Courier and Local Delivery Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438522 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Courier and Local Delivery Services Market Size

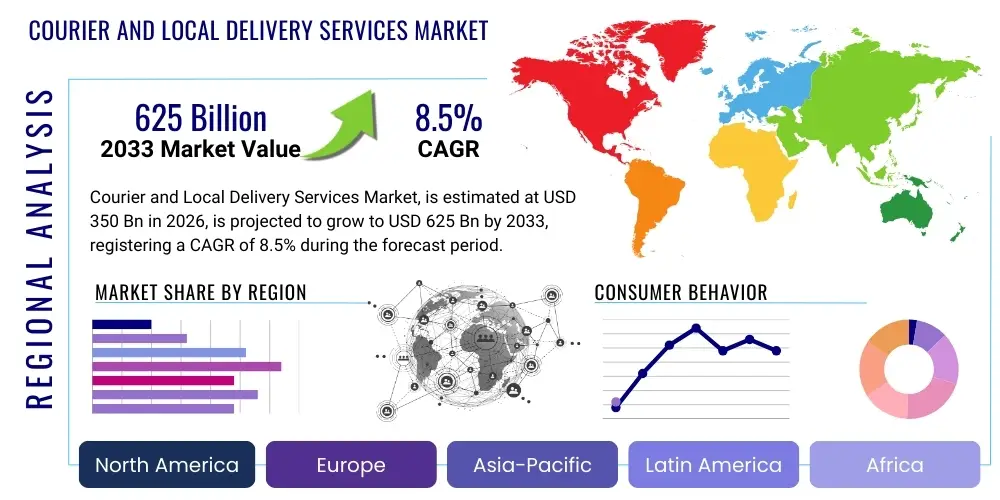

The Courier and Local Delivery Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 350 Billion in 2026 and is projected to reach USD 625 Billion by the end of the forecast period in 2033.

Courier and Local Delivery Services Market introduction

The Courier and Local Delivery Services Market encompasses a wide range of logistics operations specializing in the rapid, reliable, and secure transportation of parcels, documents, and goods, primarily focusing on last-mile and intracity deliveries. This sector is fundamentally driven by the exponential expansion of e-commerce, necessitating robust, scalable, and highly efficient delivery infrastructure to meet rising consumer expectations for speed and transparency. Local delivery services, in particular, have witnessed transformative growth due to the proliferation of on-demand services for groceries, food delivery, and specialized retail items, transforming urban logistics landscapes and emphasizing short delivery windows.

Key applications of these services span across B2C logistics (direct-to-consumer shipments), B2B distribution (supply chain support for manufacturers and retailers), and C2C services (peer-to-peer parcel exchange). The primary benefits offered by modern courier services include optimized supply chain management, reduced operational overhead for retailers, comprehensive tracking capabilities, and enhanced customer satisfaction through predictable delivery schedules. Furthermore, the market is crucial for facilitating immediate economic activity, especially for Small and Medium Enterprises (SMEs) relying on efficient transport networks to reach their local customer base.

The primary driving factors sustaining market growth include surging global disposable incomes, rapid urbanization leading to concentrated demand centers, and significant technological adoption, particularly in route optimization software, autonomous vehicles, and drone delivery trials. Regulatory support for cross-border e-commerce, coupled with sustained investment in logistics infrastructure (e.g., micro-fulfillment centers and dark stores), further reinforces the market's trajectory, moving away from traditional models toward highly flexible, digitally integrated delivery ecosystems that prioritize speed, efficiency, and sustainability.

Courier and Local Delivery Services Market Executive Summary

The Courier and Local Delivery Services Market is characterized by intense competition, rapid technological integration, and a fundamental shift toward customer-centric logistics models, driven heavily by global business trends related to e-commerce fulfillment and just-in-time inventory management. Business trends highlight increasing consolidation among major logistics providers seeking economies of scale, alongside aggressive investment by technology giants (such as Amazon and Alibaba) into proprietary delivery networks to control the entire supply chain experience. A critical development is the emphasis on sustainability, forcing companies to integrate electric vehicles (EVs) and low-emission delivery options into their fleets, balancing operational efficiency with environmental responsibility, thereby transforming infrastructure requirements.

Regionally, Asia Pacific (APAC) stands as the dominant growth engine, fueled by massive, rapidly expanding consumer bases in China and India, coupled with high rates of smartphone adoption facilitating digital commerce. North America and Europe, while mature, focus heavily on technological innovation—specifically in automation, robotics for warehousing, and testing autonomous last-mile solutions to mitigate high labor costs and congestion challenges in urban centers. Emerging economies in Latin America and MEA are seeing substantial investment in infrastructure to support nascent e-commerce markets, prioritizing reliable cold chain logistics and secure delivery platforms.

Segmentation trends indicate significant expansion in the express and same-day delivery segments, particularly in metropolitan areas, reflecting premiumization of speed. End-user segmentation shows B2C and C2C dominating volume growth, while B2B segments demand higher specialization in handling sensitive or high-value freight. Furthermore, the operational model is shifting towards hyper-local, decentralized fulfillment strategies, utilizing micro-hubs and parcel lockers, which optimizes resource allocation and dramatically reduces delivery latency, positioning the market for sustained high-velocity growth throughout the forecast period.

AI Impact Analysis on Courier and Local Delivery Services Market

Users frequently inquire about AI's role in mitigating logistical bottlenecks, automating decision-making processes, and predicting future demand fluctuations within the highly dynamic local delivery space. Common questions center on how AI-driven optimization algorithms can improve route density and reduce operational costs, whether AI will replace human delivery agents, and how machine learning ensures predictive maintenance for delivery vehicle fleets. Concerns often revolve around data privacy, the transparency of automated decision-making in parcel handling, and the necessity of upskilling the existing workforce to manage AI-integrated systems, indicating a strong user interest in both efficiency gains and the ethical/societal consequences of advanced automation.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the courier and local delivery services market by providing unprecedented levels of operational efficiency and predictive capability. AI algorithms are crucial for dynamic route planning, where variables such as real-time traffic, weather conditions, delivery window constraints, and parcel priority are processed instantaneously to generate the most efficient path. This significantly reduces fuel consumption and delivery times, directly impacting profitability and service reliability. Furthermore, AI enhances warehouse and sorting efficiency through optimized inventory placement and automated item identification, minimizing manual errors and accelerating throughput.

Beyond logistics optimization, AI is heavily utilized in customer service and risk management. AI-powered chatbots and virtual assistants handle the majority of customer tracking inquiries, providing immediate responses and freeing human agents for complex issues, enhancing the overall customer experience. In risk management, machine learning models analyze historical data to predict potential delivery failures, identifying high-risk areas or atypical delivery patterns (e.g., fraud detection), allowing couriers to implement proactive security measures and improve service integrity across all operational phases.

- AI-Powered Dynamic Route Optimization: Minimizes mileage, fuel consumption, and transit time by accounting for real-time variables.

- Predictive Maintenance: Uses ML to analyze telematics data, forecasting vehicle component failures before they occur, reducing downtime.

- Automated Warehouse Management: Optimizes sorting, storage density, and robotic movement within fulfillment centers.

- Demand Forecasting: Machine learning models accurately predict peak volume periods and localized demand spikes, enabling proactive resource allocation.

- Enhanced Security and Fraud Detection: Identifies suspicious patterns in delivery addresses or payment methods, bolstering service security.

- Customer Service Automation: Deployment of AI chatbots for instant tracking updates and routine query resolution.

DRO & Impact Forces Of Courier and Local Delivery Services Market

The Courier and Local Delivery Services Market is subject to a complex interplay of forces where relentless demand from e-commerce acts as the primary Driver, while infrastructural limitations and high initial capital expenditure present significant Restraints. Opportunities are primarily centered around leveraging technological innovations like automation and data analytics to overcome market frictions, resulting in a sustained high Impact Force characterized by disruption and rapid operational change across the global logistics value chain. The reliance on swift delivery windows in urban environments puts immense pressure on operational agility, making technological differentiation a critical survival factor.

Drivers include the explosive growth of global e-commerce, shifting consumer preferences towards same-day and next-day delivery models, and increasing cross-border trade facilitated by globalization. Urbanization also plays a pivotal role, concentrating large consumer bases in high-density areas, making local delivery economically viable and highly necessary. Furthermore, the increasing adoption of specialized delivery services, such as temperature-controlled logistics for pharmaceuticals and groceries, expands the serviceable market and drives demand for advanced operational capabilities.

Restraints predominantly involve rising operational costs, notably fuel prices and labor shortages, which squeeze profit margins, especially for last-mile delivery. Regulatory complexity, particularly concerning cross-border customs procedures and local urban traffic restrictions, presents significant hurdles. Moreover, the constant need for substantial capital investment in new technologies (like electric vehicle fleets and autonomous sorting systems) and maintaining sophisticated IT infrastructure acts as a barrier to entry for smaller players, leading to market consolidation.

Opportunities are emerging through technological advancements, including the successful deployment of unmanned aerial vehicles (drones) and autonomous ground vehicles (AGVs) for last-mile delivery, especially in remote or low-density areas. Expansion into specialized value-added services, such as reverse logistics and customized packaging solutions, offers new revenue streams. Strategic partnerships with local retailers and integration into comprehensive fulfillment ecosystems (e.g., micro-fulfillment centers located closer to consumers) provide pathways for sustained competitive advantage and optimized service reach, ensuring market resilience against volatile economic conditions.

Segmentation Analysis

The Courier and Local Delivery Services Market is comprehensively segmented based on service type, operational model, end-user, and mode of transport, reflecting the diverse requirements and complexities inherent in modern logistics. Segmentation provides critical insights into market dynamics, revealing where investment is flowing, with rapid growth seen in segments catering to time-sensitive and high-value shipments. The complexity of urban environments drives specific requirements in service categories, while end-user dynamics define volume versus value metrics, enabling targeted service development and strategic resource allocation across the supply chain.

- By Service Type:

- Standard/Economy Delivery

- Express/Time-Definite Delivery

- Same-Day Delivery

- Deferred Delivery

- Customized/Specialized Logistics (e.g., Cold Chain)

- By Operational Model:

- Traditional Hub-and-Spoke Model

- Decentralized/Hyperlocal Model (Micro-fulfillment)

- Crowdsourced Delivery Model

- By End-User:

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Consumer-to-Consumer (C2C)

- Government and Public Sector

- By Mode of Transport:

- Road Transport (Vans, Trucks, Motorcycles)

- Air Transport

- Rail Transport

- Drone and Autonomous Vehicle Delivery

Value Chain Analysis For Courier and Local Delivery Services Market

The value chain for the Courier and Local Delivery Services Market begins with upstream activities focused on securing essential physical and technological resources, followed by midstream operations encompassing core logistics processes, and culminates in downstream distribution and customer service. Upstream analysis involves sourcing vehicles (conventional and electric fleets), IT infrastructure (telematics, WMS, and route optimization software), and crucial labor resources. Key players in this phase include vehicle manufacturers, software developers specializing in logistics, and energy providers, whose costs and reliability significantly influence overall operational expenditure.

Midstream activities are centered on efficiency in warehousing, sorting, and primary transportation. This involves managing large fulfillment centers, cross-docking facilities, and managing line-haul networks to move parcels between major hubs. The integration of advanced robotics and automated sorting systems is critical here for scalability and speed. Downstream analysis focuses entirely on the last-mile delivery phase, which is the most expensive component of the value chain. This phase utilizes local distribution hubs (micro-fulfillment centers) and employs diverse transport modes tailored for urban environments, emphasizing speed, accuracy, and customer experience management.

The distribution channel is predominantly dual-mode: direct and indirect. Direct channels involve proprietary carrier services (e.g., FedEx, UPS) handling the entire process from pickup to final delivery, ensuring maximum control over service quality and data. Indirect channels utilize third-party logistics providers (3PLs), freight forwarders, and increasingly, gig-economy workers or crowdsourced platforms (e.g., DoorDash Logistics) to handle specific legs, particularly the last mile. The trend is toward hybrid models, where carriers leverage both proprietary assets and flexible indirect partners to optimize coverage and handle fluctuating volume spikes efficiently.

Courier and Local Delivery Services Market Potential Customers

The end-user/buyers of courier and local delivery services are broadly categorized into three main groups: large e-commerce enterprises and retailers, traditional brick-and-mortar businesses, and individual consumers (C2C). Large e-commerce platforms represent the single biggest customer segment, demanding highly scalable, reliable, and technologically integrated delivery solutions capable of handling massive volumes and complex international shipments. These customers prioritize carriers offering advanced tracking, guaranteed delivery windows, and seamless integration with their own sales and inventory management systems.

Traditional brick-and-mortar retailers, manufacturers, and wholesalers form the B2B segment, seeking efficient bulk transport, just-in-time inventory fulfillment, and specialized handling for sensitive goods (e.g., electronics, automotive parts). These businesses require reliable scheduling, specialized handling compliance, and often utilize deferred or standard delivery services, valuing consistency and cost-effectiveness over absolute speed. The relationship in B2B is often contractual and long-term, focused on integrating courier services deeply within the customer's supply chain architecture.

Individual consumers (C2C) and small, independent online sellers utilize courier services primarily for non-commercial or small-scale business purposes, relying heavily on accessible pricing, convenient drop-off/pickup locations, and robust return logistics (reverse logistics). This segment is highly sensitive to price and convenience, driving demand for innovations such as parcel lockers, postal kiosks, and simplified online booking platforms, thereby defining the need for high-density, easily accessible local delivery infrastructure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Billion |

| Market Forecast in 2033 | USD 625 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FedEx, UPS, DHL Group, Amazon Logistics, XPO Logistics, Nippon Express, DSV Panalpina, C.H. Robinson, Geodis, Ryder System, TFI International, J.B. Hunt Transport Services, Estes Express Lines, YRC Worldwide, Zipline, Gopuff, DoorDash Logistics, Instacart, Postmates, Lalamove |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Courier and Local Delivery Services Market Key Technology Landscape

The technological landscape of the courier and local delivery services market is undergoing a rapid digital transformation, primarily centered on achieving efficiency, speed, and transparency throughout the logistics chain. Key technologies include advanced telematics and IoT sensors deployed across vehicle fleets, providing real-time data on location, performance, driver behavior, and cargo condition. This data feeds into complex Transportation Management Systems (TMS) and Warehouse Management Systems (WMS), which utilize sophisticated algorithms to manage inventory flow and optimize resource deployment, moving beyond static planning to dynamic, responsive operations management, thereby maximizing asset utilization and minimizing delays.

Automation remains a cornerstone, with robotics and automated guided vehicles (AGVs) increasingly common in sorting centers and micro-fulfillment hubs, drastically reducing the time and labor required for package handling and sorting. Furthermore, the development of specialized delivery vehicles, including electrically powered last-mile vans and cargo bikes, addresses sustainability mandates and overcomes urban congestion issues. Blockchain technology is also beginning to gain traction, primarily for ensuring immutable records of custody and secure tracking of high-value or sensitive shipments across international borders, enhancing trust and compliance within the ecosystem.

The most disruptive technological developments, however, lie in autonomous and semi-autonomous delivery systems. This includes the testing and scaling of drone delivery for remote or specialized urgent medical logistics (e.g., Zipline), and the deployment of sidewalk delivery robots and autonomous ground vehicles (AGVs) in select urban and campus environments. These technologies aim to fundamentally reduce the reliance on human labor for routine last-mile deliveries, although widespread commercialization is still dependent on favorable regulatory environments and public acceptance, setting the stage for significant long-term structural changes in delivery execution.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market due to the massive scale of e-commerce markets in China, India, and Southeast Asia. High population density and rising middle-class disposable incomes accelerate demand for express and hyperlocal delivery. Investment is focused on expanding fulfillment networks and integrating advanced supply chain technologies to handle peak season volumes efficiently.

- North America: Characterized by high labor costs and complex geographical challenges, North America is a leader in technology adoption, particularly in AI-driven route optimization, warehouse robotics, and autonomous vehicle testing. The market is highly consolidated, with major players like FedEx, UPS, and Amazon Logistics heavily investing in proprietary final-mile capacity and same-day capabilities to secure market share.

- Europe: This region is strongly influenced by strict regulatory frameworks concerning labor, emissions, and data privacy. The focus is heavily on sustainability, driving rapid adoption of electric vehicle fleets (e-vans, cargo bikes) for urban deliveries and the utilization of parcel lockers and network alliances (e.g., postal operators) to enhance delivery density and lower environmental impact.

- Latin America (LATAM): Growth in LATAM is driven by improving digital connectivity and expanding middle classes, particularly in Brazil and Mexico. The market faces challenges related to infrastructure quality and security, leading to high reliance on innovative payment solutions and secure last-mile protocols. Crowdsourced and flexible delivery models are rapidly gaining prominence.

- Middle East and Africa (MEA): Growth is robust, particularly in the GCC countries, propelled by substantial government investment in smart city infrastructure and diversified economic strategies moving away from oil reliance. The African continent shows high potential, driven by mobile money penetration and improving logistics corridors, although geopolitical instability and fragmented infrastructure remain significant hurdles.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Courier and Local Delivery Services Market.- FedEx Corporation

- United Parcel Service (UPS)

- DHL Group (Deutsche Post DHL)

- Amazon Logistics

- XPO Logistics, Inc.

- Nippon Express Co., Ltd.

- DSV Panalpina A/S

- C.H. Robinson Worldwide, Inc.

- Geodis (SNCF Logistics)

- Ryder System, Inc.

- TFI International Inc.

- J.B. Hunt Transport Services, Inc.

- Estes Express Lines

- YRC Worldwide (Yellow Corporation)

- Zipline International Inc.

- Gopuff

- DoorDash Logistics

- Instacart

- Postmates (Uber Eats)

- Lalamove

Frequently Asked Questions

Analyze common user questions about the Courier and Local Delivery Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Courier and Local Delivery Services Market?

The predominant driver is the exponential growth of global e-commerce, which necessitates efficient, fast, and scalable last-mile delivery solutions to meet escalating consumer demand for expedited shipping options, such as same-day and next-day delivery guarantees.

How is technological innovation impacting the cost structure of local delivery operations?

Technological innovations, particularly AI-driven dynamic route optimization and warehouse automation, are significantly lowering operational costs by reducing fuel consumption, minimizing delivery errors, and decreasing the reliance on manual sorting labor, leading to improved profitability margins.

Which geographical region exhibits the highest growth potential in the courier market?

Asia Pacific (APAC) demonstrates the highest growth potential, largely fueled by rapidly expanding middle-class populations, massive e-commerce penetration rates in countries like China and India, and sustained investment in localized delivery infrastructure.

What are the main sustainability challenges facing courier services?

The main challenges involve reducing carbon emissions associated with large vehicle fleets, managing urban congestion, and transitioning to electric vehicles (EVs) for last-mile delivery, requiring substantial investment in charging infrastructure and fleet modernization efforts.

Are autonomous vehicles and drones expected to replace traditional human delivery drivers?

While autonomous vehicles (AVs) and drones are being deployed for specific, short-range, and remote deliveries, they are more likely to augment, rather than entirely replace, human drivers in the near term, focusing on optimizing logistics in highly congested or difficult-to-reach areas.

What role do micro-fulfillment centers play in urban logistics?

Micro-fulfillment centers (MFCs) are strategically located small warehouses near dense urban areas. They reduce the distance of the final mile, enabling faster delivery times, lowering transportation costs, and supporting the infrastructure required for same-day and on-demand services.

How do global supply chain disruptions affect local delivery services?

Global supply chain disruptions often lead to inventory backlogs and unpredictable arrival times, compelling local delivery services to enhance their flexibility, utilize decentralized warehousing models, and adopt predictive analytics to manage fluctuating parcel volumes and maintain promised service levels.

What is the significance of reverse logistics in the market?

Reverse logistics, managing the process of product returns and exchanges, is crucial for customer satisfaction in e-commerce. Efficient reverse logistics services have become a key differentiator, requiring specialized infrastructure and streamlined processes to handle increasing return volumes cost-effectively.

Which service type segment is experiencing the fastest revenue growth?

The same-day and express delivery service types are experiencing the fastest revenue growth, driven by consumer willingness to pay a premium for speed and convenience, especially for high-value goods and immediate necessity items like prepared meals and groceries.

How are 3PLs adapting to the requirements of hyperlocal delivery?

Third-Party Logistics Providers (3PLs) are adapting by integrating crowdsourced delivery platforms, investing in urban micro-hubs, and forming specialized partnerships with last-mile technology firms to offer flexible, scalable, and geographically precise delivery solutions that cater to hyperlocal demand patterns.

What are the major challenges in scaling drone delivery?

Major challenges in scaling drone delivery include regulatory hurdles regarding airspace restrictions, ensuring compliance with noise pollution limits, developing robust beyond-visual-line-of-sight (BVLOS) technology, and overcoming public safety concerns related to automated flight paths over populated areas.

How does IoT technology enhance fleet management efficiency?

Internet of Things (IoT) sensors installed on vehicles provide crucial telemetry data, enabling real-time monitoring of vehicle health, optimizing driving behavior for fuel efficiency, improving cargo security via location tracking, and supporting sophisticated predictive maintenance schedules.

What is the role of Big Data analytics in defining future delivery strategies?

Big Data analytics leverages vast datasets on consumer behavior, traffic patterns, and logistics performance to forecast future demand accurately, optimize pricing strategies, identify network inefficiencies, and customize service offerings for specific regional or demographic market segments.

How does the Courier and Local Delivery Services Market support Small and Medium Enterprises (SMEs)?

Courier services provide SMEs with essential access to broad distribution networks, allowing them to compete effectively with larger retailers by offering reliable shipping options, handling complex international documentation, and simplifying their fulfillment processes without massive internal investment.

What security measures are increasingly being adopted in parcel delivery?

Security measures include geo-fencing for delivery confirmation, secure digital parcel lockers accessible via unique codes, advanced anti-theft tracking systems, and biometric authentication for high-value deliveries, all designed to mitigate package theft and ensure chain of custody integrity.

How are labor shortages being addressed in the delivery sector?

Labor shortages are addressed through increasing automation in warehouses, deploying gig-economy and crowdsourcing models for last-mile flexibility, offering competitive wages and benefits, and investing in advanced technology like AI to maximize the productivity of the existing workforce.

What impact does the growth of cold chain logistics have on the market?

The growth of cold chain logistics, driven by pharmaceutical and perishable food delivery, mandates specialized equipment (temperature-controlled vehicles, insulated packaging) and advanced monitoring technologies, creating a high-value, highly regulated segment within the overall delivery market.

How important is customer experience management in modern courier services?

Customer experience management is paramount; it extends beyond successful delivery to include proactive communication, real-time tracking transparency, flexible rescheduling options, and streamlined returns, serving as a primary differentiator in a commoditized service environment.

What is the difference between B2B and B2C delivery requirements?

B2C delivery is characterized by high volume, smaller package size, and rapid speed requirements, focusing on residential addresses. B2B delivery involves larger, often palletized shipments, precise scheduled drop-offs, specialized handling (e.g., lift gates), and contractual compliance.

How are companies minimizing the environmental footprint of urban deliveries?

Companies are minimizing their footprint by deploying large-scale EV fleets, optimizing route planning for reduced mileage, using cargo bikes in congested city centers, consolidating shipments, and investing in sustainable packaging materials.

What are the key considerations for cross-border local delivery?

Key considerations include managing complex customs clearances, ensuring compliance with varying international trade regulations, minimizing transit times through efficient international hubs, and providing reliable end-to-end tracking visibility across multiple jurisdictions.

How does inflation influence pricing strategies in the delivery market?

Inflation, particularly in fuel and labor costs, forces carriers to implement dynamic pricing models, surcharge adjustments, and increased service fees. Carriers must balance maintaining competitive pricing with preserving operational profitability amidst rising input costs.

What strategic advantages do companies gain from owning their own delivery infrastructure?

Owning infrastructure (e.g., Amazon Logistics) provides better control over service quality, allows for rapid customization of services, ensures security, and, most importantly, provides deeper integration of technology and data analytics throughout the entire delivery lifecycle, leading to cost efficiency.

What is the current status of regulatory approval for widespread autonomous ground vehicle (AGV) use?

Regulatory approval for AGVs is highly fragmented; while trials are permitted in certain low-speed, geofenced environments (e.g., university campuses), broad street deployment faces significant regulatory obstacles regarding liability, necessary infrastructure changes, and ensuring public safety interaction protocols.

How are logistics providers utilizing mobile applications to improve efficiency?

Mobile applications empower drivers with real-time route changes and manifest updates, facilitate digital proof-of-delivery (e-POD), enhance communication with dispatchers, and provide customers with precise tracking, thereby streamlining the final delivery confirmation process.

What impact does urbanization have on local delivery operations?

Urbanization increases population density and demand concentration, making hyperlocal delivery models viable, but it simultaneously increases operational challenges due to traffic congestion, restricted access zones, and limited parking, necessitating smaller, more agile delivery methods.

How do parcel locker networks affect last-mile efficiency?

Parcel locker networks significantly improve last-mile efficiency by enabling drivers to complete multiple deliveries at a single secure location, reducing failed delivery attempts and the time spent waiting for customer interaction, especially in high-density residential areas.

What cybersecurity threats are most relevant to courier service data?

Relevant cybersecurity threats include data breaches targeting sensitive customer information (names, addresses, payment details), phishing attacks aimed at drivers or administrative staff, and ransomware attacks disrupting critical TMS and WMS operations.

How do seasonal peaks (e.g., holiday season) influence the need for flexible capacity?

Seasonal peaks mandate extreme flexibility in capacity planning, requiring carriers to temporarily scale up workforce, rapidly deploy temporary sorting facilities, and leverage crowdsourced and independent contractor models to manage volume surges that can exceed standard capacity by over 50%.

What is the expected long-term effect of COVID-19 on the courier market?

The long-term effect of COVID-19 is a permanent acceleration of digital commerce adoption and a heightened consumer expectation for robust, contactless, and rapid home delivery services, solidifying e-commerce as the foundational driver of market demand for the foreseeable future.

What is the role of blockchain technology in logistics transparency?

Blockchain ensures logistics transparency by creating decentralized, immutable records of every transaction and handling event in the supply chain, minimizing disputes, improving auditability, and guaranteeing the authenticity and origin of goods.

How do carriers manage delivery complexity in multi-story residential buildings?

Carriers manage this complexity through partnerships allowing access to restricted areas, utilization of dedicated service elevators where available, and employing mobile apps that facilitate better communication with building management or residents for efficient access and delivery completion.

Why is customization crucial for B2B courier services?

Customization is crucial in B2B because clients often require specialized handling protocols, fixed delivery schedules (just-in-time), integration with their specific enterprise resource planning (ERP) systems, and compliance with industry-specific regulatory standards (e.g., hazardous materials).

How does the gig economy model impact the traditional employment structure of courier services?

The gig economy model introduces flexibility and scalable labor capacity but creates regulatory ambiguity concerning worker classification (employee vs. contractor), putting pressure on traditional carriers to adapt their labor models or risk being undercut on immediate staffing costs.

What financing models are common for investing in high-cost logistics technology?

Common financing models include large-scale venture capital investments for startups focusing on automation, strategic corporate acquisitions of tech firms, public-private partnerships for infrastructure development, and substantial long-term loans for fleet electrification and capital asset upgrades.

What is the competitive landscape like for last-mile delivery specifically?

The last-mile segment is fiercely competitive, featuring traditional giants (UPS, FedEx), technology-integrated retailers (Amazon), and hyper-local disruptors (DoorDash, Lalamove), all competing on speed, price, and localized coverage, often leading to very thin profit margins.

How do governments influence market trends through infrastructure spending?

Governments influence trends by investing in new road networks, public transit improvements that reduce congestion for delivery vehicles, developing smart city infrastructure (e.g., dedicated EV charging stations), and regulating traffic flow, directly impacting operational efficiency and costs for carriers.

What are the primary challenges in expanding cold chain services in emerging markets?

Challenges include unreliable electricity supply, lack of specialized handling expertise, high capital cost of refrigerated vehicles and warehousing, and insufficient regulatory oversight to ensure the integrity of temperature-sensitive pharmaceutical and food products throughout transit.

How are customer preferences shifting regarding delivery notification methods?

Customer preferences are shifting strongly toward proactive, personalized communication via SMS and mobile app notifications, demanding precise, real-time estimated time of arrival (ETA) updates, and the ability to dynamically change delivery instructions or reschedule deliveries on short notice.

What role does machine learning play in optimizing vehicle load capacity?

Machine learning analyzes package dimensions, weights, and destination clustering to determine the optimal way to load vehicles, ensuring maximum utilization of cubic space and distributing weight evenly, thereby reducing the need for multiple trips and lowering overall fleet costs.

Why is data standardization crucial for international courier operations?

Data standardization ensures that tracking information, customs documentation, and address formats are uniformly exchanged between different international partners and regulatory bodies, minimizing costly customs delays and ensuring seamless cross-border parcel handoffs.

What innovative solutions are used for securing packages left at residences?

Innovative solutions include smart security cameras integrated with delivery platforms, secure, connected outdoor parcel drop boxes (lockers), and partnerships with local businesses (PUDOs - Pick-up and Drop-off points) to serve as safe, accessible receiving locations.

How does urban sprawl affect the profitability of local delivery?

Urban sprawl increases the average distance between delivery stops and lowers delivery density per route, significantly increasing fuel and labor costs, which directly challenges the profitability of local delivery operations compared to highly condensed city centers.

What are the ethical considerations surrounding AI deployment in logistics?

Ethical considerations include potential job displacement due to automation, ensuring algorithmic fairness in route allocation and driver performance evaluation, and managing the security and privacy implications of collecting massive amounts of real-time movement and personal data.

What is the market relevance of cargo bikes in modern urban logistics?

Cargo bikes are highly relevant in densely populated, heavily congested urban centers where they offer superior maneuverability, zero emissions compliance, lower operational costs, and the ability to access areas restricted to larger motorized vehicles, enhancing service flexibility.

How do companies measure operational efficiency in the courier market?

Operational efficiency is measured using key performance indicators (KPIs) such as on-time delivery rate (OTD), delivery density (parcels per hour), cost per mile, vehicle utilization rate, and failed first-attempt delivery rates, which inform strategic adjustments.

What role do mergers and acquisitions (M&A) play in market consolidation?

M&A activity is driven by the desire for economies of scale, geographical expansion, acquiring specialized technological capabilities (e.g., specific software), and eliminating competition, leading to a highly consolidated market dominated by a few global mega-carriers and integrated service providers.

How are carriers managing the shift towards high-volume small parcel delivery?

Carriers manage this shift by investing heavily in automated small parcel sorting systems, optimizing networks for package aggregation, and deploying dedicated last-mile fleets comprising smaller vehicles designed specifically for efficient residential deliveries.

What is the impact of rising energy costs on the adoption of electric vehicle fleets?

Rising energy costs accelerate the business case for adopting electric vehicle (EV) fleets, as the high initial capital outlay for EVs is offset by lower long-term operating costs (reduced fuel and maintenance expenses), making electrification a strategic imperative for cost stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager