Courier franchise service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434688 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Courier franchise service Market Size

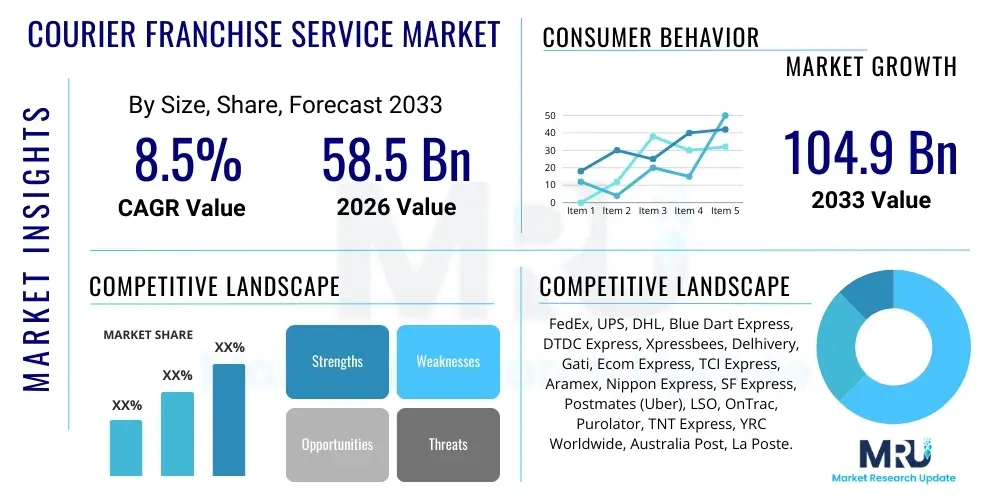

The Courier franchise service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 58.5 Billion in 2026 and is projected to reach USD 104.9 Billion by the end of the forecast period in 2033. This substantial expansion is primarily driven by the exponential growth of the global e-commerce sector, which necessitates robust, scalable, and localized last-mile delivery solutions. Franchise models provide established logistical frameworks and brand recognition, allowing entrepreneurs to rapidly tap into this demand. Furthermore, the increasing reliance of small and medium-sized enterprises (SMEs) on outsourced logistics and efficient supply chain management contributes significantly to the sustained market trajectory, especially in emerging economies where centralized infrastructure is still developing.

Courier franchise service Market introduction

The Courier franchise service market encompasses business models where established logistics companies (franchisors) license their brand name, operating systems, proprietary technology, and logistical expertise to independent local operators (franchisees). This structure allows for rapid market penetration and localized service customization, offering a standardized yet decentralized approach to parcel, document, and freight transportation. The primary applications of these services are concentrated in Business-to-Consumer (B2C) e-commerce fulfillment, urgent Business-to-Business (B2B) document and component delivery, and essential pharmaceutical and cold-chain logistics. The core value proposition of the franchise model lies in providing high-quality, reliable delivery services while minimizing the capital expenditure and risk associated with launching a new logistics operation from scratch.

A major benefit distinguishing courier franchise services from independent carriers is the immediate operational leverage derived from the franchisor's global network and standardized technological infrastructure. Franchisees gain access to optimized routing software, centralized tracking systems, extensive training programs, and volume purchasing power for vehicles and supplies, which enhances operational efficiency and service reliability. These services are crucial for businesses requiring timely and secure delivery, especially those operating under strict Service Level Agreements (SLAs) or handling high-value goods. The model effectively mitigates the typical barriers to entry in the logistics industry by providing a proven business blueprint and established customer trust, vital components in the competitive last-mile delivery segment.

The driving factors propelling the market include the continued digitization of retail sectors globally, leading to increased parcel volumes that far exceed traditional postal capacities. Urbanization further drives demand for efficient intra-city logistics, making localized franchise operations essential for navigating complex urban environments. Moreover, the fragmentation of global supply chains requires reliable, traceable cross-border courier services, where major franchisors offer seamless international connectivity. The sustained focus on time-definite delivery options, often guaranteed through premium express services offered by franchisees, underscores the market's trajectory toward higher-value, speed-focused logistical solutions that cater to the instant gratification economy.

Courier franchise service Market Executive Summary

The Courier franchise service Market is characterized by robust resilience and accelerated growth, primarily fueled by global digital transformation and the expansion of cross-border e-commerce. Key business trends include aggressive technology adoption, particularly in AI-driven route optimization and automated sorting facilities, designed to combat rising labor and fuel costs. There is a strong movement towards sustainable logistics, with major franchisors investing heavily in electric vehicle fleets and optimizing packaging materials to meet consumer and regulatory demands for environmentally responsible delivery. Furthermore, the market is experiencing consolidation, with large international players acquiring regional specialized franchisors to strengthen their localized last-mile capabilities and expand their service offerings into niche areas such as cold chain or dangerous goods handling.

Regionally, the Asia Pacific (APAC) market remains the primary growth engine, driven by massive domestic consumption in China and India, coupled with underdeveloped logistics infrastructure that makes franchise models particularly attractive for rapid expansion. North America and Europe, while mature, are focusing on premium express services, complex B2B logistics, and establishing dense networks of Parcel Lockers (PUDOs – Pick-up/Drop-off points) to improve delivery efficiency and address failed delivery attempts. Emerging markets in Latin America and the Middle East and Africa (MEA) represent significant long-term opportunities, spurred by increasing smartphone penetration and the consequent surge in online shopping, requiring the scalable, branded solutions that franchising provides.

Segment trends reveal that the Express Delivery segment continues to command the highest revenue share due to the premium pricing associated with guaranteed speed and time-definite services, essential for critical e-commerce and corporate logistics. However, the Standard Delivery segment is experiencing volume growth, driven by increasing cost sensitivity among mass-market e-commerce platforms. From an application perspective, the B2C segment, linked directly to online retail, dominates volume metrics, yet the B2B segment, focusing on supply chain movement of components and critical documents, remains vital for high-margin revenue generation, often requiring specialized contractual franchise arrangements focusing on reliable fleet management and dedicated service personnel.

AI Impact Analysis on Courier franchise service Market

User queries regarding AI in the courier franchise sector predominantly focus on three critical areas: the potential for AI to optimize profitability through enhanced operational efficiency, the security implications of utilizing autonomous or semi-autonomous delivery systems, and the future role of human personnel within the franchised network. Users are particularly interested in how AI-powered route optimization and demand forecasting can reduce variable costs, specifically concerning fuel consumption and driver wages, which are major expenditure points for franchisees. Concerns also center on the investment required for integrating sophisticated AI platforms, often asking whether franchisors will centrally manage and subsidize these expensive technological upgrades, ensuring smaller franchisees remain competitive against large, vertically integrated logistics providers.

The key themes emerging from this analysis indicate high expectations for AI to solve persistent logistical bottlenecks, such as managing peak demand fluctuations and navigating congested urban delivery zones. Users expect systems capable of real-time adjustment of delivery schedules based on live traffic data and weather conditions, moving beyond static routing algorithms. Furthermore, there is strong interest in predictive maintenance using machine learning to monitor franchisee fleet health, minimizing vehicle downtime and ensuring service reliability, a cornerstone of the franchisor's brand promise. This integration of AI is not just viewed as a cost-cutting measure but as a fundamental shift toward creating highly adaptive, resilient, and data-driven logistical networks that can guarantee superior customer experience.

The franchisor-franchisee relationship is set to evolve significantly as AI centralizes operational control and standardizes processes. While AI provides the optimal solution, the franchisee retains the responsibility for execution and local customer interaction. Therefore, the successful deployment of AI relies heavily on the quality of data shared across the entire franchise ecosystem and the standardization of execution protocols enforced by the franchisor. Failure to adopt these technologies could severely hinder a franchisee's ability to compete on speed and price, underlining the necessity of centralized technology mandates to ensure network-wide operational parity and maintain brand integrity in a digitally competitive landscape.

- AI-powered demand forecasting enhances operational planning and resource allocation for managing seasonal peaks.

- Machine learning algorithms significantly optimize multi-stop delivery routes, reducing fuel consumption and last-mile labor costs.

- Automated sorting systems integrated with AI vision technology accelerate throughput and reduce parcel misdirection errors at distribution hubs.

- Predictive maintenance analytics monitor fleet performance, minimizing vehicle downtime and extending asset lifespan for franchisees.

- Chatbots and AI-driven customer service platforms handle routine queries, freeing up franchisee staff for complex issues.

- Autonomous vehicle planning and drone delivery integration strategies are developed and refined using AI simulation environments.

- Centralized data analytics provide franchisees with actionable insights into local market performance and service gaps.

DRO & Impact Forces Of Courier franchise service Market

The Courier franchise service Market is powerfully influenced by dynamic forces, primarily driven by the unstoppable momentum of global e-commerce and the associated demand for fast, reliable delivery, especially across borders. However, this growth is constrained by significant operational challenges, chiefly the escalating costs of fuel, the scarcity of labor, and increasingly complex regulatory environments regarding environmental standards and gig economy employment practices. Strategic opportunities arise from technological innovation, such as the implementation of drone delivery and widespread utilization of secure PUDO (Pick-up/Drop-off) networks, which offer potential solutions to last-mile efficiency challenges. The interplay of these forces dictates market profitability and shapes the required investment strategy for both franchisors and local franchisees seeking sustainable growth.

Drivers: The dominant driver remains the persistent expansion of B2C and C2C e-commerce, creating massive parcel volumes that require scalable logistical solutions. Rapid urbanization mandates localized, time-sensitive delivery services, benefiting the geographically decentralized model of franchising. Furthermore, the globalization of supply chains means that SMEs increasingly rely on branded, reliable international courier services provided through franchise networks, ensuring customs compliance and traceability across multiple jurisdictions. The established trust associated with major courier brands acts as a powerful driver, attracting both new franchisees and corporate customers who prioritize reliability over cost minimization.

Restraints: Significant restraints include the volatile nature of global fuel prices, which directly impacts the profitability of last-mile delivery operations, a cost often borne by the franchisee. Intense competition from both established integrated logistics giants and disruptive regional tech-enabled delivery startups places downward pressure on pricing and necessitates continuous, expensive technological upgrades. Regulatory burdens, particularly those related to vehicle emissions standards in major cities and varying labor laws governing contract versus employee status, add complexity and compliance costs to the standardized franchise model. Infrastructure inadequacies in many emerging markets also slow down service speed and increase operational friction.

Opportunities: Key opportunities lie in the adoption of electric vehicle (EV) fleets and establishing comprehensive charging infrastructures, supported by franchisor investment, addressing both sustainability goals and long-term fuel cost volatility. Expanding the PUDO network concept drastically reduces failed delivery attempts, improving customer satisfaction and increasing delivery density, thereby enhancing franchisee profitability. Additionally, the proliferation of specialized logistics services, such as cold chain for pharmaceuticals or highly secure delivery for financial documents, presents premium, high-margin opportunities that leverage the standardized quality controls inherent in the franchise system.

Segmentation Analysis

The Courier franchise service Market is systematically segmented primarily based on Service Type, Application (End-User), and Geographic Reach, reflecting the diverse logistical needs of global commerce. Service Type segmentation, encompassing Express and Standard options, differentiates based on transit time and price sensitivity, fundamentally shaping the operational intensity and required technological investment of the franchisee. The Application segmentation clearly defines whether the delivery targets Business-to-Consumer (B2C) e-commerce parcels, Business-to-Business (B2B) supply chain components, or C2C transactions, each requiring distinct handling protocols and fleet compositions. Furthermore, segmentation by Geographic Reach, covering Domestic versus International services, highlights the complexity of customs clearance and intermodal transport capabilities essential for global franchisor networks.

The Express Service segment, characterized by guaranteed fast delivery windows (e.g., next-day or same-day), is critical for high-value or time-sensitive goods, generating significantly higher revenue per parcel. Franchisees operating within this segment require advanced logistical software, specialized security protocols, and strict adherence to routing schedules. Conversely, the Standard Service segment, while offering lower margins, handles the bulk volume from routine e-commerce transactions, requiring optimized density of delivery routes and efficient hub sorting processes. The ability of a franchise system to seamlessly manage both speeds—leveraging shared resources like sorting facilities and central technology platforms—is a key competitive differentiator in attracting a broad customer base.

The B2C application segment remains the largest volume driver, directly proportional to the growth of online retail. Franchisees in B2C focus heavily on last-mile consumer experience, utilizing tools like real-time tracking, flexible delivery windows, and efficient return handling (reverse logistics). In contrast, the B2B segment demands specialized contracts focused on reliability, security, scheduled pick-ups, and the movement of heavier, sometimes hazardous, freight. This requires franchisees with appropriately certified vehicles and staff training. The future success of franchisors depends on their ability to provide integrated technological solutions that efficiently cater to both massive B2C volume variability and the high-service, low-volume consistency demanded by B2B clients.

- Service Type:

- Express Delivery (Time-definite, Premium Pricing)

- Standard Delivery (Volume-driven, Economical)

- Same-Day Delivery (Hyper-local, Specialized Fleet)

- Application (End-User):

- Business-to-Consumer (B2C - E-commerce fulfillment)

- Business-to-Business (B2B - Corporate logistics, component shipping)

- Consumer-to-Consumer (C2C - Peer-to-peer shipping)

- Healthcare and Pharmaceuticals (Temperature-controlled logistics)

- Geographic Reach:

- Domestic Services

- International Services (Cross-border, Intermodal)

- Fleet Type:

- Automobile Fleets (Vans, Trucks)

- Two-Wheeler Fleets (Urban and Hyper-local delivery)

- Specialized Vehicles (Refrigerated, Hazardous Materials)

Value Chain Analysis For Courier franchise service Market

The value chain for the Courier franchise service Market is intricate, starting with upstream suppliers and extending through the highly decentralized distribution network managed by franchisees to the final customer. Upstream activities involve the procurement of essential assets and infrastructure components: vehicle manufacturing (vans, trucks, two-wheelers), logistics technology providers (SaaS for routing, tracking, warehouse management systems), and material suppliers (packaging, labels). Franchisors manage these upstream relationships centrally, leveraging bulk purchasing power to ensure standardized quality and cost advantages for their network. Efficient upstream management is vital as asset quality and technology standardization directly influence the operational success and reliability promised by the franchise brand.

The core value creation happens in the middle stage, where franchisors provide the intangible assets—the brand, operational systems, and proprietary technology—while franchisees provide the localized human capital, vehicle assets, and direct market execution. Distribution channels are typically a hybrid model combining the franchisor's large-scale hub-and-spoke infrastructure (for long-haul and sorting) with the franchisee's dedicated last-mile delivery territory. The indirect channel, managed entirely by the independent franchisee, is critical for achieving the density and speed required for urban delivery. Direct relationships, where large corporate accounts are managed centrally by the franchisor, often pass fulfillment execution to the local franchisee for consistent service delivery.

Downstream activities focus on the delivery of the service to the end-user. This stage includes critical functions like real-time parcel tracking, secure payment processing, proof-of-delivery (POD) collection, and reverse logistics (returns management). The efficiency of this downstream segment directly impacts customer satisfaction and retention. Potential customers, including major e-commerce platforms and global B2B clients, rely heavily on the integrity and speed of this final process. Therefore, the franchisor must ensure all franchisees strictly adhere to technological standards and customer service protocols to maintain network reputation and brand equity, linking upstream technology investment directly to downstream market performance.

Courier franchise service Market Potential Customers

The Courier franchise service Market caters to a wide spectrum of potential customers, characterized by their varying volume, security, and speed requirements. The primary consumer segment consists of Small and Medium-sized Enterprises (SMEs) and independent e-commerce sellers who require reliable, scalable logistics without the capital investment of building their own delivery network. These businesses often lack the negotiating power to secure favorable rates or coverage with major carriers directly, making the standardized pricing and expansive reach offered by franchised courier services highly attractive. They rely on the franchise model for both domestic and international shipping of goods ranging from manufactured components to consumer electronics.

A second major customer category involves large corporate entities, including major retailers, financial institutions, and manufacturing firms (B2B). These large-volume shippers often enter into centralized master service agreements (MSAs) directly with the franchisor, but the actual fulfillment and execution are delegated to the local franchisees within the designated territory. These customers demand highly specialized services, such as scheduled fleet management, secure document transport, or temperature-controlled movement of critical supplies. The franchised model is appealing here because it guarantees standardized service quality and compliance across numerous geographic locations, upheld by the franchisor’s strict operational mandates.

Finally, individual consumers (C2C) constitute a significant portion of the potential customer base, particularly for urgent document shipping, returns processing, and peer-to-peer parcel exchange. The convenience and accessibility of franchised drop-off locations (often utilized by franchisees) and the trust associated with a known brand name are key determinants for these sporadic shippers. As the sharing economy grows, and as returns become a larger part of the e-commerce lifecycle, the demand for accessible, reliable C2C and reverse logistics services provided through local courier franchisees will continue to expand, often utilizing PUDO points managed or operated by the franchisee.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 58.5 Billion |

| Market Forecast in 2033 | USD 104.9 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FedEx, UPS, DHL, Blue Dart Express, DTDC Express, Xpressbees, Delhivery, Gati, Ecom Express, TCI Express, Aramex, Nippon Express, SF Express, Postmates (Uber), LSO, OnTrac, Purolator, TNT Express, YRC Worldwide, Australia Post, La Poste. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Courier franchise service Market Key Technology Landscape

The operational success of a courier franchise relies heavily on a standardized, centralized technology stack provided by the franchisor to ensure efficiency and uniformity across all independent territories. Key technological focus areas include advanced logistics management systems (LMS) and enterprise resource planning (ERP) solutions that integrate order intake, warehousing, sorting, and dispatch. These systems are typically cloud-based, allowing franchisees, regardless of their size, to access sophisticated tools for optimized load planning and operational oversight. Crucially, the standardization of mobile applications for drivers and centralized tracking APIs for customers are paramount, ensuring a seamless, high-visibility customer experience that reinforces the franchisor’s brand reputation for reliability.

Route optimization software, often leveraging Artificial Intelligence (AI) and Machine Learning (ML), represents the core competitive technology. These algorithms process vast amounts of real-time data, including traffic flow, predicted weather, parcel delivery density, and pre-set customer time windows, dynamically adjusting driver routes for maximum efficiency and minimum fuel consumption. For franchisees, this technology is non-negotiable, providing the efficiency required to maintain profitability in the competitive last-mile segment. Furthermore, the increasing adoption of Internet of Things (IoT) sensors in fleets allows for continuous monitoring of vehicle health, driver behavior, and, critically, the environmental conditions within specialized compartments (e.g., temperature monitoring for cold chain goods), enhancing service quality and compliance.

The future technology landscape centers on automation and digitization of physical interfaces. Investment is escalating in automated parcel sorting systems within franchisor distribution centers, utilizing robotics and high-speed conveyor belts to drastically reduce processing time and labor dependency. Digital payment and verification technologies, including biometric scanning and electronic proof-of-delivery (e-POD) systems, are standardizing the handover process, improving security and speed. For franchisees, the mandated use of these systems ensures that their operations are integrated into the global network seamlessly, maintaining data integrity and providing the necessary audit trail for compliance and customer dispute resolution, positioning the franchise model as a technologically sophisticated option.

Regional Highlights

The global Courier franchise service market exhibits distinct regional dynamics, dictated by economic maturity, e-commerce penetration rates, and regulatory environments. Asia Pacific (APAC) dominates the market in terms of volume and growth trajectory. This region, spearheaded by rapidly growing consumer markets in China, India, and Southeast Asia, leverages franchise models to quickly establish reliable logistical networks in often fragmented and diverse geographical areas. The necessity for reliable cross-border e-commerce services within APAC further drives demand, requiring robust international franchising capabilities. Franchisees in this region focus intensely on two-wheeler and hyper-local delivery solutions to navigate congested urban centers, often utilizing mobile technology for localized operational management.

North America and Europe represent mature, high-value markets where growth is stable and highly focused on service quality, speed, and sustainability. In these regions, the primary driver is the demand for premium express services, complex B2B supply chain solutions, and robust reverse logistics. Franchisees in North America and Europe typically operate larger fleets and benefit from highly integrated technological infrastructures provided by established franchisors like FedEx and UPS. Furthermore, regulatory pressures regarding environmental standards (e.g., city emission zones) are forcing rapid adoption of electric vehicles and sophisticated route planning, creating substantial capital expenditure demands that are often subsidized or managed centrally by the franchisor.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions offering significant untapped growth potential. In LATAM, increasing digital penetration and consumer confidence in online transactions are stimulating demand, though challenges related to fragmented infrastructure and security necessitate specialized, localized franchise solutions. The MEA region, particularly the Gulf Cooperation Council (GCC) states, benefits from strategic geographical location (connecting East and West) and heavy investment in logistics infrastructure. Franchise systems are critical in these areas for providing standardized service reliability that international companies require, successfully navigating regional customs complexities and varying address verification systems to ensure last-mile service integrity.

- Asia Pacific (APAC): Highest volume market; driven by e-commerce density in India and China; intense focus on scalable, hyper-local franchise models and technology adoption for complex routes.

- North America: Mature market; emphasis on premium express delivery, B2B services, and sophisticated integration of AI for route optimization; high investment in sustainable fleet transitions.

- Europe: Regulatory leader in sustainability; strong demand for PUDO networks and localized collection points; highly competitive due to entrenched national postal services and robust cross-border shipping requirements.

- Latin America (LATAM): Rapid growth driven by digital adoption; market challenges include security and infrastructure development; franchising is essential for building trustworthy brand presence.

- Middle East and Africa (MEA): Strategic hub for global logistics; high growth potential fueled by economic diversification and urbanization; demand for high-security, specialized transport services through established international franchises.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Courier franchise service Market.- FedEx

- UPS

- DHL

- Blue Dart Express

- DTDC Express

- Xpressbees

- Delhivery

- Gati

- Ecom Express

- TCI Express

- Aramex

- Nippon Express

- SF Express

- Postmates (Uber)

- LSO

- OnTrac

- Purolator

- TNT Express

- YRC Worldwide

- Australia Post

Frequently Asked Questions

Analyze common user questions about the Courier franchise service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Courier franchise service Market through 2033?

The Courier franchise service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. This steady growth is underpinned by sustained global e-commerce activity and the necessity for franchised models to deliver reliable, localized logistical solutions.

How is AI specifically impacting the profitability of courier franchisees?

AI significantly impacts franchisee profitability by optimizing last-mile delivery processes. This includes utilizing machine learning for highly efficient route planning, which minimizes fuel consumption and driver hours, and improving demand forecasting to reduce operational waste during non-peak seasons.

What are the key operational challenges restraining market growth in the franchise sector?

Key operational challenges include navigating volatile global fuel price fluctuations, securing and retaining quality delivery personnel, and complying with increasingly stringent environmental regulations (emission standards), which necessitates expensive fleet upgrades for franchisees.

Which market segment currently holds the highest revenue potential?

The Express Delivery segment commands the highest revenue potential within the courier franchise market. This segment is characterized by time-definite guarantees and premium pricing, catering primarily to urgent B2B shipments and high-value e-commerce goods requiring speed and reliability.

How do franchisors support franchisees with technological requirements?

Franchisors centrally provide and mandate the use of advanced, standardized technology platforms, including cloud-based Logistics Management Systems (LMS), proprietary route optimization software, and real-time tracking applications (IoT), ensuring network-wide operational parity and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager