Coworking Space Management Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433182 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Coworking Space Management Software Market Size

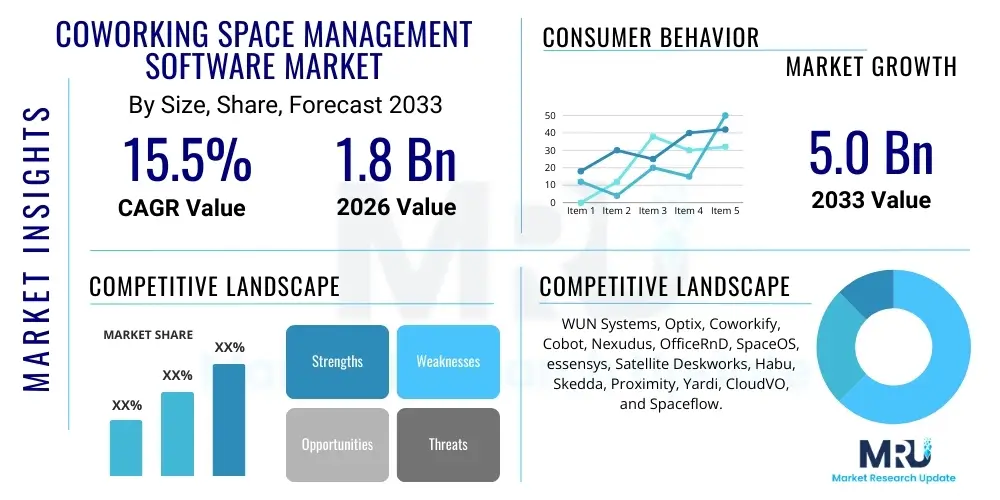

The Coworking Space Management Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $1.8 Billion in 2026 and is projected to reach $5.0 Billion by the end of the forecast period in 2033.

Coworking Space Management Software Market introduction

The Coworking Space Management Software Market encompasses specialized digital tools designed to automate and optimize the daily operations of flexible and shared workspace environments. These software solutions are crucial for managing bookings, membership databases, billing and invoicing, access control, and community engagement within coworking facilities. The primary objective of these platforms is to enhance operational efficiency, improve member experience, and maximize space utilization and revenue generation for space operators.

Key functionalities often include integrated payment gateways, interactive floor plans, communication portals, and detailed analytics dashboards that provide insights into occupancy rates and member behavior. The rapid global shift towards flexible work models, catalyzed by technological advancements and the rise of the gig economy, has fundamentally accelerated the demand for robust, scalable management solutions. Furthermore, the expansion of hybrid work strategies adopted by large corporations, which often involve utilizing external coworking facilities or managing internal flexible hubs, solidifies the necessity of comprehensive management software.

Major driving factors include the proliferation of independent coworking spaces, the necessity for contactless and automated facility management post-pandemic, and the increasing trend among commercial real estate owners to diversify their portfolios by offering flexible workspace options. The benefits derived from deploying this software are substantial, ranging from reduced administrative overhead and enhanced security through integrated access systems, to fostering a vibrant member community through dedicated communication tools. The product is rapidly evolving, integrating technologies like IoT for smart space management and AI for personalized service offerings.

Coworking Space Management Software Market Executive Summary

The global Coworking Space Management Software Market is characterized by robust growth driven primarily by the escalating demand for operational efficiency and seamless member experiences within the flexible workspace sector. Business trends indicate a strong pivot towards cloud-based, subscription (SaaS) models, offering scalability and lower upfront costs, making sophisticated management tools accessible to independent operators and large chains alike. Furthermore, consolidation is becoming visible among software providers, with larger entities acquiring niche platforms to integrate advanced features such as advanced analytics, real-time reporting, and sophisticated financial management modules, thereby streamlining the overall value proposition for workspace operators seeking comprehensive solutions.

From a regional perspective, North America and Europe currently represent the most mature markets, exhibiting high adoption rates due to well-established technology infrastructure and a significant existing base of coworking spaces. However, the Asia Pacific (APAC) region is poised to demonstrate the fastest growth rate, fueled by rapid urbanization, increasing entrepreneurial activity, and significant investment in commercial real estate development focused on flexible office formats, particularly in major economic hubs like Singapore, India, and Australia. Emerging markets in Latin America and MEA are also showing promising potential as local economies embrace hybrid work models, although adoption can be slower due to varying regulatory landscapes and capital availability.

Segmentation trends highlight the dominance of the Cloud deployment segment due to its inherent flexibility and cost-effectiveness. In terms of end-users, while the small and medium-sized space operators traditionally formed the core customer base, the Large Enterprise segment is experiencing accelerated growth. This surge is attributed to large corporations implementing internal flex spaces or seeking centralized platforms to manage their hybrid workforce's access across multiple vendor-operated coworking locations. Integration capabilities with existing enterprise resource planning (ERP) systems and IoT infrastructure remain critical differentiating factors for vendors targeting these large-scale deployments, demanding high levels of customization and robust security features.

AI Impact Analysis on Coworking Space Management Software Market

User inquiries regarding AI's influence in the Coworking Space Management Software Market predominantly focus on automation capabilities, personalization, and predictive analytics. Users seek clarity on how AI can move beyond simple task automation (like automated billing) to solve complex operational challenges, such as dynamic pricing based on real-time demand, predictive maintenance to minimize facility downtime, and optimizing space layout based on utilization patterns. Key concerns revolve around data privacy when utilizing machine learning models trained on sensitive member data, and the cost-effectiveness of implementing advanced AI features for smaller space operators. Expectations are high for AI to deliver truly seamless, personalized member journeys, from automated visitor registration using facial recognition to tailored recommendations for community events or services.

The incorporation of Artificial Intelligence is transforming coworking space management from reactive administration to proactive, intelligent operation. AI algorithms are increasingly being used to analyze vast streams of data, including access logs, booking patterns, and member feedback, enabling operators to derive actionable insights that directly impact profitability and user satisfaction. For example, machine learning models can accurately forecast future occupancy rates, allowing operators to adjust staffing, utility consumption, and marketing efforts proactively. This level of predictive insight is invaluable in a high-overhead, demand-sensitive industry like flexible workspaces.

Furthermore, AI significantly enhances the member experience through personalization. AI-powered chatbots handle routine member queries 24/7, freeing up community managers for higher-value engagement. Dynamic pricing engines leverage complex algorithms to adjust desk and meeting room rates in real-time based on factors like time of day, day of the week, historical demand, and competitor pricing, thereby maximizing revenue yields. These AI capabilities transition the software from a simple management tool into a strategic asset for optimizing both the physical space and the associated community services.

- Automated dynamic pricing based on real-time demand fluctuations.

- Predictive maintenance scheduling for facility equipment and resources.

- AI-powered chatbots and virtual assistants for 24/7 member support.

- Enhanced security through facial recognition and behavioral anomaly detection in access control.

- Personalized service recommendations and community event matching.

- Optimization of HVAC and lighting systems based on real-time space utilization (IoT integration).

- Advanced occupancy analytics and spatial optimization planning using machine learning.

DRO & Impact Forces Of Coworking Space Management Software Market

The Coworking Space Management Software market is influenced by a compelling set of drivers (D) related to the structural changes in the modern workforce, restraints (R) primarily centered on operational complexities and security, and opportunities (O) stemming from technological integration and market expansion. The overarching impact forces dictate that the inherent flexibility and efficiency gains offered by the software solutions strongly outweigh the current implementation challenges, pushing the market into a high-growth trajectory. The widespread acceptance of hybrid work models across industries is the most significant driver, making sophisticated management solutions essential for maintaining productivity and compliance across distributed teams.

Key drivers include the global expansion of the flexible workspace model, increasing necessity for seamless, automated processes such as booking and billing to handle high member turnover efficiently, and the critical need for robust data analytics to inform real estate investment and operational decision-making. Conversely, market growth is restrained by factors such as the high initial deployment costs and complexity associated with integrating new software into legacy building management systems, particularly for older or smaller independent operators. Furthermore, significant concerns surrounding data security, privacy compliance (like GDPR or CCPA), and the necessary expertise to manage and maintain advanced software platforms also pose barriers to wider adoption, requiring vendors to continuously invest in robust security protocols.

Opportunities for market players are abundant, primarily through the deeper integration of Internet of Things (IoT) devices for smart building management, offering end-to-end solutions that link physical space monitoring with member management. The expansion into niche markets, such as university campuses, corporate headquarters managing internal flexible zones, and specialized industry hubs, also presents lucrative growth avenues. The demand for all-in-one platforms that combine space management with community building tools, payment processing, and comprehensive financial reporting in a single, user-friendly interface will continue to define successful product strategies and impact market dynamics significantly over the forecast period.

Segmentation Analysis

The Coworking Space Management Software Market is segmented comprehensively across several key dimensions, including Component, Deployment Type, Enterprise Size, and End-User. This granularity in segmentation allows for targeted market strategies, identifying which product offerings resonate most strongly with specific operational needs of flexible workspace providers. The component segmentation differentiates between core software modules and complementary services, acknowledging that many operators require ongoing support, training, and customization services alongside the software itself. The deployment type, primarily cloud vs. on-premise, reflects operational preferences concerning accessibility, scalability, and data control, with cloud dominance accelerating due to the distributed nature of modern business operations.

Segmentation by enterprise size is crucial, recognizing the distinct needs and budget constraints of Large Enterprises versus Small and Medium Enterprises (SMEs). Large operators, such as global chains like WeWork or Industrious, demand highly scalable, multi-site management systems with advanced integration capabilities, while SMEs prioritize ease of use, rapid deployment, and affordability. The End-User segmentation further refines the market, distinguishing between traditional coworking spaces, corporate flex spaces, shared labs, and other hybrid models, each having unique requirements regarding access control, resource booking, and community management features. Analyzing these segments provides vital insights into product development pathways and regional adoption rates, driving strategic investment in specialized features like hybrid meeting technology or specialized billing mechanisms for large corporate accounts.

The evolving landscape of flexible work continually shifts the weight of these segments. For instance, the growing corporate adoption of "Space as a Service" models has dramatically boosted the potential of the Large Enterprise segment, requiring vendors to pivot from solely managing individual members to managing corporate account entitlements and centralized billing across multiple locations. Simultaneously, the demand for holistic solutions integrating property management (like lease administration) with operational tools is pushing the boundaries of the "Software" component, favoring vendors who offer comprehensive platform ecosystems rather than discrete applications.

- By Component:

- Software (Platform and Modules)

- Services (Implementation, Training, Support, and Consulting)

- By Deployment Type:

- Cloud-based (SaaS)

- On-premise

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By End-User:

- Coworking Spaces and Business Centers

- Corporate Flex Spaces (Internal Managed Spaces)

- Shared Labs and Maker Spaces

- Incubators and Accelerators

Value Chain Analysis For Coworking Space Management Software Market

The value chain for the Coworking Space Management Software Market begins with upstream activities focused on foundational technology and development. This phase involves the creation and licensing of core technologies, including cloud infrastructure providers (like AWS, Azure), database management system vendors, and specialized IoT sensor manufacturers crucial for smart space functionality. Software developers and engineering teams constitute the primary value creators here, translating market needs into robust, scalable code and ensuring seamless integration with third-party hardware and payment gateways. The quality of this upstream component directly impacts the stability, security, and scalability of the final product offered to the end-user.

Midstream activities involve the core creation and customization of the software platform itself. This includes developing the user interface (UI/UX), integrating modules such as booking calendars, CRM, billing systems, and access control APIs. Crucially, the distribution channel plays a vital role in determining market reach. Most modern vendors utilize a direct distribution model through their proprietary sales teams and online platforms (SaaS subscription model), which allows for greater control over the customer relationship and faster deployment of updates. Indirect channels, involving partnerships with real estate technology consultants, facility management companies, or regional Value-Added Resellers (VARs), are also employed, particularly when targeting large-scale corporate clients requiring specialized integration services.

Downstream activities center on deployment, training, maintenance, and ongoing customer support provided directly to the coworking space operators and end-users. This stage is critical for customer retention, as the complexity of integrating access control hardware, payment systems, and accounting software requires significant post-sale support. Direct engagement ensures vendors can gather real-time feedback for iterative product improvement (a core benefit of the SaaS model), while indirect support through certified partners extends geographic reach and local language capabilities. The entire chain is focused on delivering not just a piece of software, but an integrated operational ecosystem that maximizes the profitability and efficiency of the physical coworking facility.

Coworking Space Management Software Market Potential Customers

The primary and most traditional segment of potential customers for Coworking Space Management Software comprises independent and chain-operated Coworking Spaces and Business Centers. These operators rely heavily on the software to manage the core aspects of their business—membership contracts, flexible desk assignments, meeting room booking, utility tracking, and automated invoicing. For these dedicated flexible workspace providers, the software is not merely an administrative tool but the central operating system that governs revenue realization, member satisfaction, and operational compliance. They seek platforms that offer high reliability, strong integration with payment gateways, and sophisticated community engagement features to differentiate themselves in a competitive market.

A rapidly expanding customer base includes large Corporate Enterprises utilizing internal flexible spaces, often referred to as ‘corporate flex.’ As corporations restructure their headquarters to adopt activity-based working or hybrid models, they require sophisticated software to manage the booking of internal resources, track utilization rates across departments for internal cost allocation, and ensure compliance with security protocols. These corporate clients prioritize seamless integration with existing IT infrastructure (SSO, HR systems) and require enterprise-grade security and robust data reporting capabilities far beyond what small operators might need. The software helps them justify real estate portfolios and optimize their physical footprint efficiently.

Furthermore, specialized end-users such as academic Incubators and Accelerators, shared R&D Labs, and specialized Maker Spaces represent growing niche segments. These customers have unique requirements, such as managing shared technical equipment, tracking material consumption, or handling complex tiered access rights based on project status or membership type. Software tailored for these niches must be capable of handling complex resource scheduling and inventory management alongside standard membership administration. The diversity in potential customers necessitates that software vendors offer modular, highly configurable platforms capable of meeting widely varying operational demands and security mandates.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.8 Billion |

| Market Forecast in 2033 | $5.0 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WUN Systems, Optix, Coworkify, Cobot, Nexudus, OfficeRnD, SpaceOS, essensys, Satellite Deskworks, Habu, Skedda, Proximity, Yardi, CloudVO, and Spaceflow. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coworking Space Management Software Market Key Technology Landscape

The technological landscape of the Coworking Space Management Software Market is rapidly advancing, moving beyond simple booking and billing systems to incorporate sophisticated smart building and data analytics capabilities. Cloud computing remains the foundational technology, with Software-as-a-Service (SaaS) models dominating due to their inherent scalability, automatic updates, and ability to handle globally distributed operations. This infrastructure is critical for supporting the high availability and real-time data synchronization required by modern flexible workspace operators who manage dynamic occupancy rates and mobile member interactions across multiple time zones. Furthermore, strong Application Programming Interface (API) architecture is essential, enabling seamless integration with crucial third-party systems like electronic door locks, accounting software (e.g., QuickBooks), and customer relationship management (CRM) platforms, creating an interconnected ecosystem for holistic facility management.

The integration of the Internet of Things (IoT) is a major technological differentiator. IoT sensors embedded in desks, meeting rooms, and common areas provide real-time occupancy data, allowing the software to automate resource allocation, optimize energy consumption (HVAC and lighting), and provide accurate utilization reports. This granular data informs facility managers on which areas are under or over-utilized, enabling data-driven decisions regarding space redesign or pricing adjustments. Alongside IoT, sophisticated Mobile Applications are paramount. These apps serve as the primary interface for members, facilitating everything from booking resources and checking in via mobile access credentials, to interacting with the community and submitting support tickets. A smooth, feature-rich mobile experience is critical for retaining modern, flexible workers who demand convenience.

Finally, Artificial Intelligence (AI) and Machine Learning (ML) are becoming standard features, especially in platforms targeting large enterprise clients. AI is employed for advanced predictive analytics, forecasting demand trends, automating responses via chatbots, and implementing dynamic pricing strategies to maximize yield management. Blockchain technology, although nascent, holds potential for securing smart contracts related to flexible membership agreements and ensuring tamper-proof access logs. Vendors are competing fiercely on the ability to harness these technologies to offer actionable insights and true automation, transforming the administrative burden of running a coworking space into a data-optimized, self-governing operation.

Regional Highlights

The global market for Coworking Space Management Software exhibits significant variation in maturity and growth trajectory across different geographical regions, heavily influenced by local real estate trends, regulatory frameworks, and technological adoption rates. North America, comprising the United States and Canada, stands as the most mature market. This region benefits from early and widespread adoption of cloud-based solutions, high prevalence of large, established coworking chains, and a robust technological infrastructure. The demand here is driven by the necessity for enterprise-grade solutions capable of managing complex, high-volume transactions and integrating deeply with existing corporate security and financial systems. US vendors often lead innovation in integrating AI/ML for dynamic pricing and advanced analytics, setting industry benchmarks for operational efficiency and scaling.

Europe represents a highly fragmented but rapidly consolidating market, where strong emphasis is placed on data privacy and security compliance, particularly adhering to regulations like GDPR. Key markets such as the UK, Germany, and France show high adoption, driven by strong growth in small and mid-sized flexible operators and a growing trend of corporate real estate owners converting traditional assets into managed flex spaces. European operators prioritize modular systems that allow for regional customization, particularly concerning language support, tax regulations, and payment processing standards. The region sees a balance between centralized management platforms targeting large chains and niche, community-focused software providers catering to independent operators focused on localized member experience.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily fueled by rapid urbanization, substantial foreign direct investment in commercial real estate, and a flourishing startup and SME ecosystem across nations like India, China, and Southeast Asian countries. The demand in APAC is often for mobile-first solutions, given the high rate of mobile technology use. Challenges in this region include diverse regulatory environments and fragmentation across various local languages and currencies, requiring vendors to develop highly adaptable and localized platforms. Meanwhile, Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets, where adoption is accelerating as major cities embrace flexible working concepts. Growth in these regions is driven by the need for low-cost, scalable solutions to manage newfound flexible office capacity, often bypassing traditional infrastructure directly to cloud-based platforms.

- North America: Market maturity, high technology adoption, demand for enterprise-grade security and advanced AI integration, driven by large corporate hybrid work mandates.

- Europe: Strong focus on GDPR compliance and data security, high growth in the UK and Germany, driven by conversion of traditional real estate to flexible models, emphasizing localized features.

- Asia Pacific (APAC): Fastest growing region; demand driven by urbanization, high mobile penetration, rapid startup growth, and need for localized, highly scalable solutions in emerging economies like India and Southeast Asia.

- Latin America (LATAM): Emerging market, growing interest in cloud-based solutions to manage new flexible office supply in major capitals, seeking cost-effective management tools.

- Middle East and Africa (MEA): Nascent growth driven by economic diversification efforts and strategic initiatives to establish business hubs, emphasizing scalable solutions for new developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coworking Space Management Software Market.- WUN Systems

- Optix

- Coworkify

- Cobot

- Nexudus

- OfficeRnD

- SpaceOS

- essensys

- Satellite Deskworks

- Habu

- Skedda

- Proximity

- Yardi

- CloudVO

- Spaceflow

- Archibus

- Andcards

- LiquidSpace

- Convene

- Upflex

Frequently Asked Questions

Analyze common user questions about the Coworking Space Management Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key benefit of adopting cloud-based coworking software over on-premise solutions?

The primary advantage of cloud-based (SaaS) coworking software is superior scalability and accessibility, allowing operators to manage multiple locations globally with real-time data synchronization and lower upfront capital expenditure. Cloud solutions also benefit from automatic security updates and continuous feature deployments, minimizing internal IT overhead for space operators.

How does Coworking Space Management Software integrate with smart building technology?

The software integrates through Application Programming Interfaces (APIs) and IoT connectivity protocols to link the platform with physical assets like smart locks, HVAC systems, and occupancy sensors. This integration enables automated access control based on bookings, real-time tracking of space utilization, and energy efficiency optimization.

Which segmentation segment is expected to experience the highest growth rate during the forecast period?

The Large Enterprise segment, under the Enterprise Size segmentation, is anticipated to show the highest growth rate. This is driven by large corporations increasingly managing their internal flexible spaces and needing sophisticated, scalable platforms to handle centralized billing, compliance, and multi-site hybrid workforce management across their global real estate portfolios.

What are the main security challenges associated with coworking management platforms?

The main security challenges involve ensuring the privacy of member data (especially financial and personal identifiable information), preventing unauthorized access through integrated smart locks, and maintaining compliance with regional data protection regulations like GDPR. Vendors must prioritize robust encryption, secure API connections, and multi-factor authentication protocols to mitigate these risks.

What role does AI play in revenue management for coworking spaces?

AI plays a critical role in revenue management by implementing dynamic pricing algorithms. These algorithms analyze historical demand, real-time occupancy rates, seasonality, and competitor pricing to automatically adjust the cost of desks and meeting rooms, maximizing yield and ensuring that pricing is always optimized for current market conditions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager