required for state-of-the-art C-UAV systems, coupled with ongoing maintenance and training costs, can be prohibitive for smaller organizations or nations with limited defense budgets. Regulatory hurdles, especially concerning the use of jamming technologies that might interfere with legitimate communications or air traffic control, present significant deployment challenges. Ethical considerations surrounding the use of kinetic or directed energy solutions, particularly in civilian airspace, also pose a restraint, necessitating careful policy formulation and operational guidelines. The potential for collateral damage from kinetic interceptions or the risks associated with electromagnetic interference from jamming systems are critical factors that slow down widespread adoption in certain scenarios. Moreover, the rapid evolution of drone technology means C-UAV systems must constantly be updated, leading to obsolescence challenges and increased R&D costs, further constraining market growth.

Despite these restraints, the market is rife with opportunities. The most significant opportunity lies in the continuous integration of emerging technologies like Artificial Intelligence (AI) and Machine Learning (ML) to enhance autonomous threat detection, classification, and response. AI-powered C-UAV systems promise higher accuracy, faster reaction times, and reduced reliance on human operators, making them highly desirable. The development of multi-layered defense architectures, combining various detection and neutralization techniques, offers a comprehensive solution against diverse drone threats, representing a substantial market opportunity. Furthermore, the expansion of C-UAV applications beyond traditional military and homeland security domains into commercial sectors, such as protection of airports, stadiums, data centers, and critical infrastructure, opens up new revenue streams. Miniaturization and cost reduction through advanced manufacturing processes also present opportunities to make C-UAV solutions more accessible to a broader range of end-users. Strategic partnerships and international collaborations for joint development and deployment of advanced C-UAV technologies further amplify these opportunities, fostering a dynamic and innovative market landscape.

Segmentation Analysis

The Counter UAV market is meticulously segmented across various parameters to provide a comprehensive understanding of its diverse landscape and growth dynamics. These segmentations typically include classifications by technology (e.g., kinetic, electronic warfare, directed energy), platform (e.g., ground-based, handheld, vehicle-mounted, shipborne, airborne), end-user (e.g., military & defense, homeland security, commercial), and range (e.g., short-range, medium-range, long-range). Each segment reflects unique operational requirements, technological maturities, and market adoption rates, highlighting specific areas of investment and innovation. This granular analysis allows stakeholders to identify key growth drivers within specific niches and understand the demand patterns across different applications and geographical regions, facilitating targeted product development and market entry strategies. The interplay between these segments ultimately defines the competitive environment and future direction of the C-UAV industry, underscoring the market's adaptability to evolving threats and technological advancements.

- By Technology:

- Kinetic Systems (e.g., net guns, projectile launchers, missile systems)

- Electronic Warfare (EW) Systems (e.g., RF jammers, GPS spoofers, cyber takeovers)

- Directed Energy Weapons (DEW) (e.g., high-energy lasers, high-power microwaves)

- Other Technologies (e.g., acoustic sensors, visual spectrum, thermal imaging, radar)

- By Platform:

- Ground-Based C-UAV Systems (e.g., fixed installations, mobile units)

- Handheld C-UAV Systems (e.g., drone guns, portable jammers)

- Vehicle-Mounted C-UAV Systems (e.g., integrated into armored vehicles, patrol cars)

- Shipborne C-UAV Systems (e.g., naval vessel integration)

- Airborne C-UAV Systems (e.g., mounted on helicopters, other aircraft)

- By End-User:

- Military & Defense (e.g., army, navy, air force, special forces)

- Homeland Security (e.g., border patrol, law enforcement, customs)

- Critical Infrastructure (e.g., airports, power plants, oil & gas facilities, nuclear sites)

- Commercial (e.g., private security, event management, corporate campuses)

- By Range:

- Short-Range C-UAV Systems (up to 1-2 km)

- Medium-Range C-UAV Systems (2-10 km)

- Long-Range C-UAV Systems (10+ km)

Value Chain Analysis For Counter UAV Market

The Counter UAV market's value chain is a complex ecosystem, beginning with upstream activities focused on advanced material science and component manufacturing, extending through sophisticated system integration, and culminating in downstream deployment, maintenance, and support. Upstream analysis involves the supply of critical components such as high-performance sensors (radar, RF, EO/IR), specialized electronic components for jamming systems, powerful laser modules for DEW, and robust structural materials for platforms. Key players in this stage are often specialized technology providers and component manufacturers. The midstream segment is dominated by defense contractors and technology integrators who assemble these components into complete C-UAV systems, performing extensive R&D, software development for AI and control systems, and rigorous testing. This integration phase is crucial for developing multi-layered and effective counter-drone solutions. Downstream analysis focuses on the distribution channels, which are predominantly direct sales to government agencies, military forces, and large enterprise clients, often involving long procurement cycles and bespoke customization. Indirect channels, through system integrators and distributors, cater to smaller commercial clients or provide regional support services. The entire value chain is characterized by a high degree of technological sophistication, stringent quality control, and a strong emphasis on continuous innovation to keep pace with evolving drone threats.

The upstream segment of the Counter UAV market value chain is characterized by a reliance on highly specialized and often proprietary technologies and raw materials. This includes manufacturers of advanced semiconductor components essential for electronic warfare systems and AI processing units. Suppliers of high-grade optical lenses, thermal sensors, and radar arrays form another critical part of this segment, providing the foundational elements for detection and tracking capabilities. Furthermore, developers of sophisticated algorithms for signal processing, image recognition, and threat assessment contribute intellectual property that is vital for the intelligence of C-UAV systems. The materials science sector also plays a role, supplying lightweight yet durable composites and alloys for various C-UAV platforms. Research and development institutions, both private and governmental, are integral at this stage, pushing the boundaries of what is technologically feasible and translating scientific breakthroughs into practical components. The cost and availability of these high-tech components can significantly impact the overall production costs and market competitiveness of C-UAV solutions.

Moving downstream, the distribution channel for Counter UAV systems is primarily direct, particularly for high-value contracts with military and defense organizations. These sales often involve detailed tenders, extensive negotiations, and long-term support agreements directly between the prime contractors and government clients. For homeland security and critical infrastructure protection, direct sales also dominate, sometimes facilitated by government procurement agencies. Indirect distribution channels exist but are typically focused on servicing smaller commercial clients or providing localized support and maintenance. This includes partnerships with regional security integrators who may bundle C-UAV solutions with broader security packages. The complexity and bespoke nature of many C-UAV systems necessitate direct engagement with end-users to ensure proper integration, training, and ongoing technical support. After-sales service, including software updates, hardware maintenance, and operational training, forms a critical part of the downstream value chain, ensuring the long-term efficacy and reliability of these sophisticated defense systems. The choice of distribution channel often depends on the scale and complexity of the C-UAV solution, as well as the specific needs and procurement processes of the end-user.

Counter UAV Market Potential Customers

The Counter UAV market primarily serves a diverse range of high-stakes end-users and buyers, predominantly within the governmental and commercial security sectors. The most significant customer segment is military and defense forces worldwide, including armies, navies, air forces, and special operations units, which require robust C-UAV capabilities to protect personnel, assets, and strategic locations from adversary drones. Homeland security agencies, such as border patrol, customs, law enforcement, and national guard units, constitute another major customer base, focusing on safeguarding national borders, critical public infrastructure, and managing large public gatherings. Beyond government entities, the market extends to the private sector, specifically critical infrastructure operators like airports, nuclear power plants, oil and gas refineries, and data centers, all of which face severe risks from unauthorized drone intrusions. Emerging commercial applications include private security firms tasked with protecting corporate campuses, high-profile events, and private estates. These diverse customer groups share a common imperative: to neutralize the growing threat posed by malicious or errant unmanned aerial vehicles, thereby driving sustained demand for advanced C-UAV solutions.

Within the military and defense segment, potential customers are actively seeking C-UAV systems that offer multi-mission capabilities, survivability in contested environments, and seamless integration with existing command and control structures. They prioritize solutions that can effectively counter both individual drones and coordinated swarm attacks, often demanding sophisticated electronic warfare, kinetic, and directed energy options. Naval forces require shipborne systems capable of operating in harsh maritime environments, protecting fleets from aerial threats. Air forces are looking for airborne C-UAV solutions or integrated ground-to-air defense systems. The overarching requirement is for reliable, resilient, and rapidly deployable systems that can operate 24/7 with minimal false positives and maximum neutralization effectiveness, often necessitating significant investment in R&D and long-term procurement contracts. The increasing focus on asymmetric warfare and the proliferation of low-cost, off-the-shelf drones among non-state actors continue to bolster military demand for advanced counter-drone technologies.

Homeland security agencies represent a growing and increasingly critical customer segment. Their needs often differ slightly from military applications, with a stronger emphasis on non-kinetic neutralization methods to minimize collateral damage in civilian areas. Border agencies require long-range detection and tracking capabilities for porous borders, while law enforcement focuses on portable, rapidly deployable systems for urban environments, public events, and critical incident response. Airports are a specific sub-segment with unique requirements for C-UAV systems that can detect and mitigate drone incursions without disrupting air traffic control or posing risks to legitimate aircraft. Operators of critical national infrastructure, such as power grids, water treatment plants, and communication hubs, are increasingly recognizing their vulnerability to drone-based sabotage or espionage, prompting investments in fixed-site C-UAV installations with robust perimeter defense capabilities. The commercial sector, while nascent, shows potential for growth in protecting large corporate facilities, high-value assets, and public events where safety and privacy are paramount. These diverse customer needs underscore the broad applicability and customization requirements within the Counter UAV market, pushing manufacturers to develop versatile and adaptable solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.75 billion |

| Market Forecast in 2033 | USD 7.64 billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Northrop Grumman, Lockheed Martin, Raytheon Technologies, BAE Systems, Thales Group, Leonardo S.p.A., Saab AB, L3Harris Technologies, Rafael Advanced Defense Systems, Elbit Systems, DroneShield Ltd., Dedrone, Robin Radar Systems, Citadel Defense Company, SRC Inc., Blighter Surveillance Systems, Ascent Vision Technologies, Israel Aerospace Industries (IAI), Boeing, Rheinmetall AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Counter UAV Market Key Technology Landscape

The Counter UAV market is characterized by a rapidly evolving and sophisticated technology landscape, driven by the imperative to stay ahead of increasingly advanced drone threats. Core technologies include multi-spectral sensor fusion, integrating radar, radio frequency (RF) detection, electro-optical/infrared (EO/IR) cameras, and acoustic sensors for comprehensive detection and tracking capabilities. Electronic Warfare (EW) is paramount, encompassing advanced jamming techniques to disrupt GPS, control links, and data transmission, as well as spoofing capabilities to take control of drones. Directed Energy Weapons (DEW), particularly high-energy lasers and high-power microwaves, are emerging as key neutralization technologies due to their precision, speed-of-light engagement, and low cost per shot. Artificial Intelligence (AI) and Machine Learning (ML) are increasingly integrated for autonomous threat classification, behavioral analysis, and rapid decision-making, enhancing the overall intelligence and effectiveness of C-UAV systems. Furthermore, network-centric architectures, secure communication protocols, and cyber-takeover capabilities are vital for integrated, multi-layered defense solutions, representing the forefront of C-UAV technological innovation and deployment.

Sensor technologies form the foundational layer of any effective C-UAV system. Radar systems, from traditional ground-based units to compact 3D active electronically scanned array (AESA) radars, provide long-range detection and tracking of small, fast-moving aerial objects. RF detection sensors passively listen for drone communication signals, allowing for early detection, classification, and even identification of drone types and sometimes their operators. Electro-optical/infrared (EO/IR) cameras offer visual confirmation, identification, and precise tracking, especially valuable in day/night conditions and for forensic analysis post-event. Acoustic sensors, though typically short-range, can provide supplementary detection in challenging RF environments. The trend is towards sensor fusion, where data from multiple sensor types is combined and processed by advanced algorithms, often AI-driven, to create a more robust and reliable picture of the airspace, minimizing false alarms and maximizing detection probabilities against stealthy or small drones. This integrated approach ensures comprehensive coverage and redundancy, critical for high-stakes security applications.

Neutralization technologies represent the active countermeasure capabilities within the C-UAV landscape. Electronic Warfare (EW) techniques are widely deployed for their non-kinetic nature, allowing drones to be disabled or deterred without physical destruction. RF jammers broadcast powerful signals to disrupt drone control links or GPS navigation, forcing them to land or return home. GPS spoofers can subtly manipulate a drone's perceived location, causing it to deviate from its intended path. More advanced EW systems can even attempt to hijack a drone's control, taking it over remotely. Directed Energy Weapons (DEW) are a rapidly maturing segment, with high-energy lasers (HEL) capable of physically damaging or destroying drones by burning through their airframe or critical components, offering instantaneous engagement. High-power microwave (HPM) systems can fry a drone's electronics, causing it to cease function. Kinetic solutions, while more traditional, still play a role, involving net guns to capture drones, projectile launchers, or even integrated missile systems for military-grade threats. The choice of neutralization technology depends heavily on the operational environment, the nature of the threat, and the desired outcome, with a growing preference for modular and multi-modal systems that can adapt their response based on real-time threat assessment.

Beyond sensors and effectors, the underlying intelligence and connectivity of C-UAV systems are increasingly crucial. Artificial Intelligence (AI) and Machine Learning (ML) are transformative, enabling systems to learn from past encounters, predict drone behavior, and autonomously classify targets with high accuracy. AI algorithms are used for pattern recognition in sensor data, distinguishing between legitimate and malicious drone activity. They also optimize jamming frequencies, laser firing patterns, and overall system resource allocation for maximum effectiveness. Network-centric architectures allow individual C-UAV units to communicate and coordinate their responses, forming a unified defense perimeter against multiple or swarm threats. Secure communication protocols are vital to prevent adversarial jamming or spoofing of the C-UAV system itself. Furthermore, advancements in miniaturization allow for more portable and discreet systems, while enhanced power management and ruggedization ensure reliability in diverse and challenging operational environments. The integration of cyber capabilities, to potentially hack into and disable drones remotely, represents another cutting-edge aspect of the C-UAV technology landscape, promising sophisticated, non-destructive counter-measures for future threats.

Regional Highlights

- North America: This region stands as a dominant force in the Counter UAV market, primarily driven by substantial defense expenditures from the United States and Canada. The US Department of Defense and Homeland Security are major adopters, investing heavily in advanced C-UAV systems to protect military bases, critical infrastructure, and national borders. The presence of leading defense contractors and a robust ecosystem for research and development further fuels innovation and market growth. Concerns over domestic drone misuse, coupled with a proactive stance against national security threats, ensure continuous investment in cutting-edge counter-drone technologies. This region often pioneers the integration of advanced AI and sophisticated electronic warfare capabilities, setting benchmarks for global C-UAV development. The demand here spans across fixed-site installations, mobile tactical units, and portable systems for a wide array of governmental and private sector applications.

- Europe: Europe represents another significant market for Counter UAV solutions, propelled by increasing security threats from terrorism, illegal border crossings, and industrial espionage facilitated by drones. Countries like the UK, France, Germany, and Italy are making substantial investments in C-UAV technologies for both military and civilian applications, including airport security, critical national infrastructure protection, and large public event safeguarding. The region benefits from a strong domestic defense industry and collaborative R&D initiatives, such as those under the European Defence Agency (EDA). Regulatory frameworks for drone usage and countermeasures are also evolving, creating a structured demand for compliant and effective solutions. The emphasis in Europe is often on non-kinetic countermeasures to minimize collateral damage, making electronic warfare and sophisticated sensor systems particularly sought after.

- Asia Pacific (APAC): The Asia Pacific region is rapidly emerging as a high-growth market for C-UAV systems, driven by escalating geopolitical tensions, border disputes, and extensive military modernization programs in countries like China, India, South Korea, and Japan. The increasing proliferation of drones in the region, both commercial and military, necessitates robust defensive capabilities. Defense spending is surging across many APAC nations, leading to significant procurement of C-UAV technologies. Furthermore, the region's rapid industrialization and expansion of critical infrastructure, such as ports, airports, and energy facilities, generate substantial demand for protection against unauthorized drone activities. Local manufacturing capabilities are also developing, fostering a competitive and dynamic market environment that is increasingly focused on domestically produced, technologically advanced solutions.

- Latin America: This region is witnessing a gradual but steady adoption of Counter UAV technologies, primarily driven by internal security challenges, border protection needs, and efforts to combat illicit activities such as drug trafficking and illegal mining, where drones are often employed. Countries like Brazil, Mexico, and Colombia are investing in C-UAV systems for law enforcement, military, and critical infrastructure protection. The market here is still in its nascent stages compared to North America or Europe but is expected to grow as governments recognize the escalating threat posed by easily accessible drone technology. Economic constraints often lead to a preference for cost-effective and adaptable solutions, focusing on essential detection and basic neutralization capabilities.

- Middle East and Africa (MEA): The MEA region is a critical market for Counter UAV solutions, heavily influenced by persistent geopolitical instability, ongoing conflicts, and a heightened threat of terrorism. Countries within the Middle East, particularly Saudi Arabia, UAE, and Israel, are among the leading investors in advanced C-UAV technologies, driven by real and present drone threats from state and non-state actors. These nations often seek sophisticated, combat-proven systems and are willing to invest in cutting-edge solutions, including directed energy weapons. In Africa, the market is primarily driven by counter-terrorism efforts, border security, and protection of critical energy infrastructure. The demand profile in MEA is often for robust, military-grade systems capable of operating in challenging environmental conditions and integrating with existing defense architectures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Counter UAV Market.- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Raytheon Technologies Corporation

- BAE Systems Plc

- Thales Group

- Leonardo S.p.A.

- Saab AB

- L3Harris Technologies, Inc.

- Rafael Advanced Defense Systems Ltd.

- Elbit Systems Ltd.

- DroneShield Ltd.

- Dedrone

- Robin Radar Systems B.V.

- Citadel Defense Company

- SRC Inc.

- Blighter Surveillance Systems Ltd.

- Ascent Vision Technologies (AVT)

- Israel Aerospace Industries (IAI)

- The Boeing Company

- Rheinmetall AG

Frequently Asked Questions

Analyze common user questions about the Counter UAV market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is a Counter UAV (C-UAV) system?

A Counter UAV (C-UAV) system is a comprehensive solution designed to detect, track, identify, and neutralize unauthorized or hostile unmanned aerial vehicles (UAVs), commonly known as drones. These systems employ various technologies such as radar, RF sensors, EO/IR cameras, and acoustic sensors for detection, and utilize methods like electronic jamming, directed energy weapons (lasers), or kinetic interceptors for neutralization. Their primary purpose is to safeguard critical infrastructure, military assets, national borders, and public spaces from potential drone-borne threats, ensuring airspace security and mitigating risks associated with malicious drone activities.

What are the main types of technologies used in Counter UAV systems?

The primary technologies deployed in Counter UAV systems include Electronic Warfare (EW) which involves jamming drone control signals or GPS, Directed Energy Weapons (DEW) such as high-energy lasers or high-power microwaves for physical incapacitation, and Kinetic Systems that use projectiles, nets, or other physical means to intercept drones. Additionally, detection capabilities are powered by radar systems, radio frequency (RF) sensors, electro-optical/infrared (EO/IR) cameras, and acoustic sensors. Modern systems often integrate artificial intelligence and machine learning to enhance detection accuracy, threat classification, and autonomous response capabilities, creating multi-layered defense solutions against evolving drone threats.

Who are the primary end-users of Counter UAV solutions?

The primary end-users of Counter UAV solutions are predominantly governmental and critical infrastructure entities. This includes military and defense forces (army, navy, air force) for protecting personnel and assets, homeland security agencies (border patrol, law enforcement) for national security and public safety, and operators of critical infrastructure such as airports, power plants, oil and gas facilities, and nuclear sites. The commercial sector, including private security firms for corporate campuses, high-profile events, and private estates, is also an emerging end-user segment. These diverse groups seek C-UAV systems to mitigate the growing risks associated with unauthorized drone intrusions and malicious activities.

What are the key drivers propelling the growth of the Counter UAV market?

The key drivers fueling the Counter UAV market's growth include the escalating threat of malicious drone activities by terrorist groups and criminal organizations, the widespread proliferation and accessibility of commercial off-the-shelf drones for illicit purposes, and the increasing global demand for robust security measures across military, homeland security, and critical infrastructure sectors. Additionally, continuous technological advancements, particularly in artificial intelligence, machine learning, and advanced sensor fusion, enhance the effectiveness and attractiveness of C-UAV systems, driving further adoption. Geopolitical instability and a heightened focus on national security also contribute significantly to market expansion.

What challenges does the Counter UAV market face?

The Counter UAV market faces several significant challenges, including the high initial acquisition and operational costs of sophisticated C-UAV systems, which can be prohibitive for some potential buyers. Regulatory complexities surrounding the use of electronic warfare technologies and kinetic solutions, particularly in civilian airspace, pose significant deployment hurdles. There are also ethical concerns related to collateral damage and the potential for electromagnetic interference with legitimate communications. Furthermore, the rapid pace of drone technology evolution constantly demands system upgrades and innovation, leading to issues of technological obsolescence and continuous research and development expenses, making it challenging to maintain an edge against emerging threats.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager