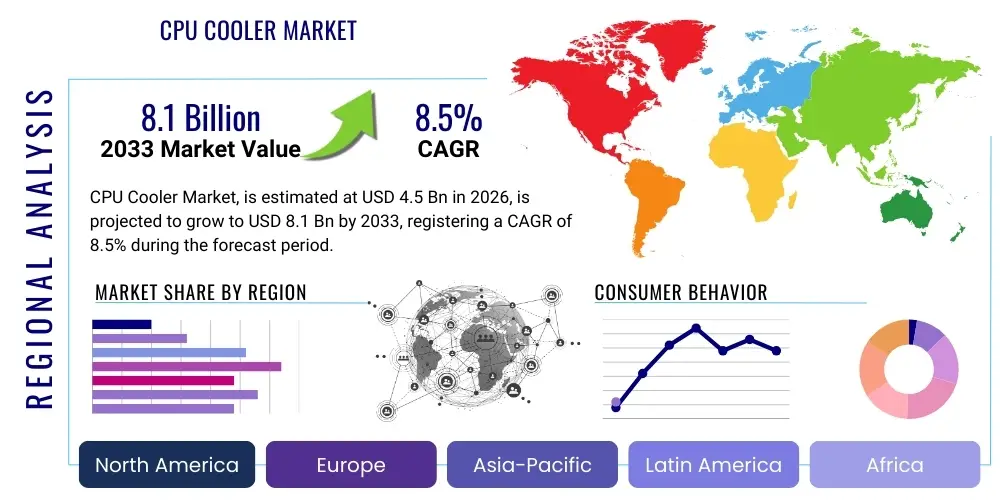

CPU Cooler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436612 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

CPU Cooler Market Size

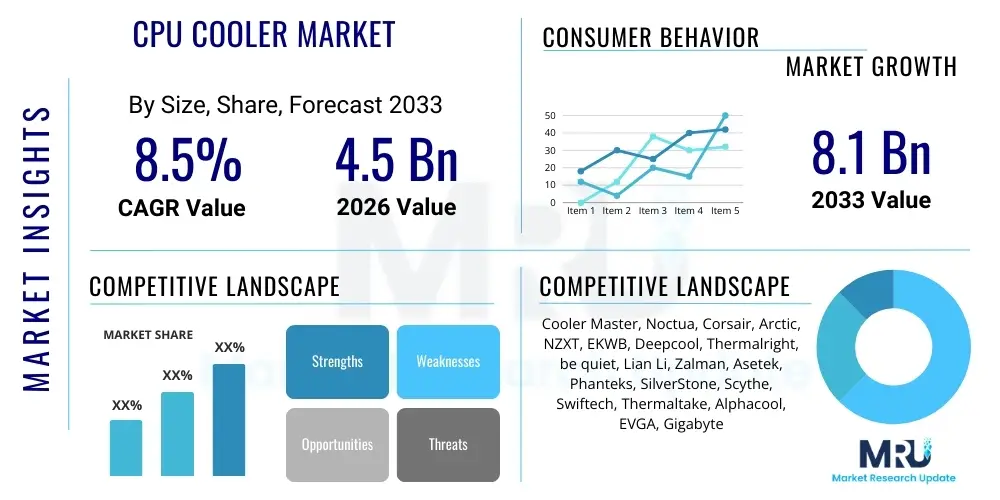

The CPU Cooler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $4.5 Billion in 2026 and is projected to reach $8.1 Billion by the end of the forecast period in 2033.

CPU Cooler Market introduction

The CPU Cooler Market encompasses the global sales and distribution of thermal management solutions designed to dissipate heat generated by Central Processing Units (CPUs) in computing devices. These essential components prevent thermal throttling, ensuring optimal performance and longevity of the processor, particularly in high-performance computing (HPC), gaming, and professional workstation environments. Product types span traditional air coolers utilizing heat sinks and fans, advanced liquid cooling systems (AIO and custom loops), and specialized technologies like immersion cooling for data centers.

Major applications of CPU coolers include consumer electronics (desktops and laptops), enterprise computing (servers and data centers), and specialized industrial systems. The necessity for effective thermal management has intensified significantly due to the continual increase in processor Thermal Design Power (TDP), driven by advancements in multi-core architecture and higher clock speeds demanded by modern software and demanding workloads such as artificial intelligence training and 4K/8K media rendering. The market benefits substantially from continuous technological innovation in heat transfer efficiency and aesthetic integration.

Key driving factors accelerating market expansion include the exponential growth of the global gaming industry, where overclocking and sustained performance require premium cooling solutions; the massive expansion of cloud computing infrastructure necessitating robust server cooling; and the rising adoption of high-end personal computers for professional content creation. Furthermore, increasing consumer awareness regarding system performance degradation due to overheating and the aesthetic appeal of customizable cooling systems, particularly RGB lighting integration in AIO units, contribute heavily to market dynamism and premium product sales.

CPU Cooler Market Executive Summary

The CPU Cooler market is currently characterized by a rapid shift toward liquid cooling solutions, driven primarily by the stringent thermal requirements of next-generation processors from major manufacturers like Intel and AMD. Business trends indicate strong consolidation among key component suppliers (e.g., pumps, radiators, and fans), alongside intense competition focused on optimizing cost-efficiency and incorporating smart cooling technologies, such as integrated temperature monitoring and software control for fan speeds. This emphasis on performance-per-dollar, coupled with aesthetic customization (RGB/ARGB lighting), defines current product development strategies. Server and data center cooling, particularly in hyperscale environments, represents the fastest-growing segment, demanding energy-efficient and maintenance-friendly large-scale solutions.

Regionally, the Asia Pacific (APAC) area dominates the consumption landscape, fueled by a booming PC gaming culture, substantial manufacturing capabilities in countries like China and Taiwan, and the deployment of extensive data center infrastructure across key economies such as India, Japan, and South Korea. North America and Europe remain pivotal markets for high-margin, premium cooling solutions and sophisticated enterprise liquid cooling installations, driven by advanced technological adoption and robust professional computing markets. The focus in these regions is increasingly on sustainability and energy consumption reduction, pushing manufacturers towards passive or highly efficient active cooling technologies.

Segment trends highlight the dominance of Air Cooling by volume, primarily due to its affordability and reliability in the mainstream market, but Liquid Cooling (specifically All-In-One or AIO units) is rapidly gaining market share due to superior thermal performance and ease of installation compared to complex custom loops. Within the Liquid Cooling segment, the shift towards larger radiators (360mm and 420mm) reflects the escalating TDPs of modern processors. By application, the Gaming PC segment is the primary revenue generator, while the Server/Workstation segment offers the highest growth potential, requiring robust, industrial-grade cooling systems capable of continuous operation in demanding environments.

AI Impact Analysis on CPU Cooler Market

User queries regarding AI's impact on the CPU cooler market frequently revolve around several core themes: whether AI workloads necessitate new cooling standards, the potential use of AI for dynamic thermal management within cooling systems, and the increased demand generated by AI infrastructure build-out. Users are concerned about whether current consumer and enterprise cooling solutions can handle the sustained, intensive heat generated by high-performance CPUs and GPUs running large language models (LLMs) and training complex neural networks. Expectations are high that AI algorithms will eventually be integrated into cooling hardware to predict thermal loads based on workload patterns, thereby optimizing fan/pump speeds proactively rather than reactively, leading to higher efficiency and reduced noise profiles. Furthermore, the massive proliferation of AI data centers is universally expected to drive unprecedented demand for advanced, large-scale liquid and immersion cooling solutions.

- Increased Thermal Density: AI training and inference require sustained high processor utilization, dramatically increasing the average TDP (Thermal Design Power) and demanding more efficient, high-capacity cooling solutions, particularly pushing the adoption of liquid cooling.

- Dynamic Thermal Management (DTM): AI algorithms are being integrated into controller chips (e.g., in AIO coolers) to learn specific user workload thermal patterns and dynamically adjust cooling parameters (pump speed, fan curves) for optimal noise reduction and thermal dissipation.

- Hyperscale Data Center Demand: The foundational infrastructure for AI (cloud computing and enterprise AI platforms) necessitates vast numbers of servers, driving significant demand for high-efficiency, rack-level cooling systems, including specialized cold plates and direct-to-chip liquid solutions.

- Optimization of Cooling Design: AI-powered simulation tools are being used in the R&D phase to optimize heat sink geometry, fluid dynamics in cold plates, and fan blade design, resulting in faster and more efficient product iteration cycles.

- Immersion Cooling Acceleration: AI server farms are major adopters of two-phase and single-phase immersion cooling due to its superior heat dissipation capabilities and energy efficiency compared to traditional air cooling in high-density rack environments.

- Predictive Maintenance: AI can monitor vibration, temperature fluctuations, and pump efficiency to predict component failure in cooling systems, particularly crucial for mission-critical enterprise environments, reducing downtime risks.

DRO & Impact Forces Of CPU Cooler Market

The market dynamics are defined by several interlocking factors, where the consistent increase in CPU complexity acts as the primary Driver (D), forcing cooling technology innovation. Restraints (R) mainly stem from the high initial cost and complexity associated with advanced liquid cooling setups, which limit mainstream adoption, alongside ongoing concerns regarding the durability and long-term maintenance of sealed units. Opportunities (O) are vast, centered on the emergent need for enterprise-level cooling in AI and cloud computing infrastructure, coupled with the potential for highly efficient, environmentally friendly cooling solutions like immersion systems and sophisticated phase-change cooling, addressing the growing focus on computing sustainability. These forces collectively shape the competitive landscape and technological investment decisions within the industry.

The core driving force remains the relentless technological advancement in CPUs, leading to higher core counts and clock speeds, thus increasing the required heat dissipation capability. This continuous thermal pressure ensures that basic stock coolers are insufficient for performance use cases, creating robust demand for aftermarket and premium solutions. However, a significant restraint involves the physical limitations and noise profiles of air cooling systems, which struggle to effectively manage ultra-high TDP chips within standard chassis sizes. Furthermore, standardization issues across different CPU sockets and chassis form factors occasionally complicate product compatibility and adoption, particularly for smaller manufacturers trying to enter niche markets.

The impact forces influencing the market trajectory are multi-faceted. The high impact force is exerted by the gaming and eSports industry, which consistently demands peak performance and is willing to invest heavily in premium, aesthetically pleasing cooling solutions, often incorporating sophisticated RGB lighting ecosystems. A medium impact force comes from regulatory pressures in developed economies pushing for reduced energy consumption in IT infrastructure, subtly favoring highly efficient liquid cooling over power-intensive air handling systems in data centers. The low impact force involves the slow-but-steady penetration of advanced materials science, such as graphene and advanced composite phase change materials, into mainstream cooling components, promising future incremental efficiency gains without drastic cost increases.

Segmentation Analysis

The CPU Cooler Market is meticulously segmented based on product type, heat dissipation mechanism, application sector, and end-use configuration, allowing for targeted analysis of growth pockets and competitive strategies. Understanding these segments is crucial as different end-user groups, ranging from high-end gaming enthusiasts to large data center operators, prioritize distinct attributes such as cost, noise levels, thermal capacity, and physical footprint. The market composition reflects a balance between established, low-cost air solutions and rapidly expanding, high-performance liquid cooling systems.

- By Product Type:

- Air Cooling (Heat Sinks, Heat Pipes, Fans)

- Liquid Cooling (All-in-One (AIO) Systems, Custom Loop Systems, Direct-to-Chip Solutions, Immersion Cooling)

- By End-Use Application:

- Gaming PCs (High-Performance/Overclocked)

- Desktop PCs (Mainstream/Entry-Level)

- Workstations/High-End Professional Systems

- Servers and Data Centers (Enterprise and Hyperscale)

- By Component:

- Radiators

- Pumps and Reservoirs

- Cold Plates/Water Blocks

- Fans (Case Fans, Radiator Fans)

- Thermal Interface Materials (TIMs: Pastes, Pads, Liquid Metal)

- By Distribution Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket/Retail

Value Chain Analysis For CPU Cooler Market

The CPU Cooler market value chain begins with upstream activities involving the sourcing and processing of raw materials, predominantly high-purity copper, aluminum alloys, and specialized plastics used in fans and pump housings. Key upstream suppliers include metal refiners, TIM chemical manufacturers, and electronic component producers for pump motors and controller PCBs. Efficiency and cost control at this stage are paramount, as the price volatility of industrial metals directly impacts manufacturing costs. Optimization here focuses on lightweighting materials while maximizing thermal conductivity.

The midstream phase involves design, manufacturing, and assembly. This is where intellectual property related to heat pipe technology, cold plate microchannel geometry, and pump design efficiency is realized. Manufacturers invest heavily in CNC machining, soldering technologies for heat pipes, and automated assembly lines for AIO units. Quality assurance, particularly pressure testing for liquid coolers and noise profile optimization for fans, adds significant value. Companies with strong vertical integration, controlling both component manufacturing and final assembly, typically achieve higher margin capture and faster time-to-market for new socket standards.

Downstream activities include distribution, marketing, and final sales. Distribution channels are bifurcated into OEM sales (supplying pre-built system integrators like Dell or HP) and Aftermarket sales (targeting DIY builders via retail and e-commerce platforms). The aftermarket channel is heavily influenced by content marketing, reviews, and eSports sponsorships, requiring robust digital engagement strategies. Indirect distribution via authorized distributors and large-scale e-tailers (e.g., Amazon, Newegg) dominates consumer sales, while direct sales relationships are critical for penetrating the enterprise data center market with custom liquid cooling arrays and maintenance contracts.

The complexity of the CPU cooler value chain mandates distinct strategies for different product categories. For air coolers, the value chain is relatively straightforward and cost-sensitive, focused on maximizing material sourcing efficiency. For liquid coolers, particularly high-end custom loops, the chain includes specialized knowledge transfer and system integration services provided at the downstream level. Direct distribution is crucial in the enterprise segment, as data center operators require specific installation, scale, and long-term support services that generic retail channels cannot provide, shifting the value proposition from a simple hardware sale to a managed thermal solution.

CPU Cooler Market Potential Customers

The primary end-users and potential customers of CPU coolers can be broadly categorized into four major groups, each possessing unique thermal requirements, budgetary constraints, and purchasing criteria. The largest and most volatile group is the PC Enthusiast and Gaming Community, which drives innovation in aesthetics and extreme performance. These buyers prioritize peak thermal dissipation for overclocking, coupled with visual features such as Addressable RGB (ARGB) lighting and sleek designs, often leading them to purchase premium AIO or custom liquid cooling systems through aftermarket channels.

Another crucial customer segment is Original Equipment Manufacturers (OEMs) and System Integrators (SIs), including major brands that build pre-configured desktop and server machines. OEMs demand high volume, standardized, reliable, and cost-effective cooling solutions, typically relying on custom-designed air coolers or standardized AIO units optimized for specific chassis designs. Their purchasing decisions are driven by strict regulatory compliance, low failure rates, and long-term supply agreements rather than bleeding-edge performance, creating a highly competitive B2B segment focused on volume and stability.

The fastest-growing segment, offering the highest long-term revenue potential, comprises Data Center Operators and Cloud Service Providers (CSPs). These enterprise buyers require scalable, highly efficient, and energy-conscious cooling solutions for thousands of servers. Their transition toward high-density computing (driven by AI and HPC) makes traditional air cooling impractical, accelerating their adoption of advanced liquid cooling technologies, including Direct Liquid Cooling (DLC) and immersion systems. Purchasing criteria here are dominated by Total Cost of Ownership (TCO), power usage effectiveness (PUE), and ease of maintenance at scale, requiring manufacturers to provide comprehensive infrastructure solutions, not just components.

Finally, Professional Workstation Users and Content Creators represent a stable, high-margin niche. These individuals (e.g., video editors, 3D renderers, engineers) require sustained, quiet performance for long computing sessions. While they need high thermal capacity, they often prioritize low noise output and reliability over extreme overclocking potential, leading them to select well-engineered, quiet air coolers or high-quality, dependable AIO units. The demand in this segment is less sensitive to market volatility but requires products marketed specifically for professional reliability and acoustical performance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $8.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Cooler Master, Noctua, Corsair, Arctic, NZXT, EKWB, Deepcool, Thermalright, be quiet, Lian Li, Zalman, Asetek, Phanteks, SilverStone, Scythe, Swiftech, Thermaltake, Alphacool, EVGA, Gigabyte |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CPU Cooler Market Key Technology Landscape

The CPU Cooler market is experiencing continuous technological evolution centered on maximizing thermal transfer efficiency and integrating smart control systems. A key advancement in air cooling involves the refinement of heat pipe technology, specifically the use of sintered powder or groove wicks and varying internal fluid compositions to improve heat transfer capacity and orientation independence. Coupled with this is the optimization of fin density and shape in heat sinks, often achieved through sophisticated computational fluid dynamics (CFD) simulations, allowing large air coolers to dissipate 250W TDP and above while maintaining acceptable noise levels. This push for passive performance without excessive fan speeds remains a core R&D focus for manufacturers targeting the low-noise computing segment.

In liquid cooling, the technological focus is dual-pronged: enhancing pump efficiency and improving cold plate design. Modern AIO pumps are transitioning towards Ceramic Bearing Pumps (CBP) and 3-phase motors, significantly extending Mean Time Between Failures (MTBF) and reducing acoustic output while maintaining high flow rates. Cold plate technology is evolving to incorporate ultra-fine micro-skived or micro-channel structures, dramatically increasing the surface area for heat exchange with the CPU integrated heat spreader (IHS), ensuring efficient heat transfer even with highly localized thermal hot spots characteristic of modern processor dies. Furthermore, the integration of quick-disconnect fittings in custom loops and server DLC systems simplifies maintenance and infrastructure scalability.

A burgeoning technological segment is the adoption of IoT and smart control systems. Contemporary CPU coolers increasingly feature integrated microcontrollers (MCUs) that communicate directly with motherboard sensors and proprietary software suites. This enables advanced features such as PWM (Pulse Width Modulation) fan control mapped to specific CPU core temperatures, diagnostic monitoring, and seamless synchronization with system lighting ecosystems (AURA Sync, Mystic Light, etc.). For the enterprise segment, this includes telemetric monitoring of coolant temperature, pressure, and leakage detection within server racks, enabling proactive thermal management and ensuring high uptime for mission-critical operations powered by advanced technologies.

Regional Highlights

The global CPU Cooler market demonstrates distinct regional dynamics, primarily dictated by technological adoption rates, manufacturing presence, and the scale of IT infrastructure development. Asia Pacific (APAC) holds the largest market share and is expected to exhibit the highest CAGR during the forecast period. This dominance is attributed to several factors, including the region's position as a global manufacturing hub for PC components (particularly Taiwan, China, and South Korea), a massive and rapidly growing professional gaming and eSports consumer base, and intense investment in new hyperscale data centers, especially in emerging economies like India and Southeast Asia. The local market competition drives innovation in both budget-friendly and high-performance segments simultaneously.

North America and Europe represent mature markets characterized by high average selling prices (ASPs) and a strong preference for high-quality, premium brands. In North America, demand is heavily influenced by the substantial presence of major tech companies, leading to sustained demand for high-end cooling solutions in R&D, corporate workstations, and massive cloud infrastructure deployments. European demand, particularly in Nordic countries and Germany, often prioritizes energy efficiency and low noise operation, driving demand for technologically advanced, quiet, and robust thermal solutions that comply with increasing environmental regulations and high standards for home office environments. These regions are also early adopters of innovative technologies like sealed server racks and advanced Direct Liquid Cooling (DLC).

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller market shares but offer significant growth opportunities. LATAM’s market is rapidly expanding, driven by increasing internet penetration, urbanization, and a burgeoning middle class investing in consumer electronics, including entry-to-mid-level gaming PCs. MEA, especially the Gulf Cooperation Council (GCC) countries, is witnessing substantial investment in smart city projects, data center construction, and digital transformation initiatives, creating a fertile ground for enterprise cooling system adoption. However, market growth in these regions is often constrained by supply chain complexities and fluctuating local currency values, making pricing a key competitive factor.

- Asia Pacific (APAC): Dominant market share due to large-scale manufacturing, massive PC gaming populace, and the rapid deployment of hyperscale data centers supporting regional AI and cloud expansion. Key markets include China, Japan, South Korea, and India.

- North America: High-value market segment driven by advanced processor technology adoption, substantial demand from the cloud computing sector, and a preference for premium, high-performance liquid cooling solutions in consumer and enterprise segments.

- Europe: Focus on energy efficiency, low-noise components, and high-reliability server cooling. Strict regulatory environment promotes the adoption of green and sustainable thermal management systems.

- Latin America (LATAM): Emerging market experiencing rapid growth in the retail sector due to rising disposable income and increasing penetration of gaming and enthusiast PC building culture.

- Middle East and Africa (MEA): Growing enterprise demand fueled by government digital transformation mandates and increasing investment in local data center infrastructure to meet regional data localization requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CPU Cooler Market.- Cooler Master Co., Ltd.

- Corsair Gaming, Inc.

- Asetek A/S

- Noctua GmbH

- EK Water Blocks d.o.o.

- NZXT, Inc.

- Deepcool Industries Co., Ltd.

- Thermalright Co., Ltd.

- Arctic GmbH

- be quiet! (Listan GmbH & Co. KG)

- Lian Li Industrial Co., Ltd.

- Zalman Tech Co., Ltd.

- Scythe Co., Ltd.

- Phanteks (Cooltek GmbH)

- SilverStone Technology Co., Ltd.

- Swiftech, Inc.

- Thermaltake Technology Co., Ltd.

- Alphacool International GmbH

- EVGA Corporation

- Gigabyte Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the CPU Cooler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between AIO liquid coolers and high-end air coolers?

The primary difference lies in heat transfer medium and dissipation area. AIO (All-In-One) liquid coolers use a fluid circuit to move heat away from the CPU block to a large radiator (dissipation area) that can be chassis-mounted, offering superior thermal performance for high TDP CPUs, especially when overclocked. High-end air coolers, conversely, use heat pipes and aluminum/copper fin stacks directly over the CPU. While air coolers are highly reliable and easier to install, they often have a physical size limitation, which can restrict performance compared to larger liquid cooling radiators, though modern designs often perform comparably at stock clock speeds.

How is the increased heat from modern CPUs (high TDP) influencing the market for thermal interface materials (TIMs)?

The surge in CPU thermal density (TDP) is driving significant innovation and demand for advanced TIMs. Traditional thermal pastes are increasingly being replaced or supplemented by high-performance gap pads, highly efficient non-conductive liquid metal compounds (for extreme performance users), and specialized phase change materials in OEM applications. Manufacturers are focusing on reducing thermal resistance at the interface between the CPU IHS and the cooler cold plate to maximize heat transfer, directly impacting the overall cooling efficiency required for sustained high-load workloads like 4K editing and AI tasks.

Which CPU cooler segment is expected to show the highest revenue growth rate in the data center market?

The Direct Liquid Cooling (DLC) and Immersion Cooling segments are anticipated to exhibit the highest revenue growth rate within the data center market. Hyperscale and AI data centers require extreme thermal efficiency to manage high-density racks containing numerous high-TDP CPUs and accelerators. DLC solutions, which pump coolant directly onto the processor chip, offer superior Power Usage Effectiveness (PUE) and energy savings compared to traditional HVAC systems, making them essential infrastructure for future high-performance computing installations across North America and APAC.

What role does RGB lighting integration play in the current purchasing decisions within the CPU Cooler aftermarket?

RGB and Addressable RGB (ARGB) lighting play a crucial role, often acting as a significant differentiator and purchasing driver in the consumer aftermarket segment, particularly among PC gaming enthusiasts and system builders. While cooling performance remains essential, the aesthetic appeal, customization options, and seamless synchronization with motherboard and chassis lighting ecosystems heavily influence consumer preference. Manufacturers integrate sophisticated controllers and proprietary software to provide visual value, enabling higher average selling prices for units featuring advanced lighting capabilities.

What are the key sustainability considerations influencing the development of future CPU cooling technology?

Sustainability considerations are shifting technology development towards lower energy consumption and waste reduction. Future cooling solutions focus on increasing the Power Usage Effectiveness (PUE) of data centers through the use of highly efficient liquid cooling and heat reuse technologies. This involves developing passive cooling systems, improving the recyclability of cooling components (e.g., non-toxic coolants), and optimizing pump and fan designs to minimize energy draw while maximizing performance, aligning with global green computing initiatives and environmental protection standards mandated in markets like Europe.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager