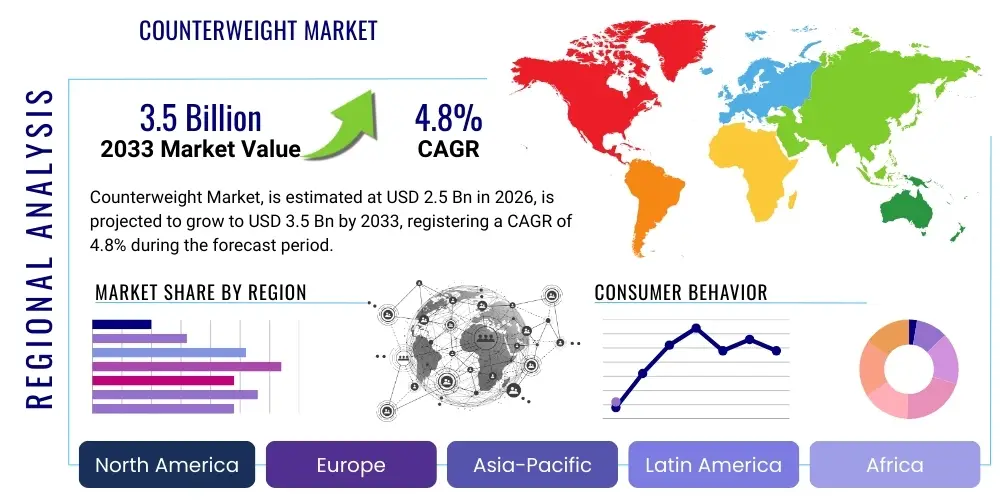

Counterweight Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437556 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Counterweight Market Size

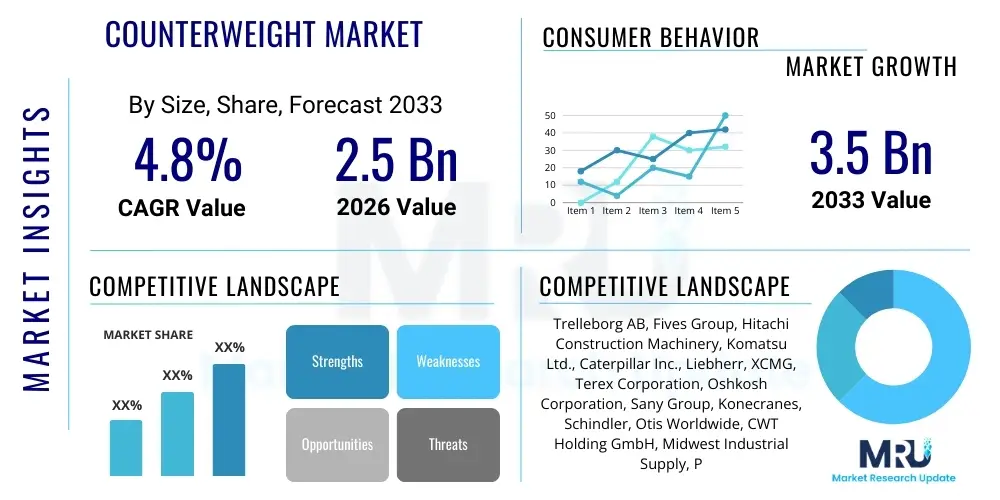

The Counterweight Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $3.5 Billion by the end of the forecast period in 2033.

Counterweight Market introduction

The Counterweight Market encompasses the manufacturing, distribution, and utilization of dense materials strategically positioned within heavy machinery, lifting equipment, and various industrial applications to ensure stability, balance, and operational safety. Counterweights are fundamental components crucial for equipment such as cranes, forklifts, elevators, agricultural machinery, and earth-moving equipment, preventing tipping, managing load imbalances, and stabilizing high-reach or heavy lifting operations. The primary materials utilized traditionally include cast iron, dense concrete, and steel, though modern innovations are exploring composite materials and modular designs to enhance density per volume while managing manufacturing costs.

The core function of a counterweight is to counteract the tipping moment generated by an external load or movement, thereby maintaining the equipment's center of gravity within a safe operating envelope. In the construction industry, for instance, tower cranes rely heavily on precisely calculated and installed counterweights to safely lift massive loads at extended radii. Similarly, in material handling, forklift counterweights—often forming the rear structure of the vehicle—are critical for balancing the weight carried on the forks. The stringent safety regulations across global jurisdictions, particularly in construction and logistics sectors, necessitate the continuous demand for high-quality, certified counterweight solutions, driving market stability and specialized product development.

Major applications driving market expansion include the burgeoning global infrastructure projects, rapid urbanization requiring high-rise construction (increasing elevator installations), and the sustained growth of the logistics and warehousing sectors utilizing heavy-duty forklifts and reach stackers. Furthermore, the push towards larger, more powerful agricultural machinery and specialized mining equipment requires heavier and more precisely engineered counterweights to manage stability in diverse terrains and extreme operating conditions. Benefits derived from optimized counterweights include enhanced equipment lifespan, reduced risk of catastrophic failure, improved operational efficiency, and adherence to occupational safety standards. Driving factors are therefore inherently linked to capital expenditure in construction, logistics modernization, and industrial automation.

Counterweight Market Executive Summary

The Counterweight Market is exhibiting stable growth, underpinned primarily by relentless global investment in public infrastructure and commercial real estate development. Business trends indicate a strategic shift among manufacturers toward integrated supply chain management, optimizing the sourcing of raw materials, particularly iron ore and steel scrap, whose price volatility often impacts profitability. There is a growing trend of original equipment manufacturers (OEMs) outsourcing counterweight production to specialized providers who can offer high-density, customized solutions, including modular or adjustable counterweight systems designed for rapid deployment and machine versatility. Mergers and acquisitions are frequent among smaller specialized casting firms, allowing larger players to consolidate manufacturing capacity and gain geographical advantage.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, driven by massive urbanization projects in China, India, and Southeast Asia, fueling exponential demand for construction equipment and elevators. North America and Europe, characterized by stringent safety standards and high labor costs, prioritize advanced, precision-engineered counterweights and replacement parts, focusing on lifecycle value rather than initial cost. These mature markets are also seeing slow but steady adoption of alternative materials and designs, such as high-density concrete substitutes, aimed at reducing reliance on traditional cast iron while meeting increasingly strict environmental regulations regarding heavy industrial processes.

Segment trends underscore the continued dominance of the cast iron segment due to its superior density and proven durability, particularly in heavy construction applications like mobile and tower cranes. However, the precast concrete segment is gaining traction, especially in static applications such as permanent elevator systems and certain tractor weights, offering a cost-effective alternative where size constraints are less critical. The application segment growth is predominantly led by the construction machinery sector, followed closely by the elevators and escalators market, reflecting global trends in vertical urban development. Key strategic focus areas for market participants include developing lightweight, high-density products and optimizing geometric complexity to fit modern machinery designs seamlessly.

AI Impact Analysis on Counterweight Market

User inquiries regarding the impact of Artificial Intelligence on the Counterweight Market primarily revolve around how AI can enhance safety, optimize design processes, and integrate counterweight management into autonomous heavy machinery. Key concerns focus on whether AI will lead to 'smart' or 'adaptive' counterweights that dynamically adjust weight distribution in real-time, thereby reducing material consumption and increasing efficiency. Users also express interest in AI's role in predictive maintenance concerning counterweight mounting systems and stress analysis, ensuring compliance with evolving operational safety metrics. The general expectation is that AI will transform the traditionally static, mechanical component into a dynamically managed system, albeit gradually.

AI's immediate impact is evident in the design and simulation phase, where sophisticated generative design algorithms are utilized to optimize the geometric shape and internal structure of counterweights. This allows engineers to maximize density efficiency and minimize material usage while maintaining structural integrity under maximum load conditions. Machine learning models analyze vast datasets derived from equipment usage (e.g., crane tilt sensors, load factors, wind speeds) to recommend optimal counterweight placement and size for highly customized or complex operational environments, leading to safer job site deployment and reduced setup time.

Furthermore, AI-driven predictive maintenance systems are increasingly monitoring the wear and tear on counterweight attachment points, chassis integrity, and potential structural fatigue caused by repeated stress cycles. By analyzing vibration data and sensor inputs, AI can alert operators to potential failures before they manifest, improving equipment uptime and preventing potentially catastrophic accidents related to counterweight instability or detachment. This integration of digital intelligence ensures that the physical stability provided by the counterweight is complemented by intelligent operational management, moving the industry towards a more proactive safety paradigm.

- AI optimizes counterweight geometry through generative design, reducing material waste and improving density efficiency.

- Machine learning algorithms enhance real-time load balancing calculations for complex machinery operations, increasing safety margins.

- Predictive maintenance leverages AI to monitor structural integrity and mounting hardware, minimizing risk of detachment or fatigue failure.

- AI supports the development of adaptive counterweight systems that automatically adjust based on operational telemetry.

- Advanced simulation models using AI improve the speed and accuracy of compliance testing for various load scenarios.

DRO & Impact Forces Of Counterweight Market

The Counterweight Market is propelled by substantial drivers, primarily the escalating global investment in infrastructure development, particularly within developing economies, which necessitates extensive use of construction machinery requiring high-capacity counterweights. Concurrent drivers include the rapid advancement and deployment of automation and material handling equipment in warehouses and ports, increasing the demand for specialized, high-performance counterweights in industrial environments. However, the market faces significant restraints, chiefly the inherent volatility of raw material prices, specifically iron ore and steel scrap, which directly impacts the manufacturing cost and pricing structure of cast iron and steel counterweights. Furthermore, the sheer weight and associated logistics costs of transporting finished counterweights present a perpetual challenge, constraining supply chain efficiency.

Opportunities for market growth are abundant, focusing largely on technological innovation and material science. The primary opportunity lies in the development and adoption of high-density composite materials or alternative heavy aggregates, which can achieve equivalent mass in a smaller volume than traditional concrete, addressing space constraints in modern, compact machinery designs. Customization and modularity also present strong growth avenues, allowing manufacturers to offer quick-change, adaptable counterweight solutions that cater to multi-purpose machinery, enhancing equipment flexibility and user convenience. Emerging markets present strategic opportunities for localized manufacturing and direct supply agreements with regional OEMs.

The impact forces influencing the market are multifaceted, combining regulatory pressures with technological evolution. Strict governmental safety regulations—especially OSHA in the U.S. and similar bodies globally—mandate specific counterweight certifications and operational safety factors, acting as a strong driver for quality and compliance. Conversely, environmental forces exert pressure on manufacturers to adopt cleaner production techniques and explore substitutes for energy-intensive materials like cast iron. Competitive intensity remains high, driven by the desire of key players to secure long-term contracts with major OEMs (Caterpillar, Liebherr, Konecranes), making price and supply reliability critical impact factors determining market share and profitability across all segments.

Segmentation Analysis

The Counterweight Market is comprehensively segmented across material type, application, and end-user vertical, allowing for detailed analysis of demand patterns and strategic deployment. The material segmentation—encompassing cast iron, concrete, and steel—is critical as it dictates cost, density, and suitability for specific environments. Cast iron dominates the high-performance segment, while concrete remains the most cost-effective option for static or voluminous applications. Application segmentation, covering construction cranes, elevators, forklifts, and agricultural machinery, highlights where capital expenditure is most concentrated. Analyzing these segments is crucial for manufacturers tailoring product specifications to meet industry-specific regulatory and functional requirements.

The market structure is heavily influenced by the end-user vertical, distinguishing demand originating from infrastructure development (Construction), logistics optimization (Industrial), and food security initiatives (Agriculture). Demand from the construction sector is characteristically cyclical but high-volume, whereas industrial demand, particularly from the material handling sector, tends to be steadier and focused on standardized products. The increasing complexity and specialization of heavy machinery across all end-user groups necessitate a corresponding increase in the precision and engineering complexity of the accompanying counterweights, pushing suppliers towards tighter quality controls and specialized coating options for durability.

Furthermore, segmentation by density (high-density materials vs. standard materials) is becoming increasingly relevant, driven by space constraints in modern machinery design. High-density options, often involving specialized alloys or heavy aggregates, command a premium due to their ability to achieve the required ballast in a smaller footprint, critical for mobile applications where maneuverability is paramount. Understanding these nuanced demands allows market players to optimize their production lines, focusing either on mass-produced, cost-efficient concrete solutions for bulk requirements or specialized, high-margin iron and steel weights for premium equipment sectors.

- By Material Type: Cast Iron, Concrete, Steel, Composite Materials

- By Application: Cranes (Tower, Mobile, Gantry), Forklifts and Industrial Trucks, Elevators and Escalators, Earth Moving and Mining Equipment, Agricultural Machinery (Tractors)

- By End-User: Construction, Industrial (Logistics, Manufacturing), Agriculture, Mining

- By Density: Standard Density, High Density

Value Chain Analysis For Counterweight Market

The value chain for the Counterweight Market begins fundamentally with the upstream segment, dominated by raw material extraction and initial processing. This includes the mining and refining of iron ore, the procurement of steel scrap for casting, and the sourcing of aggregates, cement, and specialized heavy fillers for concrete counterweights. Suppliers in this phase, such as major steel mills and concrete suppliers, hold significant leverage due to global commodity price fluctuations and supply chain constraints. Efficient sourcing and hedging strategies against material cost volatility are essential for counterweight manufacturers to maintain competitive pricing and stable profit margins.

The core manufacturing stage involves specialized processes like foundry work (casting and machining of iron/steel weights) and precasting (forming and curing of concrete weights). Manufacturers must invest heavily in precision machinery, quality control, and testing facilities to ensure the counterweights meet exact specifications for mass, dimension, and structural integrity as required by OEM partners and safety regulations. Distribution channels, forming the midstream, include direct sales to large OEMs under long-term contracts, sales through heavy equipment dealers and distributors for aftermarket replacement, and specialized logistics providers handling the physically cumbersome and heavy loads across global borders.

The downstream segment centers on installation, application, and maintenance. End-users, ranging from large construction firms to small agricultural operators, require expert installation services to correctly calibrate the weights relative to the machine’s load chart, ensuring optimal safety and performance. Aftermarket services, including replacement of worn-out weights or provision of specialized attachments, represent a stable revenue stream. The transition towards digital integration means downstream activities are increasingly relying on telematics and remote monitoring to verify counterweight stability and compliance during operation, closing the loop between manufacturing quality and real-world performance validation.

Counterweight Market Potential Customers

The primary cohort of potential customers for the Counterweight Market consists of Original Equipment Manufacturers (OEMs) specializing in heavy construction, industrial material handling, and vertical transportation equipment. These key buyers, including global giants like Caterpillar, Liebherr, Konecranes, and Otis, purchase counterweights in high volume under multi-year contracts, integrating these components directly into the design of cranes, excavators, forklifts, and elevators. Securing OEM contracts is critical as it provides assured, scalable demand and establishes the supplier as a preferred partner, often dictating technological specifications and quality benchmarks for the wider market.

A secondary, yet significant, customer segment is comprised of large-scale construction and mining companies, as well as port and logistics operators. While they often purchase equipment with counterweights included, they represent the critical aftermarket demand for replacement parts, supplemental weights for customized lifting operations, and upgrades for existing machinery fleets. These customers prioritize durability, immediate availability, and cost-effectiveness of parts, often relying on global dealer networks and specialized heavy equipment service providers for procurement and installation, ensuring minimal downtime in crucial operations.

Furthermore, specialized industrial sectors, including wind power generation, shipbuilding, and precision manufacturing, serve as niche but valuable customers. For instance, the maintenance of offshore wind turbines requires specialized crane counterweights tailored for maritime environments. Agricultural cooperatives and large farming operations purchasing high-horsepower tractors constitute another steady customer base, focusing on cast iron or concrete front and rear weights necessary for achieving traction and balancing heavy implements like plows and planters. Demand from these diverse end-users necessitates that counterweight manufacturers maintain a broad portfolio, ranging from standardized mass-produced items to highly bespoke, single-use designs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trelleborg AB, Fives Group, Hitachi Construction Machinery, Komatsu Ltd., Caterpillar Inc., Liebherr, XCMG, Terex Corporation, Oshkosh Corporation, Sany Group, Konecranes, Schindler, Otis Worldwide, CWT Holding GmbH, Midwest Industrial Supply, Precision Counterweights, Butech, US Counterweights, Counterweight Solutions LLC, Heavy Weight Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Counterweight Market Key Technology Landscape

The technology landscape within the Counterweight Market, while traditionally focused on material density and casting precision, is increasingly being shaped by advanced manufacturing techniques and smart material integration. Foundry technology has seen significant upgrades, moving towards automated molding and pouring systems to minimize defects and ensure homogeneous material structure in cast iron components. Induction melting furnaces are preferred over traditional cupola furnaces due to higher energy efficiency and tighter control over alloy composition, which is vital for meeting the mechanical strength requirements of heavy-duty applications. Furthermore, sophisticated 3D scanning and Computer Numerical Control (CNC) machining are used post-casting to achieve ultra-precise final dimensions, crucial for modular systems that require interchangeable fitments.

The utilization of high-density aggregates represents a key material technology trend, particularly in specialized concrete mixtures. Manufacturers are experimenting with heavy minerals like hematite, magnetite, or industrial by-products such as steel slag to significantly increase the density of concrete counterweights, offering an economical alternative to iron without the environmental impact of extensive smelting. This shift not only addresses cost pressures but also supports sustainability initiatives, especially for static applications like elevators where spatial volume is less constrained. Surface finishing and anti-corrosion coatings, essential for outdoor equipment operating in harsh environments, also constitute a vital area of technological differentiation, extending product lifespan and maintaining aesthetic integrity.

The most forward-looking technological development involves the integration of sensors and connectivity features, transforming counterweights into 'smart' components. By embedding RFID tags or IoT sensors within the ballast structure, manufacturers can facilitate inventory tracking, verify authenticity, and enable real-time stress monitoring. These smart counterweights integrate seamlessly with the machine’s telematics system, allowing for dynamic load management and instantaneous safety alerts regarding stability issues. While this technology is nascent, its potential for enhancing operational safety and reducing insurance liabilities is substantial, driving innovation among key players seeking a competitive edge through digitalization.

Regional Highlights

Regional dynamics are instrumental in shaping the Counterweight Market, driven by varying rates of infrastructure development, regulatory frameworks, and technological adoption across continents. The Asia Pacific (APAC) region stands out as the largest market due to aggressive government spending on transport networks, residential construction, and industrial expansion, particularly in emerging economies like India and Southeast Asia. The sheer volume of construction machinery and elevator installations drives high demand for cost-effective, bulk counterweight solutions, favoring both cast iron and dense concrete materials supplied by robust regional manufacturing hubs.

North America and Europe represent mature markets characterized by replacement demand, strict safety standards, and a high preference for technologically advanced, high-density materials that minimize footprint on expensive, often constrained job sites. These regions prioritize precision-machined, high-quality counterweights and robust aftermarket support. European environmental regulations are also pushing manufacturers towards resource-efficient production and the exploration of alternative, sustainable materials, influencing design innovation significantly compared to other global markets.

Latin America, the Middle East, and Africa (MEA) offer substantial growth potential, linked to large-scale mining projects, oil and gas infrastructure expansion, and rapid urbanization in key metropolitan areas. While market penetration remains lower than in APAC or Europe, government-backed megaprojects, such as those related to the expansion of ports or establishment of new industrial corridors in the Gulf region, create pockets of intense demand for heavy-duty crane and material handling counterweights, often sourced through global procurement channels. The market structure in MEA is often project-driven and susceptible to global commodity price fluctuations.

- Asia Pacific (APAC): Dominant market share due to unparalleled infrastructure development and urbanization; characterized by high-volume demand and competitive pricing.

- North America: Focus on high-quality, precision-engineered products; strong emphasis on safety compliance and stable aftermarket demand for construction and industrial equipment.

- Europe: Driven by stringent environmental regulations and a preference for innovative, sustainable, and space-saving high-density counterweights for advanced machinery fleets.

- Latin America (LATAM): Growth tied to resource extraction (mining) and agricultural expansion, leading to demand for robust, high-durability counterweights.

- Middle East and Africa (MEA): Project-based demand fueled by large-scale oil/gas, construction, and port modernization initiatives, requiring heavy-duty ballast solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Counterweight Market.- Trelleborg AB

- Fives Group

- Hitachi Construction Machinery

- Komatsu Ltd.

- Caterpillar Inc.

- Liebherr

- XCMG

- Terex Corporation

- Oshkosh Corporation

- Sany Group

- Konecranes

- Schindler

- Otis Worldwide

- CWT Holding GmbH

- Midwest Industrial Supply

- Precision Counterweights

- Butech

- US Counterweights

- Counterweight Solutions LLC

- Heavy Weight Systems

Frequently Asked Questions

Analyze common user questions about the Counterweight market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are most commonly used for industrial counterweights, and why?

The most common materials are cast iron, dense concrete, and structural steel. Cast iron is favored for high-performance mobile machinery due to its superior density and strength, allowing the required mass to be achieved in a minimal volume. Dense concrete is preferred for static applications, like elevators and tower cranes, offering a cost-effective solution where volume constraints are less stringent. Steel is used for fabricated structures or specialty applications requiring specific welding properties.

How does the volatile price of raw materials affect the profitability of the Counterweight Market?

Raw material price volatility, particularly for iron ore and steel scrap, directly impacts the cost of goods sold for cast iron counterweights, the highest-margin segment. Manufacturers manage this risk through hedging strategies, long-term procurement contracts, and increasing the use of alternative, lower-cost materials like heavy aggregate concrete, thereby influencing pricing and segment profitability across the value chain.

Which application segment drives the highest demand in the current Counterweight Market?

The Construction Machinery segment, encompassing cranes (mobile and tower) and large excavators, currently generates the highest demand. This is driven by ongoing urbanization and massive global infrastructure projects, especially in the Asia Pacific region, requiring continuous deployment and maintenance of heavy lifting equipment that fundamentally relies on precision-engineered counterweights for safety and operation.

Are smart or adaptive counterweight systems becoming standard in new machinery?

While not yet standard, smart or adaptive counterweight systems are emerging technology. These systems incorporate sensors and AI-driven control modules to dynamically monitor load conditions and stability in real-time. This innovation is primarily adopted in high-end, specialized equipment to enhance safety, reduce setup time, and optimize performance, representing a key future trend focused on digital integration and proactive operational safety management.

What are the primary regulatory challenges impacting counterweight manufacturing?

Primary regulatory challenges involve adhering to stringent international safety and performance standards (e.g., ISO, OSHA) concerning lifting equipment stability and load charts. Manufacturers must ensure their products meet exact dimensional and mass tolerances, pass rigorous fatigue and stress testing, and comply with environmental regulations regarding material sourcing and industrial emissions from foundry operations, increasing compliance costs and technical complexity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager